In a recent paper, Ryan LeCloux and I use five macroeconomic measures to assess state economic performance (post). Here, I use updated data to evaluate Minnesota’s economic performance vis à vis Wisconsin: GDP, personal income, nonfarm payroll employment, civilian employment, and coincident indices and “adjusted” coincident indices.

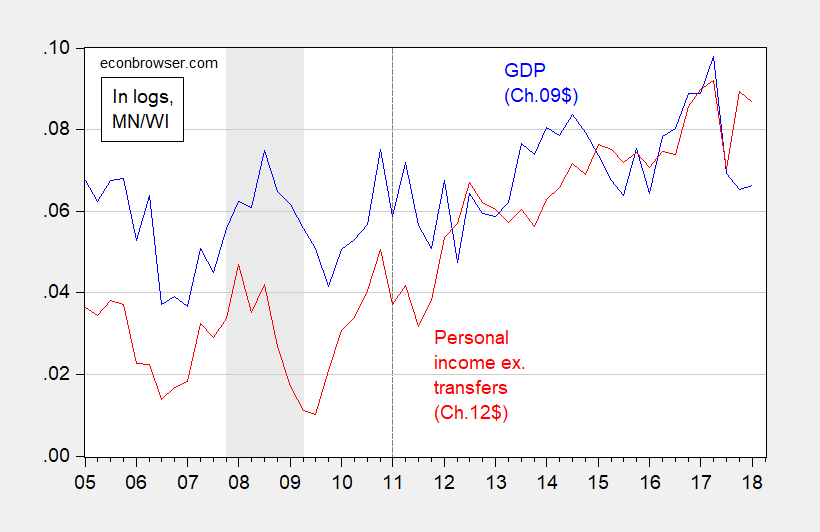

Figure 1: Minnesota/Wisconsin log ratio GDP in Ch.2009$ (blue), personal income excluding transfers in Ch.2012$ (red). NBER defined recesion dates shaded gray. Source: BEA, author’s calculations.

The GDP ratio is quite volatile. The standard deviation of (annualized) first differences of the log ratio is 4%, while that for personal income is 3.4%; moreover, the GDP ratio is leptokurtic.

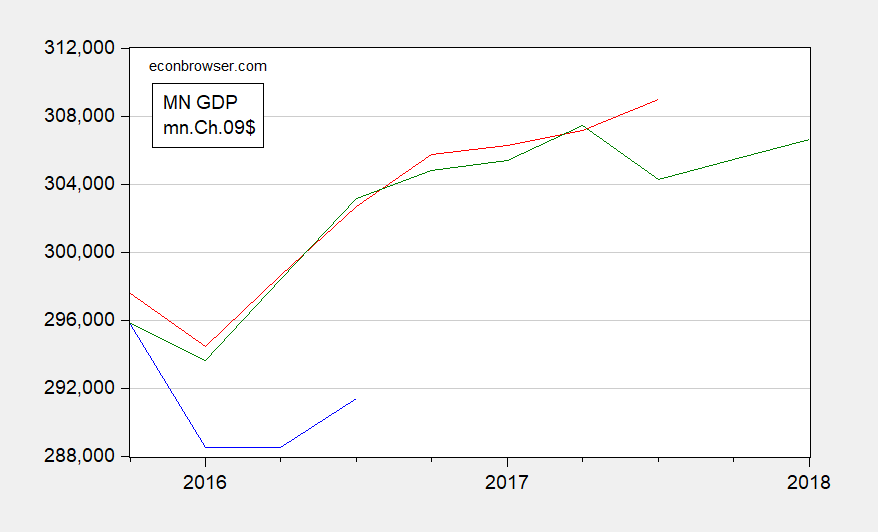

The GDP series are also subject to large revisions. Below are presented different vintages of the Minnesota GDP series.

Figure 2: Minnesota GDP in Ch.2009$, various vintages, on a log scale. Source: BEA.

Hence, it seems unwise to rely too heavily on the quarterly GDP series to infer short term trends. On the other hand, employment series seem to present similar stories regarding Minnesota vs. Wisconsin performance.

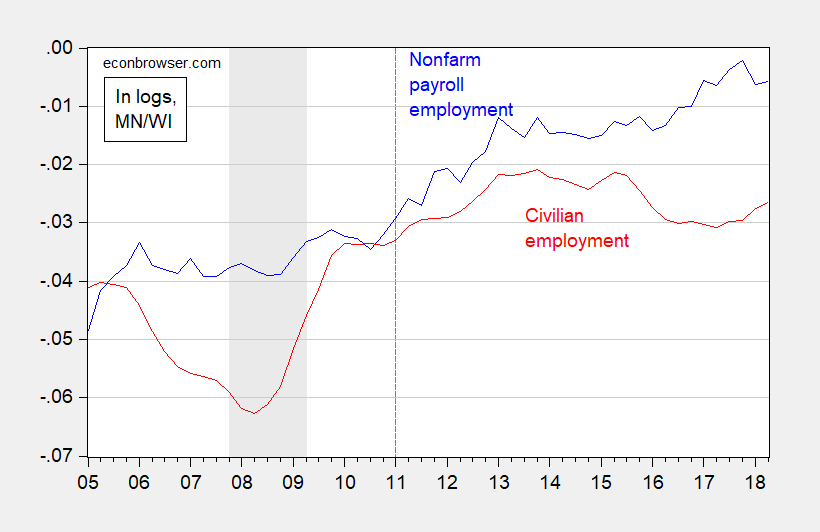

Figure 3: Minnesota/Wisconsin log ratio nonfarm payroll employment (blue), civilian employment (red). Quarterly data generated by averaging monthly data. NBER defined recesion dates shaded gray. Source: BLS, author’s calculations.

