As Ronald Reagan once said (although he did mean to say “stubborn”)

Regarding the implications of optimal currency area theory and Scottish independence, Reader Patrick Sullivan continues his reign of error, trying to argue that Canada did just fine, just like a bank crisis-free Scotland in a currency union would:

Canada didn’t have a central bank until sometime in the 1930s, and had a less severe depression than the USA.

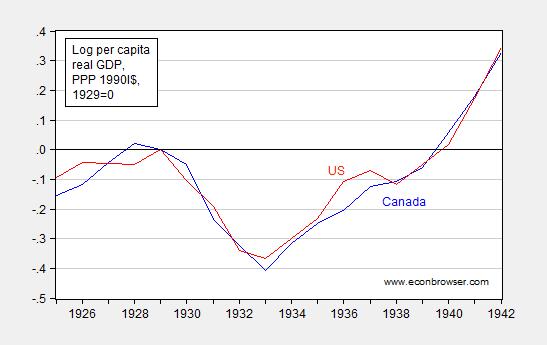

Well, with a little help from Louis Johnston, (who knows economic history much better than I), I generate the following plot:

Figure 1: Log per capita income in 1990 International dollars for Canada (blue) and United States (red), normalized to 1929=0. Source: Maddison and author’s calculations.

I dunno, but these seem to be comparable declines in output. So, yes, no central bank operating until 1935 [1] (p.22), but no, Canada suffers a pretty big shock (Canada on a de facto gold standard until 1931 (p.21)).

It constantly amazes me how people make easily falsifiable statements with such astounding confidence…

So, I think Scotland should consider very carefully independence conjoined with monetary union with England.

Fiscal federalism was very different than it is today in Canada, indeed one could look back at this period an correctly point to the fact the U.S. adopted many features of the modern welfare state before Canada. If you look at federal spending: in the US spending went up from 1929 to 1936 (the peak pre-WWII prep) by approx 130%; while in Canada the rise from 1929 to 1938 ( the peak before 1939 saw a massive increase in defence spending) was approx. 60%.

Professor Chinn is 100% right on this one – an independent Scotland would be an economic sick joke faster than you can say ‘municipal socialism is nuts.’

Professor Chinn,

As a learning question, regarding presentation of economic data, when do percentages become too large to properly compare log normalized changes to actual percentage changes? I notice looking at Maddison’s data that the USA real per capital GDP(1990I$) for 1929 is $6,899 and the 1942 GDP is $9,741. The 1929 log normalized difference from 1929 to 1974 is 0.345 or 34.5% while the actual percentage increase from 1929 to 1942 is 41.2%.

AS,

Here’s how to think about it. Let’s call Y(t) the observation in time t and Y(t-1) the observation in time t – 1. The growth rate r is

r = [Y(t) – Y(t-1)]/Y(t-1) = Y(t)/Y(t-1) – 1

Now, if you use logs, you are calculating the continuously compounded growth rate rc:

rc = ln[YIt)/Y(t-1)] or

Y(t) /Y(t-1) = exp(rc), where exp is the exponential function. Let’s expand the exponential in a second order taylor series and you get

Y(t)/Y(t-1) = exp(r) = 1 + rc + (1/2)(rc)^2

If rc is small enough such that (1/2)(rc)^2 is “small” enough to ignore, then you can drop the second order term and

rc = Y(t)/Y(t-1) – 1 so that rc is a very good approximation to r.

So, you can estimate the error as 1/2 of the continuously compounded growth rate squared and then ask yourself if the error is small enough to safely ignore.

In your example, rc = 34.5%, and so (1/2) X (34.5%)^2 = 6%, which is very close to the error between 34.5% and the true value of 41.2%. Is that too big? It depends on what you are using the calculation for but for GDP growth rates that would be too big.

On the other hand, if you are looking at annual GDP growth rates where the order of magnitude of large percent changes might be 4%, the error in using logs is on the order of (1/2) (4%)^2 = 0.08%. I would think you could live with that error.

Menzie,

There are some other stubborn facts to consider. Canada did not have a central bank until 1935. However, Canada did not experience the US banking panics of 1873, 1884, 1890, 1893, 1896, or 1907. No Canadian banks failed during the Great Depression.

It’s good that you acknowledged that Reagan meant to say stubborn. But if you want to get the stubborn facts right and not give a misleading picture, it is necessary to quote Reagan completely and in context. If you watch the video of Reagan’s speech to the Republican National Convention in 1988, you’ll see the important context that he correctly quotes Adams 3 times, first at about 10:45, then at about 11:09, and finally about 11:30, saying “facts are stubborn things.” Right at the 12:00 minute mark, Reagan does indeed say “Facts are stupid things.” But people who quote this always seem to leave out the second part. The full quote is “Facts are stupid things-stubborn things I should say.” Then Reagan laughed at his own slip of the tongue and went on.

