Now that Brownback is an ex-governor, and the tax plan he touted as a “shot of adrenaline” is largely reversed, it’s a good time to see what damage was wrought.

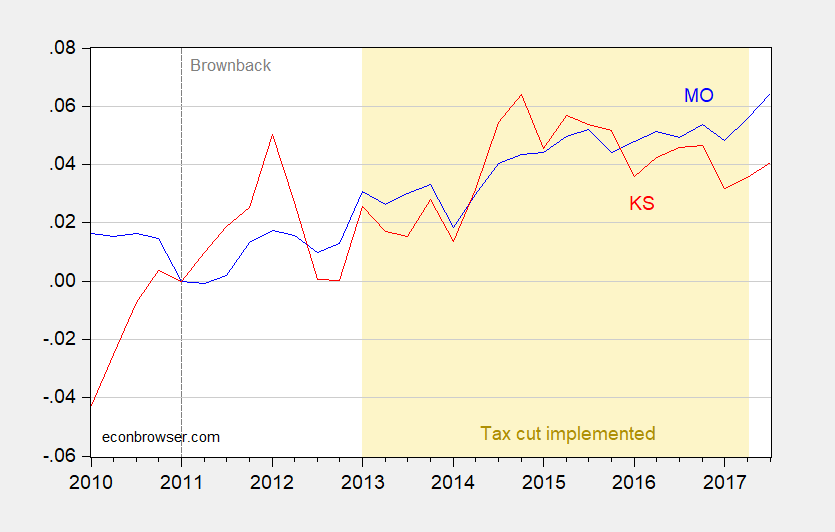

Figure 1: Log real GDP for Missouri (blue), Kansas (red), normalized to 2011Q1=0. Source: BEA and author’s calculations.

Kansas GDP growth was negative q/q from 2015Q3-2016Q1. Hence, Kansas was in recession using the conventional rule of thumb over this period. The timing of the start of the recession is in line with results obtained using the Philly Fed coincident indices and the Hamilton Markov switching approach, as discussed in this post.

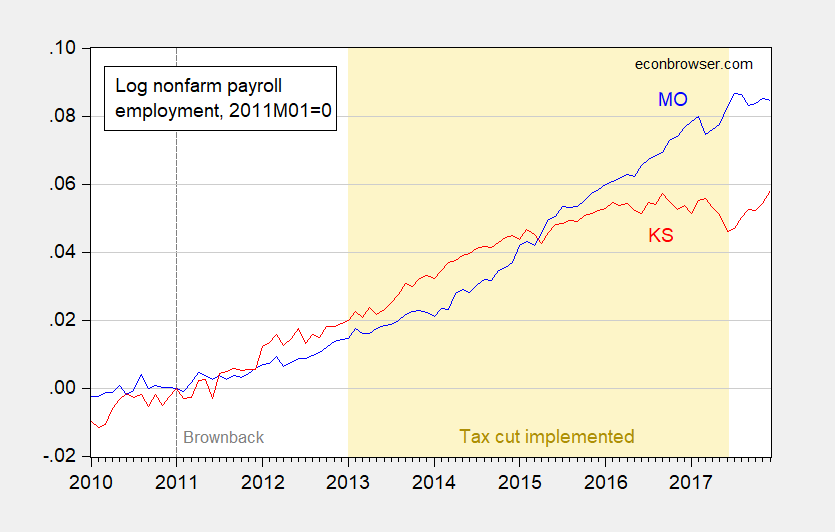

The rebound is more pronounced in the employment data which extends through December.

Figure 2: Log nonfarm payroll employment for Missouri (blue), Kansas (red), normalized to 2011M01=0. Source: BLS and author’s calculations.

As of December 2017, Kansas nonfarm payroll employment has just barely exceeded the prior 2016M09 peak, by less than 0.1 percentage points. (Civilian employment exceeded the prior April 2017 peak in October, but has since declined below that value.)

