Brad DeLong reminds me of how badly Kansas is doing, when viewed from a longer perspective.

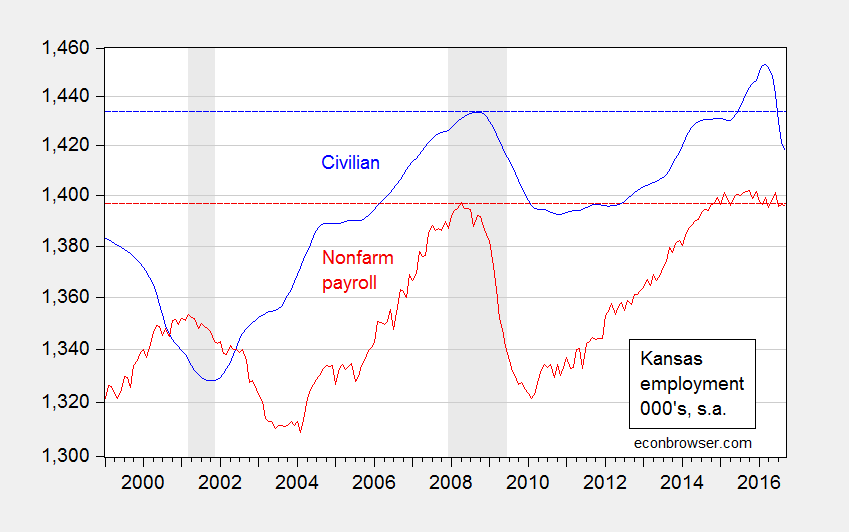

Figure 1 shows series from both the household and establishment series.

Figure 1: Kansas civilian employment (blue), and nonfarm payroll employment (red), in 000’s, seasonally adjusted. NBER Defined recession dates shaded gray. Source: BLS and NBER.

Note that the establishment series is now below not only its recent peak, but also the peak recorded in the last recession – albeit just barely (the twelve month change is not statistically significantly negative). The contrast with national performance is shown in this post. The household series — which encompasses farm employment — is also below the peak recorded in the last national recession as defined by the NBER. Keeping in mind that in 2015, the population of Kansas was about 3.7% higher than it was in 2008, this is truly remarkable accomplishment, which merits greater attention.

In February 2010, Robert Barro correctly predicted the GDP growth path based on government spending (in the stimulus plan) and tax revenue. He estimated the spending multiplier is less than half as much than the tax multiplier. So, the increase in government spending (in itself) would have a modest effect on boosting GDP the first two years, but the higher tax revenue the subsequent two years would slow GDP growth substantially. His prediction generally came true.

He concluded: My research shows an extra $600 billion of public spending at the cost of $900 billion in private expenditure.

Peak Trader: I don’t know how you can conclude Barro correctly predicted the path of GDP. He didn’t provide a counterfactual, so how do you know his GDP figures expressed relative to baseline were or were not correct.

If you want to say you prefer his multiplier estimates (which I think are out of line with consensus, assuming accommodating monetary policy), that’s fine. Just remember — if you conclude the multiplier is less than one using a sample that encompasses WWII — well then you’re almost assuredly going to get the conclusion that it doesn’t make sense to undertake a stimulus package.