(Updated with thoughts on “The Food Stamp President”)

From CBPP (10/24):

The 2009 Recovery Act’s temporary boost in Supplemental Nutrition Assistance Program (SNAP) benefits ends on November 1, 2013, which will mean a benefit cut for each of the nearly 48 million SNAP recipients — 87 percent of whom live in households with children, seniors, or people with disabilities.

The November 1 benefit cut will be substantial. A household of three, such as a mother with two children, will lose $29 a month — a total of $319 for November 2013 through September 2014, the remaining 11 months of fiscal year 2014. (See Figure 1.) The cut is equivalent to about 16 meals a month for a family of three …

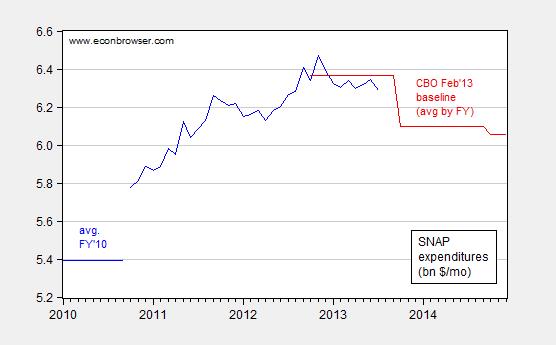

What are ramifications for expenditures? Figure 1 shows the evolution from 2010 through 2014, including the CBO’s February 2013 baseline.

Figure 1: SNAP expenditures for benefits, in billions of dollars per month, average for FY 2010 (blue), and fY2011- July 2013 (blue), and February 2013 CBO baseline (red). Source: USDA USDA, and CBO.

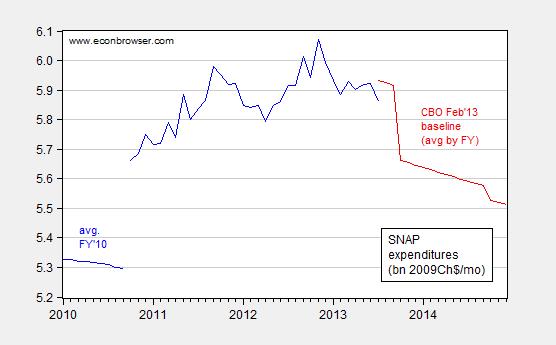

Note that the impending drop is pretty steep. It is even steeper after accounting for inflation, as in Figure 2.

Figure 2: SNAP expenditures for benefits, in billions of Chained 2009 dollars per month, average for FY 2010 (blue), and fY2011- July 2013 (blue), and February 2013 CBO baseline (red). Deflation calculated using PCE deflator; assumes 1.7% annual inflation from 2014M08 onward (1.7% is 2014 PCE inflation in the CBO February 2013 Budget and Economic Outlook). Source: USDA, USDA, CBO, and BEA via FRED.

The House is seeking to cut an additional $40 billion over the next ten years, while the Senate is seeking only $4.5 billion in cuts. [1]

What are the macro implications? From the Wall Street Journal:

Retailers and grocers are bracing for another drain on consumer spending when a temporary boost in food-stamp benefits expires Friday.

The change will leave 48 million Americans with an estimated $16 billion less to spend over the next three years and comes just months after the expiration of a payroll tax cut knocked 2% off consumers’ monthly paychecks.

Estimates of the multipliers for SNAP expenditures center around 1.5 [2]. While not a big amount overall, it’s just one more bit of fiscal drag (and a particularly uncharitable one paid for by the lowest income groups). But I guess it’s important to keep tax rates low for the top income quintile at all costs.

Update, 1:14PM, Pacific: Reader Hans writes:

A 5% reduction in spending on a program that is out of control or is it in honor of our Food Stamp President…

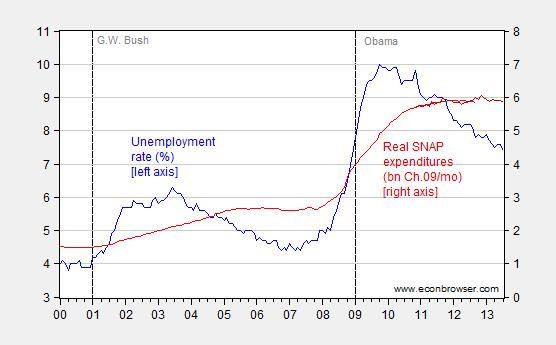

Here are some illuminating statistics for those who are interested in data as opposed to invective. Real food stamp benefit expenditures rose 97.5% from 2001M01-2009M01 (log terms), under President GW Bush. Expenditures since 2009M01 have risen 38.8% through July. These calculations use quadratic match average interpolation of the annual FY data to monthly; I use the PCE deflator to convert to real 2009Ch.$.

From 2001M01-2009M01, real food stamp expenditures rose $2.5 billion per month; from 2009M01 to 2013M07, they rose $1.9 billion per month. In annual terms, these are 29.7 bn Ch.09$ (Bush) vs.22.6 bn Ch.09$ (Obama, through July).

So expenditures rose much more, even with a relatively muted unemployment picture, under G.W. Bush than under Obama.

Here is a plot of the data I used to obtain the numbers cited. All data is freely accessible. If you don’t have an interpolation program, try doing a centered moving average.

Figure 3: Unemployment rate, %, s.a. (blue, left axis), and real SNAP benefit expenditures in bn. Ch.09$ per month (interpolated using quadratic match, red, and actual, dark red, righ axis). Dashed vertical lines at 2001M01, 2009M01. Source: USDA, USDA, BEA and BLS via FRED, and author’s calculations.

I agree, Menzie. If you want more people to be dependent on government, you must not cut the benefits. If you do not want to increase dependency, maybe stop advertising food stamps and adopt policies that get more people working. I am looking forward to the next government shutdown in 2014!

A 5% reduction in spending on a program that is out of control or is it in honor of our Food Stamp President…

Professor Chinn, I propose a new national law, just like the can not be deigned expensive care at your local ER, for the hungry…

If you are truly hungry, (see the declining rates of obesity) just walk into any open and operating restaurant and be seated and demand your free meal!

If you are a card carrying member of the O’Barrocko Club and have a tee shirt worshiping a past socialist revolutionary – you will be entitled to two free desserts…

All food ingredients must be compliant with ObombaCare.

Do not forgoet, Mr Berger, that people should not be forced to work – that is slave labor which the capitalist exploit..

Besides, the masses have a RIGHT to leisure time..

I see a pattern:

Richie Rich: If kids don’t work, they shouldn’t eat. 90 y.o. Granny? Let them eat catfood.

Clever Hans: I don’t care if kids and old folks go hungry. Let’s talk about my fantasy world, instead.

