Senator Rand Paul (R-KY) has gathered significant bipartisan support for the Federal Reserve Transparency Act of 2015, his proposal for more audits of the Fed. I’ve been trying to understand why any sensible person would think this is a good idea.

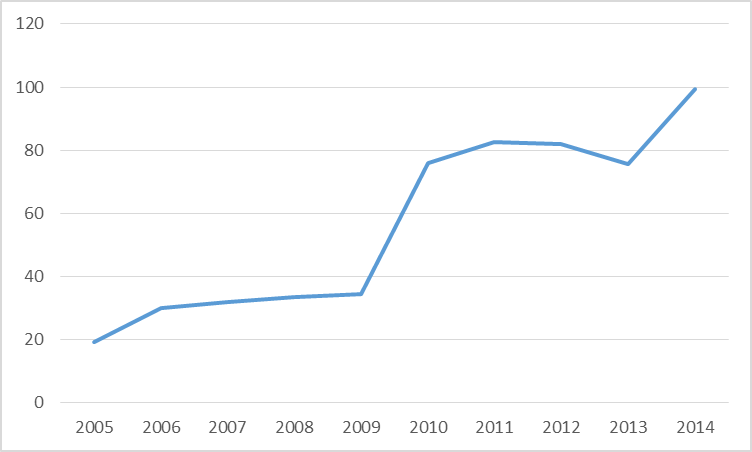

Jim Guest says the bill would serve Americans’ “right to know where their tax dollars are going.” Perhaps he meant to say Americans’ right to know where the Treasury’s revenues are coming from rather than where tax dollars are going. The Federal Reserve’s net contributions to the U.S. Treasury have averaged +$83 billion per year since 2009. Last year’s federal deficit would have been almost $100 billion bigger if it had not been for the net positive revenue contributions from the Fed.

Net receipts of the U.S. Treasury from the Federal Reserve, fiscal years 2005-2014. Data source: Treasury Bulletin.

