Source: ino.com.

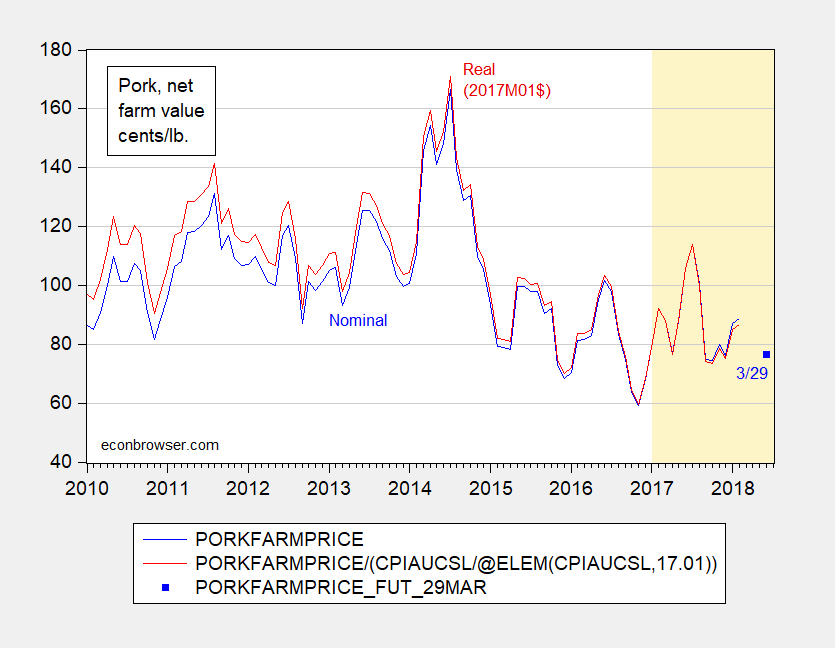

Section 232 measures were announced to be announced on 7 March, Section 301 measures on 22 March. China’s retaliation was announced on 23 March. Figure 2 depicts the evolution of hog prices:

Figure 1: Pork prices (net farm value, cents per pound) (blue), 29 March futures for June (blue square) (2017M01 cents per pound) (red). Real is CPI-all deflated. Source: USDA, BLS, INO, and author’s calculations.

Hogs were a warning shot. Fuller retaliation would likely include soybeans. Would the Chinese follow through? Markets seem to ascribe some likelihood of a more serious strike.

My view: Ag country has reason to worry.

For us’uns who buy our pork at the supermercado, that is the price we see. Wonder how these events will filter down to the supermercado?

Seems like some 50 or so years ago when I read the National Fisherman for the articles on boat building, I also found an article on the price of fish at the boat vs the price in the supermercado. The boat price jumped around with size of the landings and the market price was very stable.

Economics would tell us the price will go down. However, there are entire books dedicated to the topic of “sticky prices”, one of which I purchased and am ashamed to admit I probably haven’t gotten around to reading 10 pages yet:

https://www.amazon.com/Asking-About-Prices-Understanding-Stickiness/dp/0871541211

Here is a free white paper by the same author on the same topic:

http://www.nber.org/chapters/c8331.pdf

I’ve read newspaper articles in WSJ and other sources that say that dairy producers have such a surplus of milk in recent years that they literally (and intentionally) throw large portions of milk out. As someone who detests waste (my father was a Depression baby) it’s offensive/shocking to read at first—then not so much when you think of how dumbly America does many things.

It’s interesting that restaurants and grocers have always claimed that the cost of transporting food is a large part of the cost they “pass on” to the customer. One might ask “Since truck fuel is a big part of the transport cost in the food industry, looking at this graph (if Menzie or other commenters have better graphs or barometers of fuel cost I happily welcome it) why since roughly the last quarter of 2014 we haven’t seen any difference in food prices in general??”:

http://www.infomine.com/investment/metal-prices/crude-oil/5-year/

The pragmatic part of me tends to agree with what you imply at the end of your comment Mr Dogbert—that since this would imply a downward movement in prices (through the supply chain), I doubt the end consumer (you and me at the supermercado) will benefit one damned red American penny from it. That would be my prediction on the matter for end usage consumers.

