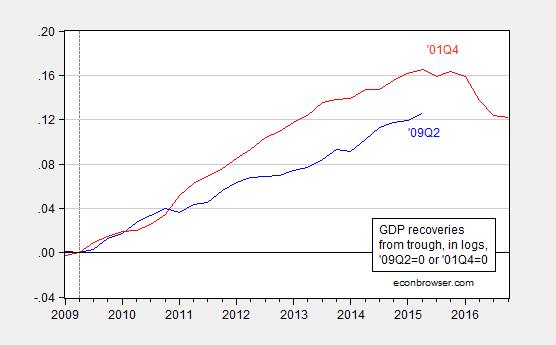

Thursday’s GDP release incorporated an annual data revision extending back to 2012. In this recovery, output is 4% lower (in log terms) than the corresponding point in the previous recovery. In Ch.2009$, 2015Q2 output was 92.9 billion lower (at quarterly rates). The comparison (in log levels, normalized to troughs) is shown in Figure 1.

Figure 1: GDP relative to 2009Q2 trough (blue), relative to 2001Q4 trough (red), in Ch2009$, in logs. A reading of 0.12 can be interpreted as meaning output was 12% higher than it was at NBER defined trough. Source: BEA, 2015Q2 advance release, NBER, and author’s calculations.

The gap falls to 2.9% when per capita GDP is compared.

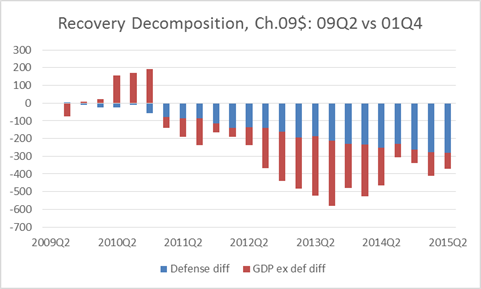

One interesting aspect of the slow recovery is the fact that government spending has been particularly low, as others have pointed out [1] (and contra common perceptions). Perhaps, more interesting is the source of the government spending that pushed output growth in the 2000’s: defense.

Figure 2: Contributions to differences in 2009Q2 and 2001Q4 recoveries, in billions of Ch.2009$, SAAR, from defense spending (blue) and all other government spending (red). Source: BEA, 2015Q2 advance release, and author’s calculations.

In other words, most of the slower growth in an accounting sense can be attributed to lower defense spending. Does this mean we should embark upon another war? After all, the same voices who argued for invading Iraq have also argued for taking military action against Iran (e.g.., John Bolton). I do believe doing so would add to aggregate demand. Figure 3 (from this post) shows how much we spent up to FY2012 in real terms.

Figure 3: Cumulative real direct costs, in constant (FY2010) dollars by fiscal year, in the Iraq theater of operations (“Operation Iraqi Freedom”). Does not include debt service costs. Source: Nominal figures from Amy Belasco, “The Cost of Iraq, Afghanistan, and Other Global War on Terror Operations Since 9/11,” RL33110, Congressional Research Service, March 29, 2011, Table 3. Data for FY2011 is for continuing resolution, for 2012 is Administration FY2012 request. Deflated by CPI-all. CPI for 2011 assumes September 2011 m/m inflation is the same as August 2011 m/m inflation. Assumes 2012 inflation is equal to August 2011 CBO forecast for CY2012 inflation.

Figure 3 incorporates only direct fiscal costs to the United States government, and excludes interest costs. See here for another tabulation.