My, it seems to be all troll, only troll in the comments section today. I might ask, “What part of ‘1.5 multiplier’ do you not understand?” but of course I know the answer: no part. Trolls don’t use grocery stores- or eat anything but human flesh, for that matter- so it’s understandable they can’t see the benefit to all the rest of us when the poorest of us- the vast majority of them children, disabled, elderly or working, have a little more money for food. Not being actual workers themselves they don’t see how more customers for grocery stores translates into more jobs at those stores, more car purchases for workers to get to those jobs- etc. etc. – until finally they even add a little change to the trolls’ stockmarket investments. Funny how even old Henry Ford could see this… But then, his head hadn’t exploded from having a Black man become president…

this is a self parody right?

DRACONIAN! This will destroy the economy worse than the sequestor!! Thank god the savings from ObamaCare will boost the spending power of the middle and lower class amounting to a multiplier of roughly 4.83. By 2018 we should have the debt paid off due to this miracle law.

Menzie

I sympathasize with the vast majority enrolled in SNAP who are not defrauding taxpayers.

However, the first line of you post raises a question.

“The 2009 Recovery Act’s temporary boost in Supplemental Nutrition Assistance Program”.

What are your recommendations for ending the temporary boost? Would you make the temporary boost permananent? Or would you gradually unwind it?

Another drag on the economy is associated with all the insured who had their low priced policies cancelled and now have to buy a higher priced Obamacare policy. I don’t think the forecasts of the impact of Obamacare on growth considered millions of Americans paying hundredes to thousands of dollars more per year for insurance. In fact, I know they didn’t factor those people into the forecast, because if they did, Obama would not have been able to claim that “if you like your current policy, you can keep it. Period.”

So, let’s look at some numbers:

SNAP cost $30 bn in 2007, rising to $82 bn for FY 13 (CBO). The number of participants rose from 28 m in 2008 to 47 m in 2013. Average benefit per participant rose from $102 / mo in 2008 to $133 / mo in 2013, an increase of 30% over five years (almost all of it coming in 2009).

At its peak in October 2009, US unemployment reached 10%, or 15 m people in a total labor force of 154 m. The average number of unemployed prior to the recession was about 7 m. In Sept. 2013, the labor force was 155 m, with 11.3 m unemployed for an unemployment rate of 7.2%.

So, unemployment is 4 m above “normal” levels and SNAP is 20 m above normal levels. And SNAP has seen rapid growth in both participants and spending per participant going into the recovery.

CBO does not see enrollment falling very fast in the Feb. baseline document Menzie references above. Participation falls gradually to 34 m in 2023, a solid 40% above the levels considered normal in the years before the recession. And it sees these elevated numbers against a 5.3% unemployment rate in 2023.

How should we characterize this situation? A conservative view would see a program run amok.

An egalitarian view would see that either i) government policies have virtually obliterated the lower middle class; or ii) some greater forces are in play, and no one really knows what those are, but essentially the US is permanently crippled, and therefore structural dependency is fundamentally unavoidable. In such a case, clearly a 3% budget deficit is not sustainable, and pulling the 90% debt-to-GDP ratio back to reasonable levels is going to be brutally hard.

The implication is thus that the US must acclimate itself to being a high tax, low growth country with really no future to speak of.

And if you understand this, then you can understand why the Tea Party is prepared to fight an all-out campaign for a more dynamic and optimistic future.

Rich and Hans,

why don’t you go down to your nearest homeless shelter and tell those kids the reason they have no food for dinner tonight is their parents are deadbeats, and to teach them a lesson in responsibility, their kids are going to have to go hungry tonight.

Does anyone have a breakdown of who receives food stamps?

Not just by age and sex but by obesity rates, smoking rates, % of high school drop-outs, etc.?

We all have our prejudices – yes, even the sensitive little mimsy liberals. But what are the facts?

tj,

is it possible those low cost policies were quite limited in their coverage? that is why they were not grandfathered into the new health care laws to begin with. it is quite possible people had significant out of pocket expenses for uncovered procedures. so now they may have a policy that actually covers those procedures. will the higher premium offset the previously high out of pocket expense for the uncovered items? or perhaps long term, people will now get preventive treatment which reduce long term costs-treatment which was unavailable under their previous plan? don’t let your ideology blind you to possibilities other than your worst case obamacare scenarios.

Thank you, Steve Kopits! You are wise and honest.

Another – more brutal – way of looking at the multiplier argument is to do a thought experiment.

What if through some magic the 47-48 million on food stamps disappeared?

Would the rest of society be a) better off through keeping and spending their own money b) worse off because of reduced spending by food stamp recipients or c) it is impossible to know.

Would the right answer change if there were 100 million on food stamps? Or 10 million? What policy would point us towards 10 million? Would more spending on food stamps be likely to achieve this?

c Thomson (7:54AM): Here’s some information on distribution of SNAP: From CBPP:

From CBPP:

I think you are all missing the point. Menzie has stated without reservation that he wants every person in the United States to be on the SNAP program. You are all looking at this as afordability or economically sound or other such nonsense. When a person is on a mission none of that matters. It is not a question of whether a person can afford a Big Mac or not. It is a question of the government using tax dollars to buy everyone a Big Mac. And it is not ever if the person wants a Big Mac or not. The government knows what is best for you and so you will eat what they tell you to eat. Afterall aren’t they paying for it? Oh, we are….Never mind!

Professor Chinn, no one questions that food stamp recipients are poor. The issue under discussion relates to the future and why they are poor.

Are food stamps in effect a subsidy for breeding economic and social inadequates? If so, is this a wise long term policy? If not, what can be done instead?

Should receiving food stamps be linked to workfare? Training? But what kind of training if the recipients are largely high school drop-outs/obese/in ill-health/mentally challenged? That is the breakdown that is needed.

As a Vietnam vet, I don’t see the point of the veteran stat – used as a sop to the right. So what? The army sucks up all kinds by the millions.

@ Baffling – I’m very far from this discussion (Brazil), and I agree that everyone should have access to healthcare, and the way to do this is with other (healthier, wealthier) people paying for it. With that said, tj has a point, there’s no way that Obamacare won’t hit aggregated demand, at least in the short term.

tj: The hike in SNAP was temporary (with a trigger rather than an end-date) in the sense that max amounts were fixed rather than inflation adjusted, and the normal inflation adjusted SNAP benefit formula would overtake and pass those values given a little time. Inflation has been lower than expected primarily because growth is poor. The sunset date has been advanced to an earlier fixed date twice as part of budget gimmicks.

c thomson nails it. No one denies that there are poor people suffering who need our help. But we need to ask ourselves whether these policies have a positive long-term impact or whether they just encourage government dependence, and we need to figure out why so many people fall into the trap of dependency in the first place. What are we doing to help people grow and become self-sufficient? Give a man a fish, he eats for a day; teach a man to fish, he eats for the rest of his life. Give a man a food stamp, he eats today. Give a man the skills to become employed and earn a living, he is better off for life.

