Accounts suggest Section 301 based sanctions on China on up to $60 billion worth of goods. [1] [2] Retaliation seems a real possibility. It’s interesting to consider likely targets, geographically.

Figure 1: 2017 state level exports to China, in billions of USD. Source: BuCensus via ITA.

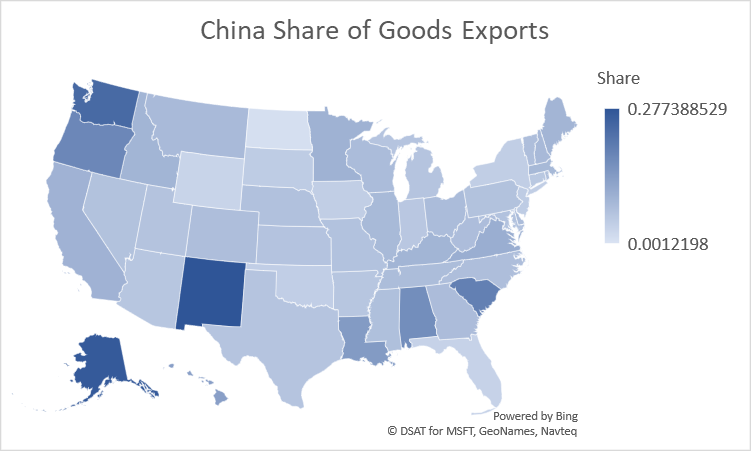

Figure 2: 2017 exports to China as share of total state level exports. Source: BuCensus via ITA, author’s calculations.

What products would be hit? From Landler & Rappaport/NYT:

Experts worry that the United States’ actions could ignite a trade war, noting that Chinese economic officials have a keen understanding of the American system and are good at designing targeted retaliatory measures against American agricultural products and other exports.

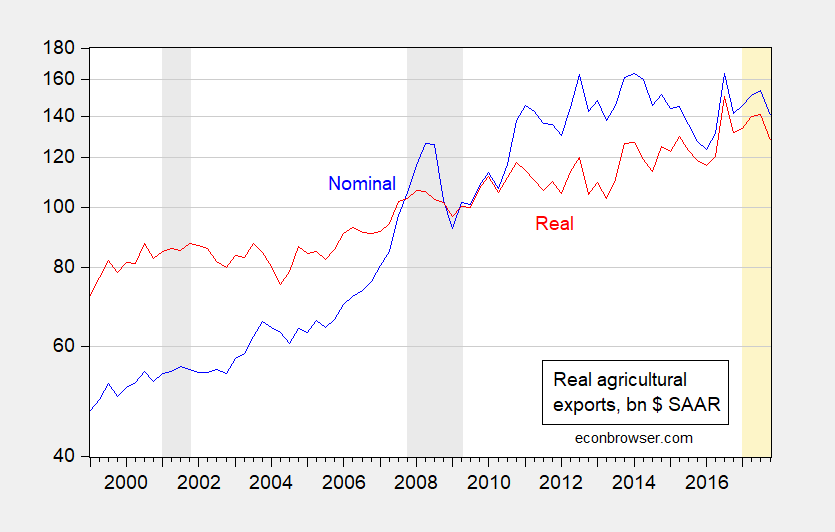

Soybeans are one likely target; in 2016, the US exported $14.2 billion to China. China has already started an investigation of US exports of sorghum to China, after the solar panel tariffs, as a hint of what might be yet to come should the US pursue further sanctions. $14.2 billion is a little over 10% of 2016 total agricultural exports of $140 billion. And agricultural exports have already been under pressure over 2017, as shown in Figure 3.

Figure 3: Agricultural exports in billions 4 (blue), and real agricultural exports in billions Ch.2009$ (red), both SAAR, on log scale. NBER defined recession dates shaded gray. 2017 shaded orange. Source: BEA, 2017Q4 2nd release, NBER and author’s calculations.

Illinois and Iowa are the top two soybean producing states.

I do wonder where this will end. Does Mr. Trump expect the Chinese to hold back? Do they need exports more than we do? Right now, maybe yes. True in a year, if the economy slows down?

