Here’s a metaphorical picture:

Source: AP/Jacquelyn Martin via Garber.

and here’s a more technical depiction.

Source: Tax Policy Center.

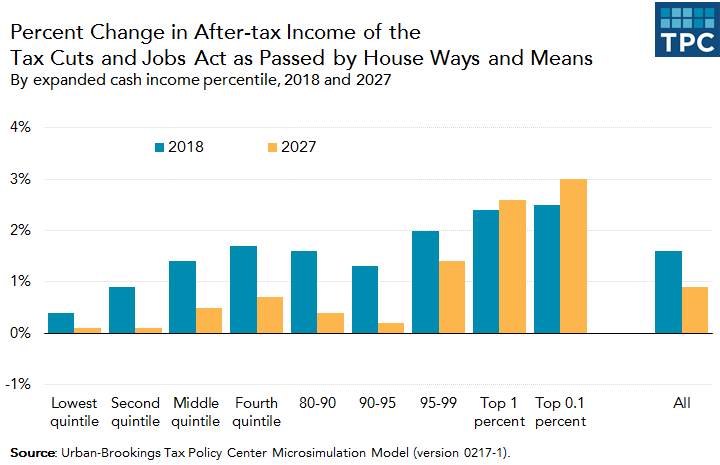

Notice that in 2027 the benefits skew much more toward higher incomes. And in general, the cuts accruing to the lower income households expire, while those to the higher are permanent.

Of course the lower income households will likely lose health care and Social Security benefits to pay for those tax cut for the rich. The TPC analysis omits this effect.

Love this picture. The wife of our Treas. Sec. is basically gloating – my husband is RICH!

E.U. countries put too much effort on reducing income inequality. Consequently, compared to the U.S., E.U. per capita income is over $10,000 a year lower, taxes are high, the cost of living is high, and there’s much more unemployment and underemployment. Moreover, E.U. countries lag the U.S. badly in the Information and Biotech Revolutions.

Too many people want to hurt the rich, because of envy. Yet, the rich work harder, add a lot to GDP, create lots of jobs, and pay lots of taxes. They contribute more than their fair share to society. So, before we punish the rich, we should ask ourselves, do we want to be like France.

As JFK said: Life isn’t fair. A school teacher makes less than a petroleum engineer. So, taxes should be progressive. However, too much effort reducing income inequality will do more harm than good in the economy.

I am hard pressed to understand why we need this tax reform. I have many conversations with friends about ideology, immigration, healthcare, education and regulation. Not once in recent years — unlike the pre-Reagan years — has tax rates or deductions come up in conversation. I don’t have anyone saying, ‘Gosh, my tax rate is so high’ or ‘I can’t believe I can’t deduct my fine wine collection as an expense.’ Where is the constituency for tax reform? This seems to be a solution in search of a problem. It seems to exist as a topic because Republicans think it should in principle, not because anyone really cares that much. Or perhaps no one outside the top 1% really cares that much.

For this reason — and because it now has an Obamacare mandate repeal — this piece of legislation will fail, and for the same reasons the last two did. The right has already lost Sen. Johnson, and they will fail to hold Flake, McCain, Corker, and probably a couple of others as well. Yet another grandiose legislative plan will go down in flames.

I am really struck by the amateurism of all this. Rather than accept that the Republicans really have a very thin majority and work for simple, LCD legislation, both the administration and Congressional leadership seem intent on trying to hit a home run every time at bat. If Republicans had the kind of majority in the Senate they have in the House, then expanded scope legislation could pass. But they don’t, and if Roy Moore goes down in flames in Alabama, as increasingly seems the case, the Senate majority will get thinner yet.

So, one can debate the prudence of posing with a trophy wife wearing black gloves and holding a sheet of Washingtons., but the symbolism is not going to go away, because the only ones who can generate enthusiasm for the proposed legislation are the really rich, and they simply are not big enough a constituency to get the legislation through the Senate.

Hope you are right. The last step is the return of a conference bill to the Senate and this would be the last time to stop this economically disruptive upward redistribution power grab. Which is apparently going to include a disruption to the health system too, while it disrupts the revenue systems of all state and local governments (most of whom have been couple to federal definitions and regimes).

Screw up the workings of the economy, screw up self government, ruin our health … all to embed upward-redistribution into the nation’s fiscal affairs — this is not what I want self government to be used to accomplish.

This is incredible. Amazing. Radical (turns the term ‘conservative’ on its head doesn’t it).

I am not sure the tax plan would trash the economy. But it would trash some individuals, because whether you win or lose depends a lot on your individual situation.

For example, it’s fine for Rove in the WSJ to say that, in New Jersey, “property taxes are below $10,000 for 90% of filers.” However, in Princeton, say, the average house is probably paying $25,000 in property taxes. And if you’re about to sell your house, might take a near $100k hit. So if you’re in the top 10% in New Jersey, you could be fairly slammed given the specific circumstances.

