Reader CoRev argues that economic uncertainty indicators such as the Baker, Bloom and Davis based on content analysis of newspaper articles are instances of GIGO (garbage in, garbage out). Here is a plot of another indicator suggesting current elevated uncertainty.

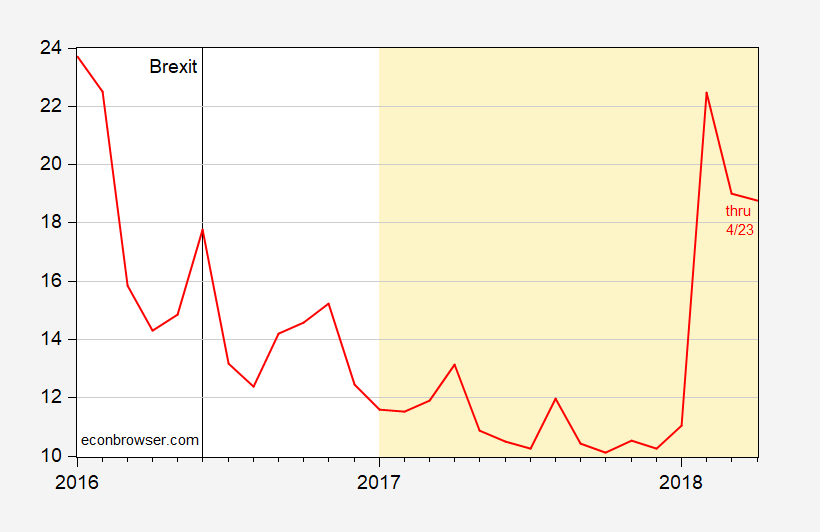

Figure 0: Measure of risk/uncertainty (red). Observation for April is data through 4/23.

This indicator is the VIX, which is “a measure of the stock market’s expectation of volatility implied by S&P 500 index options”. Compare against the criticized economic policy uncertainty (EPU) news index.

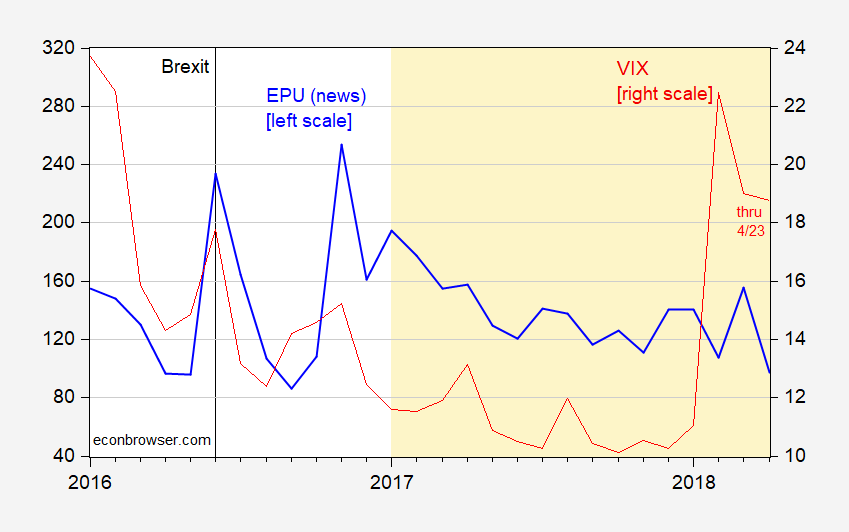

Figure 1: Economic Policy Uncertainty, news based (blue, left scale), and VIX (red, right scale). Data for April is average of daily data through 4/23. Source: policyuncertainty.com and FRED.

The EPU and the VIX covary (a regression of one on the other yields a statistically significant coefficient). The clear conclusion is that the VIX is left-biased.

Menzie

Once again you have truncated your analysis. Why did you not start from January 2009 or with the complete history of the daily EPU?

Looking at your chart the daily uncertainly is generally falling since 10 / 2016 to present and this includes all of the President Trump years. Looking at Fig 2, there is a huge spike in the VIX during 01 / 2018. It does not correspond to a daily uncertainty spike as it did for the large VIX spikes during the President Obama term. I suggest there is an alternative VIX spike cause of 01 / 2018 other than daily uncertainty index.

Ed

I can’t figure out why people think Trump continually contradicts himself on policy?? I don’t think he’s a lying piece of crap. Why would anyone think that??

https://www.youtube.com/watch?v=SYoOPgeTMQc

Did CoRev object in 2012 when Team Romney touted this index?