“A Retrospective”. Baaaaaahaaaaahaaaaahaaaaahaaaaaaaa!!!!!!! Hey Menzie, you could have added some extra “literary flair” there if you had inserted an adjective before retrospective, such as “touching”, “nostalgic”, or perhaps “lovey-dovey”.

@Menzie

Hey Menzie, Oklahoma mirrors Kansas budget-wise, in many aspects. Other than the fact Oklahomans have not had their Hallelujah moment with feckless Republican Governor Mary Fallin like Kansas did with Brownback around mid- 2017. If you remember to take 4-5 anti-depressants before you start crunching the numbers, I bet you would have fun crunching some of those out since Feckless Republican Fallin has taken office up to now. If you’re feeling extra-industrious Menzie, you might even calculate how much more revenues the state would take in, if they rose the “GPT” (gross production tax) 5–7 cents. The best part is, the dumb Okie legislators won’t enact the higher GPT, even though oil and gas industry insiders PHYSICALLY went to the state capital en masse, telling them that no jobs would leave the state, even if they raised the GPT tax. An increase in the GPT tax, along with a cigarette tax, would solve 75%+ of Oklahoma’s current budget deficit woes nearly overnight.

Given the amount of seats that have flipped in the last year in the Oklahoma Legislature, I think they are starting to catch on.

Also worth noting, Missouri went full-in to the ALEC agenda in 2017 with Eric (Nude Pictures and Blackmail of My Mistress) Greitens. Let’s see if they flatten out in the next year like Kansas has.

She did advise Oklahomans who were concerned about the causes of the increase in earthquakes in state take out earthquake insurance.

@NonEconomist

I’m not sure if you’re being facetious or not, but with all due respect—- NONE of those policies cover/pay the claim if the earthquakes are “man made”. Any guesses on what the insurance companies’ claims adjuster is going to conclude on that, since about 85% of the earthquakes originate in the northwest quartile of the state and “coincidentally” that’s where most of the fracking operations are based?? That’s presuming insurance companies weren’t already looking for any excuse under the sun to lie to you and not pay off policy claims.

Mary Fallin (and I have many vulgar nouns for the woman, but will spare Menzie the blog cleanup) is in bed with the insurance companies. You think Madam Fallin and her pals in the Oklahoma Insurance Commission don’t laugh behind closed doors because some idiot added on an insurance rider that’s never going to pay out??

See, that’s the “added bonus” living in a “red state” like Oklahoma where the Republicans running the show don’t give a rat’s dam about consumers or citizens—the oil and gas tell you that “earthquakes are your liberal imagination” and then the insurance companies don’t pay claims because “all those earthquakes are man-made”. They can frack a few feet from your 100% owned home/property and the Oklahoma Corporation Commission (oil and gas lapdogs, just like the Oklahoma legislature) go “Duuuuhh, it’s my 3 hour lunchtime, what you want me to do about it??”

Want your kids to get an education suitable for those just slightly above down syndrome IQ?? Come to “red state” Oklahoma, it’s the fantasyland waiting for you.

* I should have typed 5%–7% on the GPT, but you guys got the idea.

Look out Texas! There went Kansas.

Although, Kansas fiscal policy was less than ideal, that’s hardly the cause of a slower economy. The collapse in the Kansas agriculture and oil & gas industries, and slower growth in aerospace & aviation, with their multiplier effects, had a major impact on growth. Kansas without agriculture would be a significantly smaller economy. If California had a collapse in the high tech and tourism industries, it would have a major effect on its economy, although California is more diversified than Kansas.

Of course, with state budgets, cutting business and income taxes without offsets in government spending, deductions, exemptions, tax credits, etc. and just relying on stronger growth is not a good idea, particularly when the economy is on the verge of a downturn.

Oh brother! Do you have a forked tongue or what? Paul Ryan needs you to help him with his incessant two faced spin.

