UK PMI collapses. Term spread moves toward inversion.

From yesterday’s FT:

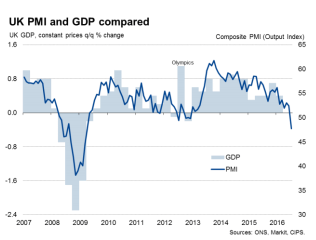

A special edition of the purchasing managers’ index (PMI) – a well-regarded survey of activity produced by research group Markit – has been published to provide a picture of how the UK economy has fared after the referendum. The picture is not pretty.

The PMI survey for Britain’s powerhouse services sector – which accounts for nearly 80 per cent of the economy – has dropped to a seven year low of 47.4 for July from 52.3 at the June survey. Any reading below 50 indicates contraction. The outcome was far lower than economists’ forecast of a reading of 48.8.

Here’s the relevant graph.

Source: “UK economy suffered ‘dramatic deterioration’ after Brexit vote – Markit,” FT, 22 July 2016.

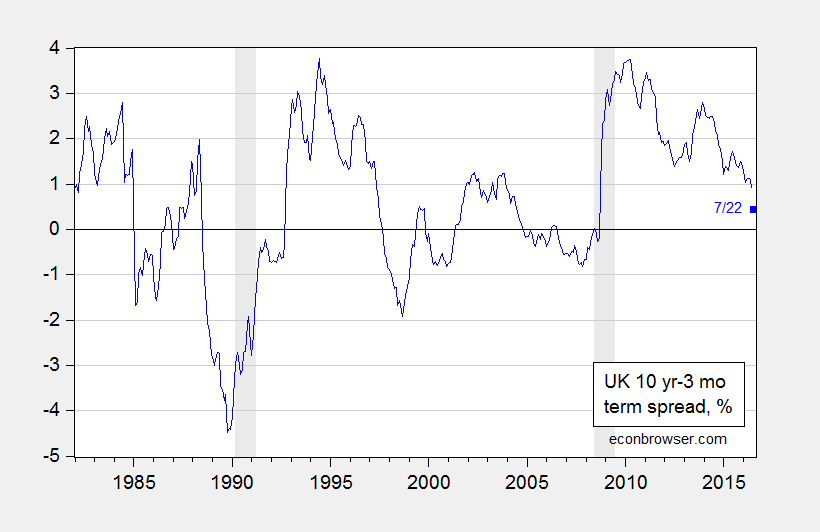

The yield curve has not yet inverted.

Figure 1: Ten year minus three month UK Treasury spread. July observation for 7/22. UK recession dates shaded gray. Source: BoE, Economist, Wikipedia, accessed 7/23.

Note that, as discussed in this post, most of the flattening of the yield curve has been due to a falling long yield, rather than a rising short rate.

While the yield curve does not appear to be a reliable indicator of recessions in the UK (as defined by ECRI), there is a statistically significant correlation between yield curve and (real time measures of) GDP growth over the subsequent 4 quarters (see Chinn and Kucko, 2015).

Δyt+4 = 1.43 + 0.47spreadt + ut+4

Adj-R2 = 0.14, N = 104, 1987Q3-2013Q2. bold denotes significant at the 5% msl, using HAC robust standard errors.

A drop in the spread of about 0.5 (that’s the drop in the ten year since the Brexit vote) implies about a 0.25 deceleration in GDP growth.

>>A drop in the spread of about 0.5 (that’s the drop in the ten year since the Brexit vote)

>> implies about a 0.25 deceleration in GDP growth.

Assuming the standard error of the spread parameter is .22, then, from the perspective of a confidence interval estimate, the drop in the spread by .5 can result in anywhere from .015 to to about .46 deceleration in GDP growth. In other words, deceleration can be all over the place.

SMG: Yes, that is correct.

What ought this to imply for monetary policy?

the PMI index is falling from end 2015: the same happen in others EU country: maybe there are other reasons, and Brexit is only a shock that intensified the resolult? Italy or Germany as an example have the same trend to Juin http://www.tradingeconomics.com/italy/services-pmi

Yield curve has been on a slide since 2010. Nothing to do with Brexit.

Check out global yield curve, looks similar to UK in that it has been on the slide for years as well.

The big question is why are you linking something that is, at best, only poorly linked to the EU referendum to Brexit?

John: See this post. The UK yield curve has flattened the most since the vote, among advanced economies I surveyed. I believe that outcome is suggestive.

The assertion that a dataset proves “suggestive” of some proposed cause rather than correlated or directly causally related seems like a classic case of academic econ weasel-wording.

What we’d like to do is disentangle correlations twixt the flattening of the UK yield curve as Brexit specifically. This seems problematic, inasmuch as the misguided austerity policies since 2010 can’t be obviously removed from the picture. And the austerity policies, frankly, seem much more likely to be directly causally related to the flattening of the UK yield curve than Brexit.

