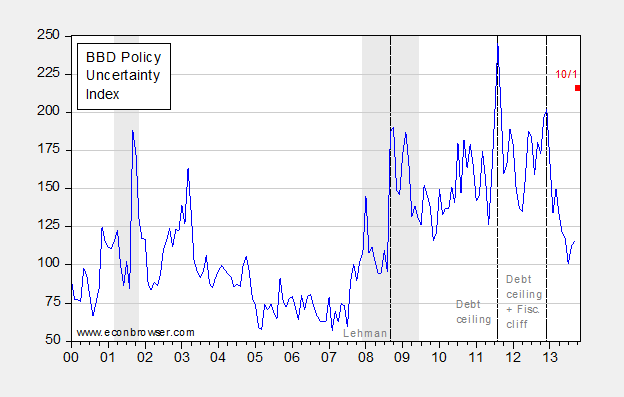

A snapshot for those who argue that policy uncertainty is slowing down the economy.

Figure 1: Baker, Bloom and Davis Policy Uncertainty Index (blue), and observation for 10/1 (red square). September observation is average of daily observations for September. NBER defined recession dates shaded gray. Source: Baker, Bloom, and Davis, accessed 10/1/2013.

This graphic brought to you courtesy of the House of Representatives.

For a longer time series on changes in the components of the uncertainty index, see this post.

Update, 4:15PM Pacific: Some readers have pointed out with alarm that the blue line in Figure 1 is the monthly average of daily data, while the red square is the latest (daily) observation. I’ve done this countless times (with no objection from today’s critics Anonymous 11:20AM, and Rick Stryker in the past), and seen equivalent graphs in memos my year in the Federal government, but be that as it may, in the interests in fully disclosing the data, and to obviate fears of nefarious motives on my part, here is Figure 2, in all its glory.

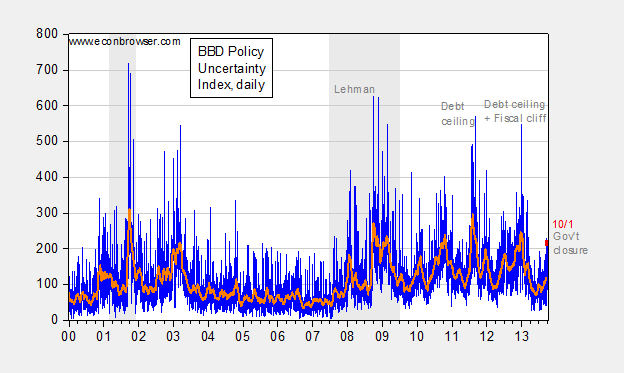

Figure 2: Baker, Bloom and Davis Daily Policy Uncertainty Index (blue), 31 day centered moving average (orange), and observation for 10/1 (red square). NBER defined recession dates shaded gray. Source: Baker, Bloom, and Davis, accessed 10/1/2013, NBER, and author’s calculations.

Now, I suppose the Index could drop and stay low for the next few weeks, making the 10/1/2013 observation a true aberration. But with the debt ceiling looming, I ask whether reasonable people think that’s likely.

Menzie,

Thanks for this information.

Average

2011 172.2

2012 170.1

2013 (8 months) 129.3

The uncertainty has fallen every year since the Republicans were returned to the House of Representatives.

The 10/1 dot is their daily index. The blue line is the monthly index, which is less volatile since it’s an average over the daily index. If you plotted their daily index and compared it with the 10/1 dot, you’d reach a different conclusion.

Ricardo: You of course neglected to mention that the index was 155.5, in 2010, before the Republicans took the House. I.e, the index rose upon the Republicans taking the house, and as of the last complete year of data (2012) had not returned to those levels. So far (first nine months), 2013 is below 155.5, but October is off with a bang.

Right, and US GDP growth just blew away its European peers from Q3-Q4 2011, just as US policy uncertainty reached its highest recent peak.

And then there was the sequester, and US growth again outpaced its European peers.

Does policy uncertainty matter? Does fiscal consolidation matter? I’m not convinced.

Does oil matter? You bet.

Does monetary policy also matter? It looks like it does. (Scott Sumner will make a market monetarist out of me yet, whatever that means.)

We’re going to have uncertainty for the rest of our lives. Congress hasn’t passed an actual budget since 1997 (no the omnibus spending bill of 09 was not a real big boy budget). Both sides need to get real and stop playing my party good your party bad.

Menzie: So much for logical consistency on your part. If the graph was government spending instead of policy uncertainty you would be arguing that GDP growth would be even higher still.

