That is the title of a post by Maury Obstfeld, Chief Economist at the IMF, on the occasion of the release of the April 2016 World Economic Outlook forecasts.

Global growth continues, but at an increasingly disappointing pace that leaves the world economy more exposed to negative risks. Growth has been too slow for too long.

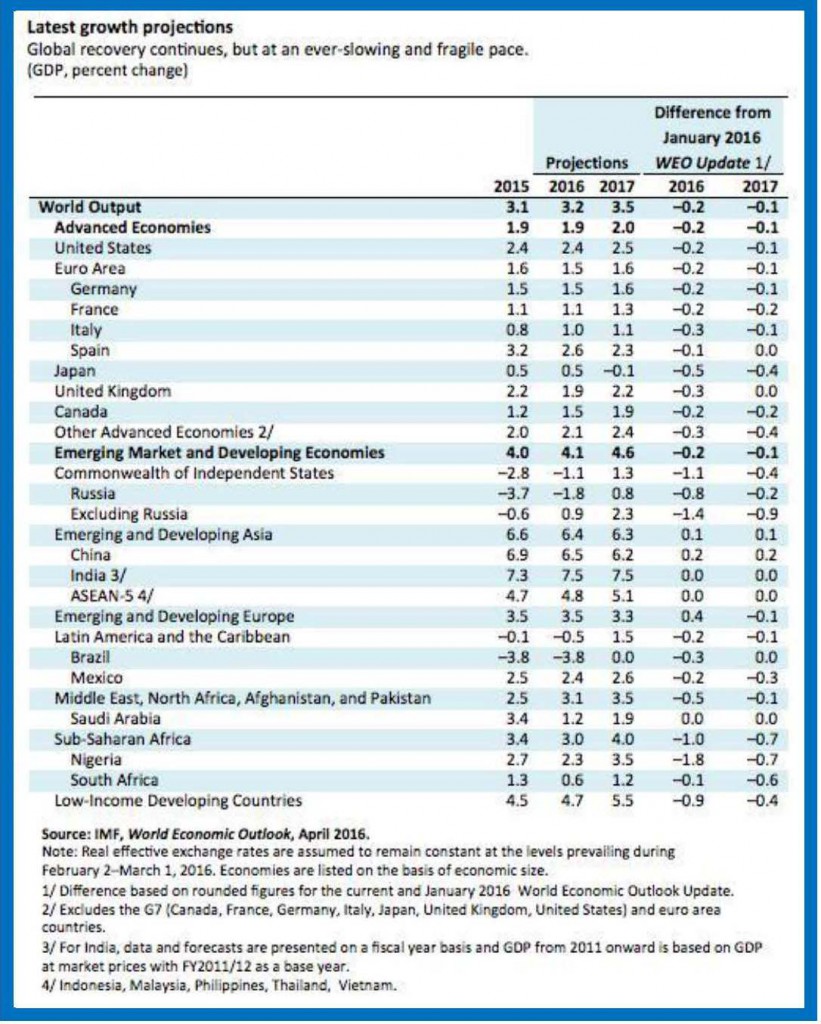

The new World Economic Outlook released today anticipates a slight acceleration in growth this year, from 3.1 to 3.2 percent, followed by 3.5 percent growth in 2017. Our projections, however, continue to be progressively less optimistic over time.

The downgraded forecasts reflect a broad-based slowdown across all countries. …

The central scenario that the World Economic Outlook projects, however, now looks less likely compared with possible less favorable outcomes. …

What risks concern us the most? Prominent among them are financial and non economic risks?

For the answer, see the post; forecasts are shown below:

More IMF stuff: http://www.telegraph.co.uk/business/2016/04/11/olivier-blanchard-eyes-ugly-end-game-for-japan-on-debt-spiral/

So, Japan is melting down because of debt and Obstfeld’s (I’ll call him the “economics king” for later) solution is governments should spend more (increase debt)? But, of course, he wants to have balanced budgets so that means tax a whole lot more (no impact on producers, eh?). “Balanced budget tax reforms can move fiscal policy in more growth-friendly directions, while also better supporting aggregate demand, labor force participation, and social cohesion.”

