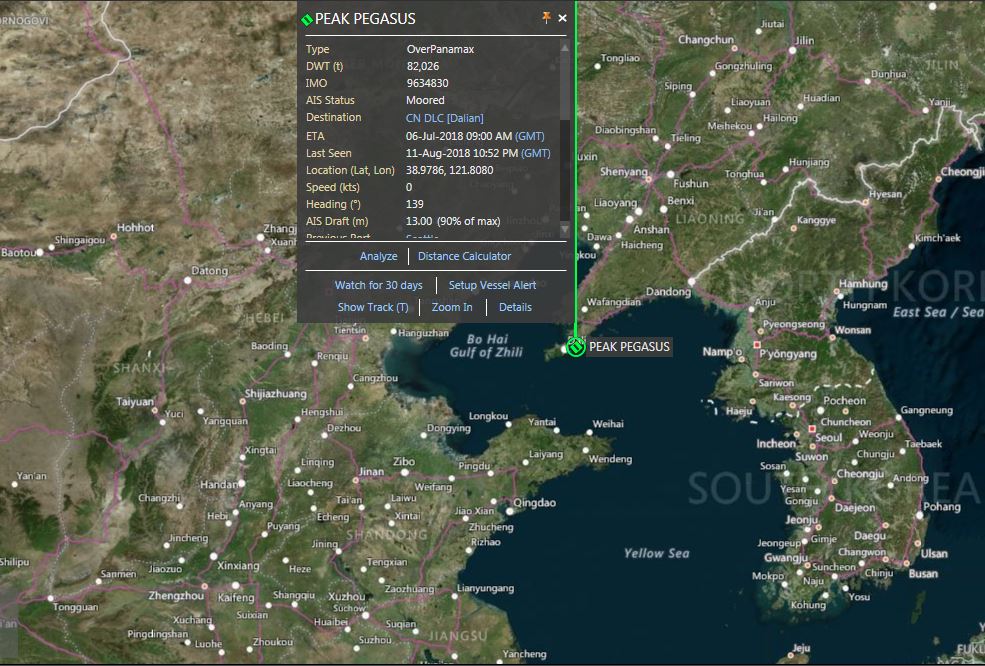

Not quite the Flying Dutchman, Peak Pegasus and its load of US soybeans finally docks at Dalian in China.

Source: Reuters.

To me, this suggests the owner of the ship’s contents (trading house Louis Dreyfus) has decided that the tariffs are here to stay, and (given the transportation costs of moving to an alternative market) there is not a higher net price to be obtained (more, here). What decisions the other ships in the same situation take will be instructive about market participants’ expectations regarding the trajectory of US soybean prices relative to Argentine and Brazilian soybeans.

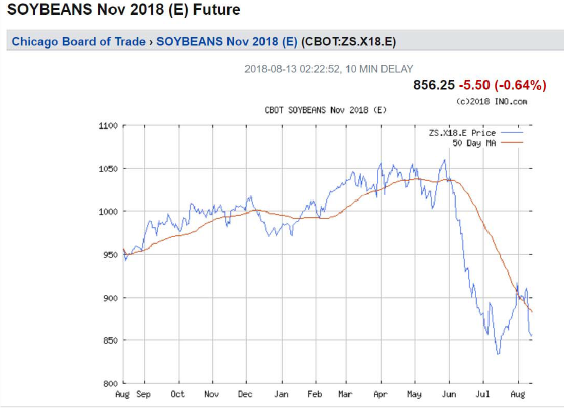

November futures as of Friday suggest no recovery to pre-trade war levels.

Update, 11:45PM Pacific: As of Monday morning, the decline continues.

Aaaaahh!!! Come on Menzie, it’s fun to follow ships path on the water. Admit it!!! The little kid hiding in you somewhere gets a little kick out of it. Zerohedge blog used to be good at posting up stuff of this nature, but I have no idea now. ZH seem to have dilapidated a bit since its golden days. I could probably still tell the sailors of Pegasus some good places to eat there (or at bare minimum get drunk). Although the landscape of China seems to change at lightning pace, I bet a few of my old haunts are still going.

“Peak Pegasus”. Am I the only one that thinks that name is weirdly coincidental with certain visitors of this blog?? I feel a Q-Anon conspiracy in the making here.

On a sub-note:

This is the little known story of how Rock Hudson discovered global value chains. It was during a crossroads in his life, when one of his co-stars on “Ice Station Zebra” had bluntly yelled at him “Your B-level community theater acting has gotten as bad as Charlton Heston’s!!!! I’ve had it with you!!! :

https://youtu.be/gk7n3sWdhKo?t=1m

Soon after this, Hudson started up a small boutique style cupcake outlet, where he acquired a bad rash. No one knows what happened after that.

Has anyone checked with CoRev to see if the numbers quoted in this story are accurate??

https://www.businessinsider.com/trump-tariffs-trade-war-layoffs-business-losses-2018-8

This could be part of the MSNBC conspiracy to report reality to voters. Damned liberals and their objective facts crap!!! I just hope the dumbsh*t rednecks in South Carolina that gave their 9 delegates to Orange Excrement don’t read this. Oh wait, I forgot most of the dumbsh*ts in South Carolina can’t read. Why do I always forget that schools don’t teach reading south of the Mason-Dixon line?? Really gotta stop forgetting that.

