Today, we are fortunate to be able to present a guest contribution written by Steven J. Davis, William H. Abbot Distinguished Service Professor of International Business and Economics at the University of Chicago Booth School of Business and Senior Fellow at the Hoover Institution.

Donald Trump has upended U.S. trade policy. The particulars include a U.S. pullout from the Trans-Pacific Partnership (TPP), threats to jettison the North American Free Trade Agreement, a refusal to affirm new WTO judges, tariff hikes on steel and other goods, frequent rhetorical attacks on major trading partners, and a wrong-headed obsession with bilateral trade deficits.

Trade policy under the Trump administration also has a capricious, back-and-forth character that undermines a rules-based trading order. Less than three months after withdrawing from the TPP, the President said he would consider rejoining for a substantially better deal, only to throw cold water on the idea a few days later. Initially, the administration justified steel tariffs on the laughable grounds that Canada, for example, presents a national security threat. Later, President Trump tweeted that tariffs on Canadian steel were a response to its tariffs on dairy products. Some countries get tariff exemptions, some don’t. Exemptions vary in duration, and they come and go in a head-spinning manner. Two days ago (August 10), the President tweeted that he “just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey” for reasons unclear. For a fuller account of tariff to-ing and fro-ing under the Trump administration, see the Peterson Institute’s “Trump Trade War Timeline.”

The rhetorical attacks and capricious nature of the Trumpian approach to tariff policy also invites retaliation. Tit-for-tat tariff hikes between the United States and China are well underway. Canada, Mexico and the European Union have also imposed new tariffs on American imports. Many of the retaliatory tariffs fall on American farmers, prompting the administration to promise up to $12 billion in aid to help farmers cope

with the costs of the President’s trade policy battles.

Needless, added complexity is another feature of Trump administration trade policy. The Department of Commerce has rolled out a slow-working, burdensome process for requesting company-specific exemptions from the new steel and aluminum tariffs, as neatly recounted in a Wall Street Journal editorial:

[C]ompanies must submit a request attesting that their imports aren’t made in the U.S. in “a satisfactory quality” or “sufficient and reasonably available amount.” Companies must state the uses for their steel product, their average annual consumption of the product, as well as the number of days required to take delivery, manufacture and ship the product. They must also estimate the maximum and minimum composition of 24 chemical elements in their products including molybdenum, antimony and vanadium. There are dozens of other queries, but we’ll spare you.

Oh, and a separate request is required for each width, length, grade shape, and form of steel or aluminum product. A single company, Primrose Alloys, has submitted more than 1,200 steel product requests, according to Commerce’s database. All 14 that have been reviewed so far were denied.

Businesses may also submit statements to support their requests, which naturally turn political…

Crony capitalism, political favoritism, and extra sand in the gears of commerce – here we come!

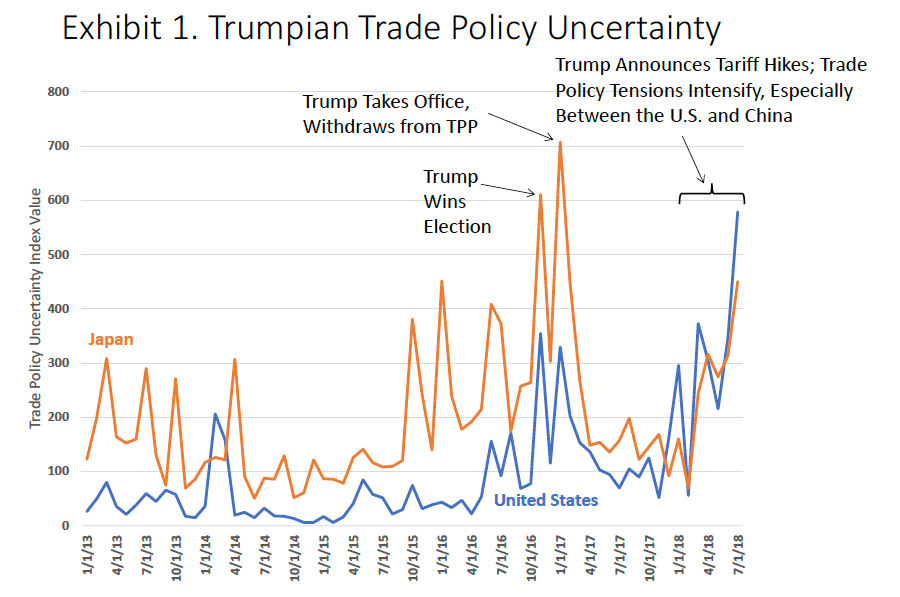

One consequence of all this is a tremendous, Trumpian upsurge in anxiety and uncertainty about trade policy and its economic fallout. Exhibit 1 displays a monthly index of U.S. Trade Policy Uncertainty (TPU) that I developed with Scott Baker and Nick Bloom. It reflects the frequency of articles in American newspapers that discuss economic policy uncertainty and trade policy, in particular. Since Trump’s surprise victory in the November 2016 election, the average TPU index value is up nearly five-fold relative to 2013-15. The full history of the U.S. TPU Index (available from 1985 at PolicyUncertainty.com) shows no other episode of similarly elevated uncertainty, except for the period from 1992 to 1994 due to NAFTA-related concerns.

