A rapid collapse in the Wisconsin fiscal prospects (but pretty predictable, as long as one doesn’t believe in supply side miracles).

Three weeks ago, I documented the deterioration in Wisconsin budget prospects. Since then, the fiscal hemorrhaging has continued.

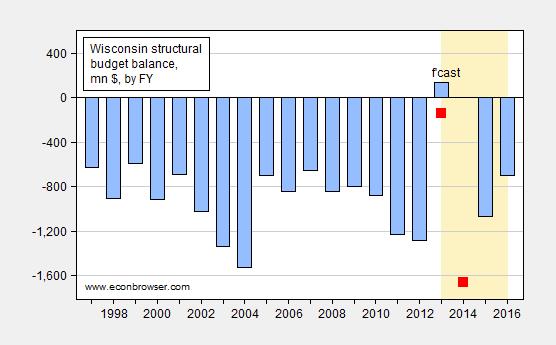

Figure 1: (Negative of) General Fund Amounts Necessary to Balance Budget, by Fiscal Year, in millions of dollars (blue bars); and estimate taking into account shortfall of $281 million for FY2013-14, and total $1.8 billion for biennium (red squares). “structural” denotes ongoing budget balance, assuming no revenue/outlay change associated with economic growth. Source: Legislative Fiscal Bureau (September 8, 2014), Wisconsin Budget Project, and author’s calculations.

The FY2013-14 estimate (red square) incorporates the estimated $281 tax revenue shortfall. It does not incorporate the likely higher than budgeted Medicaid expenditures.[Peacock/WBP] I estimate the FY2014-15 shortfall using the $1.8 billion estimated shortfall for the biennium noted by WisPolitics.

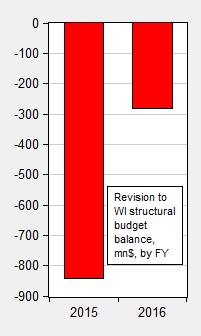

The downward revision in the structural budget balance since May is also remarkable.

Figure 2: Change in the (Negative of) General Fund Amounts Necessary to Balance Budget, by Fiscal Year, in millions of dollars, going from May 22 to Sept 3 (red bars). Source: Legislative Fiscal Bureau (May 22, 2014), Table 6, and Legislative Fiscal Bureau (September 8, 2014) and author’s calculations.

But at least we gave tax cuts to upper income households!

Funny how these things work, isn’t it? By the way, Minnesota and Illinois are also having revenue surprises- to the upside. Of course, neither did the Bush-like tax cuts that Walker and company pulled in Wisconsin.

35 years of evidence and the jury is back. TAX CUTS DO NOT INCREASE REVENUE. And cutting workers’ take-home pay tends to hurt an economy. Who knew? Actually, all of us outside of bubble-world knew.

Doubly funny is the right-wing spin of “Well, it’s only projections and those can change.” They sure weren’t singing that tune 6 months ago when they put in these stupid tax cuts. They were treating the one-time projected surplus like it was set in stone. Again, quite Bush-like.

The Wisconsin budget is shrinking though slowly due to the battle being fought by the rent-seeking government unions especially concerning their pension loot. Those who see their compensation tied to a constantly increasing government sector are working overtime even defying court orders to stop witch hunts in an effort to keep Wisconsin’s leadership role in government pork. Those who hold demand side mercantilist views shouldn’t criticize something they don’t understand. The demand side analysis always sees government increases as a sign of health even when the world looks like Japan.

No excuse is too stupid to be lapped up by Walker supporters

Menzie,

Since you bring it up perhaps this is part of the reason.

http://legalnewsline.com/news/251647-district-attorneys-wife-drove-case-against-wis-gov-walker-insider-says

Ricky, you are an irony MACHINE. People who don’t understand somethng shouldn’t write about it. You card you.

Unions, operating on the cost side of the budget, are preventing tax cuts, on the revenue side, from doing their magic. How do you think of this stuff?

Cutting taxes $100 to $300 on workers earning $30,000 to $75,000 a year wouldn’t have much of an effect.

A $5,000 tax cut instead may be enough to jolt the economy into a self-sustaining consumption-employment cycle.

Large tax cuts worked under Kennedy, Reagan, and Bush, ceteris paribus (and Clinton benefited from the “peace dividend,” $10 oil, and the Baby-Boomers reaching their peak productive years).

Of course, in the Great Depression, taxes were too low to cut taxes. So, government spending was needed.

oh for goodness sake: the large tax cut that “worked” under jfk was to a tax system where the highest marginal rate was 91%. it’s not analogous here at all.

the reagan tax cuts did not “work,” if by work you mean “deliver the revenue that reagan claimed they would,” which we can see by the fact that after the 1981 cut, reagan proceeded to raise taxes in a variety of ways.

the bush tax cuts did not “work” in the slightest, producing neither the jobs nor the revenue that were promised for them.

the remarks about clinton are simply silly beyond description.

