From Reuters:

China’s yuan currency overtook the euro in October, becoming the second-most used currency in trade finance, global transaction services organization SWIFT said on Tuesday.

The market share of yuan usage in trade finance, or Letters of Credit and Collection, grew to 8.66 percent in October 2013. That improved from 1.89 percent in January 2012.

This is a milestone, but it’s not an entirely surprising one. As I noted in this September 2013 post, based upon this Ito and Chinn paper:

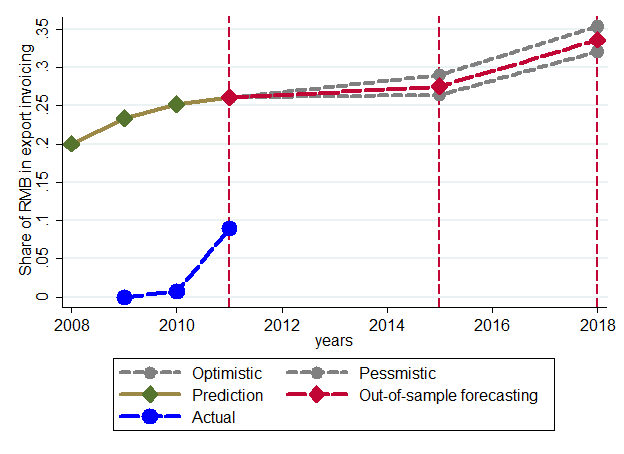

…we employ a panel time series analysis to predict invoicing, and conclude that 2010 levels of CNY invoicing of exports are below model-predicted levels, suggesting further increases in home currency invoicing are plausible.

That is, the CNY was well under model predicted levels, so rapid increase in use was not surprising once Chinese authorities allowed use of the CNY in trade transactions. This is shown in the figure below.

Figure 10 from Ito and Chinn, “The Rise of the “Redback” and China’s Capital Account Liberalization:

An Empirical Analysis on the Determinants of Invoicing Currencies,” July 2013.

By the way, while this is a milestone, it’s important to keep in perspective the fact that trade invoicing (actually trade settlement) is only one aspect of the dimensions of an international currency. More on this issue in this post, as well as here.

Menzie,

Thanks for this. I missed it. I have been in a discussion with friends who are traders on this subject and I made the point that this was coming after China began directly invoicing Australia in RMB. It is now reality and no longer a forecast.

Yuan/US$

Yuan/US$ to Broad Index

Yuan/US$ to Other Index

China’s net exports to Yuan/US$ to Broad Index

http://research.stlouisfed.org/fredgraph.png?g=pBw

China’s net exports are where they were during the 2008-09 crash and in the early 1990s when US and Japanese FDI ramped in China-Asia as part of offshoring and “globalization”, which has culminated in China’s “middle-income trap” and decelerating global real GDP per capita and global regional GDP PPP.

Yawn. Z-z-z-z-z-z-z-z-z-z . . .

How does this measure count transactions between two members of the euro area? Are they included?