Otherwise, I worry mostly about the deficit. I would greatly like to see the budget brought into balance, and I am unconvinced that giving really rich guys a tax break is warranted under the circumstances.

In any event, I don’t think a lopsided deal is going to hold McCain, Flake, Corker, Johnson, and very possibly not Collins and Murkowski–certainly not if the mandate removal is part of the package. If the vote ends up in mid-December, the Republicans may be short the Roy Moore seat, too.

And that photograph above doesn’t help the administration’s cause, either.

A “quick and dirty” tax calculator is here: https://www.marketwatch.com/story/the-new-trump-tax-calculator-what-do-you-owe-2017-10-26

I agree that most people are not uncomfortable with their tax situation. I’d probably save a couple thousand a year under the new plan, but that’s based on my situation of chronically living below my means. People who have stretched themselves with debt might not fair as well.

All along, the tax plan was focused on freeing up capital for corporations and the wealthy with the notion that this would allow for more business investment and jobs creation. Changes to taxes for everyone else is not much more than window dressing. Whether or not the business investment and jobs creation works out is yet to be seen.

I’ve heard that part of the plan was to incentivize corporations to bring back earnings to the U.S. that are not presently taxed, even if that was at a low rate. Haven’t read much about that facet lately.

Have we seen Trump’s tax returns yet?

No.

That’s good enough reason for real tax reform.

(And there are lots of other reasons but none of them are addressed in the current tax cut package. So I hope you are right that this tax cut package will fail.)

PeakTrader The EU includes a lot of countries…some very rich and some not so rich. The same with this country. Some states are very rich and then there’s Mississippi. Some of the EU countries have less income inequality and higher per capita income than the US. Yes, they pay more in taxes, but they also get a lot more. If you want low taxes, then go to some godforsaken rural town in the Old Confederacy. Of course, you’ll get what you pay for, which isn’t much.

A lot of recent research suggests that extreme income inequality tends to hurt growth. Instead of reading Forbes articles you might want to try reading some of the new economic growth literature.

As to the rich working hard, let’s just say I’m skeptical. Based on that picture of Mnuchin and his trophy wife, I’m not seeing a lot of hard work going on…unless you think activities like flying to see a solar eclipse is hard work. And based on his public comments about Treasury issues, I don’t see any evidence that the guy is terribly bright. In fact, I’d call him something of a dullard…just like his boss. Mnuchin and his ilk are very good at rent seeking, but not much else. And as to the sin of envy, what about the sins of arrogance, hubris and selfishness?

The US badly lags the EU in automotive engineering, high speed transportation and medical care. And that big US advantage in biotech has given us an opioid crisis.

2slugbaits, a megalopolis, e.g. the northeast corridor, which has 50 million people, attracts labor and capital, and has higher income. You won’t find that in rural areas. It also generates more tax revenue and allows more spending. Some small countries in Europe, e.g. less than a million, or have abundant natural resources compared to their populations, are better off, but most are worse off than Mississippi.

If you mean by extreme inequality, there are too many successful people in the U.S., like Bill Gates or Jeff Bezos, then I say the more, the better. And, I agree with you, we need fewer politicians. Of course, Europeans make 19th century products better, but they benefit enormously from the innovative products in our health care industry.

If California didn’t attract labor and capital from the rest of the country and the world, it would be northern Mexico.

Some small countries in Europe, e.g. less than a million, or have abundant natural resources compared to their populations, are better off, but most are worse off than Mississippi.

This is not true. Every European OECD country has a higher per capita GDP than Mississippi.

http://stats.oecd.org/index.aspx?DataSetCode=PDB_LV

50 million people, attracts labor and capital, and has higher income.

Land is also in important economic input. Rural Mississippi has plenty of that. But I take your point…a point which supports my argument. Population density is an important factor in technological advancement. This is a key finding in current economic growth theory.

If you mean by extreme inequality, there are too many successful people in the U.S., like Bill Gates or Jeff Bezos, then I say the more, the better.

What has Bill Gates done lately? His greatest contributions came when he was a dopey and poor college dropout. But lately Microsoft makes its money by engaging in rent seeking and strangling competitors with better ideas.

Europeans make 19th century products better, but they benefit enormously from the innovative products in our health care industry.

Really? How many pharma companies are German? A lot. How many of the top cancer breakthroughs are French? Quite a few.

If you want lower taxes, you move to Florida. I was talking to a hedge fund friend of mine who’s looking for a job, and he noted that there are lots of opportunities in Florida. A bunch of funds are leaving the northeast and moving there due to high taxes. That’s why Connecticut is floundering and relatively few top end homes have been sold there recently.

