August employment figures are out. Time to re-evaluate this mid-December Political Calculations assertion that California was in recession.

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis. [text as accessed on 12/27/2017]

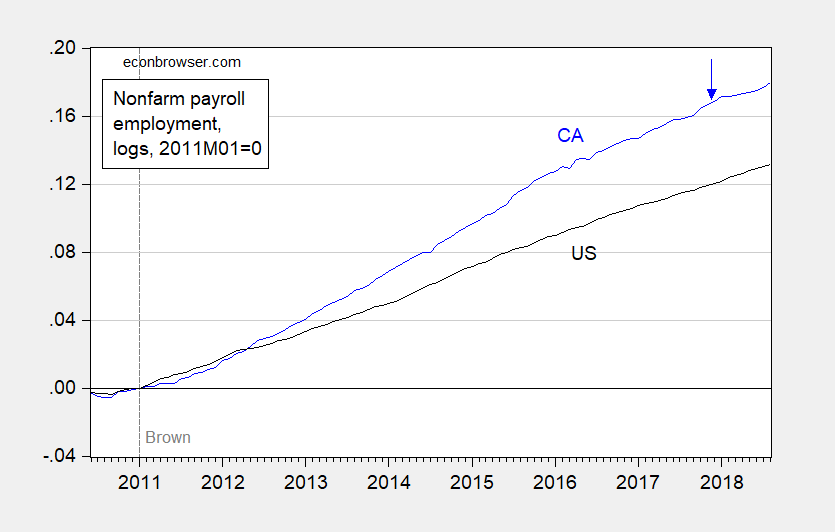

The release provides an opportunity to revisit this question (the 2018Q1 state GDP figures are discussed here). It’s (still) unlikely that a recession occurred.

Figure 1: Nonfarm payroll employment in US (black), and in California (blue), both in logs, normalized to 2011M01=0. Blue arrow at timing of Political Calculations recession conjecture. Source: BLS and author’s calculations.

According to my work with Ryan LeCloux, the growth elasticity of real GDP with respect to NFP employment is about 0.85 (statistically significant), so we can be reasonably certain that GDP is still trending up.

It is true that civilian employment peaked in March 2018, but just barely, and given the imprecision of the household survey at the state level, I think it unwise to rely too much on this observation.

Seems strange “Political Calculations” is so dogmatic in labelling the situation in California as a recession. Unless for them it’s just a matter of checking boxes by certain barometers and saying “this is a recession”. Outside of maybe the economic effects of the wildfires, where exactly would they be saying the causation is?? If some of California crops are getting hit from the retaliatory China tariffs I might also see that, but my understanding on that is the real “latent” or “delayed” impact on China’s retaliatory tariffs isn’t going to happen until end of calendar year 2019.

Professor Chinn,

Forecasting an ECM from 2010m12 to the present, using FRED series (PAYEMS minus CA nonfarm employment (CANA)) and CANA, CANA appears to be consistently above the forecast line from 2013 to the present. Since the US is most likely not in a recession, would my forecast (assuming it is correct) provide some evidence that California is not in a recession?

AS I’m too lazy and there’s too much football on tonight to model this myself, but just looking at the raw time series data I wouldn’t expect to find an ECM relationship because the California employment seems to diverge from the national employment. With an ECM you would expect each time series to be nonstationary, but there should be a cointegrating linear trend that keeps them from diverging over the long run. In other words, just looking at the raw data I don’t see the “correction” piece of the ECM. But again, that’s just based on an ocular analysis.

Also, following Lutkepohl you probably wouldn’t want to use seasonally adjusted data in an ECM or VECM because the seasonal adjustment technique applied to each of the individual time series could corrupt any potential cointegrating relationship. Instead you might want to use nonseasonally adjusted data and then include seasonal dummies in the error correction model itself.

2slugs,

Thanks for the response. You are the expert. I am not being argumentative, just a few explanatory comments to follow. Looking at the raw data, I see the diversion.

Using the log of the data from 1992m9 to 2010m11 and from 1992m9 to the present, I seem to have stationary residuals on the long term equations. I am not familiar with Lutkepohl, so I used seasonally adjusted data. I have not done an ECM model with nonseasonally adjusted data. This sounds interesting to try.

Response should be from AS. Anonymous must be due to late hour typing.

AS I’m hardly an expert. You might find these links useful:

https://www.diw.de/en/diw_02.c.244287.en/about_us/people_at_diw_berlin/staff/staff.html?id=diw_01.c.390894.de&sprache=en

https://www.amazon.com/New-Introduction-Multiple-Time-Analysis/dp/3540262393

Lutkepohl spent a year at UC-San Diego back in the 1980s, so I’m guessing Prof. Hamilton might know him.

2slugs,

Thanks for the recommendation, I ordered Lutkepohl’s book. I hope the “introduction” title is accurate and the book will not require a live-in tutor to read and use.

Just received Lutkepohl’s book. At first glance a live-in tutor is required. I’d need some EViews examples in order to translate some of the math into usable models.

California is a Yuge state and parts are in recession. The two flywheels of the state GDP, LA and SF areas are carrying the rest of the state. Here is a tidbit from the LAT: http://www.latimes.com/projects/la-pol-ca-next-california-economy/#

“Tehama feels worlds away from Silicon Valley — the kind of place that exports walnuts and black olives, not a buzzy new app or revolutionary gadget.”

Yes there are two California’s. The farm sector is getting killed by Trump’s stupid trade wars. But the high tech sector may pull state GDP even if the benefits tend to go to the well to do.

Worth mentioning here : counties in northern, northeastern, NE Sierra also “less healthy” by most objective measures. That’s also true of the southern SJ Valley, Kern and Tulare (thanks, Kevin and Devin) resting near the bottom in state rankings. Higher rates of adult tobacco use, more obesity, higher percentages of uninsured. Of course, Trump won handily in many of these areas.

In general, areas with the most common economic problems are red and are represented in Congress by Trump bootlickers. Witness the continued high unemployment rates in the SJ Valley where McCarthy and Nunes bloviate about the evils of both the extended Bay Area and SoCal, including both Orange and San Diego counties. Those places, in other words, with unemployment numbers 3X to 4X LOWER than theirs.

Add in the north and NE side of the Sacramento Valley represented by “real deal conservative” LaMalfa, who’s pocketed well over $5 Million in federal subsidies since 1995 (plus payments for his crop insurance), and you add more counties with less education, fewer technical job skills, and more unemployment.

The exceptions, are Placer and El Dorado counties, two of the state’s wealthiest, which have remained red and have consistently gained population. They have low unemployment rates and benefit greatly from their proximity to the burgeoning Sacramento economy, including big increases to home values.

It’s very difficult for outsiders to understand the depth and breadth of California, especially for those who must rely on stereotypes to comprehend the complexities of the state.