Trending down.

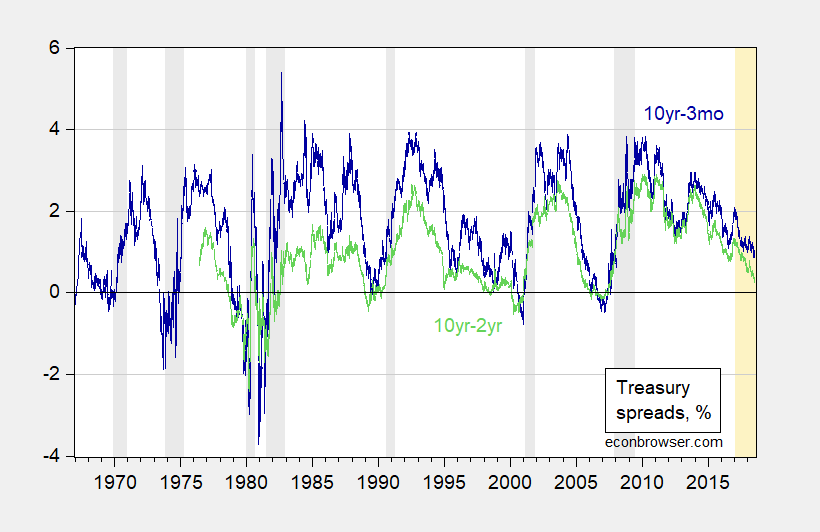

Figure 1: Ten year-three month Treasury spread (blue), and Ten year-two year Treasury spread (green), %. 7/17 observation as of noon, using on-the-run yields. Source: FRED, Bloomberg, author’s calculations.

For a longer term perspective, here is the corresponding graph for 1967-2018.

Figure 1: Ten year-three month Treasury spread (blue), and Ten year-two year Treasury spread (green), %. 7/17 observation as of noon, using on-the-run yields. NBER defined recession dates shaded gray. Orange denotes Trump administration. Source: FRED, Bloomberg, author’s calculations.

For econometric evidence regarding the predictive attributes of these term spreads, cross-country, see Chinn and Kucko (2015).

This fall in the spread is not from the 10-year rate falling. It has risen by 40 basis points since the beginning of 2017. It seems the 2-year rate has rise by 140 basis points over the same time period:

https://fred.stlouisfed.org/series/DGS2

Of course PeakDishonesty keeps telling us that the FED is running an easy money policy. Then again PeakDishonesty does lie about everything including his latest praise of St. Reagan.

Given NGDP growth and inflation, it’s difficult to rationalize those arguing that monetary policy has been too loose/easy.

I’m still interested in Governor Brainard’s comments regarding the term structure of interest rates, and hope the BOG can go back to its pre-Obama days with more members because I’m not nearly as trusting of (non-NY and non-Minneapolis) district presidents. However, Kashkari (the non-economist per Dr. Menzie Chinn) has recently suggested he doesn’t buy Brainard’s yield curve theory Let’s hope the democrats can get off of their asses and vote on the nominees and stop playing the same game that the republicans played when they decided a Nobel was not enough and then Obama ignored empty seats (and, by extension, the economic recovery) thereafter. Politics and monetary policy shouldn’t mix.

Well, they can’t help but mix since Presidents who have to run for reelection during a recession or a slow recovery usually become “ex” Presidents after a first term. But that was before the days of Russian Bots and screening out voters who might not vote for you, so who knows how 2018 and 2020 will play out, especially in states under firm Republican/Oligarch control. (The perfect oligarch party is the North Carolina Republican Party, for when Art Pope says “jump,” they respond “how high?” See also Scott Walker’s Wisconsin Republican Party where Scott makes sure to clear where he stands with Richard Uihlen, Diane Hendricks, John Menards, and the Johnson Family.) Obama ran a pretty sound economy from the neoliberal point of view, although politically his Fiscal restraint and concessions regarding Government spending and tolerance of Fed pulling back its bond buying in 2010 and then again in 2013 almost cost him his reelection and certainly led to the Democrats getting smacked around in the mid-terms. Its pretty clear that Trump is going run on Democrats being the party of MS-13, and stopping Mexico from influencing the elections, and stopping the Muslim “menace” that has “infiltrated” Europe from coming to America. And he will be boasting that this is the Greatest Economy ever, with the Greatest Growth, who needs trade.

