With apologies to Seinfeld. It seems like a long time ago that conservatives argued for cutting taxes and cutting spending so as to spur expansion — but the Brownback and Walker experiments in Kansas and Wisconsin are in some sense just being completed now, some five years after Governor Brownback’s “shot of adrenaline” forecast.

Louis Johnston, who among other things has been following the Minnesota and Wisconsin experiences, brings my attention to this formal analysis of the Kansas and Wisconsin experiences, using a variety of econometric methods (differences-in-differences, shift-share, synthetic control method, etc.). From Two tales of two U.S. states: Regional fiscal austerity and economic performance, by Rickman and Wang [Working Paper version]:

This paper assesses the effects of U.S. state fiscal austerity on state economic performance using the recent economic experiments in Kansas and Wisconsin. Our results suggest that rather than experiencing stimulative growth effects from reductions in taxes, if anything, Wisconsin and Kansas experienced negative economic multiplier effects from reduced state and local government spending (Chinn, 2014) and increased economic uncertainty. The results for Kansas are consistent with evidence that its changes in business taxation resulted more in tax avoidance than creation of additional real economic activity (DeBacker et al., 2017). The economic experiments in Wisconsin and Kansas, along with those elsewhere (Arduin, Laffer and Moore Econometrics, 2011), were advocated as a means to stimulate growth in the short-run without having to reduce state government expenditures because of projected offsetting growth-induced tax revenue collections. In these two cases, the governing parties appeared to negatively affect their economies in the short run.

Internationally, the International Monetary Fund likewise admits underestimating the negative multiplier effects of fiscal austerity on European economies (Blanchard and Leigh, 2013). …

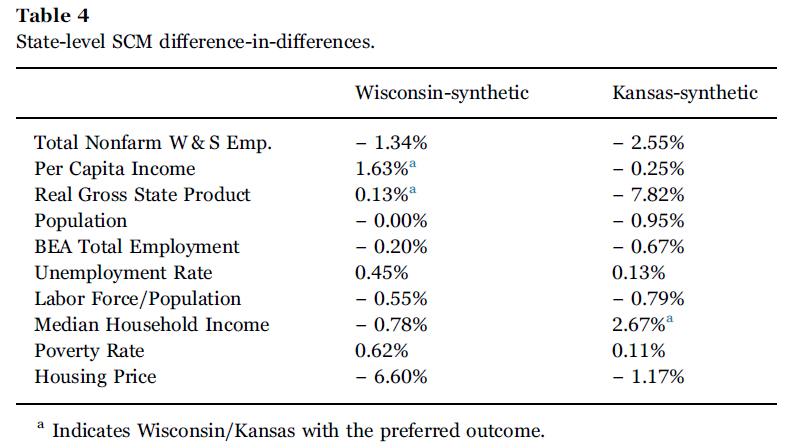

The authors compare performance in Kansas and Wisconsin against a synthetically matched comparator which matches along a series of predictor variables, and find that for most indicators, the synthetic comparator outperforms either Kansas or Wisconsin.

Source: Rickman and Wang (2018).

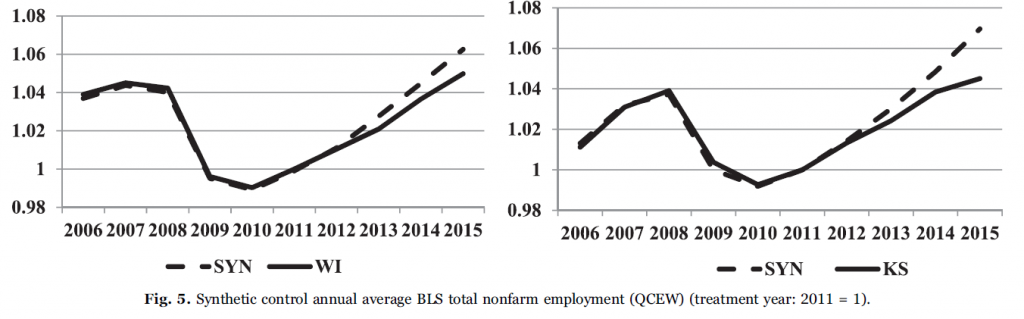

Figure 5 from the paper depicts how employment in the two states evolves, relative to comparator states that have the same characteristics. The characteristics are:

natural amenity scale; rural-urban continuum code; manufacturing dependence; mining dependence; farm dependence; persistent poverty counties; retirement destination; recreation dependence; long-term population losses (all year 2000 or earlier). Other predictor variables used include U.S. Census Bureau population density in year 2000, shift-share industry mix employment growth four-digit level (2002–2007) (Dorfman et al., 2011), U.S. Census Bureau educational attainment among the adult population (25+) in year 2000 high school completion, associate’s degree, bachelor’s degree or higher, Fraser’s Economic Freedom Index (Goetz et al., 2011) and following the convention in SCM, pre-intervention values of outcome variable (2006, 2008, 2010). … industry dependence and the shiftshare

growth industry mix growth as predictor variables …

Source: Rickman and Wang (2018).

The solid line under the dashed indicates the state underperformed relative to the counterfactual.

“Our results suggest that rather than experiencing stimulative growth effects from reductions in taxes, if anything, Wisconsin and Kansas experienced negative economic multiplier effects from reduced state and local government spending”.

The balanced budget multiplier in action!

@ pgi

pgi, I think we agree on most things, but I think the better terminology there would have been “The deficit budget multiplier”. That’s the lunacy of the entire thing. Republicans in those two states (and others) are creating state budget deficits at the same time government stimulus is disappearing. Instead of “robbing Peter to pay Paul” they are “robbing Peter AND Paul”, BOTH.

Yep – the budget is not balanced necessarily. The concept is one where one changes G by the same amount that one changes T. So maybe the constant deficit multiplier.