However, believe it or not, there are other ways of boosting aggregate demand, even when restricting oneself to spending on goods and services – and that’s spending on directly productive assets, such as infrastructure. To make this point concrete, note that in dollar terms, overall government spending more than accounts for the GDP differential. GDP was 371.7 Ch.09$ billion (SAAR) lower than the corresponding point in the previous recovery. Government spending on goods and services was 559.4 Ch.09$ billion less. As noted in this post, a big program of spending on infrastructure would clearly benefit the economy both on the supply and demand side. And yet, there is no evidence of movement here, particularly given the refusal of certain elements to consider more tax funding for such measures.[2]

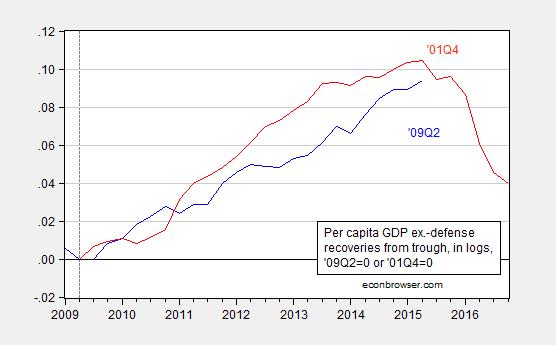

Update, 8/3 2:30PM Pacific: Here is an alternative visualization of the recoveries, with GDP ex.-defense in per capita terms.

Figure 4: Per capita GDP ex.-defense relative to 2009Q2 trough (blue), relative to 2001Q4 trough (red), in Ch2009$, in logs. A reading of 0.4 can be interpreted as meaning per capita output excluding defense spending was 4% higher than it was at NBER defined trough. Source: BEA, 2015Q2 advance release, NBER, and author’s calculations.

The gap is 1% as of 2015Q2.

The Afghanistan and Iraq wars were needed. However, “nation building” was an expensive mistake. It was also a mistake not to take ISIL out decisively before it became embedded, recently.

Instead of nation building, the federal government should’ve saved that money, reducing federal deficits (rather than spending on something else), along with raising taxes and housing lending standards, when the 2000s expansion was underway.

Peak Trader – Please explain exactly why the Iraq war was needed

The first Bush didn’t finish the job, because he appeased Congress.

It was unknown what a madman, and his sons, would do sitting on trillions of dollars of oil, particularly holding a grudge or seeking revenge after the first Gulf war, which you recall took place after the invasion of Kuwait, and massive environmental damage was created by Iraq on purpose.

We also know chemical weapons were used against his own people. So, why wouldn’t WMDs be used someday against the U.S., or a coalition partner, perhaps by his sons? And, credibility is needed to deter other similar episodes.

If Iran refuses to comply with the inspectors and kick them out of the country, is that enough to invade Iran and overthrow the regime?

If not, then when?

The Iraq War was one of the most important, and damaging, episodes in the history of U.S. foreign policy. Obviously, the circumstances in Iraq and Iran are different. And smart people may offer smart explanations for why the demand for capitulation that proved so disastrous in America’s dealings with Iraq is well-suited to America’s dealings with the country on Iraq’s eastern border.

It’s hard to pretend that nothing has happened over the last 15 years to throw that worldview into question. It’s only fair, therefore, that when people who championed the Iraq War debate the Iran deal, they be made to face that war’s consequences too. Were that the norm, I suspect the debate over Iran would barely be a debate at all.

The war should’ve been limited to regime change.

A new dictator would’ve likely emerged, and he’d know better, from the prior regime change.

The world community should’ve taken a hard line with Iran. Dismantle your nuclear program or end up like Iraq.

The Middle East is a mess anyway. Nuclear proliferation will make an even bigger mess.

And, there are other sources of power besides nuclear power, like solar and wind, for oil rich Iran.

Moreover, what good is a “red line” on the use of chemical and biological weapons without a swift and severe reaction on their use?

just curious peak,

“If Iran refuses to comply with the inspectors and kick them out of the country, is that enough to invade Iran and overthrow the regime? If not, then when?”

what is your justification for invading another sovereign nation? because they did not obey your orders? if so, then when do we invade russia and china? north korea? and when germany acts against our wishes, there as well?

I haven’t heard anything about invading “Russia, China, North Korea, and Germany” and well over a hundred other countries?

It’s naïve to assume those countries always comply with international laws and treaties.

It seems, invasion of a “sovereign nation” is unacceptable to you, regardless of what that country does.

Joint Plan of Action – Wikipedia

“The nuclear program of Iran has been a matter of contention with the international community since 2002, when an Iranian dissident group revealed the existence of two undeclared nuclear facilities.

