From WSJ op-ed via AEI:

The second factor [in the slow recovery] is less obvious, but possibly also of great importance…. Congress and [the] President signaled their intentions to introduce major changes in taxes, government spending and regulations–changes that could radically transform the American economy.

…

… other government proposals created greater uncertainty and risk for businesses and investors. …

Congressional “reforms” of the American health delivery system have gone through dozens of versions. The separate bills passed by the House and Senate worry small businesses, in particular. …

…How hard the Fed will fight inflationary pressures through open market sales and other actions that raise interest rates is a significant source of uncertainty about future inflation and about the potential for monetary policy tightening to choke off the recovery.

The uncertainty about monetary policy has important political dimensions as well. The Fed now faces greater political pressures than at any other time in the past quarter century, … These pressures may intensify greatly if, and when, future Fed actions to restrain inflation conflict with politicians’ desires to prop up housing and the major government enterprises enmeshed in housing finance.

Even though some of the proposed antibusiness policies might never be implemented, they generate considerable uncertainty for businesses and households. Faced with a highly uncertain policy environment, the prudent course is to set aside or delay costly commitments that are hard to reverse. The result is reluctance by banks to increase lending–despite their huge excess reserves–reluctance by businesses to undertake new capital expenditures or expand work forces, and decisions by households to postpone major purchases.

That was written by Steven J. Davis, Gary Becker, Kevin M. Murphy, on January 4, 2010.

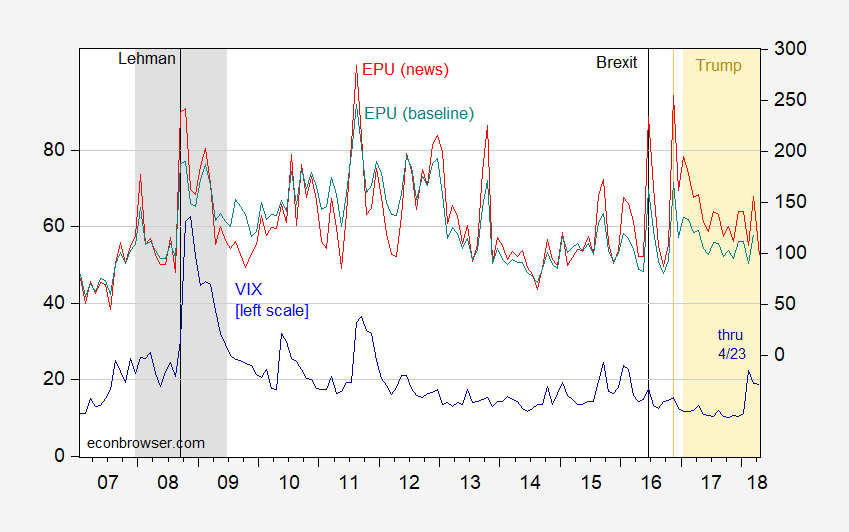

Here is a plot of the economic policy uncertainty indices for the US, both news and baseline, as well as the VIX.

Figure 1: VIX (blue, left scale), EPU-News (red, right scale), EPU-baseline (teal, right scale). NBER defined recession dates shaded gray. Source: FRED, policyuncertainty.com, NBER.

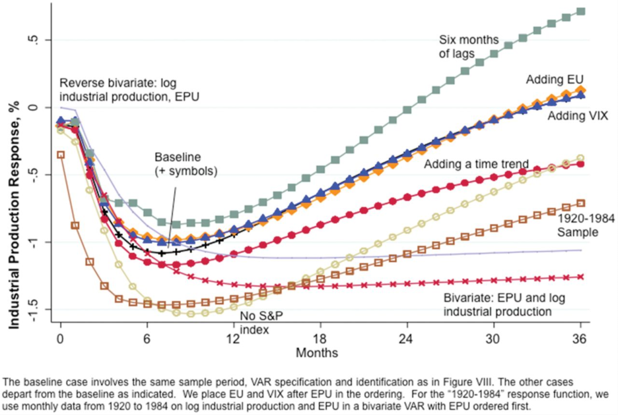

Does this matter? Maybe, maybe not. Baker, Bloom and Davis in the Quarterly Journal of Economics (2016) provide this set of impulse response functions differing by specifications, suggesting a negative impact on industrial production.

Figure 9 from BBD (2016).

Of course, it is possible that these IRFs pertain to shocks that are not policy uncertainty shocks per se. However, it is amusing to me to see people who argued that uncertainty was important in times past now saying it’s not.