Burning Question of The Day: Does this mean my doufu is going to get more expensive at Wal Mart?? I like to fry my doufu in a pan with a thin coat of oil and then shake on a liberal amount of cayenne pepper (and very tiny, error on the small side amount of salt). I call it “Degenerate Laowai’s Bean Curd”. It’s an acquired taste. Best served with Harbin beer or any beer of the Liaoning region. If you don’t have that choice here in America, this is your go-to “stand-in” beer:

https://www.flickr.com/photos/ulteriorepicure/222931827

Trust me kids, I’m a professional.

Menzie

So you have taken up the challenge of becoming an agricultural economist. Congratulations. I hope that I had some part of your decision as I have asked you about that several times. Haven’t had much small successes like that in my life. The agricultural people will be the better for having you there with them.

Ed

Ed Hanson: I’ve written on ag and ag policy since 1982. See the farm policy chapter in The Policy Game by Peter Navarro. I was the RA on the chapter. See also this article coauthored with Navarro.

Menzie, with all due respect (And I genuinely have a high regard for you and respect you as a teacher and your intelligence), I don’t think working with Navarro is the part of my resume I would “highlight” if I was you. You may find yourself denying you ever knew the man, not far in the future. Kind of like the Biblical story of Peter and the crowing of the rooster. Which would make Navarro……. OK, let’s pretend I never mentioned this analogy.

Peter Navarro back in the 1980’s still had his sanity. Are you saying Menzie should have predicted Navarro’s turn on anti-Chinese nonsense simply because they wrote a good paper way back then? As Krugman once noted – Glenn Hubbard is a good economist when he wants to be.

@ pgi

Your point is valid and noted.

Still don’t know that I would want to be associated with the man who gives validation to potentially semi-demolishing world trade. Herbert Hoover was a stand-up guy an many ways. Don’t think I’d be running around telling everyone I co-authored a book on stimulus and fiscal policy with the man.

Here’s a more recent update from Bloomberg. I did a search for agricultural commodity blogs, and found really nothing. Zerohedge is good at selling silver and gold commodities to people to make their advertisers happy, and occasionally ZH will swerve over to agriculture commodities if it suits their inflation propaganda, but nothing really there. I know blogs have kind of passed their glory days, but I can’t believe there aren’t 3–5 good ones out there. If anyone knows some good blogs that specialize in agriculture commodities, please link it up in this thread.

https://www.bloomberg.com/news/articles/2018-03-31/china-factory-gauge-jumps-in-march-services-remain-robust

One of Krugman’s better columns, again related to the Phillips Curve. I will admit to vacillating on this in my own mind, but I tend to lean towards believing in the Phillips Curve. (at least in this current 5 minute interval)

https://www.nytimes.com/2018/03/27/opinion/immaculate-inflation-strikes-again-wonkish.html

m, as a Krugman junkie, you’ll love this: https://youtu.be/YFqoFUIsFfw

I’m not going to click on this link (and though I wager Bruce and many regular commenters on this site will probably not believe me) I will never click on Bruce’s link there. You know why?? I’ve reached an age I can smell bullcrap from about 5 miles away. But if you’re traveling in Austin Texas Bruce (renowned as the most politically liberal city in Texas, and “horrors of all horrors”—a college town) please tell Alex Jones I said GFY.

BTW, if there is away with computer code or diagnostics to check if I clicked on Bruce’s above link, I invite Menzie to do it. I suspect Menzie would be too busy for a kind of petty thing, but…….

m “too busy for a kind of petty thing”?

Oh, I’m sorry. I thought you were the Moses who wrote: Aaaaawwww, Brucie, honeybaby, little BrooshyWooshie, Did you want Mommy to kiss your booboo, to make it feel better?? And here all this time I thought liberals were the “snowflakes”.

and provided the link: https://www.stopbullying.gov/kids/what-you-can-do/index.html that’s appropriate for the maturity of people who can “dish it out” but cannot take it.

That must have been your doppelganger. You’re the one with dignity.

The great thing about the man who flops the orange rodent on his forehead everyday, is that he is always such a classy guy.

https://www.nytimes.com/2018/03/29/business/media/david-pecker-trump-saudi-arabia.html

And the VSG represents America with dignity, grace, and poise, wherever he goes:

https://www.youtube.com/watch?v=9fplSxh6WD8

m, in your own words I will never click on Moses’ link there. You know why?? I’ve reached an age I can smell bullcrap from about 5 miles away.