The entertainment never stops does it?? How is Sonny Perdue going to wrangle this one out with all his farmer pals?? I don’t see a “follow thru” on this, and I don’t see how Sonny Perdue keeps his stature with farmers (family or conglomerate) if he just sits there and goes along with this. If this is actually followed-thru on, then I see a replay of the Gary Cohn resignation, minus being Jewish and watching the VSG praise Nazis 10 feet to his left and having a much earlier and more valid, morality wise, reason to resign his post.

https://www.youtube.com/watch?v=lj60OAh7O5U

Only a chicken hawk draft dodger like Trump would think anyone wins from a war. People who actually served on the battle field realizes everyone loses from wars.

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c5700.html

U.S. Imports from China by 5-digit End-Use Code 2008 – 2017

Take a look at (14100) Iron and steel mill products.

Our imports of steel from China last year dropped to only $326 million. We import more steel from Sweden!

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c5700.html

Our exports to China!

(00100) Soybeans leads the list!

We also export over $10 billion of cars to China.

In a year, the economy will not slow down. Though Menzie prays for that.

In a year, the economy will quite probably slow down, not because of religious intervention, but because the economy is near full employment and expanding faster than its potential growth rate.

Let’s not allow our political views to get in the way of economics.

TalkingPointsMemo features an informative AP story on the new trade wars:

https://talkingpointsmemo.com/news/trump-punish-china-tariffs-60-billion-products

A few facts on soybeans:

https://ycharts.com/indicators/us_soybean_price_world_bank

Price = $418/ton

Production by country:

https://www.worldatlas.com/articles/world-leaders-in-soya-soybean-production-by-country.html

“1. USA (108.0 million metric tons)

In the US, soybeans are the dominant oil seed, and account for 90 percent of the nation’s oil seed production, according to USDA. That is an agricultural commodity class that also includes canola/rapeseed, sunflower, and flax seeds, as all of these are produced into vegetable oils. The US accounts for 34 percent of the world’s soybean production. At 42 percent market share, it’s also the largest exporter of raw soybeans according to Commodity Basis.”

We are the largest producer of soybeans with annual revenues near $45 billion per year.

“4. China (12.2 million metric tons)

China accounts for 4 percent of soybean production in the world, according to Commodity Basis. Much of the country’s”.

China is the 4th largest producer with annual revenues of only $5 billion per year. They import about $13 billion of soybeans per year from the U.S., which represents about 30% of the demand for U.S. soybeans.

If China limits imports of U.S. soybeans, American farmers will lose big time while those Chinese soybean growers will do very well.

Rough year for China to target soybeans, holdover stocks are low and Argentina is deep in drought. Interesting times. Anyone here have expertise in ag exports.? How much can China deny its people, as it tries to juggle corn soybean and cotton?

Ed

Your comment suggests soybean prices are high from a lack of world supply. Did you see my chart of soybean prices as they are now only $418 per ton as opposed to $591 per ton 4 years ago. I’m sure the Chinese people will find plenty of sources of food on the world market but with 1/3 of US production of soybeans being from exports to China – I’m also sure US farmers will suffer.

The U.S. is not alone: https://thediplomat.com/2017/12/eus-new-anti-dumping-rules-threaten-trade-relations-with-china/

China’s strategy for decades has been to target specific industries and then, through dumping, cripple those foreign producers and create a dependency on China-sourced goods. https://www.ft.com/content/25975472-ea30-11e7-8713-513b1d7ca85a

The ill will felt by Beijing over its status within the WTO may deepen following a decision this month by the US, EU and Japan to form an alliance to take on China over allegations that it unfairly subsidises its industries, forces foreign companies to transfer technology and engages in other unfair practices.

Let’s take this from your story:

“In recent years, European industry has dealt with imported products being sold at prices below the cost of production (ie “dumped” prices), causing financial damage. The main modifications in the anti-dumping legislation framework are expected to improve transparency. Dumping is calculated by comparing the export price of the product in the EU with the domestic price in the country where it is produced. However, this method proved ineffective in pinpointing state interference, which distorts the European market. Especially in countries with regulated markets (RM), the authorities extensively control or subsidize exporting enterprises, directly affecting the prices of products. In these cases, new benchmarks for the costs and sale of products in countries with a similar economic development as the exporting country will be taken into consideration. The Commission will be in charge of preparing reports vis-a-vis each country’s market data.”