If it’s true that, as Menzie claims, ‘A household of three, such as a mother with two children, will lose $29 a month….’

Then, since this is a 5% reduction in benefits, that family is currently receiving in SNAP, $580 per month, and will have to get by with $551 after Nov. 1. Is that anything to get hot and bothered by?

And, as for the ‘macro implications’;

‘The change will leave 48 million Americans with an estimated $16 billion less to spend over the next three years….’

That means that another 260 million Americans will have the same $16 billion to spend–or their elected representatives will.

c Thomson –

I may be a bit more sympathetic to Menzie’s point than you might imagine. I can see how incredibly strained our household budget is, and we’re pretty close to the top of the pyramid. The reality is that costs have continued to rise faster than wages–and these can only be impacting those less fortunate more severely.

Having said that, if Menzie’s view is of a permanently dysfunctional country, a kind of economic wasteland, then we really need to discuss where we are on the matter. These are not questions of individual policy, but rather deeper issues reflecting very, very dark views about the future.

Does Menzie really believe that the US can never return to 20 m people on SNAP–or can’t until well into the next decade? How does that pair with his GDP outlook? What’s keeping the economy down? Or is all this dysfunction the result of a heaping of egalitarian policies, from SNAP, to disability, to healthcare policy, which together are bringing Eurosclerosis to the US?

Would Menzie not prefer 3% GDP growth and 0% deficit growth, even if it meant reducing SNAP? Would he be willing to pay for that? I would.

“Estimates of the multipliers for SNAP expenditures center around 1.5” (with a reference to a USDA pub that seemingly supports this, and of course, no self-interested bias there…).

If the multiplier is really 1.5 (and the Federal Governmnet never lies, right?), then let us put ALL of us, all 300 million of us in the good old United States on SNAP. Imagine what that would do to GDP, it would grow by leaps and bounds, even well beyond the Keynesians’ wildest imagination. Thus, let’s do it. Because, apparently, this is the Economics that is being taught in some of the best centers of Economic Thinking in the world. And thus, they must be right.

“What if through some magic the 47-48 million on food stamps disappeared?” This is offered as one’s person’s thought experiment, but it seems to run through many comments as a deeper wish repressed with varying degrees of success.

many of you have great solutions for making the poor productive members of society. have any of you ever lived in the poorest neighborhoods? or even visited without racing through with locked doors? opportunities simply do not exist in those neighborhoods. when you are down on your luck, you may be able to give a call to a friend in high places for help. these folks have no high places. and redeveloping those areas rarely work out for the folks that were displaced-they cannot afford to live in the redeveloped areas.

some of you have commented on how we can use private-public partnerships to incentivize the redevelopment of some of these neighborhoods-especially ones on desirable land. it works great for the wealthy who move in-but i have not seen much benefit to the poor who become displaced from those areas.

Stephen,

If 21 million of the current 48 million people on food stamps are kids, then it wouldn’t seem likely we’ll be at 20 million people on food stamps anytime soon.

The unemployment rate is still 2.5% above where it was five years ago. We have 4 million less employed people in the US than we did in 2008, despite adding 13 million people to the population.

You ask, rhetorically, what is keeping the economy down and speculate that social welfare policies are slowing growth. I would argue that the distribution of wealth in this country is causing a lack of demand. When the top 1% have >40% of the wealth and the bottom 80% have about 7% of the wealth, a consumer driven economy is going to suffer.

Uber –

Here’s an alternative explanation, from the HLDI

“…there was an inverse relationship between the growing unemployment spread and the falling ratio of teen drivers to prime-age drivers. Population changes and changes in state licensing ages contributed somewhat to the decline in the teen driver ratio, but HLDI analysts estimated that 79 percent of it was connected with the increasing unemployment spread. A majority of states had graduated licensing laws in place before 2006, so most of the laws’ impact on teen driving rates would have been felt earlier.”

[My bold]

It’s a chronic shortage of oil, in essence.

http://www.iihs.org/iihs/news/desktopnews/drop-in-teen-driving-tracks-with-teen-unemployment-hldi-study-finds

I am not sure that the data particularly supports your thesis, Uber.

The last time the middle class saw real progress in the US was under the second half of the Clinton administration, where Fed spending was brought down to 18.5% of GDP and the budget was in surplus.

I suspect, but do not know, that budget deficits are linked to income stagnation and inequality.

I do, however, think that oil is primarily responsible for the current malaise, just as it was after 1979. And I think we need to address that.

Further, I personally do not believe a long-term model where 1 in every 6 citizens is on food stamps is viable. If that’s your social model, you’re screwed.

I also believe that the only real reserves the economy has today are to be found in government spending. And you won’t access that if you don’t align incentives. Period.

Hans: Food Stamp President? Real food stamp benefit expenditures rose 97.5% from 2001M01-2009M01 (log terms), under President GW Bush. Expenditures since 2009M01 have risen 38.8% through July. Calculations use quadratic match average interpolation.

From 2001M01-2009M01, real food stamp expenditures rose $2.5 billion per month; from 2009M01 to 2013M07, they rose $1.9 billion per month.

I find it astonishing the people who are all for cutting food aid expose their total inhumanity so openly. They either have zero first hand knowledge of the straights of the people who depend on food aid or they really don’t give a damn. Then like Ricardo they make absurd accusations that Chinn wants everyone top be on food aid. What ignorance!

How can we justify giving food to people in the United States making over $11,000 per year when 77% of the people in Ethiopia live on less than $2 per day? There is something strange when we feel remorse for people who are rich by international standards but ignore the starving. And Menzie even wants to feed the rich in the United States.

The increases under Bush and Obama were largely similar in percentage terms, but twice as large in dollar and headcount terms for Obama.

From 1999 (last Clinton year) to 2008 (last Bush year), participation increased by 55% and benefits per person by 41%. Total cost increased by 119% or $19 bn in dollar terms.

Under Obama, from 2008 (last year of Bush) until 2012 (last full year), participation increased by 65%, per capita benefits by 31%, and overall cost by 115% or $40 bn in dollar terms.

I would agree that the increase under Bush was fairly scandalous–there is a reason the Tea Party exists, after all. However, in dollar terms, the increase under Obama was twice as large. Further, the rate of increase under Obama in per capita benefits was 6.9%, versus 4.4% under Bush. And the absolute number of participants grew by 10 million under Bush in eight years, and 18.4 million under Obama in four years.

If President Obama feels that the program is out of hand and running counter to his wishes, he has only to mention the fact to win the support of Congressional Republicans.