The International Atomic Energy Agency, charged with monitoring and ensuring peaceful nuclear activities, referred the matter of Iran’s nuclear program to the UN Security Council in February 2006, after finding that Iran had not been in compliance with its duties as a signatory of the Nuclear Non-Proliferation Treaty. For what the IAEA judged to be continued non-compliance, the UN Security Council has voted four times since 2006 to impose limited economic sanctions against Iran. In its resolutions, the Council required Iran to fully cooperate with the IAEA and to suspend all uranium enrichment-related activities.”

peak, it seems, invasion of a “sovereign nation” is completely arbitrary to you, regardless of what that country does. and that is the whole point. we have already demonstrated great hubris in our invasion of other middle eastern countries, with limited justification.

“And, credibility is needed to deter other similar episodes.”

and we have lost credibility because of those invasions. the justification for the invasion of iraq was dubious-and that cost us credibility. and that is why we suffer in dealing with iran today. the cheney-bush doctrine of military engagement damaged significantly our ability to deal with international situations today. it is an unfortunate legacy we will have to deal with for some time.

And, instead of raising the Fed Funds Rate from 1% in June 2004 to 5 1/4% in June 2006 and maintaining that rate till September 2007, a slower and smaller tightening could’ve taken place, avoiding QEs in the 2010s.

U.S. trade deficits should’ve been smaller as a percentage of GDP in the 2000s than the 1995-00 boom, boosting U.S. GDP, although oil prices were rising substantially from 1999-08. The structure of the 2001-07 expansion was unsustainable.

Here in Buffalo NY in 2005, the child poverty rate was 37.5%. In 2013, it grew to 45% and in 2014 it continued unabated to 50.6%: in 2014, more than 1/2 of the cities’ children lived below the poverty line (Buffalo News, Sept 18, 2014). Massive spending on infrastructure would perhaps trickle down to the kids living in poverty in Buffalo, but I’d like to see some comment on the issue of massive spending in transitioning from fossil fuels to renewable energy.

Does your definition of “infrastructure” include massive spending to replace our coal, oil, natural gas plants with wind, solar and geothermal sources of energy? That’s something we need to do, according to the overwhelming majority of scientists.

Oh come on. I have been to Buffalo quite a bit over the last 20 years. The numbers are bogus. What do they consider “children in poverty”? Again, they are massaged to fit the narrative.

The data comes from Census Bureau and they define child poverty….why do you think the numbers are bogus? On any of your many visits to Buffalo have you spent any time in the area east of Main St? I recommend you do. It sounds like you never ventured much beyond the Elmwood Ave/Bidwell Pkwy area.

“The Afghanistan and Iraq wars were needed” Otherwise those NBC (WMD) would have been transferred to Syria. Snark!

Even the UN (which the U.S. made their numerous resolutions credible) and the EU knew Saddam and his two sons deserved to see Allah 🙂

Bravo, Menzie, for publicly addressing this issue and using the term “military Keynesianism”.

As for domestic infrastructure spending possibly in lieu of spending for never-ending imperial wars for oil empire, we desperately need a national discussion about which “infrastructure” in the context of the 21st century and Peak Oil and the “new normal” of “secular stagnation”, i.e., post-2007 real final sales per capita of ~0%.

Spending more for “health” (sick or illth) care and “education” (“credentialing”, whether students learn anything useful or not) has already begun to exhibit prohibitive costs and diminishing returns from allocation of scarce resources.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1ygo

In fact, real final sales less gov’t and household spending for illth care is precariously close to decelerating to “stall speed” or a recession-like rate as of H1.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1ygs

The per-capita YoY rate for Q2 (not shown because data for population is only available through May) is slightly below 1.5%, which is the slowest rate since 2008-10 and 2001-03.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1ygu

Moreover, illth care spending is growing at a differential YoY rate that is more than twice the rate of real final sales ex gov’t, occurring previously at the onset of recessions in 2008 and 2001.

