Against a backdrop of people who are dismissive of data and expertise, it is refreshing to see analysts rise to the challenge of tracking the economy while the government shutdown delayed the release of critical macroeconomic data. From Jim Stock of the CEA, “Economic Activity during the Government Shutdown and Debt Brinksmanship”:

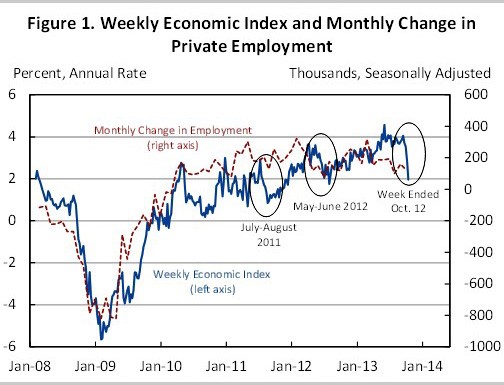

To understand what [the deterioration in eight weekly activity indicators during the first two weeks of October] means for overall economic activity CEA combined these indicators into a “Weekly Economic Index” that is scaled to match the overall growth rate of economic activity (see Figure 1). This “Weekly Economic Index” is designed to extract the main common “signal” from the noise of these different indicators.

Here is Figure 1 from the report.

Figure 1 from J. Stock, “Economic Activity during the Government Shutdown and Debt Brinksmanship,” CEA (October 22, 2013).

The eight indices used in constructing the weekly economic indicator are (1) the Johnson-Redbook Same-Store Sales Index (y/y % change), (2) ICSC Same-Store Sales Index (y/y % change), (3) New UI claims (thousands), (4) Gallup Job Creation Index, (5) Gallup Economic Confidence Index, (6) Rasmussen Consumer Index, (7) AISI Raw Steel Production (y/y % change), MBA Mortgage Applications (y/y % change). The Weekly Economic Index is the first principal component of these eight series, and the first PC accounts for 58% of the overall variance. (The series is rescaled to have the same mean as real quarterly GDP y/y growth rate from 2008 on.

What is the bottom line obtained from Figure 1? Economic activity dropped considerably due to the government shutdown. I’m sure there are commentators in certain circles who thought there was little impact (e.g., [1] [2]), and in some sense could not be contradicted because government statistics were not being released (how’s that for a strategy for winning an argument?). However, the Weekly Economic Indicator puts the arguments of the nay-sayers to rest.

For those who follow the indicators for the macroeconomy, the statistical approach will sound familiar. In fact, it is similar in concept to the Chicago Fed National Activity Index (CFNAI). Of course, this makes sense, since that index was based on the statistical approach forwarded by Stock and Watson (1999). (The point of this documentation, of course, is to pre-empt the “statistics-deniers” who no doubt will complain that the methodology is bunk, or some other such nonsense — example here).

Following implications for the impact on economic activity follow directly:

This paper shows that a range of indicators show that sentiment, job creation, consumption, and some elements of production grew more slowly in the first half of October than in previous months. Moreover, it combines all of these indicators into a single measure termed the Weekly Economic Index which is consistent with a 0.25 percentage point reduction in the annualized GDP growth rate in the fourth quarter or a reduction of about 120 thousand jobs in October, based solely on the indicators available covering the period through October 12th. These estimates could understate the full economic effects of the episode to the degree it continues to have an effect past October 12th—as it most likely would.

Other discussion of the CEA’s index, see Donald Marron, Brad Delong,

Oil and Economic Growth

Yesterday, at Princeton University, I presented a model of how a constrained oil supply limits OECD GDP growth. Those interested should feel free to drop me a line, and I’ll forward the presentation.

I have no problem at all with the methodology, but it’s incomplete. It doesn’t consider the rebound that occurred following the shutdown.

No doubt that the total permanent impact is smaller than represented because consumption, hiring and sentiment almost certainly rebounded after the resolution.

The index also appears to have departed from reality since early 2013. The index was rising while employment growth was declining.

Does anyone actually believe there will not be a similar spike up over the following month?

I am not claiming the economic effects are trivial, just overstated in the analysis above.

An analogy would be Wal-Mart sales following a blizzard. Sales crash during the blizzard, but rebound sharply afterward. Not all sales lost during the blizzard are recovered. However, only an idiot would claim that none of the sales lost during the blizzard will be recovered in the days after the blizzard ends.

Either the data is lying, or the uncertainty created jobs!

“In brief: according to the BLS’ magic calculations, in one month, the month during which the so-called uncertainly surrounding the government shutdown hit its peak (if one listens to CEO apologists), the US work force saw the rotation of some 594K part-time workers into a whopping 691K full-time jobs, in addition to adding over 100K net new jobs in the month.”

We need more uncertainty to put people back to work.

This is not going to be like a blizard and Walmart sales. With the blizard there is simply an expected blocking of peoples ability to go and spend, not their will to spend. This shutdown and threat of another coming in January are clearly going to change how people act and feel. Government employees and contractors (and other creditors) have been presented with a realistic scenario of not being paid either for a period of time, or even never being paid. Behavior will change in response to this newly found recognition of a vulnerability. The partial bounce back may even be muted by social security recipients realizing that they may one day find their checks delayed (and need to have a cash reserve to deal with that).