Having your words mirrored can be illuminating.

I’ll admit that I did stoop… briefly… to your level of mockery and that really was unnecessary when your own words make a mockery of your credibility. There is a difference between intelligence (for which I’ll give you the benefit of the doubt) and maturity (for which you display little). I knew quite a few of you back in the 60s at UWM.

” a pork tariff imposed by China, which spent $42 million on Iowa pork products in 2017, would back up the Iowa market and force prices sharply downward.”

For those of you who eat bacon every morning (I don’t) it means breakfast got a bit cheaper. Of course an Iowas farmer will have less income to buy the eggs.

As I stated above—whether a lower wholesale price gets “passed on” to the consumer remains to be seen. I remain skeptical. Would be happy to be wrong in this specific instance. And if some observant commenter wishes to (with facts in hand) say “you were wrong about pork prices at the grocers” later, I will eat my medicine.

Dear Dr. Chinn,

I think your view of what is happening in U.S. agriculture is spot on.

I also found this interesting: https://www.agriculture.com/crops/wheat/goodbye-kansas-wheat

This seems like anecdotal evidence that U.S. farmers are dealing with climate change with adaptation (switching to other crops, i.e. more drought-tolerant corn/sorghum) and migrating to other areas (from southwest Kansas to Iowa). (By the way, current ag policy either denies or ignores climate change.)

I found it odd that the author concludes by saying, ” the tax burden of the Ukrainian producer is minimal vs. the U.S. wheat farmer’s. ” But there was nothing in all the items listed in the article up to that point that had anything related to tax burdens?

Also interesting that our U.S. administration seems to favor Russia. Yet, Russia is a major competitor in the products of U.S. rural voters who voted for the current GOP administration.

Thank you.

Thank-you Menzie.

I read the article. A fine example of attempting to bring rational interest into politics. Funny how it never works for long. I wonder if additional functionality such as INERTIA might have been included, capturing the fact we have had a farm bill for decades, and we will continue to have one. One other note, take care about publishing old papers like this, it was readable. Expectations of your writing might again include a READAABILITY (LESSMATH, MOREEXPLANATIONOF SLANT).

Anyway, a simple pro political nose counter and power politic person would be a better predictor than ideology, especially when it comes to the appropriations rather than the budgetary process. At least now, but I seem to remember it was the same back then. The big difference was you did not have to look at the whole Senate ideology to know where a vote was heading. Back then, it was the power of Committee Chairman that determined the nuts and bolts of legislation. It was a better time.

Ed

P.S. Searching for “The Policy Game” but haven’t found a copy I would like. If you have an extra copy hanging around and would sign and send it, I would actually read it. I have a shelf for those I respect and this book would be so placed.

Ed Hanson: This is a paper forthcoming: The Once and Future Imbalances?.

Afraid I only have one copy of the The Policy Game, and it’s signed by Peter, so afraid I won’t part with it…

Now back to the topic at hand. Where are hog futures going. I suggest nobody knows. There are some who will make a lot of money and others who will lose a lot of money (especially other’s people money) and the farmer will continue to do what they have to do to continue in the business.

Hog Futures are down. Unless Hog Futures are up. Check out Nasdaq and this chart.

https://www.nasdaq.com/markets/lean-hogs.aspx?timeframe=3y

Ed

Ed Hanson: We economists often appeal to futures because under certain assumptions they should constitute optimal forecasts. For hog futures, see this paper, for commodities including storable, see Chinn-Coibion (2014).

Hold on to that book, Menzie, I appreciate even your response.

Now about any futures or any options for that matter, I am a babe in the woods. Perhaps if I had been lived in Arkansas I could have reached the extraordinary, magnificent, dizzying, heights of Hilary knowledge, but it was not to be. So for now I will read you and others and look at charts that look like random walks.

Just checking, but was not the Nasdaq chart I linked a futures chart? I ask because your response could imply it was not.

Ed

Ed Hanson: That wsa a futures chart, for June 2018; obviously, like spot prices, they move up and down. Hence, event studies as a rule focus around the immediate time around the event. That’s why daily charts are useful.