Notes to Exhibit 1: Data downloaded from PolicyUncertainty.com on 10 August 2018. The U.S. series follows “Measuring Economic Policy Uncertainty” by Baker, Bloom and Davis in the Quarterly Journal of Economics, November 2016. The series for Japan follows “Policy Uncertainty in Japan” by Arbatli, Davis, Ito, Miake and Saito, NBER Working Paper No. 23411, May 2017. U.S. data are rescaled to 100 from 1987 to 2015 to match the normalization in the Japanese data.

Exhibit 1 also shows an analogous TPU Index for Japan that I developed with Elif Arbatli, Arata Ito, Naoko Miake and Ikuo Sato. Movements in the two TPU indices are remarkably coherent since Trump’s election. Both countries’ TPU indices surge on Trump’s election win in November 2016, his presidential inauguration and withdrawal from the TPP in January 2017, and the escalation of trade policy tensions since February 2018.

The exhibit supports two conclusions: First, the surge in trade policy uncertainty since November 2016 emanates from a course change in the United States. Second, the U.S. shift is reverberating around the globe.

One question raised by these developments is whether, and how, firms are reassessing their capital investment plans in light of recent tariff hikes and fears of more to come. By raising input costs, domestic tariff hikes undercut the business case for some investments. Of course, tariff hikes might also raise domestic investment in newly protected industries. Retaliatory tariff hikes by trading partners affect domestic investment by curtailing the demand for U.S. exports. An uncertain outlook for trade policy gives firms in all industries a reason to delay investments, while they wait to see how trade policy disputes unfold. The complexity and discretionary nature of tariff exemptions further compounds the uncertainty facing business decision makers.

The monthly Survey of Business Uncertainty (formerly Survey of Business Executives), fielded by the Federal Reserve Bank of Atlanta, offers some evidence on these matters. The SBU elicits information about each firm’s expectations and uncertainty regarding its own future capital expenditures, sales growth, employment, and costs. I developed the SBU in collaboration with Nick Bloom of Stanford and David Altig, Mike Bryant, Brent Meyer and Nick Parker of the Atlanta Fed.

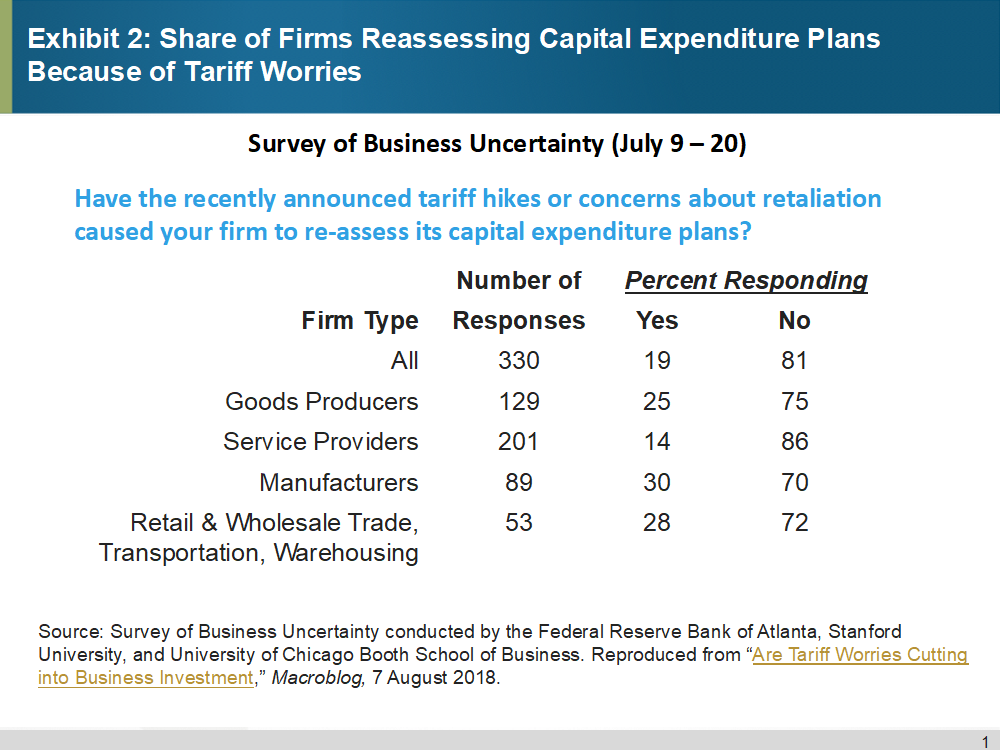

The July 2018 SBU includes the following question: “Have the recently announced tariff hikes or concerns about retaliation caused your firm to re-assess its capital expenditure plans?” Yes, said about one-fifth of our respondents.

As Exhibit 2 shows, the share of firms reassessing their capital expenditure plans because of tariff worries is higher for goods-producing firms than service providers. It’s 30 percent for manufacturers and 28 percent in retail & wholesale trade, transportation and warehousing. In contrast, it’s only 14 percent among all service providers in our sample. These sectoral patterns make sense, given that manufacturing firms, for example, are more engaged in international commerce than most service providers.

