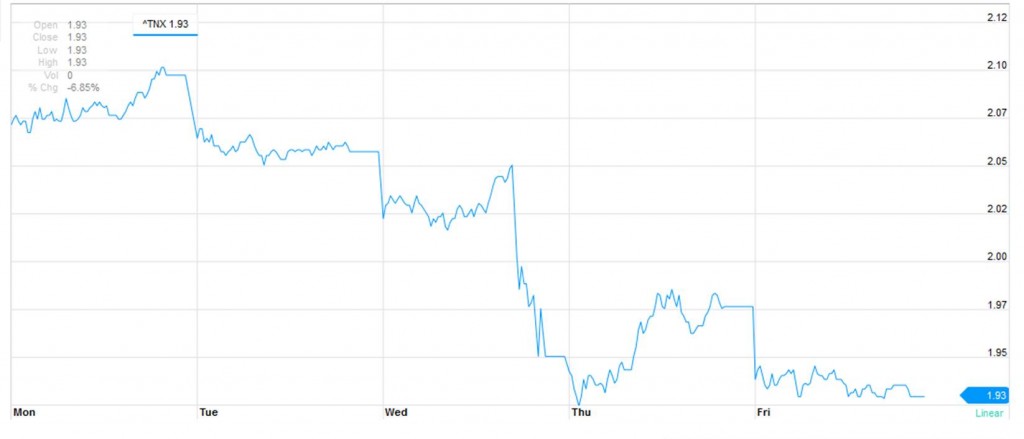

As widely expected, at Wednesday’s FOMC meeting the Federal Reserve dropped its statement that “the Committee judges that it can be patient in beginning to normalize the stance of monetary policy”, the magic formula that many observers had thought would open the way for a hike in interest rates at the Fed’s June meeting. But the yield on a 10-year U.S. Treasury bond dropped 10 basis points immediately following the FOMC release.

Interest rate on 10-year U.S. Treasury bonds as captured by CBOE TNX quote. Source: Yahoo Finance.

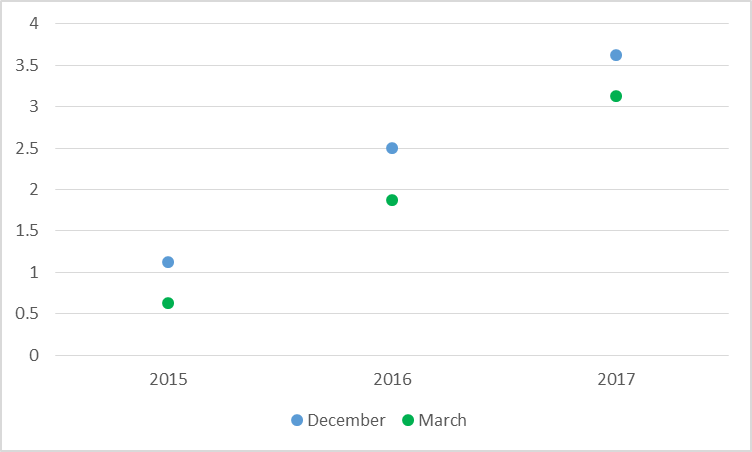

More important than leaving the word “patient” out of the latest FOMC statement was a significant downward revision in the interest rate that the Fed itself seems to be anticipating. The median FOMC member now anticipates a fed funds rate over the next few years that is 50 basis points lower than was anticipated last December.

Anticipated target for fed funds rate for end of indicated calendar year of the median FOMC participant as of December 17, 2015 (in blue) and March 18, 2015 (in green).

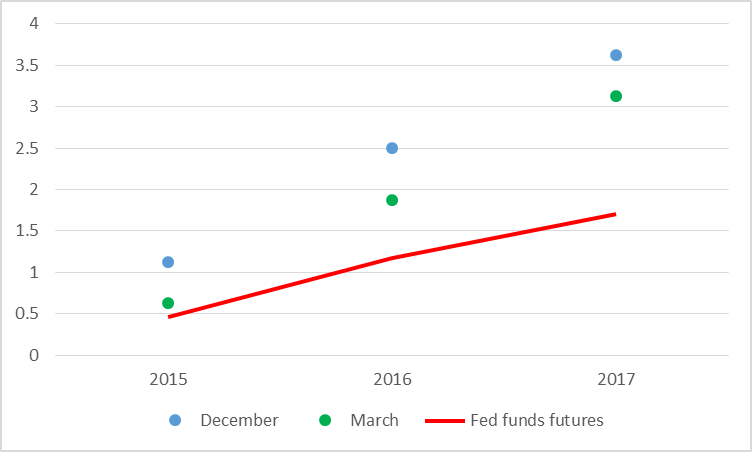

Notwithstanding, the fed funds futures market is pricing in significantly lower expectations yet.

Median FOMC fed funds rate forecast and price as of March 20 of December fed funds futures contract for indicated year. Updates a similar graph by Tim Duy.