There are current deficits and then there are debt “bombs”. https://www.cnbc.com/2017/10/18/state-pension-funds-continue-to-fall-behind-heres-how-much-you-owe.html

“States with the best funding levels include Wisconsin (98 percent), South Dakota (97 percent), New York (93 percent), Tennessee (88 percent) and North Carolina (87 percent).

Payments for state debt and pension liabilities are already taking up a bigger share of annual state spending, putting added pressure to raise taxes or cut other spending. In Illinois, about 32 cents of every dollar of revenue goes to pay interest on state debt along with contributions to fund pensions and other retirement benefits.”

“Fiscal responsibility” extends beyond the current year. If “austerity” means not heading toward a pension crisis, there appear to be quite a few states without that word in their governing vocabulary. “Golden” California has a per capita liability 38% higher than Kansas and 144% higher than “stupid” Wisconsin. Ever hear the parable about the grasshopper and the ant?

“the paper depicts how employment in the two states evolves,” I’m sorry….. did you mean to type devolves???

With all due respect to Blanchard and Leigh (especially Blanchard, as I have a book he co-authored and actively seek the free versions of his white papers online), Yanis Varoufakis was SCREAMING from the rooftops about the fecklessness of austerity LONG before 2013. Varoufakis’s “thank you” was to be called an economic heretic, outcast by European elites, verbally castigated by the Troika, and patronizingly patted on the head like a child by the likes of sell-outs Lawrence Summers and Christine “Free Money For Tapie” Lagarde.

Schauble, Martin Schulz, Jean Claude Juncker, and the rest of the mad-hatter thieves of the EU/Troika prescribed austerity for Greece and others, which would have (had Tsipras not been intelligent enough to take on Varoufakis as his finance minister) created either 0% economic growth or sub-zero economic growth for Greece at the same time French and German banks were requiring usury rates from Greece for fear of being exposed for the supreme hypocrites they were. If Tsipras had taken 95% of Varoufakis advice instead of about 15% of Varoufakis advice, French and German banks would have pissed their pants, then capitulated, and Greece probably would have avoided the hell hole they find themselves in, clear to THIS day.

Then, AFTER all this, the IMF (International Monetary Fund) goes “Uh, oops, We were wrong. Don’t expect us to apologize to Varoufakis, because that will be a cold day in hell when we apologize to Varoufakis—-but now that it’s painfully obvious to anyone above down syndrome level intelligence, we want you to know, we did an autopsy on the patient we beat to death, and uh, we were wrong.”

Wanna know the ENTIRE story?? I highly recommend this book. Copy this ISBN# 978-0374101008 and get it from your local bookstore.

I just don’t get economist’s beliefs. Menzie obviously believes in this alternative view of a state’s highly complex econometrics, over real worldly state level potential where Pgl and Menzie admit no one in the field calculates state level potential. What is important?

Simply because some agency has not officially produced an estimate of a state’s potential output does not mean one should not try to capture something similar in another way. You used to chastise Menzie for not trying harder and now you chastise him for trying?

Pgl, if not potential then what was the model calibrated and validated against? What value is any output from unvalidated models? If you and Menzie believe calculating state level potential is not done or not done because it is too difficult, then why do you believe this model’s output?

As it is often said; predictions are difficult especially those of the future.

“What value is any output from unvalidated models?”

Maybe you should precisely define “unvalidated”. It seems that you think Menzie is making some modeling error even if you are struggling to articulate what the error was. Of course the real test would be for you to put forth a better model. So far you have not even tried.

Pgl, I don’t have to precisely define anything. Model V&V is a fairly well know process. One it appears you have no familiarity. I am not at all surprised since you did not understand the importance of estimating “potential” at the state level.

Apparently you did not read Menzie’s references, one of which made this statement: “…The policies enacted after the election of the two governors were promoted as a means to stimulate growth in the state economies (Citizens for Tax Justice, 2012″…) You seem unable to consider why would anyone want to know sGDPs to compare their growth?

Your disputatious attitude seems to cloud/hinder your common sense.

@ CoRev

CoRev, Your intellectually vacuous argument is the equivalent of saying, circa 1968 “Why should we make the effort to explore the Moon, when we still don’t know how much rocket fuel it would take to get to Mars??”

Moses, I usually just skip over your angry and mindless comments, but I noticed this highlighted insipid comment: ” circa 1968 “Why should we make the effort to explore the Moon, “. I noticed because I worked on the Apollo missions, and remember the kind of little mindedness associated with those comments, but more importantly I remember how how wrong those few were then. Just as your mindless comments are today.

Now back to my skipping of your useless commentary.

WORKE is CoRev

And I’ll just skip over your usual useless comments as well as your incessant baseless insults. Have a nice day!

“I don’t have to precisely define anything. Model V&V is a fairly well know process. One it appears you have no familiarity. ”

Another intellectually vacuous argument indeed. CoRev cannot be bothered to define what his real issue is and he seems to even care. Yes validation is well known but CoRev is so far above us all that he does not need to bother to mansplain this to us.

I’m done with his arrogance. Good luck dealing with his incessant spinning laced with silly insults.

Pgl, just smiling. Who was it asked: pot calling the kettle…?????

A shift in income from relatively overpaid government workers to relatively underpaid private workers can lower gross state product, and demand can fall, since income is lower,

Since States cannot expand fiscal policy through budget deficits, it would’ve been better to freeze government spending for several years and any budget surplus returned to taxpayers. And, since low income workers will likely receive little of the tax refund, the state minimum wage should be raised.

That is, the shift in income was from fewer overpaid government workers to more underpaid private workers.

And the evidence that you have presented to show the magnitude of this alleged effect is ?????????????

Don’t contradict yourself – above you cited reductions in taxes and state and local spending.

Don’t you even understand what you cut & paste?

You are babbling nonsense as usual. For the sake of this comment section – please stop!

