Today, I gave a presentation in the Wisconsin Alumni Association’s Global Hot Spot series, entitled America’s Macroeconomic Policies and the Global Economy. One figure from the presentation bears highlighting.

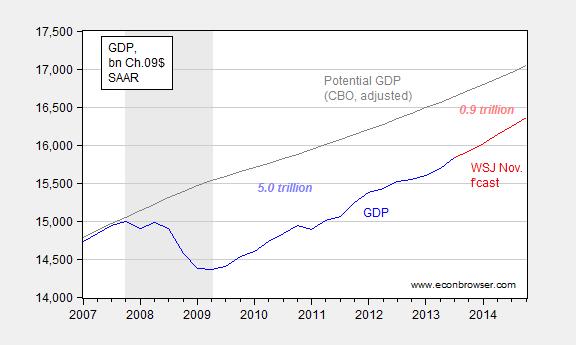

Figure 1: Real GDP (blue), mean survey forecast from November WSJ (red), and potential GDP from February 2013 (gray). Potential GDP in Ch.05$ adjusted to Ch.09$ using ratio of 2011 actual GDP. NBER defined recession dates shaded gray. Source: BEA, CBO, WSJ, NBER, and author’s calculations.

The figure in light blue italics is the cumulative loss in Chained 2009$ from 2007Q4 to 2013Q3. The figure in pink italics is the cumulative loss incurred from 2013Q4 through 2014Q4, assuming the WSJ mean forecast holds.

Note that the potential GDP series is my adjusted series. CBO has not released an official series consistent with the recent BEA benchmark, which incorporates intellectual property; it may be that I have over-estimated potential relative to what CBO is planning to publish, but the general magnitudes are likely similar.

Could we do more to close the gap? I think so — see here; and also here, regarding extending emergency unemployment benefits.

I find it so interesting how potential GDP is determined upon supply potential without considering a demand potential. Because there looks to not be enough demand to reach potential output.

The theory says, more output means more income, which means “corresponding” demand. Yet, supply won’t surpass effective demand as Keynes said and even fall short of what is considered full-employment. Unless of course you follow Say’s law.

Here is an excerpt from Chapter 3 of General Theory by Keynes…

“Thus Say’s law, that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output, is equivalent to the proposition that there is no obstacle to full employment. If, however, this is not the true law relating the aggregate demand and supply functions, there is a vitally important chapter of economic theory which remains to be written and without which all discussions concerning the volume of aggregate employment are futile.”

Oh no, we’re failing to meet an imaginary and largely mystical benchmark! Somebody call somebody!

It would be an interesting additional chart to cumulate the difference between potential and actual over the period. Then one could see the magnitude of our policy errors and that the cost continues to rise.

One could look at the process as one of delayed investment. We had a national investment opportunity to spend so as to recover the lost yield you see here, and at a very high rate of return. We chose not to do it. The yield not received is equivalent to a loss of wealth.

We can get back to where we were, but we can never get back to where we could have been.

Those numbers fit pretty well with the idea that for every 10 million workers we produce about $1 trillion of GDP. So for every year with excess unemployment we lose abut $1 trillion per 10 million (excess) unemployed.

But AJB, who do we tell? Perhaps the millions of unemployed?

If 2007 was a bubble economny, then why isn’t GDP over potential. Seems like some serious measurement errors including bubble economies in with “normal states of the world. I suspect correcting for this mistake would lead to vastly different results. It looks here like 2007 was almost a normal full employment economy, not a bubble. Does it take a bubble to get to full employment? That’s weird semantics.

pete,

“Does it take a bubble to get to full employment? ”

currently there is a view emerging that the we are in an economic world that only reaches full employment in bubbles. we have seen this during the past decade with a couple of bubbles (dot com, housing…). we may not really understand what “normal” is going forward.

baffled…my point exactamently…natural growth rates appear to be much lower, so that these bubbles have pushed us above trend, resulting in crashes. Or, in the Lucas world we expect the Fed to bubble us out of our troubles, and thus it is self defeating. All accompanied by a huge increase in income for the top and stagnant wages. Seems to argue strongly against activist policy. We need another Volker to stop the madness. Unfortunately the market is already trading the Yellen put.

Want more GDP growth, get more oil.

Wages in the oil sector are almost twice normal levels. What does that tell us? That oil is the constrained commodity and that the world wants more of it.

How is the administration supporting expanding US production? Do we have substantial leasing of Federal lands? Is Alaska being fast-tracked? Is Keystone XL being built? Doesn’t seem so.

pete,

you actually missed the point. full employment in 2007 was because we were in a bubble-but employment was not above trend. the history is showing the only way to get to that full employment is when the economy is in a bubble. if that is the case, we have a serious problem because the past is showing we cannot reach full employment without help-not a good economy.

pete said

“We need another Volker to stop the madness.”

really? I assume that means you want higher rates? really? in an economy which is below potential you want higher rates? please tell me how higher rates provide help to a weak economy with no inflation?

kopits,

what if we spent that trillion plus dollars from the oil wars on renewable and hydrogen energy systems and discard the need for oil? no more foreign energy wars, renewable energy sources, and a future not directed by fossil fuel execs?