@ Menzie

You and apparently some of your commenters think I am too vulgar?? Do me a big favor if you don’t want to spend large amounts of time filtering my comments. And/Or eventually banning me from the site (which I guess is no skin off your back). Don’t be posting crap from AEI because that is about the quickest way to get me going.

I’m getting older now (in case anyone couldn’t tell from my crotchety posts). When I think of outfits like “AEI”, I think it’s the old people that get it wrong most of the time and NOT the young high school and college kids. We complain about “young people ‘nowadays’ “, but the reality is the older group aren’t teaching kids how to pass the torch on, much less how to hold it properly for the handoff. Listening to this new band (new to me anyway) called “All Them Witches” and their CD “Sleeping Through The War”. This is pretty good stuff. When I listen to stuff like this, and bands “Mastodon” and “Baroness” I think young people are listening to better stuff then my generation was (certainly ’80s pop anyway). “Kids” or young people are much sharper intellectually than “we” give them credit for. I imagine most of the kids in Menzie’s class can do an OLS regression etc, and are sharper than 8/10ths (including myself) of the people visiting this blog. And when I imagine those young people in Menzie’s class and in patches across America, it’s the only thing that gives me positive feelings about getting past this period with Trump. Although I’m of the opinion our society has never fully recovered from Reagan, so….. I hope the young voters come out in 2018 and 2020—we need their intelligence at the voting booth.

https://www.youtube.com/watch?v=nAFXqHgW3g4

AEI may be garbage but the best approach in my view is to air out the garbage.

@ pgl

That’s a fair and well-made point by you. “AEI” still makes me nauseated.

Respect is earned.

When baffs first started commenting, as I recall, his analysis was very weak. But he kept at it, and I will always quickly check what he writes today. He earned that.

I have very little tolerance for ad hominem attacks and weak analysis from anyone, left or right. Honestly, I don’t read those comments. Not Ed’s, not Peak’s, not pgl’s, not yours.

If you want my attention, make your case and let me decide its merits. Before you write something, make sure your data is right. Don’t overrun the limits of your data. This is the classic mistake, where commenters put their lines of defense too far forward (which Slugs caught me doing on the previous post). Make your post short (Ed).

If you attack anyone personally, don’t expect me to read what you write. Life is too short.

So, do your homework, make your point, and let us decide its merits. There is nothing bad about being wrong; there is nothing good about being mean.

Cop-out Kopits

Did you still feel Xi Jinping is unconditionally surrendering to the Chinese peasants because of “rapid economic growth”?? What year did you predict??—2075?? I forgot the year you gave. I just remember thinking in the time frame you gave for Xi Jinping to abdicate power to Chinese peasants you’d probably be down at the nursing home as the staff identifies your closest relatives for you. Also, if you can tell any of us how you chose the name “Princeton Policy Advisors” for a blog, when you appear to have ZERO connection to the University and/or township, that would be so cool on your part.

No one wants respect from someone because he spent time interacting with East European-trash and then proclaims himself an expert and makes appearances on right-wing outlets read by PeakIgnorance and 3 of his Alabama cousins. So who you mistakenly thought wanted respect from you is kinda beyond me.

When you want to interact with me, you know what you have to do.

steven lives in princeton. i spent time in plainsboro, always jealous of you townies 🙂

steven has his opinions, and can make valid arguments (I may not always agree) often times. i certainly would not place him in the same category as some of the trolls on this site. in particular, steven is willing to learn from others on this blog. that makes debate with him worthwhile. i have no problem with disagreeing with somebody, and steven and i have our share of disagreements. but he does not appear to me to be a partisan hack. he has his own life experiences which shape his views, and i appreciate them. moses, there are hacks on this site you can certainly focus on. kopits is not one of them.