The question is whether or not the synthetic comparator truly measures performance because of “austerity” or if some other regional factor is in play.

Compare Wisconsin to free-spending Illinois:

https://www.illinoispolicy.org/state-of-the-state-illinoisans-starving-for-certainty/

https://mcdonaldhopkins.com/Insights/Blog/Tax-and-Benefits-Challenges/2018/01/18/Illinois-Population-continues-to-decline-eroding-the-tax-base

http://qctimes.com/opinion/columnists/guest-view-in-illinois-it-s-all-about-the-economy/article_df9d9997-7a5b-5eb6-8020-560ecde3b4bf.html

http://www.ides.illinois.gov/lmi/ILMR/DecliningLaborForce.pdf

http://www.repbrianstewart.com/2018/01/column-let-us-find-light-in-illinois.html

https://newsroom.niu.edu/2015/03/30/illinois-leads-nation-in-population-decline/

Otherwise, it’s an interesting exercise.

The post lost me at ‘synthetic’.

If you want fiscally sustainable growth, pay for fiscally sustainable growth.

http://thehill.com/opinion/white-house/363820-trump-can-win-on-deficits-solve-the-debt-ceiling-and-own-congress-forever

Meanwhile, this in the WSJ

Wisconsin, Facing a Worker Shortage, Pitches Its Benefits

https://www.wsj.com/articles/wisconsin-facing-a-worker-shortage-pitches-its-benefits-1518431400?mod=searchresults&page=1&pos=5

As people starve and riot in Venezuela, some Americans, who visited France, are shocked its per capita income is over $10,000 a year lower than the U.S., taxes are ridiculous high, including the Value Added Tax, which makes products even more expensive, and a huge wasteful government. Living standards are even worse than reflected in GDP.

The liberal/socialists may be interested in the cartoons near the bottom of the link.

https://www.google.com/amp/s/danieljmitchell.wordpress.com/2014/08/25/it-doesnt-seem-possible-but-france-is-going-from-bad-to-worse/amp/

The latest Steve Bannon tweet! Which has nothing to do with Menzie’s point. No we are not interested in your right wing cartoons.

Oh wait – no cartoons in Peaky’s latest link. Just a cartoonist rant from the clown known as Daniel Mitchell. I do regret wasting my time even opening this nonsense.

PeakTrader some Americans, who visited France, are shocked its per capita income is over $10,000 a year lower than the U.S.,

Once again you are proving how clueless you truly are. Per capita income in France is lower than per capita income in the US; however, that’s entirely because French workers enjoy more vacation time. French workers are slightly more productive than American workers per labor hour. In other words, Americans prefer to take their labor compensation in the form of money wages while French workers prefer to take their labor compensation in the form of leisure time.

https://data.oecd.org/lprdty/gdp-per-hour-worked.htm

2slugbaits, here’s a clue: Working less or being unemployed results in lower income.

That’s one reason French are poorer.

They also have less work experience.

French businesses would rather invest in capital equipment than workers, not because French workers are better than American workers.

Your trolling is embarrassing your poor mother. Stop.

As my wife’s family would say as they enjoy weekends in their second home in the Loire.

Votre ignorance est seulement surpassée par votre stupidité.

Since you have a deep understanding of France and its economics, I’m sure you’ll have no trouble recalling that phrase.

You should move to France, since you’re so smart and well informed – you can have a second vacation home! 🙂

“As people riot in Venezuela….”. Why not throw in the inflation rate in Zimbabwe while you’re at it? I’m sure these comparisons (?) will be crystal clear to all the liberal/socialists who want nothing more than to become economic evildoers here.

A 3 year old link to somebodies blog?

Lulz.

The post lost me at ‘synthetic’.

If you want fiscally sustainable growth, pay for fiscally sustainable growth.

http://thehill.com/opinion/white-house/363820-trump-can-win-on-deficits-solve-the-debt-ceiling-and-own-congress-forever

Meanwhile, this in the WSJ

Wisconsin, Facing a Worker Shortage, Pitches Its Benefits

https://www.wsj.com/articles/wisconsin-facing-a-worker-shortage-pitches-its-benefits-1518431400?mod=searchresults&page=1&pos=5

Steve Kopits: Then don’t bother reading. Problem solved!

In a world where there are no wage ceilings (at least not so far in Wisconsin), why is there a shortage?

I noticed that Steve’s link was to something he wrote. I started to read it but then realized how silly it was.

Steve – nice try at self promotion there!

Why is it silly?

The difference between you and me, pgl, is that you are operating in a one ideology model, and I am operating in a three ideology model.

You think Adam Smith had a carve-out for politicians, and I don’t. You think governance is hopeless, and I think it’s a pretty easy fix. You’re willing to complain about Republican politics, but you don’t have any real constructive suggestions how to manage the situation. I do.

You like politics — and economics — as a hobby. I prefer them as a profession. In a profession, you’re paid for results. You don’t think politicians should be paid for maximizing sustainable economic growth. I do.

So, you’re right, we’re not on the same page.

“The difference between you and me, pgl, is that you are operating in a one ideology model, and I am operating in a three ideology model.”

Now you are simply trolling. Not going to engage in this any more.

Steve, I often wish there was a LIKE button.

I don’t troll people, pgl. I try to teach and learn when I can.

I presume, like me, you live in the US. I am disturbed by trends I see in governance, very much the same trends I saw in Hungary after 2001. In 2005 in Budapest, I had a lunch with my uncle, earlier a noted emerging markets macroeconomist at the IMF and, at the time, on the Monetary Council at the National Bank of Hungary (the FOMC equivalent). He wanted to form a Fiscal Council to oversee fiscal policy in Hungary (which indeed he subsequently did).