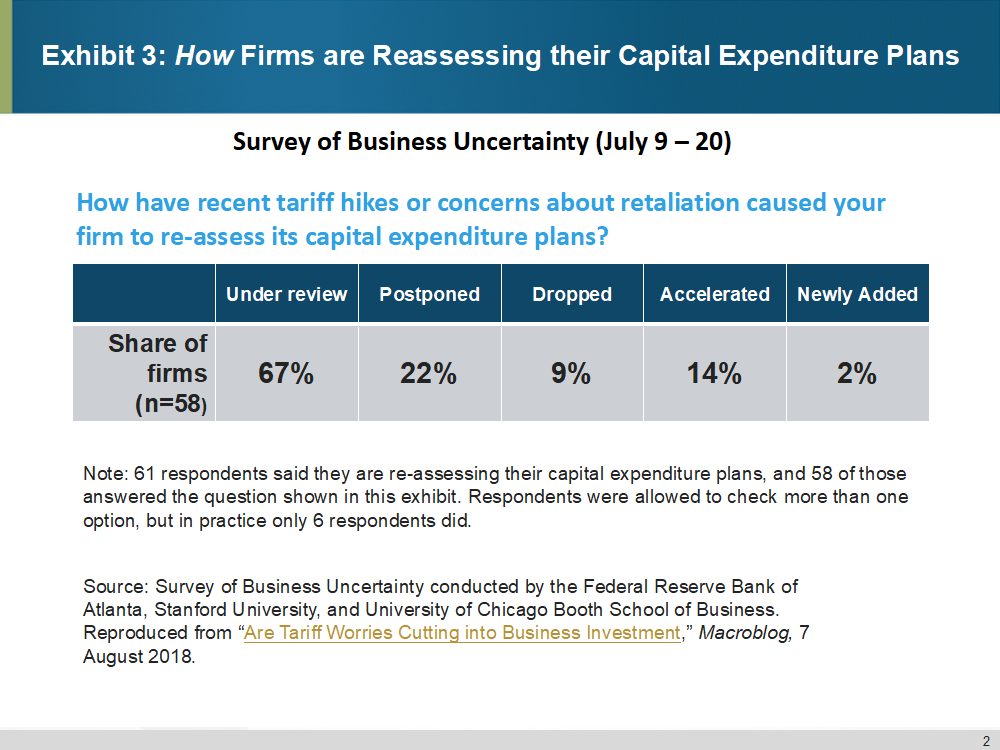

We also asked firms how they are reassessing their capital expenditure plans in light of tariff worries. Exhibit 3 provides information on this issue. Among firms reassessing, 67 percent have placed some of their previously planned capital expenditures for 2018–19 “under review,” 31 percent have “postponed” or “dropped” previously planned expenditures, 14 percent have “accelerated” their plans, and 2 percent (one firm) added new capital expenditures for 2018–19.

Finally, we asked firms how much tariff worries affect their previously planned capital expenditures. Among firms re-assessing, an average 60 percent of their capital expenditure plans are affected. The predominant form of reassessment is placing previously planned capital expenditures “under review.”

Let’s sum up the U.S. survey evidence: About one-fifth of firms in the July 2018 SBU say they are reassessing capital expenditure plans in light of tariff worries. Among this one-fifth, firms have reassessed an average 60 percent of capital expenditures previously planned for 2018–19. The main form of reassessment thus far is to place previously planned capital expenditures under review. Only 6 percent of the firms in our full sample report cutting or deferring previously planned capital expenditures in reaction to tariff worries. These findings suggest that tariff worries have had only a small negative effect on U.S. business investment to date.

Still, there are sound reasons for concern. First, 30 percent of manufacturing firms report reassessing capital expenditure plans because of tariff worries, and manufacturing is highly capital intensive. So, the investment effects of trade policy frictions are concentrated in a sector that accounts for much of business investment. Second, 12 percent of the firms in our full sample report that they have placed previously planned capital expenditures under review. Thus, the negative effects of tariff worries on U.S. business investment could easily grow.

Third, trade policy tensions between the United States and China have only escalated since our survey went to field. As of July 6, the U.S. began imposing tariffs on $34 billion worth of Chinese imports with another $16 billion scheduled to take effect on August 23. China responded by imposing tariffs on $34 billion in U.S. exports, coupled with threats to slap new tariffs on an additional $16 billion. Responding in turn, the President ordered the U.S. Trade Representative (USTR) to begin the process of imposing a 10 percent tariff on another $200 billion in Chinese imports. China promptly vowed to retaliate. On August 1, the President directed the USTR to consider raising tariffs on $200 billion of Chinese imports from 10 to 25 percent. China responded by threatening additional duties on $60 billion worth of U.S. imports, and warning that it could adopt further countermeasures. These developments suggest that the negative effects of tariffs and tariff worries on U.S. business investment could grow much larger.

What about the effects of Trumpian trade policy uncertainty on business investment in other countries? A recent Reuters survey of Japanese firms offers some evidence. (Many thanks to Arata Ito for alerting me to this survey and for summarizing the results in English. See here for a related article in English.)

The Reuters survey, which went to field from July 2 to 13, includes the following question: How is your firm likely to change its previously planned capital expenditure for the [2018] fiscal year in response to rising trade tensions between the U.S. and China and Europe? 253 large- and medium-sized firms responded.

Three results: First, 24 percent of respondents to the Reuters survey report a wait-and-see stance. That is, they may defer or cut their previously planned capital expenditures for fiscal year 2018 in response to trade policy tensions. Second, the share of firms adopting a wait-and-see stance is larger for manufacturing firms, echoing our finding in the SBU. Third, about half the firms that produce iron and steel, nonferrous metals, textiles, pulp or paper are taking a wait-and-see stance. In short, the survey evidence says that Trumpian trade policy uncertainty also discourages business investment abroad. This type of response in other countries dampens the demand for U.S. exports.