You know I die for good quality & FREE ( !!!!! ) white papers. And you put white papers in your responses to Hanson and not me??

https://www.youtube.com/watch?v=tpsEdM74maA

OK, I’m a mature individual, I can handle this:

https://www.youtube.com/watch?v=qS7nqwGt4-I

Moses Herzog: I’m not sure what a “white paper” is, but many of my research papers are freely accessible here.

I’m not sure what a “white paper” is,

Being quite familiar with all things bureaucratic, there’s actually a definition of a “white paper”.

https://en.wikipedia.org/wiki/White_paper

Notice that there are other colors of paper as well…green paper, yellow paper and blue paper.

Bureaucrats of the world unite! You have nothing to lose but your binders!

2slugs, some comments make me with there was a “LIKE” button. “Bureaucrats of the world unite! You have nothing to lose but your binders!” 😉

@ Menzie

I thought I had heard the two terms “white paper” and “academic paper” used interchangeably by Mike Konczal and other people I had read. Apparently white paper has a more commercial tinge to its meaning. “White paper” could also be a government agency “report”. I intended no offense by this and apologize for being wrong on this. Also white paper (I did not know this until really about 5 minutes ago) also has a more casual format. Again I meant no offense by this and apologize for my bad use of lexicon.

Once again (no sarcasm here) I have learned something reading this blog.

Moses Herzog: None taken, just wasn’t sure what you meant. Anyway, I am happy to have everybody read my papers – most available as NBER Working Papers, in turn available through university IPs, or can be found somewhere via google scholar.

There is a running joke in my office – when I write something that the bosses want to take credit for, it is called a White Paper. When I write something they don’t like – they want to Black it out. Me? I prefer the color green!

Menzie

I make no bones about it, what I don’t know about the lean hog market is essentially unlimited. such as even why it is the June contract you chose to put up a chart, but expect it is for good reason. But lets face it the chart looks little different than it has for the last 3 years, a little lower than sometimes, higher than other. But nothing you could point to that tariff uncertainty has panicked the market. And it would be surprising if it did. Although it is a futures market, like other un-storable commodities, hogs are baked in no less than 10 months because of sow heard size and production time. For some reason, an impression seems to be taken place that China has a lot of ammunition in this tariff game. They don’t. Here is what Jim Long said over at The Pig Site;

http://www.thepigsite.com/swinenews/44536/jim-long-pork-commentary-2018-profits/

“China is a contradiction. Lots of new sow houses being build, but lots being shut down. The Chinese Government reported this October that China sow herd was 34,87 million, down 5.3% from a year ago (almost 2 million sows lower). China hog price is 15.05 RMB/kilogram or $1.02 US liveweight/ lb. Industry is quite profitable; except packers, as over 13 million sows have gone out of production. With huge excess packer capacity, they get to work for next to nothing.

Why is the swine production still downsizing despite huge profits (over $75US/ head) for three years now? Its mostly due to new tough environmental laws, closing farms. It is estimated 5 million sows have been and will be forced out of production for environmental reasons.

We expect China’s hog price will stay very strong through 2018. China will continue to import large quantities of pork.”

He wrote this Jan. 4, 2018, before the kerfuffle grew. And he would seem to be right, China hog prices will stay very strong, so much that much of the nation will find pork prohibitive to buy, and lower type foods will be substituted. They can mitigate that though, by true and realistic and fast negotiations with the USA and take advantage of our powerful, efficient, and bountiful hog agriculture.

Ed

PS. Ungated “How Reliable Are Hog Futures as Forecasts?” Colin A. Carter Sandeep Mohapatra. The ‘this paper’ referenced above.

https://academic.oup.com/ajae/article/90/2/367/99876

Ed Hanson: There’s always news. Market correspondents seem to believe the news of tariffs mattered, as noted in the link provided in my post.

One can have lots of variation in a series, and still have an event be statistically and economically important. This is the distinction between having a high R-squared in your regression, and a significant estimated coefficient.

Ed Hanson: By the way, part of the cyclical behavior of prices can be attributed to the hog cycle. You should read up on it; it’s a canonical model in ag economics.

