Last week marked the tenth anniversary of Econbrowser. That gives me an occasion to talk a little about why I started the blog and what we’ve accomplished with it.

One of my goals was to bring a real-time dimension to academic research. Ten years ago I had just finished a research paper with U.C. Riverside Professor Marcelle Chauvet. We were suggesting a simple pattern-recognition algorithm for dating economic recessions that we thought would work with real-time data. One of the challenges to people making practical business or policy decisions is that the data keep getting revised. Many economists work with the numbers as they’re currently reported when they look for patterns in the data. But for our project we used an approach that was at the time a little unusual, assembling the different data sets as they had actually been reported at each separate quarter and month in history and seeing what the inference of our algorithm would have been at each date, something that’s very easy for anybody today to do using tools like ALFRED. This approach, which I might call “simulated real-time analysis,” suggested that our methods held promise. But it is one thing to look today at historical “real-time” data and say, “here is what I could have concluded at the time.” It is another thing to actually make the calls in real time. That’s one of the things we have been doing at Econbrowser.

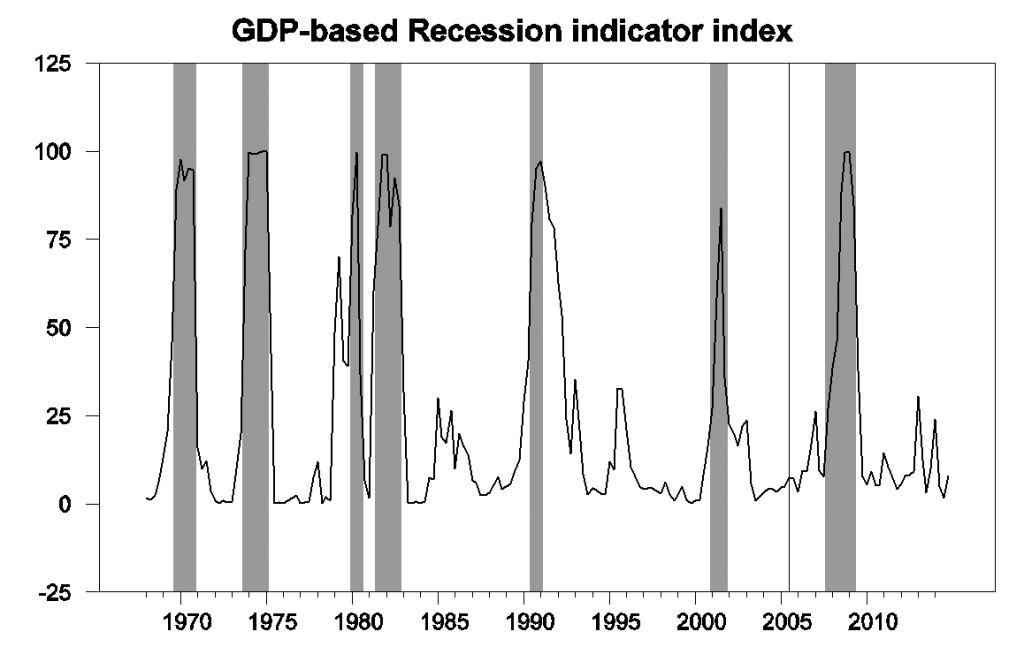

The graph below is one example of that. It plots the Recession Indicator Index that we initiated ten years ago. Everything to the left of the vertical line is “simulated real-time analysis,” that is, what the algorithm would have concluded given only data as it had been reported at the time but with the analysis all conducted in 2005. The data the right of the line is what I would call “actual real-time analysis;” every one of those data points was published here at Econbrowser one quarter after the indicated date over a ten-year period.

GDP-based recession indicator index. Values to the right of the vertical line have each been publicly reported exactly one quarter after the indicated date, with 2014:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

Another one of my goals for the blog was to open better dialog between academic economists, policy makers, and people outside of economics. I was very concerned– and remain so today– about how insular some of my academic colleagues can let themselves become, writing just for other economists using assumptions and conventions shared by other economists. I think it is a very healthy exercise to try to explain from scratch why we think what we do in a way that an intelligent person, who did not share any of the preconceptions or prejudices of academic economists, could follow and evaluate. Such an exercise can often uncover blind spots that the traditional academic protocol can miss. I was fortunate that Menzie Chinn had an interest in joining me in this effort almost from the very beginning, adding his expertise in international and other areas of economics and a passion for covering policy issues.