“Kansas fiscal policy was less than ideal”

I guess you would have gone for even deeper spending cuts so as to have even more tax cuts? Yes it was less than ideal as the spending cuts reduced aggregate demand more than the tax cuts spurred consumption. But you advocate the exact type of fiscal policy that Kansas on a daily basis. And now you say it was “less than ideal”?

How do you know the spending multiplier was higher than the tax multiplier? – More disposable income and less government waste can raise living standards.

I certainly did not get that estimate from the Laffer-Kudlow-Moore econometric model! is that the one you use to formulate your economic forecasts?

The Voice for Liberty agrees with Menzie but it does note how the governor and Peaky come up with their bogus information:

https://wichitaliberty.org/kansas-government/the-kansas-economy-and-agriculture/

“Kansas without agriculture would be a significantly smaller economy.”

You keep asserting that ag is a yuuuuge part of the Kansas economy but Menzie has already documented the very modest percent of Kansas value-added that comes from ag. Please read what he posted and stop this dishonesty.

Stop making things up like state governments and try to be honest. Significantly does not equal ”yuuuuge.”

And, I didn’t “keep asserting.” I posted two studies reported by Kansas and Missouri once. They showed Kansas agriculture-related proportion of its economy is about 45% and Missouri is about 30%, or Kansas is 50% more than Missouri. It should be easy for you to be more honest, since you’re totally dishonest.

“They showed Kansas agriculture-related proportion of its economy is about 45%”

And I posted something that showed how incredibly dishonest this 45% figure is. Maybe you are not Stephen Moore’s wannabe as you have become THE MASTER at intellectual garbage!

This is rich from Stephen Moore’s wannabe. You write all sorts of misleading intellectual garbage and then you get angry when someone calls you on it?

Kansas fiscal policy was less than ideal, that’s hardly the cause of a slower economy.

The exact same policies have been implemented many times over, and fail. And the Heritage Foundation excuse, “Oh, well, the policy wasn’t optimal.” fails.

When do you finally look at the facts, and then decide, “That didn’t work, at all.”?

Right, the politician/lawyers spend and squander too much.

When will you finally wake up?

that would describe supply side politicians very well.

Kansas badly needed protection from all those wild-eyed big spending Leninists who dominated public life in general and the state legislature in particular?

Five years ago, the father of Kansas’ grand experiment, Art Laffer, opined in numerous California newspapers on the benefits of a flat 6.5% income tax for California. Just what the state needed. A tax plan to revive the state’s economy in no time.

Hogwash, of course, especially for the middle class, which if you believe supply sider fairy tales, is the focus of most concern.

That hogwash becomes quite clear when you calculate what is and what the Lafferites contend should be.

In 2016, a California couple with a TAXABLE (after deductions and credits) income of $100,000, owed $3991. ($4213 minus two personal exemptions @ 111 each for that final amount owed) That’s a tax rate of 3.991%

Doesn’t take much knowledge of basic arithmetic to see that Laffer’s grand scheme would have raised that couple’s tax considerably. Under the Laffer proposal, that same couple would have owed $6500 (6.5%), an increase of $2509, a 60+% increase. Of course, you could have mailed in your return on a post card!

Hmm! If a flat tax would increase taxes owed by that couple and all the couples with incomes below theirs, just who would benefit?

Gee, I wonder. But thank you Dr. Laffer for your concerns, but not for what you helped do to the citizens of Kansas.

Here is an Oklahoma REPUBLICAN legislator, commenting on HER OWN LEGISLATIVE F__K-UPS, in a South Dakota newspaper. Why admit all this in a South Dakota newspaper when she is an Oklahoma lawmaker?? Probably because the only statewide paper in her state of Oklahoma, which for decades held monopoly power on print news in Oklahoma “The Daily Oklahoman”, now known online as “newsok dotcom”, refuses to print any local political opinions that differ with their own selfish agenda.

https://www.thelostogle.com/2018/02/05/ok-lawmaker-admits-to-past-failures-in-out-of-state-newspaper/