Steven Kopits: First of all, shouldn’t we be comparing in real terms (and I’m not even controlling for the size of the population)? Second, when considering the increases, isn’t context important? Unemployment for instance has been higher since 2009M01, as compared to the preceding eight year period. Be that as it may, my calculations are still correct — in real dollar terms, expenditures rose more under G.W. Bush than under Obama. Figure 3 illustrates these points.

Somehow, the argument has been framed in such a way that you are unfeeling if, after an increase of over 135% [97.5% x 1.388] in the food stamp program since the beginning of George Bush’s 1st term, you consider the program to be somewhat out of control.

I’m sure that inflation has somewhat eaten into the value of that increase and the number of people out of work or underemployed has increase dramatically in the past 5 years. The question is: what is the plan to fix the underlying problem? That’s the point Steven Koptis is making, I believe.

If you believe that President Obama’s policies are placing the country on the right track after 5 years of less-than-mediocre performance, then when is the right time to budget a cutback in food subsidies? Never?

Just out of curiosity, does any of the funds go to non-citizens [I can’t officially ask if they go to illegal aliens because that is not politically correct]? If so, has that been a recent development?

Steven Kopits says that he can understand and sympathize with those needing programs like SNAP; and unlike a lot of others here, I think he’s sincere and I take him at his word. He also points out (quite correctly) that the middle class hasn’t really seen economic gains since the Clinton years. But I don’t think the reason is oil. The problem is that virtually all of the GDP gains since the Great Recession have gone to those at the very top of the income ladder. Unless we find a way to reverse the long run trend of growing income inequality I’m afraid the number of people needing SNAP, Medicaid and unemployment benefits will continue to grow even when the economy gets back to full employment. If you’re a conservative who is worried about people becoming slackers and dependent on the government dole, then you better start worrying about income inequality as well. Fix income inequality and you’ll fix the reasons programs like SNAP will continue to grow.

“Fix income inequality…” How? Inequality has increased all over the industrial world – even in countries with much more progressive tax systems -so the traditional mantra of ‘tax the rich’ makes little sense.

The point of such tax increases is just to make our liberals feel good – about themselves. ‘Look, we are doing something.’ Whee. Color me compassionate.

Surely a real answer would involve massive social changes, especially in the US, with its second rate high schools, still high levels of teen pregnancy and a massive % of minority high school drop-outs.

Oh and we might need to reverse globalization.

Throw in some system of bribing socially and economically inadequate women only to have one child and we might get somewhere.

The sad and unpalatable truth is that we are overproducing people who need a roaring boom to be even marginally employable.

John B. Taylor has a view of “income inequality” that might be of interest to open minds.

http://www.hoover.org/news/daily-report/156136

baffled

Regarding 2 points from your comments above-

1. I agree, there were lousy policies that needed to be cancelled. My point is that the government has no right to tell someone they can’t rely on a catastrophic policy in which they pay out of pocket for the first $10,000 of medical expense and then insurance kicks in after that. You want to lump every non-obamacare compliant policy as garbage. That’s not true. Very few existing policies are obamacare compliant (by design), but many of those policies meet the needs of the individual policy holder for a price the individual can afford. If people can’t afford a cheap crappy policy, how are they going to afford a more expensive Obamacare alternative?

Do you think Obama actually believed it when he said “if you like your policy, you can keep it. Period.” ?

2. I can tell by your comments regarding public private partnerships you didn’t look at East Lake. People were temporarily relocated then brought back to a nice neighborhood with new homes where subsidized housing exists in the same neighborhood as nonsubsidized housing. Your ideology won’t permit you to allow an investor to earn a profit even when it makes the poor better off.

2slugs

I couldn’t agree more with you that everyone needs to wake up to the fact that there is a growing fraction of society that is socially/economically partitioned from the path to prosperity or an acceptable standard of living.

If solutions are not found in the near future, a charismatic leader will unite the inner city poverty-stricken and they will march on the suburbs.

The Democrats/Progressive solution of transfers is no solution at all. Progressives don’t understand the difference between “relief” and “development”.

Democrats/Progressives focus on what people lack and then throw money and relief at the problem. Democrat/Progressive policies do not provide opportunities.

A better solution is to assess and develop the human and physical assets in place in order to create opportunities for personal and economic growth.

Slugs, I agree income inequality is an issue. How to solve it is probably where we differ. Raising taxes on the wealthy to give to the poor is the obvious solution, but is it the best? Just like with so many other societal ills, we need to ask the tough questions. Why are there so many poor people? We spend much more on education than we did several decades ago, yet students are certainly no smarter and arguably less prepared. So what is even more money going to to do? How do we prepare young people to become independent adults? Is it today’s culture to blame? What is it? But just taking more money from the wealthy doesn’t seem like a real solution to me.

Here in Brazil we have a progarm called “Bolsa Família”. If the per capita income of your family is less than X, the goverment will give you money. It did wonderful things in hour society, specially in the beggining (our North and Northeast regions are really poor). But, after 10 years, the situation of this population didn’t improve a thing, except for the money of “Bolsa Familia”. No improvement in human or physical capital, because those are long term policies, that don’t get anyone elected (google it).

My point is: those programs can be good things, but you have to have another plan for this population from the start (education, is always education), or it will end really bad.

An FYI, in regards to the earlier posts about policy uncertainty, there is a paper out you may know about:

“The Impact of Policy Uncertainty on U.S. Employment: Industry Evidence” by J. Christina Wang for the Boston Fed.

Abstract: “The anemic pace of the recovery of the U.S. economy from the Great Recession has frequently been blamed on heightened uncertainty, much of which concerns the nation’s fiscal policy. Intuition suggests that increased policy uncertainty likely has different impacts on different industries, to the extent that industries differ in their exposure to government policies. This study utilizes industry data to explore whether policy uncertainty indeed affects the dynamics of employment, and particularly its impact on industry employment, during this recovery. This analysis focuses on heterogeneity across industries in terms of the fraction of their product demand that can ultimately be attributed to federal government expenditures. The estimation results reveal that policy uncertainty indeed retards employment growth more in industries that rely more heavily on federal government demand: the growth rate of employment in these industries appears to have been four-tenths of a percentage point lower during the quarters in recent years when policy uncertainty spiked.”

BTW, one benefit of cutting food stamps is that the vast number of white Americans – who receive the majority of food stamps – will be impacted. These people, interestingly, tend to live in more rural areas (because in cities there is more diversity so you see whites and other races on food stamps) and vote for the GOP. In fact, one of the most GOP counties is in E. Kentucky, is basically all white and is over half on food stamps.

I sometimes wonder about the political dynamic. Let them cut it and then, with no black man running for President, remind white voters that this is what happened.

Mr Sullivan, well stated…

Professor Chinn, this program has gone out of control under BarrockoBush and needs to reined in…Thank you for the added information..