In New Jersey, our governor elect has promised to raise the taxes on the wealthy, which could certainly mean a raise from 9% to right around 13%–California’s rate, and the highest in the country (before NJ, NY and CT, just for the record). I hope our new governor was lying, but if not, the job opportunities in Palm Beach are just going to keep getting better and better.

Basically, states with lower taxes are attracting more jobs. Those with high taxes — Wisconsin is one — are attracting fewer jobs.

In California, there are many high income people driving up home prices, while much of the middle class and many businesses flee the state for a lower cost of living and lower taxes. The economic model has become “that of a gated community, with a convenient servant base nearby.”

Progressives are concerned about income inequality. Yet, in California, there are many affluent neighborhoods with very run-down, poor, crowded neighborhoods down the hills or a few miles away.

LOL. Now you are making stuff up.

San Jose Mercury News make things up?:

https://www.google.com/amp/www.mercurynews.com/2017/04/24/leaving-california-after-slowing-the-trend-intensifies/amp/

This is the paragraph in the article I partially quoted:

“Some so-called progressives hail these trends, as forcing what they seem to see as less desirable elements — that is, working- and middle-class people — out of the state. They allege that this is balanced out by a surge of highly educated workers coming to California. Essentially, the model is that of a gated community, with a convenient servant base nearby.”

Looks like Hillary’s “deplorables” are leaving the state. So, the elitists can practice slavery.

PeakTrader

It is myth that people move just because their taxes are high. It is about career opportunities and where they are located as they say in real estate: Location, location, location.

Kopits

While it is true that there are opportunities in Florida but taxes are high in other areas- property taxes and sales taxes just to get the services you want. I know because I used to live in NE Florida.

An undated article (post-2015) to Peak’s point.

http://www.sacbee.com/site-services/databases/article32679753.html

On the other hand, California is still competitive with the Northeast.

It seems, the elites in California spend some money on the poor to make sure they’re able to make it to the voting booth.

Some European nations have higher income per capita than we do. And the ones that do not have had to rebuild after WWII. Peak Trader’s talent for misleading comparisons knows no bounds.

Pgl, that’s a lame excuse. Europe had thousands of years of wealth, while the U.S. had a vast wilderness. And, it didn’t take long to rebuild and expand after the Civil War. Europeans aren’t that slow.

the europeans behind the iron curtain were certainly lagging in recent decades.

I get the sense you think World War II was a 6 days event. Of course you are contradicting yourself when you say the Europeans are not that slow while defending your false claim that a progressive state leads to slow economic growth. I do wish you would get your right wing spin straight someday.

“Too many people want to hurt the rich, because of envy.”

false.

“Yet, the rich work harder,”

false.

about half of the wealthy got there because of a silver spoon. peak is an example of that class of wealthy. they are similar to the aristocracy of past eras. these folks are not necessary for a modern society, but feel entitlement. the other half are actual contributors, and are needed by society. peak is not an example of this class of wealthy. this group should be encouraged. for example, an estate tax helps to keep the wealthy populated with actual producers, rather than trust fund babies. that is good for the economy.

What about the children of the wealthy, who work hard, but don’t have to? Typically, their parents instill a work ethic into them, unlike couch potatoes collecting welfare.

eric trump would be wealthy today, if he came from a poor family? being wealthy from inheritance does not mean one is good at allocating capital oneself.

PeakTrader This is a myth. The empirical evidence tells us that the main effect of inherited wealth is that those who inherit exit the workforce earlier than they otherwise would have. The effect is fairly strong. One estimate finds that even with a fairly small inheritance of only $30K (i.e., the median inheritance), the inheritance effect induces a 4.4 percentage point increase in the probability of retiring early. And keep in mind, that’s with a fairly small inheritance.

http://www.nber.org/papers/w12386

I agree, but that’s not what I said. Lots of people with a median inheritance of $30,000 will retire early, work less, or take more time off work. If you received an unexpected windfall, you may take a vacation.

so peak trader, you believe having more eric trumps would be beneficial for the economy. brilliant way to grow the economy with such a policy. it is just the modern version of an aristocracy. inefficient and wasteful allocation of capital.

look peak, with an estate tax, i still get to have a bill gates or zuckerburg. but i can eliminate an eric trump. that is a net positive.

Too many people want to hurt the rich, because of envy.

I’d like to see that study.

In fact, I’d like to see the studies that provide support for your emotional argument.

You need a study to show people are emotional!

France is doing just fine! More vacation days, higher life expectancy, cheaper child care for all, maternity leave, superior transport infrastructure…certainly a country can’t have it all, but let’s not use this hackneyed shortcut to deter attention away from deep seeded inequality issues that plague the US.