I argued that I thought this would ultimately fail, because it neglected to align the interests of politicians with fiscal rectitude. It depended, in its roots, upon that Smithian carve-out, that politicians actually wanted to produce good policy, but were somehow inhibited by, well, something. That was completely at odds with my experience with politics in Hungary, which I would not hesitate to describe as venal. As I have written here before, there’s not a fascist in Hungary who wouldn’t trade his jackboots for a $200k bonus. I wanted to use that venality to improvement governance, no different than in the private sector. I said it 13 years ago, and now am saying it again. There is nothing new in what I am saying.

It also turned out that I was right. Prime Minister Orban disbanded the Council in 2011 and booted my uncle out of the country.

Now, we are facing a similar situation in this country, which I scarcely recognize on some days. If we had a bonus plan as I have suggested, the Republican tax plan would never have passed, the follow-on spending would not have been approved, and policies geared towards greater efficiency and effectiveness in government would be underway. The budget would be heading rapidly towards balance, rather than into its current death spiral.

The matter of aligning incentives is thus not a small, incidental matter. It is fundamental to fiscal policy and regulation, to bipartisanship and potentially to civil society.

The failure of governance in Hungary ultimately led to my return to the US. I would prefer not to have to move again, and perhaps you share that feeling.

To that end, I will do what I can to influence the terms of the debate.

Let me further elaborate.

When I was taking PhD econ courses at Columbia, boy, everyone was really smart. And I sat there thinking, if we’re so smart, why are we working for politicians, and not vice versa?

And then I went to Hungary, and I was shocked by what I experienced. In all those econ courses you take, it is always assumed that decision-makers are actually interested in good policy, as would be determined using economic tools (pick you ideology).

What I found was that there was minimal demand for good governance. And then it slowly dawned on me: In the economics business, we are suppliers of solutions. But that’s only half the equation. You also need demand for solutions.

So how do we create demand for good governance? Historically, it is assumed that politicians are indeed acting in the public interest, that there is demand because politicians are ‘statesmen’ doing their duty. Put another way, politicians are — or at least largely — to assume an agency role with respect to society. In this world, Adam Smith’s notion that men act in their own self-interest is false–there is a carve-out for politicians. Donald Trump, businessman, might be a profit-maximizer, but get him elected, and he’s a humble public servant. You must believe that.

Now, if you are in a one ideology world, then politicians should do exactly what you want, for, say, a fiscal conservative, bring small government, low taxes and a balanced budget. In a three ideology world, politicians can do that, or they can spend a lot of money on redistribution, or start wars — to name just three conflicting policy directions. In a three ideology world, you will face a structural principal-agent problem, because the politician is almost entirely unconstrained, such that policy will generally come down to what is expedient at the moment. (I encourage you to watch the 60 Minutes interview with Kirsten Gillibrand if you want to see this in action.) That is, the principal will come to dominate the agent, and this is the ultimate cause of poor governance and corruption around the world.

To remedy that, I have singled out a single objective function — the fiscally conservative one — and linked pay to achieving these goals. In other words, we are collapsing, in this instance, a three ideology world to a one ideology world and specifically linking pay to performance, that is, we are reasserting control of the voter over the politician, in essence, rejoining the principal to the agent. Doing good is aligned with doing well.

If Walker and the Wisconsin state legislature were paid according to the state’s GDP growth, I can assure you there would be demand for Menzie’s synthetic analysis. Without it, the analysis and Menzie’s writing about is it just a hobby. It may constitute wailing and complaining, but not advice.

“Now, if you are in a one ideology world, then politicians should do exactly what you want”.

No economist that lives in the real world would argue that lawyers (the people that rule everything) always take the advice of economists. I wish there was some solution to this but alas I do not see Steve’s solution as nirvana.

I also wish people here would stop pretending that those who do not take their unique world view are complete morons. We get this garbage enough from Peak Trader. If others wish to behave like Peaky – then I will just ignore their tiresome insults. I suspect others here are already ignoring this senselessness.

Well, we are migrating from ‘silly’ to ‘not nirvana’. That’s progress, I think.

I am not suggesting that incentive pay will bring nirvana. I am suggesting that it represents a different prioritization of policy. For example, we spend upwards of $100 bn in some years in Afghanistan. That would stop.

The $125 bn in McKinsey cost savings at DoD would likely be implemented.

The $100 bn in Medicare expansion that produces $5 bn in benefits would be carved back and turned into a mental heath program.

Things like that. I am not arguing that it would be Pareto optimal in every respect. But in that world, if a program is worth spending money on, it is worth raising taxes for. And if you’re going to borrow money at the government level, it had better generate enough GDP to pay for itself. It brings fiscal discipline, without the constraints of, say, a balanced budget amendment. From the Congressman’s point of view, it’s not Other People’s Money anymore. In that sense, we have created demand for good governance.

As for single ideologies, I think most people have a primary preference and tend to disavow the legitimacy of other ideologies. We do it quite a lot here in the comments section at Econbrowser (and every other website).

The three ideology component is quite important as it is the primary driver of the structural principal-agent problems. Put another way, the fact the government does more than just create the preconditions for wealth creation — it also redistributes monies and uses them to fund destructive warfare — is the very factor leading to poor governance and corruption. The act of defining an objective and linking pay to the achievement of that objective is how we surmount principal-agent problems.

“In a world where there are no wage ceilings (at least not so far in Wisconsin), why is there a shortage?”

During the last 1990’s the hi tech companies of Northern California did not face wage ceilings. But they heavily compensated R&D employees with benefits known as employee stock option compensation. One theory was that they were paying in this form so as not to racket up wage compensation. Benefits can be more easily taken away if the boom ends. It turns out that this was good for shareholders (I guess) but workers saw their total compensation quickly fall. Beware of the short term benefit ploy!