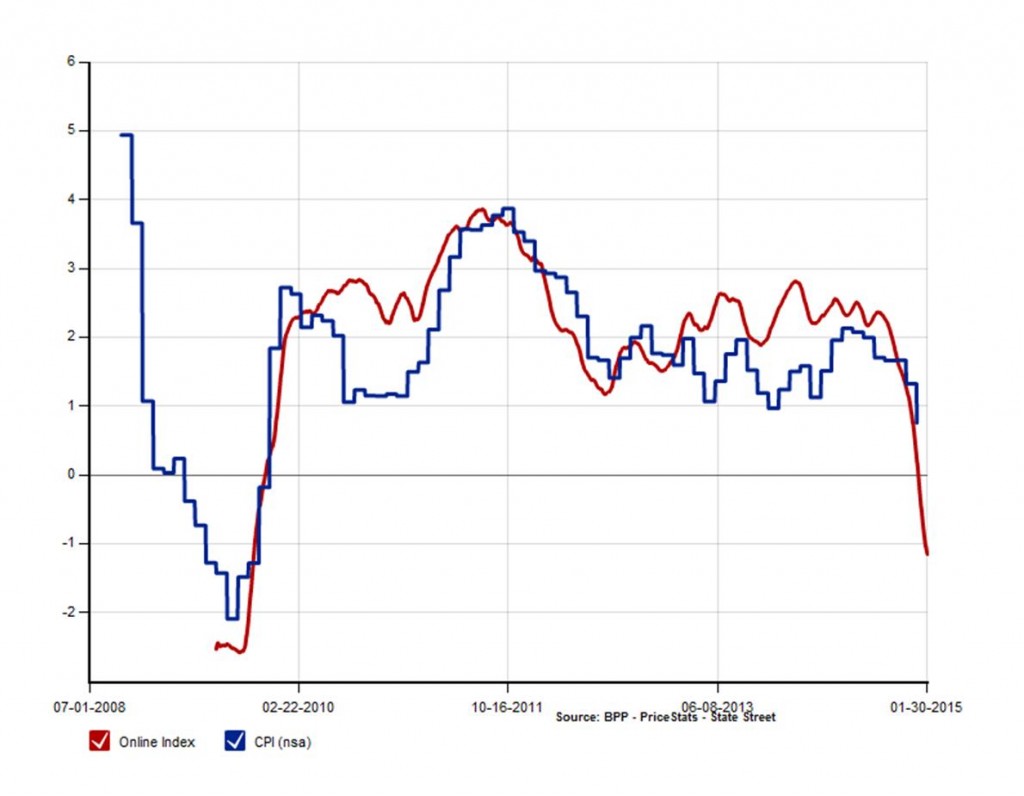

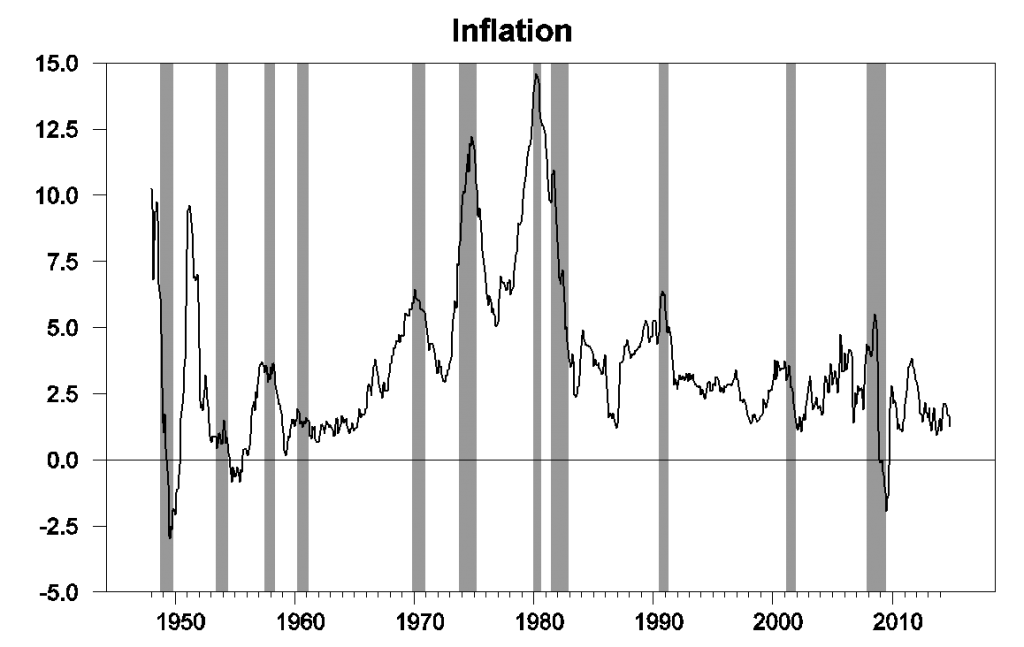

John Tate thinks the bill would help address “the silent, destructive tax of monetary inflation.” But inflation as measured by the consumer price index has averaged under 1.8% over the last decade. That’s the lowest it’s been since the 1960s.

Of course, many of the same people who favor Senator Paul’s bill distrust government-collected inflation data like the CPI. So suppose you look at the private Billion Prices Project, which mechanically collects a huge number of prices each day off the internet. According to BPP, inflation over the last year has been if anything lower than the official numbers.

Year-over-year U.S. inflation rate as estimated by BPP (red) and CPI (blue). Source: Billion Prices Project.

Others may take the view that more transparency in and of itself is a good thing. But the Fed is already audited; you can read the audit yourself here. You can examine the Fed’s assets directly down to the level of CUSIP, if you like. Here at Econbrowser we’ve been reporting detailed graphs of the Fed’s assets and liabilities for years using publicly available sources like the weekly H41 statistical release. Cecchetti and Schoenholtz note this conclusion from Richard Fisher, president of the Federal Reserve Bank of Dallas and one of the FOMC’s outspoken critics of quantitative easing:

We are– I’ll be blunt– audited out the wazoo. Every Federal Reserve Bank has a private auditor. We have our auditor of the system. We have our own inspector general. We are audited. What he’s talking about is politicizing monetary policy.

The Wall Street Journal’s David Wessel elaborates:

In 2009, Congress changed the law to allow GAO audits of loans made by the Fed to a single company, such as Bear Stearns or Citigroup, but only when the Fed invoked Section 13(3) of the Federal Reserve Act. (That’s the provision that allows the Fed to lend to almost anybody under circumstances it deems “unusual and exigent.”) The Dodd-Frank law of 2010 further widened the GAO’s authority, allowing it to review the Fed’s internal controls, policies on collateral, use of contractors and other activities—but the GAO is still blocked from reviewing or evaluating the Fed’s monetary-policy decisions.

The Audit the Fed bill would change the law again, and allow the GAO to examine and criticize all monetary policy decisions without restriction.

If we did want to see a lot more inflation for the U.S., Paul’s bill would be the way to get it. The main effect of the bill would be to give Congress an additional tool to exert operational control over monetary policy. The political pressures will be very strong not to raise interest rates when the time does come to start to worry again about inflation. And when the Fed does get to raising rates, it will mean extra costs for the Treasury in paying interest on the federal debt– Congress isn’t going to like that. The primary effect of the legislation would be to give Congress one more stick with which to try to beat up on the Fed when the Fed next does need to take steps to keep inflation from rising.

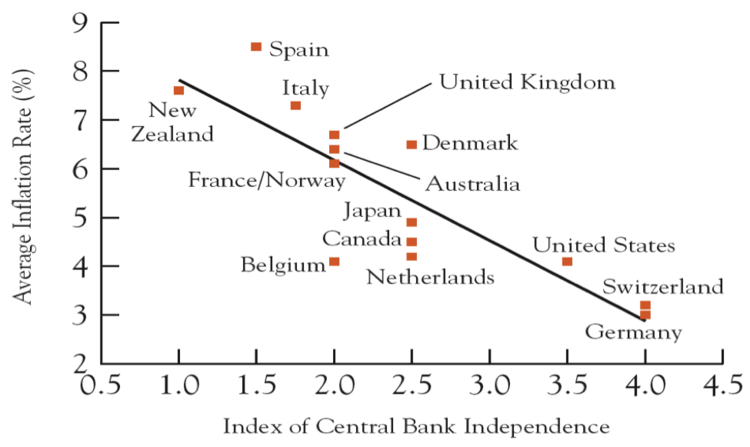

In fact there’s a pretty dependable historical correlation– the more political control over monetary policy that a country gives to the legislature and the administration, the higher the inflation rate the country is likely to get.

Source: Alesina and Summers (1993) via Cecchetti and Schoenholtz.

Senator Paul’s bill is unambiguously a bad idea.

