A reader alerts me – from CNBC, indications farmers are going to take a hit, as export volume drops off a cliff.

United States tariffs are beginning to take their toll on farmers and the storage, shipping and freight operations they need to move their crops to market.

In North Dakota, soybeans from 2017 are still in storage after China pulled its contracts. Of the 15.9 million bushels left from that year’s crop, 12.1 million bushels are sitting in grain elevators. That is an increase of 68 percent.

“There aren’t any shipping contracts to move them out of those facilities and get them to ports in the Pacific Northwest for export, either,” said Simon Wilson, executive director of the North Dakota Trade Office.

…

In Wisconsin, Chippewa Valley Bean, a kidney bean processor and supplier, slashed prices on its remaining beans from the 2017 harvest to move them out. Cindy Brown, the company’s president, told CNBC the company is taking a financial hit but had to do it.“We are playing catch up on moving product and bursting at the seams,” Brown said. “We had to do something. We not only need the room but also needed to pay our growers on contracts we made with them in 2017.”

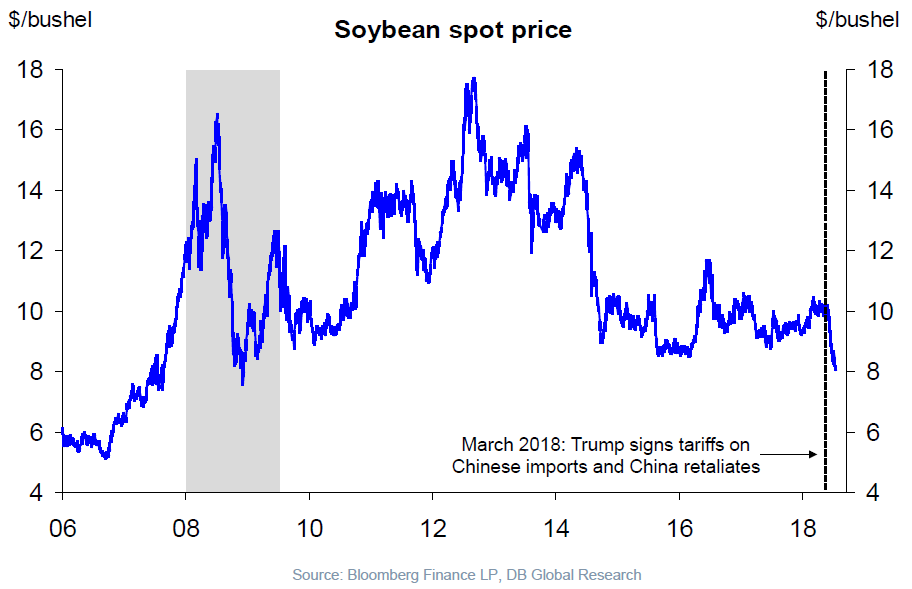

This article confirms what we knew a month ago, as depicted in this picture — end-market year stocks far exceeded previous years’ levels.

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

This is my call for all the commenters who claimed that farmers were just going to “wait out the Chinese” and be able to sell their crops at a profit when prices recovered in the Fall, to provide countering evidence in favor of their predictions.

This post is completely bogus. CoRev and Ed Hanson have shown through their research papers at conservative think tank “My Name Is Mud” LLC. that the value of crops rise as they sit in grain elevators over an extended period of time. ‘Cuz they like said so, and stuff. BELIEVE ME!!!!

https://www.youtube.com/watch?v=953PkxFNiko

https://www.youtube.com/watch?v=s2DIp8_r9uU

“Princeton”Kopits endorsed this comment and Dr. Phil and Oprah were the public notaries.

I nominate this for post of the year.

But every patriotic farmer who loves his country and its glorious leader will gladly go bankrupt if doing so brings China to its knees. His crops may languish and the bank may foreclose, but his desire to MAGA will trump all.

