Today, we are pleased to present a guest contribution written by Eric Sims and Jing Cynthia Wu (both from the University of Notre Dame), based on their paper of the same title.

In “Evaluating Central Banks’ Tool Kit: Past, Present, and Future,” we develop a structural DSGE model that allows one to simultaneously study the three principal tools of unconventional monetary policy in a unified framework – quantitative easing (QE), forward guidance (FG), and negative interest rate policy (NIRP). The model features the usual real and nominal frictions found in NK-DSGE models. In addition, there exist financial intermediaries that engage in maturity transformation by funding themselves with short term debt from households and holding long term debt that is issued by firms to support investment. Intermediaries are subject to an endogenous balance sheet constraint. This constraint gives rise to excess returns of long over short bonds. Intermediaries also hold interest-bearing reserve balances with the central bank. The central bank can create reserves to purchases bonds from intermediaries; doing so alleviates the balance sheet constraint they face, resulting in lower interest rate spreads and higher aggregate demand. A ZLB constraint is imposed on the nominal interest rate on short term debt held by households, but the central bank may push the interest rate on reserves into negative territory. Negative interest rates affect the real economy through both a forward guidance and banking channel. Lowering the interest rate on reserves into negative territory signals a commitment to lower short term rates in the future, stimulating the economy in a manner identical to forward guidance. On the other hand, negative rates on reserves erodes the net worth of intermediaries, which exacerbates the balance sheet constraint they face and pushes interest rate spreads up.