Howard, your statement is beyond “silly.”

The Kennedy tax cuts contributed to the longest expansion in U.S. history, up to that time.

The Reagan tax cuts contributed to the V-shaped recovery and taxes were later raised to slow the expansion to a sustainable rate.

When Bush raised taxes, in 1990, we had a moderate recession in the 1982-07 economic boom.

Clinton raised taxes when the expansion was underway, but didn’t cut taxes in 2000.

Fortunately, Bush cut taxes in 2001 and we had a mild recession, along with building upon the 1995-00 boom, when the economy produced above potential output and beyond full employment.

The Reagan tax cuts were, as I’ve noted in other comments, followed the next year by the largest tax increase in US history, followed the next year by tax increases, the next, the next, the next, etc. Even the 1987 tax reform deal, which lowered rates from 50% to 38% (or so – I don’t remember), raised other taxes to pay for it. And even then, the US national debt doubled under RWR.

The structure of taxation was different in days of yore, especially after WWII, because it was a system of surtaxes on top of low stated rates. That was shifted but you have to look at the levels of income closely because the surtax makes clear it’s the amount over x, something people forget when they think about marginal rates (though the ideas are the same).

Saying JFK’s tax rate reduction sparked things is nuts. There was the space program and the arms race and Vietnam and a lot of highway spending, etc. which all classify as government stimulus.

Jonathan, your statement is misleading.

For example, the 1981 tax cut was twice as big as all the subsequent tax hikes in the 1980s.

http://www.ritholtz.com/blog/2010/09/reagan-tax-increases/

I never stated government spending, including defense spending, doesn’t add to economic growth.

The Reagan economic boom generally reflected a boom in private goods, that continued to 2007.

Also, I may add, to my statement above, the Bush tax cut in early 2008 gave the Fed time to catch-up easing the money supply. The U.S. was on the path to a mild recession, until Lehman failed in September 2008.

peak trader, i don’t think you’re either reading or writing very carefully.

i didn’t say that the jfk tax cuts weren’t effective, i said they had no analogy to wisconsin taxes. if wisconsin’s highest marginal rate was 91%, then it would.

i did say that you can’t claim reagan’s tax cuts “worked” when they didn’t deliver the revenue that was forecast for them and when they were significantly reversed in the years to come. saying they were part of a “v-shaped recovery” doesn’t prove a thing: i was part of that v-shaped recovery too (got a new full-time job): does that mean that i caused it? further, ascribing the recovery to the tax cuts and not to the interest rate cuts first and foremost is quite simply a misreading of history.

the bush tax cuts should be judged based on what was promised for them: they failed to deliver either the jobs or the revenue promised for them. they didn’t “work” in the slightest, nor have you provided evidence they did.

your clinton comment still makes no sense: here’s the facts. he raised taxes and the economy outperformed the bush years, the reagan years, and the jfk years.

Howard, I responded to your comments appropriately.

Obviously, you didn’t understand my responses.

Cutting taxes in a recession and raising taxes in an expansion generates more tax revenue.

Tax revenue isn’t dependent on just tax rates, it’s also dependent on employment.

And, per capita real GDP growth was stronger in 1982-90 than in 1995-00.

Of course, the 1995-00 boom was on top of previous booms, and the 2001-07 expansion looks weak, in part, because it was on top of huge economic gains, in 1982-00 (also, trade deficits reached $750 billion a year, in the mid-2000s, which subtract from GDP).

It seems to me that much of the issue revolves around the income distribution within a particular state. When you have a state with low average income, higher taxes can be individually onerous; whereas in a state with higher average incomes, a higher tax rate may not affect the quality of life or consumption patterns as greatly. It’s a chicken-egg question: do higher taxes and government spending create an environment where better jobs thrive or does the presence of better paying jobs allow government to tax and spend more without adverse affects?

http://taxfoundation.org/blog/release-annual-state-local-tax-burdens-rankings or this http://247wallst.com/special-report/2014/04/02/states-with-the-highest-and-lowest-taxes/3/

Note where Wisconsin ranks. Yes, these are 2011 data published in April, 2014. Perhaps there is a later analysis available. But the question remains: would Wisconsin benefit by moving from the 5th highest to the highest state tax burden?

Bruce, your second link says: “The combination of such taxes meant (Wisconsin) residents faced the fifth-highest tax burden in the U.S. and also paid $3,387 — or 8.3% of their incomes — in Wisconsin state and local taxes.”