Trump’s People Court!

https://www.youtube.com/watch?v=dLYfwprjtog

Dear Menzie,

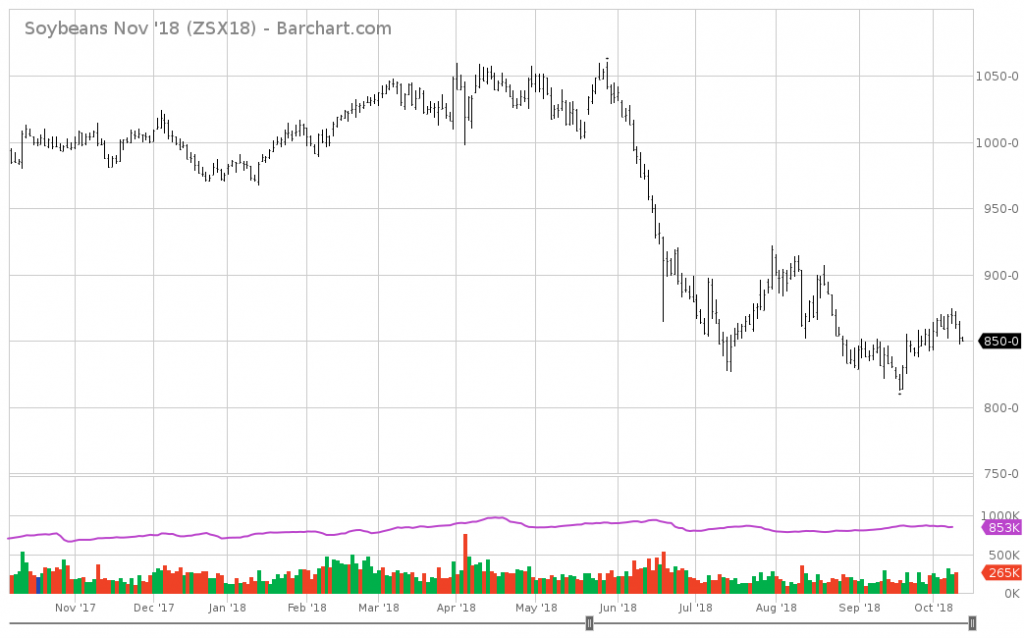

Clearly the farmers will suffer dramatically, since they won’t have sales this year, and next year’s sales will be much less than predicted. But suppose the price elasticity of soybeans is -1, which is what it looks like from the price fall, not as much the Barchart graph. Can you make a prediction about sales revenue that you believe in, so we can check what the effect of storage really is?

Julian

“This is my call for all the commenters who claimed that farmers were just going to “wait out the Chinese” and be able to sell their crops at a profit when prices recovered in the Fall, to provide countering evidence in favor of their predictions.”

But it is only early October. As soon as CoRev finishes his 1st draft of his new sophisticated model so he can submit it to the American Economic Review, he will share us with his prediction that soybean prices will hit $12 a pound just in time for Thanksgiving!

Some good ol’ visual graphics. Brookings and other folks in small print in the link:

https://i.redd.it/4w9lhzauuir11.png

A dose of reality may be about to occur in China.

“China may soon regret slapping tariffs on US soybeans”

https://www.cnn.com/2018/10/01/economy/china-soybeans-trade-war/index.html

Some takes from the article:

“Hong Kong (CNN Business)One of China’s major moves in the trade war with the United States is in danger of backfiring on its own farmers….

“There simply aren’t enough soybeans in the world to satisfy Chinese demand” if you take out US supplies, said Michael Magdovitz, a commodities analyst at investment bank Rabobank in London. ”

and

“While China has alternative sources for soybeans — mainly Brazil, but also Argentina — it can’t buy enough from those countries to replace what it would have imported from the United States. Soybeans are a seasonal business: South American farmers grow and harvest their crops at a different time of year to their US counterparts.

Brazil also can’t grow enough to meet Chinese demand. Brazilian farmers “are already maxing out their soybean and soymeal exports to China,” Puette said.

That has nudged up the prices of Brazilian soybeans in recent months, while prices for US exports have fallen because of the threat of losing Chinese business, according to data provider AgriCensus. Brazilian soybeans now cost significantly more than US supplies.”

and China as a source may not be all great:

“Xu, the sales manager at Hebei Power Sea Feed Technology, complained that Chinese soybeans are even more expensive than US and Brazilian ones.”

The end result should be that soybean sales to China will be both delayed and at a lower volume and price until China comes to the negotiating table with serious offers.

CoRev: Yeah, well doesn’t seem like that’s a near term scenario, as implied by this post.

I’m sorry, but your response does not relate to my comment. As your above reference: “In Wisconsin, Chippewa Valley Bean, a kidney bean processor and supplier slashed prices on its remaining beans from the 2017 harvest to move them out. Cindy Brown, the company’s president, told CNBC the company is taking a financial hit but had to do it.” does not relate to soybeans.