A good article. But you should double check who is really sponsoring this bill.

Kevin: Oops, thanks! Fixed right away.

If it takes a Phd to understand the FED, where does that leave us mouth breathers?

Reminds of the old H.L.Meniken quote: A democracy is where the common man knows what he wants and should get it HARD!

No doubt H.L. Mencken was one of our best political pundits. As he said many years ago:

“The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary.”

It’s also important to note that Richard Fisher recently also said that the Fed’s power structure should be modified so that the regional banks have more power and the Board of Governors and the NY Fed have less. I agree that it’s important for the central bank to be independent and free of political interference. On the other hand, I certainly do not like the idea of unelected bureaucrats in Washington and NY having undue influence on the economy. That strikes me as undemocratic. At least when politicians screw up we can vote them out of office.

rand and company have backed themselves into a corner. even if they understand the downside of their proposed actions, they cannot change their minds without facing the wrath of the tea party and other backers of the “audit the fed” crowd. they will continue to offer proposals which have no chance of success, praying that the rest of the legislature and executive branch retains the ability to block their execution. none of them really want to take responsibility for their actions. who really thinks monetary policy should be politicized.

very nice article prof. hamilton. it’s nice to see a conservative stand up to the crazies every once in a while.

Please use capital letters. I was distracted from your point right from the very first as I wondered whether the first word was “Brand” with a missing “B”, or what.

TheFed remits to Teasury are round trips from the taxpayer and back. They represent a delfationary tax on the bond market which prefers deflation over the taxes caused by QE. What the audit will show is a future of deflation as the Fed has no way to emit free and unencumberd money into the economy, and we have not had true monetary injection since the Nixon shock.

Regardless of whether it is a good idea*, I think most people are latching on to this bill for secondary and tertiary reasons. In other words, they sign on to this, and THEIR hobby horses might get a hearing. Take a look at Bernie Sanders’ auditing the fed statement from 2011 (link below), which mentions “socialism for the rich” in the context of bank bailouts. I doubt there is a lot of agreement between him and someone like Rand or Ron Paul on a lot of stuff.

*And no, this does not appear to be a good idea, to say the least. Or rather, it’s unnecessary and unproductive. If there’s one valid issue worth spending time on in these lists of complaints, there are probably ten that aren’t, and there are, as J.H. notes and outlets like The Wall Street Journal have noted, other ways of dealing with any legitimate issues or questions.

Oops, forgot the link: http://www.sanders.senate.gov/newsroom/press-releases/the-fed-audit

Through the IRS, Dodd-Frank, Sarbanes-Oxley, and a host of other intrusions the government is giving an anal exam… I mean auditing every company in the US. But the one “private” bank that has failed miserably to fulfill its charter is not even audited by its own <a href=Inspector General. Professor, can you tell us how we can find out how much has the FED given to foreign governments and what were the provisions? If you cannot I would venture to say the FED does not have proper oversight.

There is absolutely no reason not to audit the FED unless there is something to hide. We know from the information that has been released from the FED that they mislead in their statements. There is noting wrong with a properly run central bank. I would venture to say with the FED’s track record of currency stability it is definitely not properly run.

I have worked enough in large corporations to know the disasters that come from lack of proper oversight, and yet this is just what we are doing with the most powerful economic engine in the world. Not calling for an audit of the FED is beyond irresponsible.

Not calling for an audit of the FED is beyond irresponsible.

Who is saying the FED should not be subject to audits? Try reading JDH’s post. No one objects to the FED being audited by competent agencies and competent auditors. The FED is already audited…audited up the ying-yang. The so-called audit that JDH is talking about is just a dog whistle term for direct control of the FED by the stupidest political party of one of the stupidest Congresses, led by one of the stupidest senators. These folks are clodhoppers. Have you ever dealt with their staffers? Dumb as fence posts. Can you imagine a Tea Party Congress and a President Rick Perry exerting “audit” control over the FED?

Slug,

I entered the link wrong so try this. If you actually think the FED is audited you need to stop smoking that Colorado yellow snow.

And this comment, “No one objects to the FED being audited by competent agencies and competent auditors” tells us that you have not listened to the FED apologists especially the FED governors.

Back when the US had no central bank the currency was stable and the country was in the most prosperous period in its history. Since the FED the currency has been a disaster, unemployment has been out of control, and the waste (that we know about) has been criminal. No CB is better than what we have now.

Ricardo, I suggest you go to Measuring Worth , http://www.measuringworth.com/

and look at the actual data on growth.

You will find that the long run trend per capita real GDP growth from 1850 to 1950 was 1.4% and since 1950 it has been 2.1%

Also go to the NBER, http://www.nber.org/cycles.html

and look at the actual data on recessions.

You will find that prior to 1950 recessions occurred almost twice as frequently before 1950 as after 1950.

Moreover, since 1980 the time between recession has been about ten years.

I’m sorry but your claim that the US was more prosperous and stable before we had a Fed just does not stand up the facts.

I suggest that in the future the best way to deal with Ricardo is just to 100% ignore him, regardless of what he says.

Spencer,

Nominal GDP 1850-1950 4.87%

Real GDP 1850-1950 3.78%

Nominal GDP 1950-2013 6.59%

Real GDP 1950-2013 3.18%

I don’t know where you are getting your numbers but the above is from the site.

