With update links to CBO and the CEA comment on the minimum wage.

Despite the likely benefits, policymakers in Wisconsin make statements such as the following (from Fox6Now):

“I’m not a big supporter of artificially increasing the minimum wage. I think the marketplace is a much better way to go,” [Wisconsin Assembly Speaker Robin] Vos said.

The minimum wage is by definition the lowest hourly remuneration that employers may legally pay. As a legal requirement, it can only be changed “artificially”. The marketplace could alter the equilibrium wage rate, as supply and demand conditions change — but that would be changing, not the minimum wage, but … the equilibrium wage rate. I guess Speaker Vos means that the equilibrium rate — which has been delivered by the marketplace thus far — is the one we should be happy with. (Dr. Pangloss would nod in assent.) At this juncture, it’s useful to remember that, just like not all things organic are necessarily good for you, not all equilibria are optimal. A free market is not necessarily a competitive market, and in the presence of monopsony power and asymmetric information, one can imagine intervention improving outcomes.

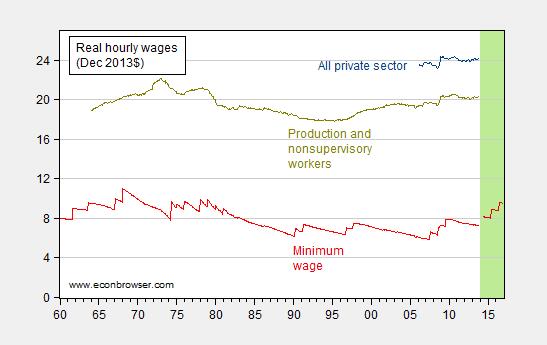

In my view, an increase in the minimum wage could have an impact on income inequality in Wisconsin. According to EPI, 22.4% of the total Wisconsin workforce would be affected by the minimum wage (i.e., the floor would bind, and other wages not bound would rise in a ripple effect), a share slightly higher than that pertaining to the national workforce (21.3%).

Figure 1: Share of Wisconsin workforce affected (both directly and indirectly) by a $10.10 minimum wage in effect by July 2016. Source: Economic Policy Institute; see EPI for details of calculations.

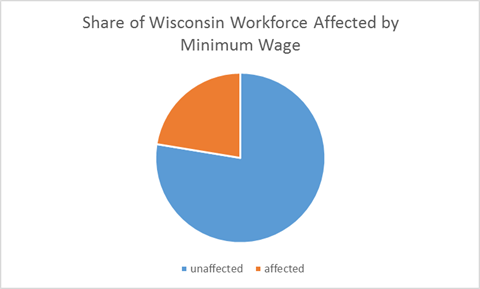

More importantly, for low income workers, an even greater share would be affected.

Figure 2: Share of Wisconsin workforce with income less than $20,000 affected (both directly and indirectly) by a $10.10 minimum wage in effect by July 2016. Source: Economic Policy Institute; see EPI for details of calculations.

To the extent that minimum wage increases tend to have negligible employment effects, the higher wages should increase the total low-income wage bill, as discussed in this post, which recounts the recent empirical literature, and provides a diagrammatic exposition elaborating on this point.

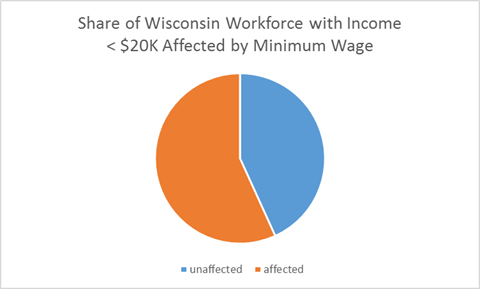

The President has voiced support for an increase in the minimum wage to $10.10 in three increments, as laid out in the Fair Minimum Wage Act. A time series plot of the minimum wage starting from 1960 is presented below, along with minimum wage that would obtain assuming passage of the FMWA in March (merely for expositional purposes — this is not a forecast!).

Figure 3: Minimum wage (blue), minimum wage under Fair Minimum Wage Act (FMWA) assuming passage in March 2013 (blue +), and real minimum wage in December 2013 dollars (red), and under FMWA assuming CPI-all urban inflation evolves as in WSJ January 2014 survey, mean response, forecasts linearly interpolated (red triangles). Projection period shaded light green. Source: BLS via FREd, WSJ January 2014 survey, and author’s calculations.

Note that the increase in the minimum wage under the FMWA brings the real minimum wage (assuming the mean WSJ forecast trajectory) back only to levels of April 1979 (the maximum is 10.79, in December 2013 dollars, recorded in February 1968).

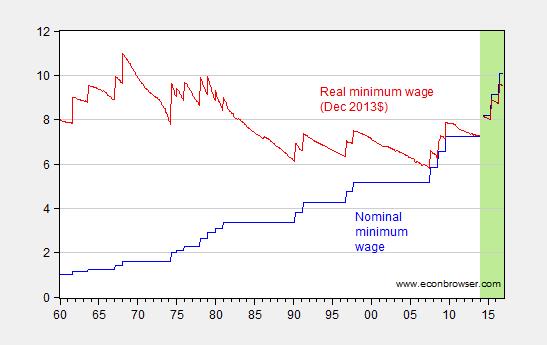

Moreover, the proposed minimum wage increase merely shrinks the nominal gap between the minimum wage and the average hourly wage rate for production and non-supervisory workers to that prevailing in 2002 (assuming the average hourly wage rate stays at 2014M01 levels, an assumption which likely overstates the degree to which the gap is closed).

Figure 4: Real minimum wage in December 2013 dollars (red), and under FWMA assuming CPI-all urban inflation evolves as in WSJ January 2014 survey, mean response, forecasts linearly interpolated (red triangles), average hourly wage for production and non-supervisory workers (olive) and for private sector workers (dark blue). Projection period shaded light green. Source: BLS via FREd, WSJ January 2014 survey, and author’s calculations.

Nobody claims that raising the minimum wage will alone reverse fully trends in income inequality in place since (particularly) the 2000’s. However, if one wants to do something concrete and feasible about income inequality, this is one place to start.

Jason Furman and Betsey Stevenson at the Council of Economic Advisers recap the empirical literature on the effects of the minimum wage on employment, turnover, and productivity, in a blogpost yesterday.

[Updated text: edits added 11AM Pacific – MDC]

Update, 2/18, 4:15pm:

CBO has released a report which notes the general improvement of the situation for low income households, and a dispersion of forecasts centered around small job losses. The CEA comments.

“In my view, an increase in the minimum wage could have an impact on income inequality in Wisconsin.”

Way to really take a stand!!

Figure 2 is an obvious DUH.

And number three, it infuriates me to no end that PhD. economists think that supply and demand does not affect low end labor. If you increase the price of low end labor…. Congrats, you’ve just supported an unknown quantity of workers either losing their jobs, or not being hired in the first place. It’s laws like this that are the reason that teen unemployment is so high.

of course, you could go with the argument of robert strayton in the wsj the other day, and advocate $5 an hour minimum wage. he felt this wage was empowering to those with a job, with poverty ceasing to exist!

What’s the deflator you’re using?

anonymous,

“Congrats, you’ve just supported an unknown quantity of workers either losing their jobs, or not being hired in the first place.”

have you read any studies on this effect. the results appear to say raising the minimum wage (within reason) does not alter those employment dynamics. i would imagine because at the end of the day, companies paying at the low end already have cut bare any excess employees and wages. they cannot cut back the number of employees, or the work cannot get done. hence the supply-demand curve behaves a bit differently in this limit.

If the min wage is lowered then the max rate on credit cards should be lowered too. Say if the min wage is lowered to $5 then the CC rate should be 5%.

How did EPI get their estimate of the number of workers directly impacted by a minimum wag hike?

Nationally, in 2012 minimum wage workers accounted for only 2.75% of employment.

I find it difficult to accept the EPI estimate that over 20% of workers are directly impacted by a minimum wage hike>

Salim: I used CPI-all urban (FRED code CPIAUCSL), as it was the only one for which I had forecasts from the WSJ survey. I have added text to clarify.

