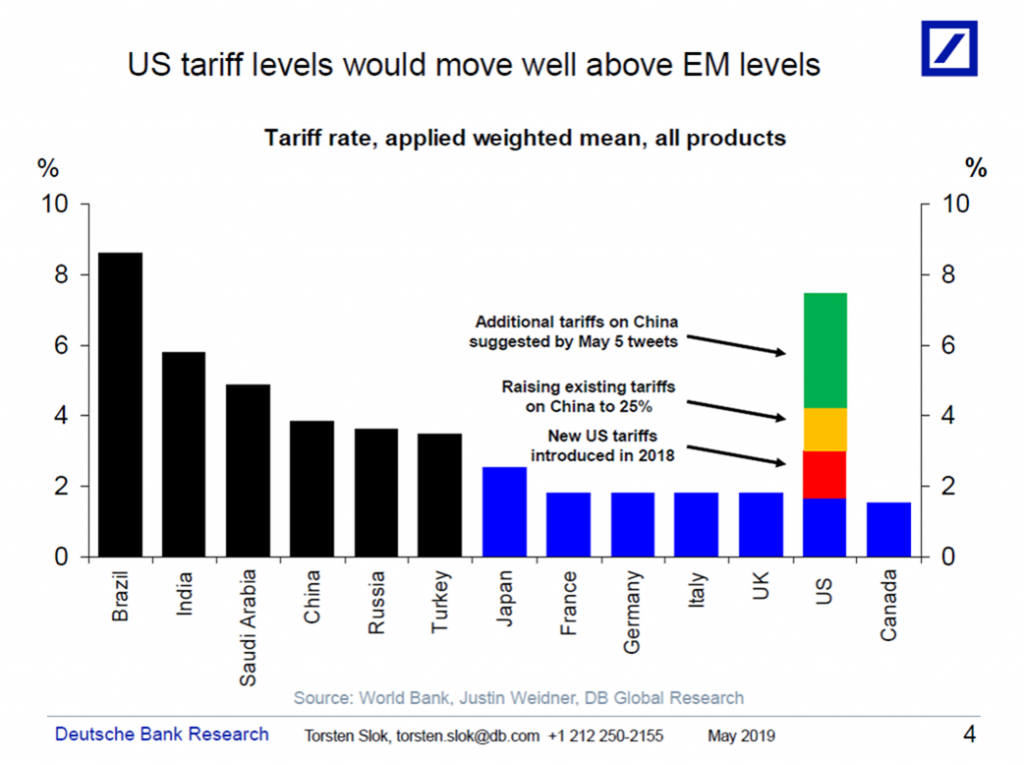

Here is the state of play for US tariffs. We’re a developing country!

As Mr. Trump’s trade war lumbers on, with American consumers bearing the bulk of the burden thus far, it’s useful to review the facts regarding the war. Here are the EconoFact articles on trade policy.

Overview

- http://econofact.org/what-do-we-learn-from-bilateral-trade-deficits

- http://econofact.org/looking-for-export-growth-in-all-the-wrong-places

- http://econofact.org/is-the-trade-deficit-a-drag-on-growth

- https://econofact.org/import-tariffs-can-also-reduce-exports-video

Technology

- https://econofact.org/what-is-the-problem-of-forced-technology-transfer-in-china

- https://econofact.org/can-both-the-united-states-and-china-be-winners-in-a-global-technology-race

Sectors

- https://econofact.org/how-much-of-your-car-is-made-in-mexico

- https://econofact.org/threats-to-u-s-agriculture-from-u-s-trade-policies

- http://econofact.org/will-steel-tariffs-put-u-s-jobs-at-risk

Legal Aspects and International Organizations

- https://econofact.org/u-s-trade-policy-going-it-alone-vs-abiding-by-the-world-trade-organization

- http://econofact.org/what-is-the-national-security-rationale-for-steel-aluminum-and-automobile-protection

History

Regional Trading Arrangements

- http://econofact.org/can-president-trump-terminate-nafta-or-korus-without-congressional-approval

- http://econofact.org/the-economics-of-the-korea-u-s-free-trade-agreement

- https://econofact.org/driving-home-the-importance-of-nafta

Countries

I’ll read all these links after I finish the latest Trump tweets as to how China is paying for these tariffs and we’ll collect $500 billion a year in customs duties. Or something like that!