Moses Herzog: Clearly, all “fake news”… at least by Mr. Trump’s definition.

Got turned on to this by the guy who writes the “Gin and Tacos” blog. Who probably is even a bit to far to the left, even for me. But he’s pretty informative on political stuff. Gerrymandering is becoming a very hot topic, as it’s slow weaving it’s way through the courts, and SCOTUS only wants to take it on when certain kind of “refinements” to the argument have been made. I’m sure this has been a semi-hot topic in the Wisconsin area. But anyway, here is the link SCOTUS opinion (which amazingly was a unanimous SCOTUS opinion as it relates to the procedure of the case. Now I know you have to do tons of reading for your job, so maybe when your done doing work the last thing you wanna do is read legal cr*p, you wanna go fly a kite er something. But I think sometimes this stuff is fascinating and more “down to Earth” than people imagine. I wanted to give you this link, and suggest that you skip the first 22 pages, and go on down where the page numbering restarts to page 1, where Kagan gives her concurring opinion. It’s 14 pages long It might be fascinating to you as a man who at least keeps a peripheral eye on politics, and knowing that gerrymandering is a crucial issue. This is the road lawyers are going to have to take, if they wanna win these gerrymandering related things.

https://www.supremecourt.gov/opinions/17pdf/16-1161_dc8f.pdf

Euro currency dropping pretty fast this morning. Related to political mess in Turkey—and, wait for it….. wait for it….. “contagion”. I don’t know this Joachim person, but they seem to know what the heck they are talking about, so I thought I would put this thread up, which I found on The Guardian paper website:

https://twitter.com/TheVolawatcher/status/1028516189943877632

Can we estimate whether the Peak Pegasus delivery made $ for the contents owners? Can we even tell who owned those soybeans, Chinese importers or US exporters? It is a common practice for ships to idle outside a busy harbor waiting for dock access to unload and load cargoes as one article claimed. Do we know if the Chinese buyers already registered the cargo before tariff implementation? Do we know anything about the prices involved with this single shipment to determine a bottom line?

Have soybean farmer’s yet or will they even be hurt by the tariffs? Anyone up for a little arithmetic?

Avg. actual price received by farmers for 2017/18 soybeans $9.47/Bu. (from 7/2018 WASDE Report)

Price received for ~1/2 of the 2018/19 harvest $10.05+ (low estimate in the pre-tariff time frame) From WaPo article

Typical profit/loss on ~1/2 2018/19 harvest +~$0.58/Bu!

WASDE estimated price for remaining ~1/2 2018/19 harvest ~$9.35?Bu (from latest WASDE Report)

Typical profit/loss on ~1/2 2018/19 harvest -~$0.12/Bu!

Total profit/loss on ~1/2 2018/19 harvest +~$0.46/Bu* (*before any Fed subsidy and crop insurance payout)

! simple arithmetic

These results should have permeated the actual physical soybean market at all levels, except for the derivatives (futures) market. The numbers have been available for months in these many articles about soybeans, and it is because they were available I asked that a simple P&L statement be done for the average soybean farm. A business versus economic view of the tariffs’ impact on farmers is all that was needed to dispel some of the 2018 doom and gloom, but the TDS impacts swayed too many view points.

So can we estimate whether the Peak Pegasus delivery made $ for the contents owners?

“So can we estimate whether the Peak Pegasus delivery made $ for the contents owners?”

Knock yourself out here. Of course do factor in the fact that the tariffs were likely an unexpected expense near $6 million. I do trust you know how to factor that into your amazing precise Excel model!

Pgl, “Knock yourself out here. Of course do factor in the fact that the tariffs were likely an unexpected expense near $6 million. I do trust you know how to factor that into your amazing precise Excel model!” Another ill conceived question. Which owner, at which cycle and which location would you like the calculation? Or do you have access to the sales contracts to determine details? Just wondering, since those are critical to any calculation(s). Uhm, didn’t I just do that for the original owner, the farmer? Why, yes, I did. Now what, pgl?

Do you see how the real world can get in the way of economics models?

How are you doing on verifying the $10.05 “Break Even Price”? You do recognize that it can not be true, or nearly every soybean farmer in the US lost money last year? With your prior analysis it should mean that they left the 2018 market. Oh, wait, this is 2018 and the WASDE report said otherwise. Who to believe? What to believe? Certainly pgl has disqualified himself.

CoRev: You make absolutely no sense. If a firm is below (economic) breakeven, it can continue to operate as long as it has reserves. Even if it’s below accounting breakeven, it can. But, theory says that if it’s operating below economic breakeven, but covering variable costs, it will eventually exit. In microeconomics, that is the distinction, in fact, between short- and long-run…

For the love of god, read a micro textbook!