The blog in this way functions as a personal journal for me, as I try to make sense of what I see and learn from watching the real world unfold, sometimes contrary to my anticipations. Over the last decade we followed the financial strains associated with the housing bubble as they built, snapped, and continue to reverberate today. At the beginning I was definitely underestimating the full implications of what was going on. The biggest reason I was wrong about the bubble early on was a question about incentives– why would financial institutions and investors put hundreds of billions of dollars at risk with fundamentally unsound loans, I asked? Today I think the answer is a combination of misaligned incentives— the actors were often gambling with other people’s money– and a form of groupthink— it’s very hard to be the only person in your institution arguing that the profits everybody is making at the moment are going to come back to bite them very hard.

Another topic I changed my mind about was world oil supplies. I began as a skeptic about peak oil. My views evolved as I watched conventional oil production stagnate over the last decade. But I was surprised also at the success of the unconventional production from U.S. shale oil. It’s a little amusing that one of my posts from 2005 as well as 2015 were on the same topic, namely, what in the world is oil doing at $55/barrel? Though the first was asking why the price was so high, and the second why it was so low.

And it will be interesting to see which force will win out over the decade to come, as well as to gauge the ultimate success of unconventional monetary policy, and see what holds for the future of the U.S., European, and world economies. I’ll be sharing my thoughts on these issues, and listening to yours, right here at Econbowser.

I want to be the first to thank Jim for ten years of being a leader in bringing sophisticated economic analysis to the critical policy issues of our day. The econoblogosphere — and public economic discourse — has been elevated immeasurably by your insights. To many more years!

(And of course many thanks for the honor of allowing me to tag along for the ride)

I agree with Menzie & want to echo his sentiments with regards to Dr Hamilton for the exact same thing. Dr Hamilton is a leader, a huge asset in the econblogosphere & public economic discourse. Here’s to may more years of Dr Hamilton’s presence in this public forum.

Happy tenth anniversary, Professor. Congratulations on the blog’s longevity.

And a sincere expression of gratitude for indulging my participation over the years. Good karma.

Congratulations from Germany as well

Congratulations, Jim and Menzie!!

Although I don’t comment very often, I’ve been a loyal reader/follower from pretty much day 1. I follow quite a few blogs, both econ and other, and this is one of the very few that I make sure to read every new post. I’ve used many posts in my classes, and several have also influenced my research. You’ve created an extraordinary resource!!

PS

As a teacher of Econ to high school students, I have found the blog invaluable as it shows what a career in economics can look like and also illustrates real-world applications of the concepts we cover. I have only been following for the last year or so, but am infinitely thankful for what you do here. Congratulations, you are having a genuine and valuable impact.

Congratulations to you both!

My favorite blog! My thanks for doing it

I believe you have achieved your aims. Well done sir(s)

Congratulations to both Jim and Menzie for a job well done this past decade. You are both real pros.

Congratulations on the first 10 years! I look forward to continuing to learn from you. Thank you.

Congratulations! This blog remains one of my favorite reads for your thoughtful and pragmatic analysis, which has only improved over the years as you’ve learned from events.

Professor,

Econbrowser presents data and analysis in a way that no one else is. I have great respect for you and for this site. Your approach of looking at data and at revisions is something that is often simply ignored. I congratulate you one 10 years of unique education and debate.

You’ve done an excellent job making the issues you write about accessible to a non-economist such as myself. Thank you!

Congratulations. Wishing you the best on the next ten years of blogging.

Amen to the other comments. Congratulations.

Question? My eyeball observation of your recession indicators is that the signal for the last recession was later than in earlier recessions.

Is this right and is it a function of it being the only recession that is out of sample?

congratulations! in addition, you set a fine example by showing how an academic, or any expert for that matter, could and should evolve their perspective over time as the picture changes. we need more leaders demonstrating, that with time, one could and should reassess their convictions on a topic.

Have not been a reader for the full 10 years but really appreciate the efforts. Wouldn’t mind a republish of the log post and a little more explanation of the statistical techniques but I guess that would turn this into a class. Thanks again for the efforts

I think a more in depth post mortem on the failed hundred dollars to stay prediction is warranted. To the extent that you have addressed it at all, has only been in the most passing manner.