@ baffling

I’d like to see how you know Kopits actually lives in Princeton, as I think you are talking out of your a*** [edited by MDC]

Although it is cute you have heroes in life—I suggest you aim higher than Kopits. There is a saying “The blind leading the blind”. You and Kopits fall into this category.

moses, i guess you could simply google steven kopits. unless he has some elaborate ruse, i see no reason to doubt his affiliation to the the princeton area.

steven is not my “hero”, but i have no reason to belittle him. he does not hide behind an anonymous name (like myself i guess). i call him out when it warrants, and he usually does not take offense but finds some common ground.

on this blog, there are plenty of people whose integrity you should question. you have the resident idiot, corev. you have peaktrader, who is just smart enough to be dangerous, but not smart enough to have a real phd. rick stryker uses his powers for the dark side-his type are dangerous. but steven does not fall into those categories. his agenda has been biased by his time in hungary, and his affiliation with big oil, but he at least tries to present a defendable position. and i usually don’t see him intentionally distort the facts-that falls into the rick stryker and peaktrader category.

baffling

I’m actually semi-sorry to say what I am about to inform you. I mean feel mildly guilty informing you of the truth. But when Kopits pats you on the head like a little boy, basically telling you you were an idiot when you first came to this blog, but now he’s proud of his little boy sounding smarter now, and then Kopits refuses to answer the question of why he calls his blog “Princeton Policy Advisers” when he seems to have ZERO connection either to the University or township and you say “i see no reason to doubt his affiliation to the the princeton area.” your reaction is humorous in a morbid kind of way. You are either as naive as Melania Knauss marrying Trump, thinking Trump wouldn’t be the perpetual, unending, continual philanderer that we all know he is, or you’re just very dumb. Sorry….. I mean I’m sorry to you.

Moses, you have been given information and a way to verify who Steven is. Perhaps his website is one giant, elaborate hoax. Perhaps his visits on cnbc are fake. But you have been given an opportunity to verify Steven (i.e. The data), and you do not appear to have done so. Is there any amount of evidence which could change your mind? Be careful, such behavior begins to mimic the village idiot on this blog corev. There is no amount of evidence which could ever exist which would change his opionion on things. I hope you are not the same way. We have a number of trolls on this site, as I already mentioned. It is probably best to target your angst towards them, as they are part of the propaganda machine you seem to despise.

Very well said Stephen. I heartliy agree

Menzie, this is a great post because it points out that “uncertainty” is relative to what might be negatively impacted.

“Even though some of the proposed antibusiness policies might never be implemented, they generate considerable uncertainty for businesses and households.”

Trump has demonstrated a bias (yes, I’ll use that word) toward pro-business policies and tax reduction (as opposed to take increase) actions. While there may be some “uncertainty” about the level of impact, directionally these biases are seen as positive and have been reflected in increased consumer confidence and business plans. Uncertainty about North Korea? That’s sort of dissipating. Uncertainty about regulations strangling economic progress? That’s been dissipating. Perhaps the only uncertainty that remains is how long Mueller is going to play the gotcha game.

• https://www.cnbc.com/2018/04/24/consumer-confidence-at-128-point-7-in-april-vs-126-reading-expected.html

• https://www.cnbc.com/2018/02/20/small-business-confidence-hits-record-in-2018-after-tax-reform-win.html

• https://fred.stlouisfed.org/series/BSCICP02USM460S

• https://www.nytimes.com/2018/04/22/world/asia/china-north-korea-nuclear-talks.html (well, China’s government officials are feeling uncertain)

• https://247wallst.com/energy-economy/2018/04/25/crude-oil-price-slips-as-inventory-drops-sharply/ (hmm, the Saudi’s might be concerned their strategy isn’t working)

• https://www.cnbc.com/2018/04/23/john-mccallum-chinas-xi-jinping-has-to-act-to-avoid-trade-war-with-us.html (China really doesn’t want this)

I wanted to put this link up, of course it’s NYT, and I saw it over on Mark Thoma’s website (Thoma is the KING of economics and finance amalgamation and synthetizing and also a good writer in his own right). Uwe was so incredibly under-rated and never got his just due–he should have been a household name to people for his healthcare work: https://www.nytimes.com/2018/04/22/opinion/a-tribute-to-uwe-reinhardt.html?partner=rss&emc=rss

Uwe’s paper: https://www.healthaffairs.org/doi/pdf/10.1377/hlthaff.25.1.57

As I read through it, it did touch upon issues of pricing that many people have wondered about … and still remain a mystery. If you are old enough for Medicare, you will have seen statements for services that show amount billed and then amount approved and then amount you may have to pay. The amount billed is rarely the amount approved. Then if you have supplemental insurance, you may see the same categories of information. Then you may or may not receive a bill for the differences between the amount billed and the amount approved. It’s all very blurry.