There is no doubt that tariffs will raise the cost of goods sourced from China.

Now, let’s look at the dirty word “tariff” and replace it with the alternative word “tax”. Sort of like VATs. These, like the sales taxes or gasoline taxes, are taxes we can all share. They go to the general revenue of the federal government and can be used for anything from new weapon systems to social justice programs (who could argue about that?).

This list was compiled in 2014, so there may be some deletions and additions, but it is a fair representation although some of the items may be considered “penalties” (a euphemism) instead of taxes:

#1 Air Transportation Taxes (just look at how much you were charged the last time you flew)

#2 Biodiesel Fuel Taxes

#3 Building Permit Taxes

#4 Business Registration Fees

#5 Capital Gains Taxes

#6 Cigarette Taxes

#7 Court Fines (indirect taxes)

#8 Disposal Fees

#9 Dog License Taxes

#10 Drivers License Fees (another form of taxation)

#11 Employer Health Insurance Mandate Tax

#12 Employer Medicare Taxes

#13 Employer Social Security Taxes

#14 Environmental Fees

#15 Estate Taxes

#16 Excise Taxes On Comprehensive Health Insurance Plans

#17 Federal Corporate Taxes

#18 Federal Income Taxes

#19 Federal Unemployment Taxes

#20 Fishing License Taxes

#21 Flush Taxes (yes, this actually exists in some areas)

#22 Food And Beverage License Fees

#23 Franchise Business Taxes

#24 Garbage Taxes

#25 Gasoline Taxes

#26 Gift Taxes

#27 Gun Ownership Permits

#28 Hazardous Material Disposal Fees

#29 Highway Access Fees

#30 Hotel Taxes (these are becoming quite large in some areas)

#31 Hunting License Taxes

#32 Import Taxes

#33 Individual Health Insurance Mandate Taxes

#34 Inheritance Taxes

#35 Insect Control Hazardous Materials Licenses

#36 Inspection Fees

#37 Insurance Premium Taxes

#38 Interstate User Diesel Fuel Taxes

#39 Inventory Taxes

#40 IRA Early Withdrawal Taxes

#41 IRS Interest Charges (tax on top of tax)

#42 IRS Penalties (tax on top of tax)

#43 Library Taxes

#44 License Plate Fees

#45 Liquor Taxes

#46 Local Corporate Taxes

#47 Local Income Taxes

#48 Local School Taxes

#49 Local Unemployment Taxes

#50 Luxury Taxes

#51 Marriage License Taxes

#52 Medicare Taxes

#53 Medicare Tax Surcharge On High Earning Americans Under Obamacare

#54 Obamacare Individual Mandate Excise Tax (if you don’t buy “qualifying” health insurance under Obamacare you will have to pay an additional tax)

#55 Obamacare Surtax On Investment Income (a new 3.8% surtax on investment income)

#56 Parking Meters

#57 Passport Fees

#58 Professional Licenses And Fees (another form of taxation)

#59 Property Taxes

#60 Real Estate Taxes

#61 Recreational Vehicle Taxes

#62 Registration Fees For New Businesses

#63 Toll Booth Taxes

#64 Sales Taxes

#65 Self-Employment Taxes

#66 Sewer & Water Taxes

#67 School Taxes

#68 Septic Permit Taxes

#69 Service Charge Taxes

#70 Social Security Taxes

#71 Special Assessments For Road Repairs Or Construction

#72 Sports Stadium Taxes

#73 State Corporate Taxes

#74 State Income Taxes

#75 State Park Entrance Fees

#76 State Unemployment Taxes (SUTA)

#77 Tanning Taxes (a new Obamacare tax on tanning services)

#78 Telephone 911 Service Taxes

#79 Telephone Federal Excise Taxes

#80 Telephone Federal Universal Service Fee Taxes

#81 Telephone Minimum Usage Surcharge Taxes

#82 Telephone State And Local Taxes

#83 Telephone Universal Access Taxes

#84 The Alternative Minimum Tax

#85 Tire Recycling Fees

#86 Tire Taxes

#87 Tolls (another form of taxation)

#88 Traffic Fines (indirect taxation)

#89 Use Taxes (Out of state purchases, etc.)