Also the determination of recessions is bogus. With the “recessions” of the late 1800s industrial production went through the roof while the “economists” were saying we were in recession. I would much rather live in a world with ever increasing goods and services with falling prices than in a world with increasing GDP and crashing currency with declining production.

Ricardo: You’ve got total (not per capita) real GDP growth rates there. Spencer was writing about per capita. So, just so you understand, per capita is total divided by population (since you have demonstrated being math-challenged in the past, such as when you added together percent growth rates…I’m going to be explicit).

To set terms, let’s define log real per capita GDP = ypc. A regression of ypc on time trend over 1850-1950 yields a coefficient of 0.016, implying 1.6% growth. For 1950-2013, the same regression yields a coefficient of 2.1%.

Ricardo I have no idea where you learned you economic history, but I shudder to think it might have been at an accredited university. Economic growth in the 19th century was volatile and the depressions were long lasting. The currency was not steady. And since when is “steady currency” something we should care about as a macroeconomic goal unto itself? Ever hear of the Panic of 1837? It lasted deep into the 1840s. It also gave us the Know Nothing Party…BTW, are you a charter member? And some historians argue that it helped give us the Civil War because it broke down what had been two heterogeneous political parties into two largely sectional parties. And economic growth was pitifully low despite hordes of young workers arriving via immigration and unrestrained stealing of arable lands from native Americans. The British funded the railway expansion. Oh…and then there was slavery. All those land, capital and labor inputs at dirt cheap prices and per capita growth was closer to what it was back in the days of the Roman Empire than to today’s growth rates.

And just to repeat. The FED is regularly audited. See JDH’s comments above. In any event, the Tea Party nutjobs in Congress do not actually mean “audit” when they say “audit.” What they really mean is Congressional control.

I mean auditing every company in the US.

Actually I would say the majority of companies in the US are not audited in any given year, at least not audited by the Federal or State governents. Even the ones that are such audits at best only cover a small portion of their transactions.

In terms of individuals the numbers are even more dramatic. Unless you have an exceptionally unusual financial life, you are unlikely to ever be audited by the IRS even once…and even then most audits are relatively light affairs.

it is a myth that the gov’t exercises anything like close oversight over the economy. Almost the entire economy operates more or less on the honor system to one degree or another.

In the century since the Fed was created, inflation has been 3.2%. Every 22½ years the value of a person’s hard earned dollar has halved. It was not this way before the Fed. The credit boom that precipitated the Great Depression was caused by Fed money creation. The very existence of the Fed enabled Nixon to take the dollar off gold. The Great Stagflation of the 70s was caused by the Fed. The credit bubble that resulted in the Great Recession was due to the Fed. Virtually every recession in the postwar period was precipitated by tight money necessitated by the Fed having let inflation get out of hand. The Crashes of ’29, ’87, 2000, ’07 – all traceable to the Fed. During and since the Great Recession, the US debt-to-GDP ratio has been at an historic level, far beyond optimal for healthy economic growth. Excessive growth of money and credit enabled the federal government to grow from 5% of the economy in 1930 to 20% today. The Fed is a direct cause of big government. The money and credit economy has increasingly become disconnected from the real physical economy. This enables front-running large banks and wealthy elite, who are insiders given the revolving door, to sell to the public at the top of markets, short the market, and then buy back legal ownership to the physical economy at cents on the dollar. Time and again. TBTF has entered the lexicon because of the Fed. Industrial capitalism has morphed into financial capitalism because of the Fed. It is past high time that sensible people think something should be done about the Fed. This entire history ought to be on prime time.

” the higher the inflation rate the country is likely to get.”

And why exactly is this a bad thing? The lower quintiles in the USA have seen little wage inflation for decades and counting. I think another interpretation of that inflation chart is that central banks that are not captured by private banking might function as better guardians of aggregate societal utility.

The Fed board of directors is populated by private bankers an this conflict of interest has led to monetary policy that disproportionately benefits financial institutions and indirectly the wealthiest of the wealthy. The Fed’s repeated failure to regulate large financial institutions and its provision of trillions in “no string attached’ liquidity to these to big too fail institutions is a complete abrogation of its dual mandate.

IMO, audits are not needed — what is needed is nationalization of the private banking components of the Federal Reserve and reform of its board and OMC that creates a firewall between private capital/banking and monetary policy.

apologies for the typos (e.g. “too big to fail”).

What is wrong with transparency in government? The current audits of the Fed are of the least important assets of interest, government bonds. Everyone knows the safety of government bonds. But what about the loans to failing banks and foreign governments? Bernanke says that disclosing that information would “stigmatize the banks” but what grounds do they have for concealing the financial stability of the banking system from the public? Don’t they have a right to know? The Fed participates in a fraud to conceal the facts from its citizens? The public are children to be patronized because they can’t handle the truth?

JDH warns that change brings the risk of inflation, but given the Fed’s abject failure to meet even their paltry goals regarding inflation and thereby bringing misery to millions of Americans, maybe that wouldn’t be such a bad idea. It is a uniquely disastrous institution that had failed to meet both of its statutory dual mandates simultaneously. Could it be any more of a failure?

Real reform for the Fed would involve not just audits, but changing its mechanism for board membership. It is completely dominated by the interests of the banking oligarchy. In Putin’s Russia, that is decried as tyranny. In the U.S., it’s business as usual. Where are the representatives of the working public? Where are the representatives of labor on the FOMC?

joseph, are you willing to accept runs on banks? is it ok for the ordinary public to lose all of their money in savings because our central bank needs to be transparent about which banks have loans? if you are going to backstop the depositors, it is not wise to encourage the backstop to be used. and if you do not want to backstop the depositors, fine. but we saw what happened during the bank runs of the great depression. choices need to be made.