Rick Stryker: Yes, so you make my point – you can get in trouble being in a common currency zone without fiscal union if shocks are asymmetric, even without problem banks.

Menzie,

But you missed my point. Patrick was reacting to Krugman’s claim that an advantage of a central bank for Canada is that it can bail out Canada’s banks. Patrick was making the historically correct point that Canada’s banking system has always been stable and has never needed or used the lender of last resort function.

If you want to say that Patrick was wrong about how severe the Great Depression was for Canada, I think you also have to acknowledge that he was right on the esoteric subject of the history of Canadian banking, just as you should also acknowledge that Reagan never really said “Facts are stupid things” in the way Left Wing mythology would have us believe.

“Reign of error” is an unfair characterization.

Rick Stryker: But you miss my point that even if there are no banking problems, being in a currency zone without a fiscal union (and possibly without a lender of last resort), you can get into big trouble. Hence, Patrick R. Sullivan’s point about banks was relevant, but not dispositive (in any case, I didn’t dispute the no banking crises point).

And as they say (in the context of Canada), “past performance is not guarantee of future returns”….

But back to my main point: is Patrick R. Sullivan wrong that the downturn in Canada was smaller than that in the United States — yes or no?

Menzie,

I’m not disputing that Canada had a downturn that was as severe as in the US. Indeed, I think you could argue that the Canadian depression was worse, since the recovery was also weaker. During the 10-year Depression-recovery period, productivity in the US returned to trend but never did in Canada.

I also didn’t miss your point. I’m just questioning your “reign of error” characterization. I’m also suggesting that if you are doing a post on factual errors, it’s a bit incongruous to start that post with a pseudo-fact about Reagan.

Well, Menzie, if we accept your; ‘these seem to be comparable declines in output [between Canada and the USA].’

Then where does this conclusion come from, since Canada and the USA did NOT have ‘monetary union’

‘So, I think Scotland should consider very carefully independence conjoined with monetary union with England.’

Patrick R. Sullivan: Canada is on the gold standard as is the UK as is the US — so they don’t have control over their own monetary policy. That’s the point I’m trying to get at. But for me, all I want you to do is simply admit you made a factual error. You can try to interpret all the rest in whatever way fits your particular model.

That’s supposed to be an answer to my question about your non-sequitur regarding ‘monetary union’, Menzie?

Btw, Canada went off gold in 1931. The USA not until 1933.

I’ll also clarify that I don’t think Scotland should declare independence (but it is a complex issue). I’m just trying to figure out where the idea that it’s some big deal that Scotland would continue to use the British Pound, comes from.

Patrick R. Sullivan: You fess up on your error regarding Canadian vs. US output drop (you haven’t yet, so I assume you stick to the claim? If so, maybe I’ll republish the graph in a new post), and I’ll explain (actually I have already explained, but apparently you haven’t understood).

Oh, and I still await your defense of the Pacific Research Institute study you were quoting at length…

Once again, I thank you for your comments — each and every one is a gem of misinformation and mendacity, useful as grist for the blogging mill.

rick,

“Patrick was making the historically correct point that Canada’s banking system has always been stable and has never needed or used the lender of last resort function.”

but for nearly 80 years it has operated with a central bank, which actually does exist as a lender of last resort-that threat of deterrent is quite powerful. kind of like a country’s nuclear deterrent strategy. you expect to never use it, but that does not mean it has had no effect. it is very hard to prove canadian bank stability existed without the influence of its central bank.

Baffling,

How do you explain the fact that in the US and other countries the banking system was affected by the 2008 Financial crisis but not in Canada, even though they all had central banks?

‘…a central bank, which actually does exist as a lender of last resort-that threat of deterrent is quite powerful.’

How is it a deterrent? Usually it’s seen as a stimulus to greater risk taking.

rick, the bank of canada provided financial support to canadian banks during the depths of the financial crisis. while banks in canada performed better overall, they still struggled. that performance was probably predicated on the stronger regulatory requirements imposed on canadian banks. so a central bank and strong banking regulations were shown to be beneficial in the case of canada.

patrick, if you cannot understand why a central bank willing to backstop a run on a bank helps to prevent such runs, that is your problem.

I was actually on the floor of the 1988 Republican Convention in New Orleans when Reagan made that speech. When he made that gaffe, the guy next to me laughed sheepishly and said “Oh no!”

I know the article mentioned it, but just to clarify John Adams actually said the quote, although he used “stubborn”.

“Facts are stubborn things; and whatever may be our wishes, our inclinations, or the dictates of our passion, they cannot alter the state of facts and evidence.”

