I’ve just returned from two highly stimulating conferences in Beijing. The first was a Columbia-Tsinghua conference on “Capital Flows and International Financial Systems”, organized by Jiandong Ju and Shang-Jin Wei, and the second a NBER-China Center for Economic Research conference on “China and the World Economy”, organized by Yang Yao, Shang-Jin Wei, and Chong-En Bai.

The RMB Exchange Rate, Capital Market Openness, and Financial Reforms in China

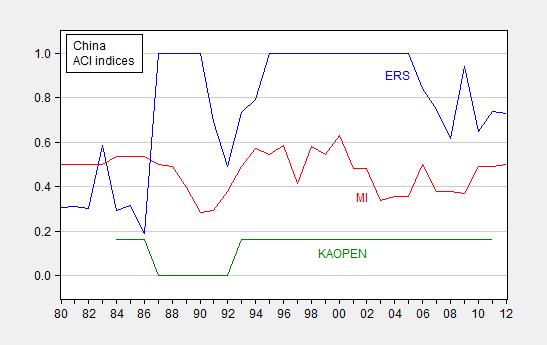

Figure 1: Aizenman-Chinn-Ito trilemma indices for China. ERS (blue) is exchange rate stability, inverse of standard deviation of exchange rate changes; MI (red) is monetary independence, inverse of correlation of policy interest rate with base country interest rate; KAOPEN is Chinn-Ito financial openness index. See here. Source: ACI

A policy panel at the Columbia-Tsinghua conference was chaired by Chaired by Shang-Jin Wei (Chief Economist Designate, Asian Development Bank, Professor of Economics at Columbia University, and NBER). The participants were:

- Joshua Aizenman (Professor of Economics and International Relations, University of Southern California and the NBER)

- Menzie Chinn (Professor of Public Affairs and Economics, University of Wisconsin, Madison, and NBER)

- Pierre-Olivier Gourinchas (Professor of Economics, University of California Berkeley and NBER)

- Fan He (Professor and Associate Dean, The Institute of International Economics and Politics, The Chinese Academy of Social Science)

- Jiandong Ju (Professor and Director, Center for International Economic Research at Tsinghua University)

- Jun Ma (Chief Economist, Research Department, People’s Bank of China; former Chief Economist for Greater China, Deutsche Bank)

The presentations were not made available online, and I can’t do justice to all the presentations. However, one surprising aspect of the discussion was the widespread agreement that capital account liberalization was an undertaking that needed to be conducted very slowly and deliberately. Aizenman (presentation), Gourinchas and He highlighted the potential for financial or balance of payments crises should capital account and domestic financial liberalization be improperly sequenced. Gourinchas further noted that the benefits of capital account openness were uncertain, and apparently relatively small, so the urgency for liberalization was not so great. (Update: Gourinchas’s points here.)

Both He and Ma noted that capital account liberalization had already progressed to a certain extent, with Ma making the case more forcefully. Ju argued that premature liberalization of the capital account could lead to capital flight and and domestic financial crisis as the housing market collapsed. Some discussion of the Ma, He, and Ju presentations are reported in the People’s Daily.

The major point of my presentation was that development of the RMB as an international currency was not costless, despite the pride that might be engendered by such a outcome. In particular, an internationalized currency exposes an economy to external shocks, and some loss of monetary autonomy if other countries peg to it. Such already seems to be the case for China. Some of these points are discussed in this paper.

International Economics (Columbia-Tsinghua)

I couldn’t attend all the sessions at the Columbia-Tsinghua conference (there were at times parallel sessions), but here are some of the papers I caught.

Jing Zhang (FRB Chicago) presented “Saving Europe?: The Unpleasant Arithmetic of Fiscal Austerity in Integrated Economies” (with E. Mendoza and L. Tesar).