Fortunately, the negative investment effects of Trumpian trade policy uncertainty appear to be modest thus far, and they occur against a backdrop of strong macroeconomic performance – at least in the United States. Under less favorable circumstances, or if trade barriers continue to rise, the Trumpian approach to trade policy has the potential to cause a good deal more economic pain.

In closing, I should note that the harmful consequences of tariff hikes and trade policy uncertainty extend well beyond short-term investment effects. For other critiques of the Trumpian approach to trade policy, see the worthy commentaries by Robert Barro, Alan Blinder, John Cochrane, Doug Irwin, Mary Lovely and Yang Liang, Greg Mankiw and Adam Posen, among others.

This post written by Steven J. Davis.

And, yet, the elimination of all forms of trade barriers is a worthy goal.

To make the U.S. more competitive and increase U.S. exports.

Our major trading partners need to get on board.

Play fair!

Get on board?- it is your boy (Trump) that has initiated this trade war. Either you admit he is a fool or you become the fool’s fool!

PeakTrader You’re either braindead or incredibly naïve if you believe Trump supports across-the-board free trade. He has strongly opposed free trade his entire public career. What Trump does support is free and open markets to other countries for US products and strong tariffs to protect US markets.

I hear a lot of farmers who supported Trump clinging to some belief that while there’s short term pain now, over the long run foreign markets will open up to US products. Dream on! At this point it’s clear that the best Trump will be able to accomplish is a return to the ex ante position we had before he started all this trade war nonsense. And in that case all of the pain will have been for nothing except that his supporters will hail it as a great victory.

make the U.S. more competitive and increase U.S. exports.

And yet you’re not in the least bit alarmed over Trump’s yu-u-uge fiscal deficits with an economy that is operating at full employment and above the ZLB. Your cognitive dissonance is simply stunning. Apparently you don’t see any connection between deficits, interest rates and exchange rates, but yet we’re supposed to believe that you studied economics.

2slugbaits, your false assumptions are what’s “stunning.”

Trump has said he wants to eliminate all trade barriers.

https://www.google.com/amp/s/ktla.com/2018/06/09/president-trump-calls-for-elimination-of-trade-barriers-including-tariffs-between-u-s-and-closest-allies/amp/

You want to continue the failed economic policies of the Obama years, which resulted in huge budget deficits, enormous government debt, and highly accommodative monetary policy with low interest rates that failed to close the output gap, except through the destruction of potential output.

I stated in early 2009, huge tax cuts and massive deregulation are the major appropriate response to the financial crisis and to close the output gap. You’re the one, who sees no relationship of economic variables, which is why you’ve been wrong.

PeakTrader: Trump said he wanted zero tariffs, just like he said he wanted a deal on DACA, and health care coverage for everybody. Look at what he does, not what he says.

Menzie Chinn, Trump’s opponents, including in the Republican Party, have been a negative force in making progress on free trade, DACA, health care, etc..

peaktrader, you are coming up with excuses for trump’s shortcomings.

PeakTrader Why would any leader trust any agreement with Trump? The man has a history of breaking agreements before the ink is dry. That describes his entire private business life and we see plenty of evidence of the same trait in his public life. How many times has he told a woman he loves her and would be faithful through thick and thin, for better or for worse? The man has spent four decades arguing that free trade agreements were for suckers, so why do you think a 71 year old man suddenly changes his mind? You’re delusional. If he really supports free trade, then why didn’t he set the bar lower and just go for freer trade. You should be suspicious of anyone who won’t settle for the good and only insists on the perfect. That’s an obvious smokescreen. It’s just a case of setting up an advance excuse for not having to really do what you said you would do. But Trump is right about one thing. Trump could shoot someone on 5th Avenue and you’d still believe in him no matter what.

I stated in early 2009, huge tax cuts and massive deregulation are the major appropriate response to the financial crisis and to close the output gap.

This isn’t 2009 and the economy isn’t in a deep recession and the interest rate is not at the ZLB. If you don’t understand the difference between the 2009 economy and the 2018 economy, then there’s no hope for you. Instead, you should just go live at zerohedge.com. Or join crackpot poster JBH over at InfoWars.

I love it when people, who are not able to muster a fact-based response, run the the rabbit hole of Obama or Clinton.

John, yes, it’s quite a rabbit hole pretending the weak and expensive Obama “recovery” is somehow normal or even good.

https://www.advisorperspectives.com/dshort/updates/2018/07/27/q2-real-gdp-per-capita-3-41-versus-the-4-06-headline-real-gdp

Obviously, some people can easily be brainwashed into believing anything.

If you ignore enough relevant factors, you can also believe Clinton singlehandedly created an economic boom in 1995-00.

Of course, slower economic growth is expected, including from demographic shifts. Nonetheless, we should’ve closed the output gap by the end of 2011. There’s still substantial slack in the economy nine years after the downturn!

People here critical of Barro ignore the fact that he correctly predicted “Obamanomics” would be a failure.

I also made that prediction, although it turned out worse than I expected.