When examining these series, it’s important to recall that generally, the establishment series (like nonfarm payroll employment) are more reliable than the household series [1]. Given this, it seems clear that Minnesota is outpacing Wisconsin.

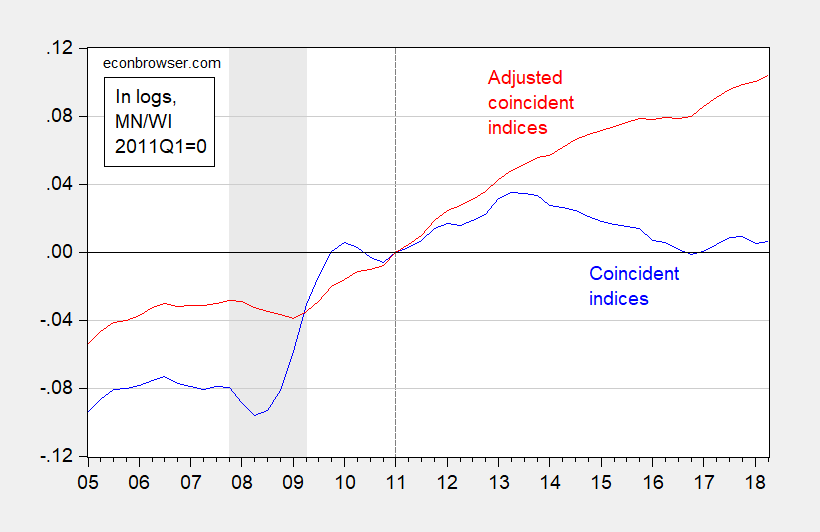

Finally, we come to the Philadelphia Fed’s coincident indices. I’ve relied on these series to compare performance across states, and most recently made reference to them here. In Figure 4, I show the simple log ratio of the coincident indices. By and large, Minnesota growth outpaced that of Wisconsin until about 2013, with a partial reversal, and ending with resumption of Minnesota outperformance in the last year.

Figure 4: Minnesota/Wisconsin log ratio coincident indices (blue), and “adjusted” coincident indices (red), both 2011Q1=0. Adjustment to Minnesota is 0.65, to Wisconsin is 0.29, based on Chinn and LeCloux (2018), Table 2. Quarterly data generated by averaging monthly data. NBER defined recesion dates shaded gray. Source: Philadelphia Fed, author’s calculations.

As we document in Chinn-LeCloux, the elasticity of GDP with respect to the coincident index (growth rates) is not typically unity. Using the estimated elasticities or “sensitivities” reported in Table 2, I adjust the coincident indices to mimic GDP, and show the adjusted ratio in red. Then the growth of Minnesota relative to Wisconsin shows up unambiguously.

Realize this is just friendly teasing Menzie, but have you ever thought of working for the Minnesota tourism bureau??

I live in a state where you can often hear the phrase “Well, if you dern’t net like eht har, thuhn wy dern’t yer git theh hell out!?!?!?!”—the mating call of white trash rednecks still yearning for their GED. More apt to be heard emanating from a mobile home park during “politically charged” years.

If you live in a central red state then odds are people are getting the hell out. Either by moving or dying.

Catching up on unread NYTs tossed onto the floor. Always be careful kids, you never know who could be funding/sponsoring studies. Heinz sponsored studies on ketchup and Hershey’s sponsored studies on chocolate tend to be, eh, less reliable:

https://www.nytimes.com/2018/06/18/health/nih-alcohol-study.html

I have had a friendly disagreement with Professor Chinn, over the recent BEA number on GDP of 4.1% (a number I view as much too high), which I am sure Professor Chinn doesn’t see as “infallible”, but he supports the BEA number as “largely trustworthy” (these are my interpretations of Menzie’s thoughts on this, if I am putting words in his mouth I apologize). Menzie easily has the upper-hand at this point as I have no empirical data to back up my contention. I am still holding strong to this opinion of mine, that the 4.1% GDP number by BEA is largely unbelievable in the current context of this economy.

Now, some may think I “searched out” this article. But I happened to find it as I was going through old hardcopy NYTs that I had not read. Some people believe the BEA to be nearly infallible. I can only say NASA is also largely seen to be nearly infallible, and yet…….

https://www.nytimes.com/2018/06/14/science/asteroids-nasa-nathan-myhrvold.html

Would most people assume that NASA is stellar in the department of measuring things accurately?? Most people would say so. Certainly most educated people would say so (“educated” here meaning those with 4-year university degree or higher). Food for thought.