Spencer: Good point. I have added a link to the EPI document that provides some details of the approach used; the figures are for direct and indirect effects.

‘…at the end of the day, companies paying at the low end already have cut bare any excess employees and wages. they cannot cut back the number of employees, or the work cannot get done.’

Really? I don’t remember the last time I used a checkout line manned by a human being at my grocery store, as it’s been years. I swipe my purchases myself and pay a machine (and get change too). Why couldn’t I do the same at McDonalds?

patrick,

the self checkout is an option, although there have been several instances of company’s closing them down after a while as well. you get theft for unpaid items. and when i have to wait in line too long-especially at the grocery store-while the customer needs to look up the produce code,i simply leave my cart and go to another store. its a statement of principle. why should i pay the grocery store and do their work? they are not paying me-and the savings is not being passed on to me, it is converted into profit. unlike you, i tend to shop at stores without self checkout-they are more of a hassle than convenience.

‘… unlike you, i tend to shop at stores without self checkout-they are more of a hassle than convenience.’

Well, suit yourself, I’m never one to impose my own beliefs on someone else; unlike some I could rather easily name. But, you’re missing the point. Make it legally impossible to employ low skilled labor at economically rational wages, and you’ll get the work outsourced to automation.

I’m old enough to remember when every skyscraper employed elevator operators. How about you?

you can also look from the perspective that automation simply frees the labor to conduct more productive tasks. you make the assumption that no other opportunities exist, and the automation simply reduces the number of jobs. this may not be the case. also, if it is true that there are no other jobs, then automation essentially reduces your potential customer pool. it is not a long term sustainable approach unless other opportunities appear, as eventually revenue dries up. the automation argument against a minimum wage is extremely suspect long term.

Why even go to McDonalds — pick a frozen burger and heat at home…

Those interested can see my presentation for the Center on Global Energy at Columbia University on Tuesday at the link below:

http://energypolicy.columbia.edu/events-calendar/global-oil-market-forecasting-main-approaches-key-drivers

Excellent! Thank you.

If there were not a legally mandated minimum wage, there would still be a lowest contracted wage at any given time in the relevant area – which could reasonably be referred to as the “minimum wage”.

Patrick R. Sullivan: You must live in a drastically different place than I live in (and just visited last week, Bay Area). In the past month, I believe I have used automated check out …once. [Actually on reflection, I haven’t done it once in the past month]

Brent Bruckner: Yes, I guess that would be true in some trivial way, using language in a fashion that nobody else uses. (A language specific to one’s self seems pretty unuseful, but heck it’s a free country.)

Couldn’t a hike in the minimum wage exacerbate income inequality?

By raising the minimum wage, you essentially raise the minimum level of productivity a potential worker must provide in order to be hired. Those at the lowest end of the skills spectrum will never be able to get the first job needed to acquire the intangible skills like knowing to show up to work on time, be polite to customers, etc. Therefore there is a risk that those people become trapped in a cycle of never being able to get a job.

Second, if you hike the minimum wage too much, doesn’t that discourage people from obtaining more human capital and thus moving on to better jobs? If I can make $30k a year ringing the cash register, why should I go to trade school to learn to be a plumber or electrician or other higher-paid worker? Moreover, if I can drop out of high school and make $14 at McDonalds, why should I even bother to get my high school diploma?

Third, won’t a hike in the minimum wage encourage businesses to shift to more capital-intensive processes over the longer term? Yes, some research has shown that in the short-run there do not appear to be significant dis-employment effects related to minimum wage hikes, but we must also consider the longer-term consequences. Already, most grocery stores, home improvement centers, etc., have increased the use of self-checkout kiosks so that one employee can monitor four customers checking out simultaneously rather than having four cashiers. Think that can’t happen at fast-food restaurants? Think again. Many fast-food and fast-casual restaurants, particularly on the east coast, already have patrons place orders for food using tablets or touchscreen kiosks; and they have reduced the number of waiters and waitresses. Do you not think McDonald’s is considering semi-automated food preparation equipment so that one person can attend the fryer, burger grills, and milkshake machines simultaneously? It’s already happening!

Fourth, if the goal is to help low-wage families, isn’t an expanded and revamped EITC program a much more effective alternative? Even a so-called “basic income” welfare program would be a better alternative.

Fifth, isn’t the federal minimum wage debate entirely misplaced anyway? Shouldn’t states and municipalities set their own minimum wages to best reflect the needs of their residents, taking into account the types of people on minimum wage, costs of living, the range of job opportunities, etc.? It is much cheaper to live in Alabama than it is NYC, so shouldn’t the minimum wage reflect that?

I’ll be the first to concede that a small bump in the minimum wage to keep up with inflation probably won’t do much harm. But groups like EPI and people like Bob Reich seem to ignore all the potential negative effects of larger increases.

Brian,

It’s not hard to show how a hike in the minimum wage could increase unemployment and perhaps even reduce welfare. I’m confident any college sophomore with an econ major would be able to show that. But before that sophomore graduates he or she better be able to show why that simple econ 101 example may not be true. And it may not be true in a lot of cases. For example, a lot of labor markets are characterized by employer monopsony powers. Hopefully that econ major will be able to demonstrate why a hike in the minimum wage in a monopsonistic labor market not only increases wages, but also employment. And depending on the relative elasticities of the labor demand and supply curves, an increase in the minimum wage could increase both the unemployment rate and total employment. More people working but the unemployment rate goes up.

As to the EITC, I don’t see why the minimum wage shouldn’t be seen as a complement to the EITC. The EITC inevitably has a high marginal tax rate, which discourages work due to the substitution effect. But a higher minimum wage means that the effective tax penalty of the EITC could be lowered. It also means low wage companies won’t be able to dump a lot of their wage costs onto taxpayers. While I support the EITC, one of the hard truths is that it does make it easier for some companies to shift labor costs onto the taxpayer. A higher minimum wage would correct that.

The general rule is that increasing the minimum wage primarily increases unemployment for teenagers. As a public policy matter I’m not convinced that this is an entirely bad thing. I would rather see a young 24 year old family breadwinner make a higher wage even if it means that 16 year old living at home has to find other things to do with his or her time besides flipping burgers. Say…oh, I don’t know…maybe spend more time in the library??? I’m also not convinced that teens even learn good work habits by taking minimum wage jobs. When I was in college I also managed a kitchen with about 25 cooks working for me. I used to start workers at 60% above minimum wage because it screened out those workers who treated the job as a “throwaway” job. I’ve seen way too many teenagers learn some very bad work habits as a result of their early experiences at minimum wage jobs.

Brian

“By raising the minimum wage, you essentially raise the minimum level of productivity a potential worker must provide in order to be hired. ”

your view is thus these folks have very little potential, so i will pay them accordingly because they cannot reach that new minimum level. actually most folks have greater potential than you think, but if you pay them low wages they will give you a low wage commitment.

“Second, if you hike the minimum wage too much…”

simply be careful how much you raise the minimum wage. but i really need to know why a CEO is worth 200 or 1000 times the lowest paid workers? their are also alot of very talented folks who would love to have an upper management position-and have the skill set. seems like the laws of supply and demand are being skewed at the upper end?

“Already, most grocery stores, home improvement centers, etc., have increased the use of self-checkout kiosks so that one employee can monitor four customers checking out simultaneously rather than having four cashiers. ”

and i have found, especially at home improvement stores, significantly more help wandering around the store assisting me with the proper purchases. i would imagine this is because they found the help was more valuable to revenue than checkouts. but i don’t think they would have the same number of store helpers if they had not reduced the checkout folks. this is an example of a winning proposition using technology. it does not have to be a replacement, but an enhancement to the shopper and workers who still have jobs.

“Fifth, isn’t the federal minimum wage debate entirely misplaced anyway?”

a national minimum wage will be required until locals recognize the need to pay people a fair wage. let’s be honest, the national minimum wage is very low. if a business cannot survive paying folks that rate, then maybe they should shut down so a more efficient business can take over?

‘You must live in a drastically different place than I live in…’

More than you know, Menzie. More than you know.

