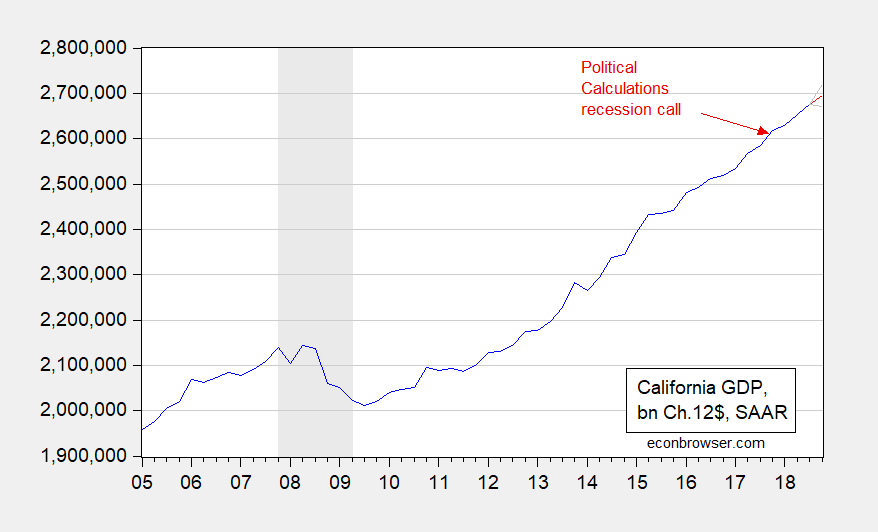

Back a little over a year ago, Political Calculations asked if California was in recession.

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis. [text as accessed on 12/27/2017]

Today’s release of the 2018Q3 state GDP figures provides an opportunity to revisit this question — it’s likely no recession occurred.

Of course, the GDP figures will be revised. However, as of now, these data suggest to me that California did not enter in, and is not currently in, recession. For previous assessments, see: [1] [2] [3] [4] [5] [6] [7], [8], [9], [10], [11], [12], [13], and [14].

On March 19th, benchmark-revised state level employment rates for Oct 2017-Sept 2018 and January 2019 will be released. At that time I’ll continue with Part XVI of this series on California.

California is always interesting to watch as a barometer for the nation. Economic conditions, clothing styles, new food trends, new energy technologies etc. I say that as one who has basically lived somewhere along I-35 most of my life and sometimes feels just a tinge of jealousy to those living near the coast in an urban area.

Tell you something that dawns on me just now thinking of this, and I have done no searching online yet as of this moment. How is Kamala Harris polling vs her Democratic competitors in the state of California?? If she can get past the early rounds of the primaries (a big “IF” at this early juncture), one has to assume Harris will slam dunk California and that becomes a major factor in the latter rounds.

[edited by MDC]

@ Menzie

I have openly “bragged” on this site before that my first presidential vote ever was for Jerry Brown in ’92. Something I am actually proud of (I wanted to vote for Paul Tsongas, but I couldn’t because of antiquated rules on how candidates got on my state’s ballot, Tsongas didn’t get on the ballot in time). I have actually become more proud of that ’92 primaries vote cast as the years rolled on, as at that time I saw Brown as slightly “loopy”, but still the best candidate in the field, outside of Tsongas.

Now, I’ve cut out the first portion of this which largely covers population issues and greenhouse gases, important but well tread issues, and jumped to the more “meaty” part. But I ask you a largely rhetorical question Menzie (but you can answer if the spirit moves you), as you listen to Jerry Brown talk, is this the difference between a leader who avidly reads books and newspapers, and certain other “leaders” we could mention who watch TV much of the day??

https://youtu.be/gsExT_661Q8?t=929

OK real gross state product is still rising but Bruce Hall is lecturing us that this is SO irrelevant. He wants to know how Home Depot sales have performed over the past 3 month. Hmmm – sales did not meet expectation for the quarter even though sales had been soaring before that. Yes – the Bruce Hall index says California is in a massive recession!

