Even if Greek Prime Minister Tsipras is able to maneuver the new agreement through the parliament [0], it’s not clear to me that — even with the aid and reprofiling of debt — Greece will resume growth (see discussion O’Brien/Wonkblog). That’s true even though there has been noticeable adjustment in production costs in Greece.

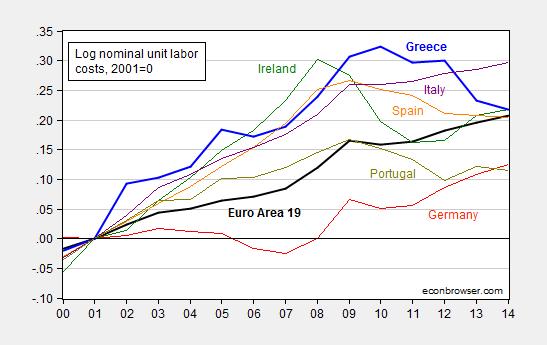

First, consider unit labor costs in some key euro area countries.

Figure 1: Log nominal unit labor costs (ULC) per hour for euro area 19 (black), Greece (blue), Germany (red), Ireland (green), Spain (orange), Portugal (chartreuse), and Italy (purple), all normalized 2001=0. Source: Eurostat, and author’s calculations.

Greek nominal unit labor costs have declined 10.8% since the peak in 2010 (in log terms). That works out to 2.7% per year increase in competitiveness. Ireland, the canonical example of the flexible adjuster, managed faster adjustment — 13.9% in 3 years, or 4.6% per year.

Since the ULCs are indices, it’s not really possible to make a direct comparison of costs of production. (See Daniel Gros/CEPS for an argument why 1999 is not the right year to normalize on; I normalize on 2001, before North/South Eurozone current account imbalances exploded.) All we know from Figure 1 is that the disadvantage between Greek unit labor costs and German has decreased. (Artus, Gravet/Natxis indicate approximately 12% Greek absolute cost disadvantage relative to Germany in 2013).

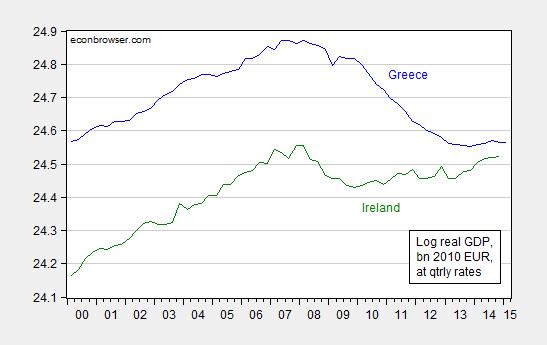

So, second, consider one interesting point — despite the comparable adjustments, output has fallen far more in Greece than in Ireland.

Figure 2: Log real GDP for Greece (blue) and for Ireland (green), in billions 2010 prices, quarterly rates. Source: OECD Main Economic Indicators via FRED, and author’s calculations.

Greek real GDP has fallen 31% (log terms) from peak to 2015Q1. Irish GDP fell 13% peak to trough, and as of 2014Q4 only 4% below peak.