Pgl, I have an anecdote to explain your: ” Beware of the short term benefit ploy!” In the lat 80s to early 90s, I met with the DC Regional Sales manager for Microsoft. His complaint was that he could not get his sales staff to work. His reasoning was he could not incentivize them as they already were millionaires. Why? Because their compensation included stock options in their “short term benefits” packages.

Sometimes ignorance is exacerbated by attitude. You are absolutely correct: “One theory was that they were paying in this form so as not to racket (sic) up wage compensation. Benefits can be more easily taken away if the boom ends. ” Ratcheted up wages are harder to justify in business down turn periods, while options based upon “boom” periods actually don’t need to be taken away because they were based upon boom period performance figures. You seem to think those who received those benefits were sorry to get them instead of wages.

Some people did cash in on those employee stock options. Of course if you received options in 2000 – not so much. What I find galling is how companies like Microsoft wanted to pretend that there was no real costs to issuing these options either for financial statement purposes or for transfer pricing purposes.

Pgl, that’s exactly why options are used: ” Of course if you received options in 2000 – not so much. ” All I am seeing from you and several others is hollow griping with little understanding or acceptance of real word solutions.

Menzie, that’s actually an interesting question. I think shortages around the country are increasingly common. However, a specific shortage in Wisconsin is actually a worthwhile question to explore. It could have to do with relative demographics, ie, more relative aging out in Wisconsin; it could have to do with perceived quality of life, ie, greater challenges in recruiting people from elsewhere in the US. Don’t know the answer. Interesting to examine from the public policy perspective.

And you’re right, I don’t always read the Wisconsin stuff.

The problem I have with ‘synthetic’ is the same as with ‘climate models’. With a synthetic approach, I could tell you that Tom Brady is over-rated. Or I could tell you that he’s the best of all time. Depends on where and how I set the bar.

Steven, there’s that LIKE button issue again.

Thanks x2, CoRev.

To wit, regarding shortages:

https://www.usatoday.com/story/news/politics/2018/02/13/ill-equipped-and-inexperienced-hundreds-civilian-staffers-assigned-guard-duties-federal-prison-secur/316616002/

Prison guard shortage? Maybe this is just another case of where the employer is too keep to pay market wages. A lot of that going around.

A related story:

https://www.seattletimes.com/nation-world/wisconsin-businesses-struggle-with-worker-shortage/?utm_source=RSS&utm_medium=Referral&utm_campaign=RSS_all

‘The large manufacturing industry in the state often can’t offer wage increases due to because staying competitive in the industry leaves little profits, said Sasha Wesolowski, human resources manager for Marquis Yachts in Pulaski. Wesolowski said the company has dozens of job openings with pay that starts at $12.50 an hour. The company has advertised the jobs on billboards, on a local parade float and on postcards to former employees the company previously had laid off. “If we can’t find the people, then we can’t continue to increase production,” Wesolowski said.’

I hope Dean Baker read this and rips it to shreds. Of course one cannot find workers at a low wage of $12.50 an hour. There is no shortage – there are just cheapo manufacturing firms looking for bailouts.

What is it good for. As Keynes said in 1936 it is good for economies which are booming to continue to boom without inflation. ( my words).

Keynesianism calls for much tighter fiscal policy when times are good than classical economics.

Not Trampis: Yes, agreed one wants contractionary fiscal policy when the economy is operating above potential. Don’t know if austerity has to be the way to go — maybe higher taxes, constant government spending, instead of lower taxes and lower government spending?

In Classical or New Classical models, I suspect fiscal policy of pretty much any sort is not welfare improving (marginal tax rates are distortionary, government spending is non-utility increasing). So agreed, Keynesians believe in counter-cyclical fiscal policy.

Menzie your comment “Yes, agreed one wants contractionary fiscal policy when the economy is operating above potential.” exemplifies the failure of the Obama administration.

CoRev Huh??? Since when was the economy operating above potential during the Obama years??? I honestly do not understand what you’re trying to say. I remember that you were one of those early Tea Party activists who thought it was a good idea for government to tighten its belt during a recession just as families had to tighten their belts. Are you trying to tell us that after all these years and all of Menzie’s posts you still believe that Tea Party nonsense?

2slugs, I see your memory has failed you again. Our discussion centered upon the values of types of incentives. You supported the values of Obama’s incentive package and I supported those of Reagan for stimulating the economy short term. The past 9 years shows which approach was more effective.

Take your blinders off, they are limiting your view which devastates your logic. You just gotta believe “crumbs” and business incentives are more effective at stimulating an economy than Obama’s approach which you supported. i can anticipate you counter arguments, but results reality exists in the numbers.

This is CoRev’s response?

“You supported the values of Obama’s incentive package and I supported those of Reagan for stimulating the economy short term. The past 9 years shows which approach was more effective.”

So Obama was a supply-sider and Reagan a Keynesian? That seems to be what he is saying here. But who knows.

Pgl, again your commonsense is lacking. The discussion was between 2slkugs and myself, then and now. You inserted your interpretation without any prior knowledge and IIRC any participation then.

CoRev You supported the values of Obama’s incentive package

Actually, I gave the Obama stimulus two cheers, not three cheers. It wasn’t anywhere near large enough (it should have been roughly twice as large) and it relied too much on tax cuts, which is a very ineffective way to stimulate demand. It was better than the nonsense we heard from the GOP, but it was still not up to the job.

I supported those of Reagan for stimulating the economy short term.

The short term effect of Reagan’s 1981 tax cut was a deep recession, remember? That’s because the Fed had to raise interest rates higher than they otherwise would have raised them. And no one can plausibly claim that so called “supply side” tax cuts have “short term” effects. To the extent that tax cuts work on the supply side the effects take a very, very long time to make a difference. Economists call that a convergence rate, and it typically takes about 20-30 years for even well designed supply side tax reform to show benefits. When talking about the “short term” you’re really talking about business cycle policies; i.e., you’re talking about Keynesian counter-cyclical policies that manage aggregate demand. Reagan’s management of aggregate demand was confused. Fiscal policy was stimulative in the face of high inflation and this pushed monetary policy to be contractionary. It was a confused mess. Only someone who thinks Tea Party economics is sound policy could support a mess like that.

