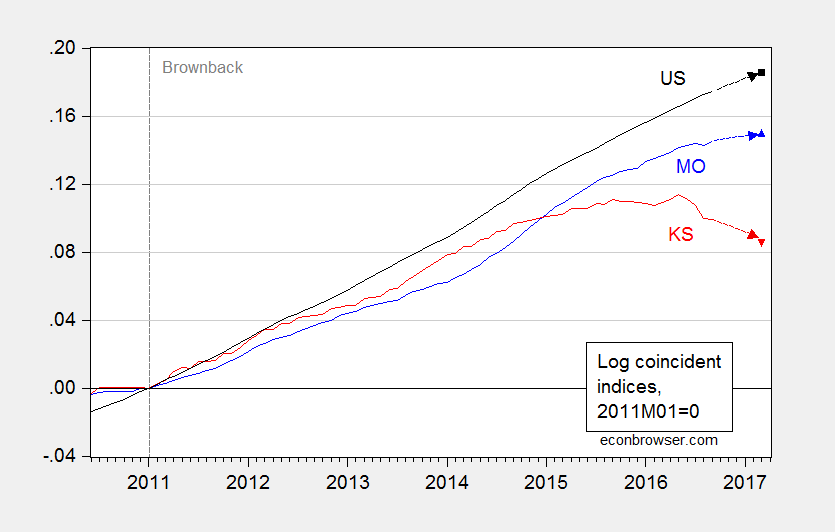

Figure 1: Log coincident index for Missouri (blue), Kansas (red), and US (black), all 2011M01=0. March 2017 observation implied from leading indices. Source: Philadelphia Fed and author’s calculations.

Update: More on Governor Brownback’s information program, here.

America can have a much higher labor force participation rate and a much lower unemployment rate?

Taxes can be too progressive and spending can be squandering.

What about all the regressive regulations low income Americans and smaller businesses pay for, one way or another, and make us less competitive in the global economy?

Here’s a question: why have corporations been hoarding their cash over the past year or so. If Federal policies of taxing spending are so great, why isn’t the private sector buying into that? Wouldn’t corporate spending of that cash be stimulative? Why haven’t government policies incentivized private spending?

http://www.prnewswire.com/news-releases/study-us-firms-accelerate-cash-hoarding-in-3q16-likely-due-to-geopolitical-uncertainty-300353788.html

How long can U.S. debt growth accelerate before it becomes an anchor rather than a stimulus?

https://www.thebalance.com/national-debt-by-year-compared-to-gdp-and-major-events-3306287

http://www.bloomberg.com/news/articles/2016-10-05/a-record-152-trillion-in-global-debt-unnerves-imf-officials

I know this goes a bit beyond Kansas, but since you are extrapolating….

not taxing spending, but tax and spending… obviously.

Here’s a question: why have corporations been hoarding their cash over the past year or so

Here’s an answer: something called secular stagnation. Private sector aggregate demand is chronically weak and there is a glut of global savings.

How long can U.S. debt growth accelerate before it becomes an anchor rather than a stimulus?

Wrong question. You should worry about interest payments as a percent of GDP. And those are not accelerating. In fact, they’ve been declining. But if you want to watch them accelerate, then vote for Trump. He’ll give you the big structural deficits and high interest rates you apparently want.

The IMF is worried about global debt, but not for the reasons you seem to believe. The IMF is worried about growing debt (largely in Europe) coupled with fiscal austerity and a tight ECB policy. That’s a recipe for high real interest rates with slow growth. And that is unsustainable. The researchers at the IMF have already made their mea culpa for recommending austerity (10 Hail Mary’s and 10 Our Father’s) and now agree that what’s needed is greater fiscal stimulus alongside an accommodative central bank.

most likely they are hoarding their cash for 2 reasons

1). there isnt sufficient demand to make them need to increase production, no increase in demand, no need for more production

2). they are still recovering from the great recession / depression

now as to why there isnt an increase in demand?

partly is consumers no buying because they are still working their way out of debt, partly its lack of jobs, partly its low wage growth (and thats no new, it just got papered over by debt). they also have no interest in getting back into debt. so we basically end up with less demand from the largest generator of demand. and they wont come back soon..

2) is obvious, business got burned, and has no confidence that we wont go back to where we were. which they partially caused (or at least wall street did it)

KS and MO colors wrong?

Hugh Loebner: Legend is wrong – fixed now.

Can you chart the level of education & common sense for the KS population compared to the US since they elected Brownback twice?

Is it the water?

Brownback won in 2014 with just 49.8% of the vote.

Trump is currently polling in the low to mid-40s nationwide.

I.e., even the antiChrist running on the GOP ticket is likely to have a floor around 40% nationally – so Kansas doesn’t really stand out in that respect.