Sometimes I think many have lost sight of the big picture. This whole tariff effort is to negotiate new and better trade deals with our partners/competitors. These negotiations often take a long time, years not months, and if the new NAFTA deal is emblematic these talks will move at an unforeseen fast pace. There seems to be no better time to negotiate other than when our economy is growing, and the tariffs are just tools to get the negotiations started and negotiators serious.

“Sometimes I think many have lost sight of the big picture.”

We get your big picture. If you do not shill for Trump’s trade war 24/7, Wilbur Ross cuts you off from your government dole. And your monthly rent is due. So do continue!

CoRev This whole tariff effort is to negotiate new and better trade deals with our partners/competitors.

Wake up! Trump is not interested in lowering tariffs. He has consistently advocated high tariffs for the last 40 years. Trump thinks free trade is for suckers. Trump thinks like the NYC real estate man that he is. Trump does not understand the first thing about international trade. And how many times do we keep having to remind you that NAFTA 1.01 is almost indistinguishable from NAFTA 1.0. There are some good things in NAFTA 1.01, such as digital and IP rights that align with TPP. There are also some very bad things in NAFTA 1.01, such as the higher domestic content provision. And even with NAFTA 1.01 we still have Trump’s tariffs on aluminum and steel. The dairy deal was fine, but it’s not part of NAFTA 1.01, only a small side concession by Canada in exchange for Trump agreeing to keep the NAFTA 1.0 resolution process in place.

Correct me if I’m wrong, but I get the sense that you tend to think of international trade in the zero sum game terms of a business person trying to out do his competitors. In that view of the world the optimal result is no tariffs on US exports and high tariffs on US imports. That’s the Trump view of international trade and it’s a disastrously wrongheaded view. Of course, you won’t know why that’s a wrongheaded view until and unless you take the time to read a textbook on international trade.

CoRev Menzie’s post was not exclusively about soybeans. The title refers to “Midwest Ag Edition” and not “Midwest Soybean Edition”. The kidney bean problem is a direct consequence of Trump’s tariffs….in this case his tariffs on EU steel and aluminum. The EU imposed a 25% retaliatory tariff on kidney bean imports from the US. That’s what is killing Chippewa Valley Bean. And don’t take just my word for it, read what the company says about it on their website:

http://www.cvbean.com/about/news/636-kidney-beans-piled-to-the-rafters-tariffs-are-biting-in-farm-country/

The article also points out that growing kidney beans was a hedging strategy for farmers who also grew corn and soybeans. So that hedging strategy has failed because of Trump’s tariffs.

How does it feel to know that your political views align with Kanye West’s mad rantings? Still want to be seen wearing that MAGA tinfoil hat?

“These negotiations often take a long time, years not months…” Problem solved. What–other than thousands potentially going broke as the years pass–could go wrong in that scenario?

How about this ‘picture’?

http://www.globaltimes.cn/content/1122602.shtml

“Qiao Shiyan, a professor of China Agricultural University, said a drop of 2 percentage points in protein level in pig feed from the current 16 percent to 14 percent can save about 10.3 million tons of soybean meal consumption, equal to about 13.7 million tons of soybeans, calculated per annual pig feed output, according to an article published on CFIA’s website on September 5.

Reducing the use will be easier in China than elsewhere because domestic farmers have long included more soy than needed to keep their hogs healthy, Reuters reported in September, citing industry experts in China and the US. Chinese farmers could cut soymeal rations by nearly half without harming hogs’ growth, the report said.”

Here is another picture.

http://en.people.cn/n3/2018/0813/c90000-9490333.html

“China is now making efforts to establish a more diversified soybean supply system by increasing the import sources and adjusting domestic production of oil-bearing crops, insider from China’s major grain stockpiler said, adding that the soybeans imported from other countries except the US can meet China’s daily demands.

China Grain Reserves Corporation (Sinograin) has expanded the purchase from South America, who contributed over 90 percent to about 2.5 million tons of imported soybeans in May.

In addition, the company is studying the feasibility to import oilseeds from emerging producing areas such as the Black Sea region. In recent years, the soybeans and sunflower seeds from Ukraine and Russia have experienced rapid growth in both production and export.

The imported soybeans from the rest of the world other than the US can meet the daily operation demands, according to Sino Grain, adding that no halt of production, short supply, or sharp rise of price has occurred.