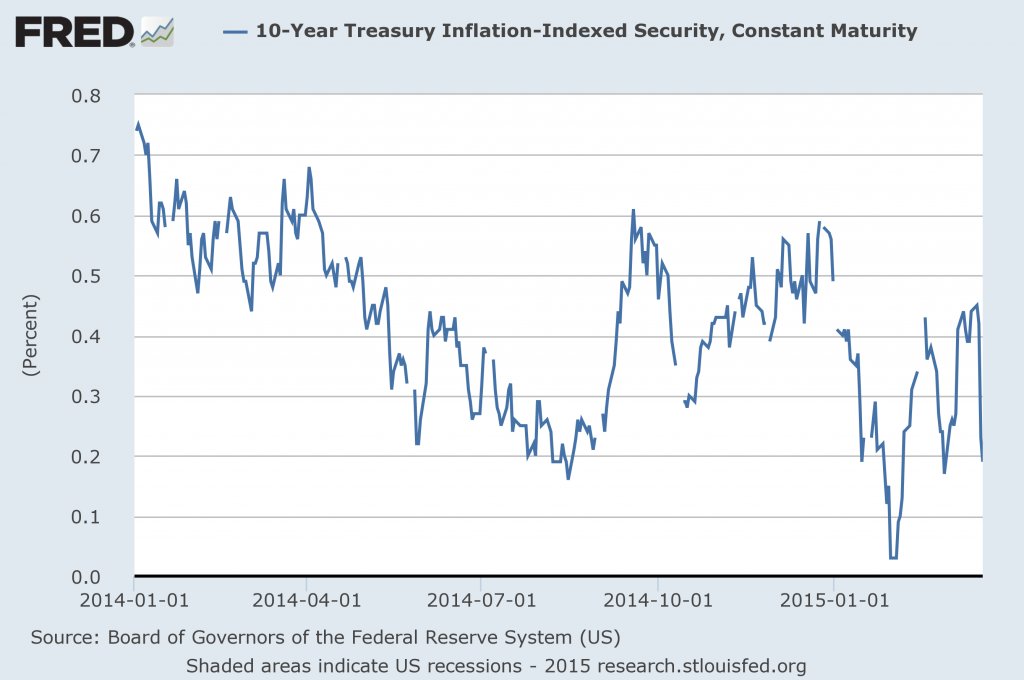

It’s also worth noting that the median FOMC “longer run” interest rate prediction came out at 3.75% from both the December and the March meetings, though the distribution of the individual “dots” from the latter has clearly drifted down. With a long-run inflation objective of 2%, that implies an equilibrium real interest rate of 1.5-1.75%. Compare that to the yield on a 10-year Treasury inflation-protected security that is now below 20 basis points.

Source: FRED.

All of which raises the question: does the Fed know something the market doesn’t, or vice versa? Tim Duy concludes “it is now clear the bond market is not moving toward the Fed; the Fed is moving toward the bond market.” But my answer to the question is: a little of both. Based on the historical evidence reviewed here I think it’s reasonable to expect an equilibrium real rate significantly above 0.2% and significantly below 1.5%. But given my own (and everyone else’s) uncertainty about exactly where the number is within that range, it makes sense for the Fed to wait a little longer before raising rates.

And as Menzie pointed out last week, international developments are leaving the Fed little choice. One important channel by which monetary policy can influence the Fed’s targets for output and inflation is through the exchange rate. A higher interest rate in the U.S. than in other countries means a stronger dollar. That makes it harder for the U.S. to export goods and makes imports more attractive, both of which mean a drag on U.S. GDP. And insofar as a stronger dollar means a lower dollar price for internationally traded commodities, it also takes us farther below the Fed’s 2% inflation target. When other countries are lowering their interest rates, that by itself tends to bring down U.S. output and inflation, and mitigates any argument for raising U.S. interest rates.

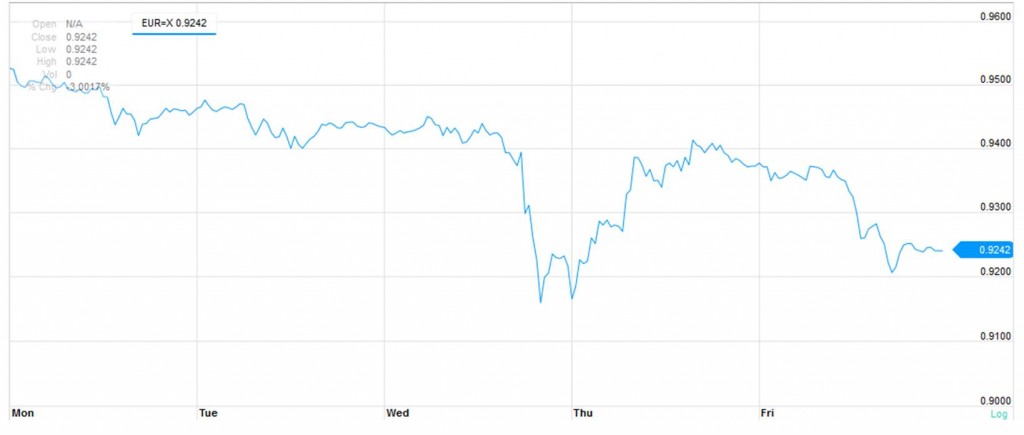

Note that the dollar fell 2% against the euro within a few minutes of the FOMC release.

