Why do interest rate differentials point in the wrong direction for subsequent exchange rate changes at short horizons, and not at long? And why have interest differentials at long maturities failed in recent years to predict subsequent exchange rate changes as well as in the past, especially for interest rates near the zero lower bound. Those are two topics taken up in a recent paper by myself and Yi Zhang (University of Wisconsin).

The Unbiasedness Hypothesis and Uncovered Interest Parity

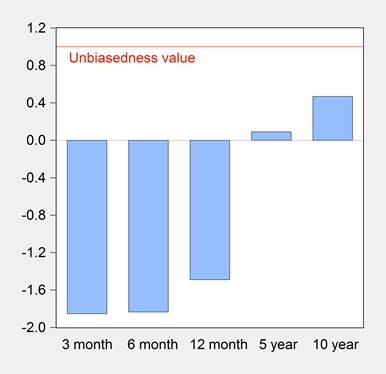

The issue of interest differentials and subsequent exchange rate changes was the topic of this 2012 post, discussing the results in Chinn and Quayyum. Figure 1 shows the panel β coefficients for the following regression:

(1) Δst+k = α + β(it,k-i*t,k) + ζt+k

Where it,k is the interest rate with maturity k, Δst+k is the exchange rate depreciation from time t to t+k, and the superscript * denotes foreign variables.

Figure 1: Panel Fama coefficients 1980Q1-2007Q4, unbalanced, with fixed effects. Exchange rates include Canadian dollar, Deutsche mark, Euro, yen, Swiss fran, and British pound, against US dollar; excludes Euro for 5 and 10 year horizons. Source: Chinn and Zhang (2015).

This updates the panel estimates that pertained to data up to 2000, reported in Chinn and Meredith (2004).

It’s helpful to consider under what conditions expected dollar returns should be equalized for securities denominated in different currencies. This is essentially a no arbitrage profits condition, so it would require (i) no barriers to the free flow of financial capital, and (ii) the securities be treated as otherwise equivalent in terms of default risk, and risk associated with how returns correlate with wealth or consumption (formally, the exchange risk premium is zero). Then:

(2) it,k = Δse t,k + i*t,k

where the superscript e denotes (market) expectations. This is equivalent to:

(3) Δset,k = (it,k-i*t,k)

Note that the condition states that expected returns are equalized, and equivalently expected depreciation equals the interest differential, namely uncovered interest parity (UIP). One can’t directly test whether these conditions hold, because one doesn’t observe the market’s expectation of exchange rate depreciation. Typical practice is to assume the actual, realized, exchange rate equals on average the expected (i.e., the rational expectations hypothesis).

(4) Δst+k = (it,k-i*t,k) + εt+k

Where ε is a random error term; under the joint UIP and rational expectations hypothesis (known as the “unbiasedness hypothesis”), the error term is a true innovation, that is an error term with mean zero, and is unpredictable on the basis of all information available at the time expectations are made. This leads to the regression in (1):

(1) Δst+k = α + β(it,k-i*t,k) + ζt+k

Then this relationship (with a coefficient on the interest differential of unity) might not show up in the data, either because of risk, because market participants make biased forecasts of subsequent exchange rate changes, or because the right hand side variable is correlated with the error term ζ (the three possibilities are not mutually exclusive).

Long Horizon and Short Horizon β Coefficients

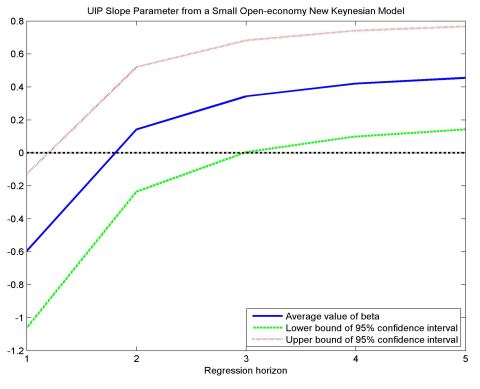

In this paper, we demonstrate that a calibrated standard New Keynesian dynamic stochastic general equilibrium (NK DSGE) model can replicate the pattern of β coefficients identified in the data, if three shocks are included – an aggregate supply, a monetary policy and a uncovered interest parity shock. The former two exhibit persistence, while the shock to the UIP relationship does not. The basic intuition is that, when the reaction function (a modified Taylor rule) responds to output and inflation gaps and real exchange rate depreciation, then the interest rate is endogenous. Since long rates are an average of short rates (the expectations hypothesis of the term structure determines long rates), then long rates are more “exogenous” in a statistical sense than short.