Although creeping toward inversion, it will remain to seen if Powell’s Fed presses forward next year into inversion territory, or whether, like in 1995, the Fed reverses back to an easier policy, particularly if Trump starts twitting about the “Deep State” at the Fed if it doesn’t ease off.

sherparick

And the Colorado democrats are controlled by four local billionaires and the teachers union. It is just politics as it always been, but somehow the voters usually eventually get different people in there. or completeness sake, the Colorado republican party is a mess. But the voters still control mostly the election results (Except in Denver, which like most big cities is machine controlled).

Ed

From the caption of your graph:

“Orange denotes Trump administration.”

Are you referring to his hair color or the color of his skin?

I think the exact tone is “leathery orange”. Soon to be a new Crayola Crayon. He does have beautiful hair though. Sensitive Stevie Mnuchin says he knows for a fact Orange Excrement’s hair drives Immigrant Melania wild with passion.

https://www.youtube.com/watch?time_continue=29&v=yCmyZcBnC2M

This youtube vid is just primitive, U.K.-guardian left-wing smear.

It’s real video of the Orange Excrement boarding Air Force 1. I agree his hairpiece and hair implants look primitive. To the point trump may have the ugliest hair of any human in the Northern Hemisphere.

May signal a recession in the next two years, but not imminent, based on the historical record.

Doubt this, would say no recession is in sight (hello, Bill McBride).

All my mates are betting that this so-called ‘trade war’ will be only Trump-hot-air-talk.

Trump’s negotiation tactic is always the same: shock and awe.

That is to say, a short war.

Possible. But the longer it drags on, the harder it is for either side to back down.

I would say we have perhaps two more years in the oil cycle. We might see a pause in prices for the next year or so, and then a sharper move up into the end of the cycle. That would be the pro forma expectation, but too early to call formally at this point.

And I’d note both the 10 yr and 2 yr are only at 2.5% — not really indicative of a smokin’ hot economy.

“I’d note both the 10 yr and 2 yr are only at 2.5%”

So the spread is zero? Check again old Princeton drop out. 10-year government bond yields are 2.85% not 2.5%. 2-year government bond yields are 2.59% not 2.5%. Try checking the data before you post one of your patented blog posts we will continue to ignore.

“Princeton” Kopits—–>> The gift that keeps giving.

Whichever university he’s claiming he graduated from this particular week, the Business Dean is now mailing out leaflets in full denial.

“It would be a mistake to think that the unexpected flattening of the US yield curve signals a looming recession, Ben Bernanke, the former chairman of the Federal Reserve has warned.”

https://www.ft.com/content/e72fdf28-8a1c-11e8-bf9e-8771d5404543

most people would think if you boost the structural budget deficit to over 6% when you are basically at full employment then short rates will rise strongly. Will they rise strongly enough to cause a recession will depend on wages getting a giddyup. My down under guess is the FED will wait to see IF wages start to rise before putting rates up above normal levels.

That’s correct, that’s Powell’s style of doing things.

https://abcnews.go.com/amp/Business/wireStory/powell-bullish-us-economy-expects-rates-rising-56639510

OMG, I just noticed that. (OK, yeah I’m slow sometimes). The FART act. Who came up with that name?? I mean which member of Trump’s staff?? Gary Cohn had already left before they chose that name, yes?? There’s NO WAY that is a coincidence.

