Despite reader Ed Hanson‘s comment:

[T]he current Monthly EPU is at an elevated level, but it has been at this elevated level 7 out of the past 9 years. The elevated value is better described as normal for about the last decade.

And his concluding admonishment:

Perspective, Menzie

I still believe that economic policy uncertainty as measured by the news based index (which Ed Hanson was discussing) is elevated.

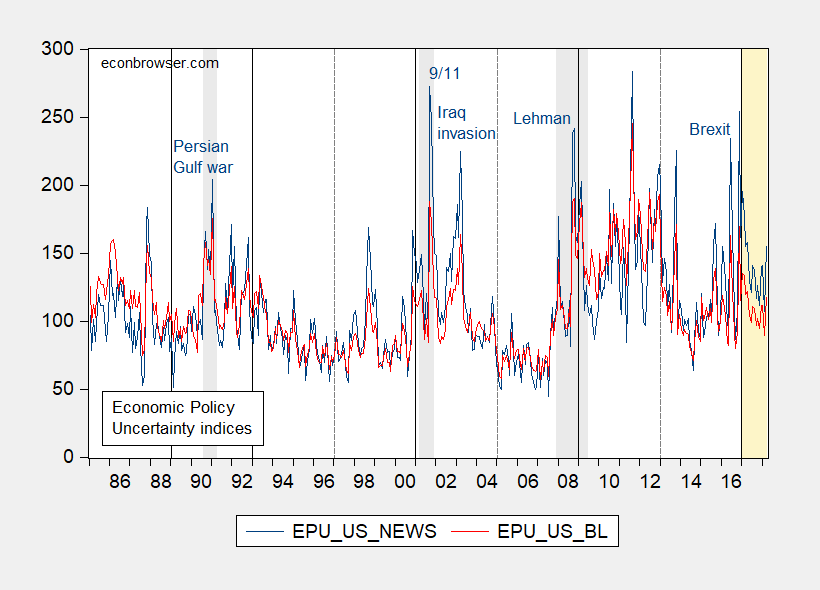

Figure 1: Monthly Economic Policy Uncertainty, news based (blue), baseline (red), as reported. Source: http://www.policyuncertainty.com.

The March reading for the news based series (baseline series) of 155.4 (117.7) exceeds the sample mean of 110.5 (107.9). The news based series exceeds the 2008M04 2018M03 sample mean of 135.9, while the baseline series falls below the 130.2 mean.

What does a formal analysis convey? The results depend on which index is used. I rely on the news-based series, since this is the focus of Baker, Bloom and Davis’s more recent work (Quarterly Journal of Economics, 2016). This series is also the series displayed on the policyuncertainty.com frontpage.

Running OLS regression over the 1985M01-2018M03 period yields the following results.

EPU = 94.61 + 9.21ELEC_TRANS – 5.80GHWBUSH -14.56CLINTON – 8.40GWBUSH + 25.22OBAMA + 38.21TRUMP + 6.80DIVIDEDGOV + +41.64PERSIANGULFWAR + 117.339/11 + 77.54IRAQINV + 40.60LEHMAN + 63.38BREXIT + 11.31RECESSION

Adj.-R2 = 0.40, SER = 31.26, DW = 0.97, N=399. bold denotes significance at the 10% MSL, using HAC robust standard errors.

Where ELEC_TRANS is a dummy variable that takes on a value of 1 for the 12 months before an election through 12 months after inauguration, except when the president is re-elected, in which case the dummy takes on a value of 1 in the 12 months before to up to the month of the election; GWHBUSH, CLINTON, OBAMA, and TRUMP are dummy variables the respective administrations; DIVIDEDGOV is a dummy variable for when the two houses and the executive branch are not all controlled by the same party, RECESSION is a dummy variable for NBER defined recession dates; LEHMAN is a dummy variable taking a value of 1 for 2008M09-2009M06, 9/11 for 2001M09-M11, BREXIT for 2016M06-M07. Note the exclusion of a Reagan administration dummy means the constant pertains to that presidency.