Menzie, please do not answer my statement with more strident nonsense. DO YOU BELIEVE THAT THE 2017 AVERAGE SOYBEAN FARM’S BREAK EVEN PRICE WAS $10.05/BU AS DOES PGL? If you do show how you got that value. It would be the least you could do to clarify your approach. If you cite the IL State paper previously referenced, http://www.farmdoc.illinois.edu/manage/2017_crop_budgets.pdf, please remember it was only an example of how they recommend preparing. A basis in reality would be coincidental.

inserting yourself into a previous conversation with statements like this: ” But, theory says that if it’s operating below economic breakeven, but covering variable costs, it will eventually exit. ” Using theory and generalities adds little value to the ongoing and very specific discussion.

For the love of god, get off your economics high horse.

CoRev: I communicated with Professor Langemeier, the author of the break-even analysis for Indiana. He confirms that the figures were his best estimate of the relevant costs and yields for 2018, as I inferred before. You can go and argue with him if you believe you have superior information regarding these costs. I would look forward to seeing the exchange (although I will feel sorry for Professor Langemeier for inflicting your incoherent ramblings upon him).

Menzie, did you consider Professor Langemeier estimate was wrong? If not you must then believe that most soybean farmers lost so much money last year they doubled down and planted 99.45% of last year’s acreage to get even. Is that using rational or adaptive expectations? Then these very same farmers hedged ~1/2 their crop at much higher prices than last year’s average received price, but still below Professor Langemeier’s breakeven estimate.

His example resulted in: Breakeven Price $10.96 and Harvest Price 8.40 resulting in Earnings or (Losses) ($128)

So who do I believe more, the thousands and thousands of years of experience of actual operating farmers or a single professor trying to create an example? Which BTW would indicate a loss for nearly every year since 2014.

I’m sorry the appeal to authority failed.

Ant they are still planting soybeans?

CoRev: First you thought the $10.05 break-even was merely illustrative. Then you assert you know more than a professor of agricultural economics? A cursory examination of his Google Scholar webpage suggests he is not a hack; for sure he has more Google Scholar citations than you do.

Menzie, as I thought, you either haven’t read his paper or seriously misunderstood it. He used a SAMPLE Indiana farm for his calculations. His soybean “Breakeven” estimate for THAT farm was not $10.05 but $10.96/Bu. That farm has not made a profit on soybeans since he wrote his paper.

You claim: “Then you assert you know more than a professor of agricultural economics? “, No, but I do know that his sample farm or his values in his cost categories are NOT representative of all or even most US soybean farms. That, apparently, is more than you and the many commenters here know.

Menzie, please do not answer my statement with more strident nonsense. Your appeal to authority is still wrong.

CoRev: It was supposed to be a representative farm in Indiana with high productivity soil. It’s listed in the article, I noted it was a high soil productivity farm. What more do you want?

Menzie, Yes, I did: “First you thought the $10.05 break-even was merely illustrative.” Which BTW, is from another paper and not from your cited professor’s paper.

CoRev: What paper are you talking about, then. I used your link… Okay. This will be the next post, on how to read.

Menzie, please stop digging. The Professor Langemeier paper says this: “…This article uses a cash crop farm in Indiana to illustrate the components of an enterprise budget and to compute breakeven prices for corn and soybeans. …” and this:

“Rotation Soybean Budget Table 2 presents an enterprise budget for rotation soybeans on average productivity soil for 2016. ..”

While you assert: “CoRev: It was supposed to be a representative farm in Indiana with high productivity soil. It’s listed in the article, I noted it was a high soil productivity farm. ”

What more do you want? I want to know if we are even looking at the same paper?

If you remember you cited this paper during a discussion of enterprise budgets and the use of opportunity costs. What is it you think you are citing now?

CoRev: Apologies. So we are referring to:

http://www.farmdoc.illinois.edu/manage/2017_crop_budgets.pdf

It reports no break-even price. In addition, it does not calculate economic profits.

Menzie, why did you use my link then cite/copy an old comment from another paper and/or comment thread?

My link clearly said on the cover page: ” Introduction

Gary Schnitkey

Department of Agricultural and Consumer Economics University of Illinois”

and is for Illinois farms.

For all the grief you hand out: “For the love of god, read a micro textbook!” and

” I would look forward to seeing the exchange (although I will feel sorry for Professor Langemeier for inflicting your incoherent ramblings upon him).”

it is yourself, and perhaps your arrogance, taking this thread way off course.

Did you actually have a problem with my math example in the start of the thread?

CoRev: Again, apologies for using the wrong URL, had to go back several comments to get to your 2017 paper (I prefer a 2018 paper). Let me write again: There is no break-even calculation in the paper you cite. There is no economic profit calculation in the paper you cite.

“You claim: “Then you assert you know more than a professor of agricultural economics? “, No, but I do know that his sample farm or his values in his cost categories are NOT representative of all or even most US soybean farms. That, apparently, is more than you and the many commenters here know.

Menzie, please do not answer my statement with more strident nonsense. Your appeal to authority is still wrong.”

corev, you claim menzie and others are not knowledgable about farming and their appeal to authority is wrong. fine. but you appeal to authority all the time with the claim that you understand the farming business. please provide YOUR credentials the allow YOU to claim authority in the area of farming. what is your professional experience in the field?

