It was five years ago that the ARRA was passed…and thence arose a fierce storm of criticisms, ranging from the idea that the stimulus would occur after the recovery was complete (e.g., Ed Lazear), to the Treasury view (government spending would crowd out completely private spending, e.g., Eugene Fama). Time to take stock. The Council of Economic Advisers has released its last report on the ARRA, and other stimulus measures, discussed in a blogpost by CEA Chair Jason Furman.

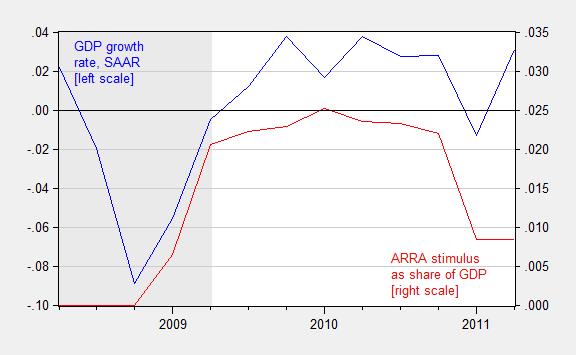

First, the estimated impact on GDP of the ARRA and other fiscal measures, relative to baseline:

Figure from CEA, The Economic Impact of the American Recovery and Reinvestment Act Five Years Later (February 2014)

The concept of “relative to baseline” is one of the most mis-understood and disparaged concepts, usually by people without an economics background. I am thankful that at least professional economists who were critics of the ARRA (e.g., John Taylor) understood and used the concept of the counterfactual.

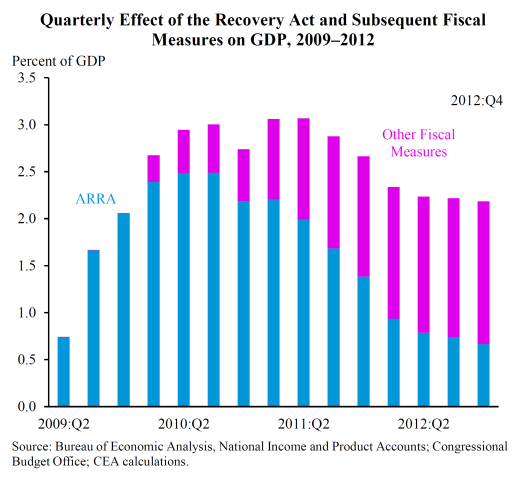

The estimated impact on GDP from the CEA, and the high-low range from the Congressional Budget Office, is shown in Figure 5 from the report.

Figure 5: from CEA, The Economic Impact of the American Recovery and Reinvestment Act Five Years Later (February 2014)

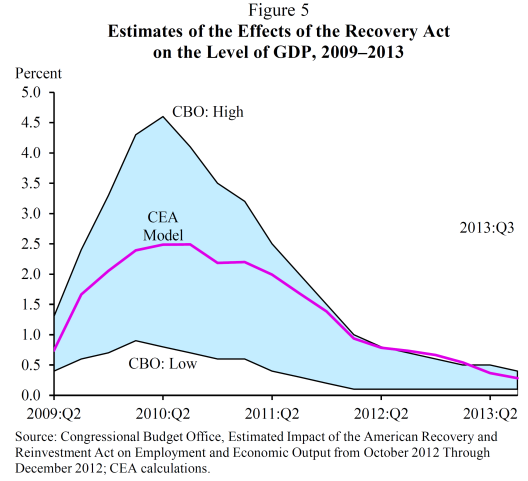

It is of note that professional/business sector economists, who do not have a political axe to grind, and the CEA have a similar perspective on the impact of the ARRA.

.Table 6 from CEA, The Economic Impact of the American Recovery and Reinvestment Act Five Years Later (February 2014)

See also the views from the bloggers in the Kaufmann survey and business economists in the WSJ survey. All the respondents might not have believed the stimulus package was a good idea, but almost all agree there was a positive impact on GDP and employment from the ARRA.

CEA Chair Furman discusses the main points of the report in his post (h/t The Hill’s On the Money blog). Here is Calculated Risk‘s take.