Since the distribution of the EPU variable seemed highly non-Normal (as did that of the residuals from the above regression, see histogram in this post), I used robust regression (essentially predicting median values instead of mean). This yielded:

EPU = 99.86 + 7.55ELEC_TRANS – 5.22GHWBUSH -16.14CLINTON -15.38GWBUSH + 15.69OBAMA + 32.83TRUMP – 0.08DIVIDEDGOV + +32.96PERSIANGULFWAR + 136.279/11 + 79.77IRAQINV + 26.15LEHMAN + 76.20BREXIT + 18.41RECESSION

Adj.-R2 = 0.26, SER = 32.00, N=399. bold denotes significance at the 10% MSL.

The baseline index, which incorporated uncertainty regarding the expiration of tax code provisions, and forecaster disagreement, yields different results than the news-based series (which is comparable across countries). With weight on forecaster disagreement (sure to be high during the great recession) and uncertainty regarding tax code provisions (due to the stimulus package and conflict between the executive and legislative branches during the Obama-Boehner years), the Obama and Trump coefficients re-arrange so that Trump era uncertainty looks less elevated. The baseline index results are sensitive to the inclusion of time trend. (They are also sensitive to inclusion of a quantitative easing dummy variable, which takes on a value of 1 from 2008M11-2014M10; then TRUMP and OBAMA take on similar coefficients).

The data are here. The output is here.

I conclude that Trump is indeed really special, when it comes to policy uncertainty.

I strongly want to protest this analysis, as I have always thought of Ronald Reagan as the biggest dummy.

Mr. Speaker, I move for unanimous consent that we include Ronald Reagan as a dummy.

I would go for the cheap “Yes, Special Ed.” joke here, (God knows I am not above cheap jokes), but somehow putting Trump in with Down Syndrome people seems way overly insulting to those with Down Syndrome.

Maybe Menzie can figure out a way to title a future blog post “Is Trump’s IQ and Forehead Hair Really Like An Afghan Hound’s??”. Then I don’t have to insult any innocent people when I answer the question honestly.

https://goo.gl/images/nKwzV0

I am kinda excited (Yeah, loser with nothing to do on a Friday night) Menzie put that input and output up, because even though I don’t 100% understand the math, I just put that file in my OpenOffice program, And I am slowly figuring out how to get the Linear (and OMG God, maybe scatter points and Logarithmic!!!!) If I get this file to work and get some of the same output as Menzie I am going to do a freaking backflip.

The EPU seems much lower under Trump compared to Obama’s first term.

Europe and China have much higher EPU indexes than the U.S..

Under Trump, the news based EPU seems to be consistently higher than the baseline.

Menzie

Your work reminds me of the saying, “if you can’t dazzle them with brilliance, baffle them with b…”. The brilliance is there Menzie, but it cannot hide the fact your charts definitively show that the EPU has been elevated for 7 out of the last nine years. You may think that 6 of the elevated years belong to President Obama it must be ignored (the no enemies on the left rule), but it is there for anyone with eyes to see.

As I said In the linked post but somehow missing from your excerpts, EPU elevated today? Yes. EPU elevated for 7 out of 9 years? Yes. Because of the number of years involved, today’s elevated EPU is the new norm and not special.

Ed

Ed Hanson: Let me repeat, then, in words plain and simple: The news based series in March with value of 155.4 exceeds the 2008M04 2018M03 sample mean of 135.9.

What do you say to that?

Menzie

I believe I already did “say to that” Your 2008M04 – 2018M03 sample includes the 2 years of the 9 of lower EPU. If you want to make a more honest comparison, measure 2008M04 – 2013M012 to the latest year. But you won’t, because your belief in quantitative will show the President Obama years with the higher sample mean. But, don’t bother because I still believe the biggest strength of the EPU is qualitative. And the norm for now is elevated, as it has been 7 out of the last 9 years.

Ed

Ed Hanson: 155.4 still exceeds the 2008M04-2013M12 mean of 144.8.

Menzie,

Lets me understand what you are saying. One month’s EPU compared to either 9 years or 4 2/3 years has economic significance? And it is not the political you trying to spin? Lets analyze first things first.

If any one month EPU value is of economic significance and 155.4 is used as a benchmark, what other months were of equal or greater value than 155.4 and how many were there? Lets count and list in reverse time.

March ……..2018….155.4

February…..2017….177.8

January…….2017….195.0

December. 2016….161.4

November. 2016….254.1

July…………..2016….164.5

June………….2016….234.0

September.2015….171.9

August……..2015….156.5

October……2013….225.4

January…….2013….199.3

December…2012…215.0

November..2012….205.9

October……2012….166.1

September,2012….182.1

July…………..2012….180.8

June…………2012…..197.5

December..2011….184.0

September 2011….214.4

August……..2011….283.7

July………….2011…..207.2

August…….2010…..184.8

November..2010….175 (est.)