Therefore, it is not inconceivable that the US economy has decelerated from “stall speed” late in 2014 to recession, as in early 2001 and early 2008, with a similar lack of visibility, recognition, or acknowledgement of same by the economic intelligentsia, Wall St., and financial media as occurred in 2001 and 2008 prior to 9/11 and the Lehman take down.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1x6E

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1ygD

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1ygJ

The leverage in the financial system now exceeds 2006-08, which has resulted, yet again, in bubbles in real estate vs. real wages per capita and in market cap as a share of GDP, the latter of which has already peaked and begun to roll over as in Q4 2000 and Q2 2008.

Cyclical history is rhyming yet again. What is the probability that the Fed will raise rates given the foregoing evidence? My guess is 0%.

But the implicit question arises: Will the emerging conditions compel Wall St., the rentier Power Elite, and the Pentagon to engage in yet another military Keynesian adventure to rationalize resumption of QEternity to justify outsized deficit spending to prevent (or postpone) debt/asset deflation and nominal GDP from contracting? The probability of this occurring is significantly higher than 0%, I’d wager.

Your basing gdp data on flawed inflation data. Guys, we have had HUGE(with capital letters) industrial inflation since 1997 and before that were were disinflating since 1980. Technology and offshoring have really brought prices down. I have reduced the amount of inflation since 1997 and it showed some incredible points:

1.YrY 5.5% growth between 1997-00.

2.4.5% YrY growth between 2004-6

3.High consumer inflation in the mid-late 00’s during the crest of the global boom which powered commodities

4.industrial deflation is ebbing

5.The Federal Reserve System has a secret counter GDP method that uses this lowered inflation model and they show growth closer to 3% since Q3 2009. Their official figures are only for show.

The fact is, when you account for the industrial inflation, the US economy grew like mad between 1997-2007. It also means the recovery while slow, has indeed been recovering. If Obama had any guts he would tell Boner and McConnell for a bi-partisan “fix” to this issue. Bush cohorts may actually feel vindicated a bit despite the bust.

Menzie, Even though it is of course preferable to spend public money on other items than wars, it seems more difficult to gather support for health, education, transportation, science and other public spending than for just wars against horrible foreign crazies. Just wave a flag, beat your breast, shout that the US is The Best, that Satanic Commi Muslim Arab Atheists are going to invade the US of A, and many citizens are at once ready to allow more money to go to “Defense”. There weren’t so many people like Obama, who refused to vote for War against that islamist Saddam Hussein and all of his dreadful WMD (remember, Irak was said to be the fifth military power in the world at the time) in Irak.

Just a geeky technical point about the mechanics of defense spending. As a general rule across the non-DoD part of government each dollar appropriated for a fiscal year is “obligated” and disbursed in that same fiscal year. So when we say that non-DoD spending was X billions of dollars that year it has the same ordinary meaning of spending that we associate with private sector spending. This is also true for the operations & maintenance (O&M) and military pay components of DoD spending. And it’s approximately true for research & development spending. But when it comes to procurement appropriations (PA) dollar and military construction & housing spending, then we’re in a different world. Spending on ships, fixed wing aircraft and military construction means that the money does not have to be put on contract (i.e., “obligated”) for 5 years after appropriation and the law allows up to another 5 years after contract award before the Treasury actually disburses the money. For other PA funded items (e.g., tanks, helicopters, howitzers, drones, radios, etc.) the relevant timeframes are 3 years to obligate and another 5 years to disburse. For example, if Congress appropriates monies for new ships in FY2015, the contract might not be awarded until FY2019 and the actual Treasury disbursement might not be until FY2024. The NIPA tables record disbursements, so there can be long lags between appropriations and what shows up in the NIPA numbers. This problem frustrates a lot of academic economists who have used NIPA spending to show that defense spending does not increase aggregate demand. In a nutshell, they get the analysis wrong because they do not understand the Byzantine nature of DoD financial accounting. The economic impact is at time of award when business activity (e.g., borrowing, hiring labor, procuring raw materials, etc.), but what is observed in the NIPA tables is disbursements when the economic activity itself has ceased.