Menzie, “CoRev: Again, apologies for using the wrong URL, had to go back several comments to get to your 2017 paper (I prefer a 2018 paper). Let me write again: There is no break-even calculation in the paper you cite. There is no economic profit calculation in the paper you cite.”

I never said it did. Nor did I explain why I cited it. Breakeven Cost can certainly be derive from it. I wouldn’t expect much from pgl as he runs from nearly every challenge, but from you I did expect better than “There is no break-even calculation in the paper…”. Why ignore the simple math problem. What grade would you give one of your undergrad student for such shoddy and incomplete analysis? (That’s in response to your undergrad midterm question sneer from a few days ago.)

To be clear, I do not know if the derived breakeven price from this paper is any more accurate than the several higher estimates, but I am positive the Professor Langemeier estimate is probably high for all but the fewest farms, an example of 2slugs marginal farms. I would also guess the $10.05 estimate may also be more than a little high for the average farm.

Logically, the breakeven price should be below *Avg. actual price received by farmers for 2017/18 soybeans $9.47/Bu. (from 7/2018 WASDE Report). (* from my calculation. ) BTW, I cited the source for the $10.05 estimate in the calculation.

Did you even look at it, or was it considered just another incoherent rambling of another non-econ major?

And yes, you deserved some of this sarcasm for the incomplete non-apologies.

Baffled, since you claim superior experience please recalculate using your superior knowledge and numbers.

Some times I even wonder why bothering answering someone constantly proving they can not discuss the issue, and have to make a personal attack.

I’ll wait for your calculations.

““So can we estimate whether the Peak Pegasus delivery made $ for the contents owners?”

That was your question that was followed by a lot of babbling about farmers breakeven prices v. actual prices.

Of course most people would interpret “contents owners” as the JPMorgan Asset Management crowd as in the Peak Pegasus ship. We have to wonder if you ever learned to write as we know you cannot read. Did you read the Reuters story? I did which is where I got the $20 million figure. Now I know preK arithmetic is challenging for you but a 25% tariff on $20 million = $5 million.

But I did factor in the trading companies commission. The Reuters story referenced Thomson Reuter Eikon which competes with Bloomberg. Smart people who tell me that trading commissions for soybeans are in the low single digits so if JPMorgan was a broker – they lost big time. Oh wait – maybe they were speculators who bought from the farmers at depressed prices. Of course there is some other idiot named CoRev who keeps telling us farmers did not lose out.

Hey CoRev – call out that other idiot abusing your name. And learn to write as well as learn to read basic English.

Baffled, did you have a point? I will admit to using analysis, simple mathematics and logic for my conclusions. I don’t ever claim to be an expert or authority in agriculture. Would you please provide the comment quote where I claimed any authority? I’ll wait.

Pgl, Why would I have done your simple math problem? It had no relevance to the comment. I am glad you can do it though. You have shown little capability in the past. BTW, assuming that JPMorgan Asset Management is the contents owner indicates your own reading ability. From Menzie’s original article: “However, the vessel arrived just too late and has been sailing around in circles ever since while the cargo’s owners, understood to be the agricultural commodity trading house Louis Dreyfus, decide what to do.” Notice I highlighted it just to make it easier for you.

Now, I don’t know about you, but I’m not foolish enough to ASSUME a trading house could not be holding a management contract for anther party. Y’ano like ASSUMING the owner of the ship owns the cargo. Oh Wait, you just did! Clearly, you’re the smartest here. NOT!

Now to my math statement, do you believe that the Breakeven estimate is $10.05? Can you discuss how you can support that estimate or any other? Remember you used it claiming several sources, but no links. I’ll also wait for you.

CoRev: Well, here’s this quote from January 2018 (more recent than 2017):

Since it does not conform to your preconceived notions, you might be tempted to ignore the assessment. It was written by some fella named Gary Schnitkey, from the Department of Agricultural and Consumer Economics at the University of Illinois.

Isn’t that the same Gary Schnitkey who wrote the 2017 paper you were quoting? Why, yes, yes it is!

In case you don’t believe me, here is the link to the article.

That’s cash flow, not economic profit. What is current price for November delivery? $8.80 as of today.

QED.

Man, I laughed and laughed and laughed at that. You are the gift that keeps on giving. Thanks again for citing that paper as support from a truly valid source, worthy of treating as an authority.

Looking forward to your next comment!!!

“the cargo’s owners, understood to be the agricultural commodity trading house Louis Dreyfus”

Fine the cargo (or to use your term content) owners were Louis Dreyfus. Which changes nothing. You were the fool that first asked the question and then proceeded to estimate the profits or losses of farmers. I guess you are so twisted in your own babble that you have not realized that everyone here realizes you have no clue what you are babbling about.

Since CoRev can’t begin to mount that “economics high horse,” fair to say he’s content to ride into this blog on a donkey. Or, to get biblical, on his a**.

corev: “I don’t ever claim to be an expert or authority in agriculture. ”

actually you present yourself on this blog as having extraordinary insight into how farmers operate and think. you are very clear that you understand the complex details involved with how a farmer operates. i am simply asking how you obtained this information? did you work on a farm? wikipedia? your second cousin’s wife is married to a farmer, so you obtained the info by osmosis and relative distance? you are very critical of others on this blog not knowing the field of farming. what credentials do you have that permit you to judge those folks as deficient in the agriculture field, and reinforce your comments should be accepted as fact? i am quite curious. or did you sleep in a holiday inn express last night?

