The experiment continues…

From CBS News today:

Brownback took office on a pledge to make Kansas friendlier to business and successfully sought to cut the top personal income tax rate by 29 percent and exempt more than 330,000 farmers and business owners from income taxes. The moves were popular in a Legislature where the GOP holds three-quarters of the seats.

The governor argued that Kansas had to attract more businesses after a “lost decade” in the early 2000s, when private sector employment declined more than 4 percent.

The predicted job growth from business expansions hasn’t happened, leaving the state persistently short of money. Since November, tax collections have fallen about $81 million, or 1.9 percent below the current forecast’s predictions.

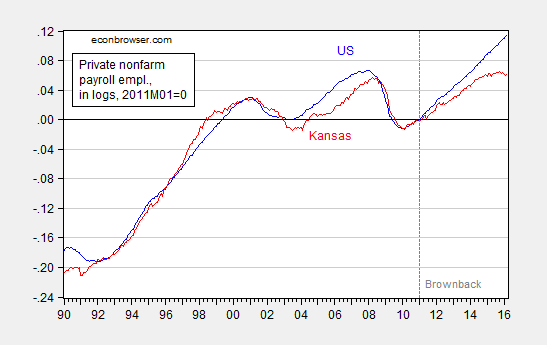

Not only is predicted job growth missing, currently employment is below prior peak. It’s hard to argue for long term diverging trends as the explanation, given the long run co-trending of national and Kansas employment. In that context, the recent (since 2011M01) dropoff is remarkable.

Figure 1: Private nonfarm payroll employment in Kansas (red), in US (blue), in logs normalized to 2011M01=0. Dashed line at 2011M01, Brownback term begins. Source: BLS, author’s calculations.

The article continues:

“We’re growing weary,” said Senate President Susan Wagle, a conservative Republican from Wichita. While GOP legislators still support low income taxes, “we’d prefer to see some real solutions coming from the governor’s office,” she said.

So even after two more ruinous years, the whistling continues, just with fewer die-hards.

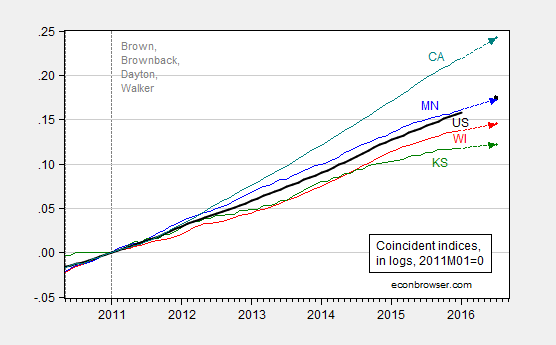

For further context, here’s a graph depicting economic performance of some ALEC-darlings (Wisconsin, Kansas ranked at 9 and 27 respectively) and ALEC betes noire (Minnesota, California ranked at 45 and 46).

Figure 2: Coincident indices for Minnesota (blue), Wisconsin (red), Kansas (green), California (teal) and US (black), and implied levels from leading indices, all normalized to 2011M01=0. Source: Philadelphia Fed, January 2016 releases, and author’s calculations.

This is dispositive. Just an absolute total failure of trickle-down supply-side econ. One issue I have is why Figure 2 does not have the same timeline as Figure 1. I know you have addressed this before, but it would be so much more convincing if the timeline was longer. Ayn Rand people always say the timeline is cherry picked…

Menzie:

A few things:

1. When will the right-leaning commentators run out of excuses and just admit things are going horribly?

2. How much, if any at all, of what you show is a bounce back from a bad low? (I feel like this has been asked before, so forgive me if I am one of many.)

3. For a state like Kansas, which isn’t growing quickly, isn’t set to grow quickly, and in the case of rural counties is losing population, any idea of how more immigration might help? I know there are some obvious political roadblocks to increasing immigration as well as some concerns about how the immigrants could adapt (e.g. their skill levels, etc.), but you have to think it’d possible be helpful to the state’s economy, even if it didn’t erase the problems Brownback, et al created.

One question- does it make sense to use non farm payroll data for states that are more heavily agricultural based? If the tax cuts were aimed (partially) at farmers as was implied, then should farm payrolls be a part of this.