To anybody interested in *real* economics, and how good economists think about minimum wage issues, I suggest that you read Steven Landsburg’s entry “Minimum Insight” in his blog, The Big Questions.

http://www.thebigquestions.com/2013/12/02/minimum-insight/

Landsburg’s blog entry is a criticism to a Krugman piece, but not matter. His (Landsburg’s) blog entry is worth all the while to read.

Because he teaches exactly how economics is done and thought about.

Read the entry, and do not be fooled by fool’s gold.

I tried to leave a comment on the Jeff Frankel post, but kept getting an “incorrect captcha” error message.

Anonymous (8:14AM): If you want to stay neoclassical, you can allow for market imperfections, e.g., monopsony, as Stigler (AER 1946) did, and see what happens in this case when a minimum wage is imposed. Just because you’re using a neoclassical model doesn’t mean you get Pareto optimality. For more, see this post (cited in the original post).

Brian,

You have listed all the questions economists should be asking. Economists are supposed to consider both the benefits and costs of proposed policies in the light of economic theory and tested against the empirical evidence. But, unfortunately, too many economists on the Left have become lobbyists for the whatever the current White House political strategy happens to be, loudly pointing out the benefits of the proposed policy while ignoring or minimizing the costs. (In this case, the political strategy behind the revival of the minimum wage is to distract the voting public from the Obamacare fiasco.)

Of course, economists have studied the questions you raise and there is a large body of evidence at this point. Perhaps the best survey on the costs and benefits of the minimum wage is the book “Minimum Wages” by Neumark and Wascher. I think the evidence is very consistent with the questions you asked and the answers you suggested.

Briefly, the weight of the evidence is as follows:

1) The minimum wage reduces employment of low-skilled workers, especially workers directly affected by the minimum wage

2) The minimum wage raises wages for other workers who are at the boundary of the minimum wage and also the wages of workers with somewhat higher wages relative to the boundary (because of shifting to somewhat higher productivity workers.)

3) Contrary to Menzie’s speculation, there is no evidence that the minimum wage improves the economic conditions of poor or low-income families

4) The minimum wage either has no effect on or negatively affects the acquisition of additional training. Moreover, the minimum wage results in less schooling

5) The minimum wage raises the prices of the goods and services produced by minimum wage workers.

Overall, when you look at the costs and benefits, it does not seem that the minimum wage is good social policy. The question we should be asking is the one you have asked. If we want to raise the income of low wage workers, why would we do it using a minimum wage policy, given what we know about the effects? And why should consumers of the goods and services produced by these low wage workers pay for the policy with higher prices, especially since those consumers are often low income as well?

Why not just be honest and have an income support program? And then we could talk honestly about who should pay for it.

Here’s a question from political philosophy that has always intrigued me: Why shouldn’t those who want the policy the most pay the most for it? Therefore…

Many left-wing actors, directors, and producers agitate for these policies. Why not finance the income support program with an “obscene wages and profits” tax levied on the production of Hollywood movies? Many of the supporters of these policies are professors who are enjoying the benefits of tax-exempt universities. Why not levy a tax on some of these universities’ tax exempt activities to finance a low income support program?

Rick Stryker: Hmm, what about lobbyists for the Heritage Foundation and Heritage Action…

So much disinformation, so little time. Let me address your point (3), and leave the remainder for those blessed with more spare time. You state there is “no evidence” the minimum wage has an impact on the economic conditions of low income workers. “No evidence” is a pretty strong statement. There is a paper, for instance, that seems to constitute some sort of evidence by some obscure professors (David Autor, Larry Katz for instance), that seems to contradict your expansive statement,published in an obscure journal called the Review of Economics and Statistics. I think those two authors (at obscure institutions called Harvard and MIT) might be thought of as authorities. Katz has 25,000 cites on Google Scholar for instance, while I guess in your book Autor is a slacker at 2,300 cites (of course, he only received his Ph.D. 15 years ago; how many do you have, by the way?). Since these scholars are so obscure, you might be excused for not knowing of their work. But now that you have been apprised of their work, do you want to re-think your absolutist assertion of “no evidence”? Geez.

Monopsony…in the market for low skilled labor. There’s a useful assumption.

Patrick R. Sullivan: I take it you are being sarcastic when you characterize monopsony in the low wage labor market as useful. I guess Stigler (who graduated from my high school! And incidently won a Nobel prize) thought it was useful. And I don’t literally believe it’s monopsony; just like we assume monopolistic competition — rather than monopoly — in almost all DSGEs I know of, one can think of firms as having more market power than an individual low-wage worker. Or do you think otherwise?

I think it’s quite difficult to make the monopsony argument in all but a very few cases. There are some one horse towns where this might be the case, say, a coal town in W. Va. Otherwise, even in Princeton, there have to be hundreds of potential employers at the minimum wage levels, including gas stations, convenience stores, literally hundreds of retail outlets, fast and non-fast food restaurants, grocery stores. It’s a very long list.

It would be far more feasible to make such an argument for skilled labor. For example, there are probably twenty real estate brokerages where an agent could work. So arguably, you could have some monopsony there (theoretically), but for unskilled labor, it’s out of the question.

In any given negotiation, firms probably have an advantage over the individual. But given the churn of min wage employees, this is quite fleeting.

In practice, I think what you’re likely to see are quite standard terms and wages. When McDonald’s hires burger flippers, they don’t negotiate very much. Standard applications and terms, standard wages. It’s up to the applicant to accept these or not, but there’s not a lot of tricky negotiation. Again, it’s the higher wage workers who are more exposed to the risks of individual negotiation.

Well if you can think of an example from the actual world of a monopsony in the hiring of low skilled workers, what is it?

Btw, is the Autor, Katz the best you can do? I mean they say, in their conclusion:

‘2. Does the rise in U.S. wage inequality since 1980 largely reflect the effects of a declining real

minimum wage? Our analysis suggests that the decline in the real minimum wage clearly contributed to the

sharp increase in lower-tail wage inequality in the 1980s, particularly for females. But the secular rise in

upper-tail wage inequality clearly is driven by other sources.’

I note their; ‘suggests…contributed…But…clearly is driven by other sources.’

That’s one paper with a suggestion, while virtually every other paper I’ve seen (from the US and international literature) says pretty much the opposite.

Btw, next time I’m in Renton I’ll ask around and see if anyone remembers you from high school. But, Stigler in 1946 clearly wasn’t Stigler of ‘Memoirs of an Un-Regulated Economist’. I seem to remember (without looking it up) him admitting that the economics profession had moved away from thinking monopoly was a big deal.

Patrick R. Sullivan: The authors note a minimum wage impact on the lower tail, while concluding the upper tail is driven by other factors. That seems reasonable to me — I don’t think the income of billionaires is driven by the minimum wage. By the way, I’ve taught international trade — my reading of the literature is different from yours.

Menzie,

No, I don’t need to re-think my assertion.

The paper that you cite, which is only tangentially about the minimum wage, claims that wage inequality in the lower tail has been affected by a lower minimum wage in real terms. That’s fully consistent with my point 2, which is that the minimum wage raises wages for those who continue to work at the boundary of the minimum wage and for those near the boundary. The Autor et al results are consistent with the weight of the evidence on this and I agree with it. A better cite on this topic is “The Contribution of the Minimum Wage to U.S. Wage Inequality over Three Decades: A Reassessment” by Autor, Manning, and Smith available here.

But my point 3 is not about wage inequality. It’s about the more relevant and complex question–does a higher minimum wage improve the economic conditions of poor and low income families? The question is immediately complicated by the fact, for example, that when you look at data you see that a large percentage of minimum wage workers are not in poor or low income families (e.g.,teenagers and retirees) and so the minimum wage is irrelevant for this question. Further, the minimum wage produces winners and losers. Some low income families will have higher incomes while others will have family members who lose their jobs. What is the net effect? It’s a difficult empirical question.