A masterly post, Mr Kopits! Chuck full of nuts!

Mr Hurley, this is for you.

“Historically, the food stamp program was limited to persons with both low incomes and limited liquid assets. Individuals with more than $2,000 in liquid assets could not receive assistance; households were expected to use their own assets to support themselves before turning to taxpayer-funded welfare.[14] After 2000, an increasing number of states chose to use the new broad-based categorical eligibility loophole to eliminate asset limits for food stamp recipients and greatly expand their food stamp caseloads.”

“In states using this loophole, a middle-class family with one earner who becomes unemployed for one or two months can receive $668 per month in food stamps even if the family has $20,000 in cash sitting in the bank. Because of this, food stamps has been transformed from a program for the truly needy to a routine bonus payment stacked on top of conventional unemployment benefits.”

http://www.heritage.org/research/reports/2012/07/reforming-the-food-stamp-program

Hans:

Try living on food stamps for a year and get back to me with how it goes. Try actually spending time with those who go to food pantries.

Hansel: Quoting Heritage is a bit like letting off a stink bomb in church. Take a guess at the percentage of Americans with 20K in the bank. The number of them collecting food stamps is vanishingly small. There are good policy reasons for removing asset tests, one of which is the research shows it helps people get OFF food stamps permanently if they don’t get shoved back down every time they make a little progress.

If you really want to cut the bill for food stamps: raise the minimum wage, pass cardcheck, reform the FLSA, and enforce labor law.

tj: only a tiny fraction of people have any clue what their health plan covers. This information asymmetry is used by racketeering insurance companies to fleece folks.

My folks have been in the individual insurance market my entire life, with pre-existing conditions for most of it, waivers for large parts of it, and separate plans due to the pre-existing conditions for much of it. My sister repeatedly handled the annual small group insurance purchase research for the small law firm she worked for until 2007 (she now has gov’t healthcare in Taiwan on a work visa). My grandmother was on Medicare Advantage. My grandfather was on the VA and one brother and his dependents have been on and off between VA and uninsured. Another brother and his wife and 7 kids went on Medicaid when $1M triplets arrived unexpectedly (thank goodness AZ had finally opted in back when my brother was 22 or so). I’ve had various HMO’s and PPO’s over the past 15 years as employer coverage/contributions steadily declined at my multi-billion dollar corp (still better’n avg, if less than half as good as when I made 1/3rd as much). My mother has been primary caregiver (solely out of the goodness of her heart) for several elderly neighbors who eventually ended up in nursing homes paid by Medicaid after asset exhaustion. A close friend, and one time employee, worked overseas in 3rd world countries and was often unable to obtain individual coverage for extended periods on return to the states (residence in Africa is a pre-existing condition). My brother-in-law works in IT with an 18 month typical tenure per project, and has used COBRA repeatedly (he has had several brain surgeries and has continuing related health issues, individual market was never an option).

My family are a bunch of wonky geeks who actually talk about this sort of thing. The average American is not equipped to match wits with the insurance companies to determine ahead of time what fine print pitfalls the companies have littered their policies with in the absence of a statutory minimum coverage. Under-insurance continues to be a prime cause of death and bankruptcy.

P.S. If some expenditures are shifted from imported consumer goods to domestic healthcare, that is unlikely to be contractionary mechanically.

Ricardo: False dichotomy. Spending on food stamps doesn’t preclude foreign aid. I’d happily spend dollars on food and ag aid instead of bombs.

Kopits: I hear you. I still say contributory but not causative, yet. Here’s the first cause.

http://delong.typepad.com/sdj/2013/10/why-are-we-doing-this-fiscal-policy-edition.html

The utter hatred for the poor expressed in the comments here are rather amazing.

And it is just that – hate The Tea Party is all about hate.

The irony, of course, is that cutting food stamps will make everyone poorer – but that is no matter. It is all about heaping scorn on the poor.

We are in the fifth year of slow growth caused by a Wall Street collapse. In that fifth year the cause is forgotten.

So people on the right attack the poor as lazy and shiftless, and point the finger at the government for slow growth. They utter nonsensical stuff like liberals want to get people to depend on the government – an insulting charge of their own invention. It is in fact an outright lie.

I have never heard a liberal say that – and in fact, I will repeat, it is a complete and utter lie made up by people like Steve Kopits in the hope that if they repeat it enough that it will become the truth. It is why I don’t respect people like Steve or the Tea Party types – they simply are incapable of addressing anything without seeing a hidden conspiracy on the left.

robert hurley,

Someone living on only food stamds has been done in at least two instances that I know of. One was done by a Progressive newsman. He complained that he had to stop buying at some of his favorite stores (Whole Foods) and he could not buy his favorite foods. He complained that he had to suffer.

The other instance was done by a more conservative journalist. He found that by buying at a regular chain grocery store he actually could eat quite well including desserts. He actually found that he sometimes had stamps left over.

If you eat brie and lobster you are right, food stamps are not for you.

I was listening to a radio commercial by an investment firm this morning as I was getting dressed for work and heard the pitch that people in Washington DC were working hard to cut Social Security while spending on food stampds was sky-rocketing, so everyone needed his services.

Now that pitch is correct that there are forces working to cut Social Security, Bill Clinton was the first to tax Social Security benefits. Additionally we all know that the Democrat health care bill made massive cuts to Medicare. So I asked myself, why would Progressives fight to cuts these programs while working overtime and handing our incentives to expand SNAP? That is when I realized that those on Social Security and Medicare are already trapped by the Progressive system and already controlled under the thumb of the federal government bureaucracy. The SNAP program was already feeding the poor before the massive increases under George Bush. So the massive expansion of the Bush-Obama years was bringing on those who are not poor, the lower middle-class and the middle-class.

Realizing this helped me understand why Menzie wants all Americans on the SNAP program. Those who know the hierarchy of need know that humans need, food, warmth and shelter so these are the areas the Progressives want to control. So expanding the SNAP program is a natural goal of Progressives in subduing the population. If the government controls all your needs for life then they control you.

The modern miracle cures that have been created by the free market have now added health care to the hiearchy of needs. So if you are a Tea Party member the IRS will not only deny you tax exemption, they will deny you health care and by extension the rest of the bureaucracy will deny you food. Remember that the government cannot provide you with anything. They can only take from you and deny you goods and services.

The USDA’s most direct measures of child hunger show that around 1 percent of families with children have a child who experienced hunger (skipping meals or not eating for a whole day) at least one day in the last 12 months. This is a far cry from “1 in 5” children going to bed hungry we hear regularly in the media. The USDA’s figures for an incidence of child hunger on an average day show that one tenth of 1 percent of children were hungry on an average day. This adds up to two hungry children per ZIP code.