Baffled I answered your earlier query: “Baffled, did you have a point? I will admit to using analysis, simple mathematics and logic for my conclusions. I don’t ever (remember – left out a word) claim to be an expert or authority in agriculture. Would you please provide the comment quote where I claimed any authority? I’ll wait. ”

I also admitted in another comment thread to having grown up in farming country, and worked/spent several Summers on various of the extended family farms.

Did you even look at the calculations? Can you understand them? Do you have any corrections? Do you believe the average farm lost money while being paid $9.47/Bu in 2017/18 for soybeans? Can you support any of those contentions or do you just want to change the subject even further?

“Baffled I answered your earlier query:”

corev, actually no. what i asked were your qualifications as an expert in agricultural economics. you have been quite adamant that you understand what farmers think and do, and menzie and 2slugs do not understand farming. you are claiming authority. and now i have the answer:

“grown up in farming country, and worked/spent several Summers on various of the extended family farms.”

my uncles and grandparents all had farms, and i spent many summers on them as well. mostly fishing in the pond as i recall. since you qualified your time as worked/spent, my guess is you really did not work the farm either, but did spend time there. i also grew up in the shadows of a steel mill. i guess that makes me an expert on metallurgy? i think i took one class in metallurgy in college-just like your one class of economics in college-so i should qualify as an expert as well.

your agriculture credentials are about as strong as melissa howards marketing credentials. coloser.

http://en.people.cn/n3/2018/0813/c90000-9490333.html

China to diversify supply system of soybean import

China is now making efforts to establish a more diversified soybean supply system by increasing the import sources and adjusting domestic production of oil-bearing crops, insider from China’s major grain stockpiler said, adding that the soybeans imported from other countries except the US can meet China’s daily demands.

China Grain Reserves Corporation (Sinograin) has expanded the purchase from South America, who contributed over 90 percent to about 2.5 million tons of imported soybeans in May…..

Benlu: I am dubious that in the short run China can completely substitute out for US soybeans using alternative sources and domestic import substitution. Do you have access to math of some sort to validate?

Menzi, I haven’t come across any good sources for China’s soybean stats. I did a Google search using Chinese phrase “大豆“ and found some articles(with largely overlapping figures) from China financial media which might provide a little snapshots of China soybean import pictures. Apparently, China soybean import quantities could vary quite a lot from source countries, particularly amongst US and Brazil. I guess what is material to China is the ability to significantly reduce the impact of import tariff and may well still import some shortfall from US. This post is for you so it is OK not to show it on your blog as it is partially in Chinese.

Not sure if the figures embedded in articles(in Chinese. My apology to all! ) here of use for you:

https://www.rfa.org/mandarin/yataibaodao/jingmao/ql2-08132018093327.html

“目前,中国大豆每年需求量超过1亿吨,然而中国年产量却只有1000多万吨,换言之,中国大豆的产需缺口高达9000万吨左右,需要依靠进口来补充。而美国近年对中国大豆出口约在3000万吨以上。

中国海关总署数据显示,2017年全年,中国粮食累计进口13062万吨,其中大豆累计进口9553万吨,占粮食进口总量的89%。杨先生称,来自美国、巴西的大豆都是转基因产品:“美国的,巴西的大豆,全是转基因的,一年进口9000多万吨都是。按照规定应该是给加工厂商,但是这个这块缺口大,很大一部分流向市场,做豆腐,做食品”。

中储粮油脂公司数据显示,其2017年进口大豆26.2%来自巴西,43.2%来自阿根廷、乌拉圭,30.6%来自美国。该公司相关负责人表示,在大豆进口贸易实际操作中,采购方拥有货源地选择权,更倾向于选择贸易关系良好、有稳定政策预期、进口税率更低的大豆主产国”

https://news.sina.cn/2018-08-08/detail-ihhkusku0585030.d.html?cre=wappage&mod=r&loc=3&r=9&doct=0&rfunc=81&tj=none

“中国最大粮企——中粮集团有限公司党组副书记、总裁于旭波接受中新社记者采访时表示,作为进口大豆的主要用途,其加工出豆油和豆粕均有较强的可替代性,全球有比较充足的供应,减少美国大豆进口的缺口可以通过从其他国家和地区进口来弥补。

具体而言,全球植物油贸易量超过8000万吨,豆油的供应缺口可通过进口豆油、菜油、葵油等植物油品种来满足。豆粕方面,全球油料和粕类贸易品种丰富、规模较大,可以通过增加从南美等国家的大豆进口,增加菜籽、葵籽等油料进口,增加豆粕、菜粕、葵粕和鱼粉进口,增加肉类进口四方面举措来满足中国国内豆粕需求缺口。”

I’m 99% sure anyone who wants can use Google Translate on this. Although the Google translation can be kind of funny and slightly “broken” it can often give a person a rough idea. There’s always the question of how accurate Chinese economic stats are. I think what the Politburo has access to is probably relatively accurate. But the idea they would pass these on to Chinese citizens stretches credulence from my vantage point.