– John Adams, Argument in Defense of the British Soldiers in the Boston Massacre Trials, Dec. 4, 1770.

Menzie

I am glad that facts have gained importance. Returning to the initial questions of Scotland, I have a few questions that I do not know the facts to answer them, but I will start with just one.

What would Scotland’s government debt be on day one of independence? I assume an answer to the question will include some specifics as to where the debt came from.

Ed

Ed Hanson: See Box 1 (p. 27) of this Institute for Fiscal Studies report.

Canada was on the Gold Standard until 1931, in effect in a “monetary union” with the United States, so you could say the Federal Reserve was its central bank until 1931. http://homes.chass.utoronto.ca/~floyd/bordred.pdf

The difference between US and Canadian banking is that Canada just has a handful of big banks that operate countrywide while the US has thousands of individual banks, most of which are very small, local institutions. This was even more so in the 1930s than it is now.

If you only have a very few large banks is having a central bank all that important?

Obviously, bank runs are much less likely in the Canadian case.

Has Canada ever had a single bank run?

Spencer,

No, Canada has not had a banking crisis. One key difference between the US and Canada during the Great Depression was branching. Branching was legal in Canada since 1870 but branching was very limited in the US. The Mcfadden act of 1927 specifically prohibited interstate branching in the US and allowed National banks to branch within states according to state law, which in practice meant limited branching. When the Great Depression hit, US banks were very much tied to the local communities they served and were not able to diversify risk as could the Canadian banking system. That’s an important reason why we saw the giant wave of bank failures in the US but virtually none in Canada.

spencer: Maybe a central bank is not all that important, but certainly government guarantees on the key assets banks hold are very helpful.

Menzie,

Yes facts are stubborn things.

Your graph indicates that Canada’s gap decline started in 1928 and did not turn until 1933. If Canada was on the gold standard until 1931 the FACTS say that gold had nothing to do with either the decline [around 3 years before leaving the gold standard] or the recovery [two years after leaving the gold standard]. I do appreciate you showing this. So did the decline in 1928 have anything to do with the gold standard? Actually yes. in 1929 Canada stopped redeeming Dominion notes in gold. Canada leaving the gold standard initiated the economic decline. After 1931 the Canadian dollar was essentially pegged to the dollar. The FDR took the US off of the gold standard in 1933 but then returned the US to the gold standard at $35/oz in 1934. The US was not off of the gold standard one full year. So, Canada essentially returned to the gold standard with the US in 1934.

Yes, Canada did have better laws concerning banking so they had no bank failures during the great depression.

But the “gold standard” returned at a 69% dollar rate. What kind of gold standard includes anticipated permanent upward exchange rate revisions conditioned upon economic circumstances?

Like the good internet troll that he is, Patrick R. Sullivan has hijacked the larger thread and somehow made the discussion all about the absence of a central bank in 19th century Canada rather than Scottish monetary union with England. He did this by concentrating on a Krugman throwaway line about how one (and only one) of the benefits of having your own currency, and by implication your own central bank, is that you retain greater flexibility in bailing out private banks should the need arise. Apparently Patrick R. Sullivan thinks that’s the only argument for having your own currency. But anyone who has followed Krugman must surely know that his main argument against monetary union coupled with fiscal independence is that it creates adverse terms of trade when the junior partner has to suffer deflation in order to restore competitive balance. Unlike 19th century Canada, this is especially important if you have a very open economy with lots of trade with the senior partner. That’s the Spanish lesson. Spain experienced a boom in the early 00s because they didn’t control their own currency. And then Spain experienced and continues to experience an unnecessarily harsh recession because Spain does not control its own currency. That is and always has been Krugman’s main argument. It’s a bit of a stretch to somehow paint Krugman’s position as being the great defender of Jamie Dimon’s bailout program.

As to the discussions of bank panics, I’m not sure what the point is supposed to be. As best I can tell Patrick R. Sullivan seems to believe that bank panics are due to spendthrift politicians who create bubbles that crash and then depend upon compliant central banks to inflate the debt away. In other words, he sees central banks as originators of moral hazard and nothing else. The problem is that bank panics, like the poor, have been with us always. The US had no central bank in 1837, but yet that bank panic and the contemporaneous global depression was arguably the worst in recorded history. Another lesson from 1837 is to ask what happens when an economy transitions from having a central bank (sort of) to not having one. In the case of the US, this effectively meant that investment in our economy was put in the hands of the Bank of England…the same as we might expect with Scotland under monetary union. In any event, Scotland isn’t arguing against having a central bank; Scotland is arguing for maintaining monetary union with the Bank of England. So this whole central bank discussion is a red herring.