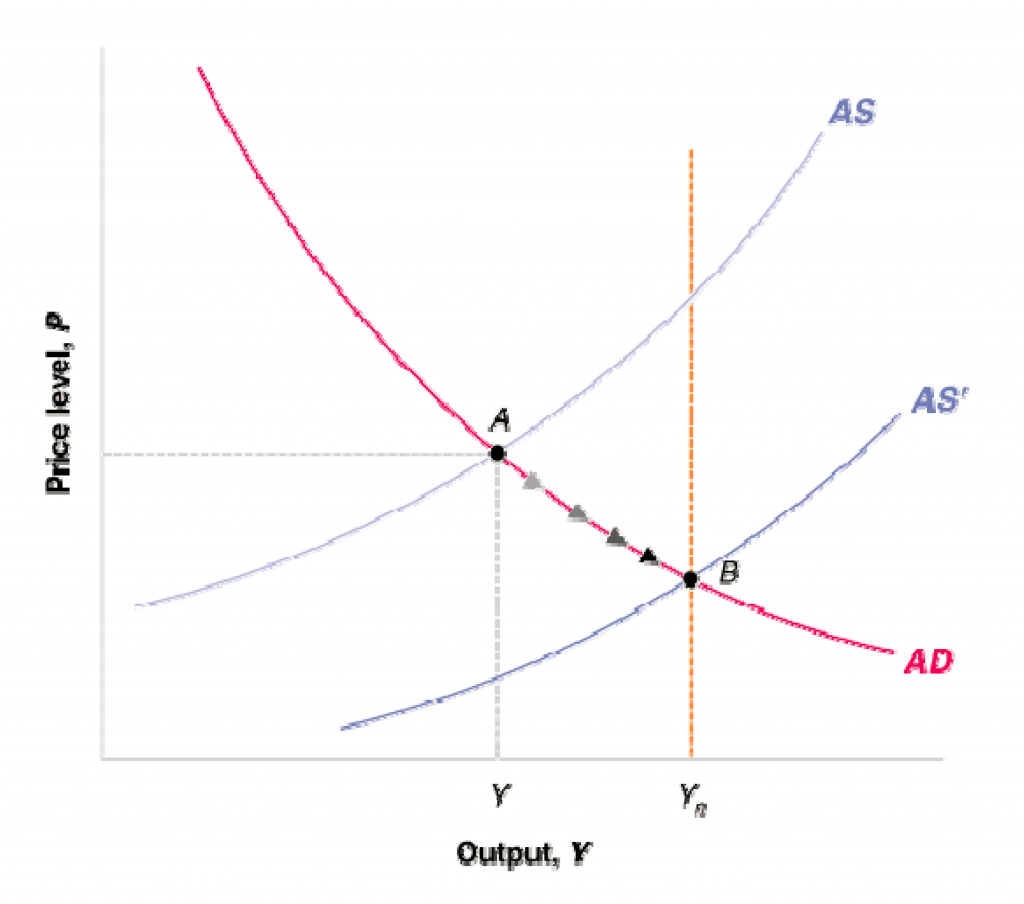

How to reconcile the comparable, large decrease in unit labor costs, and the differing paths in output? There are many factors, but I think one key point to keep in mind is that the unit labor cost (or price level) decline is a function of both the slopes of the aggregate demand and aggregate supply curves and the distance from full employment output. Recall this graph (from Blanchard and Johnston) depicting internal adjustment.

Figure 3: Adjustment toward full employment output from negative output gap, in a currency union. Source: Blanchard and Johnston, Macroeconomics.

The graph highlights that a given drop in prices (or unit labor costs) can occur with a flat AS curve with large (negative) output gap, or steep AS curve and small (negative) output gap. In other words just because the price level is falling (or unit labor costs), it doesn’t mean that one is approaching full employment. And in fact, in May, the IMF forecast the 2014 output gap for Greece at -9.3% of potential GDP. The corresponding figure for Ireland was -2.9% (see Krugman for a discussion of costs of adjustment.) In other words, demand deficiency is key to understanding the perversity of the program now being considered. It’s a sort of corollary of the point Charles Wyplosz made about the origins of the eurozone crisis, It’s About Demand, not Competitiveness.

These points are consistent with Ashok Mody’s three lessons from IMF research

Update, 11am Pacific: Charles Wyplosz concurs; we’ll be back at negotiations soon, even if this deal is approved by the Greek parliament.

1. labor costs are only one part of the whole picture

2. Greece started adjustments 2 -3 years later , and only very half hearted, please see the long list of governance improvements still due at https://econbrowser.com/archives/2015/07/possible-scenarios-for-greece#comment-190960 (with references)

3. Greek export fraction is only about 15% of GDP mainly commodities, Ireland 54%, that make relative ULC much less powerful

4. Think for a moment not as a one-factor academic, but as an entrepreneur: Why would you open or expand what kind of business in Greece?