Kopits

I’m not convinced about monetary policy. In 2006 banks held fewer reserves with the Fed than they did in 1951. No joke.

Effectively what the fed has done was to take high quality collateral in the form of treasuries out of the economy and replace it with illiquid excess reserves. Excess reserves can never leave the Fed system, which is why we’ve printed a few trillion and saw virtually no inflation.

I think you will enjoy this article.

http://www.voxeu.org/article/exit-path-implications-collateral-chains

At the risk of getting yet another “you’re out!” from Stryker is baffling, let me just point out that this chart is very misleading.

As anonymous notes, the 10/1 point is from the daily index while the blue line is the monthly index, which averages the values.

The daily index is very volatile. On 10/1 the daily index is 216 whereas yesterday it was 105. The good news is that the index has come down over 2013 but there are still some very volatile days. For example, the index was 230 on 9/21 but only 83 on 9/18.

This daily volatility is driven by the news component of the index. The important question is not what the index is on a particular day but what is it over time. As is clear from the chart, uncertainty has been unusually high during the Obama years, but has recently come down, primarily because the news and tax expiration components have declined on average.

I think it would be also very instructive for Menzie to chart the uncertainty index in Europe, both the composite index and by country. Those charts would show that the very unusually high policy uncertainty has also been a feature of the European experience since 2008. The high numbers are driven more by the UK, Spain, and Italy, but France and Germany have been higher as well. Looking at Europe will make it more clear that the uncertainty is not just about conflict between political parties in the US. Policy uncertainty has been a general feature of the crisis and its aftermath.

Anonymous (11:20AM) and Rick Stryker: See Figure 2 added. I doesn’t change what I see, particularly with the debt ceiling looming.

Jeff: Actually, the graph was for those who believed policy uncertainty was important. My view has been aggregate demand deficiency has been by far the most important reason for slow growth.

Paul Krugman’s latest on this uncertainty measure is of interesting:

krugman.blogs.nytimes.com/2013/10/01/what-they-say-versus-what-they-mean

I suspect he agrees with Menzie’s “aggregate demand deficiency has been by far the most important reason for slow growth”.

Menzie,

You are funny.

You failed to mention that the index increased every year the Democrats controlled the House and did not begin to decline until the Republicans returned to control. You also failed to mention that it was 95 during the first 6 years of the Bush administrations and it was 71.3 the last year the Republicans controlled the House 2006. It then doubled under the Democrats to 155.5 by 2010 as you note.

Thanks for playing.

Anon –

Thanks for the Fed reserves article. I know enough to know I really don’t understand the whole reserves issue well, but I appreciate that it is important.

pgl

don’t ever link Krugman. He is a newspaper salesman and nobody with a brain takes him seriously.

Anonymous: So, for your benefit, here’s a great article which lays out the origins of the shutdown.

pgl:

Don’t pay any attention to idiots whose only claim to prominence is posting statements that reveal their ignorance!

Anonymous, I could not agree with you more…

I will give Dr Krugman credit for one thing, he loves cats so we both enjoy cateconomics..

Regarding this index, is this something that should be published in PsychologyToday.com?

Robert – thanks. But onto Ricardo’s latest (clearly scientific and nonpartisan) reply to Menzie (5:43 am). I see he hasn’t taken this “analysis” back to Bush’s first term in office. When of course the funny little index spiked twice. It is indeed a very strange index so I’m not taking any inferences from it to the actual effects of Bush’s economic policies.

rick stryker,

of course there is volatility in the daily index-you think you gain insight by noting this is in response to daily news. and obviously the average gives a better overall indication of higher vs lower volatility over larger temporal spaces.

but you should acknowledge the first large spike was due to lehman, and the continued high elevation of the index was due to the deepest part of the financial crisis, and the recession which resulted FROM the financial crisis. additional spikes have come from debt limit and fiscal crises created by intransigent republicans.

rick stryker, if you cannot acknowledge these items there are your three strikes, take a seat once again. recent drop in the index is due to a very slow but positive recovery over the past six + months. obviously it will spike if we do not extend the CR and debt limit.

you state the index has been elevated in the obama years, but it would be disingenuous to imply it was high because of obama. i am sure your statement did not mean to imply this.

PGL,

You can always find “spikes” that are anomalies in any data. That is why I used yearly averages (Menzie did the same BTW). But I did include the “spikes” in my average of the 6 years of the Bush administration.

Stryker is baffling,

I’m not trying to imply that the uncertainty index is high because of the policies of the Administration. I’d like to state very clearly that the index has been high because of the Administration’s policies.

The Administration, their media allies, and fellow travelers such as Menzie are doing their best to blame the Republicans for the current situation. But to understand how we got to this point, we need to review some history.

