The yuan is sliding against the dollar. What about against other currencies?

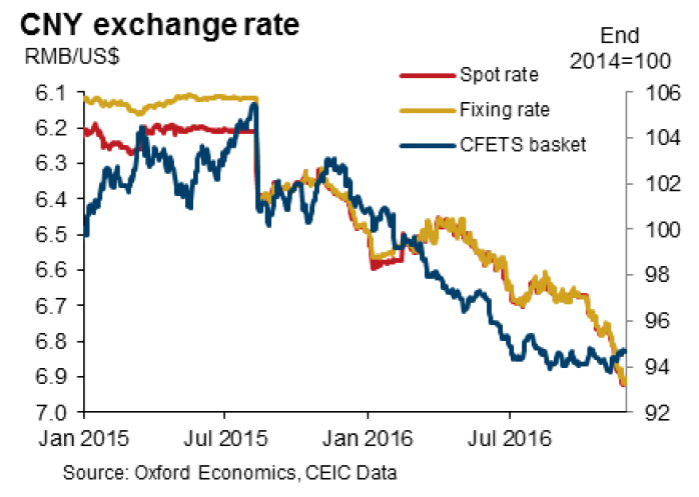

This figure, drawn from Louis Kuijs at Oxford Economics (not online), illustrates the decline in nominal terms.

Source: Louis Kuijs, “Any further CNY slide will be modest,” Research Briefing/China (Oxford Economics: November 28, 2016). Down

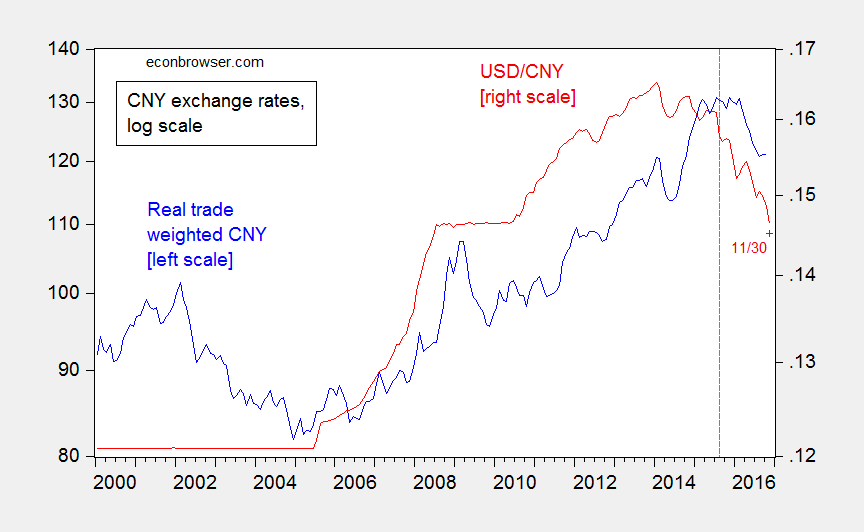

The figure shows that against the CFETS basket established last year, the yuan has also fallen. Earlier views that Chinese policymakers would maintain rough stability in this measure have thus been unfulfilled. On the other hand, the CFETS basket always seemed to me an odd basket to target. And in any case, the “real” value of the currency is what is important for many macroeconomic issues. Here, as shown in Figure 1, there is a marked divergence between the nominal bilateral and the real trade weighted.

Figure 1: Real (CPI deflated) trade weighted value of CNY against broad basket of currencies (blue, left log scale), and nominal USD/CNY exchange rate (red, right scale). + for 2016M011 is for end-of-month value. Source: Federal Reserve Board via FRED, BIS, Reuters as of 11/30.

What is the future path of the yuan? Since the yuan is a managed exchange rate — with the People’s Bank of China (PBoC) currently intervening to keep the yuan stronger than it otherwise would be — the answer to that question surely depends on the authorities’ objectives (and views of the long run equilibrium value of the exchange rate, see this post). Kuijs argues:

In the face of such outflows, there may be a case for reducing or even abandoning FX intervention and letting the FX market pressures drive the CNY weaker. This would limit or even halt the bleeding of FX reserves and could reset expectations for the CNY going forward.

However, while capital account factors point to further depreciation, in terms of the real economy there is no obvious case for significant further trade-weighted depreciation. Indeed, China still runs a healthy current account surplus and the global market share of its exports is still rising.

In such circumstances, a significant depreciation may lead to overshooting, which is unhelpful for the real economy. This is an issue for China’s policymakers, as they tend to employ a ‘real economy’ perspective on exchange rate policy. A rapid, large depreciation could also compromise confidence in the CNY, spark turmoil in global FX markets and garner unfavourable reactions from politicians around the world.