“I’ve been trying to understand why any sensible person would think this is a good idea.” Aren’t we all. I suppose logic has no place where (bad) ideas are lead by dogma.

However, I believe that you’ve succinctly addressed the issue:

“The primary effect of the legislation would be to give Congress one more stick with which to try to beat up on the Fed when the Fed next does need to take steps to keep inflation from rising.” & “Senator Paul’s bill is unambiguously a bad idea.”

“The primary effect of the legislation would be to give Congress one more stick with which to try to beat up on the Fed when the Fed next does need to take steps to keep inflation from rising.”

This is the nuttiest thing I have heard in a long time. When was the last time Congress beat up the Fed to increase inflation — like never? The closest you come to political pressure on the Fed was Arthur Burns during the Nixon administration, and that pressure came directly from the White House, not Congress. Burns was Nixon’s lapdog, not Congress’. Even Tip O’Neill supported Paul Volcker’s tight money policies.

The last 30 years has been a relentless call from Congress for increasing rates, not lowering them. If only the public were fortunate enough to have more sticks to beat the Fed into following their legal mandate. This psychotic fear of disastrous inflation around every corner is as nutty as the Germans’ obsession with the Weimar Republic. Take a pill and chill. You’re killing us here with your obsessive compulsive delusions.

Why audit the Federal Reserve – a privately owned Central Bank that issues debt on demand – which must be repaid with interest?

The only thing backing the value of a Federal reserve Dollar is the military might of the U.S. and the petro Dollar.

Federal Reserve notes are only – at best – legal tender – and not money. Only Silver and gold are lawful money.

It is time to stop playing games and semantics – America is a consumption based Country that is rapidly failing. The concentration of wealth (Fiat Dollars) in the hands of a few doesn’t benefit the many. It is time for the Fed to issue notes to the many – a guaranteed income for all – to spend into the economic and continue the illusion. Sure – the debt will NEVER be paid back. And why should it – it was created out of nothing. Write it off the books – rinse and repeat.

The alternative is Civil War – which is neither – but it is coming.

And to bring back Dollars to the US (primarily from China) – we have this!

Milwaukee EB-5 Regional Center

The Milwaukee Regional Center was established in 2007, when it was approved by the Department of Homeland Security to sponsor investment projects in southeast Wisconsin.

Created to stimulate investment in the U.S. economy and to create new jobs for U.S. workers, the federal EB-5 regional center program has grown rapidly in the last several years.

The program offers foreign investors and their families the opportunity to apply for green cards in exchange for qualified investment in qualified local projects. Investors must be approved by the U.S. Citizenship and Immigration Services (“USCIS”) in order to obtain conditional green cards and permanent green cards. To qualify for a green card, a qualified foreign investor must invest a minimum of US $1 million (or US$500,000 in targeted employment areas) in qualified businesses that create at least ten full-time permanent jobs for U.S. workers. Provided that the investment is maintained and achieves the job requirements of the program, a foreign investor may apply for a permanent green card two years after he or she obtains a conditional green card.

The Milwaukee Regional Center includes the counties of Kenosha, Milwaukee, Ozaukee, Racine, Washington, Waukesha and Walworth. Targeted employment areas within the Regional Center area that qualify for the $500,000 investment level include designated areas of the City of Milwaukee (see map), all of Walworth County and the City of Racine.

Everyone is asking, “Why audit the FED?” A better question is “Why not audit the FED?”

If you pay attention Ricardo you would be aware that the FED is already audited

Robert,

See the youtube video I linked. If you think the FED has been audited you know nothing about auditing.

I believe, and have said so many times before, that central bank independence is desirable. Consequently, I personally do not understand the fixation on auditing the Fed.

An audit, as customarily conducted, seeks to confirm that reported transactions and balances correspond to actual transactions, liabilities and assets. I presume the Fed has such audits, as well as internal controls suitable for preventing, say, Janet Yellen from transferring a billion dollars to her account.

Notwithstanding, there are a number of legitimate criticisms which can be leveled at the Fed:

1. The Fed has caused or abetted recessions. The housing bubble was facilitated by low interest rates in the US. Had the Fed raised interest rates earlier, the meltdown of the financial sector might have been prevented–possibly at the cost of an earlier recession in, say, 2006.

2. The Fed has practiced financial repression, re-allocating income from savers to borrowers, since 2008.

3. The Fed has bailed out Wall Street rather than Main Street. It has focused on interest rates and maintaining liquidity at the banks rather than providing direct ‘helicopter drops’ of money to the consumer sector to assist in deleveraging. (That would have created some inflation!) If we allow a kind of R&R argument (did JBH makes this case?) that interest rates lack a transmission mechanism in the absence of available collateral, then the appropriate solution would be to support the household sector directly with money transfers, as interest rates mediated by banks would prove ineffective. This appears to have been the case, although a direct debasement of the currency in the form of helicopter drops is a hard to imagine.

3. Financial repression has facilitated government deficits, both through low interest rates and through the Fed purchasing the government bonds which finance the deficit. This has also engorged the Fed’s balance sheet. Much of Rand Paul’s criticism seems to be centered on this issue, and it is not without some foundation. If you read analyses from the Fed’s own economists, you will find that they often viewed–with the exception of QE1–the various QE and Twist rounds as little more than a dangerous and ill-conceived publicity stunts primarily geared to show that the Fed was ‘doing something’.

