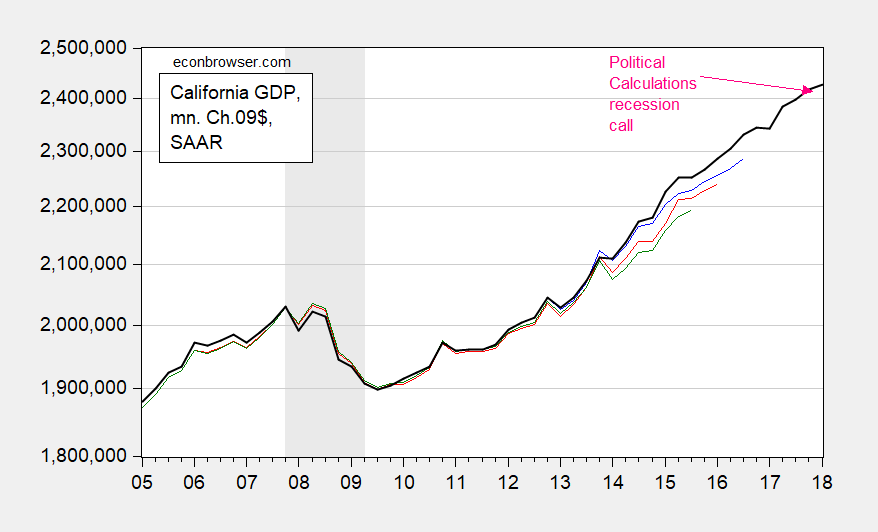

Back in mid-December, Political Calculations asked if California was in recession.

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis. [text as accessed on 12/27/2017]

The release of the 2018Q1 state GDP figures provides an opportunity to revisit this question — it’s likely no recession occurred.

Figure 1: California GDP, in mn. Ch2009$ SAAR, various vintages. Latest vintage (black). NBER defined recession dates shaded gray. BEA, and NBER.

Of course, the GDP figures will be revised. However, as of now, these data suggest to me that California did not enter in, and is not currently in, recession. For previous assessments, see: [1] [2] [3] [4] [5] [6] [7].

I’m also growing skeptical about Shadowstats.

There’s no sign of recession here in Southern Calif at the moment, but I wouldn’t be surprised if residential housing activity plateaus or declines over the net few quarters.

Calculated Risk shows home inventory starting to build. Prices increased rapidly over the last few years, but now are slowing. With higher interest rates and the GOP tax bomb, the after-tax cost of ownership has jumped substantially in coastal areas independent of price increases.