“Some short supply can totally be solved by diversifying the supply channel,” a responsible person from Sino Grain stressed, responding to the guess that China still has to import certain amount of soybeans from the US to cope with the short supply caused by the trade frictions.

The company said China will increase its import of soybeans from major production areas such as South America and Canada, as these places enjoy huge potential in production and supply. Argentina, in particular, is expected to increase over 15 million tons of supply after it recovers production.

In addition, Brazil is likely to increase its production area of soybeans and drive up production by over 5 million tons. Besides, Belt and Road countries such as Ukraine and Russia can also become potential soybean suppliers of China.”

How long before China approaches Brazil with this idea: “You buy US soy beans and then we’ll buy them from you at a 10% mark-up.”

Very simple solution to side-step tariffs.

King John’s Return: As it was explained to me, the infrastructure (loading at docks, etc.) is set up for export, not import, so Brazil will need to take some time to build. Whether they will depends on the extent to which policy uncertainty depresses investment.

John Cochrane over at Grumpy Economist had the same idea! Oh wait – Menzie still raised a modest wrinkle in its implementation.

Like there are no alternatives for soybeans. Have you not been paying attention – the Chinese are finding alternatives which may become a permanent substitution. Oh wait – you have seen that but are under strict orders from Wilbur Ross to ignore this reality.

pgl: Don’t you know — the isoquants are Leontiev! CoRev has seen the light.

Pgl, not only did I see it I commented. All other alternatives to soybeans are either more expensive and/or incomplete proteins requiring a supplement. Just like their increase of home grown soybeans are more expensive than US sourced beans, these alternatives may only reach cost parity or always be higher. Someone approaching near 8 decades in age and EXPERIENCE may have independent thoughts.

CoRev Do you know what a Leontiev isoquant is? It doesn’t sound like it.

Yes, I looked it up & just didn’t comment.

CoRev apparently looked the term up. Of course he did not understand the definition – hence his lack of commenting!

Since you have decided to what Benlu wrote – here it is again:

Benlu

October 11, 2018 at 9:39 pm

How about this ‘picture’?

http://www.globaltimes.cn/content/1122602.shtml

“Qiao Shiyan, a professor of China Agricultural University, said a drop of 2 percentage points in protein level in pig feed from the current 16 percent to 14 percent can save about 10.3 million tons of soybean meal consumption, equal to about 13.7 million tons of soybeans, calculated per annual pig feed output, according to an article published on CFIA’s website on September 5.

Reducing the use will be easier in China than elsewhere because domestic farmers have long included more soy than needed to keep their hogs healthy, Reuters reported in September, citing industry experts in China and the US. Chinese farmers could cut soymeal rations by nearly half without harming hogs’ growth, the report said.”

corev and others are making a straw man argument, implying the soybean trade is all or nothing. the chinese can simply purchase half their usual product from the us, still keep prices low, and acquire their necessary soybean stock. this does not help the us farmer, other than provide them with a buyer-although at depressed prices. this is why i asked steven several posts ago, is the lack of transactions due to us sellers not willing to sell, or simply chines buyers not willing to buy at any price right now-until they feel enough damage has been done. then they will buy, at smaller volume, at discount. us producers are not controlling the price-it is a buyers market right now.

Baffled, probably a correct analysis. China loaded up with Brazilian soya at a premium price, and they need to clear those from the storage and supply chains much like our granaries are doing with the 2017 crop.

CoRev: Well, yes, but they’re clearing out their storage by using the soybeans, which they were going to do anyways…

Menzie, what else would they do with them other than use them??? You’re off your game today.

“and they need to clear those from the storage and supply chains much like our granaries are doing with the 2017 crop.”

if our granaries are doing so, they are doing so at a low volume and lower price. this does not help support your position corev. but mostly our granaries are not clearing out, they are not using the soybeans, and the soybeans will continue to rot. and with storage maxed out, we have a 2018 crop to store…

Baffled says: “but mostly our granaries are not clearing out, they are not using the soybeans, and the soybeans will continue to rot. and with storage maxed out, we have a 2018 crop to store…” Give us your reference for this truism, please.

BTW, I have nearly always been commenting on this subject from the farmers view point, not the middle man nor end user, and certainly not the derivatives trader.

corev, these are based on YOUR observations and comments. farmers are not selling at lower prices, they are waiting for better days ahead. but if they are not selling, then they are storing-and storing large amounts from last year. and now we have a new crop arriving-this does not help our storage issues. and storage has a finite life, at which point your commodity begins to rot.