#90 Utility Taxes

#91 Vehicle Registration Taxes

#92 Waste Management Taxes

#93 Water Rights Fees

#94 Watercraft Registration & Licensing Fees

#95 Well Permit Fees

#96 Workers Compensation Taxes

#97 Zoning Permit Fees

So, what’s one more in the scheme of things?

Bruce Hall: Oh. OK. That makes the tariffs all good.

Menzie, no, Not all good, but much, much better than the carbon tax, which many if not most here prefer.

Can you predict how it may influence GDP, especially in the Net Exports category?

CoRev much better than the carbon tax

You win the Larry Kudlow Stupidest Comment Of the Day Award. Seriously, do you not know the difference between a Pigouvian tax and a tariff?

I presume the word externality is over your little head. C’mon CoRev – you don’t need to try so hard. We’ve know you are illiterate in even the basics of freshman economics. So relax!

CoRev actually wrote this?

“Menzie, no, Not all good, but much, much better than the carbon tax, which many if not most here prefer. Can you predict how it may influence GDP, especially in the Net Exports category?”

Seriously? Does CoRev have a model for this? OK – I’ll give you a few minutes to pick yourself off the floor from laughing so hard and now encourage folks read this from the CBO:

https://www.cbo.gov/publication/44223

“Lawmakers could increase federal revenues and encourage reductions in emissions of carbon dioxide (CO2) by establishing a carbon tax, which would either tax those emissions directly or tax fuels that release CO2 when they are burned (fossil fuels, such as coal, oil, and natural gas). Emissions of CO2 and other greenhouse gases accumulate in the atmosphere and contribute to climate change—a long-term and potentially very costly global problem. The effects of a carbon tax on the U.S. economy would depend on how the revenues from the tax were used. Options include using the revenues to reduce budget deficits, to decrease existing marginal tax rates (the rates on an additional dollar of income), or to offset the costs that a carbon tax would impose on certain groups of people. This study examines how a carbon tax, combined with those alternative uses of the revenues, might affect the economy and the environment.”

It is a long and interesting discussion. But don’t expect CoRev to read any of it!

Pgl jumps in with what is undoubtedly the stupidest comment in an article concerned with price increases of Chinese Good and Services affected by US tariffs, a limited subset of products bought by US citizens. His proposal and reference highlight this:

“How Would a Carbon Tax Directly Affect the Economy?

h

By raising the cost of using fossil fuels, a carbon tax would tend to increase the cost of producing goods and services—especially things, such as electricity or transportation,...” How many US produced products DO NOT USE electricity or transportation?

It will not be obvious to the Carbon Tax advocates that its implementation would raise the prices (another hidden tax but compounded by all the other taxes collected during the product’s life) of NEARLY EVERYTHING, much of which is necessary for life, instead of tariffs (another hidden tax) on a limited subset, much of which is optional with available alternatives.

Sometimes, the hypocrisy or worse the willful ignorance amazes me. After months of ridicule at least AOC has admitted her claims supporting the Green New Deal were a joke/dry humor. That will not happen here and definitely not by pgl.

BTW, AOC’s admission was based upon the exaggerated claims of CO2’s impact on climate, just as pgl’s CBO reference.

So who failed to read or understand the CBO Report?

@CoRev

I thought you were the expert here CoRev?? Why don’t YOU tell use where YOU think GDP will be?? I hope you’re better at forecasting GDP than you are at farm commodities. Let’s make it relatively easy for a wise man like you CoRev, you wanna try gauging the number for 3rd quarter 2019?? A lot of people are stressed from the holiday/Christmas shopping that time of year when the second estimate of numbers are announced and the large gap between your number and the BEA’s might give them some much needed laughs.