One way economists have tried to answer this question is to study whether higher minimum wages reduce the poverty rate. By and large, the studies find statistically insignificant results. That’s what I mean by “no evidence.” Economists have also performed simulation studies in which they try to simulate the effects of the minimum wage on the distribution of income. These studies start with facts about how how minimum wage workers are distributed along the family income spectrum, make assumptions about labor elasticities and other effects, and then look at the result of the changes in policy. These studies tend to find very modest or no tendency to equalize income since minimum wage workers are more or less even distributed across the family income distribution. That’s also what I mean by “no evidence.” Moreover, economists have looked specifically at the question of whether higher minimum wages affect the poverty rate of households headed by single mothers. Again, results are statistically insignificant. That’s what I mean by “no evidence.” The only statistically significant evidence out there is on the question of whether the minimum wage affects the probability of transition in and out of poverty. A higher minimum wage does decrease the probability of transitioning into poverty. The problem though is that the evidence suggests that the distributional effects are to redistribute income between low income families. This is, more subtly, what I mean by “no evidence.”

I don’t think you should look at refuting my other “misinformation” as a leisure activity to be undertaken by somebody with a lot of spare time. Rather, if you attempt to refute my other points, you’ll potentially learn a lot about this topic when I explain what the actual evidence is. I think you could benefit from that.

I’d note that left wing policy institutions such as the Employment Policy Institute also confuse wage inequality with the question of whether the minimum wage actually helps families in poverty. In general, I find the Heritage Foundation to be much more informed, balanced, and objective than their counterparts on the other side.

What does teaching international trade have to do with minimum wage law?

Manage to come up with a monopsonist in a labor market yet?

Patrick R. Sullivan: Other competing hypotheses for increasing inequality include importantly trade — indeed that was an enormous debate during the 1990s, and to this day — for instance here. In fact, I believe trade is part of the reason for increasing inequality. If you need to ask why, well, I suggest you read a good trade textbook (and see notes here).

Canonical examples of markets characterized by monopsony: Nursing homes as employers of care assistants; Agencies who employ thousands of people in the hotel, catering and cleaning industries.

Menzie,

I’m reposting my reply to you since it appears that something went wrong when I attempted to post my last comment. If you did get the last comment, you can ignore this one.

To answer your question, no, I don’t need to rethink my assertion.

The Autor and Katz paper that you cite does claim that the real reduction in the minimum wage affects lower tail wage inequality. But I don’t disagree with that, since it’s fully consistent with my point 2, which notes that the evidence suggests that workers who are at the boundary or close to the boundary do get wage hikes. The Autor and Katz paper is only tangentially about the minimum wage though. A cite more recent and on point would be The Contribution of the Minimum Wage to U.S. Wage Inequality over Three Decades: A Reassessment by Autor, Manning, and Smith.

However, my point 3 is is about a more relevant and complex question: Does the minimum wage improve the economic conditions of poor or low income families. Wage equality is not the same thing. To see this, note that the data show that a significant percentage of minimum wage workers are members of families that are not poor or low income (e.g., students, retirees, etc.). Thus the minimum wage in these cases is not relevant to whether poor families are helped. Moreover, the evidence shows that the minimum wage produces disemployment effects. Some workers in poor families see their incomes go up while others see their incomes go down since family members lose their jobs or can’t find one. What is the net effect? It’s a difficult empirical question.

Let me explain what I meant by “no evidence.” Economists who have attacked this question have proceeded in a number of ways. For example, many studies have examined whether the minimum wage has an effect on the poverty rate. These studies generally find that the effects are statistically insignificant. That’s what I meant by “no evidence.” Studies have also looked at the more narrow question of whether the minimum wage affects the poverty rate of poor families headed by single mothers. Again the results are statistically insignificant, i.e., “no evidence.”

A number of studies have attempted to simulate the change in the distribution of income resulting from minimum wages. Starting with facts about how minimum wage workers are distributed in the income spectrum of families, these studies make assumptions on labor response and other effects from the empirical literature and simulate the model. These studies generally find no significant redistributive effect, reflecting the fact that minimum wage workers tend to be uniformly distributed across the family income distribution. That’s also what I meant by “no evidence.”

About the only statistically significant evidence you can find is on the question of whether changes in the minimum wage affect the probability of transitioning into or out of poverty. Here the effects are statistically significant. But the problem is that the evidence suggests that income effects of these transitions are distributed between low income groups. So, more subtly, that’s what I meant by “no evidence.”

Left wing policy institutes such as the Economic Policy Institute also confuse wage inequality with the more relevant question of whether the minimum wage actually helps poor families. Of course, they are correct about wage inequality but that’s not really the important question.

I don’t think you should view refuting my other “misinformation” as a leisure activity for someone who has some free time on his hands. On the contrary, this is a “teaching moment.” If you were to attempt to refute my other points, you’d become much more informed on this question, since I’ll explain to you what the evidence actually is. I think you could benefit from that.

Rick Stryker wrote;

‘If you were to attempt to refute my other points, you’d become much more informed on this question, since I’ll explain to you what the evidence actually is. I think you could benefit from that.’

I’ll second that motion.

As I read the post, one assumption made, monopsony power results in lower wages , and this is a wrong which demands government intervention; but only with those monopsonies which pay a wage below the propose new minimum. It ignores any other non-governmental mechanisms which tend to cure that particular abuse over time. In addition the post makes no effort to distinguish the number of workers who receive lower wages in monopsony businesses and situations to those receiving lower wages in non-monopsony businesses and situations. Which leads to some questions.

Is the blunt hammer of government intervention in private enterprise the best mechanism?

If the power and abuse by monopsony is reason enough for the government hammer of minimum wage, then why is it applied to non-monopsony business, who have demonstrated neither the power nor the abuse?

The post by Menzie make the point that “a free market is not necessarily a competitive market, and in the presence of monopsony power and asymmetric information, one can imagine intervention improving outcomes.” The answer to this is, of course, one can imagine all sorts of perfections. But there is zero reason to believe that the outcome of a government solution made by very few people will be better than outcome the millions of people making decisions each day. Menzie enjoys stating the perfect conditions of a free market can not exist, but then “imagines” a governmental will produce perfect conditions. That is politics not economics.

Ed

ed

” But there is zero reason to believe that the outcome of a government solution made by very few people will be better than outcome the millions of people making decisions each day.”

the financial crisis, made by the leaders of private banks and millions of home buyers, is a startling example of a free market capital failure by your millions of geniuses.

of course, jim crow era employment was supported by millions of private individuals throughout the south. how did that work for the poor and minority?

when free market processes fail, and they have for the folks paid minimum wage, then alternatives need to be considered.

Yes, let’s raise the minimum wage so that there is more incentive for inner-city minority kids to drop our of high school and look for a minimum wage job. This will ensure a class of downtrodden for Democrats to ‘represent’ and loudly proclaim to care about.

well it certainly doesn’t appear that a low minimum wage is encouraging them to stay in school or become unemployed. i suppose a lower wage will make a difference! such silly rhetoric…

What do the studies show about the minimum wage trickling-up? It seems that the experienced worker who was making a wage equivalent to what becomes the new minimum wage would expect an increase with similar results up the employment wage ladder.

‘Nursing homes as employers of care assistants; Agencies who employ thousands of people in the hotel, catering and cleaning industries.’

By definition, monopsonies aren’t plurals.

Please explain how employees of nursing homes, hotels, caterers and cleaners are prevented from playing one of them off over the others. Then explain what prevents those same employees who fail to accomplish that competitive result, from applying at Wal-Mart, Target, Walgreen, 7-11, McDonalds or any of the millions of independent businesses that are too small to get our attention.

You also seem to be confused about the difference between the international literature on minimum wage laws in Australia (the Great Grandmother of MW laws), France, UK etc, and international trade and its effects on low skilled American labor. Those are two separate issues. Unless you have some novel theory gleaned from the ghost of George Stigler haunting Renton High School.

for those against a raise in government mandated minimum wage, or the existence of one at all, what is your stand on lawsuit limits. should their be government mandated limits-ie tort reform in the healthcare, automobile,.. ie can i limit the size of a lawsuit through government decree?