What are the macroeconomic effects of tax adjustments in response to large public debt shocks in highly integrated economies? The answer from standard closed-economy models is deceptive, because they underestimate the elasticity of capital tax revenues and ignore crosscountry spillovers of tax changes. Instead, we examine this issue using a two-country model that matches the observed elasticity of the capital tax base by introducing endogenous capacity utilization and a partial depreciation allowance. Tax hikes have adverse effects on macro aggregates and welfare, and trigger strong cross-country externalities. Quantitative analysis calibrated to European data shows that unilateral capital tax increases cannot restore fiscal solvency, because the dynamic Laffer curve peaks below the required revenue increase. Unilateral labor tax hikes can do it, but have negative output and welfare effects at home and raise welfare and output abroad. Large spillovers also imply that unilateral capital tax hikes are much less costly under autarky than under free trade. Allowing for one-shot Nash tax competition, the model predicts a “race to the bottom” in capital taxes and higher labor taxes. The cooperative equilibrium is preferable, but capital (labor) taxes are still lower (higher) than initially. Moreover, autarky can produce higher welfare than both Nash and Cooperative equilibria.

Yinqiu Lu (IMF) presented “Emerging Market Local Currency Bond Yields and Foreign Holdings in the Post-Lehman Period – a Fortune or Misfortune?” (with C. Ebeke):

The paper shows that foreign holdings of local currency government bonds in emerging

market countries (EMs) have reduced bond yields but have somewhat increased yield volatility in the post-Lehman period. Econometric analyses conducted from a sample of 12 EMs demonstrate that these results are robust and causal. We use an identification strategy exploiting the geography-based measure of EMs financial remoteness vis-à-vis major offshore financial centers as an instrumental variable for the foreign holdings variable.The results also show that, in countries with weak fiscal and external positions, foreign holdings are greatly associated with increased yield volatility. A case study using Poland data elaborates on the cross country findings.

Likun Wang (Goethe University Frankfurt) presented “Exchange rate, risk premium and factors: what can term structure of interest rates tell us about the dynamics of the exchange rate?”:

In this paper, I investigate the role of expectations on the current and future status of economies in determining the dynamics of the exchange rate, through the channel of risk premium for holding a currency. The risk premium is introduced as an additional term to a best-fit time series model and is instrumented by bilateral latent factors obtained from the term structure of interest rates. Results show that it can significantly improve the baseline model in terms of in-sample goodness of fit and out-of-sample accuracy of forecast in exchange rate changes. The non-linearity of the risk premium in latent factors further renders state-dependent and time-varying response of change in exchange rate to an identified monetary policy adjustment. Above findings hold for seven out of eight advanced-economy currency pairs (AUD, CAD, GBP, JPY, NOK, NZD, SEK against USD). Once included in the Fama regression, the risk premium can also help in solving the UIP Puzzle, which has been detected in the cases of GBP/USD and JPY/USD.

Other presentations (w/o papers online):

- Jie Li (Central University of Finance and Economics), “Volatility of capital flows: the role of financial reforms” (with Z. Shen).

- Xiaoqiang Cheng (Hong Kong Monetary Authority), “Market segmentation, fundamentals or contagion? Assessing competing explanations for CNH-CNY pricing differentials” (with M. Funke, Chang Shu, and S. Eraslan.

- Oliver Hossfeld (Deutsche Bundesbank), “Carry funding and safe haven currencies: a threshold regression approach” (with R. MacDonald).

Keynote Presentations

- Menzie Chinn (University of Wisconsin Madison, and NBER), “Global Supply Chains and Macroeconomic Relationships” (based on this paper)

- Joshua Aizenman (University of Southern California and the NBER), “The Housing Sector – Too Big and Too Bubbly to Ignore” ([presentation], related paper Real Estate Valuation, Current Account and Credit Growth Patterns, Before and After the 2008-9 Crisis”)

- Pierre-Olivier Gourinchas (University of California Berkeley and NBER), “External Adjustment, Global Imbalances, Valuation Effects” (based on External Adjustment, Global Imbalances, Valuation Effects)

- Pol Antràs (Harvard University and NBER), “Contracts and Global Value Chains” (based on this paper)

picture here (Ju, Chinn, Antràs, Gourinchas, Wei)

International Finance (NBER-CCER)

[my inexact summaries in brackets when the paper is not available online]

- Menzie Chinn (Wisconsin, Madison and NBER), “The Trilemma and Reserves: Measurement and Policy Implications” (presentation)

- Yang Yao (CCER), “Financial Structure and Current Account Imbalances” (not online) [growth differentials in the context of overlapping generations model explain current account imbalances between the US and China]

Jianguo Xu (CCER): China A-share Stock Valuation: Fundamental Risk and Speculation premium (based on this paper).