Spot on. Of course you saw the usual BS reply from PeakPathetic. He might as well have said ” yo momma wears army boots”. Lord knows Peaky would never serve his nation in a war!

peak, you continue to link this chart. you need to provide an argument on why the period after a financial crisis should resume growth at the same rate as previous decades? in fact, the decade prior has ALREADY begun to slow down. further, not sure if an exponential growth model over decades would be an appropriate one to use, as early errors would get amplified later in the curve. this is really a poor argument you have been making while providing zero support to the curve you provide.

“Of course, slower economic growth is expected, including from demographic shifts. Nonetheless, we should’ve closed the output gap by the end of 2011.”

if you accept slower economic growth, then you cannot expect to close the output gap. this is like lowering the speed limit and expecting to arrive at your destination sooner.

“Our major trading partners need to get on board.”

in case you did not realize it peak, your position actively calls for ignoring and voiding any prior agreements or contracts for which you now disagree with. i am not in disagreement that terms could exist which are more beneficial for me today in those agreements. but you are advocating for basic anarchy. any time i feel an agreement or contract is disfavorable, i have the obligation and right to change it on all parties involved to my benefit. this is how trump runs his businesses. strike a deal with a contractor to work on his casino, and after the work is done change the payout because he feels the work is only worth 70% of what he agreed to in the contract last year.

so my question to you peak, is this ability to void contracts at will a universal right, or simply a perk accorded to those named trump? the rest of us must still follow contract law, while it does not apply to trump?

Baffling, so, you don’t believe in correcting market failures either.

actually you are not describing true market failures. you are calling things you do not like as market failures. once again, you do understand you are an advocate of anarchy? you advocate for the voiding of contracts whenever it is to your benefit, and the fulfillment of contracts only when it is to your benefit. to be clear, an agreement which the us has with another country which is not in their benefit: should that country be able to unilateralyl leave the contract and demand new terms?

Lord – caught in one lie you follow up with misrepresenting what anyone else has said. The press says Trump is the biggest liar of all time. Not quite but his Minnie Me (PeakDishonesty) is!

We can expect joy in Mudville when sugar growers welcome the end to, oh, 239 years of import tariffs on foreign sugar. Which will probably happen on the same day Melania leaves Donald for life in a convent.

Past “leaders” left American Citizens out to go poor in the name of “global” play and stupid environmental fear mongering. Trump is punching the bullies in the nose. IF you don’t like the violence, take your pounds to Britain, or your deutschmarks to play with Merckle. We have not been so FUBAR in the world since FDR and his commie cronies. Clinton and Obammmma are to blame…. I am proud to be MAGA man …. get with the program. Screw those thieving corrupt Chinese with their slave labor, polluting factories, and STEALING American brilliance IP.

Peak’s alter ego or his new Minnie Me?

pgl: I thought KARLMARXisEVIL was a joke. You think he said all that stuff in seriousness?

sarcasm perhaps. but if you notice, these are the same things peak loser claims in all seriousness-no sarcasm needed. troubling world where people actually live out our sarcasm.

It really is getting much harder to decipher satire on the internet. Sarcasm has always been hard to make out online, but not satire until recently. Consider Alex Jones a prep course. Or even Glen Beck really. But I think even Beck’s base core was getting tired of the sobbing act. You know many of Beck’s Youtube uploads now get less than 2,000 hits?? That’s a big embarrassment for the man who used to have the illiterate unwashed eating out of his palm every weekday on FOX. Any day now he’ll be inviting “Princeton” Kopits on to discuss PR mortality rates, international trade theory, confidence intervals, and MLK. And at the end of every clueless verbal paragraph from “Princeton” Kopits we can expect an “Amen brother!!!!” from Beck.

KARLMARXisEVIL Important correction. It started with Wilson. Both his support for and signing of the unconstitutional Federal Reserve Act in 1913. And then getting the United States into the First World War, a war that would never have happened had the British not liaised with the corrupt Colonel House who ruled over this weak president. In fact the very election of Wilson was a travesty against the American people, as the Democrats maneuvered Teddy Roosevelt into running again splitting the vote resulting in Wilson gaining the presidency by the smallest popular vote percentage ever. Moreover as planned by Aldrich et. al., the newly created Fed immediately sprang into action enabling the vast build of war bonds necessary to fight the war. On this, read the heavily documented seminal Hidden History: The Secret Origins of the First World War, Docherty and Macgregor, 2013. The sensible hard-working isolationist American public — by a ratio of 80-20 — were full against going to war a second time in 1941. Naturally enough. But the criminal FDR baited the Japanese for an entire year before, and then when the day came deliberately kept his full knowledge of the time and date of the Pearl attack from Admiral Kimmel and General Short in Honolulu. The order had long been given by FDR ahead of time to send the modern fleet to sea. The true story is now out on these critical episodes and on much, much more. You cannot do macroeconomics without understanding this larger sphere.

Kennedy was assassinated by dark forces in and above our government. Notable of these were Allen Dulles and LBJ. The next president to attempt turning this evil juggernaut around was Reagan. They shot him too and thus engineered a holding pattern. After Reagan, the dam burst. Now President Trump has gained office. He knows it all because he alone has access to the NSA’s records of all phone calls and emails. The media is in a panic. Trump is a true patriot in the footsteps of Washington, Lincoln, and JFK. It is myopic to the nth degree to think about trade in conventional terms at a time like this. There are many fish swimming in these waters, and only the president and his close circle truly know what is going on. MAGA Mr. President. Unleash what hounds are necessary and bring it on.