Patrick R. Sullivan: Re “By definition, monopsonies aren’t plurals.” Did you actually read my comment? There aren’t many monopolies, but there is monopoly power and monopolistic competition (or do you think we’re in perfectly competitive markets? Better tell everybody who’s written down a NK DSGE in the past twenty years, including John Taylor). And so there aren’t literally monopsonies, but there are markets characterized by monopsonistic power.

I really don’t understand your point about the disjuncture between minimum wage laws, trade competition (and also other factors like biased technical change) and income inequality. If you are trying to explain income inequality, one doesn’t have to say it’s one or the other. And if one is trying to discern the relative importance of each, one would try to to figure estimate say how much comes from trade, how much comes from eroding minimum wage, etc. Are you trying to say the import competition the United States has experienced in the past thirty years accounts for zero change in income inequality? If so, you are indeed a rare bird. (Ever heard of the Hecksher-Ohlin theorem?)

Rick Stryker: Sorry you had difficulty managing the comment system.

Now, it’s strange the difference in standards you have regarding minimum wage employment effects (there you say there is evidence that it reduces employment, whereas there have been several metastudies demonstrating that there are almost as many saying employment increases as decreases), but then you say categorically there is “no evidence” that it helps poor people — even though in both cases I would characterize the evidence as “mixed”. If you want to say absolutely not one single of the low income person (say income less than $20K) is a poor person because he/she is assumed to be in a household that is wealthy, well, sure go ahead and assume up is down, and poorer is richer — nothing stops you. But nobody is going to take you seriously if you make that assertion.

By the way, take a look at the funnel graph in the CEA post I linked to. I’m sure you’ll just file that away as disturbing little nonsense, so you can say the evidence is unambiguous that there are disemployment effects from raising the minimum wage. But for the rest of us living in the real world, I think we’ll have a little more nuanced view of matters. (And in academia, if your assertion were to show up in your paper’s literature review, I think the referee would ding you.)

By the way, on the matter of “lobbyists” for one group or the other, do you still think the Heritage Foundation’s scoring of the Ryan plan plausible (you know, the one where one could change the employment effects without changing a single other number in the projections…)?

Rick Stryker: By the way, I think you have the Employment Policies Institute confused with the Economic Policy Institute (the link you gave is to this latter group, but you mis-identified the group in the text). Perhaps the Employment Policies Institute is on your mind because of its cozy (literally!) relationship with the a firm that works for the restaurants association as detailed by NYT is in the news. Talk about lobbying. I guess lots of people do projection.

The EPI analysis is deeply flawed.

Start with the impact of the min wage: over 60% are in households that make more than $30k and over half are unmarried, no kids. One quarter are in households that make more than $75k. Not exactly well-targeted to the poor. Then we have this alleged ripple effect. If there is a ripple effect, firms don’t exactly have monopsony power, now do they.

Walmart and Target earn about $3-4 per employee hour in profits (profits/(employees*avg hours)) and they ruthlessly cut costs. Total labor costs cannot rise more than revenues or the CFO gets mad (and they pay managers a lot of money and bonuses to ensure this) which means a per-hour rise must be met with hours reductions (“productivity”) or cost reductions elsewhere (technology). Prices are not going up in a weak economy, labor costs are going to be curtailed, which means that workers work harder or firms use more technology (self checkout, etc).

Having been both a manager and trained as an economist, here’s how the rise in the min wage would play out on my schedule: adjust the schedule to minimize labor costs (probably more hours for those already making $10.10, fewer for the less productive newbies only making 7.25). Everybody works harder, has to squeeze in more work in the same amount of time, and guess what if you can’t hack it too bad there are people who can replace you. The people most affected will be precisely those people with inflexible schedules (e.g. kids, commitments) and people like young college kids hungry and eager with lots of free time will get more time on the clock. In other words, it is most likely to hurt the very people to which it is targeted.

I am not saying this to be harsh, thats how it is in the real world, not academia. The woman who cannot make it to work on time regularly will get her hours cut. There will be jobs lost, mostly smaller retailers who are barely skating by as is in this weak demand economy. In the real world there are a lot of people who’s work product is marginal at the prevailing wage, because they cannot show up on time regularly, do a mediocre job (too many complaints, etc), or for whatever other reason. As a manager, job search (and training) is costly for me.

In point of fact, there are lots of people at Walmart and other retailers who make more than minimum wage – if you sell more prepaid/gift cards at the register, you get a bump. After some time on the job with proven performance, you get a bump up.

The EPI analysis is pure unicorns and rainbows fantasy. There is no ripple effect, employers are not in the fairness business. The minimum wage targets all the wrong people and likely hurts those who need it most- those with marginal job skills and inflexible schedules like single parents with kids (because hours WILL be cut). The EITC is a much better way to target these families directly, and I would just give people a lump sum to alleviate work disincentives). Income inequality starts with a conversation about why urban schools barely graduate 65% of high school students in 4 years. If you drop out, you are qualified to do what? How about the fact that in some Maryland counties, 70% of the college freshmen need remedial classes. 70%, thats a huge waste of school loans and time.

One thing we surely do not need is more labor rigidity at a time of weak demand and near zero inflation. I have been taught by smart economists that downward wage rigidity leads to involuntary unemployment during slack demand demand conditions. (I guess unless its an agenda promoted by the left of the left like the EPI).

Of course, if I am wrong about all this, why $10.10? Why not $15, heck why not $200,000? We almost certainly need more wage inflation, but by raising the demand for labor, not making it cost more.

+1

dwb: Surprisingly similar estimates are obtained by CEA using the CPS, as reported in slide 12 of this set of slides. Their estimates of how many workers are in the the +30K household income grouping seems lower than yours, eyeballing the tables. Perhaps it’s due to the use of a more recent dataset.

Your ending rhetorical question is frankly, beneath you. If the Fed were worried about inflation rising a point, why raise the Fed funds rate only 25 bps, why not 10 percentage points, just to make sure. However, I don’t think I’ll hear you making that argument soon.

I was eyeballing the supplemental EPI tables myself. Looking at the slides, 45.5% of workers affected by an increase in the minimum wage to 10.10 are in households making less than 35k. I think the EPI and slides are the exact same data and methodology – I even see the same charts on the EPI blogs as are in the slides, so I do not think these slides are independent of the EPI analysis. EPI says 28.8% are in households between 20-40k. quibbling over whether 4,5,or 6 % are in the 30-35k category exhausts the certainty of these numbers. If the # is 59%, its still a poorly targeted policy.

Also we are talking about “characteristics of those affected by an increase to 10.10,” not all households, families, or even those with a householder that works. http://www.census.gov/hhes/www/cpstables/032013/hhinc/hinc01_000.htm

I am not sure the question is really rhetorical. It’s an irritating question, because the answer is unsatisfactory. Why 10.10, or why stop at 10.10 is a legitimate question. I see people picketing for $15 at Walmart. As the EPI’s blog points out, 22,000 for a family of four in NYC, Montgomery County Maryland, Fairfax County Virginia, is not likely to be adequate – if only because of land/housing prices and housing costs. $22k will go a heck of lot farther in Minnesota or Wisconsin (or rural Alaska!) than suburban Maryland or Queens. On the other hand, labor is scarce in North Dakota, so the $10.10 is unlikely to even be binding. I find a one-size fits-all policy to be highly dubious. Moreover, Maryland does not have a poverty problem so much as it has an I can’t get a job because I am a felon problem.

So, even if I accept that the elasticity of poverty WRT a min wage increase is on the order of .2 (see Mike Konczal wonkblog Jan 4 post “Economists agree: Raising the minimum wage reduces poverty”), a 39% increase in the wage seems far away from the mean, and I find a one-size fits all policy to be highly dubious. Costs/benefits should be based on local conditions. Raising the minimum wage in MD will do zippo because the wage is less likely to be binding in suburban maryland, and the real poverty is in Baltimore, with issues much deeper than mere inefficiencies due to monopsony structure of labor markets in Baltimore. In Wisconsin or Minnesota, I would expect the wage to be more likely to be binding, and therefore both the upside benefits and the downside costs to be higher.