We can say that there is virtually no correlation between government deficit growth from 2007 to 2013 and GDP growth in a cross country comparison. Indeed, the coefficient is negative: those countries will smaller deficit growth saw better GDP growth. I have both posted on this and commented on this several times. As a result, just as we may greet the Laffer curve with some skepticism, so may we consider Deficit Keynesian. The giant budget deficits in the US did not pay for themselves. Rather, the deficit continues to grow, and this will mean that in the future, fewer tax dollars will be available for social programs and more will be paid to the holders of government debt. In other words, the giant budget deficits of the last six years will be an engine of inequality for a generation to come. Ordinary taxpayers will see their tax dollars used to pay down debt to the rentier class. The Fed was instrumental is allowing this to happen.

Finally, inflation. Wal-Mart has stated that it will raise the wages of 500,000 minimum wage employees by 10-20% in the coming year. As Wal-Mart has sufficient scale to influence wages in many communities, wages may rise more generally. One may hope that this rise represents real income gains, rather than portending an eye-opening round of inflation. Perhaps real wages will start to catch-up after a long period of stagnation. On the other hand, how many times have real wages increased by 10% in a single year? If, in fact, we see a surge on inflation, the Fed may well expect to be hung out to dry in the next election.

steven,

1. ” The housing bubble was facilitated by low interest rates in the US. ” No. the bubble was facilitated by lax lending standards by the banks and mortgage companies. a bubble could have grown even with higher interest rates, because the bubble was a result of future price increase expectations. people bought homes in order to flip them in a couple of years for profit, not because interest rates were low, although that did not hurt. the past few years of low interest rates did not produce another real estate bubble. sloppy lending standards.

2. “The Fed has practiced financial repression, re-allocating income from savers to borrowers, since 2008.” and what would have been the “natural” interest rate during the financial crisis and subsequent low growth absent the fed? you really think interest rates would have been higher? and really, why should the policy always benefit savers over borrowers?

3. “Financial repression has facilitated government deficits, both through low interest rates and through the Fed purchasing the government bonds which finance the deficit.” financial repression? maybe instead of sitting on their cash, folks could take a risk and invest in their business. i see no need to reward savers in this environment. put your money to work if you want a higher return. capitalism should reward risk takers, not risk avoiders, no? this entitlement mentality of risk free profit is not very capitalist.

For those of you who argue the fed has been disruptive by artificially holding down interest rates, how do you know what the “true” interest rate should be? in a slow/no growth economic scenario, why would you expect higher interest rates? and how would higher interest rates help grow the economy?

Baffs –

I probably would have run much the same policy as the Fed after Lehman. (I would have been deeply concerned about the housing bubble prior, and I would have greatly resisted passively letting Lehman go belly up.)

The issue, to my mind, revolves around the huge expansion in government debt and the distorted shape of the Fed’s balance sheet. While the incredible deficit numbers no doubt helped ease the pain of many Americans, there is little doubt that it has and will hurt us for a generation or more on the backside. If you think borrowing 35% of GDP is free, well, it’s not.

The more pressing issue for the Fed is if inflation rears its head. If those Wal-Mart numbers don’t have your warning bells going off… And then there’s this: “U.S. home resales fell sharply to their lowest level in nine months in January amid a shortage of properties on the market” (http://www.reuters.com/article/2015/02/23/usa-oil-cuts-idUSL1N0VR1K820150223) It wouldn’t take a huge leap of the imagination to think there’s a big wave of inflation headed our way.

If that’s the case, the Fed will be crucified–certainly by Rand Paul.

Let me clarify that. I would have stopped at QE1 (albeit, informed by hindsight.)

steven,

“While the incredible deficit numbers no doubt helped ease the pain of many Americans, there is little doubt that it has and will hurt us for a generation or more on the backside. ”

you cannot have it both ways. either you keep the economy from tanking, or you sit back and pay the ultimate price. i believe a wise choice was made. you may have little doubt it will hurt us, but why? i would imagine my future prospects were significantly enhanced versus a future where the fed stepped back and did nothing. complaining about the debt today is like somebody who went through chemotherapy complaining about losing their hair. you can vent if you want, but at some point please acknowledge the chemo actually saved your life. people have very quickly forgotten how dangerous the financial markets were during the peak of the crisis. inflation is a problem we can live with, and fix.

i think people are mistaken in believing we can be in an era of high interest rates and low inflation-which is a profitable combination for those with capital. not sure if it is realistic.

Bob Brinker sums up Rand Paul very well:

December, 2012

“It’s only because the Federal Reserve has been active that we have any growth at all in the economy….The Federal Reserve is the only operation in Washington doing its job.

The only person that would criticize Ben Bernanke would be a person who is so clueless about monetary policy and (the) role of the Federal Reserve as to have nothing better than the lowest possible education on the subject of economics….Anybody going after Ben Bernanke is a certified, documented fool….”

I don’t think the evidence on US monetary policy is compelling. Here’s my earlier post on monetary policy and the Great Recession. Bottom line: It’s hard to make the case that monetary policy was the decisive differentiator between the US and European experience since 2011. On the other hand, shale oil production growth explains the difference quite nicely.

http://www.prienga.com/blog/2014/10/17/did-the-ecb-tank-the-euro-zone

And here’s my post on deficits and GDP growth, from the comment above:

http://www.prienga.com/blog/2014/11/28/deficit-spending-and-gdp-growth

The Fed has been less effective, because of the build-up in excess reserves.