Who does he propose to tax more? Corporations? 1%-ers? The U.S. has stimulated and stimulated and expanded social program after social program… so why continued slow growth? Could it be that some spending simply yields… nothing? https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

Or could it be that because whole segments of the population have little interest in educating themselves and being productive, the effort to improve the total is like trying to roll a ball of hot tar uphill? Or maybe the economics king is just tone deaf: http://assets.amuniversal.com/257bc650d40e01334c4c005056a9545d

Bruce Hall

First, your FRED chart links to the total public debt. Did you know that this includes what most people would call “savings”? When the SS Trust Fund runs a surplus the Treasury issues special bonds. Much of the public debt is intra-governmental debt. Debt held by the public as a percent of GDP is a better number.

There is such a thing as a “balanced budget multiplier” (BBM). The BBM is when taxes go up to match higher spending, resulting in greater aggregate demand (assuming an output gap and an accommodative Fed) without increasing the deficit. I believe that’s what Obstfeld meant.

Japan is a peculiar case. Capacity utilization is fairly high and unemployment is quite low (~3.3%). The problem is deflation, which results in high real interest rates despite low nominal rates. Over the longer term Japan definitely has some supply side issues. The answer is not “business friendly” tax cuts for the wealthy. If Japan wants to increase potential GDP, then they might want to consider immigration. They also might want to devise ways to engage disaffected young males.

I think we can agree that some deficits are better than others. Fiscal deficits from tax cuts will stimulate demand, albeit not very effectively. And all you get is increased consumption. A better approach would be spending increases on infrastructure and higher education. Those things not only stimulate aggregate demand in the short run, but they push out potential GDP over the longer run. But judging by your comment it sounds like you’re finally on board with better and more effective deficit spending. Welcome aboard, Comrade Bruce. Now, if only we could get you to quit thinking of the poor as lazy….

2slug… this is better? https://research.stlouisfed.org/fred2/series/FYGFDPUN or this? https://research.stlouisfed.org/fred2/series/FYGFGDQ188S

Much of Japan’s debt is held by the public. Does that make Japan’s situation any better? And does that make the U.S. position any better?

Or is Blanchard just being an alarmist?

“Japan is heading for a full-blown solvency crisis as the country runs out of local investors and may ultimately be forced to inflate away its debt in a desperate end-game, one of the world’s most influential economists has warned.

Olivier Blanchard, former chief economist at the International Monetary Fund, said zero interest rates have disguised the underlying danger posed by Japan’s public debt, likely to reach 250pc of GDP this year and spiralling upwards on an unsustainable trajectory.”

You’re assuming government spends each dollar more efficiently than each individual, which hasn’t been the case in so many ways. Deficit spending was appropriate in the 1930s, because taxes were too low for tax cuts. Of course, some government spending is better than others.

There are many poor people, because they are lazy. They choose not to work, quit or don’t show up for work, don’t want to work full-time or overtime, etc.. And, there are many people with a decent work ethic, and little education, who end up with a decent income, along with benefits.

“If Japan wants to increase potential GDP, then they might want to consider immigration. ”

The goal is not higher GDP, but higher GDP/capita. Bringing in masses of uneducated poor people does not benefit the current citizens. Even if you open your borders and can some how vet quality immigrants, you lose your culture, and nothing is more important than your culture. Importing folks who don’t share Japan’s cultural values will not end well.

“A better approach would be spending increases on infrastructure and higher education. Those things not only stimulate aggregate demand in the short run, but they push out potential GDP over the longer run.”

This meme is so tired and absurd. Infrastructure spending only adds value if, you know, the infrastructure is actually needed. Bridges to nowhere etc add no value. In order for your proposition to work, you have to show that Japan has insufficient infrastructure to start. It’s certainly not the reason American is languishing, and I’d guess Japan’s is better than ours. And this laughable notion that moar “higher education” is always good is so played out. The millennials are facing the harsh reality now that no employer gives a rip if they have a gender studies degree. Higher education only adds value if it is in a specific area that employers demand.

“This meme is so tired and absurd. Infrastructure spending only adds value if, you know, the infrastructure is actually needed. Bridges to nowhere etc add no value.”

that may be true. but every large american city i have lived in contains inadequate transportation infrastructure. you either sit in rush hour traffic-an economical waste of resources-or roads do not provide direct connections to get you from point A to point B efficiently. therefore the meme is valid.