IF I think the min wage is a good way to reduce poverty, then maybe $12 is the right number for Maryland and $8.35056 is the right number for rural Alabama. On the other hand, I am skeptical this is an effective way to actually reduce poverty. It seems poorly targeted and the increase to 7.25 in 2006 does not seem to have done much. It certainly will not address the root causes of poverty in areas with urban decay like Baltimore and Detroit, because there is a large population of people unemployable in the first place. If you think reducing criticism of the EPI analysis to a rhetorical question is unfair, my rejoinder is that I find the EPI analysis to be as deep and persuasive as a twitter post so turnabout is fair play. People (including me) actually are interested in policies that allow people to escape poverty, and give them more leverage over employers in the labor market, I just don’t think this is it.

A 40% increase in the min wage is pretty far away from the mean

AS,

There is indeed evidence for the trickling up effect you asked about. Look at Table 2 in “The Effects Of Minimum Wages Throughout the Wage Distribution”. The third row of column one shows that for workers whose starting wage is between 10 cents above the minimum wage and 10% higher than the minimum wage, their wage went up 0.8% for every 1% increase in the minimum wage. For those workers between 10% and 20% of the minimum wage, their wage went up 0.4% for every 1% increase in the minimum wage. However, once workers wages are over 2X the minimum wage, the trickle up effect disappears.

The second column in the table is also of interest. You’ll note the lagged effects have a negative sign, indicating that employers are taking back some of that trickling up in wages in the following year.

The paper also looks at earnings, taking into account the fact that some workers will lose their jobs and others will have their hours reduced as a result of the minimum wage.

Menzie,

You are right. I meant to say Economic Policy Institute, not the Employment Policies Institute, a right-wing think tank which also discusses the minimum wage.

‘…there is monopoly power and monopolistic competition (or do you think we’re in perfectly competitive markets?’

The markets for low skilled labor is closer to perfect competition than to monopsony.

‘ Better tell everybody who’s written down a NK DSGE in the past twenty years, including John Taylor). And so there aren’t literally monopsonies….’

Thanks for that gracious concession.

‘… but there are markets characterized by monopsonistic power.’

Yes, such as the NFL, Major League Baseball, or the NCAA, but note that that isn’t about unskilled labor. Quite the opposite.

‘I really don’t understand your point about the disjuncture between minimum wage laws, trade competition (and also other factors like biased technical change) and income inequality.’

It’s elementary. When you’re in a discussion of the effects of MINIMUM WAGE LAWS on income inequality and poverty, and someone mentions that there is a literature on such laws from different countries, that is not a reason to go off on a tangent about how international trade also has effects on ineequality (especially since you’re undoubtedldy wrong about those effects anyway). I”d be surprised if you couldn’t find TAs at UW who understand that.

‘If you are trying to explain income inequality, one doesn’t have to say it’s one or the other.’

If your argument is that the erosion of the real value of the minimum wage is responsible for income inequality–and raising it will dampen the inequality–then absolutely you do need to say that. Again, this is basic logic. Unworthy of a university professor not to realize it.

‘And if one is trying to discern the relative importance of each, one would try to to figure estimate say how much comes from trade, how much comes from eroding minimum wage, etc. Are you trying to say the import competition the United States has experienced in the past thirty years accounts for zero change in income inequality? If so, you are indeed a rare bird. (Ever heard of the Hecksher-Ohlin theorem?)’

You need to get out more.

One of the things that often gets overlooked in discussions about the minimum wage is how a minimum wage dramatically reduces transaction and search costs for both workers and employers. That’s not an argument for $10.10/hr versus $7.25/hr, but it is an argument for having at some kind of minimum wage that is at least binding somewhere near the lower end. Reasonable people can differ about what that minimum wage should be, but arguments to abolish the minimum wage entirely are misplaced and out of touch with the real world experiences of both workers and employers. With a minimum wage workers can costlessly determine whether or not the prevailing minimum wage is at their reservation wage threshold, so they don’t engage in wasteful searches. And from the employer’s perspective the minimum wage relieves the employer of having to try to determine the marginal value of each individual worker’s skill. Instead, the employer concentrates on the marginal value of the task, not the specific worker.

pat sullivan,

“The markets for low skilled labor is closer to perfect competition than to monopsony.”

within many areas of the country, there exists a monopoly of capital coupled with concerted effort to eliminate collective labor behavior (ie minimize the influence of unions). we have a situation where capitol (and thus jobs) tends to be controlled by a select few individuals or companies who have done their best to minimize the bargaining position of labor. you really think this is a perfect competition? not even close!

pat, as you told menzie, you need to get out more.

Patrick R. Sullivan

Judging by your comments to Menzie, I’m pretty sure that you don’t actually know what monopsony means. Professional athletes are not in a monopsonistic labor market for two reasons. First, they have lots of career options other than playing sports. Second, they have strong unions to counteract any monopsony powers that owners might enjoy (thank you Curt Flood). And for some players with exceptional talent, they have a third reason if they also enjoy monopoly powers in terms of skill levels (think Michael Jordan or Lebron James), so their salaries are negotiated rather than determined in an equilibrium market. The fact that sports players are skilled is irrelevant to whether or not those labor markets are monopsonistic.

Now it is true that in a trivial sense hotel and restaurant owners “compete” for low skill labor. But anyone who has ever worked in a management position in those businesses knows that there’s a hell of a lot of collusion among those businesses. What else do you think they discuss at those Chamber of Commerce meetings? So those industries are examples of oligopsonists, which is just an uglier way of saying that the hotel and restaurant industries labor markets are characterized by certain monopsony powers. And low skill workers are more vulnerable to monopsony labor markets than high skill workers because they have fewer career options and because they aren’t usually represented by a union.

BTW, the classic textbook cases of monopsonistic labor markets is with small town nurses and school teachers. The reason there was a chronic nursing shortage for so long was because nursing schools pumped out too many nurses. The oversupply of nurses is what gave hospitals monopsony powers. The solution to a nursing shortage was to reduce admissions to nursing schools. Not something that your typical Tea Party conservative would understand. Similar story with teachers. And hopefully you can see why the same logic applies to hotel and restaurant workers.

Now go get a Micro 101 textbook and learn all about monopsony. And while you’re at it, learn about monopoly and monopolistic competition.

Patrick R. Sullivan: I am thankful you are commenting. I needed a laugh, and you have provided in full measure.

First, and foremost, there was no “gracious concession”. I was being sarcastic; if you missed that, you have no sense of humor.

Second, I see no documentation provided that low wage labor markets are better characterized by as perfect competition rather than monopsonistic competition. Are you saying McDonald’s is an atomistic purchaser of low wage labor?

Third, in your discussion of discerning the impacts of minimum wage regulations versus other factors, your dismissal of other factors is interesting. Apparently, you’ve never heard of omitted variable bias. ‘Nuff said.

Finally, if one is to have an adult conversation regarding income inequality, it strikes me one should know what the Heckscher-Ohlin theorem says.

Menzie,

Maybe you should be generous and allow that Patrick R. Sullivan knows the H-O theorem as Stolper-Samuelson. Okay, maybe not.

I thought that the little arithmetic exam that goes with each posting would screen a lot of the quantitatively challenged. I guess I was wrong.

‘The reason there was a chronic nursing shortage for so long was because nursing schools pumped out too many nurses.’

I stand in awe of such logic. Truly, I have a great deal to learn from youse guys.

Patrick R. Sullivan

I have a great deal to learn from youse guys.

No problem. I won’t even charge for the lesson. My life’s motto has always been “missionary work among savages.” But since it’s always better to teach a man to fish than to forever do the fishing for him, you might want to begin your economics education with a very simple, well-explained example of monopsony from Wikipedia:

http://en.wikipedia.org/wiki/Monopsony

Note this summary comment: “Yet, even when it is sub-optimal, a minimum wage higher than the market rate raises the level of employment anyway. This is a highly remarkable result, because it only follows under monopsony. Indeed, under competitive conditions any minimum wage higher than the market rate would actually reduce employment, according to classical economic models.”