Adding federal taxes, regulations, fees, and fines, it’s no wonder so many Americans are struggling.

Moreover, there’s likely a market failure in low-wage income. For example, in the fast food industry, productivity rose 25%, while the real minimum wage fell 25%.

Furthermore, there are tens of millions of low-skilled immigrants, from dirt poor countries, and their children. Many went to poor public schools and their parents aren’t interested in helping them attain a good education. So, they end-up in underpaid or low-paid jobs, thanks in part to overpaid or highly-paid bureaucrats, which adds to inequality. Of course, much of the older domestic population has also moved into higher income classes, while newer low-skilled immigrants are in the lower classes.

The explosion of means-testing and government benefits likely created disincentives to work.

U.S. firms have more market power. However, the goal of firms should be to maximize profits.

Profit is the result, and reward, of efficiencies.

Efficiencies in prior economic revolutions allow an economy to expand into new economic revolutions.

There are fundamental problems with the U.S. economy.

I thought Keynesians were supposed to be in favor of reducing government surpluses.

Patrick R. Sullivan: Then you would be mistaken. A typical Keynesian (well, more accurately somebody who ascribes to the Neoclassical synthesis) would say that one would want expansionary fiscal policy when output is below potential, and contractionary when output is above potential, so that one tends toward having something near a balanced budget when output is at potential. Now, sometimes crazy fiscal policies are undertaken which contract spending and reduce tax revenues simultaneously so as to embark upon a maximally contractionary policy, in the misguided belief that tax revenues will “boom” in such a way that revenues increase in response to a tax rate decrease. I suspect that you are an adherent of such policy frameworks. I am not.

Patrick,

Your post caught me off guard and made me laugh right out loud when I read it.

Probably not as much as Menzie’s ‘comeback’ made me ; laugh.

Btw, what about the Gestapo tactics of the Milwaukee DA Chisolm, Menzie. You okay with secret police action?

Presumably that was a laugh of ignorance since your comment was misguided and our host’s comment was accurate.

Patrick: what the hell does a DA’s action have to do with macroeconomics?

Probably not much. I’m just curious to see how far gone into fascist worship the average Wisconsin public employee is.

Exactly what factual basis do you have for implying that the “average Wisconsin public employee” has any tendency towards fascism? Or is just your way of making a baseless ad hominem attack.

I love how it’s immediately accepted that Chisholm did something wrong, no questions asked. Maybe he did act inappropriately, and if he did, I hope it’s dealt with properly.

But even if he did, it does nothing to take away from Menzie’s point about the state’s economic performance. Pretending it does is laughable and shows that you guys really have nothing left to cling to.

if one little DA can thoroughly control the behavior of the entire wisconsin conservative movement, then perhaps that movement is simply too weak and should step down. apparently that movement consists of very weak and disorganized leaders-not the type of people who should be leading a struggling state.

The declines in state income tax revenues should continue and significantly accelerate over the next three years as Wisconsin businesses (both manufacturing and agricultural) re-organize to maximize the amount of the tax credit flow-through. This will occur through two mechanisms: 1) existing businesses will re-structure and maximize the amount of the flow-through credit through aggressive transfer pricing and cost-shifting strategies; and 2) out-of-state resident business owners, and owners who have already transferred taxable business income out of state through the use of out-of-state administrative companies or upstream parent companies, will find an eager market for buy-ins by Wisconsin investors seeking to obtain these tax credits. The first step is already well underway with many companies separating into production, distribution, and administrative companies with the production company maximizing manufacturing income by aggressive transfer pricing to the distributing entity and the concentration of costs in the administrative entity. The second step is just beginning as CPA firms and tax attorneys begin to structure investment deals which will resemble the 1980s market for Real Estate Limited Partnerships before the introduction of the at-risk rules and the limitations on passive investment losses. But there are two significant differences between the old LP investment deals and the coming wave; 1) the old LP deals consisted of selling tax losses to investors, and lacking a profit incentive, the old LP deals had, at their cores, a money-losing business, while these new deals will be investments to receive tax credits from a profitable entity; and 2) unlike the real estate deals of the 1980s–bank debt will not be involved or it will be only a marginal aspect of the deal. Remember that when Walker spoke to the WMC when this was passed he spoke of it as a measure that would “end taxes” for many WMC members. The people who designed this knew fully well that the cost estimates were wholly off the mark. I would not be surprised to see state income tax revenues continue to decline at 3-4% a year for the next several years as the true costs of this reverse Robin Hood, no-taxation-of-the-wealthy measure hits full stride.

Well, taking economic/investment advice from a political pundit is hazardous. Speaking as an alum of the same institution as the blog author, I would use caution here.

I’ve met a million of ’em…