So this pain and suffering could have been avoided if the Democrats negotiated over delaying the individual mandate by one year and Congress did not get an exemption. And now Democrats are requesting an extension of the ACA. That seems…odd.

This is not going to be like a blizard and Walmart sales.

Analogies, like models, are imperfect. The point is that much of the loss as depicted in the index, will be recovered.

tj: Not so sure it will mostly be recovered in real GDP statistics. Using a bean counting approach, and using the number of employees furloughed, Macroeconomic Advisers arrived at a 0.2% SAAR reduction in 2013Q4 growth.

Anonymous wrote:

Either the data is lying, or the uncertainty created jobs!

You posted similar sentiment and the same quote from ZeroHedge in the “Chinese Anxiety” thread, so I’ll repost here the response I gave there.

What you are really saying is “the data doesn’t fit my worldview, so the data must be fake”.

I say that, because a thoughtful skeptic would consider the possibility that ordinary volatility of that BLS dataset, and ordinary measurement errors, and the imprecison of seasonal adjustments, and one-time events coincided to produce an outsized one-month change that will smooth out in the months ahead.

The historical data shows that moves of similar magnitude have occurred, in both directions, multiple times since the end of the recession.

Zerohedge’s belief that the data is fake appears to be reinforced by ZH’s assumption that the possibility of an Oct 1 government shutdown should have discouraged the switch of workers from part time to full time in September. Maybe, but I can envision the threat of shutdown stirring up a lot of activity, as one might see when a storm approaches. Federal contractors and grant recipients, for example, may have rushed to get a much billable work performed and invoiced as they could in advance of the shutdown. I know I would have.

Assuming that unexpected data is fake is a dangerous practice. It allows one to be “blindsided” by a blow from straight ahead.

Doug Short provides a level-headed review of the BLS data, with his usual array of useful graphs. He is very unlikely to ever get blindsided by the data in front of him.

http://advisorperspectives.com/dshort/commentaries/Full-Time-vs-Part-Time-Employment.php

Anonymous: “So this pain and suffering could have been avoided if the Democrats negotiated over delaying the individual mandate by one year and Congress did not get an exemption.”

I’m curious. What is this exemption you speak of?

Menzie

Using a bean counting approach, and using the number of employees furloughed, they arrived at a 0.2% SAAR reduction in 2013Q4 growth.

I’d be interested to see the assumptions. The loss in pay sums to zero within the quarter because for anyone that missed a paycheck, they get back pay. How many actually missed a paycheck? They don’t get paid daily, and most don’t even get paid weekly.

I’ll grant you that continued uncertainty in the minds of government workers and indirect counterparties will have an effect. Maybe that’s the 0.2% SAAR reduction.

I guess the bottom line is that the economic effects could have been avoided if Democrats had the foresight to accept the delay in the individual mandate that Republicans offered in exchange for adopting the CR. As we speak, Democrats in both houses and in the administration are talking about a delay.

tj GDP is a flow variable. Once it’s lost, it is lost forever. Your Wal-Mart analogy treats GDP as though it were a stock variable.

Also, if you truly believe that GDP could recover the lost output flow in the next period, then aren’t you implicitly admitting that there is a good deal of slack in the economy, and this slack can be tightened with a spurt of pent-up demand over the next month? My point is that it’s very hard to reconcile your anti-Keynesian views with your claim that there will be an offsetting spike in next month’s economic activity. I think you’re holding two mutually exclusive economic models in you head at the same time.

tj, there is a major difference between a 6-8 week delay in order to get the system operational, and a 1 year delay whose purpose is not to get the system operational, but to buy time to further shut down the program. so you are dead wrong, and you know it.

tj: If you re-read this post, you will see what I mean by the “bean counting”. The back-pay addresses the multiplier effects, but the furlough will show up in lost real GDP.

Joseph, I think this so-called “exemption” for congress is that they like anybody else in a large organization/company get health care from their employer and, therefore, do not have to go and get it through the exchanges. So they and the majority of the population have “an exemption”. As with anything else coming out of the Faux News machine, this distortion of language (by calling following the same rules as the rest of the country an “exemption for congress”) leave the false impression (at least with the morons that swallow their crap whole) that there is some special rules only applying to congress. The hypocrit from Texas who have been hyping this false concept is Cruzing along on his wifes goldplated platinum health care plan and would not personally be affected if employer-based health care was taken away from congress.

With the House legislation to retroactively repay furloughed workers, on top of DoD’s decision to bring back to work most civilian workers, the impact (in accounting terms) on nominal GDP is going to be minimized, although the impact on real GDP will remain.

A simple example –

I dig holes, 1 every 2 weeks, I could dig 2 holes every 2 weeks. I don’t dig any holes while I’m on paid vacation for 2 weeks. I dig 2 holes the week after paid vacation.

The net result over the month is that my pay and my output are unchanged compared to the months when I don’t take a paid vacation.

That said, I agree there are some residual effects, and the implicit assumption is that there is slack in the system. I’m arguing that the residual effects are smaller than advertised.

Dedude, but that isn’t true.Members of congress and their staffers will be required to get their insurance from the ACA exchanges. They will be buying the same insurance as you, I or anyone else is buying on the exchange. There is no exemption.