Figure 8: from Chinn and Zhang (2015).

Note that the term in the UIP relationship occupies a role similar to a risk premium (i.e., it drives a wedge between interest differentials and the expected depreciation), but is conceptually different. In the model, it’s random and mean zero, and has no direct link to anything one might think determines the relative riskiness of a currency (covariation of returns with asset holdings as in CAPM, or consumption growth correlations with currencies, as in the CCAPM). This approach follows Bennett McCallum’s 1994 JME paper.

The Impact of the Zero Lower Bound

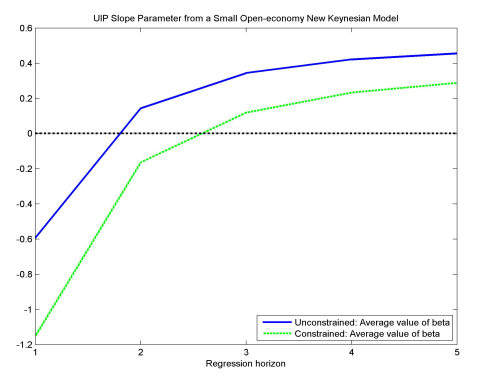

One of the observations in Chinn and Quayyum (2013) is that the long horizon coefficients for the dollar-yen and the dollar-Swiss franc declined in the more recent period. This stylized fact is confirmed in this paper as well. The more recent period is associated with relatively low long term rates in Japan, and to a lesser extent Switzerland.

Using the NK DSGE, we show that as interest rates near zero, the fact that the negative shocks to monetary policy and to aggregate supply are constrained to zero at the ZLB means that all the β coefficients are lower.

Figure 10: from Chinn and Zhang (2015). Constrained denotes close to ZLB.

This is one interpretation of the puzzle. There are other plausible explanations; for more on uncovered interest parity, from different perspectives, see these items: [1], [2], and Chinn (2015).

Hi Menzie,

This is a nice point. I think it may be related to this paper I have with Dave Cook. (actually I presented it in Wisconsin a while ago, but I think you may have missed the talk). http://conference.nber.org/confer/2014/IFMs14/Devereux_Cook.pdf

Cheers,

Mick

Mick: Excellent point — thanks for reminding me of the paper; absolutely your results are relevant to interpreting ours. In particular, the higher probability of encountering the ZLB is given exogenously (to the extent we compare far and near ZLB as two cases) in our analysis, without considering how forward guidance comes into play. We’ll definitely cite and incorporate in the next version. Thanks for the insight!

It seems, interest rates near the zero lower bound are more likely to result in biased exchange rate forecasts than interest rates farther away from the lower bound, because the market expects interest rates to rise than fall, at very low interest rates, least at some point.

I think, liquidity traps can be avoided and monetary policy isn’t the problem.

Instead, fiscal policy has become less effective – e.g. in Japan, the E.U. and the U.S. – to stimulate demand and raise interest rates.

If fiscal policy was more efficient at promoting employment, particularly full-time employment, rather than just providing money and benefits regardless of work, then income would rise faster, along with spending.

More pro-growth and fewer anti-growth policies are needed by policymakers in Washington.

Nice

Menzie was wrong on WMD, but don’t hold you breath waiting for an admission. He is too busy looking for proof that the Great Depression was worse in Canada than in the US.

Ricardo aka DickF aka Dick aka RicardoZ: Get real. See Vox. But don’t let facts get in the way of your recitation of detached-from-reality talking points. And please, make another comment on how the government is manipulating the collection of economics statistics!! I need more entries for my year-end-collection!!!

it is a sad irony that the chemical weapons uncovered were manufactured by us companies for saddam. and this was done in the 1980’s, under the leadership of saint reagan. the irony is the dangerous weapons, which could get into the hands of today’s terrorists, were made by reagan and liberated by bush. talk about a foreign policy blunder!

Sure thing Menzie. The articles are becoming pretty common. You could probably find them yourself but here, per your request, here are a couple I found interesting.

Jack Welch

Jim Clifton

rico, so welch uses his “gut instinct” rather than actual data to arrive at his conclusion-by his own admission-and we should accept his version as fact? fool. you probably feel he was an effective leader at GE as well. immelt has been cleaning up the welch messes for years.

isn’t it ironic that conservative foreign policy is what has led directly to the threat of chemical weapons by terrorists in the middle east?

I want to first caveat that I haven’t looked at your paper. But, the failure of UIP is mostly associated with large open economies. Jurek (2014), for example, uses the US vs the rest of the G10. So, how crucial is the small in “small open economy” to the results?