Back in the glory days when the President had both houses of Congress, the Democrats decided not to let “a good crisis go to waste” and ram through legislation that they always wanted to get. This was very big legislation–stimulus, regulation, and health care. And yet they did not want to do it on a bipartisan basis. They felt the crisis was their opportunity to get what they wanted, and they intended to freeze the Republicans out.

Despite enormous opposition from Republicans and the public, the President and his allies in Congress pushed through a very significant health care bill, while ignoring the wishes of half the electorate. Opposition became so serious that the bluest of states, Massachusetts, surprisingly sent to the Senate a Republican whose campaign promise was that he’d vote against Obamacare. Rather than let that happen and negotiate with Republicans, the Democrats agreed to pass the Senate bill without going to conference.

Think about this for a minute. To avoid including Republican views, the Democrats were willing to pass a bill that nobody in the Democratic party intended to pass. The senate bill was filled with all kinds of features inserted by Senators for political reasons, features that they expected to remove in conference. But they passed it anyway, saying they would fix it later.

But then the Democrats faced the judgment of the voters and lost the House. But they still had the bill with all of its problems. The responsible course would be to accept the verdict of the voters and open the bill back up to be fixed. However, that would mean including Republicans, something that they were unwilling to do. They decided instead to just drag the dead carcass of Obamacare across the finish line.

That brings us to the present. One big problem (among many others)Obamacare has is that it didn’t really plan for the burden it would impose on businesses, who bitterly complained. In a nation of laws, the proper thing to do is to go back to Congress to have the law amended. But that would mean having to compromise and accept something like a delay for everyone, not for business. Amazingly, the Administration decided to act illegally and just assert that they would not enforce this part of the law. In fact, the former constitutional law professor in his press conference asserted that he decided not enforce the business provision until 2015 because he consulted with business and because the political situation in Congress is not “normal.” He claims that he has the authority to decide what parts of the law he will enforce.

Except the President doesn’t have the authority to decide what parts of the law to enforce. This is blatantly unconstitutional.

Similarly, the Senate version of Obamacare had a section that required Congress and its staff to join the exchanges. But no one bothered to put the health care subsidies into the bill that they already receive since they intended to fix it in conference. Except they didn’t. Now, when Congress and its staff started howling that Congressional staff will quit, the Administration directed the OPM to pay the subsidy, even though in a nation of laws they should have gone back to Congress. They didn’t because that would have required negotiating with the Republicans.

Is it any wonder that the Republicans are reacting the way they are? The administration denied them their constitutional role by illegally keeping Obamacare out of the democratic process.

This is enormously bad policy. To avoid bipartisan compromise, the Administration is defending and implementing a law that they did not intend to pass. And it’s not just health care. The administration and its Congressional allies also rammed through very rapidly without proper study or consideration substantial regulatory legislation with no bipartisan support. The very high uncertainty index is just reflecting the consequences of all that.

The administration and their allies in Congress are the ones truly responsible for the government shutdown. Blaming the Republicans when you look at the history is the classic blame the victim strategy. Ricardo and tj are right that the Democrats are exploiting the shutdown and trying to make it worse in order to get away with their illegal actions on Obamacare. I’d just add this outrageous statement of Harry Reid to their list.

Asked why he won’t support a Republican bill to fund NIH during the shutdown so that children stricken with cancer can get their medicine, Reid says, shockingly enough: “Why should I do that? I have 1100 people from Nellis Air Force base sitting home. They have their problems too.” Watch the video if you want to understand what’s really going on with this shutdown and who’s really at fault.

Rick Stryker,

You just created a long rambling response full of bogus claims in an effort to rewrite history! that is why people do not take you seriously! obamacare was passed, legally, as a law by the Congress and signed by the President. you cannot handle the truth.

the only unpatriotic actitivy occuring is a group of terroristic republicans want to blow up the government because they cannot legally change a law which they dislike. actually that behavior borders on treasonous.

you want to see government work? put forth a clean CR bill and see if it passes. put forth a clean increase in the debt limit and see if it passes. i bet they both pass, and in bipartisan fashion. if you deny this, you don’t live in reality.

you need to quit living in conservative talk radio bubbles and see the rest of the world. obamacare is being embraced across the country. it truly is baffling why people like you fight sooooo hard to make sure the unemployed, underemployed and poor cannot gain access to some of the greatest healthcare in the world. why are you so mean to the underprivilaged? spoiled brat! not only is that strike three, you should be ejected from the game!

One way to use this index below:

http://seekingalpha.com/article/1726852-shutdown-2013-quantifying-political-risk