Hey, I found video of the private meeting between Wilber Ross and Peter Navarro that gave birth to the “United States Fair and Reciprocal Tariff Act”. Disappointingly, the room was not filled with cigar smoke: Obviously it goes without saying, Wilbur is BH and Navarro is Beavis.

https://www.youtube.com/watch?v=H7-Ov0EUBJg

This is obviously “dated”, especially after Monday’s events. But I’ve been a Susan Rice “fanboy” for quite awhile now—she’s an attractive woman, has a razor sharp mind, and she has a pretty good grip on world affairs. I think she’s nearly always worth reading (she did whitewash Benghazi to a degree, and I think she could be a little more publicly reflective on the lack of action after the Syria chemical strikes). My guess is Rice has her private moments of doubt on the lack of response on the Syria chlorine strikes but chooses not to hang them up on her outside laundry line). Anyway, generally I respect her view on world politics:

https://www.nytimes.com/2018/06/08/opinion/trump-putin-g7.html

Militarist Hawker,

Alleged chemical strikes. At Douma the OPCW run by US found choro-compounds associated with heated chlorine. And no nerve agent residue. Who applies heat to degrade OPCW? If I were on the jury I would vote “not Syrian Govt”.

The 2017 Idlib event is not proven. Real issues with no evidence, and white helmet staged photos by amateurs who forget physics and chemistry. If I were on the jury I would vote “not Syrian Govt”.

OPCW run by US and UK propagandists. Russian OPCW dissent has been by scientists!

While the Salafists’ war parties (NATO) scramble to get al Qaeda’s propaganda corps aka white helmets out of reach of Syrian justice.

They needed to keep lid on Benghazi supply lines to al Qaeda.

@ ilsm

Did you call Dear Leader Putin and give him the great news?? I know Putin was “deeply worried” about the children of Syria. I heard Putin cried himself to sleep each night worrying about the Syrian school children the Russian jets bombed. Maybe when trump spoons Putin at night he can nibble on his ear and Putin will feel better.

https://www.youtube.com/watch?v=0votGkvzWuM

https://www.youtube.com/watch?v=XkTtpYFVNfM

By the way a fascinating article showing the Trump effect is in fact no effect on the Yank economy.

I highlight today at my place. It is at Vox eu

…….And this is why some folks have very little respect for the economics profession. It reminds me of meteorologists who work for the national weather service, who will sit there with a straight face and tell you that a tornado that had 200+mph winds is an F1 category tornado, because all it did was damage a wheat field. Meteorologists with no marketable skills but taking a clip board or i-Pad and looking at brick damage and whether the backdoor patio collapsed or not, can sit there and tell us it was an F1 so they have a job to go to—-but if the reading on the NEXRAD radar says the winds were 200+mph, those guys looking at brick damage or the wheat field can go F— themselves.

I figure I owe Menzie at least one high quality link, in case I start drunk posting tomorrow. (I like to think I am just as cogent when drinking as not, but I am probably kidding myself, as I often do) Saw this in FT Alphaville, not sure the date of the UBS research, but I think it must be very recent or FT wouldn’t post it. Some really great points here that Menzie has tipped us off on already—effects of trade war on global value chain (supply chain), the fact that “IMF World Outlook” did not include the most recent “proposed” $200 billion in USA import tariffs. The impacts of increased prices on general demand. The effects of China’s use of NTBs (non-tariff barriers). UBS used an estimate that the NTBs would be equivalent to a 91% tariff on imports from the USA. The basis point (bp) impact on inflation would be higher in the USA and China than in other countries, and that some of Mexico’s trade retaliation decisions would come at the same time as Mexican elections. I haven’t read the 2nd link below yet, but I wager it is very worthwhile reading also:

https://ftalphaville.ft.com/2018/07/17/1531831732000/Trade-tension-and-China/ <— by Dan McCrum of FT

https://ftalphaville.ft.com/2018/07/02/1530544304000/The-Amlo-wdown/ <— Ny Jamie Powell of FT

One of Menzie’s more wise and cerebral commenters, with a proclivity to drink good wine when it’s raining outside, might be interested in this story, presuming she hasn’t read it already:

https://www.newyorker.com/magazine/2018/07/09/can-andy-byford-save-the-subways

Did you see that fed paper from last month i think on 2s10s not being so good, front end inversion was better metric https://www.federalreserve.gov/econres/notes/feds-notes/dont-fear-the-yield-curve-20180628.htm

Neil: Yes, see this post.

Some might find Tim Duy’s post: https://blogs.uoregon.edu/timduyfedwatch/2018/07/16/fed-pushing-ahead-toward-inversion/ interesting.