Menzie Chinn suggests that sharp changes in the 2nd derivative of the UK yield curve may be causally related to Brexit. A change in the 2nd derivative is the third derivative. At this point it starts to look like we’ve getting into perilously abstract territory. What’s the history of the derivative of the UK yield curve? How frequent are changes in the 2nd derivative of the magnitude we see after Brexit? What’s the mode and the mean of the absolute magnitude of changes in the rate at which the UK yield has flattened since 2010? Has anyone looked at the underlying statistical distribution of changes in the UK yield curve over the last 10 years? Does it look like a Gaussian distribution, Poisson, Weibull, or what? In that event, how unusual would a change in the UK yield curve of the kind we’ve seen since Brexit be, simply on the basis of random chance? Random matrix theory and Ramsey theory can give us some hard answers there. Has anyone bothered to do that analysis? Has anyone even looked at a Student T-distribution or a chi squared test of the variance in the change in the UK yield distribution over the past 10 years?

Menzie Chinn may well reply that the sample size since 2009 of changes of the UK yield curve is too small to support a chi square test. If so, permit me to suggest that the sample is also too small to support the causal hypothesis Chinn proposes wrt Brexit.

Standard cautionary tale about correlation:

http://www.tylervigen.com/spurious-correlations

In a larger sense, though, the whole narrative Chinn proposes doesn’t parse. I’m not getting the overall logic here.

The big narrative pushed by academic economists and elite pols runs like so: a couple of bad actors Johnson and Farage pushed a referendum that wound up blowing up the EU. If it hadn’t been for these two foolish ignorant pols, everything would’ve been fine in the EU.

This seems about as likely as the claim that a couple of bad actors Madison and Jefferson pushed a document that wound up blowing up the relationship of the U.S. as a colony of Britain. If it hadn’t been for those foolish ignorant pols in Philadelphia in 1776, everything would’ve been fine in the Britain-America relationship in the 18th century.

Does this seem likely? We know there was substantial popular support in the U.S. for independence from Britain, just as we now know there was substantial popular support in Britain for independence from the EU. If one group of politicians didn’t bring that issue up, isn’t it likely that another group would? And probably sooner rather than later?

If Farage and Johnson hadn’t pushed the referendum, does Chinn think the problem with lack of accountability and loss of sovereignity and Brussels eurocrats spewing out reams of preposterous picayune regulations that affected people in Britain without their having any say in the matter would have gone away?

Does Chinn and the other elite economists and pols really mean us to believe that minor tweaks and tinkering at the edges of the EU would have fixed this problem? Isn’t that like saying that some minor tweaks and tinkering at the edges of the laws governing how the U.S. stayed a colony of Britain would have prevented America from declaring independence at some point down the line?

That doesn’t sound like a credible narrative. I’m not buying the logic here. There were huge serious underlying problems with a foreign power trying to rule America from 3000 miles away, and no amount of minor rule changes was going to fix that underlying problem and solve the underlying issues of lack of representation and loss of sovreignity. Same seems to apply for Britain or Greece or Portugal and the EU. Blaming a couple of hapless pols for the clearly grossly unworkable design of the EU and the unaceptable lack of representation and loss of sovreignity and intentional lack of EU central bank and lack of exchange-rate-adjusting mechanism in a pan-EU Euro monetary system seems preposterous.

I’d also like to know Chinn’s suggested solution here. Is he really saying that the big problem was asking a population whether they want to be part of a social/economic bloc before imposing it on them? Would the solution be to avoid referenda in future? We have a word for that kind of policy, but it’s not “democracy.”

The big argument by economists against adhering to the results of the Brexit referendum seems to boil down to “it will hurt GDP growth.” This offers a pecular example of economists’ moral & social blind spot. Lots of policies hurt GDP growth. Legalizing slavery would certainly boost GDP growth. Lots of new valuable commodities could be bought and sold. So why not legalize slavery? Legalizing parents selling the children as sex slaves, or legalizing the open sale of narcotics to anyone including minors, would also boost GDP growth. Can economists grasp that there might exist some reasons outside the purely economic sphere why Western societies avoid legalizing such practices and choose lower GDP grwoth instead? If so, might it occur to economists that there also might exist some reasons outside the purely economic sphere that seem to the people of Britain to justify lowering their GDP growth by leaving the EU?

This leaves aside entirely the important point that since 2009 the top 1% has captured ~90% + of the gains from GDP growth anyway, so why should the average person in Britain care at all about whether GDP growth goes up or down?

If Chinn’s response is that increased GDP growth won’t help the British middle class but declining GDP growth will hurt them, that’s more properly a political issue of redistribution and progressive taxation than an issue of whether to stay in the EU, isn’t it? If the British middle class has gotten mousetrapped into a situation where they never gain economically from the EU but can only be harmed by leaving, that seems like a much bigger problem than Farage or Johnson or the referendum.

Wow, awesome comment.

mclaren: I do not understand. The slope of the yield curve is the derivative of the interest rate with respect to maturity. I look at the derivative of the slope with respect to time. So it’s the first derivative of something. And then I compare these changes across countries. So that’s a cross derivative, if you want. So I think you are, quite literally, babbling about third derivatives.

(Most people would look at what I did, and call it a kind of diffs-in-diffs calculation.)