One of the bits of information in the employment release was a decline in manufacturing employment. When added to declining exports and stagnant manufacturing output growth, the case for near-term monetary policy tightening seems more tenuous to me.

First, manufacturing employment.

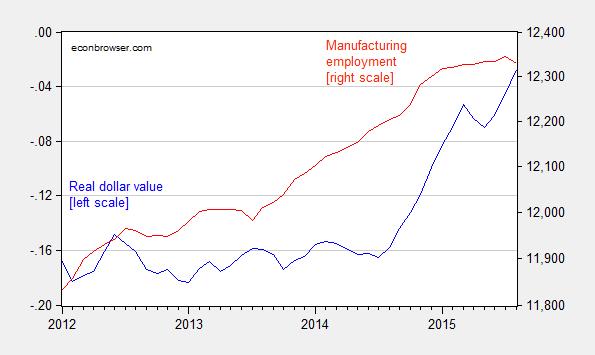

Figure 1: Trade weight real value of US dollar against broad basket of currencies, in logs, 1973M03=0 (blue, left scale), and employment in manufacturing, in thousands, seasonally adjusted (red, right logarithmic scale). Source: Federal Reserve Board and BLS via St. Louis Fed FRED, and author’s calculations.

While the decline in August employment might very well be erased in the next revision, what can be said is that manufacturing employment has flattened out several months after the dollar’s ascent began.

Next up – exports. Thursday’s trade release provided some good news, with the trade deficit shrinking and exports inching up. But what about exports?

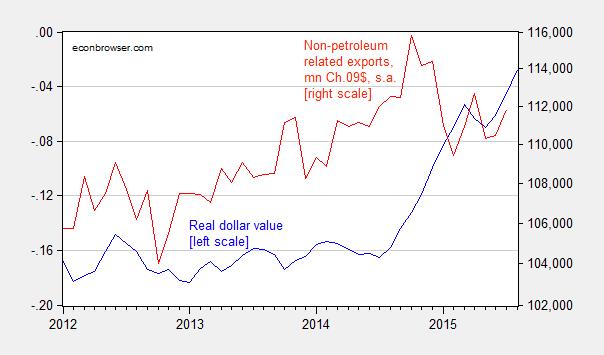

Figure 2: Trade weight real value of US dollar against broad basket of currencies, in logs, 1973M03=0 (blue, left scale), and exports of non-petroleum related goods, in millions of Ch.2009$, seasonally adjusted (red, right logarithmic scale). Source: Federal Reserve Board and BEA/Census via St. Louis Fed FRED, and author’s calculations.

Non-petroleum related exports are down slightly relative to a year ago, and down noticeably relative to the 2014M10 peak (since the right scale is log, but with original data reported — as some readers have asked for given their befuddlement with logs — one can’t read directly off the graph the percent decline; it is 3.5% in log terms).

Manufacturing output (a proxy for tradables) ticked up for the last reported month.

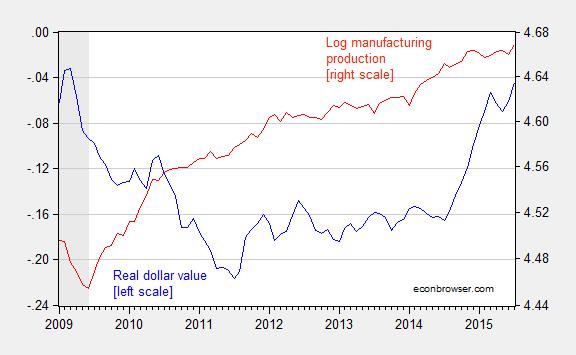

Figure 3: Trade weight real value of US dollar against broad basket of currencies, in logs, 1973M03=0 (blue, left scale), and manufacturing output, seasonally adjusted (red, right scale). Source: Federal Reserve Board and BEA/Census via St. Louis Fed FRED, and author’s calculations.

However, the deceleration in manufacturing output growth is marked over the past year (since the series is in logs, a flattening of the slope can be directly interpreted as a reduction in the growth rate). This is the best high frequency indicator for the impact on the tradables sector of the dollar, given the trend decline in manufacturing employment.

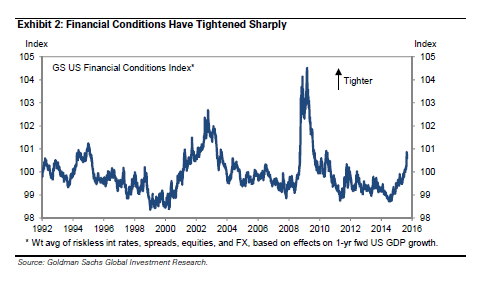

All the foregoing suggest to me we should be wary of tightening, given the tightening has already occurred, based on indicators of financial indicators. Consider the Goldman Sachs Financial Conditions Index, as of yesterday.

Source: Goldman Sachs, “US Economics Analyst: 15/36 – The Drag from China: Many Channels, Limited Impact” (Stehn/Hatzius) [not online].

So, still no urgency for monetary tightening.

See Furman/CEA, Sparshott/WSJ RTE, and McBride/Calculated Risk for more.

Yet, credit expansion is accelerating. You can’t give manufacturing any respect. The overcapacity in domestic oil is coming off. That will end soon enough.

The current economic expansion – at 74 months – is now the fourth longest in U.S. history – longer than the 2001-07 expansion.

And, while the unemployment rate has declined, to 5.1%, the core PCE inflation rate has also declined (falling to less than 1.3% – well below the 2% target).

It looks like the Fed is in another tough position.

What is the source of the tightening? What is it’s cause? The dollar for example. What is pushing its value upwards? Certainly not a fear of inflation here. Is the EU also rising? I like the article, but I don’t understand the dynamics involved. Is it a fiscal, not monetary, phenomenon? For example, what would happen were the Congress to approve $5 trillion in infrastructure work over the next five years, raising taxes to mitigate the deficit spending, all of those taxes coming from the top 10 percent? Would all this raise interest rates? It certainly would raise GDP.

Menzie wrote:

“One of the bits of information in the employment release was a decline in manufacturing employment. When added to declining exports and stagnant manufacturing output growth, the case for near-term monetary policy tightening seems more tenuous to me.”

Here is a good example of a person’s world view driving their logic. Menzie assumes that “tightening” makes the economy decline while increased liquidity makes the economy grow. It doesn’t matter whether there is any evidence that this world view is valid, it is standard economic dogma. If this is true why did the economy continue to decline through the Bush and Obama presidencies with the most massive monetary expansion in recent US history? And why is it that the “green shoots” of economic recovery showed themselves as liquidity tightened?

So does that mean that tightening always makes the economy stronger? No. Money is a tool not a magic elixir.