Bottom line: the Fed sent a dovish signal with its statement last week that to me has a lot to recommend it and seemed to have some of the desired effects.

“Patient” will be dropped in April.

Fed statement translation:

We’re warning you speculators. We’re going to raise the funds rate. Did you get that? We’re going to raise . . . the . . . funds . . . rate . . . one of these days, and we’re not going to be patient about it, except we’re going to be patient about not being patient. Did we say we’re going to raise the funds rate? Well, we are.

Oh, and price inflation is going to accelerate later this year and next year, but it won’t be too fast. We have it all under control. So, you consumers and business people had better not internalize a deflationary mindset and reduce orders, investment, production, employment, and spending, thinking we are going to allow price deflation and you’re going to get a better price later, because we are not going to allow either. No, sir. Yes, you heard that correctly: There will be no price deflation.

And, BTW, we’re going to raise the funds rate . . . one of these days, perhaps soon, but not too soon, and probably not as much and as fast as we first suggested; or perhaps not, maybe.

Moreover, the members of the Committee would be remiss if we did not encourage firms to keep wage rates, i.e., “inflation”, low for the bottom 80-90% of households and labor’s share of GDP at a record low forever.

Therefore, with our successful managing of “inflation”, keeping you speculators and HFT algobots guessing, and giving you financial media pundits something to talk about, we are confident that our forward giddiness will continue to provide the necessary political cover for Jamie, Lloyd, and the rest of the Boyz to maintain their masterful fraud, deceit, theft, and political bribery, as well as allowing us to keep our jobs.

Finally, given that we have achieved what is the largest global financial asset bubble in world history, that incidentally is not a bubble, we look forward to the opportunity at the prescribed time determined by Jamie, Lloyd, and the Boyz to take the blame for “making a mistake” that causes the next financial crisis from which the Boyz will benefit as a result of our next round of “stimulus”.

End of announcement.

The Chair and her fellow Fedsters should just tell the truth that they follow “the market”, i.e., the 1-, 2-, and 10-year Treasury yields that are largely determined by the liquidity, reserve, and asset needs and composition of holdings at a given term structure by the TBTF/TBTE banks. The Fed responds to the preferences of the TBTE banksters in perpetrating their mischief.

Yeah, I know, that’s not very “independent”.

Then the focus would be on the collective desires, actions, and resulting outcome of those who ACTUALLY determine interest rates and money supply (by way of lending “debt-money” into existence and funding fiscal deficits), not on a bunch of bankster-chosen technocrats/bureaucrats and bank execs who are merely running political cover for the TBTE banksters’ license to steal.

The Chair and FOMC would then not be required to pretend to have unilateral decision-making authority but simply express what the emerging bankster-determined term structure implies and that the FOMC is therefore just doing its job in responding to the needs of “the market”, i.e., bankster bosses who run the largest Fed member banks that in turn own the Fed.

Granted, it would be like telling the kids that there is no Santa Claus or Easter Bunny, or the spouse that you can’t afford that Porsche Cayman for her birthday, but it would place the focus of scrutiny on those who ACTUALLY determine monetary policy and its effects in the capital markets and the economy.

We’re all grown up enough to handle the truth, I’m sure. 😉 But I suspect for many of us being grown up enough does not mean that we have the sufficient courage to tell the truth, especially not internalize it and tell our peers.

Kooky whackos like Peter Schiff have been saying for years the Fed can’t and won’t raise rates… ever. WHAT A NUT JOB!!!

“Kooky whackos like Peter Schiff have been saying for years the Fed can’t and won’t raise rates… ever. WHAT A NUT JOB!!!”

😉

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=158h

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=158j

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=158l

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=158m

http://www.cmegroup.com/trading/interest-rates/stir/30-day-federal-fund.html

The 1-year yield has yet to rise above the Fed’s funds rate upper band.

The 2-year yield remains below the primary credit/discount rate.

Fed funds futures imply no increase for the funds rate above the upper band until the earliest Oct-Nov, but the decelerating North American economy and end of the one-off positive currency effects in Japan and the EZ will keep growth of global real GDP per capita, US FDI, and trade at recession-like rates for years to come, preventing the Fed from increasing reserve costs (apart from perhaps a token increase that is quickly thereafter taken back) for fear of disrupting the term structure and precipitating a catastrophic deleveraging of the MASSIVE (larger than in 2007-08) offshore carry trade for debt and equity index futures.