JBH: O..kay…

JBH You forgot to mention the fasces on the back of the Mercury dime! Another mistake like that and you’ll lose your Alex Jones secret decoder ring. But thanks for the laugh. You’re a hoot. A kooky hoot, but a hoot nonetheless.

“Crony capitalism, political favoritism, and extra sand in the gears of commerce – here we come!”

Oh joy – the Usual Suspects have already been instructed to pounce. There is lots of data here for PeakDishonesty to cherry pick and misrepresent. And of course this excellent posts links to a list of both conservative and liberal economics who have eloquently criticized this Trump disaster. Expect CoRev to suggest none of them understand economics or business!

Haven’t digested it all yet (there’s a lot here) but this is an outstanding guest post. We’re so lucky to be the beneficiaries of Menzie’s efforts to get some great people like Professor Davis, Ashoka Mody, etc. on this blog. The chorus of boos is growing for the VSG. I view this as one of two issues right now that can potentially “kill” Orange Excrement.

Alan Blinder has been one of my favs going clear back to my freshman year of college (that’s a long time folks). And Mary Lovely has been more on my radar lately.

Barro opens his oped with this?

“Most of my academic colleagues are Democrats. But even the few who are Republicans are for the most part ardent Trump opponents. So I tend to get into trouble whenever I say something positive about administration policies. Common reactions include: “Are you a Trump supporter?” or “How the hell can you be a Trump supporter?” or similar queries that are more colorful.”

Partisan politics ahead of economics. What positive can be said about Trump’s economic policies? Oh yea – we got that tax cut for the rich. It was the opposite of tax simplication. It will also reduce national savings and hence lead to less investment not more. So is the great Robert Barro now for feeding the trough of tax cheats and their lawyers? Is Barro now saying we should have less long-term growth and large Federal deficits to boot? Oh wait – maybe Barro has lost his marbles and thinks Art Laffer deserves a Nobel Prize!

Yes, Democrats are more political.

You saying the tax cuts are only for the rich is a political and ignorant statement.

The tax cuts are for businesses and households, rich and poor.

There are many ways to cut government spending to raise national saving and cut government investment, which is spending.

“The tax cuts are for businesses and households, rich and poor.”

they may be for the rich and poor, but do you deny the overwhelming majority of the tax cuts benefit the rich and not the poor?

The tax cuts help the poor.

That’s what’s important.

exactly how? by putting more money in the wealthy pockets? poor argument.

The poor get a tiny tax cut and then they have they health care benefits and Social Security checks slashed by lying right wingers like you. This is well documented so even a village idiot like you knows this. But of course you are incapable of admitting it.

Baffled: “they may be for the rich and poor, but do you deny the overwhelming majority of the tax cuts benefit the rich and not the poor?” and

“exactly how? by putting more money in the wealthy pockets? poor argument.” fails to recognize who even pays taxes let alone who pays the MOST in taxes.

Baffled, how should a tax cut for the poorest/poor work?

Speaking of poor arguments yours is irrational. We should next hear from the usual suspects the tested phrase: “Tax cuts for the rich!”, and then the typical income transfer comments.

CoRev and then the typical income transfer comments.

Hmmm…you don’t seem to have any problem with subsidized crop insurance programs. Aren’t those income transfers as well?

2akugs, “Hmmm…you don’t seem to have any problem with subsidized crop insurance programs. Aren’t those income transfers as well?” absolutely do support a short term and purposeful subsidy. Don’t you?

corev, as usual, fails to understand the discussion. peak loser said “The tax cuts help the poor. That’s what’s important.”

corev goes on a viral rant as usual. i simply responded that that is not true and it is a poor argument. corev goes on to put words in my mouth to make his usual straw man arguments.

but let’s be clear, neither peakloser or coloser are able to make a coherent argument on how tax cuts, which mainly benefit the rich, are helping the poor.

but i will say, coloser did make some commentary that starts to approach the problem

“fails to recognize who even pays taxes let alone who pays the MOST in taxes.

Baffled, how should a tax cut for the poorest/poor work?

so if you are creating policy to help the poor, as coloser adequately points out, perhaps tax cuts, particularly those that help the wealthy, are NOT the best policy in actually helping the poor. thanks for pointing this out coloser. so quit arguing the tax cuts help the poor!

Baffled, makes this claim(s): “corev goes on a viral rant as usual. i simply responded that that is not true and it is a poor argument. corev goes on to put words in my mouth to make his usual straw man arguments.”

My comment included 2 of Baffeled’s quotes, a question to him and then a prediction. Can anyone see how any of that corev goes on to put words in my mouth? Are you insane?

Baffled did ask a question: “neither peakloser or coloser are able to make a coherent argument on how tax cuts, which mainly benefit the rich, are helping the poor.” So let me answer in the vernacular of Joe Biden: “That three letter word, JOBS, JOBS, JOBS” I wonder if his TDS filter allows him to ignore the increase in JOBS, JOBS, JOBS since the passage of the tax bill?

Baffled, did quote my question: “Baffled, how should a tax cut for the poorest/poor work?”, but again his answer was rant-based and illogical: “perhaps tax cuts, particularly those that help the wealthy, are NOT the best policy in actually helping the poor….”. Repeating your illogical complaint is no answer.

What is your TAX CUT solution?