Did you get that? To the extent that labor markets are characterized by monopsony powers, the labor market is in an Alice-Through-the-Looking-Glass world. What’s up is down and what’s down is up. That’s why I said it was the kind of counter-intuitive thing that your typical Tea Party type is unable to grasp. Perhaps JDH should change the “are you human?” arithmetic test to answer a question on first derivatives, then it would screen people who do not understand micro 101 concepts like marginal cost and marginal revenue curves. On the other hand, it would also deprive those Tea Party types of the opportunity of realizing “a great deal to learn from youse guys.”

Iow, not unskilled labor?

If you will bother to think through the simple Wikipedia graphs it should become obvious that the skill level is irrelevant to whether or not a labor market is characterized by monopsony. The relevant factor is the relative abundance of the labor available to buyers of that labor and the relative ability of the sellers of that labor supply to find different careers. What makes labor markets for teachers and nurses monopsonistic is the relative abundance of people with teaching certificates and nursing degrees, as well as the paucity of opportunities in other career options. That’s especially true in small towns. And it also means that strong teacher unions actually correct a market distortion and reduce deadweight economic loss…not exactly something you often hear from clueless Tea Party types.

patrick sullivan,

apparently you have never lived in a small town, otherwise you would not be in awe of such logic. you should step away from your clean neat supply/demand theories and occasionally enter the real world, where your theories do not always work as you claim. why? because the assumptions made in your theories are often violated in the messy real world. unfortunately, what usually happens is you still claim your theories are absolute, its just the real world is not behaving properly. you really should stand in awe of such logic!

‘I am thankful you are commenting. I needed a laugh, and you have provided in full measure.

First, and foremost, there was no “gracious concession”. I was being sarcastic…’

There’s no sneaking anything past you, is there.

‘BTW, the classic textbook cases of monopsonistic labor markets is with small town nurses and school teachers.’

Iow, not unskilled labor?

Menzie wrote:

Menzie,

I totally agree wtih you. When government imposes a minimum wage there is an immediate increase in income inequality. Before the wage can work its way through the economy it raises costs on business. Because it impacts the cost of labor the immediate impact is a reduction in employment. Those employees who were employable at the lower minimum now become unemployable. Those employees who once earned a wage now earn no wage so the lower end of wages is increased.

But what of the upper end of wages? Those who earn wages higher than the minimum wage see the differential between their wage and the minimum begin immediately aggitating for increases in their wages. Some unions even have their wage reates tied to an increase in the minimum wage. So those who still have a job now take a greater part of the labor cost available.

So, Menzie, you are absolutely right and very perceptive. An increase in the minimum wage will always increase income inequality in the short-term and continued increases in the minimum wage will continually increase income inequality.

ricardo,

“Before the wage can work its way through the economy it raises costs on business. Because it impacts the cost of labor the immediate impact is a reduction in employment”

why is it not possible for the increase in working man’s wage to be offset by a decrease in management wages? why is it that management should be protected all of the time? other than the fact management is making a biased decision on how to allocate the increased cost, and thus protecting their own self interest, i am not sure in economic theory where it should make sense to always protect management salary over the working man’s salary? this could certainly be considered a failure of the efficient free market system.

Menzie,

No, the evidence is not mixed. There is a lot of misinformation in your comment. Fortunately, unlike you, I have some spare time for a thorough refutation.

You, like other defenders of the minimum wage, focus on the more narrow question of whether the minimum wage reduces employment, mentioning the meta-studies as support. The argument that you, the Council of Economic Advisors, (CEA) and others are relying on is summarized in the CEPR paper Why Does the Minimum Wage Have No Discernible Effect on Employment? In that paper, there are 2 key arguments made. The first is that the meta studies show that the consensus is wrong and that in fact the body of empirical evidence shows that the minimum wage has little of no effect on employment. The second argument is to refer to some very recent studies that find no effect. Let me deal with these in turn.

The traditional way of summarizing a body of evidence is for experts in the field to write a review of the available evidence, rendering expert judgment on what it means. One such recent review is Neumark and Wascher’s Minimum Wages and Employment. Neumark and Wascher are indeed experts in the field, having contributed significant research. They conclude from reviewing a large empirical literature that the weight of the evidence shows that the minimum wage has negative effects on employment. I find their analysis compelling and persuasive as do many others who are familiar with this area.

This traditional expert opinion method of summarizing evidence is common not only in economics but in other fields such as medicine. However, it does have its drawbacks, the most serious being that the results depend very much on the subjective judgments of the experts. In the past few decades, the statistical field of meta analysis has arisen to summarize evidence in a different way. The idea behind meta analysis is to do “statistics on statistics” and more objectively summarize a series of studies so that it is not as necessary to rely on expert judgment. The funnel plot, in slide 11 of the CEA presentation is an example of that meta analysis. The funnel plot is designed to show that the literature reviewed by Neumark and Wascher, despite their expert judgment, actually indicates no effect of the minimum wage on employment.

How so? In a funnel plot, you take a lot of studies and make a graph of the measured effect on the x axis and some measure of sample size on the y axis. There are a number of options to measure samples size; the funnel plot in the CEA presentation uses the inverse of the standard error, which emphasizes studies that have low standard errors. The theory is that when you make such a plot, the graph should look like a funnel centered at the true estimate. However, if there is publication bias, in which statistically significant estimates tend to get published more often than they should, then the funnel plot will look skewed. The skew that you can observe in the funnel plot in the CEA presentation is an argument that the evidence that Neumark and Wascher see on the effects of the minimum wage on employment is just publication bias.

This seems plausible but when you look more carefully into how the funnel plot was generated the plausibility disappears. The CEA is getting the funnel plot from the CEPR review paper, which in turn is getting it from Publication Selection Bias in Minimum-Wage Research? by Doucougliagos and Stanley, who do a meta analysis of a subset of the minimum wage literature. A key ingredient of any meta analysis is to specify transparently how the systematic review of the literature will be conducted. How will the question to be answered be formulated? How will studies be selected for inclusion? How will studies be excluded? What are the criteria for determining whether a study is valid? If included studies are biased, aren’t precisely related the question, or invalid in some way, the meta analysis itself will be invalid.

However, if you look at the paper, you’ll see none of this systematic review was actually done. The supporters of the minimum wage are just taking the results in this study at face value without subjecting them to any criticism. Maybe that’s because they don’t understand how a meta analysis is supposed to work. But the fact is the meta analysis is poorly done. The funnel plot doesn’t prove anything.

The other argument made in the CEPR review paper that the CEA, Menzie, and others are relying on is the alleged validity of the recent papers that find little or no relationship between the minimum wage and employment. The CEPR review paper, written in Feb 2013, presents this recent research as if it has not been refuted or questioned in any way. Yet, the CEPR paper omits the very serious critique of that research by Neumark and Wascher in Revisiting the Minimum Wage-Employment Debate: Throwing Out the Baby with the Bathwater? even though the Neumark/Wascher critique was available in September of 2012. Why would this critique be omitted in a review article on the effects of the minimum wage?

To summarize then: Expert review of the large body of minimum wage literature suggests a clear negative effect on employment. The meta analysis that claims this literature just represents publication bias is flawed. And the several recent studies that find no relationship between the minimum wage and employment have been severely criticized, although that criticism has not been acknowledged by the defenders of the minimum wage. Thus, the evidence is not really mixed at all. The weight of the evidence is just as I have asserted.

But maybe you are not convinced. OK, then. Let’s suppose the funnel plot research is valid and that the recent studies are valid too. Does that mean the minimum wage is good policy? No, it doesn’t. The funnel plot and the recent studies only concern the narrow question of the minimum wage’s effect on the employment level. But the policy questions surrounding the minimum wage are much broader than that. Even if it’s true that no one gets fired as a result of the minimum wage, hours could still be reduced. And if hours are reduced more than the minimum wage goes up, low wage workers could still be worse off. And there’s evidence on hours and the distribution of earnings that I’ve already mentioned. And there is also evidence on whether the minimum wage reduces the poverty rate that I’ve already mentioned. That evidence indicates that the minimum wage does not achieve the objectives its supporters tout. The funnel plot and the recent research, even if valid, have nothing to say about this other evidence though.