We’re in an 1890s-, 1930s-, and Japan-like debt-deflationary “secular stagnation” of the Long Wave/Kondratiev Wave Trough. The Fed and TBTE banks are keenly aware (and possessed of existential fear, loathing, and dread) that they have created the largest credit and financial asset bubbles in world history, but they cannot prick the massive global bubble without causing the largest global debt- and asset-deflationary crash in world history.

“Forward giddiness”, ZIRP, and NIRP (and bank bail ins, i.e., confiscation of “their money”, on behalf of banksters and their owners) reflect the central and TBTE banksters’ desperate, incessant attempts to discourage businesses and households from adopting and internalizing a deflationary mindset (which is quite “rationally” self-interested under the circumstances).

The unprecedented scale of private and public debt to wages and GDP, demographics, and decelerating (or contracting) GDP, CPI, bank lending, money supply (after bank cash/reserves), wages for the bottom 80-90%, OBSCENE wealth and income inequality, falling velocity, and the historical precedent of the Long Wave Trough and “secular stagnation” suggests that “forward giddiness” will eventually fail and debt/asset, money, and price deflation will take hold of the mass-social psyche with predictable outcomes but also unintended consequences from panicked central bank/TBTE banks’ intervention.

There is simply too much debt to wages and GDP, and “illth” care costs at $10,000 per capita and $26,000 per household, regressive payroll taxes on the bottom 90% contributing to the ongoing erosion of real, after-tax purchasing power, unsustainable excessive returns to financial capital to GDP, debilitating costs of never-ending imperial wars, and record-low labor share of GDP are cumulatively suffocating the economy in real terms per capita.

But there are no constituencies among the nomenklatura, i.e., economic intelligentsia, imperial ministerial mandarin bureaucracy, or the political or CEO managerial castes, for any viable alternatives to, or techno-economic, social, and political innovations of, the current deindustrialized, militarized, hyper-financialized, neo-imperial, corporate-state economy and trade regime.

And now, not unlike in the 1890s and 1930s, growth of global economic activity and trade has stalled and yet another imperial war cycle is due to commence shortly, with war spending and the fiscal deficit to GDP set to increase hereafter, requiring the Fed to resume QEternity rather than raise rates and cease bank reserve expansion. The “Pivot to Asia”, building a US imperial military base in Australia, increasing military spending in Saudi Arabia, Israel, India, and China, agitation and war in Central Asia and the Middle East, increasing tensions between the US and China in the Pacific and Africa, and the risk of Pakistan becoming a nuclear failed state combine to suggest that the next war cycle risks escalating into a global conflict between the western Anglo-American-Zionist empire and China as the emergent regional hegemon.

The probability that the Fed is going to raise the funds rate given the emerging circumstances and implications is virtually zero (unless the TBTE banks want a crash and thus act to precipitate one as they did shorting Dotcom stocks in 2001-02 and junk mortgage paper derivatives in 2007-08, in which case they need the Fed as political cover and the convenient scapegoat to blame for having “made a mistake” and “caused” the crisis).

I imagine this WSJ piece will draw a response. The author’s premise: The Fed is no more competent than Congress, and a lot less accountable.

*********

“It’s High Time to ‘Audit’ The Federal Reserve”

Alex J. Pollock

March 22, 2015 6:47 p.m. ET

The calls in Washington to “audit” the Federal Reserve are not for a narrow, bean-counting review of the institution’s financial statements. The audit’s goal is more fundamental: to assure that the checks and balances in a democratic government also apply to central bankers. It means figuring out how our elected representatives can effectively oversee unelected monetary “experts.”

History shows that these so-called experts are prone to destructive inflationary and deflationary blunders, and that the Fed’s actions over the last century represent the greatest systemic risk of any financial organization in the world. These actions include the runaway inflation after World War I and the overreaction leading to the depression of 1921; the failure to liquefy the banking crisis of the 1930s; setting off the internationally disastrous great inflation of the 1970s; and more recently stoking a housing bubble while failing to recognize that it was a bubble.

The Federal Reserve, established in 1913, was a prime example of the dream-world that President Woodrow Wilson imported from the theorists of the German Empire—the notion of government based on the superior knowledge of independent experts that bypasses the messy and undisciplined world of democratic politics. The fatal flaw? The Fed has no superior economic knowledge. It has only forecasts as unreliable as everybody else’s, and theories as debatable. Hence its many mistakes.

Since the Great Recession ended the Fed has been in overdrive. It is running an unprecedented, giant monetary experiment. This experiment includes years of negative real interest rates, the creation of a huge asset-price inflation, and the monetization of real-estate mortgages and long-term bonds. Should the Fed, or anybody, be allowed to carry out such vast and very risky experiments without effective supervision? The correct answer is: no.