July………….2010…..186.6

March………2009….168.0

February…..2009…202.6

January…….2009….184.8

December..2008….170 (est.)

November..2008….162.7

October…….2008…220 (est.)

September..2008…238.2

January……..2008…177.0

Since you like numbers Menzie, here they are.

President Trump 3 months at or above 155.4 out of 15 a ratio of 0.2

President Obama 29 months at or above 155.4 out of 96 a ratio of 0.3

President Obama had a ratio 50% higher throughout his administration than has President Trump, so far, above the benchmark.

My oh My oh My.

I am try to remember your post about the Uncertainty during the Obama years. Just can’t remember any, please find some for me Menzie, because it is really looking like this time it the political Menzie using carefully crafted and limited economic numbers to tell a slanted story.

Ed

Ed Hanson: You might think about small sample issues when calculating a ratio… there’s a standard error there too.

By the way, I just did a count of posts discussing “economic policy uncertainty”, using the search command on Econbrowser website. You can use it too. There are 10 posts on the subject during the Obama administrations (a pretty high count given the Baker, Bloom and Davis index has been around for only about 8 years).

Ed Hanson I believe you’re misunderstanding the point of a regression. Hint: it’s not to look at the values of the dependent variable. The point of a regression is to decompose the series into coefficients for the explanatory variables. That’s the difference between a formal analysis and an ocular analysis.

Menzie

It makes me laugh when you criticize a small sample just after you made a big deal of a single month.\ out of 9 years.

Ed

Ed Hanson: Think for a second…I made no issue of comparing a single observation’s value against a sample mean which is an estimator of a population mean. You are estimating a ratio for two different samples, and comparing a difference in means, where each ratio is an estimator of a population mean. They’re different exercises.

Menzies

I took your suggestion and did an Econbrowser search. I did it even more general search than yours. My search term was simply ‘uncertainty’. It return many, many hits. I opened most until the searched post did not mention PolicyUncertainty but had drifted to posts of different nature. I found a few more relevant post than you found. I will gladly list them if you want, but for now I will just gives totals.

I found 16 post by you before the beginning of 2017, all during the time of the President Obama administration

Here is a synopsis.

1 post had Trump 10% tariff to blame for uncertainty.

2 posts had the election of new President to blame for uncertainty.

4 posts had Brexit to blame for uncertainty.

1 post had the FED to blame for uncertainty.

3 posts were just general information about the uncertainty index.

1 post had Senator Sanders to blame for uncertainty.

1 post had the Senate to blame for uncertainty.

1 post had the possible government shutdown to blame for uncertainty.

2 posts had the House of Representatives to blame for uncertainty.

And one more thing. Exactly 0 posts mentioned President Obama or anyone in his administration.

One thing is clear, Menzie had done some excellent work with Uncertainty Index, but his political slant casts a pall over his work. This latest post is an egregious example of bias, but certainly it is not unique.

Ed

Menzie, why the apples to oranges comparison??? Explain to us the difference of a monthly value compared to the average of many months. What happens to all those monthly peaks and valleys in averaged monthly data???? Using one of the most disingenuous display methods to show data just shows a desperation.

Wow! Just wow! I see this all the time with Climate data, and point it out when I see it. Your latest displays just shows the equivalence of the two ?sciences?.

CoRev: Oh, I guess I will stop writing lines like “2017Q4 q/q growth was under the post-War average growth rate…” I think I learned that this kind of comparison could be done in high school stats.

Re: “disingenuous”… I will note that the data is straight from BBD website. They have plots like this on their frontpage. Take your issue on display of data with Baker, Bloom and Davis.

Just for you (and Ed), I’m going to do an ARCH/GARCH analysis, and see if you like that any better.

Good luck with that. About ten years ago a colleague and I had to explain to a Deputy Undersecretary the results of an EGARCH model we estimated for some project he wanted us to tackle.

Menzie, instead of strengthening your argument you are weakening it. You’ve been caught out by both of us. This is your use of terms: “Is Trump Really Special?

spe·cial

[ˈspeSHəl]

ADJECTIVE

better, greater, or otherwise different from what is usual.