BTW, I think there is a bug in the comment system. I keep getting a captcha error intermittently when I try to post. Wasn’t able to do comment last night but am trying now with this new captcha.

Rick Stryker: You keep on harping on “no evidence”. Even your beloved Neumark and Wascher paper concludes:

If the net employment effect is zero, or even pretty close, and average household income rises, then wouldn’t the low income benefit? I’m sure your retort then is no. But let’s look at what a study (working paper version) subsequently published in that obscure journal , The American Economic Review concludes:

Now, the results pertain to those with minimum wage jobs when the hike is implemented, and excludes teenagers. But then aren’t these many of the people we are concerned about. (Of course, Neumark and Wascher allow for the possibility of zero impacts and even their preferred estimates are for negligible declines).

I’m pretty sure you’re now going to change the goalposts, and argue that higher income is not really a benefit to low income households because they’ll waste it in unsustainable ways — after all spending goes up more than income. Or you’ll argue that they really shouldn’t be buying those durables like cars, as they would be better off taking mass transit.

Now I know you don’t like the inequality argument, but it seems to me that if per capita income is rising, and income inequality were to decline, in most cases the income going to a low income household would go up in level terms. So (under these conditions that might apply with a rise in the minimum wage and current income trends), let me quote from Autor, Manning and Smith:

By the way, thanks for the tutorial on meta-studies. I look forward to seeing you do one, and how you decide which studies go in the hopper and which do not… After all, if you believe 500,000 jobs/mo is a standard rate of job creation over a recovery, I really trust your views on methodology.

‘If the net employment effect is zero, or even pretty close, and average household income rises, then wouldn’t the low income benefit’

The answer is, ‘not necessarily’. Can you guess why, Menzie?

Menzie,

That’s one study. In the larger literature, you can find many studies that find little or no effect on employment. The point is that the preponderance of the evidence runs against the minimum wage. Plus, there are many dimensions to whether the minimum wage is good policy which I already outlined in my 5 points.

On the question of the meta studies, my point about the systematic review is valid. Meta studies are much more common in the medical literature and standards have developed to conduct the systematic literature review. For example, the Preferred Reporting Items for Systematic Reviews and Meta-Analyses or PRISM sets the minimum standards that should be met in the systematic review in a meta analysis. The minimum standard includes a 27 point checklist.

I guess Menzie doesn’t want to play. Here’s a clue from the New York Times;

http://www.nytimes.com/2014/02/16/us/crossing-borders-and-changing-lives-lured-by-higher-state-minimum-wages.html?ref=us&_r=0

————quote——–

Ms. Lynch is one of the many minimum-wage migrants who travel from homes in Idaho, where the rate is $7.25, to work in Oregon, where it is the second highest in the country, $9.10.

….Ms. Lynch’s story illustrates some of the competing narratives of the minimum wage debate. When she took her Oregon job last year, at an Irish-themed restaurant and bar called Mackey’s, she got more hours at higher pay….

But Mackey’s owners also told her that she would have to work harder than before for that money. Higher labor costs meant getting rid of the dishwasher, for one thing, said Angena Grove, who owns the restaurant with her husband, Shawn. And whereas Ms. Lynch covered three tables at a time in her old Idaho job, Mackey’s waitresses, with the owners helping out, cover five.

“You work for the money,” Ms. Lynch said.

————–endquote———-

patrick, in the nytimes article you cited:

““It’s a big difference in pay,” said Ms. Lynch, 20, who moved last summer from her parents’ home in Boise, 30 miles farther east, to make her Oregon commute more bearable. “I can actually put some in the bank.”

Ms Lynch was able to obtain a 25% pay raise working the minimum wage in oregon. again why are you against this? you seem to think these folks don’t want to work. they will work for fair wages. they won’t work for unfair wages.

I guess ‘baffling’ is baffled.

patrick, just baffled because you are really not making any point at all with your quotes. you showed an example of a low income person benefiting from a rising minimum wage. and inside the article, employers in idaho noted they would also need to raise their wages above the state minimum to compete for the workers. hard to see why this is bad for equality.

Ed Hansondwb: Your problem is equating higher unemployment with lower employment. The studies I’m referring to typically pertain to employment; with a higher wage, obviously some people will be drawn into a labor force resulting in a higher measured unemployment rate (possibly- not all studies agree). If the wage rate rises more than employment falls (so that the produce of wage and employment rises), then the low wage income wage bill rises. In my book, that’s an improvement. If you say people will work harder, well, then we depart from labor-as-commodity-like-widgets and move more to an efficiency wage story. I could then interpret the minimum wage as a coordinating device which results in less waste of a scarce commodity, and higher income for workers. And for all you folks who want to make sure the “undeserving poor” don’t get SNAP but work very, very hard (like the poor Zell), then you should be overjoyed.I don’t think so, I am aware of the difference. If we are talking about the Wisconsin labor market, I should see evidence of defects in the Wisconsin labor market, which would lead me to think $10.10 was right for Wisconsin. The correct answer for the min wage should be “it depends.” That low skilled min wage labor market is uncompetitive or a monopsony, or even oligoipsony, is an assumption. Evidence? Which specific minimum wage jobs markets are uncompetitive? Seasonal workers at amusement parks? Life Guards at pools**? You can drop fries in a bucket or make tacos at any one of at least 10 fast food places, restaurants, and pizza places (McD, Wendys, Chiplotle, Burger King, Sonic, Checkers, Popeyes, KFC, and others) which one has the requisite market power? You can be a cashier or restock not only at Walmart, Costco, Sams Club, BJs Warehouse, Petsmart, and Target, but at the grocery stores and home improvement stores. There are hundreds of restaurants where you can wait tables. Maybe the labor market is not perfectly competitive (search costs, training costs, transportation costs, background checks, etc.), but I do not see a lot of companies with market power either. A good employee can pick up and leave for a better job, and they often do.

Nor do I observe that big companies with the largest per-employee profit margins are employing a lot of minimum wage workers (e.g. companies making money on the backs of low wage workers). The companies with the largest per employee profits are Apple, Google, Exxon, etc. -Target and Walmart (and other retailers like Rite Aid) have the lowest per employee profits. They ruthlessly cut costs (wages are onloy one dimension of employee costs). When the cost of labor at Walmart goes up, they will ruthlessly reduce it.

And, even if I did think that the market for unskilled labor was less than perfectly competitive, where is the evidence 10.10 is the right number for the whole country? OIr Wisconsin? Walmart sets wages locally-that’s why they offer a lot more in North Dakota than rural Alabama (check!). Maybe there are some rural places and small towns where Walmart has a lot of market power to set wages, we should confine the min wage laws to those places, not urban areas with competitive labor markets?

First, Labor is not scarce. That’s the problem right there. Second, making up a story to achieve the desired outcome is confirmation bias.

Overall, so far I am still not buying what is being sold. The minimum wage analysis feels like warmed over microwave economics. It’s been studied to death, with results that are dubious If we rehash the same policy as we did in 2006, I expect the same results (not much). I have not seen anything that makes me think this is better than the EITC, better than some combination of the EITC and the min wage (if the min wage is set locally based on actual labor conditions), or better than some version of universal basic income.

By the way, looking at the CBO detail, I really don’t think I’m way out in right field. Looking at table 4, income for people less than 1.5x the poverty level goes up between 1 and 3%, which is mostly in line with what my intuition – companies keep labor costs in line with revenue increases. Expected inflation itself is around 1-2%, employers have a lot of ways to control non-wage compensation, and the uncertainty in the estimates themselves is very large.

A 39% increase in the wage for in a 3% increase in incomes for people at the poverty level is meh. We can do better. The only quibble I really have with the CBO analysis is that the redistributional effects are not accurately captured. If we were at full employment it may be a different story, but with so much slack in the labor market raising barriers to entry for a 3% increase is counterproductive.

Menzie,

The CBO, whom you OFTEN cite, seems to think this would reduce employment. Are they wrong or are you?