Baffling, the CBO analysis shows that, in real spending infrastructure funding has been somewhat higher as a percent of GDP and slightly lower using infrastructure specific price indexes than 2003, and quite a bit higher than the halcyon days of President Clinton (Bill, that is). https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/49910-Infrastructure.pdf (page 2)

Now we can always find more roads to build or bridges to replace. The question is whether that is or should be the highest priority of government spending. U.S. spending on the military has been declining as a percentage of GDP for at least 5 years. That has not been offset by a marginal increase in homeland security as a percentage of GDP (about 1/4%). So, security has not been the primary concern of this administration.

Healthcare reached 17% of GDP last year and is growing rapidly. One can argue the merits of this government spending both pro and con, but it is chewing up more and more of the total government and private spending. It is certainly an area to look at for waste and fraud, and greater efficacy and efficiency.

CBO projections show continued increases in mandatory spending as a percent of GDP, so I’m think that infrastructure spending is not going to get a big push… maybe an occasional “show horse” program. https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/49892/49892-breakout-Chapter3.pdf

Socialist countries have been great live experiments into high tax/high spend governments. Europe is often pointed to as proof of the superiority of this approach… Scandinavia in particular. But when you examine closely, you find that the wealth once accumulated in those countries in a freer capitalistic environment has been eroded by their fiscal and domestic policies… without having to worry about defense spending so much because of Uncle Sugar’s protection. Other countries such as Cuba and Venezuela have demonstrated that government micro-managing the economy is quite simply catastrophic.

So, perhaps the answer doesn’t lie in road or high-speed trains (a favorite of Governor Moonbeam), but in getting off the backs of entrepreneurs and letting the marketplace work.

http://assets.amuniversal.com/257bc650d40e01334c4c005056a9545d

Bruce Hall I don’t think you’re a stupid person, but I’ve been reading enough of your stuff to know that you just don’t have a head for macro. Some people do, some don’t. You don’t. So let’s address your points.

Public infrastructure spending should be higher today than it was under Bill Clinton! The opportunity cost of public infrastructure spending in the 1990s was much higher than it is today. You seem to think that public infrastructure spending should increase with the boom years and contract when the economy slows down. Your comment reminds me of my stupid GOP governor who said that the state “couldn’t afford” to do various projects because the economy was weak. Wrong! Wrong! Wrong! Apparently my idiot governor thinks it makes more sense to pursue infrastructure improvements when interest rates are higher and crowding out of real resources is a problem. I’m getting that same drift from your comment.

find that the wealth once accumulated in those countries in a freer capitalistic environment has been eroded by their fiscal and domestic policies

A perfect example of what I meant earlier when I pointed out that too many conservatives do not understand that GDP is a flow variable. Wealth is a stock variable. It’s not at all clear what it means to “erode” wealth by fiscal and domestic policies. Do you mean high inheritance taxes? Yes, those would erode wealth…and that’s a good thing.

As to getting off the backs of entrepreneurs and letting the marketplace work, the big problem is that the marketplace is guaranteed to fail in lots of areas like pollution control, zoning, traffic, public transportation, healthcare, water rights, etc. There may well be areas where the government should keeps its nose out, but on balance the bigger problem is that governments are letting entrepreneurs run wild in the very things that are least productive.

Oh…you don’t think defense spending should be declining as a percent of GDP???

2slug “Do you mean high inheritance taxes? Yes, those would erode wealth…and that’s a good thing.”

Well, see this is pretty much the crux of things, isn’t it. Your philosophy is that earning, saving, and bequeathing wealth is a bad thing because… you want it? Oh, you just want to “level the playing field”. You seem like a smart person. Were you willing to give up you As in your university classes so those getting Cs would be able to get Bs? No, of course that’s absurd. But on the face of it, it is neither my responsibility nor your responsibility to ensure that our wealth gets “fairly distributed”. Let someone else make their own wealth and give it to their family. Hell, that’s how this country got wealthy. Not some Venezuelan scheme.

With regard to spending, I merely pointed out that most of the government spending has been divvied up for the next decade, so don’t hold your breath about infrastructure. Besides, didn’t hundreds of billions just go for that? Or did it just go poof?