Opponents say an audit would threaten the Fed’s “independence.” That’s precisely why it’s necessary. The promoters of Fed independence, which of course include the Fed itself, must believe that the Fed is competent to have the unchecked power of manipulating money and credit, or in a grandiose variation, of “managing the economy.” They must believe that the Fed knows what the results of its manipulations will be, when manifestly it does not. The century-long record of the Fed provides no evidence that the Fed is competent to be entrusted with this enormous discretionary power.

The historical argument against letting Congress play a role in monetary issues is that elected politicians are always inflationist, and it takes an independent body to stand up for sound money. Yet now we have the reverse of the historical argument: a sound-money Congress confronted by an inflationist central bank—a Fed that endlessly repeats its commitment to perpetual inflation at its “target” rate of 2% a year. This means prices will quintuple in a normal lifetime. What then?

Here is the reality: The Fed is a creature of Congress, which created it and has since amended the legislation that authorizes its existence on numerous occasions. In the 1970s, Congress, with Democratic majorities, made two efforts to bring the Fed under more control. In the Humphrey-Hawkins Act of 1978, it required regular reports to Congress by the Fed. These hearings achieve nothing but the Kabuki theater of scripted presentations and sparring over questions and answers.

In the Federal Reserve Reform Act of 1977, Congress defined a triple mandate for the Fed to follow: stable prices, maximum employment and moderate long-term interest rates. The Fed has dropped any mention of one-third of its assignment—“moderate long-term interest rates”—and redefined “stable prices” to suit itself. It tells us in remarkable newspeak that “stable prices” really means prices that always go up.

How is Congress effectively to oversee its creation? Congress is too big and on average not sufficiently knowledgeable to do so directly—that’s why it has committees. But the House Financial Services Committee is also very large, with 60 members, and both congressional banking committees have numerous other difficult areas of jurisdiction, not least being the crisis-prone housing-finance sector.

So I propose that Congress should organize a new Joint Committee on the Federal Reserve. The Fed would be its sole but crucial jurisdiction. All Humphrey-Hawkins reports should be made to this joint committee, and it should have the power to audit whatever about the Fed it deems appropriate.

Such a committee should have a relatively small membership, made up of senators and congressmen who become very knowledgeable about the Fed, central banking, the international relations of central banks and related issues. Like the Senate Select Committee on Intelligence, it should include ex officio members from the leadership, but in this case, from both houses.

“The money question,” as fiery historical debates called it, profoundly affects everything else. It is far too important to be left to a fiefdom Fed.

Mr. Pollock is a resident fellow at the American Enterprise Institute. He was president and CEO of the Federal Home Loan Bank of Chicago, 1991-2004.

To Pollock’s comments and recommendations, the principal reason that the Fed resists being “audited” in the manner described is that a full disclosure and revelation of the Fed’s purpose, functioning, ownership, loyalties, and what is meant by “independence” would blow wide open the entire fraudulent scheme of fiat fractional reserve banking; how “money” is created; what “money” ACTUALLY is; who primarily benefits from the system as it has evolved; why the Fed was ACTUALLY created and by whom; why the Fed operates under such secrecy and faux transparency; and why the US Congress, White House, economic intelligentsia, Fed mandarins, and financial media influentials are effectively captured and are de facto well-paid agents perpetuating the colossal century-old fraud of fractional reserve private banking and debt-money inflation that disproportionately rewards non-productive rent seeking at the cost of labor returns to GDP.

Someone, and preferably lots of someones, needs to have the courage (or lapse in judgment and a sense of self-preservation) to state the obvious that is far from obvious to the vast majority of us: the Fed is a fraudulent institution of political cover for the TBTE int’l banking syndicate’s gov’t-granted, -enabled, and -protected monopoly and license to steal labor product, profits, and gov’t receipts for social goods in perpetuity with little or no ACTUAL accountability to those whom they deceive, defraud, steal, capture, and mercilessly exploit.

The “truth” may set one free in a manner of speaking, but under current circumstances it can also cost one one’s reputation, livelihood, loved ones, and perhaps even one’s life.

why would you want to raise rates today? schiff and others (kudlow, moore, …) have been wrong for years. why would you even give them a second thought? they have an agenda, and a stronger economy for all is not on that agenda. the problem is some people have developed a solution, raise interest rates, but they cannot find the proper problem to apply the solution. so they look like economic fools. for years. and years. and years…

Baffs –

We have Wal-Mart, TJ Maxx and Target all announcing what seem to be big wage increases for min wage labor. It’s hard to tell just how big these increases will be, but they seem to be material.

If interest rates stay low, then presumably inflation also stays low, and then these wage increases look to be all real in nature.

If so, then we’re entering a great period for the US economy. On the other hand, if it signals inflation, then we’re going to see an appreciable surge in the price level just about one quarter from now.