I’d call these BS benchmarks. It is way too easy to blame low prices on alleged dumping. I guess European companies are as afraid of global competition as the U.S. companies living off the government dole here.

pgl, I’m just going to guess that the EU doesn’t care if you call their benchmarks any of a number of derogatory terms.

I wonder if China’s plan to launch its long-awaited crude oil futures contract on March 26 has anything to do with the current US trade war against China?

I think it would be a long drawn trade war as part of US’s overall aim to prevent any other country from overtaking US as a most dominating country on this planet. What we are seeing now are just initial tactical maneuvers and test skirmishes. There are more and bigger trade battles coming.

Two serious questions: (1) how should a country react when another country steals its intellectual property? (2) Should trade policy differ based on the type of government a country has. For example, should the fact that China is a communist country without free elections, freedom of speech, press, religion, and other freedoms alter how the US should structure it’s trade agreements with China?

Tom: (1) A targeted approach makes more sense than a blunderbuss. (2) Yes, perhaps we should adjust trade policy for gross violations of basic human rights, etc., as well as use of chemical weapons in international arenas. So maybe complete autarky with respect to the Russian Federation would make sense…By the way, as a designated nonmarket economy, China does operate under more restrictive rules on application of safeguards, anti-dumping, than other countries.

Menzie makes a great point: With the possible exceptions of freedom of information (internet, newspapers, TV, etc) and the stealing of intellectual property (although that might have more to do with sheer intelligence and something inherent about Chinese culture which makes them masters of copying others better ideas), it’s hard to think of any human rights violations or other “sins” that the Chinese government does that the Russian government doesn’t also do. China has some serious violations that rarely enter the open conversation (such as prisons similar to North Korea’s that qualify more as concentration camps than prisons). Han Chinese leaders driving their foot down on Xinjiang, Tibet, and Inner Mongolian people’s necks, which for some strange reason never seems to enter the consciousness of Han Chinese as the same as how Americans have treated blacks, as Han Chinese view themselves as near Saints on racial issues).

With the possible exception of chemical weapons in Syria which was approved by Putin (which I can think of Chinese examples that even make that arguable), I would say on morality/human rights issues they match each other very comparably.

Tom

(1) how should a country react when another country steals its intellectual property?

Speaking strictly about the economics, it’s not obvious why a country should react at all. Granted, there might be some non-economic reasons; e.g., stealing advanced military technology, but here I’m restricting my comments to economic considerations only. Stealing intellectual property, whether it’s between countries or between companies, hurts one party and advantages another party. But there is also a third party and that third party wins either way. Stealing intellectual property really means stealing the monopoly rents attached to that intellectual property. Stealing that intellectual property certainly hurts the company that legally owns that property because it loses future claims to monopoly rents. But that also means third party consumers reap the advantages of competition. Stealing intellectual property is only an economic problem if doing so inhibits companies from doing future R&D. In other words, too much stealing discourages future R&D, but too little hurts economic growth. This whole issue of stealing intellectual property would be less of a problem if governments funded more basic R&D and made it freely available. And it would be less of a problem if we had large multi-national trade agreements like TPP rather than bilateral tariffs.

(2) Should trade policy differ based on the type of government a country has.

Are you asking this from a moral perspective, or an economic perspective?

That is a great rebuttal to this nonsense from Martin Feldstein:

https://www.project-syndicate.org/commentary/trump-steel-tariffs-targeting-china-by-martin-feldstein-2018-03

Brad DeLong also mocked the idea that the Trump team is even smart enough to be running this strategy.