GDP numbers have long been a joke in China—nobody doubts that China’s growth far exceeds that of the USA year-to year for a long time now. But when province leaders see their jobs are tied to the GDP and other economic barometers, it’s obvious they are going to LIE on a Hillary Clinton type level. If they have numbers like 5% over America’s 2%, ok, I’m buying that. It’s when you get into the 12% to 14% numbers, people like me are going to call “bullshit!!!”. But then, I am calling bullshit on the recent BEA number of 4.1% number—so, I am asking in not a completely ironic way “What the hell do I know??” Feel free to stick the knife in here.

https://tradingeconomics.com/china/gdp-growth-annual (don’t know if that website is credible, but appears to be accurate numbers on first glance)

I hear people in China are using Google translate to display what CoRev has been writing here. And yes the laughter from China is so intense that it has caused massive waves off the California coast. Surfing time!

This article has better information. I guess you might already have the relevant information.

https://m.nbd.com.cn/articles/2018-08-10/1243863.html

“巴西阿根廷可填补大豆进口

每日经济新闻(微信号:nbdnews)查阅美国农业部7月发布的报告发现,2017年-2018年,美国生产大豆近1.20亿公吨,占据世界总生产量3.37亿公吨的近36%,共出口5674万公吨,占据世界出口总量1.52亿公吨的37%。

其他三大出口国,包括巴西、阿根廷、巴拉圭,在同一时段共生产大豆1.68亿公吨,其中巴西的产量和美国接近同样约1.20亿公吨。南美三国共出口大豆8565万公吨,占据世界出口总量的56%。

另一方面,美国大豆在生产量上升的同时,出口量同比有所下降,较2016年-2017年的5896万公吨下降了近4%。南美三大出口国的大豆出口量却呈上升,较2016年-2017年出口的7951万公吨,一年后的出口量增长了近8%。

据普渡大学3月28日发布的一项研究显示,若关税正式生效,美国对中国的大豆出口可能下降约29%。但是,中国作为大豆买家,并不愁美国大豆的替代者。

首先,巴西和阿根廷可填补进口的美国大豆数量下降的空缺。

据CNBC报道,巴西在2017年向中国出口了超过5000万吨大豆,约占中国进口总量的57%,是中国大豆的第一进口国。此外,每日经济新闻(微信号:nbdnews)查阅联合国粮食及农业组织发布的一篇研报发现,美国、巴西和阿根廷占全球大豆总产量的82%,其中阿根廷和巴西的产量增长最快,而美国产量增长速度较慢。

另一方面,中国还可采用豆油和豆粕替代原料大豆。

根据罗萨里奥谷物交易所的数据显示,阿根廷是这两种产品的最大出口国。据联合国粮食及农业组织的研报,大豆是一种价值高、经济效益好的作物,大豆生产的经济可行性取决于其副产品,即豆油和豆粕的商业利用,二者分别占大豆经济价值的三分之二和三分之一。….. “

Am I the only one who is scratching his head over naming a surface ship after a winged horse? It’s like the merchant marine version of Chitty-Chitty-Bang-Bang.

@ 2slugbaits

Was thinking more along the lines of “The Adventures of Baron Munchausen” myself.

https://www.youtube.com/watch?v=ixbStXcVqW4

2slugbaits wrote:

Am I the only one who is scratching his head over naming a surface ship after a winged horse?

I’m not surprised. Sometimes those in a position to name a new ship might let one of their children do the honors.

A quick glance at Wikipedia suggests another, probably more likely reason: Pegasus’ father was Poseidon.

I would have picked “The Kraken”.

“you either haven’t read his paper or seriously misunderstood it.”

This is from CoRev? The fool who has not read a single economic textbook in his life?

Pgl, another foolish statement. I admitted to taking just one under grad Econ course which did have a text book I read. You’re on quite a roll for irrelevant commenting today, but for you that is nearly every day and comment.

Really? PeakStupidity claims he got a “junior PhD” (which does not exist at the Univ. of Colorado) but then he never can tell us a single book he read or the name of any of his professors. I see you cannot do so either. Oh wait – Dr. Seuss and the Cat in the Hat. That’s your economics text book! Excellent!

Pgl, childish.

“I admitted to taking just one under grad Econ course which did have a text book I read.”

corev almost made an honest and fair comment! you took ONE econ course, so of course you have the knowledge necessary to challenge Menzie on numerous topics. one course means you really never learned anything about economics. it was probably even a freshmen year intro course as well. and i would bet the house you never read the book. you probably never even bought the book, let alone looked at it. your economics literacy is built upon surfing web sites.

Baffled, “…you took ONE econ course, so of course you have the knowledge necessary to challenge Menzie on numerous topics. …” Yes, but generally lose in trying to follow the jargon, models and math. I usually challenge Y’all for your personal attack, bias and lack of knowledge/logic when commenting.

This soybean series is replete with comments based upon failed logic and no knowledge. You, OTH, usually just go for the personal attack indicating a lack of knowledge.