“Healthcare reached 17% of GDP last year and is growing rapidly. One can argue the merits of this government spending both pro and con, but it is chewing up more and more of the total government and private spending. It is certainly an area to look at for waste and fraud, and greater efficacy and efficiency.”

bruce, one area where government does spend alot is in healthcare-medicare specifically. one solution to decrease that spending is eliminate the vast majority of medicare-today. provide some basic services. but baby boomer needs such as knee and hip replacements? let retirees today buy a private insurance policy or pay for that service out of pocket. let’s not punt the football to the next generation. make those cuts today. this will decrease government spending, provide a tax cut to all workers, and “let the marketplace work” with private insurance immediately. are you willing to support this move today?

baffling, “let retirees today buy a private insurance policy or pay for that service out of pocket. let’s not punt the football to the next generation.”

Absolutely agree! Stop collecting taxes related to medicare and make seniors take responsibility for their own lives. But don’t stop there! Do the same for everyone. Now we are getting somewhere!

I never believed we could come to such an accord.

how do you think this will affect gdp? what percentage of seniors could afford to purchase insurance? would you enforce a pre-existing condition clause? what would be the monthly cost of such an insurance policy? let’s be sure we understand the cost/benefit prior to making such a change.

and we are interested in making the changes immediately, effective for everyone. obviously many seniors are going to be upset with the sudden loss of medicare today. what do you tell them? do you have any politicians lined up who would support this motion? who? enough to make a change?

Bruce Hall Yes, the debt held by the public is a better number…quite a bit better.

Japan’s current debt is the result of past fiscal decisions. Without those fiscal decisions of yesteryear it is a near certainty that Japan would be even worse off today. People might gripe about having to pay higher taxes to pay the interest on those bonds, but they shouldn’t forget that their incomes are higher today than they would have been without that deficit spending in years past.

PeakTrader You’re assuming that all saving is spent; i.e., you’re assuming away the problem, so naturally the answer sounds simple. Almost any government spending is more productive than no spending, and that’s what happens when S > I. If wages are downwardly rigid, then output will fall. And that lost output is lost forever because output is a flow variable, not a stock variable…a key point that many conservatives on this blog seem to forget.

I don’t think there are anymore poor lazy people today than there were 40 years ago or 140 years ago. This is just bad armchair sociology. Besides, when there’s an output gap a keener work ethic might help any particular individual, but in the aggregate it doesn’t increase employment or output. In fact, anything that pushes out the aggregate supply curve without a corresponding increase in aggregate demand only makes the output gap worse. Recessions are not about lazy workers; they are about weak aggregate demand. Lazy workers become a problem when the output gap is closed because those lazy workers represent forgone potential GDP. But when there’s a significant output gap laziness is probably a macroeconomic virtue.

Trump/Sanders Japan is an aging society. The Japanese can either invest in foreign companies and live off the returns from those overseas investments made possible by the labor of foreign workers, or they can import those workers and live off the income taxes generated by those new immigrants. That’s pretty much the stark choice facing the Japanese…unless you think 90 year olds should still be in the labor force.

Culture, schmulture. A nation of old folks supported by a shrinking number of workers as a percent of the total population won’t end well either. Do you think the culture of Japan’s aging retirees would be the same as the culture of Japan’s alienated and disgruntled workers who must support those retirees? Sorry, but culture is not static…and it shouldn’t be.

As to infrastructure spending, let me remind you that the bridge to nowhere was the pet project of a leading conservative Republican senator. I could also name some roads to nowhere in rural areas that are championed by conservative Republican senators. The obvious solution is to vote out idiot Republican senators from rural states. But infrastructure spending on aging sewer and water systems probably isn’t a waste. Infrastructure spending on the electrical grid probably isn’t a waste. Infrastructure spending on lock & dams probably isn’t a waste. Infrastructure spending on out-of-date port facilities isn’t a waste. I could go on.