I don’t know which is right, but I would be tracking the data like a hawk at this point.

http://www.cbo.gov/sites/default/files/02-16-wagedispersion.pdf

Hourly earnings: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=159L (1.5% YoY)

Weekly earnings: http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=159J (2.5% YoY)

Steven, the workers you mention are at the bottom half of the bottom ~80% working class. The bottom 80% receive ~40% of US income, which is growing at ~1.5-2.5% nominal, whereas the bottom half of that group receive ~10% of US income. To avoid wages increasing for the 40% of US workers above them, employers will likely reduce hours and/or promote some workers to supervisors who are increasingly required to work 50+ hours/week with only a modest increase in wages, no overtime pay beyond 40 hours/week, and expected to do the work of subordinates for no additional pay beyond 40 hours/week.

Then, if the economy is slowing for the cycle as I anticipate is likely, reduced hours and slower economic activity could reduce jobs even at higher low pay, implying a net wash and little, if any, inflationary wage pressure.

Moreover, with wages to GDP at a record low going back to the Great Depression, the after-tax wages and purchasing power of the bottom 40% who receive 10% of wages are so small that the wages and hours would have to increase dramatically and persist without loss of employment for the net effect to pass through much to prices.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=159Z

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15a3

Finally, business revenues are growing at an average rate of just 2.5-3%, labor costs are at ~80-85% of costs, and the sum of wages and profits after tax, inventories, and depreciation is at a recession-like rate. Historically under these conditions the economy was at or below “stall speed” and decelerating into recession (the exception being 1986, which followed the energy sector bust, the Long Wave Peak for CPI, and The Plaza Accord and US$ peak), with the U rate bottoming and rising 50-100%+ during the subsequent 12-18 months.

We’re very late in the business cycle and perhaps at or below “stall speed”. But because the post-2007 and -2010 trend rates of real GDP per capita are the slowest since the Great Depression, we are not going to experience the typical business cycle growth rate deceleration from, say, 3-4% real to below 2% and then 0% to negative YoY or on an average 4-quarter SAAR basis. As in Japan since 1998 and the EZ recently, the rate of change of deceleration will be much slower than before 2007, making it exceedingly difficult for most models or coincident and leading indicators to discern cyclical “stall speed” or recessionary conditions until long after growth has stalled or contracted.

This is among many reasons why I expect jobless claims to begin to increase into the 350,000s in the months ahead, the deficit to GDP to increase later in the year, and the Fed to maintain ZIRP indefinitely and resume QEternity later in the year.

BC –

If Wal-Mart and Target raise wages, then I would presume that pretty much every big box on the strip will also raise wages. In turn, every smaller mid-town employer, the CVSs and grocery stores of the world, will also raise wages over the next year or so. That affects many, many people.

Can you every remember a time when major employers like Wal-Mart and Target announced wage increases like this? I can’t, and therefore think it’s something unusual and possibly exceptional. That warrants paying attention to.

As for end of cycle, I am hard pressed to understand what needs correction. Is this stock market a bit high? Yes, but is it massively over-priced? I don’t think so. Housing? Still in recovery. Labor markets? Still seem to have slack (wages haven’t yet moved up much, have they?). Household debt service ratios? At record lows. Interest rates? In the cellar. Inflation? Non-existent. Current account deficit? Manageable. Federal budget deficit? Manageable at 2% of GDP.

Where is the big imbalance in he economy which requires correcting?

Steven, replies to your good questions follow:

During debt-deflationary regimes of the Long Wave Trough (the effects against which the Fed has been leaning since 2001), what gets “corrected” is the overall level of debt to wages and GDP. The hyper-financialized nature of the US economy today has resulted in total annual net flows to the financial sector equaling total annual US GDP output. That is, all US value-added output since 2008 is pledged to the claims held by the financial sector (and its top 0.001-0.1% to 1% owners) and indirectly via the financialized sectors of the economy, i.e., “illth care” via insurance, “higher education” via student loans, etc.

Similarly, total credit market debt outstanding to average term has an imputed compounding interest equivalent to 100% of GDP effectively in perpetuity. Again, all value-added output of the US economy is pledged to the claims of the financial sector, meaning that there will be no “escape velocity” for real GDP per capita.

The larger the financial bubbles become as a share of wages and GDP, the larger and more persistent the net financial (rentier) claims against output, and the slower growth of real GDP per capita will be.

Moreover, combined total gov’t, “illth care”, “education”, and household and business debt service is an equivalent of 54% of GDP. The economy cannot grow unless these sectors cumulatively grow, but the remaining 46% of the private sector cannot sustain growth with the drag from the former, resulting in a Catch-22. (This is similar to the situation in the EZ, being ~50% of GDP, with gov’t spending, including direct gov’t spending for “illth care” rather than via private insurance.)

US total stock market valuation, including small caps, is more overvalued than in 2000, with an implied total return of 0% to negative for the next 7-10 years. As a share of GDP, US equity market capitalization is above that of 1929 and is back to the level of 2007, exceeded only once before by the level in 2000.