As far as this comment is concerned-

“This is dispositive. Just an absolute total failure of trickle-down supply-side econ.”

What is mentioned is not dispositive without mention of spending cuts. If spending wasn’t cut you (at least in rational expectations models) don’t expect tax cuts to be permanent.

baconbacon: Agriculture value added accounted for 5.3% of state GDP in 2014. One could use civilian employment from the household survey, but sampling error is enormous at the state level.

I’m seem to recall a recent post where Illinois success was being touted. Now I know many things go into “success”, but shouldn’t one consideration be how people are voting with their feet?

http://www.chicagotribune.com/news/local/breaking/ct-chicago-population-record-loss-met-20160324-story.html

http://www.chicagotribune.com/news/opinion/editorials/ct-illinois-census-brookings-edit-0107-20150106-story.html

I pointed out in comments on other posts that Wisconsin is facing a demographic problem. So is Kansas and Illinois definitely is.

http://www.illinoispolicy.org/wp-content/uploads/2013/10/out-migration.png

These are long-term trends that can’t be bucked over the course of 3-5 years with favorable tax treatments. Jobs are not materializing because the basis for these states’ populations are slow-growth to no-growth sectors. You just can’t hire enough government employees or build enough roads to make up the difference.

We are not talking about not “bucking the trend” over a short period. We are talking about falling below their own trend line and the national trend after instituting a set of policies that were supposed to revive the economy and “beat” the national trend. If they were keeping up (but not beating) you could argue that it just takes longer time (although it would difficult to make up a mechanism by which the tax cuts would have an effect that was delayed by years).

Are we discuss Illinois now?

This analysis from the St. Louis fed is interesting as it compares Kansas under Republican Governor Sam Brownback and Missouri under Democratic Governor Jay Dixon. https://www.kansascityfed.org/en/publications/research/me/articles/12-11-2015/mwe-12-11-15-update

I’ll leave it to the Brownback beaters to tell me what Missouri is doing so very much better as they share many regional similarities. I can only guess it is the rapid growth of state government in Missouri that kept things humming.

Might I suggest a little tweak to your wonderful graph of performance in the States, which is already neatly labelled “Brown, Brownback, Dayton, Walker”?

You (or a graphic artist friend) could put a picture of each governor at the 2016 end of their respective lines. Such a great disparity in performance between business killing California and the economic miracles of Kansas and Wisconsin really deserves to have faces put on it.

It could even become a bumper sticker.

Since Brownback became Governor, there’s been a steep rise in Leisure and Hospitality.

http://data.bls.gov/timeseries/SMS20000007000000001?data_tool=XGtable

Baconbacon:

Yes, spending was cut. Kansas has a balanced budget amendment. Brownback met the shortfall with cuts. So, then even under your interpretation, this is dispositive.

Spending cuts and lower taxes lead to less growth.

Hogwash. Your statement is the one of an ideologue clueless about the precepts of basic economics, esp. as they apply to supply and demand.

Baconbacon said there needed to be spending cuts for this to be a valid critique of rational expectations etc. not just tax cuts. Read it above. So, I responded that there was also spending cuts and not just tax cuts in Kansas. How is that an ideological comment?

You just do not like the evidence and choose to attack me instead.

So you would have us believe that for states to increase employment they should raise their tax rates??

The short answer is yes!

Colorado should be included in your comparison charts as it is probably the most libertarian state in the U.S.

In 1994 we passed TABOR, or the Tax Payer Bill of Rights, which includes a state tax rate of 4.9 percent and makes it illegal for the government to spend more than a pre-set amount of money each year (formula based on population increases and inflation). For that revenue to increase, voters have to agree to it. And whether or not you agree with that policy, using Colorado as one of your comparison metrics would be illuminating for those trying to choose between being more liberal or more libertarian.

Your analysis is highly flawed.

http://www.farmerhayek.com/2015/06/krugman-is-wrong-on-kansas.html

Levi Russell: Thanks for leading me to waste 2 minutes I’ll never get back. Besides displaying an inability to spell my name, Farmer Hayek clearly hasn’t read my earlier pieces explaining (1) the choice of states, (2) the idea of fixed effects in unemployment rates, and (3) the various pieces using counterfactuals inferred from pre-shock historical correlations between the US and the respective states (I’ve done it for Wisconsin and for Kansas). But on (3), from his discussion, I’m not clear he’d understand the statistical analysis.