We should next hear from the usual suspects the tested phrase: “Tax cuts for the rich!”, and then the typical income transfer comments.

coloser, you are attempting to put words in my mouth. now apologize. and you still have not shown me how tax cuts for the wealthy help the poor. you do know trickle down voodoo economics has been shown to be a failure, right? what an idiot.

maybe Barro has lost his marbles

Actually, on a serious note I’ve heard that he has “lost his marbles” and on more than a few occasions his son Josh had to discreetly intervene on his father’s behalf. Makes for a lot of uncomfortable moments for Barro’s friends and colleagues. Similar issue with Ed Prescott’s mental faculties.

WOW! “Partisan politics ahead of economics.” and pgl doesn’t recognize his own commenting fits in the center of this target. Next we are going to re-hear: “This an economics blog!”, when most comments are political.

I bet you thought Stopler-Samuelson was a left wing political statement. This is what happens when you understand nothing about even basic economics!

Pgl, why change the subject? I actually didn’t care about their politics. Why do you?

You clearly do not care about economics either. So why are you even here?

Oh yea – Team Trump is paying you to write your incessant intellectual garbage. But that has nothing to do with politics. For real?!

Mankiw’s account of the history of international trade theory just skips Hecksher-Ohlin-Samuelson. That is a major omission. What gives? Oh wait – he did not want to acknowledge Stopler-Samuelson which acknowledges that some groups lose from free trade. Of course Mankiw never wants to discuss distributional issues as long as we continue to pass more tax cuts for the rich.

Pgl: “Oh wait – he did not want to acknowledge Stopler-Samuelson which acknowledges that some groups lose from free trade. ” And some groups lose from fair trade, foreign trade, or any trade. See how easy it is to make sweeping statements?

what a stoopid comment idiot.

CoRev The H-O and S-S theorems don’t just say “some groups” lose from free trade, they predict which specific groups lose from free trade. So I wouldn’t call that a “sweeping” statement.

I see my error – I assumed CoRev might understand a well established theory. After all – the seminal article was written in 1941 and my international economists have explained if not expounded upon S-S. But for CoRev – this one was WAY over his head too!

Today’s guest post reminds me a lot of what we’ve seen with the Brexit disaster…another idiotic idea that Trump endorsed. The immediate effects of the Brexit vote seemed like much ado about nothing. In fact, GDP growth actually went up. But it turns out that the increase in GDP was due to households spending out of saving, which temporarily increased the consumption component of GDP. Sound familiar? But now reality is setting in and Britain isn’t handling it well. Businesses are reluctant to invest because they don’t know what the regime rules will be in a post-Brexit world, so they just sit on the sidelines waiting for the dust to clear. Meanwhile, labor productivity languishes and high skill jobs in the finance sector move to Frankfurt. There won’t be any sudden “come to Jesus” moment after Brexit, but 20 years from now Britons will notice that their living standards are noticeably lower than anyone else’s in western Europe and Britain’s economy will be more autarkic. That’s our future if Trump is re-elected. No big drop in GDP, just a few tenths of a point shaved off year after year for a generation.

Do I like the idea of tariffs? No.

The fact is this has been, still is, and will continue to be reality subject to cycles.

Deal with it and stop whining. If it is “so bad” then roll the dice and vote him out in 2 years. That’s how the system works. Survival of the fittest.

To me, any outfit seeking exemptions are either in trouble already, lazy/corrupt and willing to take a handout from the taxpayers. BUT…if the system is so broken, they can get it and have no sense of ethics, why not try for it. They are no different than the person filing for soc sec disability for an ingrown toenail and taking it once they get it. An exemption is another word for a subsidy.

It’s ridiculous and a lose-lose…but it is NOT anything new.

Capitalism: Adapt to changing markets, outwit the competition, or exit the business. Whiners and moochers? Read a history book or two…if you dare…or are you above that?”

Jesse: So you entertain a belief that there are no irreversibilities in development of a WTO, global value chains, bankruptcies?

Did Orange Excrement decide that a Russian aluminum corporation with connections to Manafort and Putin wasn’t a security threat?? Funny how these things work out and how these “accidents” happen. I’m sure CoRev or PeakIgnorance can explain this to all of us:

https://www.nytimes.com/2018/08/09/us/politics/rusal-tariff-exemption.html

https://www.warren.senate.gov/newsroom/press-releases/warren-investigation-forces-trump-administration-to-reverse-tariff-exemption-for-us-subsidiary-of-sanctioned-russian-company-

https://www.politico.com/story/2018/04/23/us-sanctions-russia-rusal-oleg-deripaska-545660

Did Putin promise Trump that on his next state visit to Moscow he’ll rub his foot in Trump’s private parts clear to climax in exchange for excluding Russian firms from Section 232 tariffs??

No worries here folks, nobody who watches “FOX and Friends” reads any newspapers anyway. It’s all good:

http://www2.philly.com/philly/business/trump-commerce-paper-mill-newsprint-tariffs-20180612.html

https://www.marketwatch.com/story/trump-era-tariffs-are-hitting-this-one-industry-especially-hard-2018-06-29

“PeakTrader

August 13, 2018 at 4:23 pm

Of course, slower economic growth is expected, including from demographic shifts. Nonetheless, we should’ve closed the output gap by the end of 2011.”

This bizarro comment from PeakContradiction was supposed to be in praise of Barro. I guess Peaky does not know that Barro was criticizing any attempt to use aggregate demand management tools to close the output gap back then.