Permanent instability, every 3 months since 2010 haggling with the IMF why promised reforms where not done, high taxes, now the second default

5. demand in the Greek boom year 2008 was fuelled by some 26% total deficit : Government deficit 13.9% (IMF WEO) and private 12.5% (http://stats.oecd.org/index.aspx?queryid=34814) , spend on consumption, not on invest. When the music stops the foreigners do not finance that any longer. Why should they?

6. english language and alphabet, rule of law, in Ireland you know what you get, in Greece not, for some import/export software support, getting personal from a around the world is more important than labor costs for many businesses

genauer:

1. Agreed. I think I said that explicitly in the text. Why yes, I did.

2. Yes, there’s a long ways to go on governance. But I don’t think it’s been zero. See Karl Whelan.

3. I think when you are relatively closed, being able to adjust on competitiveness dimension is actually even more important. That’s the lesson from Argentina, which was also had a similarly small tradables sector.

4. I agree: red tape and economic uncertainty is unlikely to make you want to set up a new firm. Also true, low aggregate demand is unlikely to make you set up a new firm.

5. You are characterizing a sudden stop. But you’ve hit an important point — lots of private sector lending was unsustainable. So far there has been little bail-in of the private sector (i.e., German and French banks). Shouldn’t there have been?

6. Certainly reforms are necessary. But it’s no use to be moralistic about it — structural reform in the midst of deep recession (see Figure 2) is unlikely to be particularly effective.

@ Prof. Chinn

2. The truth is , governance is improved little in the last 5 years, and Poule Thomson form the IMF fell prey to systematic institutional resistance, and the temptation to report some kind of some sort of progress. The IMF has failed its role in this haggle. The clown Karl Whelan (“The Bundesbank should write itself a cheque” , over 750 billion) has disqualified himself for life.

3. Argentina is VERY different from Greece, just look at the CIA descriptions (https://www.cia.gov/library/publications/resources/the-world-factbook/geos/ar.html)

Argentina is food and energy self sufficient

“Argentina benefits from rich natural resources, a highly literate population, an export-oriented agricultural sector, and a diversified industrial base” They can say to the world “screw you”, at least short term

Greece imports about 40% of food, especially elementary, and near 100% of energy

“Greece has a capitalist economy with a public sector accounting for about 40% of GDP”

That is a potential for total breakdown, Somalia style, with EU humanitarian aid escorted by US 6th and 7th (?) fleet Apache gunship and maritime escorts,

like Black Hawk Down, to subdue the anarcho-communist terrorists:

https://www.youtube.com/watch?v=AUJ6cxWdZwA

Can’t believe it ? Already today the anarchos fire-bombed the police on Syntagma Square before the Greek Parliament

And the live report from my friends is : “alpha, star, mega, anti1 and skai [privately owned] all have live coverage of the Molotov marathon; Nothing on any of the 4 ERT channels. [newly reopened Government channel under left-extremist Syriza control ]

Parantheses [] added my me.

4. The constant attempts by you and the Krugman crowd to steer this to INTERNAL “aggregate demand” is noted. A TYPICAL American islander view, with 2 small neighbors and otherwise surrounded by fish, with exports of only 10%, and most of that proprietary monopolies like Amazon, Google, Facebook, Apple.

What a tiny Greece, in a 50 times larger environment of many neighbors, needs is EXPORTS. Typical example from Greece , Annie from England, locating 30+ years ago to Greece, could have gone to Italy or Australia, successful company in intelligent lighting , business all over the world, profitable before 2008, and now their business strangled to death, and reaching age 68 unable to sell to a partner or anybody else because of archaic corporate laws.

5. I didn’t say “sudden”. And the bail-in of the private sector did happen in 2012, reduction to 0.45 face value, and structured to a 21.5% real value (according to ISDA auction results). Typical would have been twice that.