2slugs regained some firing memory cells: ” it relied too much on tax cuts, which is a very ineffective way to stimulate demand. “, but his logic is still failed. Make that case in another few months and even better still next Nov. 350 firms have given out bonuses and raises and some both. Nearly all have cited the TRUMP tax cuts. You and pgl still won’t accept how poorly structured was Obama’s incentive, but more importantly the impact of his follow-on business disincentives.

You also are true with this: “The short term effect of Reagan’s 1981 tax cut was a deep recession, remember?” But the recession followed stagflation. Or are you too young to remember stagflation’s effects?

Actually one could restrain inflation with tight monetary policy. After all this is how we did it in the early 1980’s as Reagan passed a massive tax cut and increased defense spending. And that worked wonderfully – right? Oh wait!

CoRev

I know this can’t compare to your “riveting” story of talking to middle management sales (Sales Dept folks are renowned for talking out of their arse on any topic under the sun) guy at “Blue Screen of Death” Microsoft. Tom Peters and Jack Welch are dying with envy I’m sure.

But the Economic Crisis of 2007-2008, which initiated under “W” Bush and hit the stock market in late Sept 2008, stuck President Obama with an unemployment rate that peaked “officially” around 10%. When he left office it was under 5%. President Obama and Ben Bernanke helped save a complete and thorough clusterF**K handed to them from Henry Paulson and “W” Bush. A crisis instigated by derivatives and credit swaps that Hank Paulson was warned of multiple times was arriving, and ignored</b. These are the numbers encompassing President Obama's entire term, you can plug in any year you like:

https://data.bls.gov/pdq/SurveyOutputServlet

Now, if you choose not to believe those numbers under President Obama, then you can’t happily quote them under the VSG either. I don’t think you’ll find Labor Force Participation Rate, (a number I put more faith in than most people do) to be any better under Trump either, as far as improvement from where the ball was handed off from one presidential administration to the next administration.

CoRev supported those of Reagan for stimulating the economy short term.

After all this time I would have hoped that you would have learned at least a little bit of macroeconomics. During the Great Recession the interest rate was at the ZLB, so that pretty much took monetary policy off the table. That left fiscal policy. The Obama ARRA was a mix of tax cuts and spending increases. Both will increase aggregate demand, but spending gets you more bang for the buck. If you don’t know why that’s true, then please work the math and the answer should be obvious. Reagan actually had two approaches; the 1981 tax cut and the 1986 tax reform. They were polar opposites in terms of incentives and consequences. The 1981 tax cut tended to stimulate an economy that was already suffering from high inflation and low productivity. In order to further combat the 1981 tax cut the Fed had to raise interest rates higher than they otherwise would have. That acted to contract the economy. Basically you had a fiscal policy and monetary policy that were working at cross purposes. Not my idea of an effective mix. Even Reagan’s own economic advisor eventually admitted that the 1981 tax cuts and spending hikes were a disaster. He even wrote an NBER paper on that.

But nothing in your response is relevant to what I asked you. You sniffed at Menzie’s point that a contractionary policy is appropriate if the economy is running above potential GDP. The general consensus is that the economy is running at or slightly above or slightly below potential GDP right now. Note the uptick in today’s inflation and the very high PPI inflation rate. Given those numbers and given the lag time for fiscal policy, the correct policy should be contractionary rather than stimulative. The folks at the Fed are pretty sharp, so I’m pretty sure they will be raising interest rates faster than they would have otherwise raised rates were it not for the Trump tax cut and spending binge.

I might add to this excellent discussion but it seems it would offend CoRev if I did. OK – from this day on, I’m ignoring this insulting troll. I’m sure that would make him happy.

2slugs, what you asked was from a faulty memory. Nuff said!

My point was current history shows which methods were/are more effective. You just repeated your failed past arguments for which their effectiveness have been disproved.

How many more election losses will it take to understand how out of step with rational thinkers are you and those following your proposed norms?

Translation: You don’t know anything about macro, can’t do math and can’t give a straight answer to a simple question. A Trump and Nixon voter through and through. You still didn’t tell us why Menzie was wrong to say that a contractionary policy is appropriate if the economy is above potential GDP.

“You don’t know anything about macro, can’t do math and can’t give a straight answer to a simple question.”

At which CoRev fires about something about calibration and validation. It is like The Onion writes his comments.

2slugs a won point is clear when one side (loser) turns to personal attack while ignoring the discussion issues. My point then and now:

“… current history shows which methods were/are more effective. You just repeated your failed past arguments for which their effectiveness have been disproved. “

Glad I have chosen to stay away from such babbling. Good grief!

corev, your comments about economics are about as stupid as your comments about climate science. they make absolutely no sense. they are irrelevant drivel. you are the guy in the meeting everybody rolls their eyes at when you make a statement of fact about the topic at hand. try and listen to 2slugs for once. he knows what he is talking about. you do not, but pretend anyway.

CoRev current history shows which methods were/are more effective

Yes. It’s also important to get the history right. The Reagan recession was your garden variety Fed induced recession. The Great Recession was a financial recession. Different kind of creature. And if you’ve ever read the academic literature on financial recessions you would know that the US recovery was actually slightly better than expected for financial recessions. If you want to know a failed theory, then take a look at the Reagan 1981 “supply side” tax cuts. They were supposed to increase savings. Savings actually plunged. They were supposed to increase investment. What actually happened was a steep plunge followed by a one-off spike in 1984, then followed by mediocre investment growth that was consistently lower than Clinton. In fact, it was lower than under Carter. If you look at the BEA’s GDP decomposition you’ll see that the bump in GDP under Reagan was primarily due to sharply increased government spending during the middle of the decade. The Reagan “supply side” tax cuts were supposed to pay for themselves, remember? They didn’t even come close. So yes, history is important. But it’s especially important to get the history right. Those who worship St. Ronnie have this annoying habit of misremembering the facts.

