But still looks darned high. Wonder what it is in the UK…

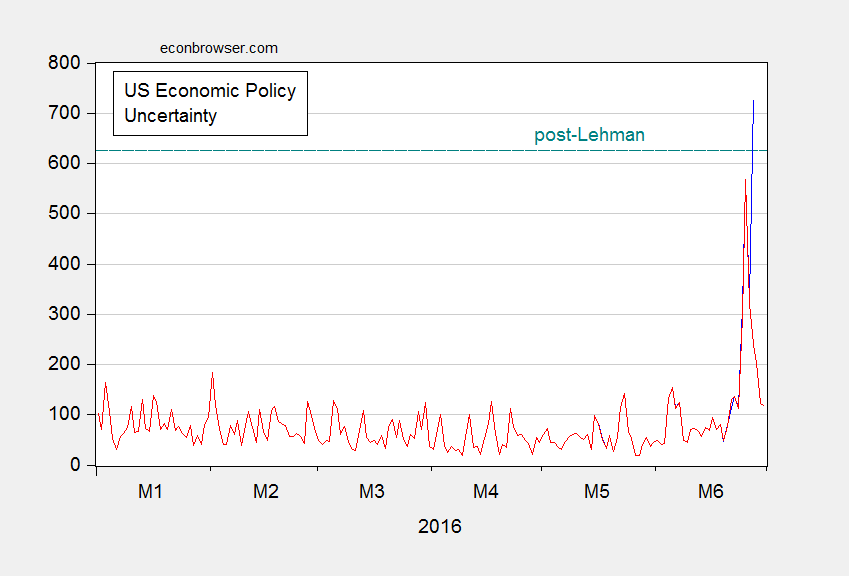

As reader Neil points out, the big spike in policy uncertainty was revised down. But still, uncertainty on 6/25 was still remarkably high, at 564.

Figure 1: Daily economic policy uncertainty index, accessed 6/27 (blue), accessed 7/1 (red). Horizontal teal dashed line denotes maximum value post-Lehman. Source: Baker, Bloom and Davis, via Economic Policy Uncertainty accessed 6/27 and 7/1.

As Nick Bloom notes in a comment on the previous post on policy uncertainty post-Brexit:

It is also hard to compare Lehmans to Brexit and say which is worse – Lehmans was truly terrible as a financial shock but potentially narrower in scope, while Brexit is less damaging on impact but may be worse long-run if global trade and pro-growth centrist policies in Europe unravel. Ever since WWII these policies have helped promote European growth, and in a post-EU world Southern Europe could swing wildly to the left and Northern Europe become more insular.

And yet, there’s uncertainty how the U.K. will exit the E.U., along with the fate of the E.U. itself.

the future is always uncertain

Globalization in the U.S. reduced prices, raised profits, and freed-up limited resources for emerging industries in exchange for offshoring industries and jobs. However, we have a capital glut and a jobs deficit, or too many idle resources.

I think, a stronger expansion, employing more capital and labor, is being held back by excessive regulation and litigation, high taxes, and a low minimum wage (stronger growth will raise tax revenue). International trade, for example, is not the problem.

Immigration has become a problem, because anemic growth and offshoring restricted the supply of jobs. In many industries, immigrants compete with the domestic labor force for jobs and depress wages. Consequently, many domestic workers lost better jobs and accepted worse jobs or dropped-out of the workforce. So, it’s important to control immigration, to fill industries that have labor shortages and drain or reduce labor surpluses in other industries.

“Globalization in the U.S. reduced prices, raised profits, and freed-up limited resources for emerging industries in exchange for offshoring industries and jobs. However, we have a capital glut and a jobs deficit, or too many idle resources.”

but you do not think a stronger expansion, employing more capital and labor, is being held back by offshoring industries and jobs, by a capital glut and a jobs deficit, and by too many idle resources?

You could have Americans dig holes and fill them up again or exchange valuable goods instead of worth less paper for valuable goods in the global economy to create jobs and raise GDP, but it’s completely unnecessary. Thanks to globalization, we have more capital and labor to produce valuable goods for Americans. We just need to create economic conditions to employ more capital and labor.

you need to create incentives which enhance jobs in the us. imports improve the standard of living only if locals can actually afford to purchase those items. if they are losing domestic jobs, they cannot afford to make those purchases. this is how the middle class in america has been hollowed out. as we have seen in the past few decades, record corporate profits do not necessarily trickle down into improved standards of living for a broad swath of americans. krugman has argues correctly, that globalization can be good, but part of the “profit” from globalization must return to the domestic market in ways that help grow local jobs and those affected by globalization. cash stranded overseas is an example of the failure of companies to understand their responsibilities to the domestic economy when given the opportunity of globalization.

Your statement is full of false assumptions. Globalization created millions of high-paying U.S. jobs, while immigration created millions of low-paying U.S. jobs. The middle class has not been “hollowed out.” You’ve benefitted from profit maximization in the form of lower borrowing costs, higher 401(k)s, more output utilizing fewer inputs through efficiencies in production and greater competition, which lower prices and free-up resources for the economy to expand, etc.. You can thank firms later.

peak, i grew up in the rust belt, right in the middle of steel and auto country. i lived in those “false assumptions” you claim. i have been fortunate enough to hold a well paying white collar job my entire life. i had many uncles working in the steel mills and auto plants, blue collar middle class. they have not fared so well with the growth of globalization. the middle class was most definitely hollowed out in my hometown. if firms who outsourced were required to recirculate some of that profit back into the local economies which were decimated by the outsourcing, the state could have saved a great deal in unemployment benefits and the local economies would have muddled forward. a similar argument can be said for the likes of walmart. when a firm begins to move its profits outside of the local economy, then the local economy suffers. the problem is not globalization or walmart itself, i would agree with your arguments on how they have played an important role in raising living standards. it is the ideological application of profit motive which creates the damage. when too much money is removed from a local economy, in the name of profit, bad things happen to that local economy.

Baffling, you may be surprised to know U.S. manufacturing real output doubled from 1982 to 2007. The U.S. economy is most dynamic, which is good. Otherwise, most of us would still be farmers. Money is removed from a local economy, because of progress, not because of profit. You’re the one wanting to create an “ideological application” of profit to create damage. Wasting money to slow the inevitable and reducing the rewards of risks erode capital. Your uncles should be thankful they had good jobs for so long in a closed economy, while Europe and Asia were rebuilding after WWII and weren’t very competitive till the 1970s. It’s time to move on.

“Baffling, you may be surprised to know U.S. manufacturing real output doubled from 1982 to 2007.”

and the us gdp grew even faster. so manufacturing did not keep up, it fell behind. but in your mind everything is hunky dory.

“It’s time to move on.”

i would imagine an ex-banker who contributed to the latest financial crisis would take such an outlook. apparently when it comes to profits, there is no moral or social responsibilities. win at all costs. it is easy to cast ruin on communities which exist a thousand miles from your corporate office.

Real manufacturing output grew three times faster than population growth from 1982 to 2007.

It’s ridiculous to blame the entire financial industry for making rational decisions in response to government policies.

High income people not only work to produce more value for society, they pay a lot more in taxes and give money to charities.

I guess, you believe they don’t do enough. Who’s stopping you from mortgaging your house, starting a business, and hiring people? Maybe, you’re waiting for someone else to do it.

“It’s ridiculous to blame the entire financial industry for making rational decisions in response to government policies.”

it is absurd to even claim the financial industry made rational decisions leading up to the financial crisis. only an ex-banker who contributed to the financial crisis and wound up losing his job would take such a perspective. you are in denial of the causes of the financial crisis.