Sales in California for those ugly solar panels in will soar soon:

https://www.google.com/amp/s/www.cnbc.com/amp/2019/02/15/california-solar-panel-mandate-could-cost-new-homeowners-big.html

This bothers you? Gee – you must work for the Koch Brothers. Climate change – good. Doing something about it – bad! Same old Peaky!

pgl, go back and read what I wrote. You’re good at parsing thoughts; you’re not so good at the whole point. The last discussion was about recession prediction and possible indicators of a future recession. Menzie has said that recessions can come quickly and that it is difficult to predict those turning points. So we look for indications that a recession may be coming soon (1-2 years?). If you look at quarterly GDP numbers, you can see that they are lousy predictors of their own future as they bounce around and get adjusted. https://www.moneycrashers.com/leading-lagging-economic-indicators/

Will you argue that home sales and prices have not fallen? https://www.latimes.com/business/la-fi-home-prices-20190130-story.html

Will you argue that vehicle sales have not fallen? https://www.bloomberg.com/news/articles/2019-02-14/u-s-retail-sales-fall-most-in-nine-years-amid-stock-plunge

Will you argue that leading indicators are not indicative of an economic slowdown? https://upfina.com/leading-indicators-signal-slowdown-will-continue/

No one is saying a recession has started/is starting. But there are signs of economic weakness from many quarters that should be watched. But I’d side with those who don’t believe that Trump is driving the U.S. economy into a recession this year (although Menzie was obviously right about soybean exports which constitute 10% of the U.S. economy… oh, wait, that’s 0.01%). Inflation is low, interest rates are low, the energy sector is very strong (except in California), and Home Depot is still selling a decent amount (even if the trajectory is not pointing as high). Again, we are looking at signs… indicators… clouds on the horizon.

California may not be in a recession and portions of California may continue to thrive through the next recession (as will portions of other states).

“pgl, go back and read what I wrote.”

LOL! Why don’t you go back and read your own link? Or the 10-K and 10-Q filings of Home Depot. Sorry Bruce but I’m not bothering with the repeated babbling you utter here. Until you grasp the bare minimum of research skills, NO ONE should bother with your repeated fact free and really dumb blather.

Let’s take Bruce’s latest:

‘Home sales plunge in Southern California to lowest level since 2007, as prices inch up’.

Maybe this is bad news for one region’s economic prospects. But Bruce needs to read what HE wrote. He was not talking about Los Angeles. He was talking about the national economy. Yea I know people in LA think they are the entire economy but sorry Bruce – it ain’t so.

As I just noted – reading Bruce Hall’s blather is a complete waste of time.

Your cherry picking of one region’s housing market when YOU were predicting a national recession (not a local downturn) is beyond stupid and dishonest for you. OK – it goes beyond the abilities of research impaired Bruce Hall to do something simple like going to FRED to check out real residential investment so let me:

https://fred.stlouisfed.org/series/PRFIC1

It is not exactly soaring on a national basis but this is a far cry from what happened before the Great Recession. Should we monitor this? Yes. Should we go all panic mode like Bruce Chicken Little Hall is doing? Snicker!

pgl

Your cherry picking of one region’s housing market when YOU were predicting a national recession (not a local downturn) is beyond stupid and dishonest for you.

Good parse. Let me remind you of the post title: Is California in Recession? (Part XV)

Oh, my. I provide a piece of information relative to an indicator of economic activity for California and you go all Homer Simpson on me. Sure, I also provided other indicators of economic activity and certainly some were national in scope. But I forgot that California was not affected by national economic trends. Sorry, silly me. /sarc

And what have you offered besides sophomoric insults? Nada, nilch, zip. Still stuck in the 5th grade I see. Perhaps you’d like to offer up something of value to the forum? Oh, wait, you did offer up a national indicator of real estate fixed investment. You should read your links.

Okay, one for you and half a dozen for me.