Nonetheless, the Fed has done its job, even in a liquidity trap:

Lower interest rates and higher asset prices induce people to spend and borrow, and reduce saving, a lower cost of capital spurs production, refinancing at lower rates increases discretionary income, lower mortgage rates makes buying a home more affordable, 401(k)s and IRAs increase in value, etc. There are massive multiplier effects throughout the economy.

You can praise the Fed later.

Peak –

That’s the whole point of item 3 on my list above. If we take an R&R view of the financial crisis, then it is a balance sheet, not income statement, problem. That is, the issue is not interest rates but rather availability of collateral for loans. This perspective suggests that interest rates reductions will prove largely ineffective, which is consistent with the observed data.

However, as collateral becomes available, those reserves will start to move into the economy, creating demand, causing collateral to revalue further, and thereby pulling more reserves into the economy. Thus, there is at least the theoretical possibility that once deleveraging is complete and the economy starts to recover, the availability of collateral begins to draw those reserves into circulation, leading to inflation. Therefore, the effect of Fed policies will not be felt primarily during the recession, but rather during the recovery. That’s the risk.

Steven, the Fed raised asset prices substantially.

And, the Fed raised revenues and reduced expenses.

Tens of millions of households and firms benefited.

It’s not the Fed’s fault the recovery has been weak.

I’m all for central bank transparency and independence. I haven’t studied the details of this bill, but it sounds like it is a trojan horse, trying to sneak in less independence under the guise of more transparency.

Where I disagree with Jim is his incorrect suggestion that the Fed is not a consumer of tax dollars, which misrepresents how the Fed is funded.

The seignorage that a central bank earns is the result of its publicly granted monopoly to create the national currency. The public has every right to know that money is being spent well. The Fed funds its operating expenses out of that publicly granted seignorage income. Every dollar the Fed spends on operating expenses is a dollar less remitted to the public and a dollar more that must be collected in taxes.

So Congress has every right to demand a thorough accounting of the Fed’s expenses. The recent news story that Yellen is wasting money on a heavy duty security detail as if she’s some terrorist target was deeply shameful and a clear abuse of weak public oversight. If Rand were going after that, I would applaud him.

Besides, it so happens that most of the Fed’s assets are Treasurys. So most of its income comes from taxpayers. And another part of the Fed’s income comes from a mixture of private mortgage lending and federal government guarantees (GSE bonds and GSE MBS). Jim writes as if the Fed were earning from the private economy, when it’s mostly just remitting money back to Treasury that the Treasury previously paid to the Fed.

Ever been to the Fed’s building in DC? Nice view from the cafeteria down the Mall, but really nothing special. (On the other hand, visit the offices of any self-respecting private equity fund…) The issue has nothing to do with Fed operating expenses.

I would, however, question whether the Fed has all the expertise that it needs. They should be much, much stronger in oil than they are, for example.

Well “the issue” seems to be all over the map. For most it seems to be that they don’t like the way the Fed has conducted monetary policy. And on that point I’m with Jim. We shouldn’t idealize what we have, which is a semi-independent central bank controlled by presidentially appointed governors, often most of whom are appointed by the sitting president. But any reform has got to be with an eye to keeping the Fed apolitical. The last thing we want is a parallel of what has happened to the Supreme Court, which a hyper-politicized insult to judicial history in my opinion. And this bill seems trying to head in that totally wrong direction, to politicize the Fed.

As for the ridiculous security detail I mentioned, I’m just kicking back against Jim’s weird logic, which seems to suggest that we should be happy the Fed doesn’t waste its whole seignorage income buying red, white and blue shoestrings. I’m not saying the Fed is the biggest money-waster in DC or New York. I’m just saying that it does serve the public and its expenses do come out of our pockets, so it should be scrutinized and called out for its waste, the same as any other public agency. This bill doesn’t seem to have that goal.

I’m semi-retired now, but I use to visit private money management firms all over the globe — from Germany to Japan.

Believe me, you get great views from many of their offices.

If you want a great view try visiting some of the money management firms in La Jolla, Ca. — they have some of the greatest views you will find anywhere.

It sure beats anything you will find in Washington.

One of the gentlemen above said : ” … This enables front-running large banks and wealthy elite, who are insiders given the revolving door, to sell to the public at the top of markets, short the market, and then buy back legal ownership to the physical economy at cents on the dollar. …”

This is the key to understand how the system works.

I do not think it is “unambiguously bad.” Using a graph from 1993 that shows Japan inflation at 5%?? And then calling it dependable?

… and then there is Europe….

Inflation is too low and the FOMC seems to interpret a 2% “target” as a ceiling. If anything, monetary policy on average over the last 15 years has been to tight, not too loose (two recessions, no significant inflation to speak of), and the Fed erred in 2007/2008 by failing to anticipate the depth of the recession (and earlier: the effect of housing on bank balance sheets). In Sept 2008, rates were still 2%, the Fed was concerned more about inflation than unemployment and business conditions. A better approach in 2005 on housing would have been pushing for tighter credit, not necessarily raising rates. Had they acted earlier, a lot of unemployment may have been averted.

Not a fan of Paul’s bill, but if the consequence of Rand’s bill is a little more inflation, I don’t see that as a bad thing.

