From Alec Phillips/Goldman Sachs today (not online):

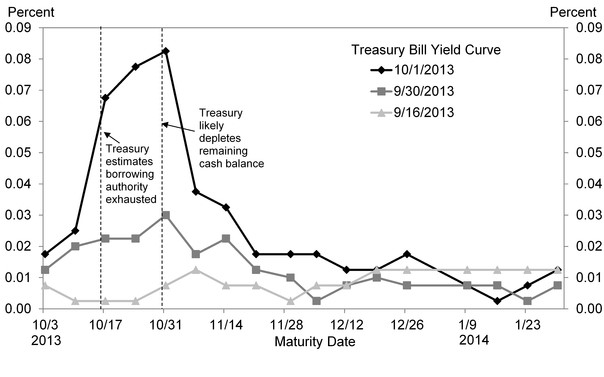

…the Treasury bill market is clearly indicating concern about upcoming debt ceiling deadlines …

…In our view this is the direct result of the increasing acrimony in Washington. Starting with the bill maturing on October 17―the day the Treasury Department has suggested it would exhaust its borrowing authority―bill rates are elevated, suggesting lower investor appetite for holding these securities. The distortion in the bill curve is most apparent in the security maturing on October 31, just after Treasury is likely to have depleted its cash balance. This unusual “humped” pattern is similar to that seen in late July 2011 during the last debt ceiling standoff.

This is shown in Exhibit 4.

Exhibit 4 from US Daily: Updated Thoughts on the Federal Shutdown and Its Implications (Phillips) (October 2, 2013).

Meanwhile the Dow is down about 1/2 of one percent over the last month. Yawn.

Interest rates of 0.08% are not very alarming.

If rate do go above 0.25%, will the Federal Reserve step in to purchase bills that are in danger of defaulting?

Menzie-

Do you honestly believe we will never default? Since GDP is growing slower than debt, explain under what scenario we don’t default. Do you really think GDP is going to change and start growing faster given the facts that…

We have a lazier culture than ever

We have horrible demographics getting worse

We have more regulation than ever

Taxes are only likely to go up

Rates are likely to go up

Young people are burdened with student debt, plus baby boomer government debt to pay for?

Health care is basically a subtle tax. It’s going to cost me $7K to pay for the birth of my child, and I have health insurance!!

Get real. There is NO hope for debt to gdp to reverse and eventually we must default.

And don’t bother mentioning reducing military spending. If Obama couldn’t do it with dem controlled congress in 09-11, nobody ever will.

Might as well default sooner rather than later. The longer the bubble blows, the worse it is going to be when it pops.

Acrimony? The essence is not that a group within the GOP is holding anything “hostage”, but that the leadership won’t allow a vote on the budget, just on the bills they want. From public statements, this enforced discipline would fall apart if the House could vote on the clean bill. The market calculation is the extent to which GOP leadership will take matters, not acrimony or the Tea Putzes.

Menzie,

Do you really not know why Goldman Sachs wants more QE? These guys are the epitome of rent seekers. TARP and Obama stimulus flowed into the pockets of these guys like a flood. Can you say crony capitalism!!

Whatever happened the OWS and their criticism of the 1%? Didn’t you support OWS? Now you support the 1%? Hmmmmmmmmm!

Ricardo,

talk about straw man posting! menzie posts a single report from GS regarding the behavior of the bond market, and we get an assessment from you that he is a hipocrit who supports wall st and OWS! could it be that he is simply showing you information so that you could be an informed member of society, rather than somebody who needs to repeat talking points from a talk show host?

Menzie and President Obama both say the grass is green. what color is it in your world?

just for clarification, the TARP money that flowed into GS was courtesy of GW Bush and his Treasury Secy Paulson (exGS), not Obama.

Baffled,

Of course TARP was a Bush/Paulson fiasco. If you have read any of my other posts you know I make this point over and over as it relates to how Bush/Paulson precipitated the crash of 2008. But real carefully. After Obama was elected Christina Roemer and crew engineered a stimulus plan that was almost a carbon copy of the Bush/Paulson plan and both were dismal failures.

Ricardo: Who is Christina Roemer?

ricardo,

I suppose we should have just let lehman fail and have the free market capitalist system work out the details. just out of curiousity, genius, without government support, which financial institutions would have survived and what funds would they have had available to push the economy forward. give me specifics, and of a magnitude which affects the US (and by default global) economy. to clarify, podunk bank and securities with $30 billion in capital as an example is soooo insignificant to the economy as to be rendered ineffective. so you really believe GS, Merrill, BoA, JPM, etc would have survived and led us to the glory land? no rhetoric, show me the numbers!

ricardo,

hey genius, still waiting on a reply. have an answer? the silence is deafening!