Like I said – YOU were the one who had misread Home Depot’s financials and then suggested they were an indicator of a NATIONAL recession. Bruce Hall – cannot read and cannot be even remotely honest about what he said. Case closed as you incessant and incoherent babbling is a waste of everyone’s time.

pgl, I must have misread what I wrote. The point about Home Depot slowing sales growth is that it is just an indicator that things may be slowing… not that they indicate a recession. I really thought you knew the difference between trajectory and recession.

Regardless, it’s hard to understand nuances with a 5th grade mentality.

Bruce Hall claimed the latest financial news from Home Depot is an indicator of a national recession. Yahoo/Finance proves Bruce Hall once again makes a fool out of himself due to his terrible research skills:

https://finance.yahoo.com/quote/HD/

Go to Financials and look at the income statement. Annual sales rose from $100.9 billion to $108.2 billion. Operating profits rose from $14.7 billion to $15.8 billion. This is not a recession indicator at all, which of course is why Brucy has decided to change his tune to focus on the Los Angeles housing market.

Dishonest? Perhaps. Stupid? Absolutely. But Brucy is about to whine that I’m the 5th grader. Hey – let’s give Bruce an award – troll of the year!

OK, Bruce: the Zillow estimate on my home has doubled since I refinanced in 2012. And that includes the recent 3% drop since the fall. BTW, if home prices were vastly lower with significant job prospects for numerous classes of workers, who wouldn’t choose to live here? (Hmmm. If home prices ad job opportunities were equal in Duluth and Santa Barbara…..)

One factor that may play negatively is that Trump’s tariff mess may that well affect California’s industrial AND agricultural exports. worldexports.com notes: “The value of California’s exports equals 11.1% of the United States’ exported products for 2017”

And “Given California’s population of 39.5 million, its total $171.9 billion in 2017 exports translates to roughly $4,350 for every resident….” Reciprocal tariff foolishness could indeed have recessionary effects.

We can be fairly certain the next recession is not an ” if” but a “when”. Given Trump’s willingness to reward some and punish others, California may indeed suffer more.

Let’s check out what Zillow Research says:

https://www.zillow.com/research/december-case-shiller-2-23139/

“For years, the housing market has been anything but “normal” or “balanced.” But as the start of the busy home shopping season looms, someone squinting at the market might be able to find signs of both normalcy and balance as the market continues to cool off after a years-long sizzle. Annual home price growth, while still rapid in a handful of the most in-demand and/or affordable markets, has fallen to a pace not far off historic norms and feels largely sustainable for now at a national level of 4.7 percent year-over-year in December. That pace is down from 5.1 percent in November, according to the Case-Shiller home price index.”

The market WAS sizzling. But now Zillow shows that housing price increases have returned to historic norms which they believe are sustainable.

Bruce Hall wants us to believe housing prices are collapsing or about the collapse. Is Bruce Hall lying? I think not. He just sucks at basic research. Bruce Hall is clueless as always!

Contracts to buy previously owned US homes fell 2.3 percent from a year earlier in January 2019, following an upwardly 9.9 percent decline in the previous month. It marks the 13th straight month of decreases in pending home sales. The sales dropped the most in the West (-10.1 percent), followed by the South (-3.1 percent), and the Midwest (-0.3 percent) while in the Northeast purchased advanced 7.6 percent. On a month-over-month basis, sales went up 4.6 percent, after an upwardly revised 2.3 percent fall and above market consensus of a 0.5 percent gain. Pending Home Sales in the United States averaged 0.77 percent from 2002 until 2019, reaching an all time high of 30.90 percent in October of 2009 and a record low of -24.30 percent in April of 2011.

• https://tradingeconomics.com/united-states/pending-home-sales

• https://d3fy651gv2fhd3.cloudfront.net/charts/united-states-pending-home-sales@2x.png?s=unitedstapenhomsal&v=201902271801a1

Still not saying there is a recession; saying that there are signs/indicators of weakness and regionally (California?) may be exhibiting more than other areas. Go ahead, parse that pgl.

Got love this troll BS:

“it’s hard to understand nuances with a 5th grade mentality.”

Ah Bruce – even a 5th grader does better research than you. Even a 5th grader writes more clearly than you. Nuances? That is your latest excuse for your incessant stupidity? OK.