There’s an extra recession in there, Menzie. There’s a crypto recession starting in mid-to-late 2011. It’s another oil shock, and you can see that GDP goes off track compared to the previous recession just at that time. Also, we know that the crypto recession in the US was an actual recession in Europe, with the CEPR marking the start at Q3 2011 (with no end declared to date). I date the end of this subsequent recession (which I refer to as GR Part 2) at Q2 2013. Now that I think about it, I actually have a very nice exposition on this topic using UK VMT. Find it here: http://www.prienga.com/blog/2015/7/21/uk-vmt-its-also-recovering

Excellent Analysis, But Pointless

As everyone Inside the Beltway knows, but folks outside it apparently do not, infrastructure spending must be offset with cuts to other spending or tax increases, e.g., the new highway funding bill is “paid for” fully with offsets. In DC speak, this is known as “paygo.”

OTOH, war spending is never “paygo” since it is always an “emergency” even when it is not, e.g., Iraq war. So war spending is simply added to the deficit without a second thought.

Accounting DC style – if you know the rules you get what you want. Otherwise, no soup for you.

“One interesting aspect of the slow recovery is the fact that government spending has been particularly low, as others have pointed out [1] (and contra common perceptions). Perhaps, more interesting is the source of the government spending that pushed output growth in the 2000’s: defense.”

This statement is incorrect. Govt spending is currently 22.5% of GDP versus a 1970-2007 average of 21.0%. Thus, government spending, by any reasonable historical measure is in fact high.

The statement thus written would be correct:

” Given the large deficits which accompanied the Great Recession, it was inevitable that government spending would prove a drag on, not a support to, growth as the economy recovered and federal spending reversed. More specifically, government spending averaged 25.0% of GDP from Q4 2009 to Q4 2011, and 24.0% of GDP from 2008-2012, compared to a long term average of 21.0% of GDP. It currently stands at 22.5% of GDP, and thus we may conclude–assuming no crowding out–that the relative decline in spending since 2011 has reduced GDP by 2.5%–an entire year’s growth–compared to what we might have expected.

“This effect is likely to continue, assuming federal government spending reverts to its longer term level of 21.0% of GDP, which in turn implies another 1.5% of GDP drag in the next 2-3 years. Subsequently, we might expect government spending to increase with–and contribute more meaningfully to–GDP.

“Therefore, we need not entirely despair of seeing higher GDP growth rates again, but we are still sorting out the aftermath of the Great Recession, and for a least a few more years, government spending is likely to remain a relative drag on growth.”

That’s my read. Graph is here. http://www.prienga.com/blog/2015/8/2/us-government-spending-as-a-percent-of-gdp

Steve Kopits: I downloaded data from the 2014Q2 release, divided nominal government consumption and investment by nominal GDP, and regressed the ratio over the 1970-2007 period, to obtain 0.2026. The corresponding ratio for 2015Q2 (advance) is 0.1774. Hence, I respectfully disagree. I provide spreadsheet downloaded from BEA here.

Professor Chinn,

I notice if I just average the ratios I get an average ratio of 0.2026. Would please you offer a bit more explanation for your regression model? Thanks

AS: It’s the same thing. Average is the constant from the regression of the ratio on a constant.

Steven Kopits: I think I might understand your numbers; you seem to be using total Federal current expenditures. I am using total government spending on goods and services, as indicated in notes to Figure 2.

Entitlements, particularly for an aging population, and interest on the national debt will likely continue to crowd-out other government spending.

And, although there are benefits to big infrastructure spending, it seems, budget deficits will worsen.

It seems, there also has to be some change in priorities.

“It seems, there also has to be some change in priorities.”

perhaps we can start with an adjustment on the upper end of social security benefits, and use those savings as a down payment on future infrastructure projects? the baby boomer generation certainly benefited from the massive infrastructure improvements since the 50’s and 60’s. cutting back entitlements, starting from the upper ss levels and moving down, would be a start? we cannot continue to delay passage of changes until after all the baby boomers are into the entitlement system, and then grandfather them into their pay structure. the baby boomer bulge is the major problem, and if it is not addressed then we are simply punishing the following generations in order to keep promises to the boomers which should have never been made. i agree entitlements need to be adjusted. but the adjustments need to start with the problem generation, not after the problem generation.