6. The opposite is the case. Painful changes only happen from a significant pain and fear level on. That wasn’t different in Sweden , Finland, Germany either.

As for the false Greece in emergency room analogy from 2slugs. IMF / Troika have now tried for 5 years a soft re-hab of a hard drug junkie. Didn’t work.

Now it is a 2 weeks cold Turkey de-tox , … or being on their own, Grexit. Tough love, from the other 98%

genauer: “please see the long list of governance improvements still due”

Included in your long list is the following:

“adopt more ambitious product market reforms … including Sunday sales.”

Germany itself has long had and still has restrictions on Sunday sales. Now we know the Germans are just trolling. The dictatorial bankers want to make Greece the neo-liberal dreamland they wouldn’t dare try at home for fear of backlash.

Joseph,

Germany has enough tax income to run her state, Greece not. Therfore your argument is a little bit shallow.

yes they do because they sell to the world high cost goods. now in Greece in reality, they shouldnt be buying German products because they dont have the national income to pay for them. which really wont hurt Germany much since it is a tiny country (10 million people total, maybe 200 billion in GDP). so Greece should never have been in the euro and only was manly cause of nato

@ Joseph

Where I live, in Dresden, I get fresh strawberries at 1 am in morning in less than 200 meter distance (I had this discussion already 4 years ago: http://de.slideshare.net/genauer/open-store) , I could buy some 8 Euro Greek Ouzo bottle in less than 10 minutes all around the clock, if I wanted,

I do buy regularly in a LIDL, not some expensvie “delikatessen”) at 9 am on Sunday, whatever I want to eat , from a 13 cent Brötchen, 49 cent 500 gram pasta. 5.49 Greek ouzo, to somewhat more pricey prime argentine filet steak, dependent on what I like in this second.

Soo, What restrictions ?

If some laid back Bavarians in their local hamlet decide for themselves otherwise, it is their decision, and not my business.

Where is what “neo-liberal” in this picture?

genauer: “If some laid back Bavarians in their local hamlet decide for themselves otherwise, it is their decision, and not my business.”

Yet you would not extend the same respect to the Greeks to decide for themselves about Sunday sales. Thank you for illustrating perfectly the hypocrisy of the German position.

genauer You’re throwing out a lot of stuff and just hoping that something sticks. It’s pointless because you haven’t accepted reality. You’re living in the same fantasy world as Merkel. The bottom line is that there will be a default one way or another. Accept that fact and move on. It was a mistake for German banks to make loans. It was a mistake to bail out the German banks. It was a mistake to prescribe austerity for Greece when the IMF admits that the multiplier is 1.5. More austerity won’t be anymore effective going forward than it was in the past. Merkel has the satisfaction of winning the pissing contest, but she’s still left with the basic problem; the more political battles she wins. the worse things will be for the Troika when Greece eventually exits the Eurozone. When a patient comes into an emergency room suffering a heart attack, that is not the time to recommend more exercise and going on a diet. Instead you stabilize the patient. The moral lecture can wait.

0. The “lot of stuff” is just reciting from the original document, I cited, not my invention.

1. What was bailed out in 2010 (Greek debt holdings in April 2010 http://www.nytimes.com/2010/04/29/business/global/29banks.html), was

a) Greek bank and funds

b) France

c) the German fraction was 9% at that time, and the German fraction of the bailout is 27%, basically a factor 3 bail-in of German, the exact opposite of what you claim

d) with the exception of the UK (heavily involved and bailed out in the Irish Troika program all 9 nations mentioned were relative to GDP more involved than Germany

Why always to single out Germany only ?