Slugs, I get the economic arguments. I guess from a moral perspective, though, I just don’t like letting cheaters get away with cheating, even if it does bring benefits to us. Maybe I’m too honest or the nuns over-indoctrinated me about being fair. And I still just think that freedom is something America should stand for and expect from our friends. We may not be perfect, but it still just leaves me uncomfortable that we’re so intertwined with a country that just doesn’t believe in freedom and democracy like we and other first-world nations do.

None of those seemed to matter with us relations with the saudis for one

Menzie

Will you now expand on your remark of March 1,” January Goods Trade Balance Dives”

“I think I’ve had enough of “winning so much”. ”

https://econbrowser.com/archives/2018/03/january-goods-trade-balance-dives

What is your solution?

Perhaps lost to some due to the big section 301 news, the following countries are currently exempt from the national security tariffs on steel and aluminum going into effect tomorrow, Friday. The European Union, Argentina, Brazil, South Korea and Australia, Canada and Mexico.

Ed

We get 25% of our imported steel from Canada and Mexico. Making them exempt is odd unless Trump simply intends to push certain Asian nations.

Oh wait – South Korea is also exempt. They are the 3rd largest exporter of steel to the US with Canada and Mexico being #1 and #2. So this is targeting China where we do not import that much steel from and perhaps Japan.

Is anyone in the White House telling Trump ANYTHING with respect to the real world data?????

Another good story from TPM – this one noting the stock market crash tying it to Trump’s trade war:

https://talkingpointsmemo.com/news/stocks-plunge-china-tariffs

Hard hit were Boeing and Caterpillar.

Through intellectual property theft, China has ripped off American businesses. The communists have no respect for property rights.

“Intellectual-property theft covers a wide spectrum: counterfeiting American fashion designs, pirating movies and video games, patent infringement and stealing proprietary technology and software. This assault saps economic growth, costs Americans jobs, weakens our military capability and undercuts a key American competitive advantage — innovation.

Chinese companies have stolen trade secrets from virtually every sector of the American economy: automobiles, auto tires, aviation, chemicals, consumer electronics, electronic trading, industrial software, biotech and pharmaceuticals. Last year U.S. Steel accused Chinese hackers of stealing trade secrets related to the production of lightweight steel, then turning them over to Chinese steel makers.

Perhaps most concerning, China has targeted the American defense industrial base. Chinese spies have gone after private defense contractors and subcontractors, national laboratories, public research universities, think tanks and the American government itself. Chinese agents have gone after the United States’ most significant weapons, such as the F-35 Lightning, the Aegis Combat System and the Patriot missile system; illegally exported unmanned underwater vehicles and thermal-imaging cameras; and stolen documents related to the B-52 bomber, the Delta IV rocket, the F-15 fighter and even the Space Shuttle.”

Dennis C. Blair is a former director of national intelligence and a former commander in chief of the United States Pacific Command. Keith Alexander is a former commander of the United States Cyber Command and a former director of the National Security Agency.

https://mobile.nytimes.com/2017/08/15/opinion/china-us-intellectual-property-trump.html

Intellectual property and the U.S. economy:

https://www.uspto.gov/sites/default/files/documents/IPandtheUSEconomySept2016.pdf

PeakTrader I skimmed your link and looked at the references. It reads like the usual crap I see coming out of state and local economic development agencies that always end up recommending tax credits and taxpayer funded incentives. Not my idea of real economics. Sorry, but the paper doesn’t make a very good economic case. And note that almost all of the references come from other government offices that have an institutional interest in promoting intellectual property rights. And there’s a lot of really bad economics. For example, the contribution to GDP they cite includes monopoly rents. I think a real economic analysis ought to be more concerned with foregone consumer surplus. It also ignores the drag on innovation that results from IP rights that are too restrictive and too long lived. Almost any paper on growth economics written over the last 25 years recognizes that technology has to spread in order to increase growth rates. The whole point of IP rights is to contain the spread of technology, not expand it. In other words, owners of IP are primarily interested in harvesting rents, not making it widely available for other researchers.

