The Wisconsin Department of Workforce Development (DWD) today released new employment data for October. Manufacturing employment surged in the establishment data, but the contemporaneously released additional three months of data from the Quarterly Census of Employment and Wages (QCEW) (through June) suggests slower manufacturing growth.

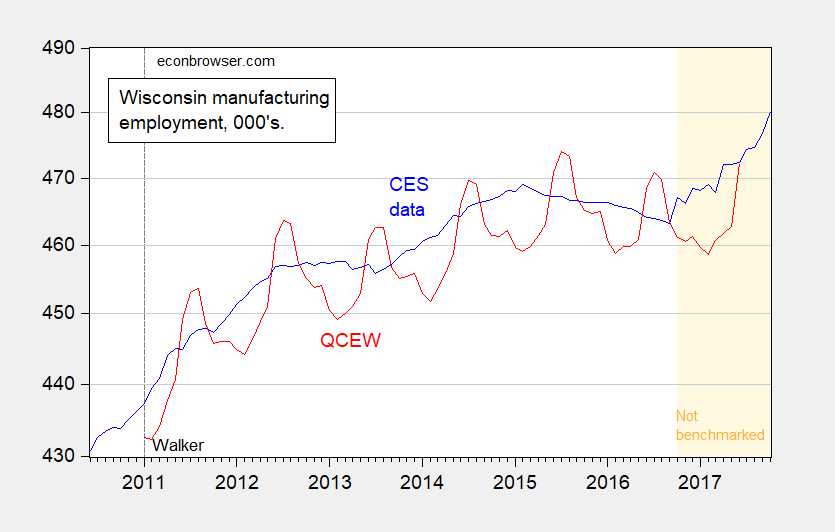

Figure 1: Wisconsin manufacturing payroll employment from establishment survey (CES) (blue), and from Quarterly Census of Employment and Wages (QCEW) (red), both measured on a log scale. Light brown shaded area denotes period where CES data has not been benchmarked using QCEW data. Source: BLS, and DWD.

When the establishment series is revised in the January data release, it will incorporate data from the QCEW. In previous two years, the manufacturing series has been revised down noticeably (see this post).

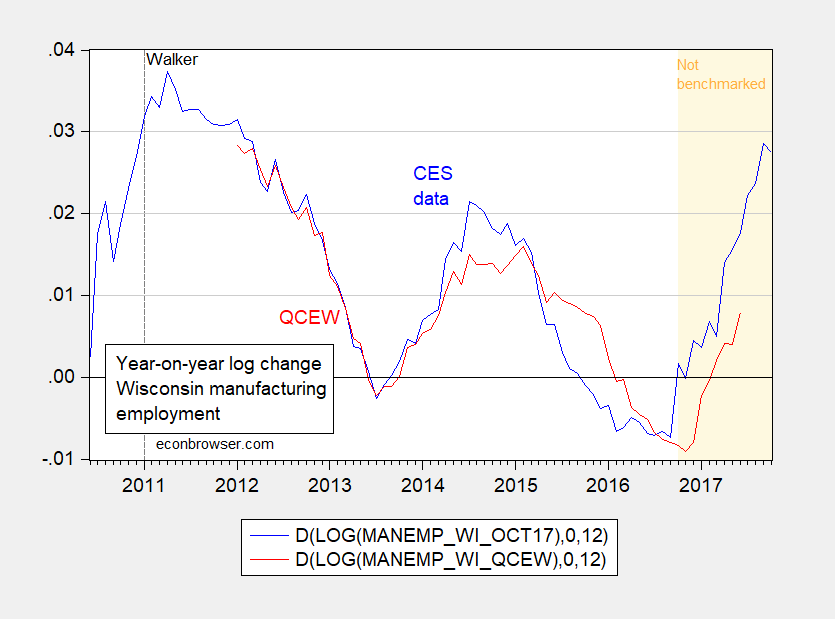

Since the QCEW data is not seasonally adjusted, it’s hard to compare the two series. I show the year-on-year log differences (percent growth rates) in Figure 2.

Figure 2: 12 month log difference in Wisconsin manufacturing payroll employment from establishment survey (CES) (blue), and from Quarterly Census of Employment and Wages (QCEW) (red). Light brown shaded area denotes period where CES data has not been benchmarked using QCEW data. Source: BLS, DWD and author’s calculations.

Another way to visualize the differences in trends is to seasonally adjust the QCEW data. I present in Figure 3 the seasonally adjusted series in levels, using Census X-13 with log transformation, ARIMA X-11 for detrending.

Figure 3: Wisconsin manufacturing payroll employment from establishment survey (CES) (blue), and from Quarterly Census of Employment and Wages (QCEW), adjusted using Census X13, log transform, detrending via X-11 (red). Light brown shaded area denotes period where CES data has not been benchmarked using QCEW data. Source: BLS, DWD and author’s calculations.

The slope of the seasonally adjusted QCEW series is flatter than that of the establishment series (the former is based on a census while the latter is a survey). While there are some definitional differences, I anticipate this lower gradient will be reflected in the revised establishment series come next year.

For more on the state of Wisconsin manufacturing, see this post and this post.

Would you not agree that, at a minimum, there appears to be some momentum behind goods producing employment in Wisconsin? Factory employment appears to be on the rise again. That’s a good thing.