As to the value of higher education, sometimes a broad liberal arts education is better than a narrow education. For example, during WWII it wasn’t just mathematicians who cracked the German codes; the government also hired literature majors because they tended to have minds that picked up on patterns and better understood linguistic structures. I doubt that many of those lit majors anticipated they’d be cracking German codes when they earned their sheepskins. You also don’t seem to understand that in the long run economic growth is almost entirely due to smarter and more imaginative workers. If you’ve ever read much growth theory then you would know that one of the “technology” metrics is years of education. A lot of the skills that come with higher education are generally applicable and not just job specific. For example, a lot of urban police departments could probably use an ethnic studies major more than they could yet another SWAT sharpshooter. In any event, when people like me talk about increasing investment in education, we usually mean increasing the number of students, increasing the number of instructors, and increasing the number of public colleges. The idea is to get more people through the college door. I am not a big supporter of policies that increase effective demand for education without also increasing the supply side. So bigger grants to med students is a bad idea if the AMA still keeps a lid on the number of med school graduates each year. The net effect of those kinds of policies is to make higher education even more unaffordable for lower income folks who won’t have fair access to those kinds of grants. An income effect on demand for college education that is not accompanied by a supply side shift is very bad public policy. That’s why Gov. Walker’s proposals are so bad. He effectively contracts the supply side of education.

You’re assuming too much saving or hoarding. Some saving is good for individuals and the economy.

There’s a difference between spending for more and squandering for less.

And, when you pay people not to work, they won’t work. Labor participation rates are much lower. Anyone who really wants a full-time job could get one, even in this anemic “recovery.”

I think, what we’ve seen is more people underproducing bringing down potential output through less actual output. So, higher full-time employment will raise incomes and aggregate demand, which will increase more than aggregate supply, since there’s an output gap with potential output limited by full employment.

That really doesn’t work. Capitalism is a debt system. Without the proper expansion debt, capitalism was dead in 1933. “boom phases” cannot last.

2slug “People might gripe about having to pay higher taxes to pay the interest on those bonds, but they shouldn’t forget that their incomes are higher today than they would have been without that deficit spending in years past.”

Ah, the old, “the government borrowed the money to make money for you, so you should be willing to pay it back” argument. I think not. You presume that incomes are higher without government creating huge debts that must be paid before we become like Japan which government made those same “income raising” decisions and now face… crap.

So the solution to the problem created by the government is more power and money to the government?

Obviously, should have stated: “You presume that incomes are higher with

outgovernment creating huge debts…”Just thought I’d pass along this tidbit from an old acquaintance of mine. Now about infrastructure and health care spending…

Some observations:

I just finished a month in Florida riding my bicycle, playing golf, visiting friends, and enjoying the wonderful weather, before driving home to Michigan.

Thoughts on Florida: There sure are a lot of old people there. It makes me feel old just being there. Of course I am old, but ….. I will say they are all friendly and polite. Why not, they are all retired and looking for something new and different. I did note the abundance of medical facilities with hearing, dermatology, ophthalmology and back pain clinics on every corner. Florida does cater to the retirees. Hey, that is me. There is an enormous amount of construction going on – houses, businesses, condos, high rises… There won’t be anyone left in Michigan if it keeps up.

Enroute home, up I-75, I could not believe the construction. About 2/3 of the Florida freeway was torn up all the way to Georgia. Then Georgia had plenty and approaching and leaving Atlanta there must have been 40-50 crews busy making the traveler wonder if it would ever end. It did not since Chattanooga is also big into bridges and new highways. Knoxville – huge construction. Lexington was the only big city that did not have big construction. Then Cincinnati, which of course really needed it, was completely jammed up. They made two lanes service three lanes. Hmm, trucks to the left, to the right, front and back – cars seem the exception. Scary driving. From Dayton to Detroit I am guessing ¾ was under construction.

Is it just me or has anyone ever driven through Atlanta when there was no construction? I have been through maybe 40 times and cannot remember a clear passage.

Oh well, it is good to be home and not worry about it until next year.

infrastructure is constantly aging-meaning it needs to be upgraded on a constant basis. on top of that, you need to add new infrastructure to address growing population and use. we are behind on addressing existing infrastructure, and sorely behind in the expansion of new infrastructure.

http://www.infrastructurereportcard.org/

in a growing economy, unless you are willing to build prematurely (and most people dislike the idea of building ahead of the curve), then one should expect constant construction to address current growing demand. it would be absurd to want a break in construction and be unwilling to build ahead of the curve, unless you are willing to accept a gap resulting in out dated infrastructure.

baffling, as I often tell my family, “Enough is too much.” Translation: you can never have enough and if you do it is excessive. We can never spend enough, but if we do it is likely too much. We can never regulate enough, but if we do it is likely too much. We can never have enough sunny, 75-degree days, but if we do it is likely too much; usw.