“Give us your reference for this truism, please.”

exactly what do you disagree with? and remember, your disagreements will amount to simply arguing with yourself corev.

https://www.proag.com/news/farmers-typically-sell-soybeans-at-harvest-but-may-have-to-scramble-to-store-them/

as i said before, this is a buyers market. and it appears there are no bids on this product. it is not a result of farmers holding out for better prices. the buyers (ie chinese) are simply refusing to buy at any price right now. this is not what i would call “winning” policy.

Baffled, having read your source it does not support your contention: “but mostly our granaries are not clearing out, they are not using the soybeans, and the soybeans will continue to rot. and with storage maxed out, we have a 2018 crop to store…” Do a search on rot and see if it is there.

Instead you article points out that farmers will have to sell other normally stored crops for cash flow, where they normally use soybeans for that purpose. And, that since most granary storage is already full, local storage is the best available storage answer. Why exaggerate when the story is already negative?

“Why exaggerate when the story is already negative?”

not an exaggeration. you simply do not want to acknowledge what is happening. even the farmers themselves admit this is really bad for them. fact is, storage space has become increasingly scarce, granaries are not shipping product because buyers are unwilling to purchase. it is not that the farmers are not willing to sell low-there appear to be very few buyers even if they want to make a fire sale. and commodities like soybeans actually do rot over time-especially when they need to be stored in ad hoc facilities. obviously they do not rot all at once-and i never claimed that they did-but there is a continuous erosion of their quality with time. corev, why the need for conintual denial? as i said before, if i claim the sky is blue you will argue it is a different color, even when you know you are in the wrong. simply the party of no. what a lonely world you must live in corev.

Baffled, why the anger? I merely clarified your comment AND corrected your exaggeration of rotting. I just commented that your source article did not mention rot, that was your assertions. You then clarified with”commodities like soybeans actually do rot over time-especially when they need to be stored in ad hoc facilities. obviously they do not rot all at once-and i never claimed that they did-but there is a continuous erosion of their quality with time”. Rotting, not only being your assertion, clarifying it was the meaningless equivalent of “all things die”. All things also rot.

corev, you are making incoherent arguments again. commodities such as soybean rot with time. i know this, and you should as well. whether it is stated directly in that article is irrelevant (although that is why they comment about proper storage conditions). you simply have a hard time accepting when you are wrong-similar to the orange one. personality flaw i guess. once again, i am claiming the sky is blue and you want to argue it is not.

As a voting farmer, at this point, with no farm bill, do you double down on your Trump support or do you think he and the GOP don’t have your best interest in mind Or do you vote for the Democrat who is at least saying sensible things (ie., Heidi Heitkamp) (By the way, I think most would see the ethanol statement as more con.) Or, do you trust your business to another season of dingbat nonsense?

What I see is an ~19% drop in the Chinese stock market since tariffs were implemented, and an ~28% since the 2018 Chinese stock market peak. Somehow I don’t think Chinese businesses, investors, and the Government hasn’t noticed. https://tradingeconomics.com/china/stock-market?embed (1 Yr chart)

My how you cherry picked the dates. Try doing the 10-year time frame to see how this stock index soared, crashed and then partially recovered. This episode had been discussed at length by the economist blogs and NOT ONE attributed the stock variations to the soybean tariff.

Hey CoRev – you deserve a prize from the White House for the most misleading thing to ever come out of it over the past couple of years. Well done!

Cherry pick? Weren’t we talking about the 2018 tariffs and not the last decades’ tariffs? You completely missed the point. Now is the time to leverage a roaring economy versus another starting to stumble when negotiating.

You may not like tariffs used for leverage, but I have yet to see any here suggest an alternative. I have seen many suggest/imply that continuing with the then current trade conditions was perhaps better. Well we tried that under previous administrations and what significant changes happened?

CoRev Now is the time to leverage a roaring economy versus another starting to stumble when negotiating.

You’ve made more than your share of boneheaded comments over the years, but this has to be one of the dumbest ever. To the extent that there’s ever a “good” time to enact tariffs, doing so when the economy is “roaring” is probably the worst time. Please read an econ book.

You may not like tariffs used for leverage, but I have yet to see any here suggest an alternative.