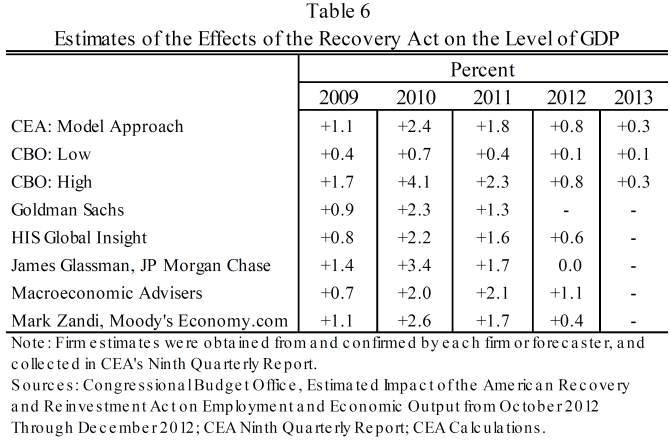

Parting graph, for the disbelievers in models and counterfactuals: Figure 3, shows GDP growth (in log terms, q/q SAAR) and stimulus as a share of GDP.

Figure 3: Quarter on quarter growth rate of real GDP, annualized (blue line, left scale) and sum of total receipt effects (reversed) and total expenditure effects from the ARRA, as a share of nominal GDP, 2008Q2-2011Q2. NBER defined recession dates shaded gray. Growth rate calculated as log first difference. Source: BEA via FRED and BEA 2013Q3 3rd release, NBER, and author’s calculations.

More discussion of fiscal policy and multipliers here.

The program was a complete waste of time, resources and money; of course then governmental

units excel in such matters.

Whom benefited, the usual suspects, unions, bankers, governmental units and bag men for the

administration. And Joe Blow winds up with the footing the bill.

If in fact this program had worked, then the Federal Reserve would have not need either FedZero

nor QEs unlimited…Those that believe it worked are the supporters of the nanny state and will

always find some reason and success in these bailouts.

so hans, i take it from your comments that you believe we should not have done any stimulus and simply let the private sector play out the depression. so without a stimulus, you would argue economically the country would be in better shape today (gdp, unemployment) than without the stimulus. is that correct?

please describe to me what the world would be like, what businesses would have excelled and which ones would have failed without the stimulus program? i’ll give you a couple of hints to start, your automotive industry and supporting businesses would have been gutted, the construction industry would have continued to collapse in both residential and infrastructure, without tarp we would be without merril lynch and morgan stanley, along with probably goldman. BoA and citi would probably be gone. this is the low hanging fruit. i’ll let you take it from there in the creation of your nonstimulus utopia.

The same topic on Professor’s Thoma website with his leftwing concerts.

http://economistsview.typepad.com/economistsview/2014/02/-the-stimulus-success.html#comments

Table 6 is just completely awesome, and I plan on using that over and over again! Thanks for posting that. Zandi is associated with the GOP, by the way, which makes it even better. Taylor is an odd fellow to figure out, I can’t quite believe that he believes what he says. His research on the stimulus is just a strange mix of conjecture and misdirection, when there are very straightforward tools to access its impact, and he certainly knows better than most how to use those tools. What does he gain by being contrarian about the stimulus? It has to be something more than pure greed, because he already has enough money and a future Noble waiting. Hard to grasp…

XO — Zandi is a Keynesian economics pimp. He is no more associated with the GOP than Christine ‘peace in out time’ Romer.

No, his was a big part of McCain’s 2008 campaign team. He also worked for some Democratic people in the past, but is associated with the GOP. Just Google “Zandi and McCain”…

If I borrowed a million dollars and bought dividend paying stocks, my income would surely rise. But you can’t conclude my investment was wise based on that income increase alone. When the stimulus is paid back, then you can start concluding it was a great and wise investment.

TWIST: IT NEVER WILL BE!

Really??? It has to be paid back so you can conclude anything? If you borrowed at 1% and invested and more than doubled your money, you still would not know it was a good investment? Ridiculous…

For the economy, you need to compare to the alternative – not investing. Even G Bush’s Paulson was scared of what would happen without it!!!