Like I said – we would tell you to grow up but your mom warns us she tried with you and failed.

non,

Well, I would certainly hope your home value has risen since 2012 or you would have made an exceedingly bad decision. However, It’s always been my understanding that we don’t look at economic downturns from a point in time 7-years ago. The link I provided relative to Los Angeles area home values was simply to point out that home sales and prices have recently weakened.

California has a lot going for it: nice weather (most of the time), lots of cheap labor (hmmm, how did that happen?), and a litany of social programs as long as the state. So, what could go wrong? Well, yes, tariffs on produce that California exports to China would have an effect, but probably less than the highly variable weather (droughts/floods) although statistics on that are difficult to find.

Your prediction of a timeframe for a California recession seems plausible given the normal business cycle and the out-of-wack cost-of-living and state debt structure. But, as I said before, there is no present recession; just a few signs of recent weakness in some key sectors.

Ah Bruce – maybe his point was simply that Zillow knows how to do research. Since you truly suck at research, I have provided the latest from Zillow Research. And it basically says – you have no clue what you are babbling about. But then we all knew that a long time ago.

Bruce Hall – having decided he cannot take responsibility for lying about Home Depot financials – has decided to play another artful game of misrepresentation!

Bruce Hall February 28, 2019 at 10:08 am

Starts with some long-winded quote he neither links to or provides any source for. Incompetence on this part or he just making stuff up. Oh a link- finally!

https://tradingeconomics.com/united-states/pending-home-sales

His shows some data than is noisy and looks BAD, BAD over the last year. Everyone – hit the max feature to get a longer term framework. The pictorial is very different. We do have to wonder – is Bruce Hall trying to deceive us again? Or is he so incredibly incompetent that he failed to look over a longer time frame? After all the man is beyond incompetent.

And wait for it – this troll will call me a 5th grader again. C’mon Bruce – get a new insult for your trolling!

Brief digression, Bruce, to practical economics: (1) Refinancing the mortgage was a no-brainer, non-loser move. Unless going from 5.5% to 3.75% and paying far less in interest/month qualifies as pound foolish. (2) Had the “Zestimate” not risen, I would still be thousands ahead in both lower payments and reducing principal much more quickly. And (3) the doubling in estimated value pretty much monitors the rise in the Dow over the same period (the Dow was close to 13,000 when we refinanced)

Re: California exports: in addition to produce (including dairy and ranch products), a tariff war will likely harm California’s vast industrial sector, a sector that includes many small businesses. The state’s top export markets–Mexico, Canada, China, Japan, and Hong Kong–seem to constantly find themselves in the crosshairs of Trump’s tariff follies.

Highly variable weather: Worse than the country’s leading state exporter, Texas? The hurricane belt in the South? Floods in the Ohio and Mississippi valleys? the Tornado alley that stretches from Texas into the upper Midwest?

Cost of living is, of course, very high, but as I said: if cost of living in Joplin or Tulsa, or Lubbock were the same as Pismo Beach (ever been there?) or San Luis Obispo, I have trouble believing that mass migration heading west would not soon be a flood.

pgl,

My original link in which you insist I am lying:

“Home Depot and Lowe’s face tough year-over-year comparisons in the fourth quarter that included hurricane-related sales and a strong year ago December that was negatively impacted by weather in 2018,” Wells Fargo analyst Zachary Fadem said in a note to clients ahead of Tuesday’s report.

“The housing market remains delicate,” he added.

For much of last year, confidence in the U.S. housing market soared, benefiting Home Depot and Lowe’s. But with mortgage rates climbing, attitudes have since started to turn sour. This may lead to home prices rising at a slower rate and the market cooling down, which has sparked some fears for the sector.

So, despite your “blah, blah, blah” attempted retort, I’ll stick with the link about Home Depot not meeting expectations as an Indicator that there could be issues ahead. My direct quote: “Perhaps Home Depot will have predicted it.” If you read the article and my statement, nowhere did I say there was presently a recession. But, pgl you seem to be fixated on mocking what you read into what I said.