The second estimate for the 3rd quarter of 2019 will come out the morning of November 27. You wanna give that one a whirl?? I would keep soybeans a neutral factor in your estimates for GDP CoRev, as in your case including soybeans in your GDP forecast might ruin your numbers.

Menzie,

Oh. OK. That makes the tariffs all good.

I didn’t say that any more than I said that those 97 examples were all good. But, since so much has been written about how the federal government is not collecting enough taxes for all of its spending (and desired new spending), it would seem that those who want a bigger federal government and those who want a more balanced (didn’t say “balanced”) would both agree that another $50-100 billion in revenues (or more) is a good thing.

However, what I perceive to be the objections are that China will also raise more tax revenue and that the 1% are not paying the full amount. Naturally, under new tariffs (taxes), the status is never quo. In this case, the winners are the U.S. government and selected industries; the losers are consumers of some Chinese products and selected industries.

There is no free lunch; someone pays for it. The disagreement seems to be “who?”.

“There is no doubt that tariffs will raise the cost of goods sourced from China.”

No doubt? Ever heard of the foreigner will pay argument. I raise this because I had to endure the CBS Morning Show talking to their “money manager” guru who to be frank is a walking talking idiot. She argued there are only two ways the incidence of a tariff could work out. Either the importer bears it – which of course will be difficult as importer’s had very modest commission rates in the first place – or it will raise the cost to consumers. As if NONE of the incidence of the tariff could be borne by the Chinese firm producing the good.

Look Trump is dead wrong when he says all of the incidence goes to the Chinese producer. Why do I say so? We have had economic studies looking at this issue and they have concluded very little of the incidence of the tariff accrues to the Chinese producer. Of course Trump pretends he has never read these studies and given his team of “economic advisers”, I doubt they know what the literature is saying either.

pgl,

While I am sure Trump has read none of this literature, he barely reads anything even a page long reportedly. However, we have had the spectacle over the weekend of Kudlow of all people admitting that US consumers will pay at least part of the cost, and he was accurate enough to note that costs borne by the Chinese would be in the form of lost sales rather than payments. The question now is, will he backtrack on this, or is he now on the way out for disagreeing tweets by Fearless Leader?

“Sexist!!!!!” What do you have against “strong” women on TV?? Really, I feel disgusted now. PIGS.

so now bruce hall is a fan of taxes. go figure.

One more? By one estimate, the tariffs will cost the average household $767 (“only” $62/month). Another estimate pegs the cost at $500 (“only” 41/month….wowser,what a deal!)

Read his lips: more new taxes. And, best of all, China will be paying them! Double wowser!

non,

By one estimate, the tariffs will cost the average household $767 (“only” $62/month).

That’s less than the “average” savings from the last tax repackaging. The “average” temperature of earth is about 61º. The average age of Americans is about 37 years. Now, whats the dispersion??

This is a Chinese product consumption tax. Your alternatives: pay the tax, find alternative sources, buy less. But you do have a choice. Let’s apply that to gasoline taxes. What are your alternatives?

Average tax cut? Well, if you’re going that way, your average cut is now down to $233. There goes the kitchen remodeling Gary Cohn AND CoRev said you could do on $1K.

Oh, given these tariffs, prices for many necessary items will increase too. And who can’t wait for our leading Noneconomist to rattle Mexican and Canadian markets too?

But, now that you’re on board with raising taxes to prove a point, we may well see China paying for the wall on the southern border since Mexico obviously won’t.

non, estimates are like a$$h****, everyone has one: https://www.nytimes.com/2019/04/14/business/economy/income-tax-cut.html

So, if the “average” is $233 or $780 or some other number, it’s a cut. Average is meaningless to the individual; tariff averages are meaningless to the individual.

If a cut is a cut, that must mean an increase is an increase. That means families with incomes below the US median (around $61K), whose tax cuts were comparatively minimal to begin with, will see those cuts diminished by tariffs.

