Most accounts of inflation focus on national statistics. While the national series is still low, in some select locations, it’s even lower.

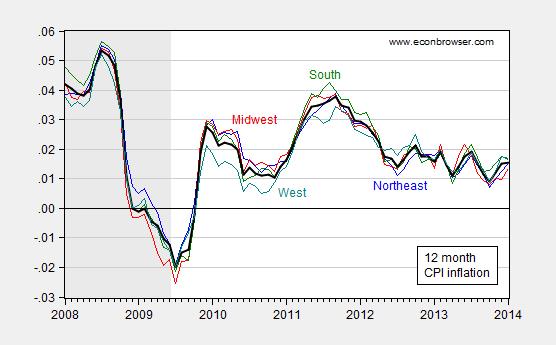

Figure 1 depicts 12 month inflation for the four BLS regions, and for the US as a whole.

Figure 1: Twelve month CPI-all inflation for Northeast urban (blue), Midwest urban (red), South urban (green), West urban (teal) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

Midwest inflation is the lowest, while all series are trending downward.

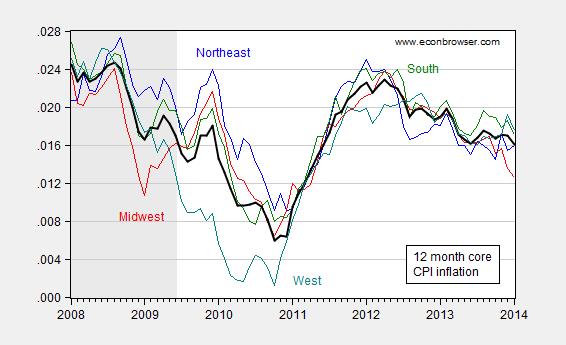

Core inflation is declining as well, with the Midwest once again leading the descent. As of January, core inflation in the region was 1.26%, less than the 1.6% recorded for the nation overall.

Figure 2: Twelve month core CPI-all inflation for Northeast urban (blue), Midwest urban (red), South urban (green), West urban (teal) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

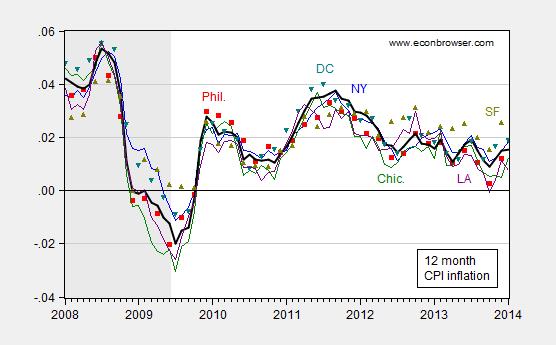

The BLS regions are pretty large, so one would not expect a lot of dispersion. Hence, I also examine the evolution in prices in several cities.

Figure 3: Twelve month CPI-all inflation for NY (blue), Philadelphia (red), Chicago (green), Washington DC (teal), LA (purple), SF (olive) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

LA and Philadelphia hit zero inflation earlier, in 2013, and inflation in those urban areas remains low. In assessing all these region- and city-specific indices, it’s important to realize that there’s considerably more sampling uncertainty, manifested in part by the greater volatility in these series. Hence, a positive reading could be obtained even when actual inflation is negative.

Does the geographical dispersion of inflation matter? In Europe, dispersion matters for interpreting the overall low rate of inflation (see IMF via Krugman). That’s partly because the lower degree of labor and credit market integration (think banking systems). In the United States, assets and liabilities are likely to be held more widely; nonetheless, for a given household, the relevant deflator for a given nominal debt is going to be at least somewhat region-specific, so actual deflation in a region is a matter for some worry.

My more central concern is that as the general inflation rate declines, it’s more and more likely that some regions are going to be facing actual deflation.

Regional inflation gives some sense of the relative strength of the regional economies.

Not surprising that Midwest would be low. CA is doing its usual cyclical bounce-back. East Coast in prosperous areas is doing OK.

Steve Kopits: Maybe — but MidWest UE is lower than both Northeast and West.

Maybe. Could be.

It still feels like the country is moving to the coasts from the center. The top 1%-ers still seem to be doing OK, and I subjectively feel like there are more of those on the coasts, and that they are to some extent propping up prices.

But I don’t know. I don’t have any firm feelings on the topic.

Meanwhile, though, total chaos at IHS Cera Week down in Houston. Huge complaints about cost increases, capex compression all around. Best guess: This ends ugly. I think the IOCs are in for a hard landing. Probably worth a post from Jim.

kopits, i hear the complaint is cost to extract oil is too high. do you feel this is a natural occurrence, or have the big oils made some poor investment choices which have pushed up the extraction cost? and if it is poor choices, do you expect any big heads to roll? i guess my question comes down to what exactly has driven up the cost of extraction over the past decade? overpayment of leases? more and more difficult drilling environments? i do appreciate your insights on this topic since you are obviously very well versed in these details.

I know you directed your question at someone specific, but I would like to comment. With regards to US onshore operations, completion costs may account for 50% of total well cost. Companies have completion backlogs due to demand; a lot of service companies are spread thin. On a larger scale, natural gas prices have been beating back some operators.