My assessment: National welfare might be higher if Farmer Hayek re-allocated his resources toward farming, and away from purported analysis.

I just love a good insult-laden comment. Carry on riding your high horse, believing that tax cuts hurt growth.

Levi Russell: If I do you the credit of correctly spelling your name, at least you can examine the various pieces that address your concerns before referring me to a piece that criticizes me for not doing things you want me to do, but weren’t aware I’ve done already. (By the way, the one link to a prior post contained references to more thorough statistical analyses — an academic would I think check through before condemning. Citations exist for a reason, don’t they?)

Yes, this would count as the failure to listen to the technocrats. You can get a kick from lowering taxes, but it’s not of infinite magnitude or immediacy.

Having said that, the unemployment rate in Kansas is 3.9%, 13th best in the nation. California has 5.4% unemployment, 34th in the nation.

If this true than Menzie is the ultimate propagandist. Menzie, what would Kansas unemployment be if the red line equaled the blue line in the top graph?

Does anyone know the specific piece or pieces of Kansas’s economy that is lagging?

I think the only thing that could help Kansas would be a Wizard of Oz tornado that would sweep a large group of citizens to that Socialist Hellhole of California.

Praise Brownback for doing the experiment in Kansas instead of California or in the Nation.

California is not socialist, because there are lots of super rich and rich people, who live really well. Obviously, Kansas needs a steady stream of super rich and rich people, like California, or at least attract top talent from everywhere else, to build more $1 million to $20 million houses.

I thought they were already fleeing those socialist hellholes of San Francisco and New York. I know I keep waiting for the price on that apartment on Central Park West, preferably in the San Remo, to drop as all the rich escape Pyongyang on the Hudson that DeBlasio is creating.

From what I can see at the BLS, Wichita and Topeka appear to be the employment laggards. Cursory searches lead to articles that suggest long-term weaknesses that are unrelated to the current Gov.

http://www.bls.gov/eag/eag.ks.htm

http://www.kansas.com/news/business/article36236142.html

Mike, stop trying to dig in and find actual causal factors. Just compare 4 unlike states, declare victory, and move on! /sarc

Definitely very different states. When we used to cross the border from Wisconsin to Minnesota it was like leaving a jungle forest and entering the desert. Two completely different states. Why, the people didn’t even talk the same language.

No, you’re right, Steve. Every state within a geographical area is exactly the same. No differences in industry structures, populations, etc. Nah… the entire country is homogeneously distributed within each state’s borders.

Looks like the supply-siders, trickle-downers and repubs are going to have to come up with new reasons for tax cuts for their wealthy financiers. I’m sure they will.

GDP is a fifth grade math problem, and 70% is consumption. Taking money from consumer class individuals to hand it over to investor class people has a predictable negative effect on the economy. Only if the economy has a huge unfulfilled need for investment capital, will there be a chance of making up for the loss of consumption by increasing the amount of investment. Does anybody really want to argue that the current 0% Fed rate QE3 economy is restrained by a lack of investment capital? The evidence suggests that corporations are so absurdly over-capitalized that they have to use their money buying back stocks for a lack of productive investment opportunities.

Republicans know this which is why, when there is a recession, Republican Presidents send checks to people in order to get them to spend us out of a recession. They wouldn’t let Obama do that, though, because they wanted him to fail.

as a liberal, i yield to no one in my dislike of ALEC and it s policies

however, looking at the graphs, esp the first one, i find it hard to convince myself that the differences are due to tax policy and not random fluctuations of some sort..

the probabilty problem here is that highly selected data sets (< 50 states) are being used; that really skews the math on statistical sig

ezra abrams: see this post for a pooled time series cross-section analysis.

Kansas slashes projected tax revenues by $228.6 million over the next 16 months: http://www2.ljworld.com/news/2016/apr/20/new-kansas-revenue-forecast-expected-spur-budget-c/

Found this interesting link over at Thoma’s place: http://www.middleclasspoliticaleconomist.com/2016/04/breakthrough-in-kansas-missouri-border.html

Maybe Menzie will find it interesting too.