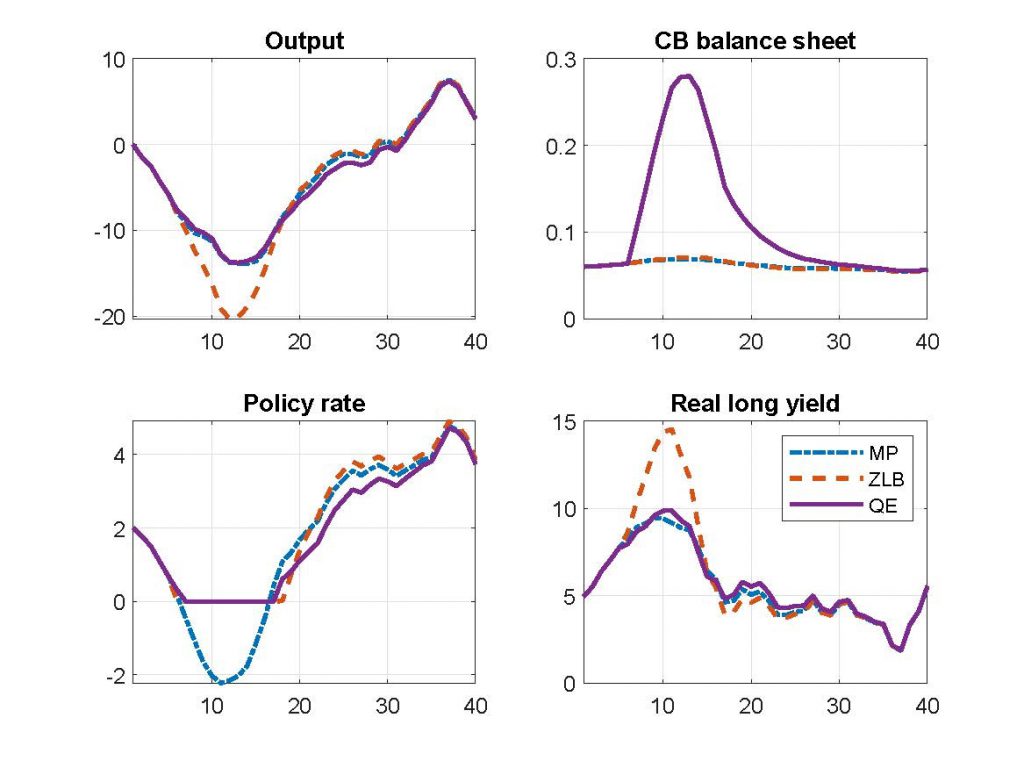

In a quantitative application, we show that exogenous changes in any of the unconventional tools can in principal affect output in a way similar to a conventional monetary policy shock. The requisite FG and NIRP interventions are implausibly large, so we argue that QE is likely to be the most desirable of the unconventional tools. We then postulate a novel but simple endogenous feedback rule for central bank bond purchases that has the flavor of a conventional Taylor rule for policy rates. Following such a rule when short term rates are constrained is successful in alleviating the adverse consequences of the ZLB. In an application meant to mimic the experience of the US in the Great Recession, we show that their endogenous QE rule significantly mitigates the output decline from a series of adverse demand shocks. By increasing the central bank’s balance sheet in an amount similar to what the Fed did over QE1-QE3, endogenous QE provides stimulus to the economy roughly the equivalent of pushing short term rates two percentage points below zero. This is close to the estimated decline in the “shadow rate” series from Wu and Xia (2016).

Shown below is Figure 7 from the paper. It plots simulated paths of output (relative to steady state), the policy rate, the central bank’s balance sheet (relative to GDP), and the real long yield (the nominal yield to maturity on private long term debt less one period ahead expected inflation). The dash-dotted blue lines show paths under conventional monetary policy with no ZLB constraint, the red dashed lines impose a ZLB with no unconventional policy, and the solid purple lines shows responses with endogenous QE during the ZLB period. It is clear that endogenous QE largely mitigates the adverse consequences of the ZLB binding.

Figure 7 from Sims and Wu (2019).

The paper concludes by discussing some consequences of central banks carrying a large balance sheet going forward. First, we argue that the speed of balance sheet normalization after a ZLB/QE episode is important for the efficacy of QE during the ZLB. In particular, failure to commit to balance sheet normalization after the ZLB induces a deeper recession and more deflationary pressures, whereas quick balance sheet normalization means that the economy performs less well after the ZLB has ended. Second, we argue that the size of a central bank’s balance sheet has important implications for the efficacy of NIRP. The larger a central bank’s balance sheet, the more important is the banking channel for NIRP. If a central bank carries a balance sheet equivalent to what the ECB is currently holding, NIRP interventions are actually mildly contractionary rather than expansionary. Third, the we provide a first attempt at quantifying the effective lower bound (ELB) on the interest rate on reserves. When central banks have small balance sheets, as they did pre-crisis, there is essentially no limit on how negative policy rates can be set in theory. But as the size of the central bank’s balance sheet grows, the maximum negative policy rate that can be implemented without incentivizing intermediaries to exit gets closer to zero.

This post written by Eric Sims and Jing Cynthia Wu.

So the bottom line here is that as a recession begins to end, a central bank (focus here on ECB) should move to “normalize,” or at least commit to doing so, but should do so gradually. Getting more towards a more normal (probably impossible to go back fully to the old “normal”) allows for the resumption of more normal policies that also operate more normally and not in counterintuitive ways, see their argument on NIRP.

This is more or less what I think for the Fed, with the recent buzz by Trumpites to lower interest rates in a hghly employed growing economy extremely unwise, especially given that they have not yet gotten back to anywhere near the “old normal” level. Trump wants to try to guarantee his reelection, although has been noted lots of voters not liking him do not care about the more or less good economy, and is willing to reduce the ability of the Fed o be able to combat a future recession when it arrives, just as he has already cooked any ability to have a future stimulating fiscal policy in such an event. But, he has been open about it. It will not be his problem. Let his probably Dem successor deal with the mess he leaves behind, hahahaha!

Your last sentence reminded me of the song “Nowhere Man”.

I have replaced Nowhere Man with Tariff Man in the following:

Tariff man, The world is at your command

He’s as blind as he can be

Just sees what he wants to see

Tariff man, can you see me at all

Tariff man don’t worry

Take your time, don’t hurry

Leave it all till somebody else

Lends you a hand

You’ve got to run this with compromised collateral, call it -17% reduction in market value, and a lowered loan-to-value ratio, say 70% instead of 80-90%. I will bet it shows that QE is ineffective.

There is a minor grammar error in the first paragraph “to purchases bonds” which I think should be “to purchase bonds”. If it is not an awkward thing, I wish the authors to be informed and that this comment PLEASE not be posted on the blog.

Only skimming the contents to this point, seems like a well laid out paper (or novella maybe). You have to think the balance sheet of the Fed is going to become a popular topic once again because the odds are high come 2020–2021 that stimulus could be on the table and the main crutch there will be QE. As a dude with German genes, the idea of a “methodical” way of doing the QE, similar to the “methodical” way of the Taylor rule appeals to me greatly (although for the record I hate John Taylor as a person, but I guess that’s besides the point here).