“CoRev: Well, here’s this quote from January 2018 (more recent than 2017):

… at trend yield levels, prices need to be above $4.00 per bushel for corn and $10.00 per bushel for soybeans for farmers to break-even.

Since it does not conform to your preconceived notions, you might be tempted to ignore the assessment. It was written by some fella named Gary Schnitkey, from the Department of Agricultural and Consumer Economics at the University of Illinois.

Isn’t that the same Gary Schnitkey who wrote the 2017 paper you were quoting? Why, yes, yes it is!”

C’mon Menzie – this is piling on. Yes we all know CoRev does not even bother to read the papers he links to. In fact, he does not even understand the questions he asks – like the one about whether the “content owners” profited!

pgl: It is kinda like “fish in a barrel”…

Fish in a barrel! The Taiwanese gentleman that taught me Econometrics used to talk about the number of fish in Brazil and its impact on US GDP growth. Gotta have a sense of humor when addressing statistics!

Menzie, yes it is kinda like “fish in a barrel”…with you two. Let me thank you again for adding profitability to my estimate and confirming my claims re: your lack understanding of the papers we were discussing. You also confirmed that “… the $10.05 break-even was merely illustrative.” as are the Schnitkey ESTIMATES you now extol.

BTW, this is a better link, includes the tables, for the paper: https://farmdocdaily.illinois.edu/2018/01/2018-grain-farm-income-the-need-for-above-trend.html

CoRev: I think I’ve always taken the Langemeier estimates as estimates. You were the one that asserted that Langemeier’s numbers were illustrative, and example of how to put the numbers in. Do you really want me to dig up your comment to verify? Respond, and I will.

Menzie, thank again for the laugh. “Illustrative

serving as an example or explanation” Langemeier, Schnitkey the OSU paper etc. are all examples of how THEY SUGGEST ” of how to put the numbers in”.

Another meaningless nit to what purpose?

CoRev: I don’t think I’ve ever commented on the OSU paper, which as far as I can tell is not a paper, just a spreadsheet template.

Menzie, I literally was laughing out loud. “CoRev: I don’t think I’ve ever commented on the OSU paper, which as far as I can tell is not a paper, just a spreadsheet template.” It certainly is exemplary or an illustrative example of a Break-even calculation.

Another meaningless nit to what purpose?

Pgl & Menzie, thanks, you finally have found a reference to a breakeven price. Neither of you remember the request that generated all your glee. Here is the question to pgl: “How are you doing on verifying the $10.05 “Break Even Price””? You do recognize that it can not be true, or nearly every soybean farmer in the US lost money last year? With your prior analysis it should mean that they left the 2018 market. Oh, wait, this is 2018 and the WASDE report said otherwise. Who to believe? What to believe? Certainly pgl has disqualified himself.”

Do you understand yet what you just did? You verified that my follow-on statement was PROBABLY true ($10.05 “Break Even Price…You do recognize that it can not be true, or nearly every soybean farmer in the US lost money last year?), and actually added to my calculation’s estimated profit. Thanks again!

Now to your quote from Gary Schnitkey. It doesn’t mean what you think! Let me set up the fundamental flaws. Menzie’s pull quote was: “Budgets for 2018 developed with a $3.60 price for corn and $9.70 price for soybeans will generate negative cash flows on many farms that cash rent farmland. Either higher prices or higher yields are needed for positive cash flows. As farmers plan for 2018, cash flow planning will result in dreary income projections on many farms.” Menzie first pulled this quote: “at trend yield levels, prices need to be above $4.00 per bushel for corn and $10.00 per bushel for soybeans for farmers to break-even.” Do you even understand what cash rent farmland. is? Your comment says NO! Your flaw?

So we have two estimates, $9.70 and $10.00, but from the paper (you blithely claim I didn’t read nor understand as well as you two), was this hidden gem: “Owned and share-rent land may have lower break-evens depending on debt levels and terms of the share-rent agreement, respectively.” Had you read the paper you would have noticed he used this cash rent farmland. term in many of his estimates. He also defined its cost: “cash rent of $267 per acre”. He also used a trend yields of 61and 68 bushels/acre. Nearly every estimate is for rented land. Not all farms nor planted acres are rented.

Pgl, I understand this is hard upper math using both multiplication and especially DIVISION, but it means for owned farms the break even price is lower ($267/61). There I wrote it out so you can practice your numbers. If its still not clear consider the meanings of owned and rented in terms of cost.

Another interesting thing is that Mr Schnitkey was careful to develop a range of estimates for two different yield situations: “For soybeans, break-even prices are calculated for costs of $601 per acre including non-land costs of $334 per acre and a cash rent of $267 per acre (see Table 2). A trend yield of 61 bushels per acre gives a $9.85 per bushel break-even price ($9.85 = $601 costs / 61 yield). A “high” yield of 68 bushels per acre has an $8.84 break-even price ($8.84 = $601 / 68 yield).