2. Who is living in what fantasy world remains to be seen : – )

3. The IMF multiplier was some fancy, driven by cherry picking of data, and immediately ridiculed by the FT

( Last updated: October 12, 2012 11:00 pm

Robustness of IMF data scrutinised

By Chris Giles in London http://www.ft.com/intl/cms/s/0/85a0c6c2-1476-11e2-8cf2-00144feabdc0.html#axzz3fogrCTvL)

and North Europe

4. Merkel has not won a “pissing contest” (your words), but , together with Schäuble, AND the majority of the Eurogroup, organized an unanonimous decision of the Eurogroup. to give Greece one very last chance, despite their despicable behavior and obvious crass incompetence (Draghi and Lagarde had to be brought in twice in Sunday night to explain to Tsipras hwo the IMF and ECB function), which has destroyed all trust from the trustworthy members of the Eurogroup.

5. Greece is absolutely not in a one night emergency room situation. Greece suffers from 40 year long drug abuse (habitual overspending), which has since 10 years become critical. And it is still in constant denial, and into habitual lying (e.g. This referendum is not about Euro membership, The banks will open on Tuesday)

genauer You still don’t get it. You seem to believe that fixing Greece’s structural problems can be done with first fixing Greece’s immediate aggregate demand problem. And you cannot fix the demand problem without restructuring (read wiping out) Greece’s debt. That’s the reality that you and Merkel don’t seem to understand. Correction…there was a story today that Merkel now agrees that austerity might make things worse, as the IMF is now saying; however, Merkel still thinks the Troika should pursue austerity as a moral lesson to the other periphery countries. So Greece is going to be turned into a sacrificial lamb. Not a good idea, especially given Germany’s history. Funny that Merkel is silent about the moral hazard associated with bailing out German banks.

As to the trust issue, who could possibly trust Merkel? She seems to think it’s Germany’s business to get involved in internal Greek politics. Greece comes up with a plan and she says “nein” because it puts too much emphasis on taxes and not enough on spending cuts. Aside from her being wrong about the macroeconomics (Greece should not be cutting back on spending), she is presenting herself as a good old fashioned imperialist butting into the domestic affairs of other countries.

Your story about the multiplier is out-of-date and wrong. The IMF initially assumed a multiplier of 0.5. They now recognize that it is closer to 1.5. That makes a huge difference in terms of policy choices.

@2slug

In exact opposite to you

I say Merkel is the proven most trustworthy person in the world.

a) show me your better example

b) tell me where she violated legitimate trust

Both Schäuble and Merkel enjoy historic record popularity

“German Finance Minister Wolfgang Schaeuble scored his highest-ever approval rating”

http://www.bloomberg.com/news/articles/2015-07-03/schaeuble-popularity-soars-as-germans-split-on-greece-in-euro

“German government approval rating at record high – poll”

http://uk.reuters.com/article/2014/08/07/uk-germany-poll-satisfaction-idUKKBN0G71T320140807

“BBC: Germany the most popular country in the world”

just not with a tiny number of extremists like you and the kruggels

I gave you multiple specific references to data analsyis to the Blanchard multiplier hoax, and debt data, etc.

You repeat with completely unsubstantiated fantasy claims, typical for people like you

I consider Merkel quite trustworthy. She’s situationally German (ie, rules-bound), but the most reliable leader of the G7.

The Trioka–at least the EZ finance ministers–has seen a big win in Greece. Let’s see if it helps, and how events unfold. The Troika’s proposed structural reforms are essentially sound–the Greeks should have voted for them years ago, and at least regarding pensions, Tsipras said so himself.

So, the ball is in play, let’s see how things turn out. But in any event, right now, the Troika can consider its hard line a success.

Alright, if we’re doing 1-6.

1. Does labor cost or the current account balance matter more? If a country’s current account is in surplus and it’s capital account is balanced (ie, in default), is there a compelling need to devalue? And the national budget is balanced and the current account is balanced, does the country have need of (net) external financing?

2. I agree on governance. But you know I have only one word for you:

Mr. McGuire: I just want to say one word to you. Just one word.

Benjamin: Yes, sir.

Mr. McGuire: Are you listening?