One unique example of large (investor disliked) capex is ExxonMobil. They have over eighteen (18) offshore rigs, large investments in onshore North American (conventional and unconventional), ambitions for unconventional exploration in Europe and are building a behemoth research campus in north Houston. Meanwhile they are confronting the notion of splitting their upstream and downstream units in the wake of investor sentiment against large projects. Shell is already starting their divestment strategy.

It is an interesting time in the oil and gas industry.

Steven,

How much of the cost increases is due to simple inflation caused by demand for drilling increasing more quickly than supply? For instance, the unit cost of many inputs (trucker salaries, “roughneck” housing, completion services, etc) has risen dramatically in N. Dakota due to a rapid ramping up of drilling.

There’s a limit to how quickly drilling can be increased: after a certain point, more investment doesn’t buy more drilling, it just raises the price to drill.

This belongs on the thread on the minimum wage, but it’s too funny to be ignored;

http://myfreedomfoundation.com/blog/liberty-live/detail/sawant-rips-freedom-foundation-for-a-study-she-obviously-didnt-read

An economist(?) in even greater denial than Menzie; if businesses are struggling with high rent and other costs of doing business, raise their labor costs on top of that!

Patrick R. Sullivan: Washington state’s minimum wage was $9.19/hr effective Jan. 1, 2013. Doesn’t seem to have hurt economic activity in the state (especially relative to Wisconsin, since Governor Walker’s advent!!!). See this post.

So you agree with Kshama that if businesses are struggling with high costs of doing business, the best thing to do is further increase their costs by raising the minimum wage by 60%?

Btw, since Menzie wants to compare Washington state with Wisconsin, here are the unemployment rates for the young (16-24, 16-19, and 20-24) in April 2013;

Washington 16.7 28.6 12.0

v.

Wisconsin 12.9 20.4 9.2

Source; http://www.governing.com/gov-data/economy-finance/youth-employment-unemployment-rate-data-by-state.html

Wisconsin does better than the national average, but not Washington.

Patrick R. Sullivan: No, I think I agree that the ever expanding share of national income going to capital should slow down, and one way to do that is to partially restore the bargaining power of labor. We can get unemployment to zero by putting an infinite tax on unemployment, or barring that, reinstitution of workhouses — if that is in your objective function.

Patrick R. Sullivan: I think I’ll take the 1.1 ppts cumulative greater increase in nonfarm payrolls in Washington state relative to Wisconsin, since 2011M01.

Wouldn’t an economist expect the share of income going to capital to increase if the wage rate for low skilled labor was artificially raised above the market clearing rate?

I see that the gremlins botched the format of my comparison of Washington youth unemployment v. Wisconsin’s

Washington: Ages 16-24; 16.7%

Wisconsin: 12.9%

Wash: Ages 16-19; 28.6%

Wisconsin; 20.4%

Washington: Ages 20-24; 12.0%

Wisconsin: 9.2%

‘We can get unemployment to zero by putting an infinite tax on unemployment, or barring that, reinstitution of workhouses — if that is in your objective function.’

Tsk, tsk, what would George Stigler have to say about such a travesty of logic?

Patrick R. Sullivan: Well, if there was monopsony power, the answer is no to your question.

The infinite tax on unemployment solution comes out of a Shapiro-Stiglitz model. You should read it.

Well, we’ve already pretty conclusively demonstrated that there is NOT monopsony power in the market for low skilled labor, so I guess your answer is, Yes, raising the minimum wage will likely raise the share income to capital.

Similarly, I’m unaware of anyone proposing a tax on the unemployed. However, since that argument is an admission that the incentives facing the low skilled labor force will affect behavior, doesn’t that undercut your belief that high marginal tax rates won’t increase unemployment?

what effect does migration have on inflation/deflation and unemployment? many folks (unemployed?) are moving out of the midwest to areas with better employment prospects and weather. does this exodus produce deflationary effects in the midwest-and possibly drop unemployment at the same time?

It looks like the regional data is not seasonally adjusted. I wonder if the different regions exhibit different seasonal patterns.

2slugbaits: Yes, the regional and city data are not seasonally adjusted. That’s why I plot 12 month (log) changes.

Oh, I see. You used seasonal log differences. For some reason I had it in my head that you just meant monthly log differences expressed at a 12 month rate. Okay, thanks.

Menzie,

How much good evidence do we have for the idea that the general perception of deflation reduces aggregate demand, in a vicious cycle? Have we seen it in computing, or in consumer electronics, where deflation is commonplace?

The title of this thread has bothered me ever since I first read it and it finally bugged me so much I had to post.

The dollar is the national currency. It does have an aggregate value. But the problem is that the dollar cannot inflate or deflate depending on geographical location. Menzie is not measuring inflation/deflation but price level. It is understandable that he is confused about monetary policy if he cannot distinguish between the two. The perversion of the tems inflaiton and deflation caused Mises to stop using the terms later in his life. He said that in normal conversation they had no meaning. Here we can see exactly what he means. For those confused consider, the purchasing power of money does not change just because the price of a commodity changes. Purchasing power is a monetary event while commodity price changes can be caused by either changes in the commodity (quantity, quality, demand) or monetary. But if monetary then the value of the purchasing power of the dollar must change and the change has to be for every commodity and location using the dollar. Ugh!

Those with this kind of confusion not only misunderstand monetary conditions but they misunderstand price signals. It is no wonder that corporations struggle with monetary windfall profits and losses.