So as of now from your reference we have estimates from $8.84 through $10.00. Pgl, don’t forget the deduction if comparing an owned farm. So as Menzie points out: “What is current price for November delivery? $8.80 as of today.” Menzie, the high production owned farm is at breakeven for the remaining crop not already hedged at pre-tariff prices. The hedged crop is profitable. Each farm has slightly different cost factors, and I wouldn’t want to go into that level of detail. It would be way beyond pgl’s understanding anyway

So Menzie, I thank you again. You should have looked at and UNDERSTOOD the calculations to determine the impact of your latest find. In your words:

“Man, I laughed and laughed and laughed at that. You are the gift that keeps on giving. Thanks again for citing that paper as support from a truly valid source, worthy of treating as an authority.

Looking forward to your next comment!!!”

CoRev: Cash flow for rented farm implies you have returns to land included, but not capital and labor… (which are returns to proprietor). So I repeat, even if you beat this break-even in this paper, you’re not necessarily break-even in economic terms.

I laughed and laughed and laughed yet more…

Keep it up!!!!

Menzie, makes even another obvious point: “Cash flow for rented farm implies you have returns to land included, but not capital and labor… (which are returns to proprietor). ” Of course it (the rent) returns to the land owner, and hopefully covers their costs. Capital and labor costs for the actual farmer are covered in other categories. Did you ever read either of his papers and look at the tables? I gave you the better link?

Your closing conclusion is another obvious statement: ” So I repeat, even if you beat this break-even in this paper, you’re not necessarily break-even in economic terms. ” NO ONE starts with the goal of being at break-even whether in economic or accounting terms. Making break-even means you are at best on very thin economic ice. So what was your point? We have yet to discuss what it would take to make a living by farming? The reason is because it is far too complex to define the specific variables and their values for each farm and farmer, not necessarily the same as Schnitkey shows by using land rent estimates. Can you yet guess why he used an average rent/acre estimate in his calculations?

You have pointedly ignored my Thank you for supporting my contention in my above calculation. But, rest assured, I am pleased that you obviously agree with that bigger picture, while picking at meaningless nits.

Please, keep up the nit picking while ignoring the bigger picture!!!!

To be sure I laughed and laughed and laughed yet more… while shooting fish in a barrel.

2slugs, asks: “CoRev Let me see if I’m understanding you. Are you saying that if you own the land then you can perpetually operate at breakeven costs?” NO! You already knew the answer by asking such an absurd question. Why did you?

I know by ignoring you think you are making points. but you are failing miserably and showing how poorly your analysis and reading skills are.

CoRev NO! You already knew the answer by asking such an absurd question. Why did you?

No, I did not know the answer. That’s why I asked it. In your previous posts you downplayed the significance of what economics call “economic profits” and you seemed to be saying that a farmer could stay afloat as long as that farmer was able to cover the breakeven point. I didn’t ask you if farmers would be happy with only covering breakeven costs; I asked you if they could perpetually operate at breakeven costs. If you’re now saying “NO!” then you are agreeing that over the long run farmers must cover all economic costs, not just breakeven costs.

2slugs: you again misunderstood the points being made. I never said nor implied: “…and you seemed to be saying that a farmer could stay afloat as long as that farmer was able to cover the breakeven point. ” What we have been talking about is P&L for soybean farmers, and the importance of the Break-even point for that calculation.

If you really didn’t know my answer to your question, then you have not been following the conversations, including your own.

CoRev Let me see if I’m understanding you. Are you saying that if you own the land then you can perpetually operate at breakeven costs?

Let me put this no lengthy discussion in context. In the article Menzie made this statement: “To me, this suggests the owner of the ship’s contents (trading house Louis Dreyfus) has decided that the tariffs are here to stay, and (given the transportation costs of moving to an alternative market) there is not a higher net price to be obtained (more, here).” Followed with a chart of soybean futures prices with this descriptor: “Update, 11:45PM Pacific: As of Monday morning, the decline continues.” From that and the history of these many soybean article he has presented he has more than implied the cargo’s owners were willing to take a loss or less profit minimizing added costs.

I then added a set of arithmetic calculations to estimate average profitability for a farmer. To date there has been no discussion of that calculation but lots of nit picking of a single component, the Break-even price estimate. The nit picking has centered on the variables and their values with little to no value added and a lot of chortling over their increased understanding of how Break-even can be calculated.

Pgl provided a sample of how tangential has been the discussion. “C’mon Menzie – this is piling on. Yes we all know CoRev does not even bother to read the papers he links to. In fact, he does not even understand the questions he asks –like the one about whether the “content owners” profited!” Yet, I repeat: “To date there has been no discussion of that calculation…” Why?

The calculation PROBABLY disproves Menzie’s oft repeated contention/implication that farmers have a net loss for their 2018/19 soybean harvest primarily due to Chinese tariffs. Are farmers concerned they may have a loss? Of course. Are they concerned that the tariffs change the international trade markets? Of course. Do they have alternatives for the 2019/20 crops? Absolutely, but to determine which is best for each farm/farmer is too complex to discuss on an economics blog. Remember, several of those alternatives include Federal subsidies, another subject only lightly covered, crop insurance, not covered at all except erroneously, changing crops, even taking the farm out of production and/or even renting out the land. But those are decisions that can be put off until late Winter and early Spring if you are a farmer, determined by crop price estimates at that time frame.