Benjamin: Yes, I am.

Mr. McGuire: Incentives.

Benjamin: Exactly how do you mean?

3. Tourism revenues are 18% of GDP in Greece, if I am reading the propaganda properly. Doesn’t seem like that closed an economy.

4. Economic waterboarding. This is a very important point, in my opinion. Macro uncertainly was and remains a chronic problem in Argentina, for example. I don’t see how one could make any serious investment in Greece under the circumstances.

5. I have no a priori objections in inflicting pain on German and French banks. Ain’t going to happen at this point, though.

6. I think there are very important reforms, mostly in administration, which would be hugely important in signaling. For example, I would right away bring in e-Greece, the Greek version of e-Estonia. Show you’re open for business. https://e-estonia.com/e-residents/about/ Forward. Together.

@ Steven Kopits, after reading your blog, your plan would be to set up a payment system for the Greek Parliament to decrease debt to GDP ratio and promote economic growth by giving them a cut of the increment above some baseline. Brilliant idea, but according to the IMF, decreasing debt to GDP by running primary surpluses reduces economic growth in a depressed economy with massive undercapacity. So your plan is to pay incentives for the impossible?

What is that engineering expression — to every problem, there is a solution that is simple, elegant, straightforward and amazingly wrong….

Well, you’ve read my blog, and that’s a start. If you’d read it just a little more carefully, you would have answered your own objections. But let’s start with the simple case, and assume you’re right.

An Incentive Plan is Ineffective

Let’s assume the incentive plan is ineffective and fails to lead to either growth or debt repayment. Then the cost of the plan is zero, and it has done no harm. Simple, right? And keep in mind that a $1 of growth is more valuable than $1 of debt repayment in terms of bonuses, and that GDP growth also prompts debt relief in the proposed plan, even in the absence of debt servicing. In any event, it is important to note that should the plan fail, it leads to no harm or material cost.

Is the Plan Compatible with Growth?

Now, to your objections, which state that “according to the IMF, decreasing debt to GDP by running primary surpluses reduces economic growth in a depressed economy with massive undercapacity. So your plan is to pay incentives for the impossible?”

Well ,first, I suggest to look at the IMF’s forecasts for Greece and the wonders of austerity. Didn’t happen. Rather, after 2011, Greece went back into recession due to the Arab Spring oil shock as I predicted here at the time. (Here are the IMF’s forecasting errors for Greece: http://www.calculatedriskblog.com/2015/02/opinion-did-germany-fulfill-their.html)

Now, the proposed system is a ‘pull’ not a ‘push’ system. Let me quote my blog post which you referenced:

“With the Bonus Plan, the system works in reverse. We create an incentive for good governance, at least to the extent that this implies maximizing sustainable GDP growth and paying down borrowed monies. We do not dictate the policies which Greece should undertake. These are left to the Parliament to decide. If Parliament wants shorter working hours or to defer privatization, so be it. But if this leads to lower growth, then the politicians will pay from their own pockets. History has shown that it is one thing to be generous with the money of others, something different to be generous with one’s own. It will prove to be true again in Greece.”

I have explicitly called for a four year moratorium on debt repayments. I have at least twice stated explicitly that the order of action is 1. governance, 2. growth, and 3. debt repayment. To repay debt, you need a source of funds. Since GDP is 25% below normal, there is a big potential source of funds out there if we can get the Greek economy going again. So, governance first, to create the climate for growth. Second is GDP growth to create a source of funds for debt repayment. Third comes debt repayment.

I would underscore that my proposed program is by far, by far, the most lenient and flexible with Greece.

Please read my comments here for more detail on my views:

https://econbrowser.com/archives/2015/07/possible-scenarios-for-greece#comments

https://econbrowser.com/archives/2015/06/anil-kashyap-on-the-greek-crisis#comments

With proper formatting.