To leverage what??? Are you trying to convince us of the Trump fairy tale that raising tariffs is just a negotiating strategy for lowering taxes? How naïve and clueless are you? Let’s repeat this one more time: Trump believes free trade is for suckers. Trump loves tariffs as much as he loves debt.

I have seen many suggest/imply that continuing with the then current trade conditions was perhaps better.

What problem do you think needs to be solved? If you’re worried about the overall trade deficits, then Trump’s policies are guaranteed to make that problem worse, not better.

Ahem. Should I draw this in canyons for you? A lot of things affect the general stock market. I guess you think you have one of those of Event Studies but you have no clue what an Event Study is. They generally have some sort of financial economics model behind them as in the various factors that could have led to a change in a particular sector’s stock valuations and then try to isolate the various relevant variables.

You little chart did none of that. None of that all. In other words it was absolutely worthless. Then again you refuse to read the economic literature on Event Studies as in Fama’s 1970 seminal paper. So why should we be surprised that you continue with your usual incredibly stupid rants?

such logic is why corev is not profitable in the us stock market either. he creates relationships that do not exist. not profitable at all.

He creates relationships that both do not exist and that he has no clue what the alleged logic even is. But he repeats his insane logic over and over and over and over and over again. I guess he thinks if he repeats the same stupid junk over and over – one day someone in Sweden is going to give him a Nobel Prize!

Pgl, what the devil are you talking about? A little specificity helps when babbling and insulting.

Now the real irony is this from CoRev:

“Pgl, what the devil are you talking about? A little specificity helps when babbling and insulting.”

Like CoRev never babbles on and on incoherently?! Yep – the devil knows CoRev has no clue what CoRev is talking about it but we are supposed to. Classic!

The U.S. S&P 500 has declined by 15% since September 20. Now if CoRev had an ounce of independence and integrity – he would blame the Trump trade wars. But he doesn’t and he won’t.

Look – I’m not blaming the trade wars as it is more likely due to higher interest rates. Yesterday Trump was clearly FED bashing. So they asked Trump toadie Lawrence Kudlow about the FED bashing and Kudlow true to form denied that Trump was bashing the FED.

And so the Usual Suspects go on and on with all sort of babble and no honesty to be found anywhere.

Yesterday’s Iowa interior closing grain prices:

Closing cash grain bids offered to producers as of 1:30 p.m.

Dollars per bushel, delivered to Interior Iowa Country Elevators.

US 2 Yellow Corn Prices were mostly 2 cents lower for a state average of 3.14.

US 1 Yellow Soybean Prices were mostly 11 cents lower for a state average of 7.52.

Iowa Regions #2 Yellow Corn #1 Yellow Soybeans

Range Avg Range Avg

Northwest 3.09 – 3.18 3.15 7.47 – 7.57 7.52

North Central 3.11 – 3.19 3.15 7.42 – 7.52 7.48

Northeast 3.01 – 3.17 3.10 7.37 – 7.62 7.50

Southwest 3.06 – 3.20 3.16 7.42 – 7.62 7.49

South Central 3.11 – 3.24 3.16 7.48 – 7.62 7.52

Southeast 2.87 – 3.28 3.14 7.50 – 7.77 7.66

Corn basis to STATE AVERAGE PRICE for the CBOT DEC contract -.49

Soybean basis to STATE AVERAGE PRICE for the CBOT NOV contract is -1.00

https://www.iowaagriculture.gov/agMarketing/dailyGrainPrices.asp

Did the administration greenlight the Khashoggi killing?

Here’s the timeline:

Friday, September 31

Khashoggi goes to consulate to obtain papers to allow him to get married

The papers weren’t ready and he leaves consulate after a couple of hours

Tuesday, October 2

3:00 a.m.:Private jet arrives in Istanbul from Riyadh

1:14 p.m.: Khashoggi arrives at the consulate

5:00 p.m.: A second jet arrives in Istanbul from Riyadh

6:00 p.m.: Second flight departs Istanbul for Cairo, en route to Riyadh

11:00 p.m.: First flight departs Istanbul for Riyadh

Wednesday, October 3

Turkish officials first report Khashoggi is missing

Tuesday, October 9

Nikki Haley announces to staff she is resigning

*****

Now, what might be the link? Perhaps the Turkish UN delegation approached Haley, whom they no doubt know well, about the incident last Wednesday or Thursday, indignant that the US would permit the Saudis to do this on Turkish soil. Haley no doubt denied it, but then made three inquiries: 1) to the White House, 2) to a back channel at the CIA or NSA, and 3) to the Saudi delegation. We already know that US intelligence knew about the plans in advance, so she probably found that out, too. And she probably looked up the Saudi delegation to chew them out, to which they responded…what? Maybe, “Of course the US knew. There would be hell to pay if we did this freelance. [….Jared?…] greenlighted the rendition.”