Pgl, object??? I didn’t care about the index then as now.

CoRev ducked the real question the 1st time when I posted this:

http://rooseveltinstitute.org/what-economic-policy-uncertainty-index-really-telling-us/

Conservatives have crafted a measurement that uses their own rhetoric as evidence to support their economic talking points…Mitt Romney’s economics team of Hubbard, Mankiw, Taylor, and Hassett have rapidly turned around an economic policy sheet titled “The Romney Program for Economic Recovery, Growth, and Jobs.” Matt Yglesias has a post on the issue of sluggish growth and Dylan Matthews has one on their review of the stimulus literature. Brad DeLong takes the deep dive through the entire piece here. I’m interested in something I haven’t seen people critically discuss enough, and that is the “policy uncertainty index.” The Romney plan argues that “uncertainty over policy – particularly over tax and regulatory policy – limited both the recovery and job creation. One recent study by Scott Baker and Nicholas Bloom of Stanford University and Steven Davis of the University of Chicago found that this uncertainty reduced GDP by 1.4 percent in 2011 alone, and that restoring pre-crisis levels of uncertainty would add 2.3 million jobs in 19 months.” This appears to be a new talking point for the candidate’s team, as the same language was in a Wall Street Journal editorial by Hubbard over the weekend.”

He is still refusing to criticize Team Romney. Let’s see if he continues to duck a simple question. Did he bash this garbage back then or not?

pgl, at it again, I see. You closed with this descriptor: “Did he bash this garbage back then or not?” I didn’t care about it then and still don’t. It is Menzie who is making it an issue.

Figured you would duck this again!

Your honor, the state would like to enter Exhibit A towards demonstrating heightened levels of self-inflicted uncertainty under President Trump. The jury will also note that the source of that uncertainty is the defendant himself, David Dennison; aka, John Barron; aka, Donald Trump (apparently even his name is uncertain) and not any supposed liberal bias:

https://www.motherjones.com/kevin-drum/2018/04/donald-trump-explains-his-syria-policy/

The state rests its case.

In regard to Trump in Syria…. which is Trump; Netanyahu hand puppet, Mohamed bin Salman’s tool both?

Is EPU run up by giving Syria to Jaish al Islam, al Nusra, etc. or a disparate multi-local Salafi power struggle as in Libya?

My contentions was the data was biased due to self and circular referencing. Menzie’ s Figure 1 shows that the VIX index may be responding to the same biased news reports as the EPU. If so, how could there not be a correlation? Or is there actually not a robust correlation on critical events?

I went back and looked at the EPU articles of reference trying to discern what caused the VIX uptick timed at Jan 2018. This is what I found directly relating to the stock market which could cause a spike in futures options/options pricing: “1 January, Financial Times, “Markets must prepare for more volatility””. (For Moses that is a direct link/reference from the EPU source.) Yup! There’s a direct early “concern” article which probably sparked the January options move. I followed this review path because of the obvious timing and directional differences in the 2018 spikes of the two indexes.

Having found one significant difference in timing and direction I wanted to see if there was a similar difference in the key date, Jan 20, 2017. Yup! There is another direction difference, but here the date is significant to my contention, the news was biased against Trump. EPU actually shows that bias while the VIX discounts the importance of that date.

The bias claim is supported by the EPU data, and circular referencing claim is supported in my earlier comment on the other thread. Most would consider this level of data issues as being problematical. Some might even give it a name: “garbage”.

Corev, you obviously have never been to university or you missed any statistics course.

you cannot assert the news reports are biased without EVIDENCE. you assertions are therefore ‘crap’ ( a highly technical term).

Not Trampis, stop guessing incorrectly. BTW, as I said your own bias won’t allow you to recognize the truth of the data. It’s called denial.

Huh?

there is this bot that goes through Google searches of the “press”, finds words totals draws inferences.

Might work if the “press” were not a trustless, propaganda machine which in most cases should be viewed in the same way I read Doonesbury..

Because this post compares “uncertainty” to the S&P500 Index Options, I thought it might be interesting to overlay the actual S&P500 Index for the period. https://www.dropbox.com/s/55hxqzc50saktc9/Uncertainty%20versus%20SP500.jpg?dl=0 . (sorry I can’t paste the image directly)

Perhaps the market will take a dive because of uncertainty, but it only seems to have paused or slightly retraced from the tax bill euphoria.