Easy to see that many of these families will have a more difficult time coping with these increases–the $62/month added by tariffs– than families with six figure incomes.

Since those with incomes in the $50-75K range were looking at average tax cut benefits of $874 from the tax cut, even someone who may be unable to grab his a______e with both hands should be able to see the problems these tariffs create for lower income families. Families most likely to shop where there are more goods available from China.

Cost of living may not sky rocket but ask those soybean farmers about their net income.

Bruce Hall You went to a lot of effort to make a very weak point. Not all taxes are the same. If a tax corrects an externality, then that is a good thing and improves welfare. Some taxes are user fees and reflect the cost of consuming some resource. The problem with tariffs is that in general they create what economists call “deadweight” losses, which are losses without any corresponding gain to anyone else. Just pure welfare losses.

2slug, I’ll reiterate what I responded to Menzie:

However, what I perceive to be the objections are that China will also raise more tax revenue and that the 1% are not paying the full amount. Naturally, under new tariffs (taxes), the status is never quo. In this case, the winners are the U.S. government and selected industries; the losers are consumers of some Chinese products and selected industries.

If tariffs are “deadweight” losses, so are all other taxes. Certainly, tariffs are not deadweight losses to the government.

well, we are in terms of income distribution, and access to medical care, and social mobility, so why shouldn’t be in terms of tariffs? Seriously, forget American exceptionalism, for a bright and shining moment (mid 20th century) the United States of America was the center of the Free World, the engine of global progress, the Arsenal of Democracy, a beacon on a Hill, etc., but those days recede into the past. In some dim reptilian way, the president and his followers grasp that (MAGA, anyone?), but the responses are, sadly, limited to flight, fight and freeze. The warm blooded concept of adaptation is, in terms of political evolution, somewhere up ahead, hopefully without one of those ‘extinction of the dinosaurs’ events. But, we’ll see.

BTW, great catalogue of resources. An invitation to look into and think about these things, rather just mouth off . . .

One side effect of tariffs is looking internally for either quality or competitively priced products (after tariffs are applied). One of the biggest/better examples of looking inward is in fuel resources. Once production and export restrictions were reduced (a form of quota controls) our own energy sources became competitive and US production ramped up to meet, first internal, and then overall demand.

I suspect we will see more changes in the import/export markets as companies adjust to the new tariffed economies. Hopefully, the end result will be a move to eliminate nearly all trading restrictions, but that can not happen until all players are using more equal trading practices. It is not the case today and the past several decades.

CoRev Once production and export restrictions were reduced (a form of quota controls) our own energy sources became competitive and US production ramped up to meet, first internal, and then overall demand.

Oh my, you’ve somehow managed to top your earlier Larry Kudlow Stupidest Comment of the Day Award. Even if we ignore the CO2 issue, this comment makes no economic sense at all. You’re essentially making an argument for autarky….go look it up. You need to think deeply about why countries engage in trade. Do you understand the concept of comparative advantage? Do you understand the difference between absolute advantage and comparative advantage?

Hopefully, the end result will be a move to eliminate nearly all trading restrictions, but that can not happen until all players are using more equal trading practices. It is not the case today and the past several decades.

More nonsense. The benefits of free trade do not depend on fair trade. And Trump doesn’t believe in free trade. That’s the one thing he’s been consistent about for decades. He has always called himself “Tariff Man” going back to the 1980s. Trump thinks international economics is just like the NYC real estate market.

You’ve been hanging around this econ blog for a long time. Isn’t it about time that you acquainted yourself with some basic economic concepts?

i find it fascinating that trump does not understand the chinese do not pay for the additional 25% tariffs, the us consumer pays for that. and his followers appear to be too stoopid to understand the difference. trump is essentially saying “i am going to tax the us consumer even more” and the trump supporter is quite pleased with the prospect of paying another 25% in taxes on products they buy. just curious how much more trump can tax his supporters before they realize what a ripoff this con-man has pulled-or are they too blind to ever realize the con? considering soybean farmers are willing to go bankrupt chanting maga, i’m not too optimistic about how this whole thing unfolds.