Also, a little note about general officers. I’ve known a LOT of general officers. Most of them are pretty sharp. Most only have a “general” knowledge about a lot of things, but that knowledge tends to be very thin…basically whatever can be distilled into a couple of Powerpoint slides. Military officers rotate through various areas on a 2 year cycle; e.g., a couple years in human resources, a couple years in operations, a couple years in logistics, a couple years in finance and accounting, etc. They get a working familiarity with topics, but not deep knowledge. So don’t be overawed by an op-ed writer just because that person was a general officer. Yes, most of them are smart, but not THAT smart.

2slugbaits, you don’t believe the director of National Intelligence and the director of the NSA know what’s going on?

And, thanks to American innovation and intellectual property protection, the U.S. leads the rest of the world combined in the Information and Biotech Revolutions, in both revenue and profit, in spite of massive intellectual property theft – the U.S. and the rest of the world benefited tremendously from U.S. innovation.

Why allow the communist Chinese to steal, cheat, and copy from American businesses, on a massive scale, when law abiding competitors and consumers pay?

PeakTrader Calm down. It’s important to distinguish between a national security argument and an economic argument. Certainly there are valid national security reasons to worry about IP theft. But the economics are a completely different matter. IP rights are intended to benefit the owners of those rights, not consumers and potential competitors. In general consumers are better off if IP rights are only weakly enforced. Economically there is no difference between a country stealing from an American firm’s IP rights and some other American firm stealing from that American firm’s IP. Whether the theft is offshore or within American shores makes no significant difference.

Clearly there is a legitimate reason for wanting to protect IP rights; viz., the prospect of temporary monopoly rents provide an incentive for new innovation. But there’s a downside to IP rights, and that is that they can also dampen innovation. The trick is to find the right balance. And here recent American law has gone off the rails. Our patent and copyright laws extend IP protections way too long. That imposes a huge cost on innovation. Shortening the life of a patent or copyright would remove a lot of the incentives to steal IP.

Why allow the communist Chinese to steal, cheat, and copy from American businesses, on a massive scale, when law abiding competitors and consumers pay?

Why should we allow copyright protections that go back almost 100 years? Why should people have to die because Big Pharma is allowed to squeeze obscene monopoly rents because of ridiculously long patent protections? Recall that the Constitution specifically says that the granting of patents and copyrights is a conditional right, subject to the condition of spurring further innovation. The Constitution does not grant holders of patents and copyrights the unconditional protection of the US government.

Two additional points. First, a lot of the IP stuff that’s being stolen by the Chinese is in the entertainment industry. I have a hard time getting too excited about the Chinese creating bootleg copies of bad Hollywood movies and hip-hop downloads. The other point is to remind you that the US did not recognize international patents until the turn of the 20th century. American inventors stole IP rights for things like telegraphs, steam powered transport, light bulbs, gasoline engines, etc. It was precisely because those European inventions were stolen and then improved upon that we saw a burst in the kind of innovation that Robert Gordon likes to cite.

2slugbaits, you’re assuming weaker intellectual property rights will benefit society more.

However, we know, existing intellectual property rights benefitted the U.S. and the rest of the world tremendously.

Weaker intellectual property rights may result in much less innovation.

Technological progress will continue and make intellectual property rights obsolete.

Leave it to BottomFeeder to measure Biotech in terms of profits rather than lives saved. I bet the only way you make money off of this is insider trading.

“2slugbaits, you’re assuming weaker intellectual property rights will benefit society more.”

His assumption is basic economics. We realize that you flunked Econ 101 but on this one we score it for 2slug. Game. Set. Match!

Of course you are talking about monopoly privileges where American companies have ripped off consumers. Leave it to BottomFeeder to support such economic inefficiency!

More unsupported assumptions by Pgl, who has only name calling and nonsense instead of economics.

Another desperate and pathetic attempt to fool people.

“More unsupported assumptions”. WTF? If you do not get the whole point of patents is to gain monopoly power then you are dumber than we give you credit for!

Some comments are just too dumb to ignore.

Pgl again strikes the pose of (S)uper economist and forgets the main purpose of patents: “The main purpose of patents is to protect innovative products and processes from unwanted copying.” The secondary purposes includes enhancing the environment for those who do innovate and take the risk, by giving “Patent owners gain a territorial monopoly right of use for a limited period.”