The FOMC has the power to cause mass unemployment if they screw up, or rampant inflation. Perhaps Paul’s bill is wrong, but why shouldn’t we hold FOMC members accountable when they screw up? Only people with perfect job security worry more about inflation than unemployment. So if the result is a compromise that shifts the FOMC’s preferences more towards the preferences of the median voter, I don’t have a problem with that at all.

Let’s be honest. There is actually nothing wrong with the bill. Nothing in this post points to any problem with it. It’s unnecessary but totally benign. The real issue is, ‘we’ don’t like the people and ideas behind the bill. That’s how a lot of political debates go: more about the message than the merits.

hmm, well banks are/were audited thoroughly too and supervised by all kinds of institutions. It didn’t help.

If you keep this in mind I understand Rand Paul and therefore it is unwise to ridiculize it. But on more audit on top won’t help and I hope the latter is your point, biut I doubt it.

this legislation appears to focus on an audit of the mortgage loans owned by the fed. what exactly is the purpose of this audit? what explicit piece of information does it obtain that the supporters are interested in? not much there. but it does open the door to other fishing expedition audits-since we did audit A why can’t we do audit B? it is this slippery slope i am sure people at the fed are concerned with-hence the resistance. the fed has audits, not sure of why we should support another audit explicitly for the congress. look at the abuse of power by guys like darrell issa to understand why the fed would be hesitant to give additional fishing expedition power to congress.

FED receives a failing grade.

George Selgin in this article clears up much disinformation in the media and posted here.

Excerpt:

conspiracy theorists of the world unite, the black helicopters and little green mean are about to invade! we need to audit the fed to stop the madness now!

the fed is appointed members, not lifetime appointees. that is sufficient oversight. now you want to audit something, perhaps the supreme court would be a place to start. lifetime appointments with no accountability!

Completely agree with your post, Jim. Well done.

“Last year’s federal deficit would have been almost $100 billion bigger if it had not been for the net positive revenue contributions from the Fed.” – this seigniorage is the result of the Fed having a monopoly on money creation. This ‘profit’ comes from this monopoly money creation, at the cost to taxpayers to sponsoring a system that is not flexible to market needs. The US government largely issues paper that is bought by the Fed, at every increasing amounts every year, not to mention the 40+ of Fed reserves that are toxic mortgages. This new money creation by the Fed is not demanded by the market (hardly any individuals own government bonds) and will ‘end badly’ (default or devaluation). Hence: audit the Fed, abolish the Fed, as in Jacksonian 19th c USA with the Second Bank. It worked then (GDP rose dramatically, despite or perhaps because of no central bank) and it will work today.

It is abundantly clear that Ray Lopez has essentially no understanding of economics or history. It is fortunate that his influence on the world is limited to meaningless and incoherent posts on a blog.

For all the wonderfulness of an independent Fed, the primo example of a kind of idealized Fed independence is that in Switzerland, the nation that harbors the criminal enterprise, HSBC.

I’m not sure what advocates here think needs an audit. I found this when looking for the Fed’s balance sheet (http://www.federalreserve.gov/monetarypolicy/bsd-monetary-policy-tools-201411.htm). The Fed has about $4.2T in assets. $2.5T is in Treasury bonds and $1.7T is in MBS’s from Fannie Mae/Freddie Mac and so on.

The other thing I see is the discount window operations which are short term loans of about $0.2B at the moment with $1.2B pledged as collateral.

What exactly then would an audit purport to show? While the Fed’s balance sheet is huge, it is remarkably simple. Unlike a Wall Street firm, the Fed’s goal isn’t to craft complex financial instruments to reap profits. It wants to create money to inject into the system by purchasing assets. Since it needs to buy a lot of assets it wants a type of asset that is very simple with a very deep market that it can pull from. Teasury bills are that. What exactly then is going to be audited? That they carefully made note of the serial numbers of every bond they purchased?

“John Tate thinks the bill would help address “the silent, destructive tax of monetary inflation.” But inflation as measured by the consumer price index has averaged under 1.8% over the last decade. That’s the lowest it’s been since the 1960s”

Was that statement meant intentionally deceive, or was the equivocation an oversight?

All of the above IMO. How is inflation a ‘silent tax’ when it is a risk like any other and a risk you can neutralize by buying insurance (for example, adding inflation clauses to contracts). If inflation is avoidable then it shouldn’t be all that destructive (if it is more destructive than the cost of insurance against it, then people would opt to buy insurance against it). This concept of destructive inflation does not mesh well with the concept of free markets being efficient. At least for ‘normal levels’ of inflation.

But often what happens here is a ‘private definition’ of inflation to mean any expansion of the money supply without regard to its impact on prices. ‘Inflation’, you see, means the money supply is bigger. There’s some type of theory here that expanding the money supply is some type of hidden, destructive tax yet the details always seem elusive and those in this school are rarely friendly to taking pointed questions from skeptics, at least that’s my impression.

Anyway why exactly would an audit prevent inflation of either type? Unless audit is a code word for something else, all auditors could do is ensure the Fed properly accounts for all the transactions as it creates money. How would that produce a different type of monetary policy, which i what it seems advocates of ‘audit the fed’ really want? Unless the ‘audit’ was really imposing a monetary policy on the Fed and the auditors are meant to enforce it. But then that would mean advocates of this are already trying to be deceptive before they even have a bill to vote on.