Some see this as inversion imminent.

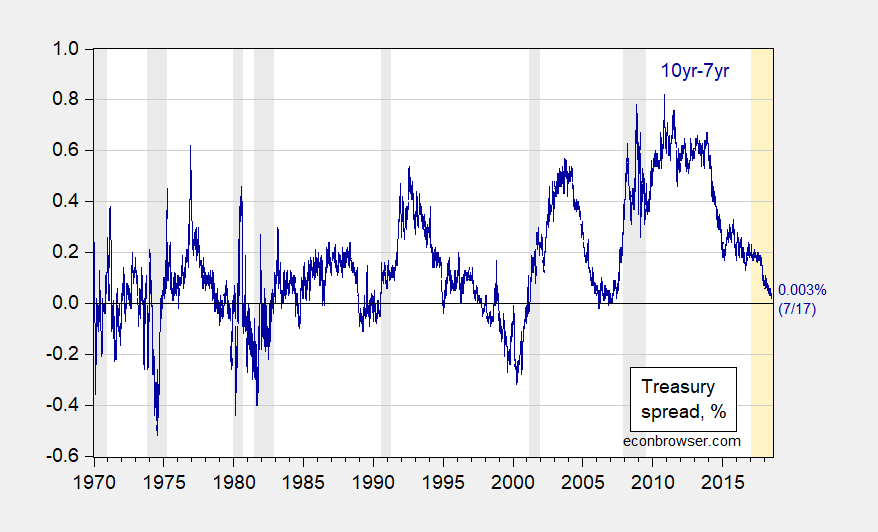

Figure 1: Ten year-seven year Treasury spread, % (dark blue). NBER defined recession dates shaded gray. Orange denotes Trump administration. Source: FRED, Treasury for 7/17, and NBER.

The more traditional Ten year-three month and ten year-two year spreads as of yesterday are shown here.

Menzie

I am not particularly interested what the generic ‘some’ say, but am most interested in what you and Jim have to say about imminent inversion. Put it out there.

Ed

Both don’t put it out there in technical terms as Ed just hates that!

Operation “Middle Aged Guy Fetching Booze” is complete. Soon Operation “Middle Aged Guy Sneakily Consuming Booze In a ‘No Booze’ Zone” will commence. Geez H Christendom, it’s been about 6 months since I have had anything. But I bore you all….

Don’t know what to say about the inversion of the curve. Anyone knows the inversion of the yield curve is a serious thing and semi-ominous. But I do think in the current context it’s not as frightening as it usually is. And Although I find it frightening and anxiety-inducing to agree with “rtd” on anything, the Brainard comments seem legit to me. I think what she said makes sense. How far does it have to invert to be worrisome?? I would say 50bp or 75 bp and hugging the “Z-L-B” and I start to think it becomes real and tangible.

I can’t wait until Autumn. It’s freaking hot and humid where I am, and I HATE HATE HATE the summer. HATE it.

buy an air conditioner; though your temper might not change.

The spread has fallen because the yield on 7-year bonds have risen by more than 90 basis points since early September.

https://fred.stlouisfed.org/series/DGS7

FED policy is getting a bit tighter.

I’m slightly confused. Didn’t they both move up in tandem from September?? The 10-year went up about 80bp which only makes a difference of 10bp. The major move would have been 2014, yes??

isn’t it that the Fed is less expansionary

“During the Fed’s 1988 tightening cycle, other areas of the curve turned negative around 6 to 28 days after the gap between 7- and 10-year yields went below zero, according to BMO. In the hiking phases that began in 1994 and 2004, inversion took hold even quicker, according to research using a seven-year off-the-run Treasury for modeling periods when the government wasn’t issuing the maturity.”

Did we have a recession in 1988? Or 1994? Or 2004? I don’t remember those recessions. We saw something similar with respect to government bond rates in early 2006. I don’t recall the 2006 recession either.