I don’t know of any “personal attack” that ignores the discussion issues. If you want to seriously engage in macroeconomics, then you simply have to learn some basic macro. And that means you have to learn some basic 1st semester calculus at a minimum. You need to know that the first derivative of a constant is zero, which is something that’s gotten you into trouble before. It also means you have to understand some basic econometrics. That’s not a personal attack; it’s guidance to help you improve your understanding of macro.

2slugs says: “And if you’ve ever read the academic literature on financial recessions you would know that the US recovery was actually slightly better than expected for financial recessions. ” And that is my explicit point! Obama’s solution was proposed by leading academician, while Trump’s was a business man’s approach.

The difference in results are clear, and becoming more so each month. I’m not pointing out your ignorance just your unrelenting bias.

And once again corev shows he has no understanding of the difference between a fed rates led recession and a balance sheet/financial crisis led recession. He seems to think they are the same. Bottom trader knows better, but still conflates the two in order to promote his ideology. I am under no illusion that corev is intelligent enough to understand the distinction-he is not.

“how many more election losses will it take…?” To prove? That borrowing to enact tax cuts has been good economic policy? That tripling the national debt in an eight year period—accomplished by the same guy who brooded when the debt reached a $Trillion—was no big deal? That two tax cuts enacted with 140,000 troops stationed on two Asian war fronts had no affect on those children whose futures the supposedly frugal deficit “hawks” always crow about? To wade through a budget surplus while arguing that paying down the national debt too quickly might be dangerous? To insist “deficits don’t matter” then insist they do after the deb has doubled under your watch?

The high ground you’re attempting to stand on is made of sand, CoRev.

noneconomist, how much more sticky stuff do you want to throw against the wall in hopes some of it makes sense. What the heck are you claiming? Just what high ground is you think I am claiming? All you have shown is you dislike some policies.

You did a nice self description when , from your mountain top, you proclaimed , “Sometimes ignorance is exacerbated by attitude.” Physician heal thyself.

@ Menzie

I read in Krugman’s most recent NYT column that he thinks this most recent “stimulus” plan, adds up to about $200 billion in actual stimulus. I’d be curious if you agree with Krugman’s number, and I’d also be grateful if you could give us a rough idea how he came to that number mathematically from the bill?? Not that I doubt him, I honestly would like to know. Here is the column.

https://www.nytimes.com/2018/02/12/opinion/donald-trump-infrastructure.html

I’ve explained before, monetary policy didn’t create Reagan’s V-shaped recovery. It was a combination of tax cuts-defense spending-deregulation-optimism. When the strong recovery was underway, taxes were raised and spending reduced, although, Reagan didn’t get the promised domestic spending cuts. “Reaganomics” was highly successful and lead to the peace dividend (including getting the Saudis to lower oil prices to help defeat the Soviet Union), contributing to strong growth in the ‘90s.

“I’ve explained before, monetary policy didn’t create Reagan’s V-shaped recovery. It was a combination of tax cuts-defense spending-deregulation-optimism.”

We saw your mansplaining. It was your usual incoherent gibberish. The rise then fall in interest rates was irrelevant? The massive appreciation of the dollar followed by a reversal (devaluation) was irrelevant? Lord – no wonder you refuse to answer Menzie when he asks you which text books you studied from! They were written in canyon.

I’ve explained monetary policy is asymmetric and you responded with your usual ignorance.

You clearly have no clue as to the meaning of the words you incessantly babble. People would learn more by talking to a dead tree.

“monetary policy is asymmetric”.

OK if interest rates were zero in 1983 then a monetary stimulus might have been ineffective. If Bottom Feeder thinks we were at the Zero Lower Bound in the early 1980’s then he is dumber than we give him credit for.

A number of Keynesian structuralists (mostly Neo-Marxist) have promoted the same policy as President Trump over the years: stimulative deficit-financed spending throughout the entire business cycle.

This is Trump simply showing us that when it comes to policy, he is eclectic and open-minded. Trump is signalling that he is an interventionist just like left-wing ideologues and politicos.

Oh you are talking about Bernie Bros like Gerald Friedman and J.W. Mason. Sorry but these two are not the brightest pencils in the Keynesian box.

Erik Poole: Not sure Post-Keynesians would have supported a tax cut aimed at wealthy and corporations, since some of these approaches rely on a chronic underconsumption perspective. Tax cuts and government transfers/spending on low income household which have high marginal propensities to consume would make more sense.

I would say the tendency to foster explicit links to private sector capital with heavy state intervention (heavy hints as to where to invest; tariffs and protection), elimination of technocratic centers of policy implementation, is reminiscent of 1930’s Germany and Italy economic policy.

There were those who believed economic adviser Cohen when he said the then proposed tax cut–about a $thousand on average– would enable middle class families to remodel a kitchen, take a family vacation, buy a new car. There’s a term for those who swallowed that line. No, not neo-Keynesian. More like “easily confused and misled” and definitive proof that P.T. Barnum knew of what he spoke.

NON, what an amazingly STUPID and biased (not ignorant) comment: “would enable middle class families to remodel a kitchen”. I just got off the phone with my son who was discussing the crumbs evident in his pay check. His first comment was he was going to redo his kitchen.

There are many, “easily confused and misled”, biased to denigrate the ?crumbs? made available by this tax change. How disconnected from real folks are they? Obviously enough to misunderstand the reasons their party lost the past national election. Sad, really!