- Pierre-Olivier Gourinchas (UC Berkeley and NBER), “Global Safe Assets” (based on this chapter)

- JU Jiandong (Tsinghua), “A Dynamic Structural Analysis of Real Exchange Rate and Current Account Imbalances: Theory and Evidences from China” (with J. Lin, LIU Q., and SHI K.) (not online) [a three sector exportables/importables/nontradables model with excess labor supply explains real exchange rate changes prior to the Lewis turning point]

Trade (NBER-CCER)

- Pol Antràs (Harvard University and NBER), “Contract Theory and Global Value Chains” (related presentations, here)

- Shang-Jin Wei (Columbia University and NBER), “Sizing up Market Failures in Export Pioneering Activities” (not online) [structural estimation of export pioneers in the electronics industry; are there enough or too many export pioneers?]

- Miaojie Yu (CCER), “Multiproduct Firms, Export Product Scope, and Trade Liberalization: The Role of Managerial Efficiency” (with L.D. Qiu).

Financial Markets (NBER-CCER)

- Rene Stulz (Ohio State and NBER), “Bank Performance during a Crisis” (not online) [determinants of bank performance during the global financial crisis, including governance, leverage, other factors]

- Joshua Aizenman (NBER and USC), “Real Estate Valuation in the Open Economy” [presentation] (related paper Real Estate Valuation, Current Account and Credit Growth Patterns, Before and After the 2008-9 Crisis”)

- Yiping Huang (CCER), “Financial Liberalization and the Middle-income Trap: What Can China Learn from Multicountry Experience?” (related summary; paper)

I’ve focused my review on the international/macro topics. Other fascinating issues in economics were also covered, including intergenerational mobility, retirement and higher education. For those, see the agenda.

What is interesting is that when China returns to the gold standard probably 90% of the discussion will be moot.

Menzie wrote,”…development of the RMB as an international currency was not costless, despite the pride that might be engendered by such a outcome. In particular, an internationalized currency exposes an economy to external shocks, and some loss of monetary autonomy if other countries peg to it.” On a gold standard a currency is highly insulated from external monetary shocks and other countries will lose their monetary autonomy as they peg to the RMB and by extension gold.

While floating currencies employ a lot of economists and government analysts, a gold standard will free these people up to do actual productive work.

Ricardo: When China returns to the gold standard? Seriously?

That of course is why there were no international financial crises in the 19th century.

Isn’t faith wonderful.

Spener,

That is why the economic growth of the 19th Centruy was over 4%. As long as you have governments meddling in the economy you will have financial crises.

Are you joking? I can no longer tell if you’re serious or joking or simply typing nonsense because your meds aren’t working. The Fed was created because the unregulated US economy and banking system had so many financial panics, as in the Panic of 1893 was followed by the Panic of 1907. This is basic US history.

Menzie,

I do appreciate your attention to China. Your posts on China have been very instructive and this one is not exception. It is interesting that the only place in the world where there is a serious debate between demand side economics and supply side economics is in China. On that it is interesting that this article by Steve Hanke was printed in the South China Morning Post..

An aside: Professor Hamilton I would really appreciate your analysis and contrast of the new GO vs GDP discussion. Many supply side economists and business experts are praising the GO as a step in the right direction. I am still inthe non-commital stage.

Ricardo

If you haven’t seen it, Mark Skousen has an article in Forbes explaining and promoting GO.

“Beyond GDP: Get Ready For A New Way To Measure The Economy”

Ed

China leaning toward a gold rmb.

First renminbi gold ETF

MSN Money

MSN Money

Most links to a gold backed rmb are just gold dealers trying to get people to buy their products. In truth if China did link the rmb to gold it is highly doubtful that the price of gold would change significantly. All that would happen is that the rmb would be used more in transactions because it would be the most stable currency in the world. There would be no reason to carry gold if the rmb was as good as gold.

Oops, the bottom link is to ZeroHedge not MSN Money.