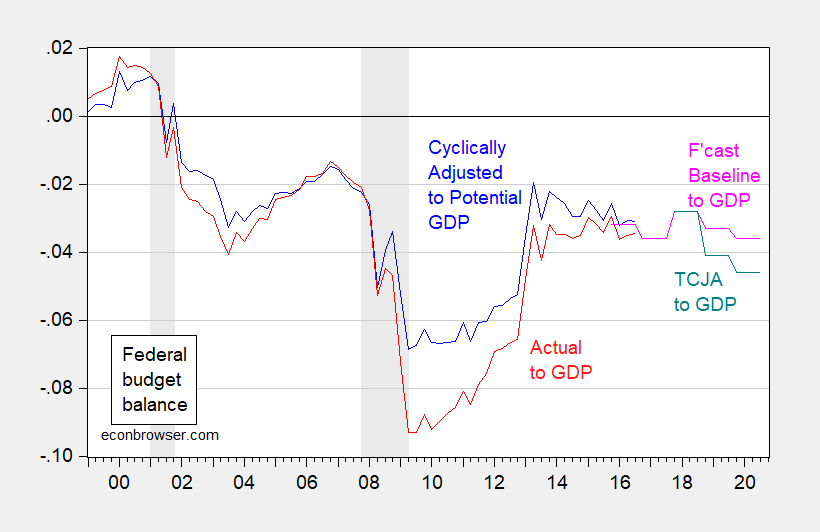

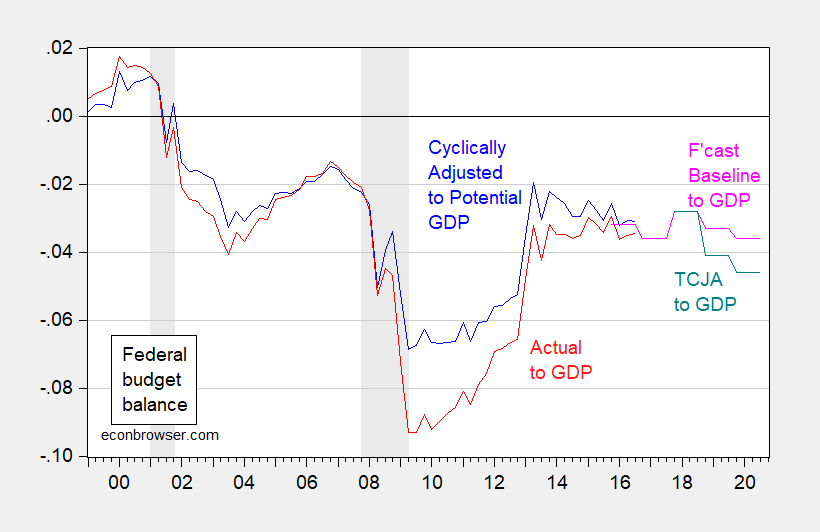

Signs are the putative Republican “deficit hawks” are about to sign away whatever integrity they had. What are the implications for the deficit going forward, keeping in mind the fact we are near or at full employment.

Figure 1: Federal budget balance without automatic stabilizers, as a share of potential GDP (blue), and Federal budget balance as share of actual GDP (red), and baseline forecast Federal budget balance from June CBO forecast (pink), and alternative under Senate budget bill (teal), both as share of projected GDP. NBER defined recession dates shaded gray. Source: CBO, Budget and Economic Outlook: An Update (June 2017), and CBO, Cost Estimate (November 2017), NBER, and author’s calculations.

Continue reading →