I understand counterfactuals. However, the true question is not whether or not ARRA increased GDP. The question that Menzie and others (Krugman) shy away from is whether or not ARRA met their expectations. If liberal economists expected ARRA to add x-amount to GDP and push unemployment lower, and it did not add x-amount to GDP and unemployment continued to go higher, than the cost-benefit analysis that the liberals used to persuade the American people to pass ARRA needs to be revisited. In my opinion, ARRA’s cost of almost $1T was most likely not worth it because it came nowhere near the expecations that liberals set for it.

anonymous,

if expectations were for $1.5 trillion stimulus as needed, but we only got $1.0 trillion due to the politics of passing Congress, then how do you evaluate a stimulus program which is in the direction that you wanted but was not of the magnitude required? do you really believe their is a linear relationship between stimulus and outcome in a depression? if you needed 1000 gallons of water to put out a fire, but negotiations with the water company only allowed for 700 gallons to be used on the fire, do you consider your efforts a failure? would you have said if i cannot have 1000 gallons, then i want none? or would you still have tried with the reduced resources knowing the probability of a positive outcome has been reduced? Krugman argued from the beginning the stimulus was not enough-and illustrated the point with numbers. and it did not meet his expectations. and we now why-he has discussed this point repeatedly. i guess we will never know whether a fully funded stimulus would have been more effective-the conservatives made sure this would never be answered-perhaps because they were afraid of the outcome.

Anonymous and baffling

Actually, the ARRA stimulus was much less than $1.5T. The bumper sticker said $787B in tax cuts and new spending; however, $77B of that simply extended the already existing exemptions for the alternative minimum tax. That $77B was not stimulus because it was already baked in the cake. In order to have stimulus you have to have a difference between the status quo and the new policy. The actual stimulus piece of the ARRA was only $710B, which was a very long way from the $1.3T that Romer recommended and the $1.4T that Krugman suggested.

Menzie: I find it humorous that you claim relative to baseline is one of the most misunderstood concepts but at the same time you the multiplier analysis that you support is making assumptions that monetary policy does not use unconventional tools, like quantitative easing. In this world the baseline is one in which there is zero response from the Fed regardless of the fiscal decisions. Not only is this a highly unrealistic assumption going forward it is a false description of what actually happened. I guess a misunderstanding of a proper baseline even eludes people within the economics profession. I suggest you spend less time knocking down straw men and more time critically thinking about your own arguments.

Jeff: Since we have had this exchange before, I find it humorous (as I usually do your posts). I’m not going to dig up the references again (go back and read our previous exchange). If you read the CBO analyses, they will note the assumptions regarding monetary policy — with the assumptions varying over time. And, gee, what has the Fed funds rate done over the past five years, anyway? Certainly, over the course of the ARRA, Fed policy did nottighten. So what is your point? I can’t see it.

Moreover, I don’t see how your critique applies to the private forecasters; I bet they conditioned on Fed policy. My guess is they probably cooked in the books some tightening, which in the end didn’t show up. So that means they were understating the multipliers. I once again don’t understand the point, unless you just want to cast aspersions.

Menzie: Yes, we have had this exchange before and yet you never seem to be able to get your head around it. I have read through the CBO analysis and I have yet to see one reference that properly models Fed policy. The most recent report cites Krugman and Eggertsson which assumes the Fed does not engage in unconventional monetary policy. And gee, what has the Fed done over the last 5 year, anyway? So if the CBO is using that model to justify the fiscal multiplier they are essentially saying in the baseline world where there is no ARRA the Fed does nothing at all because it can’t. This “baseline” approach tells you nothing at all because in no realistic scenario would ARRA not happen and the Fed not respond. Now you may say well I don’t think unconventional policies are not that effective. Well if that’s your opinion then voice it up front because that is the assumption that’s driving the results in your chart. My guess is that you know that’s an untenable position so you’d rather just slap up some pretty charts and pretend the analysis is robust. I know the CBO relies on more sources than just Krugman and Eggertson but those studies have slightly different problems. Since you seem to have such difficultly wrapping your head around this concept, its probably best to stop here. I’ll address other studies when you get this down. I don’t claim to have read each and every CBO source but if you show me one that properly models Fed policy then I’ll show you a Menzie Chinn post critical of a Democratic policy. As to private forecasters, I have no idea what there are doing. But if they are arriving at similar results my guess is that they have similar methodologies. And I don’t know about you, but when I hear some wrong repeated more than once it doesn’t convince me that its right.