New industrial output numbers, including for manufacturing, confirm a slowdown in at least part of the tradables sector.

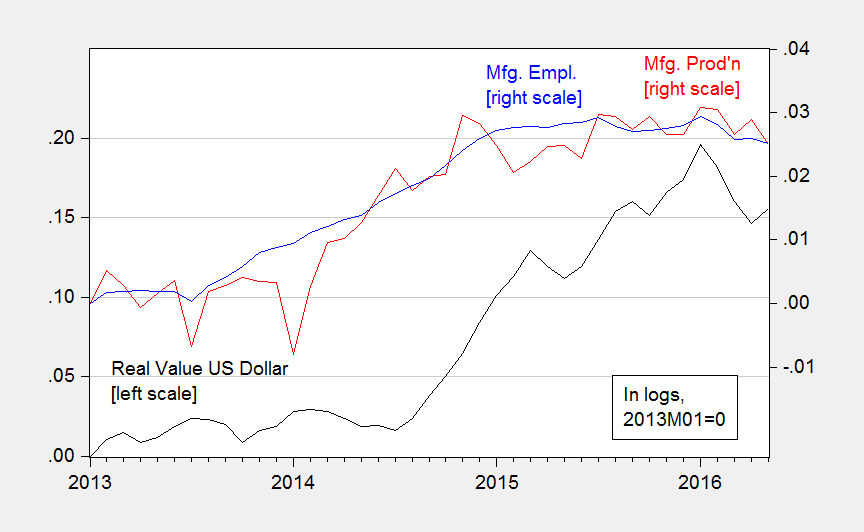

Figure 1: Real value of the US dollar against broad basket (black, left scale), manufacturing production (red, right scale), manufacturing employment (blue, right scale), all in logs, 2013M01=0. Source: Federal Reserve Board, BLS, and author’s calculations.

Both production and employment now on a slight downturn, despite recent dollar depreciation. The dollar is 14% higher in log terms relative to mid-2014.

Ending QE and reducing the deficit 75% from FY2009 was pure genius!

Industrial production and business investment are both falling just as they did before and during the last 5 recessions.

https://research.stlouisfed.org/fred2/series/INDPRO

https://research.stlouisfed.org/fred2/series/W790RC1Q027SBEA

Can’t anyone play this game?

Sorry, but this was totally utility driven. You get rid of utilities, industrial production has been running at a constant rate since 2009. I ignore this index anyways as the government completely ruined it in the 90’s. I think you can see how they adjusted the long term trend.

The Rage: The plotted series is for manufacturing.

Is still includes utlities in that manufacturing, distorting the graph. US manufacturing is irrelevant anyways and real growth in the sector has slowed since the 50’s. The dollars impact on that is pretty meh.

The Rage: I do not understand. Straight from the Fed:

The exact breakdown is here:

http://www.federalreserve.gov/releases/g17/SandDesc/table1.02.htm

I do not see utilities in the manufacturing index.

Professor Chinn,

Is there perchance a cointegration model between PAYEMS and INDPRO that is useful?

I am sorry if it is obvious, but shouldn’t we expect manufacturing sales and perhaps employment to have decreased following the rise in real value of USD ? The fact that they trend up together goes against my intuition but some explanation would be great. Analysing macro trends tends to leave me with more questions than answers or insights… please help