In pgl-world, ignoring the good and IMPLYING the patent protection mechanism is bad, is some how not dumb nor disingenuous. Our patent and property rights protections have no benefits to the US and HISTORY clearly shows the superiority of his singularly disadvantageous view. Only in pgl-world, certainly not in the real world, is public domain and open access THE BESTEST OF ALL ECONOMIC APPROACHES. Just look at China where it where it is working so well compared to a protectionist economic approach.

What was Trump’s comment about some trading partners laughing at us???? It is views and comments like pgl’s that caused Trump’s truth speaking.

The irony is that one of the reasons soybean farmers supported Trump was his implied promise to make Iowa’s Governor Terry Branstad the US Ambassador to China. Gov. Branstad had a long personal relationship with President Xi Jinping, so Iowa soybean farmers thought they had an insider advantage if Trump won. Once again, the rubes got played. They should have seen this coming because Trump was promising tariffs against China, so why is it such a big surprise that the Chinese are likely to retaliate with import restrictions on corn and soybeans. Dumb asses.

This is what I love about the Trump rubes (as you call them). They will drone on and on repeatedly how “Trump values ‘loyalty’ “. What kind of attribute is that when the “loyalty” is only a one-way street for the SOB??

Agree with Menzie that Trump’s trade response is a bad solution. However, we have been in a trade war with China for a long time, during which China amassed over $3.2 trillion in foreign exchange reserves. (The U.S. holds only $0.1 trillion of such reserves.) The only purpose of amassing so much foreign reserves was to follow a policy of export-led growth, after Japan’s model (Japan holds $1.2 trillion in such reserves). It’s just that the U.S. never responded. Even Krugman decried China’s behavior (saying “go Schumer” in a NYT op ed). Currency intervention of such magnitude (accompanied by capital controls) is far more effective at improving a county’s trade balance than tarifs or quotas, as the policy simultaneously subsidizes exports and taxes imports. It’s probably too late to do much, if anything, about the damage the practice did to U.S. industries. When responses were proposed, callow economists chastised them as “protectionist” and extolled the virtues of free trade, often assuming that people who disagreed with them didn’t understand comparative advantage. I wonder how many of these economists understood that a sufficiently distorted exchange rate can give a country an absolute advantage in everything. (In this regard, our international trade laws are mostly outdated, the equivalent of the French Maginot Line, in combating trade mercantilism in today’s world.)

Equating huge foreign exchange reserves with evil mercantilism is oversimplifying. The third largest holder of foreign exchange reserves is Switzerland ($0.8 trillion), but the Swiss would otherwise have found their local producers devastated by the appreciation of their currency that came from fears of instability of the euro, which caused many to try to protect the value of their cash holdings by converting them to Swiss franks. But can you find a similar justification for China’s massive holdings?

don assuming that people who disagreed with them didn’t understand comparative advantage. I wonder how many of these economists understood that a sufficiently distorted exchange rate can give a country an absolute advantage in everything.

Recall that a country can have an absolute advantage in everything, but that does not mean it has a comparative advantage in everything. Even if a country has an absolute disadvantage in everything, that country will still have a comparative advantage in at least one thing.

True, but that is the purpose of the exchange rate – it gives a country a price advantage in goods or services where it has a comparative advantage. I was merely pointing out that if the exchange rate is sufficiently distorted, a country could find itself with a price advantage in international trade in ALL goods and services. Of course, even China never reached this extreme, but it clearly moved the line between ‘exportable’ and ‘importable’ to enable it to export a lot of goods for which it did not have a natural comparative advantage.

It has been China’s assertion that part of the trade balance problems with US is that US has been refusing to sell to China products that China wants to buy especially those with high technology content.

1. With USD being the global reserve currency and with many countries keeping equivalence of thrillions USD as reserve, wouldn’t USD being global currency structurally induce or entail or imply trade deficits for US for for the freebies US enjoy from printing reserve currency?

2. US has been spending many thrillions on wars over last 50 years, who(and why) is obliged to balance trade deficits with US that were attributed to wars? How(by starting wars like US to create needs to import from US)?