The problem I see in advocating standard pricing for specific procedures is the very real differences in the quality of treatment. If I had a serious condition, I would opt for the University of Michigan hospital versus the local community hospital, even though the latter may claim to be able to do the required treatment. I can’t tell you if the pricing for the services would be different, but the expected outcomes would be. Examples, my wife went to the local hospital to have her appendix out. The job wasn’t done very well and the followup was sketchy. She ended up at another hospital for several days trying to get the resulting infection under control. Then she went to the same local hospital for severe back and abdominal pains. They treated her for a urinary tract infection. Later she had the same symptoms and went to a larger hospital system. They asked her when her last kidney stone was as they were treating her for the current one. Her UTI was a kidney stone.

Needless to say, we might go to the local hospital for stitches, but not much else. There is a qualitative difference that standard pricing doesn’t recognize.

That was one of many papers he wrote.

I’m sure it was. It was the one I found related to healthcare which was Moses’ point.

“That was written by Steven J. Davis, Gary Becker, Kevin M. Murphy, on January 4, 2010.”

The WSJ and AEI abusing this index to bash Obama. Another chance for CoRev to finally stand up and criticize this abuse!

Uncertainty comes about because of a lack of coherence. You have that in spades at present.

Trump obviously loves pro-business polices as he is a real estate developer. They lover crony capitalism. They play favourites. What they give away they can take back and that id of course breeds what.

what you actually want and need are pro-market policies.

been reflected in business plans?? where in the depreciation boom??

So, the EPU shows a lot more noise than the VIX. That’s to CoRev’s point. There is, in fact, a lot more written than really shows up in capital markets. In particular, the President’s tendency to tweet controversial points tends to generate a lot of froth in the news that’s not really reflected in the fundamentals. So on that point, I agree with CoRev.

On the other hand, at major policy turning points, both the VIX and the EPU tend to be elevated. During sequester in 2011, and the recent tax reform, yes, I would expect EPU to be elevated and possibly VIX as well. I think such uncertainty will be in play more broadly in the press, both left and right. So there, I agree with you.

But again, is there anyone out there who does not realize President Trump is controversial? This is like measuring the vibration on the hull of the Titanic to determine there’s water gushing in below decks. Sure, you could do it that way, or you just look over the side of the ship and note the giant hole.

If you saying that EPU should be elevated as a measure like, say, oil price spikes or interest spread inversions, ok, let’s have it. But as I look at the graph above, I doubt I could trade the relationship. Just not compelling on an eye-ball basis.

Menzie

Past business. Has the great difference of the UK EPU during Brexit between your calculation and BBD been resolved?

Ed

Yes. See my reply to your original query. I posted a few days ago.

Thank-you Menzie for the reply which was,

“Ed Hanson: The authors have responded to my query. The series you can download is the “official” series in the sense that it is accessible, but is based on only two newspapers. The series graphed is broader, but has not yet been made accessible. I am using in my analysis the series that is downloadable and is used by everybody else.”

I understand you must use the data you have, but ‘two only newspapers’. That seems to be true for all the European indexes. The US indexes use 10 newspapers and thus seem more broadly base. Until the European search is wider, I would consider them some what unreliable and should be noted so when using them.

Again, thank-you for the information.

Ed

A couple of comments:

(1) I couldn’t find anything in their paper or supplementary material that described the error bands around the IRFs. If they were in their paper, then I missed it.

(2) Not a big deal, but I noticed where one of the words they looked for under the “Monetary Policy” category was “Volker” (see page 5 of the supplementary section). Typos can be important. Obviously it should have been “Volcker”.

(3) Figure C3 in the supplemental section shows the role (or actually non-role) of political slant in the news based EPU index. They selected 5 mostly Democratic papers and 5 mostly Republican papers. There is virtually no difference between the two. So much for the political bias story. Their data stopped before the 2016 election, so I suspect that all of the wailing and gnashing of teeth we’re hearing from the TrumpBots has more to do with their feelings of isolation after having voted for someone so utterly incompetent that even the traditionally Republican newspapers could not swallow endorsing “the Donald”. So yes, there really is something “special” about Trump.

Is policy uncertainty the ‘flip side’ of private uncertainty, i.e., does policy have a negative covariance with the private stuff?

Bob Flood: Excellent question. I don’t know if anybody has addressed this. There are a variety of uncertainty measures that are “private” like. For instance, Jurado, Ludvigson and Ng use dispersion of forecast errors for many macro variables as a proxy. Gilchrist, Sim and Zakrajsak use idiosyncratic errors from a CAPM. See Ferrara et al. (2017) surveys several measures, and has a table showing correlations. Most are positive.