Yes, the Baby Boom generation has benefited disproportionately at the expense of future generations.

Basically Baffs, we have to freeze spending for two years, and then after that it can grow at trend. That’s all we’d have to do to make order in the national budget.

Yes.

In terms of GDP, all government spending counts, if I understand correctly. If government spending is coming off a cyclical peak, and G is falling (or at least not rising by trend), then the contribution of G to GDP will be relatively weak. If you believe counter-cyclical spending supports the economy in a downturn, then by extension you believe that a relative reduction in government spending will hold back the economy in a recovery. And nothing wrong with that, but it needs to be factored into GDP expectations. (Scott Sumner might disagree with this view.)

As for infrastructure, we are seeing a strong recovery in vehicle miles traveled, and will soon in air miles as well. We’re going to need to catch up from nearly a decade of stagnation and under-investment. As long as the oil supply holds out, we’ll have need of substantial investment in infrastructure, which will no doubt prove pro-cyclical, counter to the wishes of most economists.

I would emphasize that we need to distinguish between maintenance capex and new project capex. The former provides a positive rate of return, providing that project is properly selected and executed. The latter prevents the emergence of a negative rate of return, that is, maintenance capex prevents GDP from falling. It does not raise GDP beyond the actual act of construction. Thus, a new train tunnel under the Hudson or a $20 bn renovation of JFK Airport does not provide a meaningful positive return on investment. Widening I-95 north of New York would provide new capacity and an increase in GDP (indeed!). By contrast, repaving the existing lanes of I-95 north of New York merely prevents the road from becoming slow(er), but does not increase its nameplate capacity.

As the country matures, the difference becomes important. It would be extraordinarily helpful if we had a national balance sheet, so we could see the impact of infrastructure investment net of depreciation. I have to admit, I am often perplexed by the seeming lack of interest by economists in securing better statistical data. It is not very glamorous stuff, but is absolutely essential to our understanding of the economy’s dynamics.

No, I get what you’re saying.

This sentence

“One interesting aspect of the slow recovery is the fact that government spending has been particularly low…”

should have be written

“One interesting aspect of the slow recovery is the fact that government consumption and investment has been particularly low…”

By the way, over at ZH there’s a bit on GM govt vehicle sales up 59%. Even if growth is not great, employment is recovering nicely (I would say we now have a strong market here in Princeton) and governments are getting some cash coming in. http://www.zerohedge.com/news/2015-08-03/here-reason-why-gms-july-car-sales-smashed-expectations

It’s the nature of life to cut capex first in a downturn–you’ll make do with what you have. However, in an upturn, capex comes back disproportionately strongly. I think we’re beginning to see that now.

Lots of fear and loathing in the oil sector right now, with oil prices continuing to drift down in ways that are inexplicable in terms of longer view (we are now pricing in a recession-like event in China). So asphalt is cheap, and that will encourage paving, which has been about 40% below normal (in terms of asphalt usage).

By the way, I have worked my way through a decent numbers of Q2 financials, and it looks to me that US shales are good at $65-72 WTI, a price which should not constrain either oil consumption or economic growth anywhere in the world. If shales can actually produce at this level, the US economy will be off to the races in 2016, with both the oil and manufacturing sectors looking good.*.

(And if shales can’t produce, then we have the prospect of a really bad oil shock. Very little spare capacity around the globe right now.)

In any event, if the US shale sector can turn the motor back on, then we’ll see a boom in paving, vehicle construction, public infrastructure, airports, roads, parking lots, new factories, etc., as well as recovering employment in the oil sector (which will not recover previous levels, however).