Speaking of the tax bill: “Turns Out, The Rich Will Pay A Bigger Share Of Income Taxes Under GOP Tax Cuts” https://www.investors.com/politics/editorials/republican-tax-cuts-fairness-rich-share-paid/

Boston University economist Laurence Kotlikoff, along with University of California, Berkeley, economist Alan Auerbach, conducted a detailed analysis of the winners and losers of the tax bill.

They found virtually no change in the progressivity of the tax reforms. The rich, they concluded, “will pay essentially the same share of taxes” as before.

Speaking of “uncertainty”: https://www.marketwatch.com/story/consumer-confidence-in-april-rebounds-close-to-18-year-high-2018-04-24

The consumer confidence index climbed to 128.7 in April from 127 in March, the Conference Board said Tuesday. Two months ago, the index hit the highest level since the end of 2000.

What happened: The present situation index, a measure of current conditions, rose to 159.6 from 158.1. The future expectations index advanced to 108.1 from 106.2.

Americans were more optimistic about their own finances and they think jobs are easy to find, the survey showed.

In this case, the VIX — as it is real time — is the independent variable. Thus, the question is how the VIX influences EPU. Do we really want to go there?

Can’t we take a breather, with say, Wisconsin? 2.9% unemployment rate, historical low. Tied for 8th in the nation. MN is 12th.

Where O where is that “Like” button.

Steven Kopits: Since I was trying to convince CoRev of the absence of bias, I took VIX as independent variable.

Regressing the VIX on EPU yields a statistically significant coefficient as well.

Sure, on Wisconsin, saw that ALEC dropped its outlook ranking from 14 to 19 for Wisconsin. So I expect Wisconsin to do better! (That is, the Arthur Laffer Stephen Moore Jonathan Williams ranking actually predicts in the wrong direction growth performance).

I am just saying that VIX occurs first. First the VIX changes, and then people write about it. So is all this arguing with CoRev about GIGO, or against him?

In any event, this is not a good use of time.

First the VIX changes, and then people write about it.

Uh-oh. You may want to duck because you just invited a Granger test. :->

I don’t think the uncertainty in-and-of-itself is terribly important. What makes it important is how uncertainty affects macroeconomic outcomes. If the VIX drives uncertainty, then I can see where maybe we should just focus on VIX and ignore uncertainty and treat it as “epiphenomenal”, as the philosophers might say. But intuitively it seems more likely that uncertainty is what drives shocks to the VIX. What Menzie has not discussed here, but I suspect he has discussed in his macro class, is how uncertainty gets transmitted to macroeconomic effects.

You’re right, Slugs. Maybe a Granger test is warranted. It would be interesting to see if a rising EPU translates into subsequent movements in VIX. So we’re talking some sort of accumulated pressure of press reports. Could be.

On the other hand, in oil markets, the move always happens first and then a few hours later you see the stories in the press explaining why that must have happened. I’m guessing it’s going to be the same with VIX.

And you’re absolutely right about the transmission effects.

steven, my guess is the oil market is much more closed with respect to market participants who can buy/sell oil in a manner that impacts the price and volatility compared to say the vix. that smaller population may be impacted (or impact) uncertainty in oil differently than the broader market. oil etf’s may be changing that a bit, but probably not a lot. my guess is oil news is transmitted to a smaller population in a slightly different way than general market news.

Since the VIX is more “real”, being based on price shifts of actual securities rather than interpretations of news articles, this is just a restatement of the truism:

“The facts have a liberal bias”.

CoRev,

It is not only that VIX sooner and much more, but it In fact is connected to real behavior in markets. The US stock market peaked in January after a strong runup, and has in fact bee quite volatile since. Serious observers have publicly worrying about the scale of US deficit spending now in place, the US near full employment the only OECD nation projected to see a rising debt/GDP ratio over the next few years, yet we have GOPsters in Congress talking about more tax cuts (mostly for the rich again). Oh, and growth is slowing and inflation is rising. There are a wholw lot of serious things actually happening in the US economy, markets, and among policymakers that fully justify a higher VIX.

Barkley, I agree with your. Your comment, however, was mostly about “market uncertainty” with some vague references attached to policy, (scale of US deficit spending, Congress talking about more tax cuts.) US deficit spending scales were not only from the tax cuts , but from the the Dem additions to the omnibus budget bill. GOP members of Congress are forever talking, and sometimes about tax cuts. The rich pay the most taxes, so if taxes are cut without full or major reform, which quintile would you expect to see cut? Tax reform was the original goal of the tax bill, but could not get it by the senate Dems.

Unless we can assign a value to MSM reporting Trump negative bias, no amount of statistical manipulation will resolve this original question. Is Trump “special” and in what policy-based way.