Without having read the entire paper, this concept has great appeal to me, and is something that should be given a long hard look going into the next recession. In my opinion QE is always a 2nd or even a 3rd choice going onward down….. but it is not economists who force the use of this “3rd choice” (or worse) of QE. Economists and the Fed are often stuck with no better option due to American legislative ineptitude (Republican Senate etc). So economists have to make the best assumption that they are going to be stuck with this QE choice. “The best available choice in a world of sad constraints”?? So based on this, Wu and Sims have made a great choice in research avenues, and this could be quite helpful in 2020–2021 and onward.

“There exists a cutoff negative policy rate below which financial intermediaries would voluntarily choose to exit”

Does anyone know how we can get to that cutoff point or below?? Reminds me of the old Henny Youngman joke. “Take my bank, please”

Professor Chinn,

Thank you very much for the link to Professor Sims and Professor Wu’s paper. It is too advanced for me, now.

I did go to Professor Sims homepage. Professor Sims has a link to his Intermediate Macroeconomics textbook. It is also too advanced for me, now.

For life-long learners, Professor Sims IM textbook may prove quite serviceable. There is an emphasis on clear explanation: “Finally, we feel that a defining feature of this text is that it is, if nothing else, thorough – we have tried hard to be very clear about mathematical derivations and to not skip steps when doing them.”

I downloaded a copy of Professor Sims textbook for my medium to long run to-do list.

Cheers,

Frank

@ Frank

Frank, I usually pride myself in following and checking out the links. I had checked out Wu’s link first (what can I say?? I’m a sicko) and really only glanced at Sims’ link. There’s a small chance I would have gone back and wandered over the links, but actually the chances are quite small as I had become pre-occupied with the heavy task of the 70 page (??? I forgot now) paper they shared here, and possibly doubling back to look at Wu’s working paper links later to download. Truth is the chances are 0.0000000001% I would have looked at Sims’ “Textbook” link because 98% of the time it’s a publisher page link or an Amazon link to a $120+ book and I get so sick of it. I am always hunting for really solid FREE sh*t online. I have one of Blanchard’s books—but any text I can get my hands on is great because some texts are more user friendly or possibly written at a slightly lower level I can grasp more and maybe make a leap in my learning. If you hadn’t posted that comment I never would have looked and never would have got the book before Sims took the link down.

Thanks Frank (and secondary Thank You to Professor Chinn)—from Goofball Moses.

Anyone have any wagers on the Friday trade deadline by the “VSG”?? I’m guessing it’s a bluff and that he will cave or have some stall tactic by Friday afternoon.

If donald trump has no balls to face the leader of North Korea, do we think he’s going to get a pair when he can put on a kabuki show in Mar-a-Lago for the CoRev and Bruce Hall type village idiots?? Doubtful. Curious if anyone has any thoughts.

https://www.youtube.com/watch?v=lyzS7Vp5vaY

Krugman notes that Republicans not only flip flop on fiscal policy depending on who is in the White House but also on monetary policy:

https://www.nytimes.com/2019/05/04/opinion/the-sabotage-years.html

Of course this Republican hypocrisy is standard faire for Trump pet poodle also known as PeakTrader!

I find this an impressive paper. You can tell that’s someone’s life work.

The central problem is not China or trade per se, but the entrenched Corporate interests and over-powerful intermediaries as financial services — this paper predicted what’s coming. Inversion of rate will make life harder for all and correct things a bit. That’s why Trump is delaying that.

Trump runs the country like a CEO, but the Left wants to run the country like a Progressive Marx or Stalin, by relentless lying, selective talking, and surrendering.

Side topic:

Google’s founders are mentored by Prof Cheriton in Stanford. He has a staunch and simple view of Security based in openness and publicity, not a Leftist version of “equality”, “privacy”. Yes there’s at the root of Google’s success a philosophical view.

Bezos, Jobs, check their daily deeds. Only Cook jumps out and say Oh LGBT you’re great! If you concentrate on your work and vie for world class, diversity is a derived trait but not primary goal!

Reality judges. Your value is through your deeds and legacy.

Zi Zi: Are you using Google translate to compose these comments?