Adult hunger should be higher than child hunger because USDA studies show children are given preference when food is low. The USDA finds, however, that on an average daily basis, one quarter of one percent of all adults do not eat for a whole day due to lack of money. That is 2 1/2 per thousand.

Congress should be aware of the true hunger statistics, both for children and adults, as it continues to debate the farm bill in the House, which calls for a 3 percent reduction in spending on food stamps. Not 1 in 5 children go to bed hungry on a given day. It is more like 1 in a thousand. With public expenditures of more than $3,000 per purported hungry child, I suspect that cases of child hunger are due to parental irresponsibility rather than lack of public funds.

— Paul Roderick Gregory, Cullen Distinguished Professor of Economics at the University of Houston

Menzie –

You can pick you starts and stops as you like. I wasn’t able to find the monthly data quickly, so I used annual.

If you’re looking to me to defend the growth of SNAP under Bush, you’re looking to the wrong guy.

However, Obama has had every chance to curtail SNAP since Feb. 2009. He hasn’t done so, and has not proposed to do so to the best of my knowledge. Hence, we are led to conclude that he at least condones (but again, maybe none of his subordinates told him!) the current SNAP spend.

Slice it or dice it, SNAP roles have increased by 20 m since Obama took office, and spending has doubled. These are big numbers, either way you look at it. And they all occurred in what is ostensibly a recovery. On the face of it, do I think the program could do with a pruning? Yes.

But I think there are bigger issues here, Menzie. If you take a constrained oil perspective, it’s not clear that the OECD economies materially recover earlier growth trends. Maybe Statoil is right, and 1.5% OECD growth is all we can hope for in the next 30 years. If so, where does that leave us? I tend to think in spreadsheets, so SNAP to me is one outlay in a broader macro model. I am less worried about SNAP than the bigger picture it implies.

On the other hand, if I take the CBO numbers at face value, then 2023 SNAP participation should be around 20 m, not 34 m. The spend is 40% too high.

Slugs –

It’s oil alright. Everyone is running regressions, but a simple analysis will point the finger right at oil supply. If you want the presentation, drop me a line and I’ll send you the one I made at the Woodrow Wilson School last week. I’ll be making broadly the same presentation at Columbia’s School for International Affairs in early December, for those interested in the New York area.

And by the way, the oil majors are doing terribly, another really lousy quarter. The numbers are coming in right on our model. I’ll have a shorter bit on this on Platts Barrel blog, maybe next week.

Menzie –

I think Fig. 3 perfectly illustrates fiscal conservatives concerns about SNAP.

Note that after the after the 2001 recession, SNAP elevates and never declines thereafter. Note the same after the 2008/9 recession, SNAP elevates and never declines, even though unemployment is falling.

That’s exactly the point that program critics are making, that SNAP rapidly converts from being an economic adjustment program to permanent entitlement program.

I have some good news: Charitable contributions grew y/y at a nominal rate of 3.9% for 2012 to 316 $b according to Giving USA. They are not sure about 2013 since there was a threat in the tax plan to cap deductions during the fiscal cliff negotiations. They still think it will take a while to get back to 2007 levels. Its amazing how generous Americans are on their on volition! But I know that will never be enough so I see that we need to continue with or increase the mandatory “donations” via Giving IRS. Its my favorite charity because I know that all my donations go to the truly needy and there is almost no overhead or waste.

Mr Hurley, I use to take a friend to one and have seen the deluxe vehicles enter the parking lot, while I a tax slave must work and can only offered a 16 old vehicle..

The same types of events for those seeking subsidized housing, pulling in with fine rides..

BTW, Mr Hurley, are you on stamps or anyone you know?

Your defense mainly consist of Pathos to justify another vast entitlement program for your

friends. This ME-ME generation just sticks out it’s hand or into other’s pockets and takes what it wants…No accountability from them or supporters like you..No give back, hell just take it..

Why don’t you actually do something to helf them, other than robbing your neighbors…How about the Robert Hurley Food Justice Outlet…If it works we will all pitch in…

Try to remember, many of us are barely making it ourselves, under ObombaFest…

What I am afraid of is that it is NEVER enough!

Tell me, Mr Hurley, when it is enough! My pockets are developing holes already and soon no one will get anything..

But I really doubt you care about struggling people such as myself, since we will not vote for you nor support your social justice ministry…

You ax nothing from the recipient and everything from the tax slave…

Shame, shame on this type of moral and ethical thinking…Shame on all of you…Highwaymen..

$4B a year versus, well, looking at Wikipedia, I see that in FY2010, actual defense spending (DoD) was $994B disbursed. That’s the actual budget plus overseas contingencies plus other stuff they spent that I’m not going to dig into. It doesn’t include Homeland Security (maybe $40B then) or Veterans Affairs (maybe $60B) then.

Regarding oil constraints & oil prices . . .

Peak to Trough Annual Brent Crude Oil Prices, 1997 to 2013

Focusing on the rates of change in trough prices:

1997: $19

1998: $13

2000: $29

2001: $24 (1998 to 2001 rate of change: +20%/year)

2008: $97

2009: $62 (2001 to 2009 rate of change: +12%/year)

2012: $112

2013: $108 (Est. price)

The 1998 to 2009 overall 11 year rate of change in trough prices was 14%/year.

Based on estimated price for 2013, the four year 2009 to 2013 rate of change in the trough price was 14%/year. The long term 15 year 1998 to 2013 rate of change in trough prices would also be 14%/year.

If the (+14%/year rate of change) pattern holds, and we were see a year over year decline in annual Brent crude oil prices in 2017, it would be down to an annual Brent price of about $190 in 2017.

Some recent comments:

Post-2005 Decline in Global and Available Net Exports of oil VS. Rising US Crude Oil Production

GNE/CNI* Vs. Annual Brent Crude Oil Prices for 2002 to 2012:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps5f00c6e5.jpg

GNE/CNI Vs. Total Global Public Debt for 2002 to 2012:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps01758231.jpg

GNE/CNI Decline Extrapolated to 2030:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps9ff3e76d.jpg

*Definitions:

GNE = Combined net oil exports from (2005) Top 33 net oil exporters (total petroleum liquids + other liquids production, EIA)

CNI = Chindia’s Net Imports of oil (EIA)

ANE = Available Net Exports = GNE less CNI

A critically important point to remember is that the post-2005 decline in US oil consumption and the post-2008 strong increase in US crude oil production affected the demand for GNE and ANE, but rising US oil production had no effect on the supply of GNE and ANE.

ANE fell from 41 mbpd (million barrels per day) in 2005 to 35 mbpd in 2012. At the 2005 to 2012 rate of decline in the GNE/CNI ratio, ANE would theoretically approach zero in about 17 years, theoretically leaving zero net oil exports available to about 155 net oil importing countries.