From 5-years ago:

Kansas’ overall population grew by 6 percent during the last decade, up about 165,000 from 2.69 million in 2000. Most of that increase occurred in Johnson County, counties in the Wichita area and counties around Fort Riley and Kansas State University.

“Despite this growth, I would be cautious to say that there’s no reason to worry,” Kulcsar said. “The population continues to age drastically, and this will fundamentally change Kansas.”

The state’s median age will continue to rise, he said, and the aging population will rely on more public services and contribute fewer tax dollars.

https://www.k-state.edu/media/newsreleases/mar11/census30911.html

As with Wisconsin and many other states: demographics is destiny.

As so many of the above comments prove, we can argue statistics forever. Those of us who live here and see the destruction of our state every day know the truth. Our state is in deep trouble. We see with our own eyes the disastrous effects of the Brownback tax cuts. We must repeal those tax cuts immediately. That repeal won’t fix everything by a long shot. Thoughtful people know that. However, the repeal is a start. It gives us breathing time. I am so sick of ideologues on both side who only want to win. My husband and I are both retired college professors who have lived in Kansas and loved it for 42 years. I raised my children here, and they have moved back. One of my daughters-in-law is an award winning public school teacher. Another son and his wife hold high level corporate jobs. My children are successful and contribute to this state. We love Kansas, or at least we did. The leadership is now so cowardly and polarized that honest change seems hopeless; no one is working together with others. Most of all, no one is admitting mistakes and willing to try something new. I can’t tell you how many outstanding faculty at Kansas State University now want to leave. I hear that at every gathering I attend, and I attend many. I now want my family to leave as well.

If a state is already business-friendly, e.g. low taxes, small government, low cost of living, etc., making it a little more business-friendly may have little effect to attract or start-up businesses. Also, Kansas is in the boondocks, far away from megatropolises, which tend to generate business activity.

When you look at these charts, pre and post recession, it’s hard to find a lot wrong in Kansas. http://data.bls.gov/timeseries/LASST200000000000006?data_tool=XGtable Obviously, the labor force is down a bit, but that’s part of the long term trend of out migration and aging population in Kansas. See my comment above for the link.

Even the number of government employees, although down in the past few years from a spike in 2010, is about pre-recession levels. http://data.bls.gov/timeseries/SMS20000009000000001?data_tool=XGtable

So, the real issue is balancing revenue and spending. It looks as if some restoration of taxes is in order, but not so much as to swing it too far the other way. Brownback’s problem stemmed from taking a cleaver to taxes rather than a pruning knife. It was just as disruptive as massive tax increases would have been (note Bernie fans). Significant and abrupt systemic changes tend to be disruptive. In this case, the disruption was in the ability of Kansas’ government to deliver state services. The correct approach would have been to trim government expenses first and then, if/when a surplus occurs, trim spending or address prior needs.

It’s a sequence thing: jump then look is generally not as efficacious as look then jump.

Bruce Hall: I have a feeling we have had this discussion regarding the inaccuracy of the state-level household series. Beware focus on recent trends; the series is subject to big revisions.

Actually, I was looking at the series as an indicator of what has happened over the past decade. If you are saying that the entire series is nonsense, then I’ll accept the fact that it’s just another example of government waste. If you are saying that just the last couple of quarters are subject to some revision, then I don’t have a big problem looking at the overall pattern. Samples are always prone to some error and adjustments.

My point was that with the exception of the government budget problem (which is a significant problem), Kansas employment doesn’t look too bad. The loss of government jobs hasn’t hurt the overall employment look, but this tax cut mandate was handled in typical government mandate fashion… with a sledgehammer instead of a carving knife.

“When will the right-leaning commentators run out of excuses and just admit things are going horribly?”

Judging by the deluge of cranks who violate the laws of arithmetic in a frantically failed effort to make Kansas seem like [pick one: a magnificent monument to libertarian-Austrian austerity economics; a peculiar example of the Great Recession that somehow hasn’t worked in Kansas the same way it seems to work everywhere else: a marvelous proof that however bad things are in Kansas, they would have been worse if taxes on the rich were higher], not any time soon.

Reminiscent of the spectacle of astrologers trying to explain why their predictions actually work, the Tojo government on why they were actually winning the war circa 1945, the Bush maladministration on why the New Orleans flood was handled well…