@ noneconomist

Your blog id name seems more and more ironic day by day as you show more economic literacy than many other commenters on this blog.

We all do know that California is a domestic proxy for a reasonably successful progressive society – which perforce must be an oxymoron to ideological (as opposed to pragmatic) conservatives. If not causing a severe case of cognitive dissonance.

Sad.

California thrives in spite of progressive policies, unless you’re in the bottom 80%.

That’s why so many moved out.

It’s no longer Nixon or Reagan country.

Sad.

“It’s no longer Nixon or Reagan country.”

Thank God! No PeakMoronity – California’s success (which you so often berate) exists because of its progressive policies. As usual – you have gotten your panties in a bunch!

And no Republican mayors like those you thought are still in office. Sonny Bono died last century. Clint Eastwood was last mayor of Carmel three decades ago. Both cities are now Democratic ones. Sadly, no longer Reagan or Nixon country. But not ungovernable rat traps either.

But you still have Bakersfield, Barstow, and Needles. And “My Kevin” and his dimwit sidekick Nunes to hold down the fort.

But thankfully you need not lay claim to hellholes like Santa Barbara, San Luis Obispo, or Palo Alto. Or Walnut Creek, or Santa Rosa, or Monterey. Or Rolling Hills Estates. Blythe and Red Bluff will have to do.

“My Kevin”. Love it. 5-stars comment rating from the judges.

California not only attracts high-skilled workers from the rest of the country and the world, it has a strong tourism industry. Moreover:

“It has the highest concentration of billionaires in the country. It exports more computers than any other state. It is the nation’s largest producer of agriculture products by far…There is Silicon Valley in the Bay Area, which has become a dominant economic driver in the state. The farms that blanket the state’s vast center grow two-thirds of the nation’s fruits and nuts. The entertainment industry is still thriving in Hollywood (or more accurately, across Los Angeles.) And Southern California is home to two ports that receive nearly 40 percent of all foreign goods shipped into the country, plus a sprawling warehouse and transportation network needed to distribute them across the country.”

https://www.google.com/amp/s/www.nytimes.com/2018/10/10/us/california-economic-recession-jerry-brown.amp.html

My comment: California has huge natural and historical advantages over other states.

New York City does not attract talent? We have no tourism sector. No billionaires in my current town? Yea – California is a great state. Which is weird given your repeated attempts to suggest otherwise.

I don’t know when UCLA Economic Dept comes out with their numbers or summarization. That should be worth checking out. Not too much longer, because it was right in the middle of the dead space when I put my comment up about it, so, it would have been 6 weeks from then, whenever that was. They are a little bit more friendly about it than some schools and I think they may even put stuff up on Youtube every quarter. Then again it may only be annual that UCLA bother to put up Youtube clips. I’d hate for them to share their knowledge or not charge the riff-raff an entry fee. That would be horrendous behavior and unworthy of anyone with a doctorate. /sarc

Either way, the text version should be up somewhere online.

Southern California was a much better place to live for the middle and lower classes in the ‘70s and ‘80s compared to today. There were still many orange groves in Orange County. When Disneyland opened in the morning, you could park very close to the gate and there was no waiting. On low income, you could afford Disneyland and deep sea fishing excursions. You could park on Pacific Coast Highway and beaches weren’t crowded at all. With relatively low income, you could rent a nice apartment close to the beach. Santa Ana was a clean middle class city with well kept old houses and lawns.

Now, there are a lot more people and everything is expensive. Beaches are packed and you likely have to pay for parking. On low income, renting a room is expensive. There’s more traffic, in part, because two or three families often live in one house. Disneyland and deep sea fishing are much more expensive and crowded. Santa Ana looks like Tijuana. Every orange grove has been replaced, e.g. by strip malls. There’s certainly a lot more diversity with many millions of poor immigrants, from Latin America and Asia, while a large portion of the middle class moved into the upper middle class or lower upper class.