Can anyone tell me, is this a trade dispute or a security issue?

The risk is that trade talks could become a proxy for strategic competition across the entire U.S.-China relationship. If you believe China will always cheat, or that its economic rise poses an existential threat to America, then you don’t want to make any deal at all. But thinking that way can become a self-fulfilling prophesy and drive China into an even stronger mercantilist nationalism.

https://www.wsj.com/articles/the-china-trade-impasse-11557528495?mod=cx_picks&cx_navSource=cx_picks&cx_tag=video&cx_artPos=4#cxrecs_s

“One of the things that’s happened in the last three or four years has been the solidifying everywhere—including in the business community—of opposition to China,” said Bill Reinsch, senior trade expert at the bipartisan Center for Strategic and International Studies in Washington. “One of the consequences of that is that the people in this country that would normally urge temperance or caution have really kind of disappeared.”

https://www.wsj.com/articles/broad-support-for-trumps-china-fight-faces-test-as-tariffs-escalate-11557658801

Steven Kopits: China needs to be engaged, economically, technologically, militarily and diplomatically. But using tariffs unilaterally is a *stoopid* way of proceeding.

What do you suggest? What’s your one big idea?

Steven Kopits: Join TPP; re-engage in TTIP. Reduce trade policy uncertainty by relying on known WTO procedures, rather than Sec 232 and Sec 301 provisions (the former which damages allied economies as well). Undertake greater investment in R&D, fund science research more fully. End massive tax cuts which push up real borrowing costs.

Menzie’s respons: More globalism! It has been so successful to date. I’m sorry your’re swimming upstream.

CoRev More globalism!

More nativism. More inability to deal with the modern world. More of that famous “hunker down” mentality of today’s conservatives. More autarky. Meanwhile, the world advances funeral by funeral.

Menzie –

You are suggesting that China is not a security threat to the US.

I am less and less convinced. Personally, I would have slapped on these tariffs when China failed to comply with the UNCLOS ruling, to make the choice clear: If China wants to be accepted as part of the family of civilized countries, it must so behave. We’ve let that pass, we’ve let pass the mass internments of minorities, assaults on Christian churches, an increasingly hostile environment for foreign businesses and businessmen, a suppression of free speech and association, increasingly militarization, and emergent strong man dictatorship.

And that’s the point of this WSJ quote:

“One of the things that’s happened in the last three or four years has been the solidifying everywhere—including in the business community—of opposition to China,” said Bill Reinsch, senior trade expert at the bipartisan Center for Strategic and International Studies in Washington. “One of the consequences of that is that the people in this country that would normally urge temperance or caution have really kind of disappeared.”

We’re now back to the policy which I would have implemented post-UNCLOS, but for seemingly different reasons.

So, I don’t know. Maybe this is all about trade and TPP is the panacea. Or maybe this is about hypersonic missiles, three aircraft carriers, and domestic suppression of dissent and oppression of minorities — and most of all, about demonstrated aggression in the South China Sea.

Steven Kopits: Where exactly have I asserted China is not a security threat? I think I remember being challenged on supporting military pivot to Asia. I’m also probably one of the few people commenting/writing on this blog who has actual experience with CFIUS.

So how do you want to handle that threat? TPP is not going to do it.

Actually, let me take a step back. How do you characterize that threat?

Considering how F**ked up some of you people’s brains are, I guess it’s no surprise your memories of Professor Chinn’s multiple writings on American national security vis-a-vis China don’t last any longer than 1 year (if that):

https://econbrowser.com/archives/2018/05/mr-trumps-faux-national-security-based-trade-policy

https://www.vox.com/policy-and-politics/2018/5/15/17355202/trump-zte-indonesia-lido-city

No doubt Menzie is a classier, more tolerant, and more mature person than I will ever be, as even if I had the talents and work ethic to acquire Menzie’s job (or one that professionally equates to it) I would STILL unleash a a four-letter word tirade of vulgarity on you people for saying some of the things you do after Menzie has written multiple posts flavored as the one below.