CoRev: your disputacious attitude seems to cloud, hinder your common sense. As well as your apparent ability to comprehend what I said. Best of luck to your son if he can succeed in remodeling his kitchen on Cohen’s average $1000 tax cut (the subject of my comment). Even better luck if can take the family of vacation for that same amount. and may God bless and honor him if he successfully buys a new car for less than five substantial figures.

And speaking of kitchens. Two years ago, we (well, not me) decided to replace our 36 year old oven, cooktop, and range hood/fan. We’re frugal folk and don’t waste money easily. We chose a popular American brand (assembled, it said, in Georgia), in the middle–a bit lower, actually– of the price ranges available. We did no other remodel. No new cabinets, no new counters, no new wall coverings, no new floors, no new sink.

Even so, , that average $1000 touted by Cohen was bypassed quite easily. The new stuff does work nicely.

And then, last fall, it was necessary to replace two 37 year old rain gutters (big ones) that finally met their match in last year’s torrential rains. Got the best deal I could from my long time AC/sheet metal guys and had the gutters cut and installed before the rainy season. Wouldn’t you know, that mythical $1000 was bypassed again.

Of course, $1000 is not crumbs, but your apparent disputaciousness really has clouded/hindered your ability see the world clearly .But, as I said, best of luck to your son on the remodel, especially one that can be accomplished for Cohen’s average $1000 cut.

I would also be interested to know what car can had for the same figure. I’m thinking a heavily used Yugo? One, no doubt, that could serve as a useful carrier for that $1000 family vacation.

Keep me informed, please.

noneconomist, at least you were funny. You are using an approach, spreading the impact of the crumbs, that mattes: “Two years ago,…” and “And then, last fall, …” I presume in the intermediate year you could have put a down payment on a car or even gone on a nice but inexpensive vacation for those crumbs. Oh, except, that was under Obama and they were not yet available. More likely in the intermediate year you paid for health insurance, although that should have $2500 less if you believed the lies.

Just wondering.

Well, CoRev, did a little more checking on kitchen remodeling and, not surprisingly, your comments are more STUPID–way more– than mine!

As a reference point, a few years ago, in-laws did a complete kitchen remodel, the works: stove, counter tops, cabinets, floor, sinks new island, , paint, even a new refrigerator. They did so before retirement and shelled out about $17,000. That would now require a tax cut of about $1,416/month, but keep in mind, that remodel was completed in 2008.

How about now? Well, just checked prices on only hardwood flooring on one of the big home improvement sites. Lowest cost/sq.ft. is $3.79.

If I redo my kitchen, dining area and small downstairs bath, I’m conservatively figuring about 300 sq.ft @ $3.79. Add in sales tax (7.75%) and materials will run $1225. Of course, that does not include installation. (If your son’s tax cut is $100/month and his square footage is similar to mine, he’s got enough to proceed. But you said “remodel”, so we’re a long way from being done. As one salesman once told me, if you do cabinets, you probably have to do counter tops, and if you do those, you’re probably also thinking sinks……)

Oh yes. Cohen did say AVERAGE tax cut, which suggests you don’t understand “average,” making that possible $1000 AVERAGE tax cut look even more Barnumish given the figures I just quoted.

Good news: We–as in We the People–are borrowing more money to finance those tax cuts for your son and for me. That will balloon those deficits you were formerly so concerned about and will drive up the national debt that has long been a sore point with you. But now you can tell those worriers like Orrin Hatch (“trillion dollar deficits as far as the eye can see…”) to stop worrying and enjoy the ride. Even for those whose tax cuts won’t afford them the luxury of being able to afford that heavily used Yugo.

Noneconomist, what a sad testimonial to liberal thinking. You obviously believe only a complete do-all one time approach is the only way to do an improvement. Even though your own examples showed a timed and gradual approach works for spreading the impact of the crumbs.

On an economics blog why are are many, so “easily confused and misled”, and/or so biased to denigrate the ?crumbs? made available by this tax change? Where cumulative effects of one time events are studied, why would cumulative effects of on going increased incomes be such an issue? The same group who defended/believed the lies about Obama-care believe the lies about the impacts of the Tax Reform crumbs.

Give an ole guy some love here, and help him understand what motivates these beliefs. Baffled, this is your chance actually add value to this blog.

CoRev, what a sad testimonial to _____________ thinking. (Left blank because you’re farther from conservatism than I, and your failure to come to grips with that has clouded/hindered whatever principles you think you have). Safe to say, a spokesman for conservative economic thought, you’re not.

Unable to refute my comments, you slide to a supposed lament of my beliefs .

If I’m easily confused about the economic adviser TO THE PRESIDENT who claimed you could remodel a kitchen for $1000, cease the personal put downs and explain my mistakes. Do so by omitting the “Obama didn’t give you a tax cut” (unless you also reference increasing deficits that will finance such a cut).

It’s not necessary to prove a point by calling someone stupid, in capital lettters, no less, especially when you otherwise offer very little in the way of rebuttal.

noneconomist, the rebuttal has been included – twice. I even used your own series to exemplify. Jobs do not have to done all at once. What amazes me is how disconnected are folks like you and Pelosi (Ms Crumbs) to understand how that nice increase in “take home pay” will help in so many ways.

“…folks like you and Pelosi…” Of course.

What amazes me is you think you rebutted anything.

noneconomist, of course I didn’t rebut anything. I rebutted your contentions that the tax reform crumbs couldn’t be implemented to redo a kitchen, because it can only be done as a single effort. A stepped approach based upon the increase in “take home pay” due to the tax reform is clearly possible.

This is an economics blog. Please stop the ideological commenting and discuss economics of Cohn’s example.

noneconomist, while on the subject of this being an economics blog your examples ignore factors like immediately spendable “take home pay” , and leverage of that immediately spendable increase, and terms such as loans equity and others (leverage), and multipliers ( perhaps most importantly self reliance) where a DIY approach is embraced.

It’s obvious your ideology over rides common sense.