Yes, French workers have more leisure time and there’s more unemployment, many U.S. states have longer life expectancies, and American workers have benefits too. Cars are much more convenient. France taxes and spends more on infrastructure, which helps explain why they live in small houses, drive small cars, take public transportation, or ride bicycles, and why consumption is much lower. The U.S. has tremendous upward income mobility, while France is more or less static.

I think you missed out on the original picture:

https://4.bp.blogspot.com/-iPxleErsHh0/Wg103VMepGI/AAAAAAAAEYA/94enh1shILgGJkdBYDSIjy4cSwOMa0IgACLcBGAs/s1600/BATMAN-VILLAINS.jpg

Your picture has made its way to the House floor!

https://twitter.com/JoePerticone/status/931186744342597633

Per capita GDP comparisons of states and countries:

http://www.aei.org/wp-content/uploads/2016/03/statesGDPnew-1.png

And, Washington D.C. with a population of over 680,000 has a per capita GDP of over $150,000.

And that means they are producing far more wealth than the States that lag.

I thought generating wealth was a good thing. It’s not? I’m confused.

I’m not surprised you’re confused, since politicians generate wealth through nonsense.

PeakTrader Your AEI link doesn’t exactly support your point. Remember, the question was how Mississippi ranked relative to many western European countries. Your own link shows that Mississippi is near the bottom, and only barely above Italy. Other than that almost all of the other major players have higher per capita GDP than Mississippi. And notice that your list ignores some of the really high income western European countries like Norway and Luxembourg and Switzerland and Austria and the Netherlands and Ireland. And oh by the way…GDP per capita doesn’t account for the fact that western European workers put in fewer labor hours, which puts downward pressure on GDP per capita. There is virtually no difference between French and American output per labor hour.

Have you ever been to rural Mississippi or Alabama??? All you see are these huge megachurches surrounded by dilapidated and run down mobile homes resting on cinder blocks.

2slugbaits, my point, and what I stated, was most European countries are worse off than Mississippi. I wasn’t talking about only per capita GDP. Nonetheless, I didn’t know Mississippi was $4,000 poorer than the next poorest state in per capita GDP.

It looks like you can buy a very nice house with a big yard for $200,000 to $300,000 in Mississippi. Of course, when there’s high structural unemployment and underemployment, per capita GDP is lower. And, both the cost of living and the tax burden are much higher in France. American homes are more than twice as big as French homes. Also, Americans drive bigger cars – many French don’t have cars – energy prices are much lower. The tax burden in France is much higher than the U.S.. There are many more shopping malls per capita in the U.S..

Yes, you can buy a big house in Mississippi. But then you’d have to actually live in Mississippi, and no one in their right mind would want to pay that kind of price. Just make sure the walls are well padded in that big house.

Yes, the cost of living is much higher in France. My sister’s husband is a bigshot diplomat in Paris and she complains all the time about how expensive everything is. But then again, she also likes the intimate neighborhoods and the fact that there aren’t as many cultural deserts we call “malls.” Given a choice between living in France or Mississippi, I’m pretty sure most folks (who are not cultural cretins) would choose the former.

Caption missing from picture: “We’re the Mnuchins and you’re not”.

Note the disgust on Mrs. M’s face at having to take a selfie with dollar bills. “Steven! Why didn’t you tell them we wanted Benjamins?”

France’s economy is in the 1970s compared to the U.S.. There continues to be fewer and limited opportunities in the E.U. for upward income mobility than the U.S.:

Rising riches: 1 in 5 in U.S. reaches affluence

December 6, 2013

“New research suggests that affluent Americans are more numerous than government data depict, encompassing 21% of working-age adults for at least a year by the time they turn 60. That proportion has more than doubled since 1979.

Sometimes referred to by marketers as the “mass affluent,” the new rich make up roughly 25 million U.S. households and account for nearly 40% of total U.S. consumer spending.

In 2012, the top 20% of U.S. households took home a record 51% of the nation’s income. The median income of this group is more than $150,000.”

****

Growth in the

Residential Segregation

of Families by Income,

1970-2009

“The proportion of families living in affluent neighborhoods doubled from 7 percent in 1970 to 14 percent in 2007.

Likewise, the proportion of families in poor neighborhoods doubled from 8 percent to 17 percent over the same period.”

My comment:

In 1970, the proportion of Americans in the “affluent” and “upper income” classes, and also in the “low income” and “poor” classes were relatively small, while the proportion of Americans in the “high middle income” and “low middle income” classes were very large.

If you break down those six classes into three classes, the high and low classes grew and the middle class shrunk. Those three categories are almost equal in size today.

In 1970, both the high and low classes were about 18% each, while the middle class was over 60%. In 2007, both the high and low classes were about 30% each, while the middle class was over 40%.

Many middle class Americans moved into the higher classes, while many immigrants from dirt poor countries moved to the U.S. and into the lower classes.

Despite conventional wisdom, there has been tremendous upward income mobility in the U.S..