https://econofact.org/what-is-the-national-security-rationale-for-steel-aluminum-and-automobile-protection

donald trump’s answer is to piss on our best ally Canada and perform f*llatio on Kim Jong-un and Putin.

https://www.reuters.com/article/us-usa-northkorea-warmbier/trump-approved-payment-of-2-million-north-korea-bill-for-care-of-warmbier-report-idUSKCN1S124E

But you people, such as “Princeton”Kopits who is such an utter failure, even after kissing donald trump’s heinie for months on end and ignoring donald trump’s illegal loans and gifts from foreign nationals, can’t even raise to the sad “success” level of a Herman Cain. LMFAO. Keep trying “Princeton”Kopits, donald trump might need someone to clean his WH toilet lid, and that seems to fit your pay grade.

It does kind of amaze me how apathetic and indifferent people are to Menzie’s statements regarding the defense and national security of America vis-a-vis China and our tactics to them. I don’t know if Menzie will find this statement semi-offensive as at minimum 2nd generation guy, but anyone who understands Chinese culture knows it is a big deal some of the things Menzie has stated on this blog related to China. It has some similarities or parallels to a Jewish person speaking against the state of Israel or a Jewish person defending Palestine, Palestinians and the “two state” solution. There are many Jews (including American based Jews) that does not “go over” with. Menzie says some things that I am certain don’t “go over” with a segment of Chinese Americans. And then for Menzie to have to “take it from both sides” is really aggravating and beyond unfair.

Not only do some of you need to improve your reading comprehension, you also need to improve your medium-term memories.

I should put an addendum here related to my poor choice of words, when I said “state” of Israel, I was thinking more in terms of Jews criticizing the government of Israel (Netanyahu, decisions made by the Israeli cabinet, the Knesset, etc), than the state itself.

Moses –

Menzie posted this entry, so he opened the topic.

Here’s my concern: Trump is a half twist away from converting a trade issue into a security issue. So we had better have our heads on straight, because US public opinion is turning increasingly anti-Xi (and anti-Chinese by extension), and doing so because they read the news. Do you think Xi wants a good, happy and constructive relationship with the US? Not that I can tell.

And once you demonize a people, it’s hard to undemonize them (which is also happening to Americans in China). So things get potentially pretty tricky right now.

“Princeton”Kopits says: “And once you demonize a people, it’s hard to undemonize them.” Possibly the most hypocritical words ever typed on this blog. So says the horse’s ass who has tried to connect Mexican immigrants with American crime rates, when it has been shown over and over and over again that border area cities and towns have much lower crime rates than middle American cities such as Tulsa Oklahoma. Now this jackass Kopits is afraid of people being demonized?? Well I don’t expect “Princeton”Kopits to start reading anything of more difficulty than his morning cereal box, but on the chance Kopits would ever want to earn the respect that normally comes along with his supposed college degrees, I suggest he start reading materials such as the following, which are facts based, instead of the rubbish he sells on FOX news for the rural illiterates.

https://www.themarshallproject.org/2019/05/13/is-there-a-connection-between-undocumented-immigrants-and-crime

I’d like to add something else for the record, as I know many of our commenters on this blog who take such great pride in their low levels of functional literacy will never click on that Marshall Project link—when the Cato institute (an outfit that leans far more to the right politically) has TWO separate studies saying that undocumented immigrants both commit fewer crimes and are less apt to be incarcerated than their native-born counterparts, you “might” want to question how accurate your conjured imaginations are from the latest “drug lord” series iteration you and donald trump are watching on Netflix. Like it’s fun to watch, but may not have ANY connection to reality.

National Defense Strategy talks “competition [multi-dimension, can/should DoD complement DoS?] with Russia and China” as well as reorienting from counterinsurgency to great power conflict.

US Africa Command [counterinsurgency] forces are starting to try to win hearts and minds.

Then:

Trusted Capital Marketplace

https://www.defensenews.com/pentagon/2019/05/10/to-counter-china-pentagon-wants-to-create-patriotic-investors/

Compete with China ‘investing’ in certain industries, to make money and control security technology in the US.