“Southern California was a much better place to live for the middle and lower classes in the ‘70s and ‘80s compared to today. There were still many orange groves in Orange County. ”

While the first sentence is your usual BS the 2nd sentence has some truth in it. I lived in Southern Cal and the story I got from the really long term residents is that those orange groves contributed to LA’s pollution problem.

I see Peaky’s plan – increase pollution so much that those pesky Latinos and Asians will no longer live in his neighborhood. One has to wonder why PeakRacist does not simply move to Arizona so he can be surrounded by fellow white supremists!

“You could park on Pacific Coast Highway and beaches weren’t crowded at all. With relatively low income, you could rent a nice apartment close to the beach.”

Peaky wants California to return to being a virtual ghost town so his unemployed self can enjoy the beach. Someone buy this fool an airline ticket to some place like Indonesia or Malaysia where they are beaches that are not crowded. Of course Peaky would have to deal with the few Asians that are there so maybe he will hate these beaches too. Too bad all white Wyoming does not have beaches as that would be Peaky’s kind of place!

An old sailing friend sent me a facebook showing the boat parked at Survivor Island. Too nice a place for some to be isolated at.

Lots of places were better for less wealthy people 30 or 40 years ago. Why should anybody be surprised that is also true in Los Angeles? People move to certain cities for economic opportunities. If those opportunities didn’t exist, people wouldn’t move there, property values would fall, and the cost of living would go down. But if there’s no reason to move there, a low cost of living isn’t gong to help. I can think of a few places like that. Kansas, anybody? It’s tax cut paradise, but apparently that’s not enough. Los Angeles, New York, Seattle, Chicago, etc. must have something that Topeka doesn’t, and it’s not a low cost of living. There’s some market forces in action here – you would think that would be more obvious than it apparently is.

Gross Domestic Product, Fourth Quarter and Annual 2018 (Initial Estimate)

https://www.bea.gov/news/2019/initial-gross-domestic-product-4th-quarter-and-annual-2018

“Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2018 (table 1), according to the “initial” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.4 percent.”

For the year, real GDP grew by 2.9%. Not bad but not exactly what Team Trump told us when they promoted that tax cut. Details?

“The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, private inventory investment, and federal government spending. Those were partly offset by negative contributions from residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased”

For the year business fixed investment growth has been flat while residential investment has been flat. We were told by Team Trump we would have investment soaring right now – not quite. On the flip side – Bruce Hall wants us to believe that residential investment is about to lead to a recession. The BEA data does not support that either.

pgl “The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, private inventory investment, and federal government spending. Those were partly offset by negative contributions from residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased”

Wait, you are quoting a source that says:

• people are spending more (tax cuts)

• businesses are spending more (tax cuts)

• exports are up (tax cuts-more competitive pricing?/more aggressive trade policy?)

• inventory is increasing (can be ambiguous – building to meet demand or building because demand is falling,? But likely to meet demand.)

• federal government spending (hmmmm)

So, you are arguing against an imminent recession and pointing out that Trump’s agenda is working? Then we agree.

Tax cuts are the magic solution for everything? Wow Bruce – we knew you were STUPID. But being as dumb as Stephen Moore and Lawrence Kudlow? OK!

What’s the marginal benefit of each round of tax cuts to the overall economy. Never mind that they recipient probably wanted another new Lexus. Each successive round will have less positive effect. Each successive round will increase the deficit in boom times leaving more debt for not a whole lot of value. We are not investing in the nation, we are mining it. Extraction only lasts so long before it fails. Ask coal miners in West Virginia about that if you are confused.

https://www.youtube.com/watch?v=cVuVSk_IUAc

It may not be in a recession but it is “due for a reckoning”:

California’s Rendezvous With Reality.

California’s 40 million residents depend on less than 1 percent of the state’s taxpayers to pay nearly half of the state income tax, which for California’s highest tier of earners tops out at the nation’s highest rate of 13.3 percent.

In other words, California cannot afford to lose even a few thousand of its wealthiest individual taxpayers. But a new federal tax law now caps deductions for state and local taxes at $10,000 — a radical change that promises to cost many high-earning taxpayers tens of thousands of dollars.