Also, for what it’s worth the Staniford Saudi Arabia concerns (post of his you reran here), need a post mortem. Contained a statement to the effect that ‘if true, prices for gasoline will be much higher than 3.50’.

In addition, there were plenty of reports coming in on the nascent shale revolution, and you had the chance to run those also with the “if true, this will happen” style caveat, but you passed. As recently as last summer, you were dismissive of US LTO.

It’s not just that you were wrong about a prediction, but I don’t see the right penchant for looking at segments of supply and demand with a micro slant.

Steven Kopits is predicting $85 oil by the end of the third quarter. Here’s the link to the recent interview with Steven on CNBC:

http://video.cnbc.com/gallery/?video=3000384466

So far, monthly Brent crude oil prices are recovering at about twice the rate of increase that we saw following the December, 2008 monthly low in Brent prices. From January, 2015 to May, 2015, monthly Brent price increased at an annualized rate of about 90%/year. Monthly Brent prices rose at an annualized rate of 43%/year from December, 2008 to February, 2011.

Regarding Saudi Arabia, their post-2005 annual net exports (total petroleum liquids + other liquids, EIA data) have been substantially below (their recently revised upward) 2005 level of 9.5 MMBPD (million barrels per day) for nine straight years. Based on the 2005 to 2013 rate of decline in the ratio of Saudi production to consumption, I estimate that Saudi Arabia may have already shipped more than 40% of their post-2005 CNE (Cumulative Net Exports).

The key question about tight/shale plays is whether plays like the Bakken–with an average per well production rate of a little over 100 bpd, with a median production rate of less than 100 bpd, with an overall very rapid decline rate–will work in higher operating cost areas around the world.

In addition, not all shale plays are commercial in the US, and those that are commercial tend to very much gas prone.

ConocoPhillips withdraws from shale gas exploration in Poland

http://www.pennenergy.com/articles/pennenergy/2015/06/conocophillips-withdraws-from-shale-exploration-in-poland.html?cmpid=EnlDailyPetroJune92015&eid=291006698&bid=1091495

C’mon Jim, we all know the real reason you started this blog. You wanted to set up an NCAA basketball tourney group. :->

Great blog. A huge public service.

Thank you.

Oh my. dear James.

There is another 10-year-anniversary, the Alan Greenspan’s “Froth” testimony on June 9, 2005:

http://www.calculatedriskblog.com/2015/06/tenth-anniversary-of-greenspans-froth.html

Well James, Greenspan and you have much in common. Why would financial institutions and investors put hundreds of billions of dollars at risk with fundamentally unsound loans, you asked. But Greenspan knew the answer a lot earlier than you, I suppose.

Anyway, hope you continue your blog even after retirement, besides all the setbacks. You know: God turns setbacks into comebacks.

And congratulations to Menzie, my wanna-be politician, and to you for the anniversary. A bit of a comedy is your blog, I must confess.

At least its funny.

Congratulations on ten years of Econbrower!

I have learned much from it.

One of those things was not spelling.

Congratulations on ten years of Econbrowser!

Congratulations! One of the few economists that excels both at academic research and policy relevant discussions.

In reading the following NYT article about the Greek Crisis, with an emphasis on pensions and pensioners, I recalled Professor Hamilton’s post on the US Social Security system. To borrow Warren Buffet’s phrase about finding out who is skinny dipping when the tide goes out, I wonder if the tide has just receded faster for Greece than for the US, in terms of over promised and under-funded Social Security and pension plans, especially in regard to vastly underfunded state and local government pension plans. And of course, federal government owns both the asset and the liability for the Social Security Trust Fund

http://www.nytimes.com/2015/06/09/world/europe/greece-pensions-debt-negotiations-alexis-tsipras.html?hpw&rref=business&action=click&pgtype=Homepage&module=well-region®ion=bottom-well&WT.nav=bottom-well&_r=0

*Remind you of another system?

Congratulations on a decade of blogging Jim and Menzie. Econbrowser is the only blog on the internet that successfully presents serious economic analysis applied to policy questions in a way that is accessible to a wide audience. As such, you’ve created an important and influential resource. Your blog is always my first stop to keep informed on economic issues. Thanks very much for doing this.

Well done guys!