While currently rising US crude oil production has certainly contributed to keeping annual Brent crude oil prices on a plateau of about $110 for three years, something that is not widely understood is that the annual volume of oil lost to declining production from existing wells is almost certainly rising faster than the net increase in production.

Citi Research puts the decline rate from existing US natural gas production at about 24%/year, which would require the industry to replace 100% of current natural gas production in about four years, in order to maintain a constant dry natural gas production rate of about 66 BCF/day.

Since the Shale Gas boom preceded the Shale Oil boom, it’s a plausible assumption that the decline rate from existing US crude oil production is headed in the direction of the current overall decline rate from existing US natural gas production.

Assuming an average production rate of 7.5 mbpd (million barrels per day) for 2013 and assuming a 10%/year decline rate from existing oil production, we would need to replace the productive equivalent of 100% of current US crude oil production over a 10 year period, everything from the Gulf of Mexico to Alaska, in order to maintain 7.5 mbpd.

If we assume that the the decline rate from existing US oil wells increases from about 10%/year in 2013 to 20%/year in 2023 (a more likely scenario in my opinion), we would need about 12 mbpd of new production in 10 years, in order to maintain 7.5 mbpd for 10 years. Under this scenario, the annual volume of oil production lost due to declining production would increase from 0.75 mbpd in 2013 to 1.5 mbpd in 2023.

To put 12 mbpd of new crude oil production on line would require the industry to put the productive equivalent of the peak production rate of 6 North Slopes of Alaska on line in 10 years, or we would need the equivalent of the peak production rate of the North Slope (about 2 mbpd) every 20 months or so.

Of course, in the US we are seeing both an increase in the volume of oil lost to declining production, due to rising production, and an increase in the decline rate from existing production, as a higher percentage of total production comes from tight/shale plays.

For example, if we assume that the decline rate from existing US crude oil production in 2008 was about 5%/year (and 10%/year in 2013), the annual volume of oil lost to declining US oil wells tripled in five years, from about 250,000 bpd in 2008 to about 750,000 bpd in 2013 (as US crude oil production increased from 5.0 mbpd in 2008 to about 7.5 mbpd in 2013).

“I might ask, “What part of ‘1.5 multiplier’ do you not understand?”

The part where is it a made up number.

Clever Hans: I don’t care if kids and old folks go hungry. Let’s talk about my fantasy world, instead.

Posted by: benamery21 at October 31, 2013 05:47 AM

This is such a load of crap. There is a reason poor people most likely to be obese.

Food Stamp President? Real food stamp benefit expenditures rose 97.5% from 2001M01-2009M01 (log terms), under President GW Bush. Expenditures since 2009M01 have risen 38.8% through July. Calculations use quadratic match average interpolation.

From 2001M01-2009M01, real food stamp expenditures rose $2.5 billion per month; from 2009M01 to 2013M07, they rose $1.9 billion per month.

Posted by: menzie chinn at October 31, 2013 01:13 PM

You’re right menzie, we need to cut back to pre-Bush levels.

Steven Kopits,

For some reason Menzie thinks that if Obama expands a bad Bush program it somehow justifies it. I guess he thinks the Bush administration set the goal we should shoot for.

2slugbaits

“The problem is that virtually all of the GDP gains since the Great Recession have gone to those at the very top of the income ladder. Unless we find a way to reverse the long run trend of growing income inequality I’m afraid the number of people needing SNAP, Medicaid and unemployment benefits will continue to grow even when the economy gets back to full employment. ”

The problem you don’t care to acknowledge or are ignorant to is that these gains are occuring due to large govt and the federal reserve. People with wealth can extract more and more from the govt when the govt is large.

you have to have another plan for this population from the start (education, is always education), or it will end really bad.

Posted by: Marco at October 31, 2013 06:01 PM

Marco, this might work in cultures which would cherish and value education, but kids in our inner cities have no interest in school.

Try living on food stamps for a year and get back to me with how it goes. Try actually spending time with those who go to food pantries.

Posted by: robert hurley at October 31, 2013 08:48 PM

What are you even talking about? You use EBT/SNAP at ANY store that takes a credit card. You’re incredibly out of touch.

Posted by: JBH at November 1, 2013 04:31 AM

JBH, never not the best commenter on econbrowser

An excerpt from something I wrote more than six years ago:

The ELP Plan: Economize; localize & produce

http://www.resilience.org/stories/2011-08-08/elp-plan-economize-localize-produce

“This is such a load of crap. There is a reason poor people most likely to be obese.” – Anonymous [Why?]

Many of the poorer in our country eat cheap, carbohydrate-based meals which convert to sugars which are easily converted to fat. They are not “starving” by any means, but they tend to be undernourished and unhealthy… especially prone to diabetes and heart disease.

Of course, pushing salads on their children in schools exacerbates the poor nourishment though it does trim some of the fat.

But that’s another discussion.

The real issue is addressing the structural change in our economy in which corporate taxation and general tax policies and… now… Obamacare… has done to the marginal manufacturing and service jobs which have all but disappeared and which were the stepping stones for many people toward improving their economic situation. Now they are non-productive and an drag on economic growth.

The multiplier calculated in reference [2] is from a model. Models have assumptions. As an example in the reference, if the government spends $5, there is supposedly $9 of economic activity generated. If that same $5 were spent by a private sector entity, is the multiplier any different? If so, why?

“‘The change will leave 48 million Americans with an estimated $16 billion less to spend over the next three years….’ That means that another 260 million Americans will have the same $16 billion to spend–or their elected representatives will.” – Patrick R. Sullivan. I guess Patrick still believes in Say’s Law. I guess he never got the memo about the Great Depression, Lord Keynes’s 1936 book, or the recent Great Recession. Rip van Winkle took a 20 year nap. Patrick must have taken 4 of these!

Anonymous. I am not sure you would get it even if I spelled it out to you.

Hand. Actually, I do try to do something. I am retired as of last year when I turned 73. Now I work with kids in a poor urban neighborhood. Many of them from single parent families. All who have dropped out of school but want to succeed.many of them want to own their own businesses.I see the result of a society that does not understand what is happening and wants to condemn the victims. Those lives can be redeemed but further cuts to assistance will end up by costing society more in the long run.

1)I have seen bodies (at the coroner’s), in the U.S., where the deceased starved to death.

2)I used to deliver food to people in the neighborhood (my mother’s informal program). I have seen pantries which had cat food, where the tenant did not have cats. You start to realize after a while, that they didn’t really buy the cat food ‘by mistake.’

3)Teachers across America report regularly hungry children.