An Incentive Plan is Ineffective

Let’s assume the incentive plan is ineffective and fails to lead to either growth or debt repayment. Then the cost of the plan is zero, and it has done no harm. Simple, right? And keep in mind that a $1 of growth is more valuable than $1 of debt repayment in terms of bonuses, and that GDP growth also prompts debt relief in the proposed plan, even in the absence of debt servicing. In any event, it is important to note that should the plan fail, it leads to no harm or material cost.

Is the Plan Compatible with Growth?

Now, to your objections, which state that “according to the IMF, decreasing debt to GDP by running primary surpluses reduces economic growth in a depressed economy with massive undercapacity. So your plan is to pay incentives for the impossible?”

Well ,first, I suggest to look at the IMF’s forecasts for Greece and the wonders of austerity. Didn’t happen. Rather, after 2011, Greece went back into recession due to the Arab Spring oil shock as I predicted here at the time. (Here are the IMF’s forecasting errors for Greece: http://www.calculatedriskblog.com/2015/02/opinion-did-germany-fulfill-their.html)

Now, the proposed system is a ‘pull’ not a ‘push’ system. Let me quote my blog post which you referenced:

“With the Bonus Plan, the system works in reverse. We create an incentive for good governance, at least to the extent that this implies maximizing sustainable GDP growth and paying down borrowed monies. We do not dictate the policies which Greece should undertake. These are left to the Parliament to decide. If Parliament wants shorter working hours or to defer privatization, so be it. But if this leads to lower growth, then the politicians will pay from their own pockets. History has shown that it is one thing to be generous with the money of others, something different to be generous with one’s own. It will prove to be true again in Greece.”

I have explicitly called for a four year moratorium on debt repayments. I have at least twice stated explicitly that the order of action is 1. governance, 2. growth, and 3. debt repayment. To repay debt, you need a source of funds. Since GDP is 25% below normal, there is a big potential source of funds out there if we can get the Greek economy going again. So, governance first, to create the climate for growth. Second is GDP growth to create a source of funds for debt repayment. Third comes debt repayment.

I would underscore that my proposed program is by far, by far, the most lenient and flexible with Greece.

Please read my comments here for more detail on my views:

https://econbrowser.com/archives/2015/07/possible-scenarios-for-greece#comments

https://econbrowser.com/archives/2015/06/anil-kashyap-on-the-greek-crisis#comments

Let me make it even simpler for you. To install an incentive system, you have Schäuble send a note to Tsipras saying the Greek parliament also has to approve a compensation package with the following text: “Members of Parliament will receive incentive compensation as determined by IMF Rule PCR 4D until such time as Official Debt (to the EU, EZ and IMF) is extinguished.”

That’s it. We can figure out what rule PCR (performance compensation rule) 4 (country group 4, small middle income) D (in default) means next week.

I feel I must be fair to Antonis Samaras. I earlier blamed him for the election of the current socialist government and I still believe he did not do what should have been done, but to be fair he turned the Greek economy from negative GDP to positive GDP and that while reducing government. Perhaps Samaras could have saved Greece but he did not do enough to win the people.

The bottom line is that Greece has no choice except austerity. It can only choose from different kinds of austerity:

– The austerity of a Troika program (3.5% of GDP of fiscal consolidation by 2018)

– The austerity of being in default to the people who make its currency (like we’ve seen in recent weeks, but worse – they were spending down vault cash and such and would have run out soon)

– The Venezuela-style austerity and debilitating corruption of a pseudo-euro (“IOU”) with a dual exchange rate.

– The austerity of a devaluation into a new floating currency, which would be especially tough on such an import-dependent country. In theory this could work best in the long run, but in practice in Greece it didn’t.

There isn’t anyone willing to give or lend Greece enough to stay within the euro while avoiding fiscal tightening, and there won’t be. Greeks have to choose from among the options they have. I don’t see what good can come from encouraging Greece’s populist politicians to continue lying to Greeks that there’s some other way.

http://www.globalizedblog.com/2015/07/greece-is-still-trapped-act-three.html