At that point, she called the president and told him she was resigning on the spot.

That narrative seems about right. If it’s true, this is going to get really, really ugly.

https://www.vox.com/world/2018/10/11/17964494/washington-post-journalist-jamal-khashoggi-trump-saudi-arabia

Killing off journalist who criticize your government. I hear Jared has been sent over the Saudi Arabia to investigate. Betcha not to investigate alleged wrong doing but rather to learn how the Saudi techniques can be used to go after the U.S. “fake news”.

What benefit accrues to the US from such a terrible act?

But Trump made sure to note that he doesn’t want to punish the Kingdom too hard — instead, he’d rather cash Saudi Arabia’s checks.

“This took place in Turkey and to the best of our knowledge, Khashoggi is not a United States citizen,” he told reporters in the Oval Office on Thursday. “I don’t like stopping massive amounts of money that’s being poured into our country,” referring to his desire to sell $110 billion worth of weapons to Saudi Arabia, adding that “it would not be acceptable to me.”

Trump’s comments just made one thing extremely clear: He cares much more about getting American companies paid than defending human rights. What’s more, he doesn’t care that much about Khashoggi — who heavily criticized the crown prince in the Washington Post — because he is merely a US resident, not citizen.

https://www.vox.com/world/2018/10/11/17964494/washington-post-journalist-jamal-khashoggi-trump-saudi-arabia

he wants the saudi cash. probably some other payoffs down the road as well.

but you should remember, this type of behavior is not a problem for trump. he would engage in it himself, if he could get away with it. look, putin and the russians committed murder on nato soil in london using radioactive weapons. and trump did nothing but faun over putin. why would he do anything different with the saudis? he likes authoritarian and strong man behavior. and he knows there are plenty of republican cowards in the senate and house who will not stand up to him, so he will get his way and continue to cash the checks. as long as it is a few dark skinned folks from overseas, what is the problem?

Easy – this gives Trump an idea of how to get rid of our “fake news”. Of course one could say a benefit to Herr Trump is not necessarily a benefit to the nation. Trump would call this thinking left wing mob rule.

And, sadly, we’ll wait with bated breath for the appropriate House and Senate committees investigate it. All the while, that whisper from the back rows:

Jamal Khashoggi was a talented and good man, from a rather remarkable family. Cynically, I doubt that anything serious will happen because of this.

Life’s but a walking shadow, a poor player

That struts and frets his hour upon the stage

And then is heard no more. It is a tale

Told by an idiot, full of sound and fury

Signifying nothing.

It would appear that Nikki Haley has taken the under.

@ “Princeton”Stevie

If Nikki baby had one iota of morality, she never would have joined up with Orange Excrement to begin with. Nikki baby already caste her lots—and lost, whether she, or you, realize it or not. But these choices rarely register with those with near zero morality to begin with. She came to Vegas with some vouchers for the free buffet, won a couple bets. Then they offered Nikki baby some comps to get her to stay longer and lose back to “the house” more than what she had won.

Nikki baby can smile, show those nice legs, and get some dumb-shit at NYT to write an editorial about her like she’s Mother Teresa exiting the building. But instead, what Nikki baby really is, is the naive girl who got “a little” pregnant. The only difference between Nikki baby and Chris Christie standing behind donald trump at press conferences was Christie had already had his cherry popped.

https://www.youtube.com/watch?v=kVvP12MmaKs

nikki thinks she got out just in time, but the internet lasts forever. she will have a hard time overcoming her trump tenure, when forced to explain her actions and logic over the past couple of years. and she is not out of the white house yet, she still holds un position until the end of the year. so she still has some explaining to do to her un colleagues.

Ford is losing money due to the tariffs and its stock price is way down. OK, who cares about the shareholders. What about Ford workers? Layoffs? Layoffs?! Somehow CoRev and PeakTrader will turn this into “winning” too!

http://fortune.com/2018/10/09/ford-stock-today-layoffs-trump-trade-tariffs/

@AS

The murder gives leverage for the US and Israel to pressure Saudi Arabia to agree to the Jared Kushner Middle East Peace plan. Perhaps it is similar to Saddam’s invasion of Kuwait where mixed signals from the White House were misread as a green light to roll out the tanks. Maybe no one at the White House said don’t do it because they figured it would make MBS much easier to manipulate.

