As noted in The Hill, from a letter written by key House and Senate leaders to President Obama:

The continued misalignment of China’s currency is unsustainable and unacceptable.

Two observations:

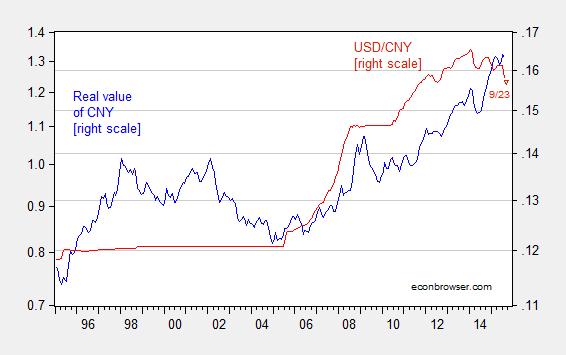

The yuan’s value. While the yuan has depreciated recently, on a trade weighted basis, the real value of the yuan is (still) 14% higher (in log terms) than it was in 2014M06.

Figure 1: Real value of trade weighted yuan, 2010=1 (blue, left log scale), and USD/CNY (red, right log scale). Source: BIS, Federal Reserve Board.

As of 9/23, the yuan was 0.6% weaker against the dollar than it was in August. That means that the yuan is still substantially stronger than it was in mid-2014.

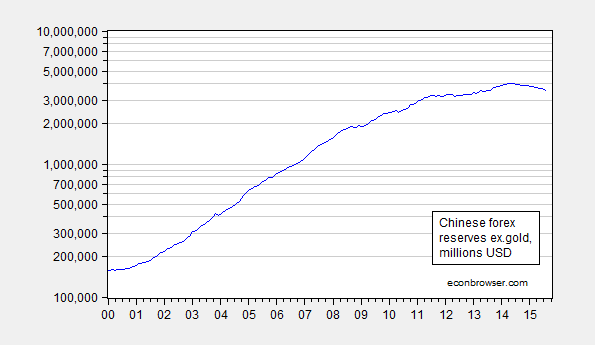

The external balance. Chinese foreign exchange reserves in dollars have been declining for the past year.

Figure 2: Chinese foreign exchange reserves excluding gold, in millions of USD, log scale (blue). Source: FRED, TradingEconomics.

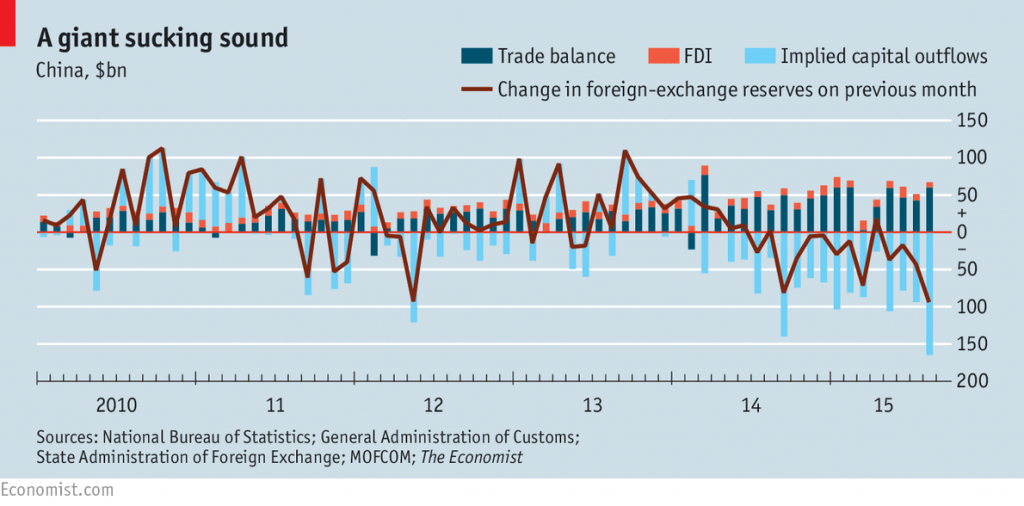

Capital outflows have been increasing, at least as can be inferred from current account data and changes in fx reserves.

Source: Economist, Sept. 19, 2015.

Put together, these points do not support severe undervaluation, even after the recent yuan devaluation. More on undervaluation here and here.

There are plenty of contentious issue-areas for the US and China to deal with. Severe yuan undervaluation is not one of them (unless much larger devaluations are in the pipeline).

The yuan is over-valued by 6-8% in my opinion. I’m finishing up my China Tracker this morning, and the indicators pretty clearly point to an over-valuation for reasons I have written about elsewhere.

Menzie,

You and I have often agreed on this issue of the yuan being overvalued and we agree once again. The exchange rates of the yuan v dollar are the least of our concerns with China. It is sad to see such bipartisan financial stupidity from our congress (especially Rep. Paul Ryan who seems to have been abducted by aliens and replaced with a wicked double).

Could someone suggest to the CEPR that they get off their collective asses and call a end to the 2011 recession in Europe?

Although it does appear the “recession” in the Eurozone that started in 2011 ended in 2013, although growth remains very tepid. http://www.tradingeconomics.com/euro-area/gdp-growth

One problem comparing U.S. states with Eurozone stats is that Europe reports growth per quarter while the U.S. reports quarterly growth at the annual rate, so that U.S. 2d Quarter growth would be reported as .97% growth, and not 3.9% annual rate.

U.S. economic policy has been far from perfect the last 6 years (deficit fetish!!!), but compared to all the other “houses” in the OECD neighborhood it has had the based decision making (April 2009 and Dec. 2010 stimulus packages and three rounds of QE and staying at the ZIRP for seven years). There is still an insufficient recognition in the U.S. and around the world that the problems of oversupply of labor and production , demographic trends of aging and slow growing populations, and finally over “saving” in world of insufficient worthy private investment opportunities and insufficient public investment, means insufficient aggregate demand. The result are structural trends to lower inflation and moderate deflation. We are all turning Japanese.