The case for resisting a significant depreciation that is not warranted in terms of the real economy would also fit with the government’s objectives to rebalance the economy, improve the industrial structure and move up the value chain.

Such considerations make steps to reduce capital outflows more likely than significant depreciation.

On the other hand, the determination of the authorities to rebalance the economy will surely be tested if growth slows down more than anticipated. In other words, to the extent that policy authorities cannot completely control the economy’s evolution then it’s possible that the choice will be for a weaker yuan. That’s essentially (I think) behind Brad Setser’s contention that there are possible multiple equilibria for the yuan:

I would argue that there aren’t just multiple possible exchange rate equilibria for China, there are also at least two different possible macroeconomic equilibria.

In the “strong” yuan equilibrium, outflows are kept at a level that China can support out of its current goods trade surplus (roughly 5 percent of GDP), which translates to a current account surplus of around 2.5 percent of GDP right now, though it seems likely to me that an inflated tourism deficit has artificially suppressed China’s current account surplus and the real surplus is a bit higher.**

In this equilibrium, a larger “on-budget” central government fiscal deficit—together with an expansion of social insurance—keep demand up, even as investment falls.

In the “weak” yuan equilibrium, China lets the market drive its currency lower—and a weaker currency increases the trade and current account surplus. Such surpluses would finance sustained capital outflows in excess of half a trillion dollars a year without the need to dip further into China’s reserves.

From a purely academic standpoint, it is interesting to see the return to general discussion of multiple equilibria as a function of (usually rational) expectations and government policy reaction functions (early e.g., Obstfeld). Entertainment of multiple equilibria has always been in the academic literature, but it’s apparent that we are now in a range of parameters and economic conditions such that multiple equilibria are more plausible.

Menzie. Great post. Wish I could say Ostfeld’s model was in the back of my mind when I was writing about different possible XR/ macro settings for China, but that would be a stretch. But there are some parallels.

I had at least two different sequences in mind. In one, Chinese residents lose confidence in the yuan’s new basket (if the target is now stability v the CFETs basket) and move in mass into dollars. Pick your reason. Maybe because they expect China will respond to Trump’s policy moves with a depreciation? Maybe because they believe China’s policy makers want a weaker currency tomorrow and thus there is an advantage to holding foreign currency today? Maybe because they doubt that China will stand behind its domestic banks (though I have some trouble with that one)? The loss of reserves is so big and so fast that China decides to allow a big move. And, the big move strengthens exports (or facilitates more import substitution) and provides a boost to the economy such that Chinese policy makers neither feel like they need to juice credit or provide fiscal support for the social safety net to assure an acceptable level of growth. The result is a weaker currency and a tighten on and off budget fiscal stance.

The other chain works the opposite way. Growth slows for some reason. And either Chinese policy makers decide they prefer a weaker currency to an on budget fiscal stimulus or a new off budget credit expansion. Or Chinese residents start to expect that China’s government will want a weaker currency to support the economy and start to shift into foreign exchange … and that puts such pressure on reserves that Chinese policy makers conclude they would rather let the currency weaken that trying a mix of say tighter capital controls and higher CNY interest rates (some //s with obstfeld there).

basically, there is an interaction between residents willingness to hold foreign exchange and their expectations about the authorities policy preferences. And the reality that if growth slows and monetary policy is eased instead of fiscal policy there will be more pressure on the currency — so what i call the strong currency equilibrium hinges on enough fiscal support for demand that China doesn’t need to cut rates too much should internal demand falter at a time when the US is likely raising its policy rate.

Definitely isn’t a fully fleshed out model. But also tries to take into account the ways in which China has a broader set of policy tools than most (capital controls, a managed exchange rate, the ability to dial up or dial down credit from the state banking system, classic monetary policy, classic fiscal policy, structural policies of various stripes including a structural expansion of social insurance, etc

Brad Setser: Thanks – I appreciate the greater detail on the equally plausible equilibria. In either case, one binding constraint that applies in all cases is the authorities will not let growth fall below X%.

I have always had the view that when push comes to shove, the authorities (at the highest level) will sacrifice capital account openness and RMB internationalization in favor of growth. For me, that rules out a number of other equilibria.

Certainly looks like China just choose to sacrifice capital account openness to a more significant degree. If the controls prove effective (a big if), you are right — it should rule out a deep depreciation unless that is what the authorities conclude is necessary for growth.

And the “growth” constraint is what makes the comparison with obstfeld’s model so fitting; the constraint there was an unwillingness to raise interest rates and sacrifice growth in the face of a run (if memory serves)