See the graph at CR:

http://www.calculatedriskblog.com/2015/08/construction-spending-increased-01-in.html

We tend to focus on GDP as a good indicator of “recovery”, but it may or may not be a good indicator of economic health.

http://www.tradingeconomics.com/

Bruce Hall: Agreed — here is a better one: Muller et al. (2011).

Menzie, I agree that pollution (i.e., toxic wastes in any form) are a cost to the economy (even if the ex-post-facto control of such wastes adds to the GDP). We should consider such costs versus the alternatives available, but also consider the quality (excluding environmental costs) of such alternatives. Should we be investing in 4th generation nuclear power plants rather than new “clean coal” or erratic “alternative” energy sources? There are no clear-cut answers because the questions are always in varying contexts.

For example, will the President’s plan for alternative energy allow the economy to run at the levels needed to sustain an ever-increasing population? Will the production of these energy facilities be less harmful than the production of conventional energy facilities? What happens to the local environments when vastly increased land is used for alternative energy production. Are there human and animal problems from alternative energy sources that could be avoided by conventional power sources? Can alternative energy be independent of conventional energy? If the answers point to less expense for maintaining the environment at the cost of economic gain, who rightly decides the course for 300 million plus people in the U.S.?

Clean air standards introduced in the 1970s made an enormous improvement in U.S. air quality. The costs were more than offset by the economic and health benefits. But the use of the words “healthy economy” in my previous comment did not refer to individual health or the quality of the environment. I was referring to economic health of the nation. They may or may not be correlated in the future. That would be an excellent analysis to apply to the chasing of marginal improvements.

Menzie,

I think you will get military Keynesianism whether you want it or not. This morning, I had the nasty experience of being called by “Campaign for a Nuclear-Free Iran”, despite my desire to have nothing to do with them. I support President Obama’s initiative, and hope it works, but think a military strike of some sort is inevitable. It’s like being against winter; you will get it anyway. The only thing that might happen is that the Keynesiansim, or the equivalent to the experience in Iraq, might be managed so that there are no riots in the U.S. or Europe, and that there might be some valuable capital built in this country (such as new sensors provided by military research) so that the effects will be less inflationary.

Julian

Julian, I think that war in the Middle East is not only inevitable, it is underway. Right now it is limited to mainly Syria and Iraq, but the sectarian and political instability resulting from the U.S. evacuation of the area ensures that ultimately Saudi Arabia, Iran, Turkey, and Israel will find a way to expand the conflict. Then Obama and Kerry will say they have done all they could do and request a vote from the UN which will condemn Israel for existing and all will be settled. I think that fits the narrative.

Okay, that’s out of the way. It’s hard to judge the “return on investment” from military spending. After all, it doesn’t really matter if Democrats or Republicans are in power, the U.S. has implicit and explicit missions to be the policeman of the world. Sometimes it is more rhetoric as the case with Carter and Obama. Sometimes it is direct actions such as the Bushes. Sometimes it is poker such as Ronald Reagan. The notion has been that whenever a potential threat begins to gain traction against the West, it is our mission to disrupt that process by any (politically correct) means necessary. Sometimes that means wasteful and rudderless wars such as Vietnam (JFK and LBJ) or lraq and Afghanistan (Bushes and Obama). Sometimes that means spending the opponent into oblivion (Soviet Union). Sometimes that means playing all sides of the battle hoping to cause fatigue among the antagonists (reluctance to attack ISIS and the lip-service for “spring” fighters). Whatever keeps the oil flowing and the battle zones elsewhere. The “return on investment” is always debatable (things would be worse if we didn’t do this or that). The fact is that the world is full of people who do not share the progressive notion of fair and just and find democracy laughable.

Now, in support of all of these military ventures is research and development when often translate into fantastic civilian benefits. For example, at $0.5 billion a pop, the 20-some GPS satellites provide worldwide location services for a vast array of applications. From tracking shipments to getting safely home, billions of people rely on this military spending. Not sure how you’d calculate the “rate of return” on that investment. Laser technology? So many others. Some could have been developed for civilian use initially, but some would not have. Who would have launched the GPS and communication satellites?

So, before you get too snarky about “military” spending, consider the alternatives.