And I really don’t get why Rick Stryker has risen to defend Patrick R. Sullivan, except possibly because anything that smacks of being anti-Menzie makes the two posters some kind of tribal brothers. We don’t often agree on things, but I’ve never thought Rick Stryker was an idiot. Most of the time he argues strongly for the importance of having a central bank that competently manages expectations. It’s kind of hard to do that if you don’t have a central bank. Has Rick Stryker regressed to some kind of crude Ludwig von Mises clownshow over at zerohedge.com? Down with fractional reserve banking! Down with fiat money! Down with the Fed! Long live gold! Ugh.

2slugs,

Where did I say that you don’t need a central bank? I just pointed out that Patrick is right in his observation about the Canadian banking system. And I corrected the record on the Reagan pseudo-quote.

One reason Canada hasn’t suffered a banking crisis is Canadian houses are much smaller than American houses and Canadians home buyers are much older.

Canadian banks benefit much more at the expense of Canadian home buyers. So, of course, that strengthens the Canadian banking system.

Canadian houses are much smaller than American houses

I believe that mortgages aren’t tax deductible in Canada. That means that housing is less expensive, the housing sector is less important to Canada’s economy, and that there’s much less likelihood of a real estate bubble.

…Canadian banks benefit much more at the expense of Canadian home buyers.

What do you mean?

The bank’s gain is the home buyer’s loss, and vice versa.

“(Canadian) lenders typically have full recourse in cases of default, meaning they can attach all of a borrower’s assets, not only the house. In the U.S. that’s not permitted in 11 states, including California, and foreclosure proceedings are complicated even in the other states.

The standard mortgage in Canada isn’t the 30-year fixed, as it is in the U.S., but a five-year mortgage amortized over 25 years. That means the loan balance has to be refinanced at the end of five years, exposing the borrower to any increase in rates that has occurred in the interim. Prepayment penalties for borrowers hoping to exploit a decline in rates, on the other hand, are very steep.

But Canadian mortgages are also portable — if you move before the five-year term is up you can apply your old mortgage to your new home. (If it’s a more expensive home, you take out a new loan for the excess.).

…mortgage interest isn’t tax-deductible in Canada, so there’s no incentive to over-borrow.

…tighter regulation, little securitization, less borrowing, etc. — and you come close to an explanation for the different experience with delinquencies and defaults in the two countries.

In the U.S., defaults peaked at about 5% of all mortgages, and exceeded 20% for those deregulated subprime loans. In Canada, defaults soared in 2008 and after, just as they did in the U.S. But they topped out at about 0.45% of all mortgages.”

Rick Stryker Did Menzie ever dispute the comment about Canada’s banking system? I went over the thread and I don’t see where he ever claimed that. My take is that Menzie said Patrick R. Sullivan’s point was a distinction without a difference because Canada was on the gold standard. The issue isn’t and never has been whether or not a country has a central bank. The issue is currency union, either through a formal monetary union of the kind that the SNP is proposing or in a de facto union through a gold standard.

As to your so called “correcting” the Reagan “pseudo-quote,” my advice would be to start thinking with both sides of your brain. Yes, yes…Reagan went back and corrected the record, as it were. But for those of us who do try to think with both sides of our brain and who do try to integrate context into things that are said (hint, hint…), the Reagan slip-of-the-tongue goes by another, more revealing name: a Freudian slip. So Menzie got the context right when he used small fonts in the parenthetical note about Reagan actually intending to say “stubborn” rather than “stupid.” He got it right because the filtered and corrected comment is not on the same psychological level as the unfiltered gaff. People that use both sides of their brain might wonder if Reagan actually did intend to say “stubborn” or if it’s more likely a case of Reagan’s ego filter catching his real intent and then trying to cover it up. I suspect that there’s a little bit of Richard Nixon in all of us and Reagan was no exception.

2slugs,

I see. These are not slips of the tongue but rather Freudian slips. Now that I’m using both sides of my brain, I have begun to wonder whether President Obama really did intend to say that his health care plan would bring efficiencies to the system. My eyes have been opened to he possibility that his ego filter may have failed to catch his real intent, which was to say his health care plan would bring inefficiencies to the system..

I thought Menzie’s reference was pretty obvious. Republicans have gotten themselves stuck with a disinformation campaign on behalf of the fossil fuel industry, so they’re saddled with saying deeply unrealistic things about things like Climate Change, coal and oil. Reagan is a Republican icon, and he’s famous for saying things that aren’t so, so there’s a sort of consistency there.

Sadly, Republicans have painted themselves into a position of defending the obviously untrue, like Democrats before the Civil War defending slavery.

That’s the kind of thing that happens when there’s a great industrial/economic transition – politicians and their followers get caught in the middle, and one side tends to be on the wrong side of history, destroying their reputation for honesty in the process.