If even a few thousand of the state’s 1 percent flee to nearby no-tax states such as Nevada or Texas, California could face a devastating shortfall in annual income.

California has no margin for error. Spiraling entitlement costs, unwieldy pension costs, money wasted on high speed rail, inadequate water storage and delivery, and lax immigration policies were only tolerable because 150,000 Californians paid huge, but federally deductible, state income taxes.

No more. Californians may have once derided the state’s 1% as selfish rich people, but now they are now praying that these heavily burdened tax payers will stay put and are willing to pay far more than before.

https://www.realclearpolitics.com/articles/2019/02/28/californias_rendezvous_with_reality_139605.html

Victor Davis Hanson? Sammy – you cite some of the dumbest people ever as your gurus!

“California cannot afford to lose even a few thousand of its wealthiest individual taxpayers. But a new federal tax law now caps deductions for state and local taxes at $10,000 — a radical change that promises to cost many high-earning taxpayers tens of thousands of dollars.”

On the first sentence, New York City is similar. And no these rich people want to live here as it is here that they can make their high incomes. They are not about to move to Bermuda where they would make nothing. Of course the SALT deductions were a tax policy mistake in my view but this was done by Team Republican. Oh no – Sammy is about to get fired from Team Trump for noting. Which means Sammy will have to live off the government dole!

First, I wanna say that I do NOT encourage people to click on the following link. I am only putting it there for exhibitory purposes or people who need verification of what I am saying–bot not because I believe in the validity of the actual link itself—to the contrary—-

But I wanted to say some people have discouraged me from reading Zero Hedge blog as they believe it is a propaganda tool or propaganda arm of the Russian government. I don’t necessarily disagree with that, in fact, I pretty much DO agree with it. However, even “RT” has some useful information sometimes, and as far as ZH I choose not to throw out the baby with the bath water. But here is an ideal example of why Zero Hedge most likely IS a propaganda tool for the Russian government:

https://www.zerohedge.com/news/2019-03-01/us-army-takes-50-tons-gold-syria-alleged-deal-isis

In defense of myself still reading ZH, I wanna say that sometimes you can get very useful information from some of the darkest corners of the web. Alex Jones is a prototypical example, Alex Jones was the first media outlet that I had heard about “Jade Helm” from back in 2015.

https://en.wikipedia.org/wiki/Jade_Helm_15_conspiracy_theories

Do I believe that Jade helm was a “conspiracy”?? NO I do not. However, very few MSM media sites were discussing it at that time, as observed by the fact I am a media junkie and had only FIRST heard of Jade Helm listening to Alex Jones. Other places were treating it like it was NOTHING. I thought it very strange thing to not discuss military drills being held in residential areas of the USA. And I know it happened because I saw it where I lived. Had I not heard Alex Jones, seeing those operations or “drills” would have been EVEN MORE worrisome to me. I only became aware of them first through Alex Jones. And I know Professor Chinn finds Alex Jones morally repulsive, but I hope he will make exception allowing this link:

https://www.infowars.com/jade-helm-troops-to-operate-undetected-amongst-civilian-population/

NYT only discussed this, on the following July, 4 months after Alex Jones covered it. There was a May 2015 NYT article on it, but seemingly mentioning it, in semi-joking fashion. Are we “paranoid” to want to know about military operations, drills or otherwise in USA residential areas???

Regarding Sammy’s comment, Tiger Woods left California, because state taxes were high.

I heard, a baseball pllayer got a 13 year $330 million contract and wanted to play in California. However, he would’ve had to pay about 50% in federal and state taxes in California. So, he signed with Philadelphia where state taxes are 3% instead of over 13%.

I wonder, if someone like Walt Disney, a conservative family man, would be as successful in California today. And, given how far left and perverted the entertainment industry is today, would he win 26 academy awards in this era?

Leftists also want to rename John Wayne Airport in Orange County California.

Could we do posts “linking together” the economic flow between the States? Cheers,