Just wondering — where is Ed Lazear when you need him?

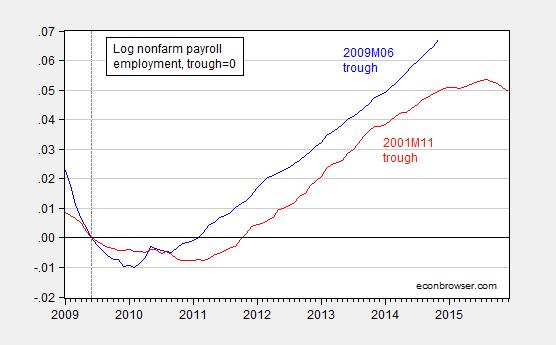

Figure 1: Log nonfarm payroll employment normalized on 2009M06 trough (blue), and on 2001M11 trough (red). NBER defined troughs. Source: BLS via FRED, NBER, and author’s calculations.

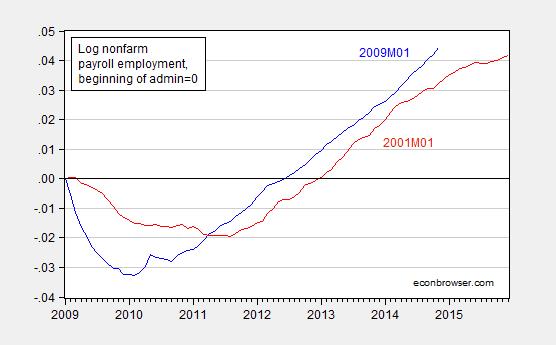

Normalizing on beginning of administrations yields this figure.

Figure 2: Log nonfarm payroll employment normalized on 2009M01 beginning of Obama administration (blue), and on 2001M01 G.W. Bush administration (red). Source: BLS via FRED and author’s calculations.

I suspect Ed might point out this: http://www.advisorperspectives.com/dshort/commentaries/Full-Time-vs-Part-Time-Employment.php

… or this: http://www.usnews.com/opinion/articles/2014/07/23/the-real-unemployment-rate-and-the-dearth-of-full-time-jobs

… or this: http://www.frbsf.org/economic-research/publications/economic-letter/2013/august/part-time-work-employment-increase-recession/

But then, I’m just guess what Ed might say.

Bruce Hall: Re: First two links, maybe you should get your talking points from somewhere else, and re: third link, update your data sources. See WSJ RTE today.

Or you can stay in denial.

Menzie, apples to oranges. Change vs. ratio. The data are not inconsistent. The full time jobs, after 6 years, are finally returning to a more “normal” portion of the workforce. So, yes, the recent history is good news; the bad new was that it took so friggin’ long to get there.

Menzie asked: How Come I Don’t Still Hear about the “Worst Recovery Ever”?

Because the voters elected Republicans to the House who slowed excessive spending stopping the slide, and then elected Republicans to the entire congress so everyone anticipates real recovery starting in only a few months.

Thanks for asking.

ricardo,

what you mean is obama has finally been able to clean up the financial disaster conservatives brought upon the country and has finally gotten our economy moving in the right direction. so send in the morons to screw it up again. look back through history, it is always the democrats cleaning up the mess left behind by a conservative government. clinton had to clean up after bush sr and left a strong economy for bush jr. obama will do the same for the next president. can’t say the same thing about the republican presidents. oh yes, thats right, bush left a sprawling growing economy for obama to enjoy, right?

It’s probably still the worst recovery ever, but improving quickly.

Paradoxically, Obama’s legacy might be quite different than how we have seen him recently.

The elements are present for a quick and clean deal with the Russians, and if they fold, the Iranians may also capitulate. I believe China, like the US, will also do the right thing, after they have tried everything else (which will take another year). Add to that low oil prices, a booming US economy and a recovering global economy, and Obama could go out on a high note.

Now, if Obama had any brains (or rather, the ideological inclination), then, like Clinton, he could do a deal with the Republicans to tighten up Obamacare, bring the budget into balance, and pass an immigration law that makes some sense. If he had the inclination.

So, the President can claim the credit, as Presidents are wont to do. But behind all of this is US shale oil production. All of it.

Here’s my view on oil and the US trade deficit: http://www.prienga.com/blog/2014/12/6/oil-and-the-trade-deficit

“he could do a deal with the Republicans to tighten up Obamacare, bring the budget into balance, and pass an immigration law that makes some sense. If he had the inclination.”

I believe in unicorns too. Are the republicans of Clinton’s era the republicans of Obama’s era. I remember a republican wanting Obama to be a one term president which to me says I want the US to fail. No thanks. That guy got pretty much what he wanted except for the one term.

“Now, if Obama had any brains (or rather, the ideological inclination), then, like Clinton, he could do a deal with the Republicans to tighten up Obamacare, bring the budget into balance, and pass an immigration law that makes some sense. If he had the inclination.”

Wins the internet today.

Steve

Those figures are completely misleading. Non-farm payroll employment reached its local peak in 2008, not 2009. The drop between 2008 and 2009 was SUBSTANTIAL. Conversely the local peak for the 2001 recession was in 2001. If you’re going to base the rest of your analysis of where we are in relation to trend, wouldn’t it stand to reason the further off trend we are the quicker we should recover.

James Gualtieri: I think what you are getting at is that we should condition on depth of recession. As I argued in this post, if you start conditioning, you should condition on several factors that people (like Reinhart and Rogoff) have argued are important.

My own belief is that full-time jobs are just an indicator of the depth of the recovery. So the WSJ and Republican desire to harp on them is just piling on after the election.

The one real success of their policies is oil prices, which does mute their criticism. Weekly net imports of crude oil have gone way down, from 9,221 thousand barrels per week in the last week of 2008 to 6,929 thousand in the last week of November 2014. In so far as the crude or motor gasoline figures of EIA are accurate representations of demand, this is down, too. For finished petroleum products supplied, from summer peak in May 2008 at 555,350 thousand barrels, demand has fallen to a summer peak of 531,146 thousand barrels in July 2014, which was something of an outlier. I don’t see the Republicans claiming the fall in demand is a great triumph, while shale oil is trumpeted.

The real test of what they are saying will be saving. As a percentage of disposable personal income, this peaked at around 8.6% at the end of 2012, when President Obama’s re-election was in some doubt. This ratio has fallen to about 5% since. If the Republican policies really work, this will stay constant or decline in the next 2 years. If not, the percentage should go up, as consumers use the savings on oil to increase personal savings, but do not consume lavishly or invest aggressively. (And yes, there will be monthly or quarterly variation so it will be possible to cherry-pick one figure which doesn’t conform to this impression, but not the whole ensemble.)

Because most of us still haven’t recovered.