More ignorance from Pgl.

Here’s what Barro said in January 2009:

“…we should avoid programs that throw money at people and emphasize instead reductions in marginal income-tax rates — especially where these rates are already high and fall on capital income. Eliminating the federal corporate income tax would be brilliant.”

http://gregmankiw.blogspot.com/2009/01/barro-on-fiscal-stimulus.html?m=1

And, demographic shifts take place slowly. The output gap should’ve been close in 2011 with very slight diminishing growth thereafter.

Peaky – we know you are dumber than rocks but I would have thought even a low IQ person like you would have recognized that Barro was talking about incentive effects and NOT Keynesian aggregate demand. And we thought CoRev was the dumbest person here. Gee Peaky – you win the Stupidest Person Alive contest hands down!!!

Barro is a highly rated economist:

https://ideas.repec.org/top/top.person.all.html

The tax multiplier can be much higher than the spending multiplier, particularly, when households needed to be “refunded” after the consumption boom of the 2000s.

Keynesian economics again we see! But Barro rejected Keynesian economics back in the 1970’s. OK Peaky – we get it. You are really, really stoooopid. Your mother must be so incredibly embarrassed!

I stated in early 2009:

Obama should change his stimulus plan to a $5,000 tax cut per worker (or $720 billion for the 140 million workers at the time), along with increasing unemployment benefits by a similar amount (rather than extensions).

This will help households strengthen their balance sheets, i.e. catch-up on bills, and pay down or pay off debt, to raise monthly discretionary income, increasing savings and spurring consumption of assets and goods.

This plan will have an immediate and powerful effect to stimulate the economy and strengthen the banking system. When excess assets and goods clear the market, production will increase.

“I stated in early 2009:”

This is likely a lie. No link. No public record? Until you produce a tape recording by Omarosa of you saying this – no one is going to believe you wrote anything of the sort until just now.

But even if you had advocated this use of transfer payments (which you rail against routinely) and tax cuts, the bang for the buck would have been much less than what Christina Romer recommended – which BTW was on the public record. A big dose of domestic government purchases in the form of infrastructure investment would have done a lot more than your alleged modest tax cut (assuming you did state as much as all of us here believe you did not).

PeakTrader So do you think the Obama economic team would have rejected a $5,000 per worker tax cut if the Republicans had offered it? Color me skeptical. Sen. McConnell made no bones about the fact that his primary interest was in defeating Obama and the country’s interest came second. Actually third. The interests of fat cat GOP donors came second. And don’t take my word for it, McConnell himself admitted that during the infamous inauguration night dinner he had with GOP bigshots.

You don’t get to live in some fantasy world. Presumably you live in the real world, which means you’ve got to accept some real world political limits. I thought the Obama recovery plan should have been about twice as big as it was, but taking half a loaf is better than taking a fourth of a loaf, which is all the GOP wanted to do. Remember, the GOP plan was tax cuts for the rich that amounted to about $350B. So your $5,000/family tax cut (I’m assuming you intended that as tax credit) would almost certainly have been welcomed by Team Obama. But Team Rick Stryker? Not so much.

2slugbaits, I don’t recall any GOP stimulus plan.

Perhaps, because Obama-Reid-Pelosi had the White House, Senate (with 60 votes), and House in 2009-11, and any GOP plan didn’t matter.

PeakTrader I don’t recall any GOP stimulus plan

Maybe you were drunk at the time.

Obama-Reid-Pelosi had the White House, Senate (with 60 votes)

Actually, that’s wrong. At the time of the ARRA vote the Democrats did not have 60 votes. The bill passed 60 – 38 with the two Republican votes coming from Olympia Snowe and Susan Collins.

peak loser is trying to rewrite history and deny that the republican party in the early days of the obama administration had NO INTEREST in providing solutions to mitigate the financial crisis. why? because any steps that would help the economy would by default help obama-and that was a no no in the conservative echo chamber.

peak loser, it is disingenuous to throw rocks in the gear of the recovery efforts and then claim insufficient action was taken. you know what mcconnell and the rest of the republicans did during that era. at least own up to the misbehavior, you hack.

Instead, we had small and slow tax cuts (rather than $700 billion in 2009) and numerous extensions in unemployment benefits (instead of a boost in benefits), along with wasteful government spending (that helped some segments of the economy, but had little effect on most household balance sheets). Also, Obama-Reid-Pelosi had many heavy regulations passed, in 2009-11, which harmed businesses and consumers, while business taxes remained high.

“Instead, we had small and slow tax cuts”.

You were drunk throughout 2009. Do you have a clue why the stimulus plan was watered down? EVERY one knows about the McConnell filibuster and what the Dems had to swallow to get past it. EVERY one but the village idiot PeakStupidity!

Wasn’t Obamacare passed when Senate Democrats had 60 votes?

Even when Senate Democrats had 58 or 59 votes, they were able to spend like drunken sailors.

I do recall, they were complaining of “spending fatigue.”

https://budget.house.gov/hbc-publication/252305/

No. Sen. Kennedy died shortly before the Obamacare vote.

PeakLoser reminds me of those Bernie Bros as his latest stupid claim is almost verbatim what they say when trying to trash Obama. Of course I do not remember Senator Sanders calling out Mitch McConnell for his unpatriotic filibusters in 2009.