The Fortune 25-100 firms have been borrowing hundreds of billions of dollars over the past 2-3 years to buy back shares to reduce float and goose earnings per share with revenue growth of 2-3%. As a result non-financial corporate debt to GDP is at a record high matched in 2007-08, Japan in 1989-95, and the US in 1928-30.

Household debt service as a share of disposable income has fallen to the low of the early 1980s, but total debt to the income of the bottom 90% and to GDP was a fraction of today’s level.

Housing is rolling over again. Besides, Millennials simply do not earn enough after taxes and debt service, have too much debt, have impossibly low credit scores, have no liquid savings, and do not have durable employment tenure to be creditworthy enough to become mortgage debtors at current median house prices.

The current account has fallen because of the plunge in oil imports, as you know, as a consequence of the unsustainable debt-induced shale bubble, as well as growth of global trade stalling from US firms’ FDI no longer growing in China-Asia and elsewhere.

The deficit to GDP is only a small part of the story. Total unfunded US gov’t liabilities (not counting underfunded state and local pension funds) according to Kotlikoff have reached upwards of $200 trillion in PV. Were this amount “on budget” and discounted at current interest rates (assuming no increase in rates) to the implied term, what would be the implied deficit and net interest costs as a share of gov’t receipts and GDP? Unpayable, clearly. How much would the Fed have to print each month for years to cover the net savings deficit and to fund the necessary deficits? Unthinkable.

The foregoing are debilitating imbalances, to be sure, unless one is a primary beneficiary of the net financial claims at the expense of the rest of the economy and society, in which case it’s all good.

Finally, regarding wages of the working poor and lower-income working class, if any group deserves an increase in earned income and real, after-tax purchasing power, they surely do. The Long Wave progression implies a bottoming of the decline in wages to GDP and a peak in returns to (especially financial) capital’s share of GDP. But “secular stagnation” now occurring in 70%+ of world GDP and the persistence of global capacity slack and surplus labor implies that labor’s share of GDP will persist at the record low going back to the Great Depression and the 1890s.

So, what needs to be “corrected”? Rather a lot, it seems to me, not the least of which are economists’ beliefs, perceptions, and lack of understanding of the myriad factors associated with the Long Wave Trough (that economists have been trained since the 1970s to believe does not exist) that are manifesting to result in “secular stagnation” for many years to come.

steven,

i agree. i simply fail to see a reason to raise rates until the data clearly says you should do so. a quarter (or 2 or 3) of higher inflation is a minor problem compared to a deflationary environment. we can fix inflation, we have problems with deflation. people too concerned with inflation do not have their eye on the ball. if we are going to error, then let it be on the side of higher inflation.

As for the US$ and net exports:

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15cw

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15cx

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=157X

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15cz

Haven’t seen any recent analysis of the predictability/efficiency of the Fed Funds futures. Other forward prices are sometimes and sometimes not predictors of future prices.

Steven Kopits: “Can you every remember a time when major employers like Wal-Mart and Target announced wage increases like this? I can’t, and therefore think it’s something unusual and possibly exceptional.”

Oh my god! The poorest of the poor get a raise for the first time in a decade (which, ironically, is why you can’t remember a time). Obviously we must use all the forces of government at our disposal to ensure such a catastrophe doesn’t continue.

You know, conservatives are always spouting off about free markets and competition and such, but when free markets and competition eat into their cheap labor, they bleat like stuck pigs and rush to use government power to minimize that competition.

‘You know, conservatives are always spouting off about free markets and competition and such, but when free markets and competition eat into their cheap labor, they bleat like stuck pigs and rush to use government power to minimize that competition.’

Really, who did you have in mind?

I think you misunderstood my message, Joseph.

I am stating that we appear to be at an inflection point in the economy. It think that we will be seeing either substantial real wages increases, which is a good thing, or substantial inflation, which may not be a good thing. But either way, powerful forces are being brought into play, it seems. January vehicle miles traveled were up 5.1% on January a year earlier. Normally, VMT tracks to GDP. If that’s the case, then we will see strong GDP growth at some point.

And we’re seeing surging oil demand growth just about across the globe. This also tends to correlate to GDP.

Things are happening, and we need to pay attention. There’s potentially a lot of liquidity sitting on the Fed’s balance sheet, and I for one am unsure how events will unfold.

steven, if we have wage increases along with inflation, are you still willing to sit tight with the fed? it’s really not a bad combination, at least over a few quarters. only if wages stagnate and inflation increases do we have a problem. the data does not seem to indicate this will be the case. you need to let the economy overheat before applying the brakes of a rate hike. 2% inflation is nothing near that point.