Without defining the meaning of your term, you leave it to your readers to define it. Is it the highest? Is it unusual? Since we do not have 5 years of Trump performance “special” can not mean better. Accordingly my apples to oranges complaint.

Compounding the weakness of your argument you make thisa point to baseline comparison Adding even more questions. Was the selected study period meaningful? How? Why? Or was it just another cherry pick?

All you have done is show your political bias. Again.

RTD would not be impressed with the quality of your work in this one.

CoRev: Well, I kinda thought the largest coefficient (in absolute value, statistical significance) for president being on the Trump dummy variable was special. But that’s just me.

When I ran the regression, I used all available monthly data. When I did the subsample comparison, I used the ten year period mentioned by Ed Hanson. And when I did another subsample comparison, it was again at Ed Hanson’s insistence (he wanted me to drop certain years because, well, because…)

CoRev Without defining the meaning of your term, you leave it to your readers to define it. Is it the highest?

My understanding is that “special” means significant at the 10% MSL.

Menzie, why the obfuscation? “I guess I will stop writing lines like “2017Q4 q/q growth was under the post-War average growth rate…”” Another article and without relevance to this issue.

You then make another obfuscation: “Re: “disingenuous”… I will note that the data is straight from BBD website.” but the analysis was yours.

RTD would not be proud of this effort.

CoRev: Compare your statement: “Menzie, why the apples to oranges comparison??? Explain to us the difference of a monthly value compared to the average of many months.” to my suggested “2017Q4 q/q growth rate is below the post war average growth rate.” They are analogous. Notice, people do the second all the time.

The point is, you would want to know if that observation is likely or unlikely to come from the same distribution as represented by the estimated mean of the population. I can look at a 2017Q4 growth rate, compare it to the mean of growth rates recorded since the end of WWII, and see if it is likely or unlikely to have come from the same distribution.

Have you ever taken a basic course in elementary statistics?

CoRev Look at the second regression equation. The coefficients in bold mean that it is statistically significant at the 10% MSL. In less precise laymen’s terms, that means there’s less than a 10% chance that the true value of the coefficient is zero. Now look at the values of the coefficients to get a sense of whether or not they are meaningful. The coefficients tell us that the Trump effect on uncertainty is about double the Obama effect and is just about equal to the effect of the Persian Gulf War on uncertainty. If you think the effect of the Persian Gulf War was an especially important source of uncertainty, then you should also agree that Trump has a special effect on uncertainty because the coefficients are virtually identical.

Menzie & 2slugs, most of the populace and clearly some to many of your readers do not live with statistics. Menzie, in answer to your question, yes, stats and econ. Neither were needed as a significant part of my working experience.

Some times specialists talk in too much jargon and overly unique meanings to their field. This series of articles are great examples. If you had a point it was lost in the presentation of the argument and clouded in bias.

When I asked what “special” meant you failed to answer or explained in jargon/unique terms. Even 2slugs had his own meaning for it.

CoRev: Sorry. As you can see, the posts are not written for you.

Well, this comment, if I can make my way through it here, is going to make Menzie’s worst student regain their self-esteem.

I’m using OpenOffice. And I have all the numbers plugged in (just sliding the file in with cursor). So when I do column B and I copy it and create a scatter diagram (instead of the line chart), So I made the chart pretty big so I can differentiate the points. Obviously I haven’t put “the predictors” in for the “adjusted” r-squared. But my r-squared for EPU_US_NEWS makes no sense. 0.0341473…..

Anyone have any theories on why my r-squared is so off, I sure would be happy to listen……

Moses Herzog Anyone have any theories on why my r-squared is so off, I sure would be happy to listen……

The most obvious answer would be that you did not include an intercept term.

Also, go back a few days worth of posts. I suggested a couple of software tools. You might also want to check out Dave Giles blog. He has a lot of examples and code for exercises using R and GRETL.

http://davegiles.blogspot.com/

Damn man, even with a great computer program, apparently I have problems with math. Getting these numbers to add up correct, I kinda feel like this chubby guy with the big beard at the end of this film clip:

https://www.youtube.com/watch?v=4HQyFWcb3AY

I may have to call PeakIgnorance tomorrow and ask him “What do you do when your Mom dropped you on your head too many times??”