4)You can’t eat a car, or borrow money on one when you owe more than it’s worth. The typical car loan is 5 years or so. The typical new food stamp recipient is off food stamps 8-10 months after qualifying. Also, just because somebody without a car gets a ride to the food bank in a late model vehicle, does not mean they own said vehicle. Lots of poor folks have friends with cars. I know my mother used to routinely take a carload of (typically carless elderly) people from her congregation to access services.

gofx: Lot of middle-class churches getting new AV systems, eh?

USDA statistics show that, even with temporarily increased SNAP benefits, food insecurity in America has been higher since the recession than it was for decades before the recession.

http://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/key-statistics-graphics.aspx

One other thing I notice about Menzie’s analysis is that he calculates the increase rate during Bush based on FY2001-FY2009. Note that FY 2001 budget was proposed by Clinton. Bush didn’t take office until 4 months into the fiscal year. The fiscal year 2009 budget was gamed by the Democratic Congress, which delayed spending bills until Obama got after which they passed the infamous ARRA. That ARRA included a 15% increase in SNAP benefits and an expansion of eligibility, which helped increase SNAP payments from $34.6B in FY08 to 50.4B in FY09 (a 46% increase). So at least part of that increase is on the Dems. After some searching I found the monthly data – for the months after the ARRA increase, the benefits were $28.4B which was an increase of 29% over the first six months, pre-ARRA. So Obama jacked the SNAP program way up and it have never looked back. He went from an annual rate of approximate 44B to the current 74.6B – a 70% increase in 3 fiscal years. Compare the Bush increase from FY02 to FY09 pre-ARRA – $18.3 to $44 – a 240% increase which is 13% per year. Obama is at 19% per year.

For those asking others to try living on SNAP, remember that the program is the Supplemental Nutritional Assistance Program. Note also that this is just one program of many.

Finally, is it just coincidence that the two worst recoveries from economic downturns are the ones where Keynesian economics was most enthusiastically applied? For a theory that is so fervently believed by the left, the evidence for it is on pretty shaky ground.

Berger: Government spending trends during the recovery have been substantially below the trend of other recessions. Austerity is not a Keynesian tenet, and the only thing shaking here is your etch-a-sketch.

This is disgraceful. Revolution is coming, for there is only so much more we can tolerate. What is going to be the spark? Hoping perhaps this would be. But we are ready. Refuse and repudiate this predatory system we’ve morphed into. Start with intentional DEFAULT-EN-MASSE on odious, predatory “debts” – student loans will be the first. Join us. Starve the predators, rebuild from there.

Join the Rebellion, folks.

Ricardo said: I was listening to a radio commercial by an investment firm this morning as I was getting dressed for work…

Ricardo working! Quite possibly the funniest thing I’ve heard all day. Thanks for the laugh.

Rich Berger: Let’s take your most charitable case, using FY2002 to FY2009 change for G.W. Bush, and FY2009 to FY2013 for Obama. The numbers are 28.8 bn Ch.09$ and 21.7 bn Ch.09$, respectively.

In America obesity is one of the symptoms of poverty. Liberals who see the poorest as victims seem to resist looking hard at what the poorest actually do, how they live, and what decisions they make that keep them down at the bottom.

Menzie, what was your point? Doing the math we get Bush: $4.11Bb/Yr Ch.09$

Obama: $5.425Bn/Yr Ch.09$

Chris Hayes invited Jeffrey Sachs to discuss these food stamp cuts on his show last night. Jeff left the macroeconomic implications to Chris and some Democratic Congresswoman and focused on how simple tweeks to the enforcement to the tax code with respect to very high income people (e.g., carried interest exemption) can more than pay for this program. As I was watching this – a friend emailed me a link to a 80 minute film “We’re Not Broke” which noted that simply enforcing our transfer pricing regulations could raise a lot of tax revenues. Republicans in Congress want to say we can’t afford this and other programs that combat poverty because they are the ones who want more tax breaks for the very rich.

A note on the recovery, and why using GDP or the the unemployment rate to measure progress among the 99% is a bad idea.

On GDP: 95% of income gains since the recession have gone to the top 1%. No recovery for the 99%.

http://elsa.berkeley.edu/~saez/saez-UStopincomes-2012.pdf

On unemployment:

For each age cohort above age 55, employment to population ratio has increased since the recession. Translation:Boomers can’t afford to retire. For each age cohort below age 55, employment to population ratio has decreased since the recession began. Translation: There aren’t enough jobs to go around.

I bring up these details because it has become fashionable to blame flat-lining employment to population ratios on demographics. That ain’t it.

In 2006, for 25-54 the 5 year cohorts all had annual labor force participation rates above 80.3%. There were slight drops for 20-24 (74.6%) and 55-59 (72%). There were large drops outside these bounds (down to 57% for 18-19 y.o.’s, and down to 52.5% for 60-64 y.o’s, steepening as you moved younger and older). From 2006 to 2012, labor force participation dropped for all age brackets younger than 55, and increased for all ages 55+. Today only 25-49 have rates of participation over 80%, but 60-64 participation rate increased 5.1% to 55.2% at the same time participation for 18-19 y.o. plummeted 16.1% to 47.8%. The trend gets steeper the farther from 55 y.o. you are. Those 75+ were 18.8% more likely to be in the labor force. Those 16-17 were 32.3% LESS likely to be in the labor force.

Due to increasing participation rates by those who can’t afford to retire, which actually added 0.6 percentage points to the overall labor force participation rate while it declined by 2.5 pp, only 30% of the decline in labor force participation from 2006 to 2012 is explained by demographics. Most of this IS really about a lack of labor demand. Result, about 1 in 10 people who should have a job, and would almost certainly work if jobs were available, are either unemployed or out of the labor force. This level of reduced employment is roughly unchanged for the past 4 years (since the beginning of 2010 we are producing roughly enough jobs to keep that from getting worse). It’s flirting with the 58% level of employment to population ratio we first hit in 1953.

My award for best comment here would go to Steven Kopits at 4:58a.

don: So we can assume your response to a lifeboat not being picked up in timely fashion would be to stop bailing? Nobody wants people to be on SNAP permanently. SNAP costs are an artifact of a sabotaged recovery. Republicans turned the ship away from picking up the poor to avoid inconveniencing the rich. Now they’re firing the deck cannon at the lifeboat.

don and kopits,

on fig 3, one would expect the number of snap recipients to either hold steady or increase during recessions, and even slightly stable economic environments. the population as a whole is growing each year, not shrinking-hence the positive slope up. so unless you are extending the wealth down the social ladder, what else would you expect. the graph is an example of the wealth divide in action. you are not getting any reduction in snap, not because it is has morhped into a “permanent entitelment” as opposed to a “economic adjustment program” (in Kopits words), but because the wealth created over that time period has not been captured at all by the poorest folks. and you wonder why people talk of class warfare?