The foreign perception of the White House’s competence and morality is falling rapidly. That perception means nothing to most Americans but it does have a chilling effect on American allies. I am from New Zealand. I think this likely killing and the use of a diplomatic residence to chop up a body is barbaric. The fact that the US is not yet taking a principled stand on the affair, given that it seems likely that they know exactly what happened, is appalling.

“The murder gives leverage for the US and Israel to pressure Saudi Arabia to agree to the Jared Kushner Middle East Peace plan.”

Aha! This must be why Nikki Haley said Jared had some hidden genius!

The Jared Kushner Middle East Peace Plan? Part of a comedy monologue, right?

Why does it take 15 Saudi’s to handle one assassination? So let’s assume Khashoggi weighs 180 pounds. Also assume that each Saudi carries one diplomatic sealed attache case back to Saudi Arabia …

Did Khashoggi have a black belt in karate? Maybe we should make a movie starring Jackie Chan!

CoRev earlier made the incredibly stupid claim that the soybean tariffs led to a Chinese stock market decline. Like only tariffs matter? Please! But then we had a massive stock market crash in 1929 that led to the Great Depression. Which some economic know nothings blamed on the Smoot-Hawley Tariff Act even if this tariff was not signed into law until the summer of 1930. I guess for everyone’s amusement, I should post this link:

https://www.britannica.com/topic/Smoot-Hawley-Tariff-Act

This is fun! Lawrence Kudlow looks at the decline in the Chinese stock market and acts even dumber than our CoRev!

https://www.cnbc.com/2018/08/17/chinas-stock-market-drop-might-not-reflect-its-economic-reality.html

‘National Economic Council director Larry Kudlow raised eyebrows Thursday when he said in a Cabinet meeting with President Donald Trump that China’s economy “looks terrible.”’

The story notes that Kudlow based this solely on the decline in stock valuations. More from this story:

‘“I think our dear friend Larry Kudlow is off the mark,” UBS’ Art Cashin said on CNBC on Thursday. “In highly efficient full-production places like the U.S., the stock market is reflective somewhat to what the economy is doing. But there’s almost a total disconnect in China,” he said. Nick Colas, who runs market analysis firm DataTrek Research, agreed. “The Chinese stock market actually tells us very little about the country’s economic welfare and doesn’t play anywhere near as dominant a role in the lives of its citizens as the US equity market does in America,” he wrote in a recent note to clients. Colas backed up his assertion by noting that the Shanghai Composite trades for less than half its October 2007 peak, yet China’s economy in the 11 years since then has more than tripled to $13 trillion. The Shanghai market staged a huge rally from 2014 into 2015, more than doubling in value, but again collapsed and is trading 45 percent lower since 2015. “This decline has had no discernible impact on consumer spending or business investment over the last 3 years,” Colas said. Colas also cited a September 2017 Bloomberg article noting that retail investors account for 80 percent of the trading volume on the Shanghai exchange. Colas said those traders can cause individual stock prices to swing wildly on arbitrary and noneconomic information. He agreed with Cashin’s point that the Chinese stock market is not very efficient and does not necessarily reflect underlying economic realities.Finally, Colas noted that the allocation of household wealth to stocks in China is relatively minuscule: 4 percent versus 23 percent in the U.S. And what about the super rich? Colas noted that they tend to invest in private equity and venture capital rather than having their core holdings in stocks.’

The story also notes that China’s real GDP is growing at a 6.5% per year rate.

China GDP to grow 6.2% in 2019: IMF

“The IMF forecasted that China’s GDP growth will be 6.6 percent this year, the same forecast in April. “

http://www.globaltimes.cn/content/1122273.shtml

Excellent discussion – thanks. It admits the trade war by itself might hurt the Chinese economy but then notes Chinese policy makers will offset any negative aggregate demand effects with macroeconomic stimulus. Smart on their part. In the meantime, our White House relies on economic advise from village idiots like Lawrence Kudlow. As noted earlier, Kudlow thinks China is going to hell simply because its stock market declined. Of course Wall Street is all that Kudlow ever cared about in the first place.