Well, after last night’s self-flatulating fiasco trying to do a OLS regression line and match some of Menzie’s numbers, I’ve decided I’m going to try to look at the silver line in the dark cloud, that I am now more familiar with the OpenOffice program and leave it at that for now. Me and math will be squaring off again in the near future in a “rematch” tentatively titled “The Self-esteem Killah In Manila”.

Moses Herzog: Many researchers are using “R”, an open source program which comes highly recommended. https://www.r-project.org/

This can be found in the ‘fellow travelers’ box on the front page of EconBrowser.

Laura Hamilton, nepotism aside, is the one who if my memory serves designed the Econbrowser website. She has as on her first page a link title

“Graphing with R”

September 23, 2014

http://www.lauradhamilton.com/posts

I think you will find her an interesting and varied resource.

Ed

It is sad to read this kind of response after being challenged. “CoRev: Sorry. As you can see, the posts are not written for you.” The challenges consist of questioning the structure and logic used in the article and not the statistical model/tools. If either/both of these are wrong or biased the tools matter little. If they, structure and logic, show bias and that bias is seen through out several articles then the arguments presented are both weak and probably invalid.

Menzie

You have misrepresented what I wrote a couple of times. One, you said that I ask you not to include the two lower EPU years (2014, 2015) from your baseline, Not exactly, I asked for a run a separate analysis from January, 2008 through December 2013, and compare it to March 2017 through March 2028. You responded with a period of time which skipped 4 months of high uncertainty in 2008 and skipping the last 8 months of possibly higher uncertainty of 2013. Can’t read your mind but it does look like it could be cherry picking, because you also continue to cling to a single month of the President Trump rather than a larger sample requested of the past year (two).

If you are taking suggestions other interesting comparisons

2008M1-2013M12 to your base time period that gave 135.9

2008M1-2009M1 to 135.9

2017M1-2018M1 to 135.9

2008M1-2009M3 to 135.9

2017M1-2018M3 to 135.9

Certainly feel free not to do these periods, I believe your time is more valuable. Face it any one who looks at the charts will see that simply it is fact that only two calendar years of since the beginning of 2008 were substantially lower in Uncertainty. The other years are close to or exceed even your single month cherry picked month. After all we know that 28 months did exceed 155.4, and 26 of these months were during President Obamas terms.

Ed

Ed Hanson: I thought I read what you wanted correctly, but maybe I didn’t.

In any case, I repeat what you

assertedcriticized (edit 12:14 4/22 MDC): “In other words, the Trump administration is indeed “special”; economic policy uncertainty has been higher than expected, even conditioning on the newness of the administration (and not including the elevated uncertainty associated with the Section 232 tariff announcement on 3/1).”That is what I was verifying.

I am going to write a post devoted to responding to you and CoRev discussing conditional and unconditional means, and interpreting regression coefficients. This seems to be desperately needed.

I am sorry Menzie,

you are really going to help me. For the life of me, I cannot remember writing the quoted;

“In other words, the Trump administration is indeed “special”; economic policy uncertainty has been higher than expected, even conditioning on the newness of the administration (and not including the elevated uncertainty associated with the Section 232 tariff announcement on 3/1).”

I went to the topic you referenced and found the quote but you wrote it, not me. Perhaps, it was an uncited previous quote or assertion by me, but the general search I made did not find it.

Ed

Ed Hanson: Sorry, I meant “criticized” not “asserted”. My mistake. Have corrected/edited with notation my comment.

So, my point is that I have verified what I set forth to do in the post… not what you wanted me to do. I’ll more fully explicate in a post on conditional forecasts.

Thank-you for the correction Menzie,

Mistakes, typos and misclicks are part the blog world. Acknowledgement, correction, and a civil apology is all that should be expected. You are example of the best in civility, even when dealing with someone who often disagrees as well differs greatly in political and economic theory.

So here goes the differs. I too, will repeat, 7 of the last 9 years has exhibited about the same level EPU, and for that, almost a decade, this level of EPU has become the norm. I will add for emphasis, from 2009 thru 2011 the EPU spent much of it time above present levels. And continue to point out it is your political slant that drives your selection economic periods and methods when the political Menzie speaks out. In addition, about your Uncertainty post over the 9 year, it is telling who you blame for spikes and elevated EPU, and it is especially telling who you never blame or even mention (Yes, that would be the President Obama or anyone in his administration).

Ed