I am not an expert in monetary policy. I don’t think a little more inflation would particularly hurt. That’s not what concerns me.

steven, i think your concern is a situation with no wage growth and high inflation, no?. and i am not sure the data supports that as a possible outcome. data supporting wage growth seems to be greater than data supporting high inflation. nevertheless, i think your view is far more reasonable than those who have been wanting interest rate hikes for years now. at the end of the day, dealing with inflation from the zero lower bound is probably much easier than dealing with it from an interest rate at 5% already.

Baffs –

I was one of the first, maybe the first, in the blogosphere to state that wage increases were likely to be on the way. I have not changed this view. Whether or not we have inflation, I expect real wage increases.

My concerns reflect rather inflation and interest rates.

Nominal interest rates have been at historically low levels for an extended period of time. This has not, to date, resulted in increased inflation. Best I can tell, we believe this has not happened due to a lack of collateral to bring bank reserves into circulation as loans. Thus, low interest rates have not proved effective in stimulating the economy. However, as growth and collateral recover, there is some chance that the massive bank reserves at the Fed will come into the market. We just don’t know very much about how that might happen, and even if it would, and if it did, whether the Fed could act in a timely fashion.

I had earlier stated that, with affordable and plentiful oil, the global economy would again begin to behave as it did prior to 2005. The data are strongly supportive of this view, to wit, note astounding VMT growth. Q2 in particular is likely to show eye-popping oil demand growth. Thus, the now prevalent belief that easy money will never lead to inflation may prove unfounded. The rules in force prior to 2005 are increasingly likely to valid today, and Q2 is likely to prove an inflection point in this regard.

But does it matter? I still do not have any confidence that I understand the supply and demand of capital. Are interest rates low because of excess savings? Or a lack of investment? Or is it something else? Jim et al have authored a good statistical analysis of interest rates and growth, and I think it’s a valuable addition to our knowledge. But we need to keep in mind that we live in the age of China and oil, and this means that statistical relationships valid before 2005 may not have applied to the 2005-2014 period. In the case of oil, we are now back in the pre-2005 period. I don’t know about China. I do not have a good model of that economy.

Therefore, I am cautioning that

1) the Fourth Oil Shock is over. Expect a strong rebound across the globe (perhaps excepting China)

2) Interest rates have been very low for a very long time. We don’t have a good understanding of if or how this period unwinds.

3) The Fed has a grotesquely bloated balance sheet, stuffed with potential liquidity which might enter the economy under certain not well-defined or well-understood circumstances.

So, the data are suggesting that some sort of unusual period is coming up. I don’t know how it plays out, but I would strongly recommend that we keep a close eye on the incoming numbers. They may surprise us.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15jj

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=15jk

A wage increase and the resulting real, after-tax increase in purchasing power is the definition of “inflation” for the neo-imperialist, rentier-socialist/-communist, Orwellian “Inner-Party” top 0.001-1% and their neo-nomenklatura Establishment ministerial economic intelligentstia technocrats and politicos captured and in the employ of, and beneficiaries of the conference of legitimacy and status by, the rentier Anglo-American-European Power Elite and their bankster oligarchs.

What they and their (un)economic intelligentsia do not tell us is that debt-money-induced debt/asset “inflation”, known as “financial wealth”, increasingly “printed” by the Fed and financially engineered by the Fortune 25-100 CEOs/CFOs, has now become a net prohibitive, neo-feudal, rentier claim on all valued-added output of the economy forever.

But most among the professional middle-class next 9% below the top 1%, the Orwellian “Outer Party” members, don’t realize it (or can’t afford to say so to risk their credibility, legitimacy, and bourgeois status), or they have faithfully internalized decades’ worth of fallacies that prevent them from seeing the contradictions of their beliefs and perceptions, to the peril of the system.

It is not easy, if at all possible today, to a construct a succinct, “sexy”, Twitter-worthy “meme” that effectively relates this “metanarrative”, one that can compete for more than a few milliseconds with online porn, financial media pundits’ self-styled, self-serving fallacies, the incessant flurry of politically self-serving, Orwellian data from the “Ministry of Truth”, an amply fat-filled, Kardashian-like gluteus maximus, or the fraud of the “selection” process every four years for the CEO of the decadent, militarist-imperialist, rentier-socialist corporate-state.

https://www.youtube.com/watch?v=pLtwWsLgaz8

https://www.youtube.com/watch?v=cvpQMkYY5mY

But that is the objective of decadent, militarist-imperialist, corporate-state propaganda, is it not?

Shemitah 5775/2015. 🙂

“And as Menzie pointed out last week, international developments are leaving the Fed little choice. One important channel by which monetary policy can influence the Fed’s targets for output and inflation is through the exchange rate.”

Do you think that the Fed’s monetary policy should be more proactive or reactive to markets? Their recent forward guidance seems to be more concerned with reacting to how fast/slow the international recovery is happening than about how to provide favorable economic conditions at home… Does a rules-based or discretionary-based system seem more logical to you?

Thanks,

Fred