Menzie,

Oh, no, the world is ending. Worse news I heard since those same dang hogs ate my cousin

Thank God, I am using my son’s laptop and was able to pick it up and twist it to compensate the left slant you are linking. Really, Menzie, Talking points Memo, Bloomberg. Take my suggestion and just link to the various and better agriculture commentaries that the farmers and ranchers have created. They are factual, inclusive, and quiet. They explain what is happening in the markets without the hysteria. So much better.

Ed

Ed Hanson: Bloomberg is slanted? Reuters too? Part of the cosmopolitan media conspiracy? By the way, in an earlier post, I used Farm Bureau data and information. I hardly think they are out of touch (although they do have a slant).

I don’t think I wrote anywhere that the world is ending. However, since net farm income has been pressed in recent years, in the absence of a generous five year farm bill (the President’s FY2017 proposal was for lots of support cuts), then that pressure would increase with sanctions. The US has a comparative advantage in agricultural commodities, and tariffs will work to depress the prices of those exports. This is true if the Chinese impose them, or the EU, etc.

Apparently the great ag analyst Ed Hanson has failed to notice the list of sponsors on the right site of that website he gave. The man writing the article is employed by a large company in genetics and breeding of pigs, and is a significant player in the Canadian market. At least one other makes hog and poultry equipment. And yet another makes pig and poultry “additives” such as Biotronic, Digestarom, and Mycofix. Mmmmm, those names have me hungry for bacon already. I’m not sure how much it serves them to proclaim thinning profit margins in the next year when their sponsors are in the hog industry.

Poor Ed Hanson, he seems not quite to have the idea on what objective journalism is, or maybe even just the word objective.

<b. @ Mr Hanson

The site you gave is not written or managed by farmers and ranchers. “Thepigsite” is a site run by people who make money off of ranchers and farmers. How about giving 2 or 3 of these links to commentaries “by farmers and ranchers”?? I wager if they are not huge conglomerates with an agenda (or maybe even if they are) we’d all be happy to read them.

Meaningless factoids of today: Both of my grandfathers worked as meatpackers in the state of Iowa. One, who died before I was born, for a relatively short time (I actually have no idea on time frame as my Dad rarely discussed these things) and the other his entire adult working life. The one who worked as a meatpacker his entire life had his retirement “expedited” by Mexican immigrants (it’s a good wager most were illegal, but that I don’t know “for a fact”). My grandma was told by a packinghouse foreman (is that what they are called in a packinghouse??) that it took 3 Mexicans to do the work of my Grandfather when he left. I suspect he told her this just to make her feel good, but I have absolutely no idea either way. He had monster-sized arms and hands–it’s conceivable—I tend to bet against it though. My Dad worked in a packinghouse for a very shortwhile (like a summer job or something??) with his father. I strongly suspect largely to get emotional approval from his Dad. Which he never got, at least verbally.

I think it’s a strange component of life, that many men who do not get along with their fathers at all, or even “like” them, will still avidly seek this kind of “approval” from their fathers.

BTW—If it wasn’t for “The GI Bill” my Dad would have never gone to college, much less get his Master’s degree in education. Some of you “conservative” Republicans may be familiar with “The GI Bill”—you know, it’s one of those “evil, big-government programs”. My Dad never used it to get a pay-day loan, or use it to attend a for profit “college” so guys like Trump could run-off with everything he had and leave him with a non-marketable degree. My father just never got the “wisdom” of the Reaganite Republican party. Oh well….. lucky for the VSG, Betsy Devos, and Corinthian “colleges”, there’s a sucker born every minute. My Dad just wasn’t one of them.

https://www.huffingtonpost.com/entry/breaking-judge-rejects-for-profit-college-accreditor_us_58acc0cae4b0d818c4f0a322

Update

Looks like 25% on the piggies. No word yet on if this pork tariff will be tagged on Kelly Clarkson as she passes through customs.

https://www.nytimes.com/2018/04/01/world/asia/china-tariffs-united-states.html

I’ve had a lot of mixed feelings about China my entire life. Probably even more so after living there a significant time and then leaving there. I’d say in this case, America is to blame. I believe John James Rambo called it “drawing first blood”. The part of the hot head local Sheriff Teasle would be played by Donald Trump.

https://youtu.be/1LO6gGXcIhU?t=1m10s

Wait……wait…… I see…… I see…… Carnac the Magnificent sees another event study related to the stock market, tariffs, and hog futures in the very near future.